Key Insights

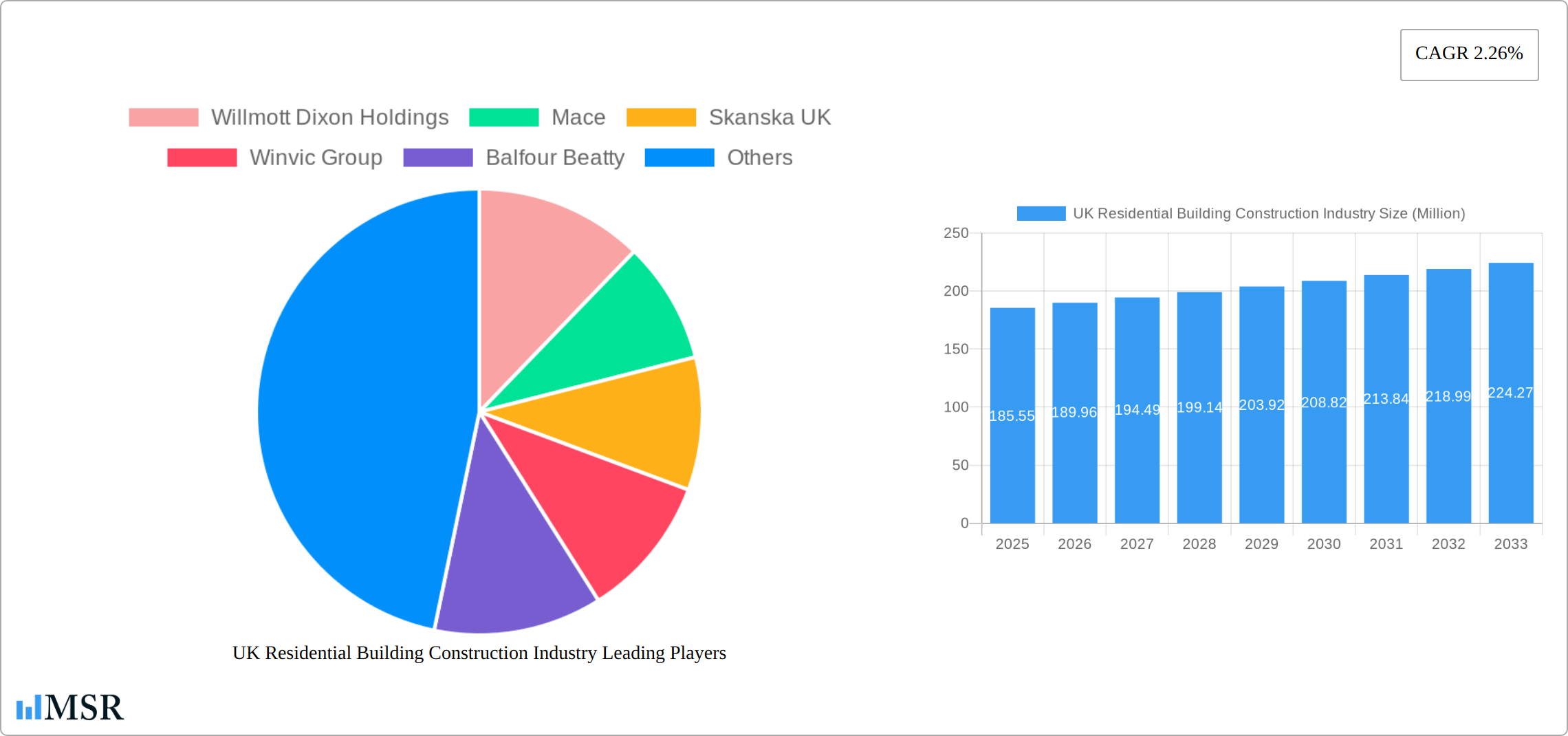

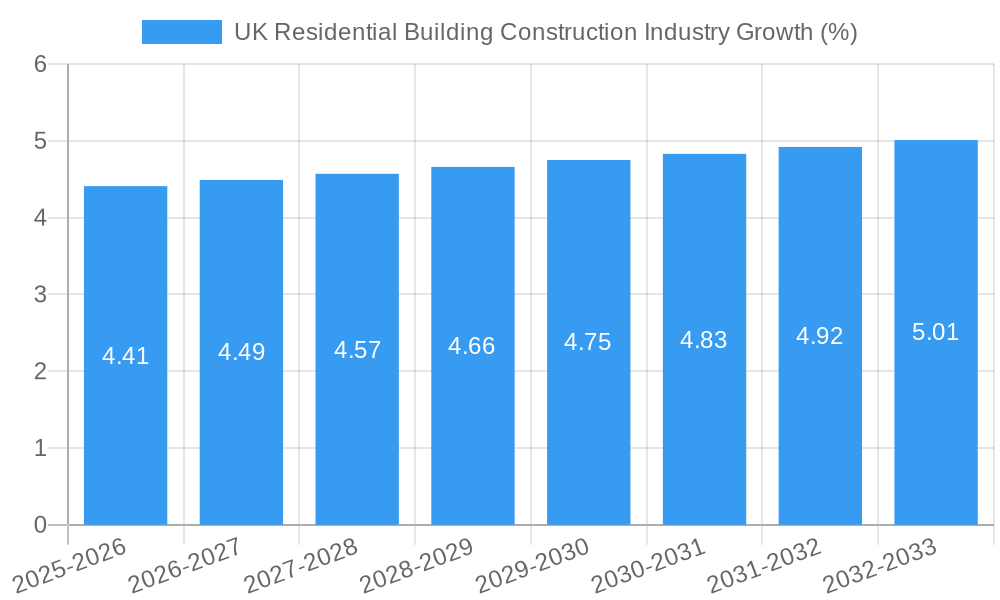

The UK residential building construction industry, valued at £185.55 million in 2025, is projected to experience steady growth, driven by factors such as increasing urbanization, population growth, and government initiatives promoting affordable housing. The 2.26% CAGR indicates a consistent, albeit moderate, expansion over the forecast period (2025-2033). Key market segments include villas and landed houses, and condominiums and apartments, with London, Birmingham, Glasgow, and Liverpool representing significant city-level markets. Major players like Willmott Dixon Holdings, Mace, Skanska UK, and Balfour Beatty dominate the landscape, showcasing a competitive yet consolidated market structure. While growth is expected, challenges remain, including fluctuating material costs, skilled labor shortages, and potential economic downturns influencing consumer confidence and investment in new housing. The industry's performance will be significantly impacted by broader macroeconomic conditions and government policies aimed at stimulating or regulating the housing market. Regional variations exist, with London and the South East likely experiencing higher growth rates compared to other regions, driven by higher demand and property values.

The segmentation reveals a preference for various housing types catering to diverse income levels and lifestyles. The presence of established, large-scale companies indicates a high level of market maturity and professionalism. Future growth will likely be influenced by technological advancements in construction techniques, sustainability initiatives focusing on environmentally friendly building materials and practices, and changes in consumer preferences towards smart home technology and energy-efficient designs. A continued focus on addressing the housing shortage through innovative construction methods and regulatory frameworks will be crucial to sustaining the industry's long-term growth and profitability. Careful monitoring of economic indicators and potential external shocks impacting the wider UK economy will be essential for accurate forecasting.

UK Residential Building Construction Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the UK residential building construction industry, covering market dynamics, key players, emerging trends, and future growth prospects from 2019 to 2033. The report uses 2025 as the base and estimated year, with a forecast period extending to 2033 and historical data encompassing 2019-2024. It's an invaluable resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The analysis includes detailed information on key segments (Villas & Landed Houses, Condominiums & Apartments) across major cities like London, Birmingham, Glasgow, Liverpool, and the rest of the UK. Leading companies such as Willmott Dixon Holdings, Mace, Skanska UK, Winvic Group, Balfour Beatty, Kier Group, Galliford Try, Lendlease, Bouygues UK, Morgan Sindall Group, and Laing O'Rourke are profiled.

UK Residential Building Construction Industry Market Concentration & Dynamics

The UK residential building construction market is characterized by a moderately concentrated landscape, with several large players commanding significant market share. While precise market share figures fluctuate, companies like Balfour Beatty and others consistently hold substantial portions. However, the industry also accommodates numerous smaller and specialized firms, contributing to a diverse competitive ecosystem. Innovation is driven by advancements in sustainable building materials, construction technologies (e.g., modular construction), and digitalization of processes. The regulatory framework, including building codes and environmental regulations, significantly impacts industry practices and costs. Substitute products, such as prefabricated housing and alternative construction methods, are steadily gaining traction. End-user trends, particularly a growing demand for sustainable and energy-efficient housing, are reshaping the market. Mergers and acquisitions (M&A) activity within the sector is reasonably active, with an estimated xx M&A deals annually over the last five years, driven by consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with top players holding xx% of the market.

- Innovation: Focus on sustainable materials, modular construction, and digitalization.

- Regulatory Framework: Stringent building codes and environmental regulations.

- Substitute Products: Growing adoption of prefabricated housing and alternative methods.

- End-User Trends: Increased demand for sustainable and energy-efficient homes.

- M&A Activity: Approximately xx M&A deals per year over the past five years.

UK Residential Building Construction Industry Insights & Trends

The UK residential building construction market exhibits robust growth, driven by several factors. The market size in 2024 was estimated at £xx Million and is projected to reach £xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Strong population growth, particularly in urban areas, fuels demand for new housing. Government initiatives aimed at addressing housing shortages further stimulate the market. Technological disruptions, such as the increasing adoption of Building Information Modeling (BIM) and offsite manufacturing, are improving efficiency and reducing construction time. Changing consumer preferences, with a focus on sustainable, smart, and personalized homes, influence design and construction methods. However, challenges like labor shortages, material cost inflation, and regulatory complexities pose potential impediments to sustained growth.

Key Markets & Segments Leading UK Residential Building Construction Industry

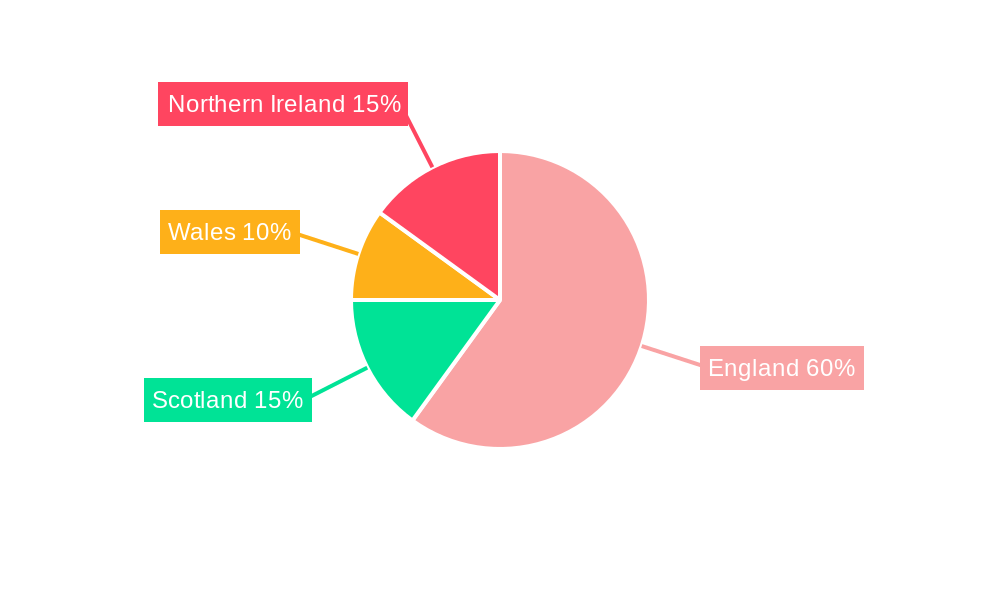

The London region dominates the UK residential building construction market, accounting for approximately xx% of the total market value in 2024. This dominance is attributed to high population density, strong economic activity, and substantial investment in infrastructure. The "Condominiums and Apartments" segment shows the highest growth trajectory among building types, driven by a preference for urban living and higher population density.

Drivers for London's Dominance:

- High population density and strong demand for housing.

- Significant investment in infrastructure and regeneration projects.

- Concentrated economic activity and higher disposable incomes.

Drivers for Condominiums and Apartments Segment Dominance:

- Preference for urban living and reduced maintenance requirements.

- Higher population density in major cities leading to space constraints.

- Investment attractiveness compared to other segments.

Other key cities like Birmingham, Glasgow, and Liverpool also exhibit substantial growth, albeit at a lower rate than London. The "Rest of the UK" segment contributes significantly to overall market volume, reflecting a diverse spread of housing demand across the country.

UK Residential Building Construction Industry Product Developments

Significant product innovations are reshaping the UK residential building construction industry. Advancements in sustainable building materials, such as cross-laminated timber (CLT) and recycled materials, are reducing the environmental impact of construction. Modular and offsite construction methods are enhancing efficiency, reducing construction time, and improving quality control. Smart home technologies, integrating energy-efficient systems and automated controls, are becoming increasingly popular, raising consumer preference for modern homes. These technological advancements are improving the competitiveness of firms adopting them.

Challenges in the UK Residential Building Construction Industry Market

The UK residential building construction industry faces various challenges impacting growth. Labor shortages, driven by Brexit and skills gaps, constrain project timelines and increase labor costs. Supply chain disruptions, exacerbated by global events, lead to material cost increases and project delays. Strict regulatory compliance requirements and complex planning processes can add significant time and costs to projects. Intense competition and price pressures further impact profitability. These factors combined result in an estimated xx% reduction in project profitability in 2024.

Forces Driving UK Residential Building Construction Industry Growth

Several factors are driving the growth of the UK residential building construction industry. Government initiatives supporting affordable housing and infrastructure development stimulate construction activity. Technological advancements, such as BIM and prefabrication, improve efficiency and productivity. Strong population growth and urbanization create a sustained demand for new housing. Increased investment in regeneration projects in cities further drives market expansion. For example, the government’s commitment to building xx Million new homes by 2030 is a significant growth catalyst.

Challenges in the UK Residential Building Construction Industry Market

Long-term growth depends on addressing key challenges and leveraging opportunities. Continued investment in research and development of sustainable building materials and construction methods is crucial. Strategic partnerships between developers, contractors, and technology providers are necessary to foster innovation. Expansion into new markets, such as eco-friendly or retirement housing, can create new revenue streams. Government support for skills development and tackling labor shortages is vital to industry sustainability.

Emerging Opportunities in UK Residential Building Construction Industry

Emerging opportunities exist in various areas. The growing demand for sustainable and energy-efficient housing presents significant opportunities for firms offering green building solutions. The increasing adoption of smart home technologies creates opportunities for integrating intelligent systems into new constructions. Expansion into the modular and offsite construction market can improve efficiency and reduce construction time. Focus on creating affordable housing solutions for a growing population addresses critical social needs.

Leading Players in the UK Residential Building Construction Industry Sector

- Willmott Dixon Holdings

- Mace

- Skanska UK

- Winvic Group

- Balfour Beatty

- Kier Group

- Galliford Try

- Lendlease

- Bouygues UK

- Morgan Sindall Group

- Laing O'Rourke

Key Milestones in UK Residential Building Construction Industry Industry

- December 2022: Delivery of 375 low-carbon rental homes in Bristol City Centre through a public-private partnership, showcasing progress in sustainable housing initiatives.

- December 2022: Lendlease's One Sydney Harbour project reaches a critical milestone ("topping out"), securing over $3.7 Billion in sales, highlighting the strong market demand for high-end residential properties.

Strategic Outlook for UK Residential Building Construction Industry Market

The UK residential building construction industry is poised for continued growth, driven by sustained demand for housing, technological advancements, and government support. Strategic opportunities exist in sustainable construction, smart home integration, and offsite manufacturing. Addressing challenges like labor shortages and supply chain issues is crucial for ensuring consistent market expansion. Focusing on innovation, strategic partnerships, and market diversification will be key to capitalizing on future growth potential.

UK Residential Building Construction Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Condominiums and Apartments

-

2. Key Cities

- 2.1. London

- 2.2. Birmingham

- 2.3. Glasgow

- 2.4. Liverpool

- 2.5. Rest of the UK

UK Residential Building Construction Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Residential Building Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Government mandates pertaining to Energy Efficiency

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Condominiums and Apartments

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. London

- 5.2.2. Birmingham

- 5.2.3. Glasgow

- 5.2.4. Liverpool

- 5.2.5. Rest of the UK

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas and Landed Houses

- 6.1.2. Condominiums and Apartments

- 6.2. Market Analysis, Insights and Forecast - by Key Cities

- 6.2.1. London

- 6.2.2. Birmingham

- 6.2.3. Glasgow

- 6.2.4. Liverpool

- 6.2.5. Rest of the UK

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas and Landed Houses

- 7.1.2. Condominiums and Apartments

- 7.2. Market Analysis, Insights and Forecast - by Key Cities

- 7.2.1. London

- 7.2.2. Birmingham

- 7.2.3. Glasgow

- 7.2.4. Liverpool

- 7.2.5. Rest of the UK

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas and Landed Houses

- 8.1.2. Condominiums and Apartments

- 8.2. Market Analysis, Insights and Forecast - by Key Cities

- 8.2.1. London

- 8.2.2. Birmingham

- 8.2.3. Glasgow

- 8.2.4. Liverpool

- 8.2.5. Rest of the UK

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas and Landed Houses

- 9.1.2. Condominiums and Apartments

- 9.2. Market Analysis, Insights and Forecast - by Key Cities

- 9.2.1. London

- 9.2.2. Birmingham

- 9.2.3. Glasgow

- 9.2.4. Liverpool

- 9.2.5. Rest of the UK

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas and Landed Houses

- 10.1.2. Condominiums and Apartments

- 10.2. Market Analysis, Insights and Forecast - by Key Cities

- 10.2.1. London

- 10.2.2. Birmingham

- 10.2.3. Glasgow

- 10.2.4. Liverpool

- 10.2.5. Rest of the UK

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. England UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Residential Building Construction Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Willmott Dixon Holdings

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Mace

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Skanska UK

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Winvic Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Balfour Beatty

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Kier Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Galliford Try**List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Lendlease

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Bouygues UK

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Morgan Sindall Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Laing O'Rourke

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Willmott Dixon Holdings

List of Figures

- Figure 1: Global UK Residential Building Construction Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Residential Building Construction Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Residential Building Construction Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Residential Building Construction Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UK Residential Building Construction Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UK Residential Building Construction Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 7: North America UK Residential Building Construction Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 8: North America UK Residential Building Construction Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UK Residential Building Construction Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UK Residential Building Construction Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: South America UK Residential Building Construction Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America UK Residential Building Construction Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 13: South America UK Residential Building Construction Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 14: South America UK Residential Building Construction Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UK Residential Building Construction Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UK Residential Building Construction Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe UK Residential Building Construction Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe UK Residential Building Construction Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 19: Europe UK Residential Building Construction Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 20: Europe UK Residential Building Construction Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UK Residential Building Construction Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UK Residential Building Construction Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa UK Residential Building Construction Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa UK Residential Building Construction Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 25: Middle East & Africa UK Residential Building Construction Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 26: Middle East & Africa UK Residential Building Construction Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UK Residential Building Construction Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UK Residential Building Construction Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific UK Residential Building Construction Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific UK Residential Building Construction Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 31: Asia Pacific UK Residential Building Construction Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 32: Asia Pacific UK Residential Building Construction Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UK Residential Building Construction Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Residential Building Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Residential Building Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UK Residential Building Construction Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Global UK Residential Building Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UK Residential Building Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global UK Residential Building Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global UK Residential Building Construction Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 13: Global UK Residential Building Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global UK Residential Building Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global UK Residential Building Construction Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 19: Global UK Residential Building Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global UK Residential Building Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global UK Residential Building Construction Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 25: Global UK Residential Building Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global UK Residential Building Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global UK Residential Building Construction Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 37: Global UK Residential Building Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UK Residential Building Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global UK Residential Building Construction Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 46: Global UK Residential Building Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UK Residential Building Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Residential Building Construction Industry?

The projected CAGR is approximately 2.26%.

2. Which companies are prominent players in the UK Residential Building Construction Industry?

Key companies in the market include Willmott Dixon Holdings, Mace, Skanska UK, Winvic Group, Balfour Beatty, Kier Group, Galliford Try**List Not Exhaustive, Lendlease, Bouygues UK, Morgan Sindall Group, Laing O'Rourke.

3. What are the main segments of the UK Residential Building Construction Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 185.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Government mandates pertaining to Energy Efficiency.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

December 2022: 375 low-carbon rental homes are delivered as part of a historic restoration project for Bristol City Center through public-private partnerships.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Residential Building Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Residential Building Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Residential Building Construction Industry?

To stay informed about further developments, trends, and reports in the UK Residential Building Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence