Key Insights

Canada's automotive actuators market is poised for significant expansion, driven by the escalating integration of Advanced Driver-Assistance Systems (ADAS) and the surging demand for electric and hybrid vehicles. The market's growth trajectory is underpinned by several pivotal factors. Foremost is the increasing adoption of actuators across diverse vehicle systems, including throttle control, seat adjustment, braking, and closure mechanisms, a trend amplified by the pursuit of enhanced vehicle automation and passenger comfort. Concurrently, the transition to electric and hybrid powertrains is accelerating the demand for electric actuators, recognized for their superior efficiency and precision over hydraulic and pneumatic alternatives. While passenger cars currently represent the largest market segment, commercial vehicles are anticipated to experience substantial growth, propelled by the rising need for automated fleets and improved safety standards. Major industry players, including Denso, Nidec, and Bosch, are actively investing in research and development to pioneer next-generation actuator technologies aligning with the automotive industry's evolving requirements. Additionally, regulatory mandates for enhanced vehicle safety and fuel efficiency are indirectly stimulating market expansion. Despite facing challenges such as supply chain disruptions and volatile raw material costs, the overall market outlook remains robust.

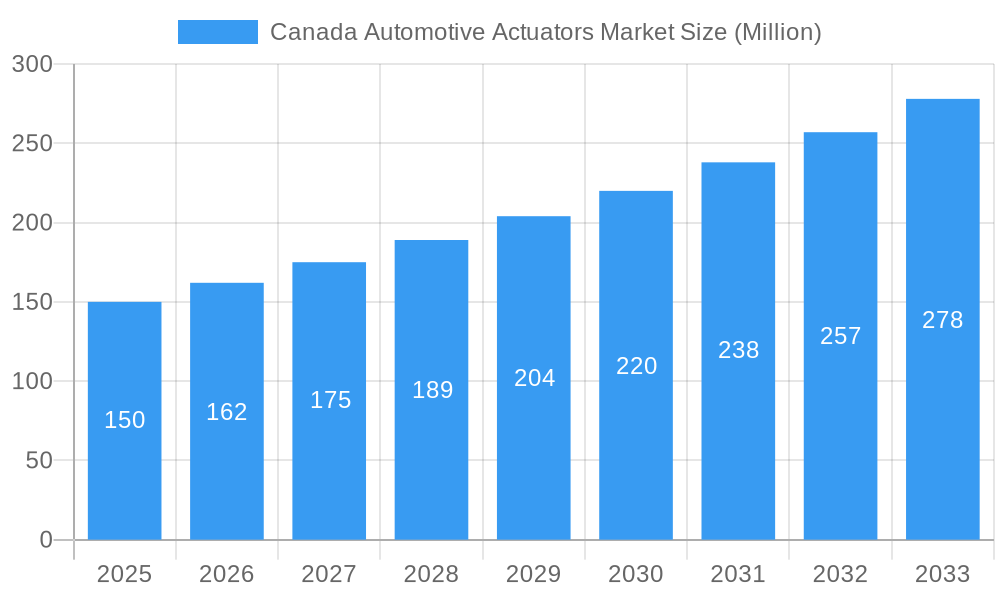

Canada Automotive Actuators Market Market Size (In Billion)

For the forecast period spanning 2025-2033, the Canadian automotive actuators market is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.6%. This growth will be primarily propelled by continuous advancements in automotive technology and the expanded integration of actuators in a wide array of vehicle applications. Market segmentation by application type (e.g., throttle, seat, brake, closure actuators) and vehicle type (passenger cars and commercial vehicles) offers crucial insights into the distinct dynamics within each segment. A granular regional analysis, encompassing Eastern, Western, and Central Canada, will further elucidate market activity distribution and potential regional growth variations, essential for developing targeted market entry strategies and optimizing resource allocation. The competitive landscape, featuring established global manufacturers and specialized component providers, signifies a dynamic and evolving market.

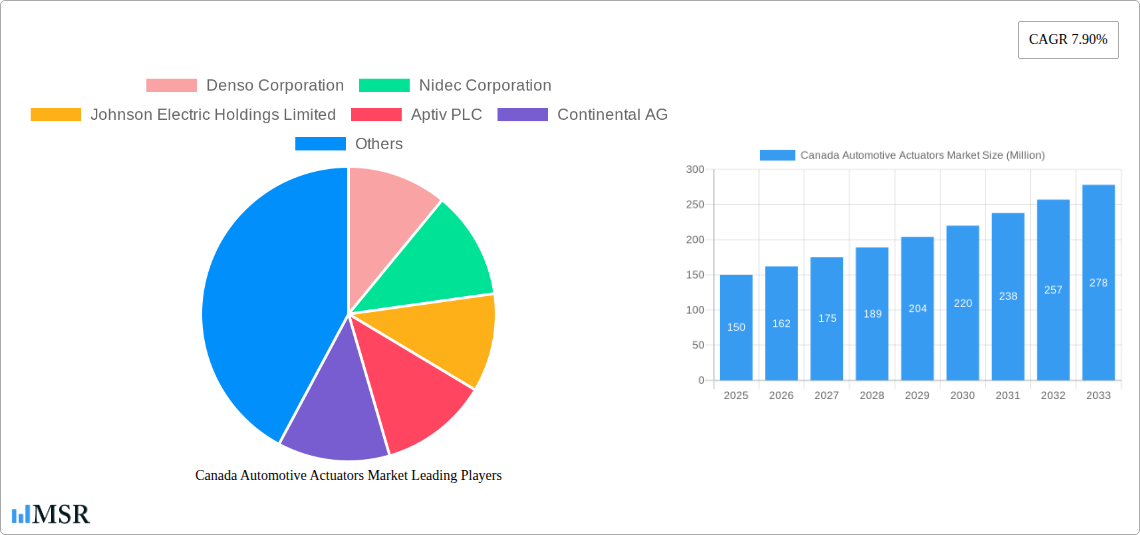

Canada Automotive Actuators Market Company Market Share

The estimated market size for automotive actuators in Canada is valued at $23,576.68 million as of the base year 2025.

Canada Automotive Actuators Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Automotive Actuators Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report dissects market dynamics, leading players, and future growth trajectories. The study meticulously analyzes key segments including Application Type (Throttle Actuator, Seat Adjustment Actuator, Brake Actuator, Closure Actuator, Other), Vehicle Type (Passenger Car, Commercial Vehicle), and Actuators Type (Electrical actuators, Hydraulic actuators, Pneumatic actuators). Expect detailed data, insightful analysis, and actionable recommendations to navigate this dynamic market.

Canada Automotive Actuators Market Market Concentration & Dynamics

The Canadian automotive actuators market exhibits a moderately concentrated landscape, with key players like Denso Corporation, Nidec Corporation, and Bosch vying for market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and strategic partnerships. The innovative ecosystem is characterized by a steady stream of R&D investments focused on improving actuator efficiency, durability, and integration with advanced driver-assistance systems (ADAS). Stringent government regulations concerning vehicle safety and emissions play a significant role in shaping market dynamics. Substitute products, such as manually operated systems, pose limited competition due to the increasing preference for automated features in modern vehicles. End-user trends indicate a growing demand for enhanced comfort, safety, and fuel efficiency, driving the adoption of advanced actuators. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx M&A deals recorded between 2019 and 2024, mostly focused on expanding product portfolios and strengthening market presence.

- Market Share (2024): Denso Corporation (xx%), Nidec Corporation (xx%), Bosch (xx%), Others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: Canadian Motor Vehicle Safety Standards (CMVSS).

Canada Automotive Actuators Market Industry Insights & Trends

The Canadian automotive actuators market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily driven by the increasing demand for passenger and commercial vehicles, fueled by economic expansion and rising disposable incomes. Technological advancements, particularly in electric and hybrid vehicles, are creating new opportunities for advanced actuators with improved energy efficiency and performance. Evolving consumer preferences toward enhanced vehicle features, such as automated climate control and power-adjustable seats, further fuel market expansion. The market size in 2024 was estimated at $xx Million, and it is projected to reach $xx Million by 2033. The growth is also influenced by the increasing adoption of ADAS and autonomous driving features, requiring sophisticated and reliable actuators for precise control and safety.

Key Markets & Segments Leading Canada Automotive Actuators Market

The passenger car segment currently dominates the Canadian automotive actuators market, accounting for approximately xx% of the total market share in 2024. However, the commercial vehicle segment is expected to witness faster growth during the forecast period, driven by increasing demand for heavy-duty vehicles in the logistics and transportation sectors.

Dominant Segments:

- Vehicle Type: Passenger Cars (xx% market share in 2024)

- Application Type: Throttle Actuators (xx% market share in 2024), followed by Seat Adjustment Actuators.

- Actuators Type: Electrical actuators hold the largest market share due to their efficiency and precision.

Growth Drivers:

- Economic Growth: Expanding Canadian economy boosts vehicle sales.

- Infrastructure Development: Investments in transportation infrastructure fuel demand for commercial vehicles.

- Technological Advancements: Electric and autonomous vehicle trends.

Canada Automotive Actuators Market Product Developments

Recent product developments in the Canadian automotive actuators market focus on miniaturization, improved energy efficiency, and enhanced integration with advanced driver-assistance systems (ADAS). Manufacturers are investing in the development of smart actuators with embedded sensors and control systems to optimize performance and reduce maintenance needs. These innovations enhance vehicle safety, fuel economy, and driving comfort, providing a significant competitive edge in the market.

Challenges in the Canada Automotive Actuators Market Market

The Canadian automotive actuators market faces challenges such as fluctuating raw material prices, increasing competition from international manufacturers, and the complexities of integrating advanced actuators into modern vehicles. Supply chain disruptions and potential trade restrictions can also impact market growth. The volatility in the global automotive industry also adds to the uncertainty in market forecasts. These factors may result in a xx% reduction in projected market growth in specific years.

Forces Driving Canada Automotive Actuators Market Growth

The Canadian automotive actuators market growth is propelled by technological advancements in electric and autonomous vehicles, leading to the need for more sophisticated and efficient actuators. Economic growth and increasing vehicle production further boost demand. Supportive government regulations related to vehicle safety and emissions standards create a favorable environment for market expansion.

Challenges in the Canada Automotive Actuators Market Market

Long-term growth in the Canadian automotive actuators market is reliant on continuous innovation, strategic partnerships, and expansion into new market segments, particularly in commercial vehicles and autonomous driving technologies. Investments in R&D, focusing on lightweight materials and improved actuator efficiency, will be crucial for sustained growth. Furthermore, navigating the evolving regulatory landscape and ensuring a secure and resilient supply chain will play a pivotal role in long-term success.

Emerging Opportunities in Canada Automotive Actuators Market

Emerging opportunities lie in the integration of actuators with advanced driver-assistance systems (ADAS) and autonomous driving technologies. The rising demand for electric and hybrid vehicles presents significant opportunities for manufacturers of energy-efficient actuators. Expansion into niche markets, such as specialized commercial vehicles and off-road equipment, also presents a growth pathway. Moreover, exploring new materials and designs to reduce weight and improve performance will create new market avenues.

Leading Players in the Canada Automotive Actuators Market Sector

- Denso Corporation

- Nidec Corporation

- Johnson Electric Holdings Limited

- Aptiv PLC

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Hitachi Ltd

- Stoneridge Inc

- Mitsubishi Electric

Key Milestones in Canada Automotive Actuators Market Industry

- 2020: Introduction of new electric actuator models by Denso Corporation.

- 2022: Strategic partnership between Nidec Corporation and a Canadian automotive manufacturer.

- 2023: Launch of a new generation of brake actuators with improved safety features by Bosch.

- 2024: Significant investment in R&D for advanced actuator technologies by Aptiv PLC.

Strategic Outlook for Canada Automotive Actuators Market Market

The Canadian automotive actuators market presents a significant growth opportunity over the next decade. Continued technological advancements, coupled with rising demand for advanced vehicle features, will drive market expansion. Strategic partnerships, focused R&D investments, and proactive adaptation to evolving regulatory landscapes will be crucial for success. Companies that can effectively address supply chain challenges and offer innovative, cost-effective solutions will be well-positioned to capture significant market share.

Canada Automotive Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Actuators Type

- 2.1. Electrical actuators

- 2.2. Hydraulic actuators

- 2.3. Pneumatic actuators

-

3. Application Type

- 3.1. Throttle Actuator

- 3.2. Seat Adjustment Actuator

- 3.3. Brake Actuator

- 3.4. Closure Actuator

- 3.5. Other

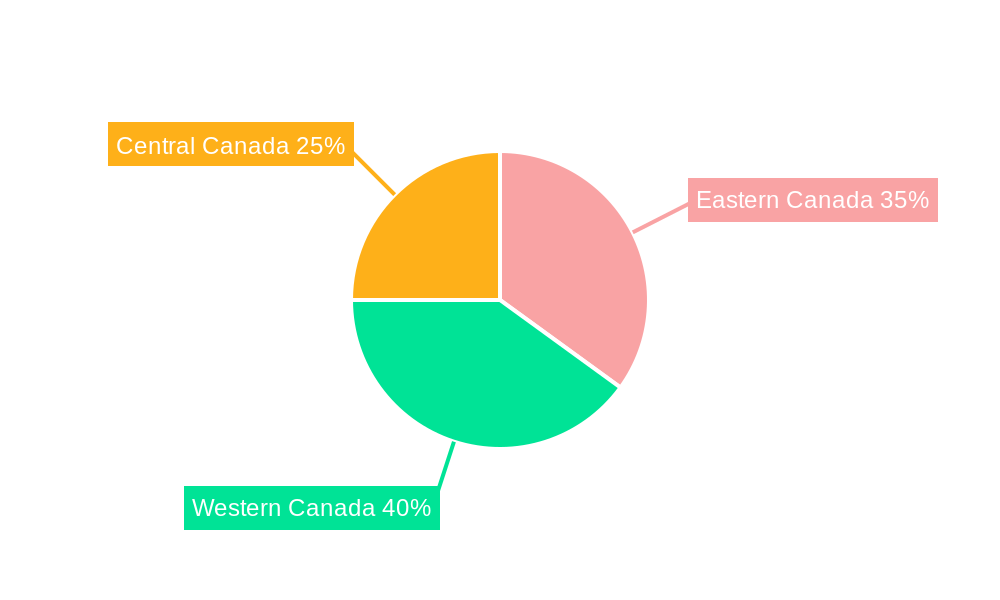

Canada Automotive Actuators Market Segmentation By Geography

- 1. Canada

Canada Automotive Actuators Market Regional Market Share

Geographic Coverage of Canada Automotive Actuators Market

Canada Automotive Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electrification of Vehicles

- 3.3. Market Restrains

- 3.3.1. Precise Testing and Validation

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Actuators Type

- 5.2.1. Electrical actuators

- 5.2.2. Hydraulic actuators

- 5.2.3. Pneumatic actuators

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Throttle Actuator

- 5.3.2. Seat Adjustment Actuator

- 5.3.3. Brake Actuator

- 5.3.4. Closure Actuator

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Electric Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stoneridge Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Canada Automotive Actuators Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Canada Automotive Actuators Market Revenue million Forecast, by Actuators Type 2020 & 2033

- Table 3: Canada Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canada Automotive Actuators Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canada Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Canada Automotive Actuators Market Revenue million Forecast, by Actuators Type 2020 & 2033

- Table 7: Canada Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canada Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Actuators Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Automotive Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Johnson Electric Holdings Limited, Aptiv PLC, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Hitachi Lt, Stoneridge Inc, Mitsubishi Electric.

3. What are the main segments of the Canada Automotive Actuators Market?

The market segments include Vehicle Type, Actuators Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23576.68 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electrification of Vehicles.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow.

7. Are there any restraints impacting market growth?

Precise Testing and Validation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Actuators Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence