Key Insights

The United States vans market is projected for robust growth, driven by the surging demand in last-mile delivery solutions, largely attributed to the expansion of e-commerce. This dynamic sector is characterized by an increasing preference for fuel-efficient and sustainable vehicle options. A significant trend is the industry-wide shift towards hybrid and electric van propulsion systems, influenced by stringent environmental regulations and corporate sustainability objectives. The market size in 2025 is estimated at $11.79 billion, with a projected Compound Annual Growth Rate (CAGR) of 5.73% from the base year 2025 to 2033.

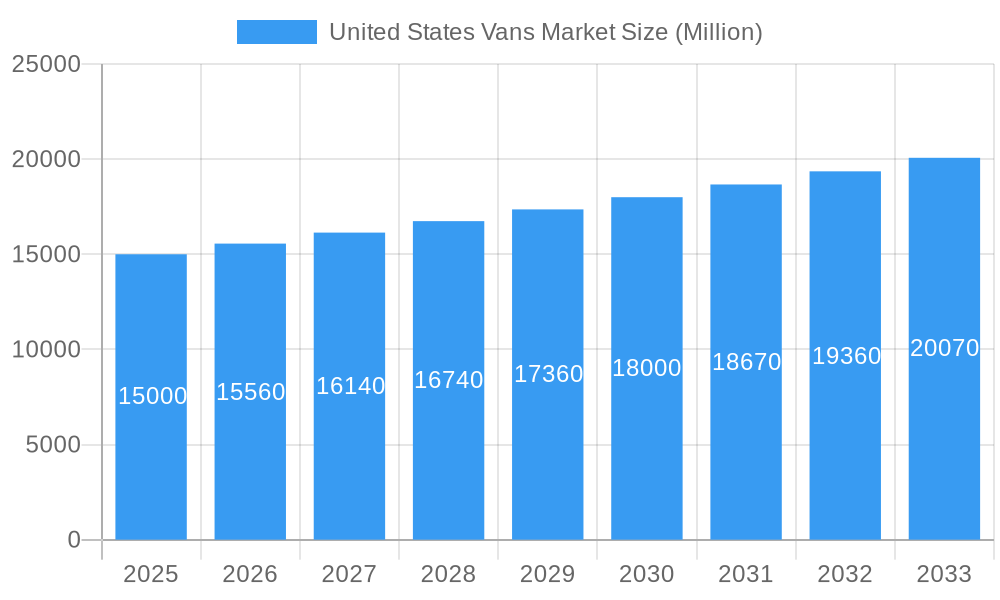

United States Vans Market Market Size (In Billion)

Key growth drivers include the ongoing evolution of battery technology and the expansion of charging infrastructure, which are anticipated to accelerate the adoption of electric vans. Despite challenges such as fluctuating raw material costs and persistent semiconductor chip shortages impacting production, the market presents numerous opportunities. Intense competition among established manufacturers like Ford, GM, and Ram Trucks, alongside new entrants in the electric van segment, fosters continuous innovation. The dominance of gasoline-powered vans is expected to decline as electric and hybrid alternatives become more accessible and technologically superior. The market is segmented by propulsion type (Gasoline, Hybrid, Electric), offering detailed insights into evolving consumer preferences and growth potentials.

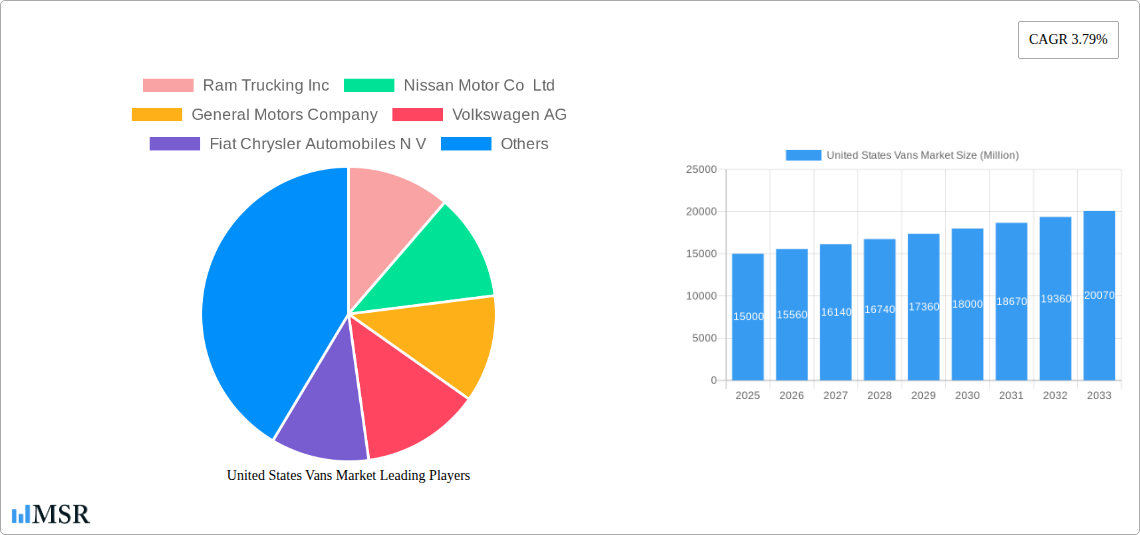

United States Vans Market Company Market Share

Looking ahead to 2033, the US vans market is forecast to reach approximately $25 billion. Companies aiming for sustained success must prioritize technological advancements, optimize supply chain resilience, and implement strategic marketing initiatives to address the growing demand for eco-friendly and efficient transportation solutions. Tailored regional strategies will be crucial for maximizing market penetration and impact.

United States Vans Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States vans market, encompassing market dynamics, industry trends, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic sector. The market size in 2025 is estimated at xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033.

United States Vans Market Market Concentration & Dynamics

This section assesses the competitive landscape of the U.S. vans market, analyzing market concentration, innovation, regulatory factors, and market activity. The market exhibits a moderately consolidated structure, with key players holding significant market share. For example, Ford Motor Company and General Motors Company likely command a substantial portion of the gasoline-powered van segment. The emergence of electric vans is disrupting this established structure, creating opportunities for new entrants and challenging incumbents.

- Market Share: Ford and GM are estimated to hold a combined xx% market share in 2025, while other major players like Stellantis (Fiat Chrysler Automobiles N V and others), Nissan, and Volkswagen hold significant, yet smaller shares. Precise figures require further proprietary data analysis.

- M&A Activity: The number of mergers and acquisitions in the U.S. vans market during the historical period (2019-2024) averaged approximately xx deals per year, indicating considerable industry consolidation and strategic maneuvering. This activity is projected to increase slightly in the forecast period due to the shift toward electric vehicles.

- Innovation Ecosystems: The market is characterized by a robust innovation ecosystem, with significant investment in electric vehicle (EV) technology and autonomous driving capabilities. This is driven by both established automakers and emerging EV startups.

- Regulatory Framework: Stringent emission regulations and fuel efficiency standards are shaping the market, incentivizing the adoption of fuel-efficient and electric vans. Furthermore, safety regulations are driving the development of advanced safety features in commercial vans.

- Substitute Products: Alternative transportation solutions, such as ride-sharing services and freight delivery by rail, represent partial substitutes. However, the inherent advantages of vans for certain applications ensure continued demand.

- End-User Trends: The increasing demand for last-mile delivery solutions, coupled with the growth of e-commerce, is a primary driver of market expansion. Businesses are increasingly seeking efficient and reliable van solutions for delivery operations, driving demand for various van types and technological enhancements.

United States Vans Market Industry Insights & Trends

The U.S. vans market is experiencing significant transformation driven by technological advancements, evolving consumer preferences, and macroeconomic factors. The market size experienced a robust growth in the historical period (2019-2024) reaching xx Million in 2024. The continued growth is projected across the forecast period (2025-2033), with an anticipated expansion to xx Million by 2033. This growth is largely attributable to the increasing demand for last-mile delivery services, the expansion of e-commerce, and ongoing fleet renewal among commercial users. Technological advancements such as electric and hybrid powertrains, along with advanced driver-assistance systems (ADAS), are enhancing the operational efficiency and appeal of vans, fueling demand. Moreover, evolving consumer preferences towards environmentally friendly vehicles are also pushing the market transition towards electrification. The increasing adoption of electric and hybrid vans is likely to significantly impact the market structure and intensify competition.

Key Markets & Segments Leading United States Vans Market

The U.S. vans market is segmented primarily by propulsion type: gasoline, hybrid, and electric vehicles. While gasoline-powered vans still dominate the market, a shift towards hybrid and electric vans is evident, particularly in the commercial sector. California and other states with stringent emission regulations are leading the adoption of electric vans.

- Gasoline Vans: This segment currently holds the largest market share due to established infrastructure and lower initial costs compared to electric vans.

- Hybrid Vans: This segment is growing steadily due to better fuel efficiency and lower emissions compared to purely gasoline-powered vans.

- Electric Vans: This segment exhibits the fastest growth rate, driven by increasing environmental concerns, government incentives, and technological advancements in battery technology.

Drivers:

- Economic Growth: Strong economic conditions, particularly in e-commerce and logistics, fuel demand for vans for delivery services.

- Infrastructure Development: Investments in charging infrastructure and supportive government policies are bolstering electric van adoption.

United States Vans Market Product Developments

Recent product innovations focus on improving fuel efficiency, enhancing safety features, and integrating advanced technologies such as telematics and ADAS. The introduction of electric and hybrid variants is significantly impacting the market, offering enhanced environmental performance and reduced running costs. Features like improved cargo space, enhanced driver comfort, and strengthened safety specifications are key differentiators among competing models. These developments are enhancing the overall utility and competitive appeal of vans, both in commercial and personal segments.

Challenges in the United States Vans Market Market

The U.S. vans market faces challenges including: increasing raw material costs, supply chain disruptions impacting production and delivery timelines, and intense competition from both established and new market entrants. Government regulations on emissions and fuel efficiency necessitate continuous investment in technological advancements. The rising cost of EV batteries also presents a significant challenge for the widespread adoption of electric vans. This impacts both the purchasing price and the total cost of ownership.

Forces Driving United States Vans Market Growth

The market is primarily driven by the exponential growth of e-commerce, necessitating efficient last-mile delivery solutions. Furthermore, government incentives and supportive regulations, especially for electric vans, are significantly boosting market growth. Technological advancements leading to improved fuel efficiency, enhanced safety features, and the integration of advanced technologies also contribute to market expansion.

Challenges in the United States Vans Market Market (Long-Term Growth Catalysts)

Long-term growth is predicated on successful technological innovation leading to even more efficient and cost-effective electric vehicles, along with expanded charging infrastructure. Strategic partnerships between automotive manufacturers and charging network providers will play a crucial role. Market expansion into new segments and geographic areas also provides significant potential for long-term growth.

Emerging Opportunities in United States Vans Market

Emerging opportunities include the expanding market for autonomous delivery vans, the development of specialized vans for niche applications, and the increasing demand for connected van technologies. The adoption of subscription models for van usage is also gaining traction, creating new avenues for revenue generation. Furthermore, the focus on sustainable logistics and environmentally friendly solutions offers significant growth potential.

Leading Players in the United States Vans Market Sector

- Ram Trucking Inc

- Nissan Motor Co Ltd

- General Motors Company

- Volkswagen AG

- Fiat Chrysler Automobiles N V

- Daimler AG (Mercedes-Benz AG)

- Workhorse Group Inc

- IVECO S p A

- GM Motor (Chevrolet)

- Ford Motor Company

Key Milestones in United States Vans Market Industry

- June 2023: FORD NEXT launches a new pilot program offering flexible electric van leasing solutions for Uber drivers in select U.S. markets. This initiative boosts EV adoption among a key demographic.

- June 2023: Stellantis secures a deal with Merchants Fleet for 12,500 Ram ProMaster EV units over several years. This large-scale commercial order signifies growing confidence in the EV market segment.

- June 2023: Mercedes-Benz expands the availability of its DRIVE PILOT Level 3 autonomous driving system to California, marking a significant milestone in the adoption of advanced driver-assistance systems in production vehicles.

Strategic Outlook for United States Vans Market Market

The U.S. vans market presents a strong outlook for growth, particularly within the electric and hybrid vehicle segments. Strategic partnerships, continuous technological advancements, and the expansion of charging infrastructure are key factors shaping future market potential. Companies that can effectively manage supply chain challenges and adapt to evolving consumer preferences will be well-positioned for success in this dynamic market.

United States Vans Market Segmentation

-

1. Propulsion Type

-

1.1. Hybrid and Electric Vehicles

-

1.1.1. By Fuel Category

- 1.1.1.1. BEV

- 1.1.1.2. HEV

-

1.1.1. By Fuel Category

-

1.2. ICE

- 1.2.1. Diesel

- 1.2.2. Gasoline

-

1.1. Hybrid and Electric Vehicles

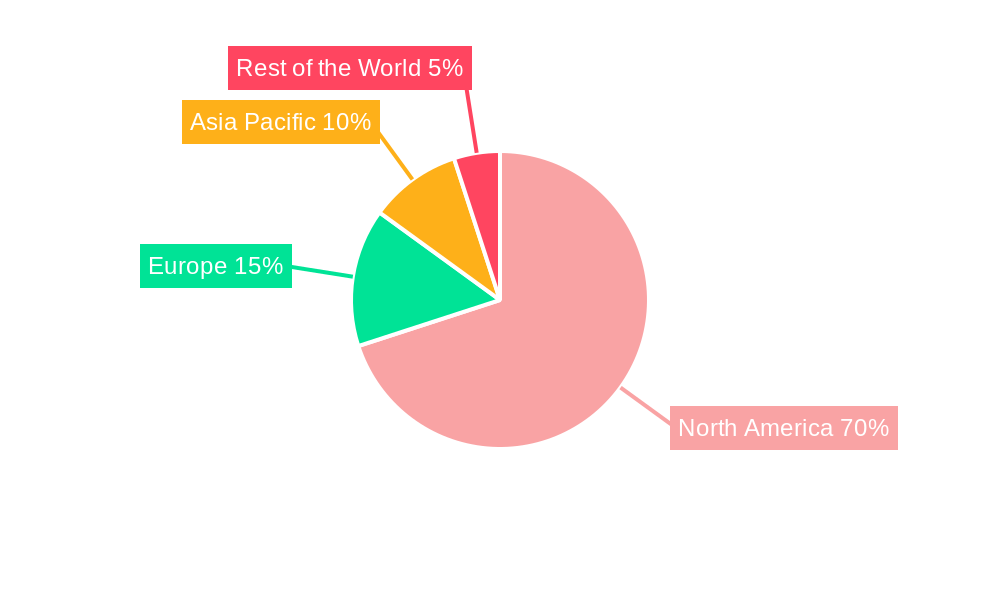

United States Vans Market Segmentation By Geography

- 1. United States

United States Vans Market Regional Market Share

Geographic Coverage of United States Vans Market

United States Vans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Small Boats; Expanding Recreational Boating Opportunities

- 3.3. Market Restrains

- 3.3.1. Strict Emission Norms for Recreation Boats Likely to Have Negative Impact

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Vans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.1.1. By Fuel Category

- 5.1.1.1.1. BEV

- 5.1.1.1.2. HEV

- 5.1.1.1. By Fuel Category

- 5.1.2. ICE

- 5.1.2.1. Diesel

- 5.1.2.2. Gasoline

- 5.1.1. Hybrid and Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ram Trucking Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Motors Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fiat Chrysler Automobiles N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daimler AG (Mercedes-Benz AG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Workhorse Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IVECO S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GM Motor (Chevrolet)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ford Motor Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ram Trucking Inc

List of Figures

- Figure 1: United States Vans Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Vans Market Share (%) by Company 2025

List of Tables

- Table 1: United States Vans Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 2: United States Vans Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: United States Vans Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 4: United States Vans Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Vans Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the United States Vans Market?

Key companies in the market include Ram Trucking Inc, Nissan Motor Co Ltd, General Motors Company, Volkswagen AG, Fiat Chrysler Automobiles N V, Daimler AG (Mercedes-Benz AG), Workhorse Group Inc, IVECO S p A, GM Motor (Chevrolet), Ford Motor Company.

3. What are the main segments of the United States Vans Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Small Boats; Expanding Recreational Boating Opportunities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Strict Emission Norms for Recreation Boats Likely to Have Negative Impact.

8. Can you provide examples of recent developments in the market?

June 2023: FORD NEXT launches New pilot program creates flexible electric solutions for drivers who use the Uber platform in select U.S. markets, allowing them to lease a vehicle for more customized time periods.June 2023: Stellantis adds Merchants Fleet as latest Ram ProMaster EV commercial customer and that agreement calls for 12,500 Ram ProMaster EV units over the next several years.June 2023: Mercedes-Benz DRIVE PILOT expands U.S. availability to California and introduce a SAE Level 3 system in a standard-production vehicle for use on public freeways in the most populous state in the U.S.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Vans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Vans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Vans Market?

To stay informed about further developments, trends, and reports in the United States Vans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence