Key Insights

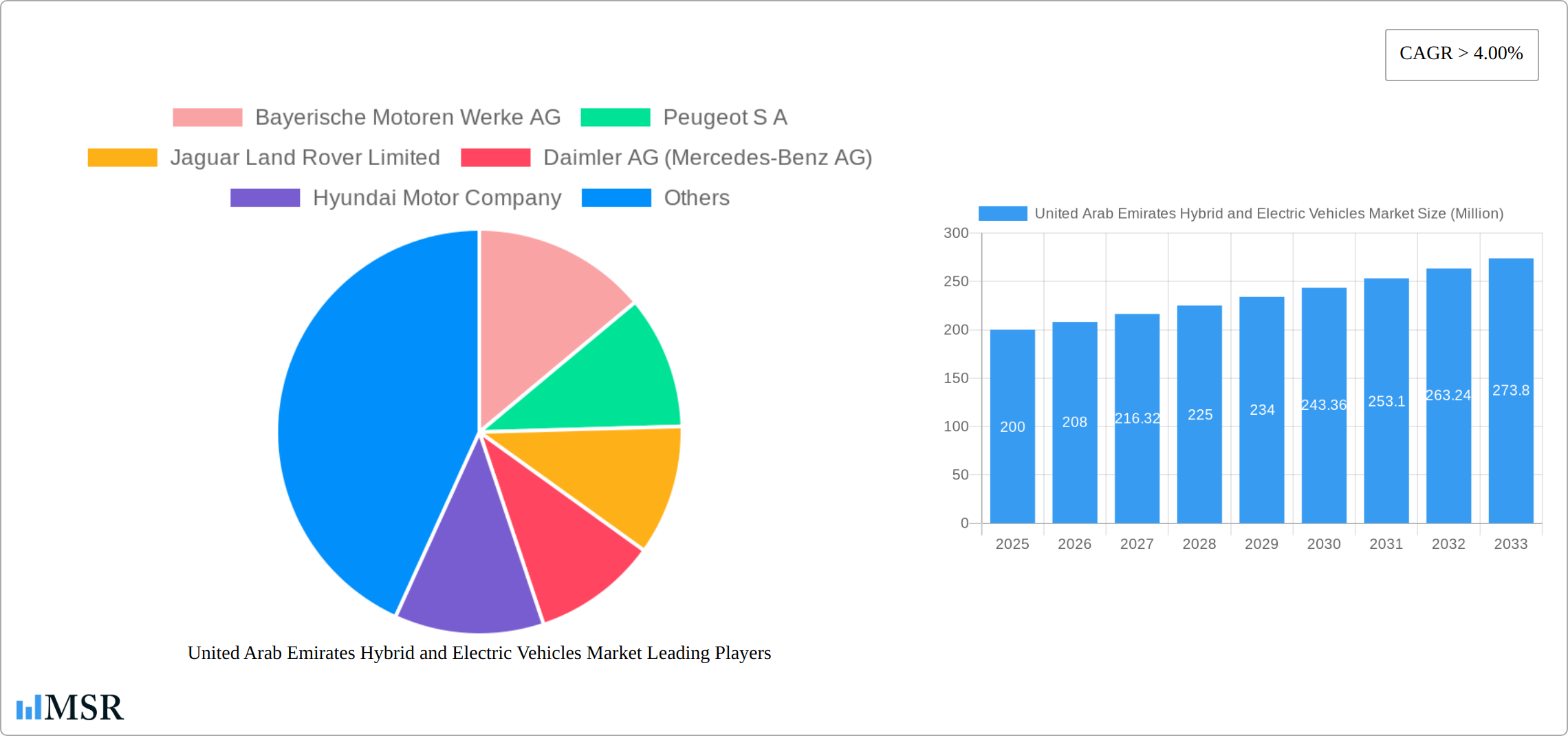

The United Arab Emirates (UAE) hybrid and electric vehicle (HEV/EV) market is experiencing robust growth, driven by government initiatives promoting sustainable transportation, rising fuel costs, and increasing environmental awareness among consumers. The market's Compound Annual Growth Rate (CAGR) exceeding 4% since 2019 indicates a significant upward trajectory. While precise market size data for the UAE specifically is absent, considering the global market trends and the UAE's commitment to sustainable development, a reasonable estimation places the 2025 market size at approximately $200 million USD, with projections exceeding $300 million by 2033. This growth is fueled by several factors including substantial investments in charging infrastructure, attractive government incentives for HEV/EV purchases, and the increasing availability of diverse models from major manufacturers such as BMW, Mercedes-Benz, Tesla, and Toyota. The luxury vehicle segment, encompassing brands like Porsche and Jaguar Land Rover, likely contributes significantly to the current market value, although the mass-market segment (represented by Hyundai and others) shows promising potential for future expansion as prices become more competitive and technology advances. However, challenges remain, including the high initial purchase price of EVs, range anxiety, and limited public charging infrastructure outside major urban centers. Addressing these concerns through continued government support and private sector investment will be crucial for sustaining the market’s rapid expansion.

The segmentation of the UAE HEV/EV market reflects global trends. Fuel categories like HEV (Hybrid Electric Vehicles), PHEV (Plug-in Hybrid Electric Vehicles), and FCEV (Fuel Cell Electric Vehicles) are all present, although PHEVs and BEVs (Battery Electric Vehicles – a subset of EVs) likely dominate. The vehicle types include passenger cars, two-wheelers, and commercial vehicles, with passenger cars expected to hold the largest share. Government regulations aimed at reducing carbon emissions and improving air quality are expected to further stimulate the adoption of HEVs and EVs across all segments in the coming years. The consistent influx of technologically advanced vehicles from global manufacturers underscores the strong investment confidence in the UAE's evolving automotive market. Despite initial challenges, the long-term outlook for the UAE HEV/EV market remains positive, signifying a significant shift towards sustainable mobility.

United Arab Emirates Hybrid and Electric Vehicles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning United Arab Emirates (UAE) hybrid and electric vehicles (HEV/EV) market, offering invaluable insights for stakeholders from 2019 to 2033. The study covers market size, growth drivers, key segments, competitive landscape, and future trends, leveraging data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Expect detailed breakdowns across vehicle types (passenger vehicles, two-wheelers, commercial vehicles, medium-duty commercial trucks), fuel categories (HEV, PHEV, FCEV), and leading players like Bayerische Motoren Werke AG, Peugeot S A, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Volvo Car A, Tesla Inc, Porsche, Groupe Renault, Audi AG, Toyota Motor Corporation, and Honda Motor Co Ltd. The report projects a market valued at xx Million by 2033.

United Arab Emirates Hybrid and Electric Vehicles Market Market Concentration & Dynamics

The UAE HEV/EV market presents a moderately concentrated competitive landscape, featuring a mix of established global and regional players vying for market dominance. Market concentration analysis, utilizing the Herfindahl-Hirschman Index (HHI) and detailed market share data for key participants, reveals a dynamic interplay of forces. Significant factors shaping market dynamics include ongoing innovation in battery technology, the expansion of charging infrastructure, and advancements in vehicle design and performance. The UAE's proactive regulatory environment, encompassing substantial incentives and stringent emission standards, serves as a catalyst for market expansion. Substitute products, primarily conventional internal combustion engine (ICE) vehicles, face intensifying pressure due to escalating fuel costs and growing environmental consciousness. End-user trends reveal a clear shift towards sustainable transportation alternatives, particularly among younger demographics, further accelerating the transition. While mergers and acquisitions (M&A) activity has been relatively subdued in recent years (with xx M&A deals recorded between 2019 and 2024), a notable increase is anticipated as the market matures and consolidates.

- Market Share (2024): Toyota and BMW maintain leading market share positions, holding xx% and xx%, respectively. Other prominent players, such as Tesla and Hyundai, collectively command a market share of xx%.

- M&A Activity (Forecast 2025-2033): The projected increase in M&A activity over the next decade (estimated xx deals) is primarily driven by the pursuit of market expansion and the acquisition of crucial technologies.

- Regulatory Framework: Government-sponsored incentives, such as subsidies and tax reductions, play a pivotal role in driving market penetration and affordability.

- Innovation Ecosystem: Strategic collaborations between automotive manufacturers, technology providers, and research institutions are fostering rapid innovation in battery technology and charging infrastructure development.

United Arab Emirates Hybrid and Electric Vehicles Market Industry Insights & Trends

The UAE HEV/EV market is experiencing robust and sustained growth, fueled by a confluence of factors including heightened environmental awareness, strong government backing for sustainable transportation solutions, and the continuous decline in battery production costs. The market achieved a size of xx Million in 2024 and is projected to reach xx Million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements, such as breakthroughs in battery technology and the integration of autonomous driving features, are significantly shaping the market's evolution. Consumer preferences are demonstrably shifting towards environmentally friendly vehicles, with a marked preference for electric vehicles over hybrid counterparts. This increasing adoption of electric mobility is further supported by the ongoing expansion of the charging infrastructure network across the UAE. Government-led initiatives designed to accelerate the widespread adoption of electric vehicles are expected to further propel market growth.

Key Markets & Segments Leading United Arab Emirates Hybrid and Electric Vehicles Market

The passenger vehicle segment clearly dominates the UAE HEV/EV market, accounting for xx% of total sales in 2024. Within the fuel category breakdown, HEVs currently hold a larger market share than PHEVs and FCEVs, primarily due to lower initial acquisition costs and wider availability. However, growth drivers exhibit nuanced variations across different segments:

Passenger Vehicles:

- Economic Growth: Sustained economic growth and rising disposable incomes are driving demand, particularly for premium electric vehicle models.

- Government Initiatives: Subsidies and tax incentives are making electric vehicles more financially accessible to a broader consumer base.

- Infrastructure Development: The continuous expansion of the charging infrastructure network is enhancing consumer confidence and reducing range anxiety.

Two-Wheelers:

- Affordability: Electric two-wheelers provide a cost-effective alternative to gasoline-powered counterparts, appealing to budget-conscious consumers.

- Urban Mobility: Their maneuverability and efficiency make them ideal for navigating congested urban environments.

Commercial Vehicles:

- Fleet Electrification: Businesses are increasingly adopting electric fleets to reduce operational costs, meet environmental regulations, and enhance their sustainability image.

Fuel Category:

- HEVs' established presence and relatively lower cost contribute to their continued market dominance.

- PHEVs are witnessing growing traction, but high initial costs remain a barrier to wider adoption.

- FCEVs currently maintain a limited market share due to the high cost of infrastructure development and deployment.

United Arab Emirates Hybrid and Electric Vehicles Market Product Developments

Recent product developments focus on enhancing battery range, improving charging speeds, and incorporating advanced driver-assistance systems (ADAS). Manufacturers are also emphasizing design and luxury features to attract consumers. Tesla's Software Version 11.0, with new features and user interface improvements, demonstrates the ongoing innovation in vehicle software and user experience. These advancements enhance the overall appeal and competitiveness of HEV/EVs, driving market growth.

Challenges in the United Arab Emirates Hybrid and Electric Vehicles Market Market

The UAE HEV/EV market faces challenges such as the high initial cost of electric vehicles compared to ICE vehicles, limited charging infrastructure in certain areas, and the relatively long charging times for some models. Supply chain disruptions, particularly for battery components, may hinder growth. Furthermore, the lack of consumer awareness regarding the benefits of HEV/EVs remains a barrier. These factors combined can affect the market penetration rate and overall growth.

Forces Driving United Arab Emirates Hybrid and Electric Vehicles Market Growth

Key growth drivers include:

- Government support: Substantial government investment in charging infrastructure and subsidies is accelerating adoption.

- Technological advancements: Improvements in battery technology, charging speed, and vehicle range are making EVs more appealing.

- Environmental concerns: Growing awareness of climate change is increasing demand for eco-friendly vehicles.

- Falling battery prices: Reduced battery costs make EVs increasingly affordable.

Long-Term Growth Catalysts in the United Arab Emirates Hybrid and Electric Vehicles Market

Long-term growth hinges on continued investment in charging infrastructure, technological innovations such as solid-state batteries and advanced autonomous driving systems, and successful collaborations between automotive manufacturers and energy providers. Expansion of the public transportation system using electric vehicles will create further market opportunities. The development of hydrogen-based fueling infrastructure could also play a significant role in the growth of FCEVs in the long term.

Emerging Opportunities in United Arab Emirates Hybrid and Electric Vehicles Market

Significant emerging opportunities within the UAE HEV/EV market include the expanding market for electric two-wheelers, the growing demand for commercial electric vehicles, and the potential for the widespread adoption of innovative battery technologies such as solid-state batteries. Moreover, the integration of smart grid technologies and Vehicle-to-Grid (V2G) systems presents opportunities for revenue generation and grid stabilization. Finally, the market also presents promising prospects for companies specializing in sustainable battery recycling and comprehensive waste management solutions.

Leading Players in the United Arab Emirates Hybrid and Electric Vehicles Market Sector

- Bayerische Motoren Werke AG

- Peugeot S A

- Jaguar Land Rover Limited

- Daimler AG (Mercedes-Benz AG)

- Hyundai Motor Company

- Volvo Car A

- Tesla Inc

- Porsche

- Groupe Renault

- Audi AG

- Toyota Motor Corporation

- Honda Motor Co Ltd

Key Milestones in United Arab Emirates Hybrid and Electric Vehicles Market Industry

- December 2023: Honda launched the e:NP1 Plus, expanding its EV offerings and strengthening its presence in the UAE market.

- December 2023: Toyota's announcement of a $35 billion investment to introduce 30 battery electric vehicle models by 2030 signals a substantial commitment to the future of the EV market.

- December 2023: Tesla's release of Software Version 11.0 highlights the continuous evolution of in-vehicle technology, enhancing user experience with features such as new games and an updated navigation system.

Strategic Outlook for United Arab Emirates Hybrid and Electric Vehicles Market Market

The UAE HEV/EV market presents significant growth potential, driven by supportive government policies, technological advancements, and growing environmental awareness. Strategic opportunities lie in investing in charging infrastructure, developing innovative battery technologies, and focusing on consumer education to drive market adoption. Companies should also explore partnerships with government agencies and energy providers to maximize market penetration and establish a strong foothold in this rapidly evolving sector. The long-term outlook is positive, with the market poised for sustained growth throughout the forecast period.

United Arab Emirates Hybrid and Electric Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

- 1.2. Passenger Vehicles

- 1.3. Two-Wheelers

-

1.1. Commercial Vehicles

-

2. Fuel Category

- 2.1. FCEV

- 2.2. HEV

- 2.3. PHEV

United Arab Emirates Hybrid and Electric Vehicles Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Hybrid and Electric Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.2. Passenger Vehicles

- 5.1.3. Two-Wheelers

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. FCEV

- 5.2.2. HEV

- 5.2.3. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Bahamas

- 6.1.2 Jamaica

- 7. Europe United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Ireland

- 8. Asia Pacific United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Japan

- 8.1.2 Malaysia

- 8.1.3 Indonesia

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. Middle East and Africa United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 South Africa

- 9.1.2 Uganda

- 9.1.3 Kenya

- 9.1.4 Rest of Middle East and Africa

- 10. South America United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Guyana

- 10.1.2 Suriname

- 10.1.3 Falkland Islands

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bayerische Motoren Werke AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Peugeot S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jaguar Land Rover Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Daimler AG (Mercedes-Benz AG)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hyundai Motor Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Volvo Car A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tesla Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Porsche

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Groupe Renault

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Audi AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Toyota Motor Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Honda Motor Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Hybrid and Electric Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bahamas United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Jamaica United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Japan United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Malaysia United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Australia United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South Africa United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Uganda United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Middle East and Africa United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Guyana United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Suriname United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Falkland Islands United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 28: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Hybrid and Electric Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United Arab Emirates Hybrid and Electric Vehicles Market?

Key companies in the market include Bayerische Motoren Werke AG, Peugeot S A, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Volvo Car A, Tesla Inc, Porsche, Groupe Renault, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd.

3. What are the main segments of the United Arab Emirates Hybrid and Electric Vehicles Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

December 2023: Honda has launched e:NP1 Plus in 2023.December 2023: Toyota have a plan to spend $35bn to introduce 30 battery electric vehicle line-up by 2030.December 2023: Tesla has introduced the Software Version 11.0 with new user interface, games, updated navigation and many features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Hybrid and Electric Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Hybrid and Electric Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Hybrid and Electric Vehicles Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Hybrid and Electric Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence