Key Insights

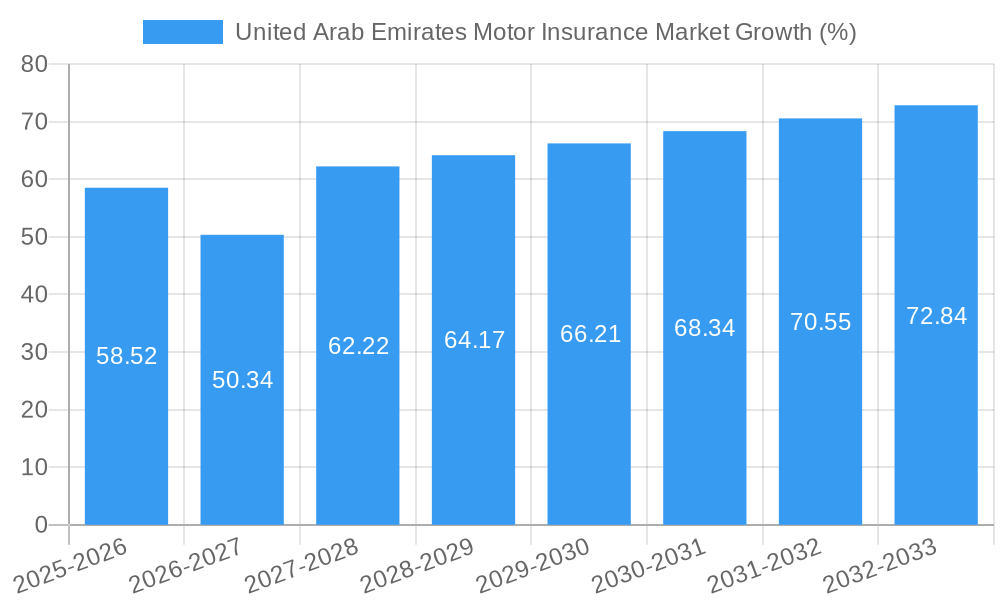

The United Arab Emirates (UAE) motor insurance market, valued at $1.40 billion in 2025, is projected to experience steady growth, driven by a rising vehicle population, increasing urbanization, and a strengthening economy. The compound annual growth rate (CAGR) of 4.12% from 2025 to 2033 indicates a consistent expansion, with the market expected to surpass $2 billion by 2033. Key growth drivers include mandatory insurance requirements, the increasing adoption of comprehensive insurance policies over third-party liability coverage, and the expanding online insurance distribution channels catering to a tech-savvy population. Government initiatives promoting road safety and stricter enforcement of insurance regulations further contribute to market expansion. The market is segmented by distribution channel (direct, banks, agents, online, others), application (commercial and personal vehicles), and type of insurance (third-party liability, comprehensive, others). Competition is intense, with both domestic and international players vying for market share. While factors such as fluctuating fuel prices and economic downturns could pose challenges, the overall outlook for the UAE motor insurance market remains positive, fueled by long-term economic growth and increased vehicle ownership.

The UAE's motor insurance sector shows promising diversification across distribution channels. Online platforms are gaining traction, signifying a shift towards digitalization and convenience. The preference for comprehensive insurance reflects a growing awareness of risk mitigation among consumers. The dominance of personal vehicle insurance over commercial vehicle insurance highlights the country's robust private vehicle market. Significant players, such as Al Buhaira National Insurance Co, Emirates Insurance Company, and others, are actively shaping market dynamics through innovative product offerings and customer service initiatives. The market's growth trajectory is inextricably linked to the UAE's overall economic health and infrastructural development. Continued investment in transportation and urban development will likely fuel further market expansion in the forecast period.

United Arab Emirates Motor Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United Arab Emirates (UAE) motor insurance market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends until 2033, covering historical data (2019-2024) and future projections (2025-2033). The report segments the market by distribution channel (direct, banks, agents, online, others), application (commercial vehicle, personal vehicle), and type of insurance (third-party liability, comprehensive, other). Key players like Al Buhaira National Insurance Co, Al Dhafra Insurance Company, Union Insurance Co, Sukoon Insurance, Emirates Insurance Company, Assicurazioni Generali S P A, Islamic Arab Insurance Company, National General Insurance Co (P S C), Abu Dhabi National Insurance Company, and Orient Insurance PJSC are thoroughly analyzed. The report's market size valuation is expected to reach xx Million by 2025 and grow at a CAGR of xx% during the forecast period.

United Arab Emirates Motor Insurance Market Concentration & Dynamics

The UAE motor insurance market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the presence of numerous smaller insurers fosters competition. The market's dynamics are shaped by a robust regulatory framework established by the UAE's Insurance Authority, driving standardization and consumer protection. Innovation is evident in the adoption of telematics and digital distribution channels, while substitute products like micro-insurance solutions are gaining traction. End-user trends reveal a rising demand for comprehensive coverage and value-added services. The market has witnessed notable M&A activity in recent years, with deals driven by strategic expansion and market consolidation. For example:

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025.

- M&A Activity: The number of M&A deals in the UAE motor insurance sector averaged xx per year between 2019 and 2024. This reflects a strategic shift towards consolidation and expansion.

United Arab Emirates Motor Insurance Market Industry Insights & Trends

The UAE motor insurance market is experiencing robust growth, fueled by factors such as a burgeoning vehicle population, rising disposable incomes, and increased awareness of insurance benefits. Technological disruptions, particularly the integration of digital platforms and telematics, are reshaping the customer experience and operational efficiency. The market is also witnessing a shift towards personalized insurance products tailored to individual risk profiles. The increasing adoption of online distribution channels indicates a growing preference for convenient and transparent insurance solutions. Market size is projected to reach xx Million by 2025 and grow to xx Million by 2033 driven by factors such as increased car ownership and government initiatives. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Key Markets & Segments Leading United Arab Emirates Motor Insurance Market

The UAE's motor insurance market demonstrates strong growth across all segments. However, the personal vehicle segment holds the largest market share, driven by the high number of privately owned vehicles. The comprehensive insurance type enjoys significant popularity, reflecting consumers' preference for comprehensive coverage against potential risks. In terms of distribution channels, agents continue to dominate, leveraging their established network and personalized service, though online channels show significant growth potential.

By Application:

- Personal Vehicle: This segment is the most dominant, fueled by the large number of privately owned vehicles in the UAE.

- Commercial Vehicle: This segment's growth mirrors the UAE's economic activity and the expansion of its logistics sector.

By Distribution Channel:

- Agents: Agents maintain a strong market share due to established relationships and personalized service.

- Online: Online channels are rapidly gaining traction, particularly among younger demographics.

By Type of Insurance:

- Comprehensive: The demand for comprehensive coverage remains high, driven by the desire for extensive protection.

- Third-Party Liability: This type of insurance is mandatory, providing a stable base for the market.

Drivers of Growth: Economic growth, increasing vehicle ownership, expanding infrastructure, and government initiatives promoting road safety contribute to the market's expansion.

United Arab Emirates Motor Insurance Market Product Developments

The UAE motor insurance market is witnessing significant product innovation, with insurers introducing telematics-based insurance solutions that offer personalized premiums based on driving behavior. Usage-based insurance (UBI) is gaining momentum, rewarding safe driving practices with lower premiums. Insurers are also incorporating value-added services, such as roadside assistance and repair network partnerships, to enhance customer experience and differentiate their offerings. These advancements leverage technological capabilities to offer improved risk assessment, efficient claims processing, and enhanced customer convenience.

Challenges in the United Arab Emirates Motor Insurance Market Market

The UAE motor insurance market faces challenges such as intense competition, regulatory changes, and fluctuating fuel prices impacting claims costs. The rising number of fraudulent claims also presents a significant challenge for insurers. Furthermore, adapting to changing consumer preferences and expectations, particularly in the digital realm, requires continuous innovation and investment. The market also faces pressure to balance profitability with affordability for consumers. These issues contribute to varying levels of profitability across the market's players and necessitate continuous adaptation.

Forces Driving United Arab Emirates Motor Insurance Market Growth

Several factors drive growth in the UAE's motor insurance sector. Strong economic growth and rising disposable incomes increase the affordability of insurance products. The government's focus on infrastructure development and road safety further supports the market's expansion. Technological advancements, particularly in telematics and digital platforms, enhance efficiency and improve customer experiences. The mandatory nature of third-party liability insurance provides a consistent base for market growth.

Challenges in the United Arab Emirates Motor Insurance Market Market

Long-term growth requires addressing competitive pressures, maintaining profitability amidst fluctuating claims costs, and innovating to meet evolving customer demands for digital convenience and personalized service. Strategic partnerships, such as that between Sukoon Insurance and AG Cars, highlight one avenue for growth and market differentiation. Expansion into niche market segments and the development of innovative product offerings are vital for sustainable long-term growth.

Emerging Opportunities in United Arab Emirates Motor Insurance Market

The UAE's motor insurance market presents several opportunities. The growth of the ride-hailing and autonomous vehicle sectors requires specialized insurance products, opening up new market segments. There is also potential for expansion into related areas like health and travel insurance. The adoption of Insurtech solutions and the use of big data analytics offer further opportunities for enhanced risk assessment and improved operational efficiency.

Leading Players in the United Arab Emirates Motor Insurance Market Sector

- Al Buhaira National Insurance Co

- Al Dhafra Insurance Company

- Union Insurance Co

- Sukoon Insurance

- Emirates Insurance Company

- Assicurazioni Generali S P A

- Islamic Arab Insurance Company

- National General Insurance Co (P S C)

- Abu Dhabi National Insurance Company

- Orient Insurance PJSC

Key Milestones in United Arab Emirates Motor Insurance Market Industry

- September 2023: Allianz's sale of its 51% stake in Allianz Saudi Fransi to Abu Dhabi National Insurance Company (ADNIC) signifies significant market consolidation and expansion for ADNIC.

- October 2022: Sukoon Insurance's partnership with AG Cars enhances its service offerings and strengthens its position as a quality-focused auto insurer.

Strategic Outlook for United Arab Emirates Motor Insurance Market Market

The UAE motor insurance market exhibits substantial long-term growth potential driven by continuous economic expansion, technological advancements, and a growing focus on road safety. Strategic partnerships, product innovation, and the adoption of digital technologies will be crucial for success. Insurers who effectively address emerging challenges and capitalize on new opportunities are poised for significant market share gains and sustained profitability in the coming years.

United Arab Emirates Motor Insurance Market Segmentation

-

1. Type of Insurance

- 1.1. Third Party Liability

- 1.2. Comprehensive

- 1.3. Other Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Banks

- 2.3. Agents

- 2.4. Online

- 2.5. Others Distribution Channels

-

3. Application

- 3.1. Commercial Vehicle

- 3.2. Personal Vehicle

United Arab Emirates Motor Insurance Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiative is Expected to Drive the Growth of the Market; Increasing Sales of Vehicle Across UAE is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Strict Regulatory Landscape is Expected to Restrain the Growth of the Market; High Costs of Product

- 3.4. Market Trends

- 3.4.1. Growth of Fintech in UAE is Diving the UAE Motor Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 5.1.1. Third Party Liability

- 5.1.2. Comprehensive

- 5.1.3. Other Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Banks

- 5.2.3. Agents

- 5.2.4. Online

- 5.2.5. Others Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial Vehicle

- 5.3.2. Personal Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6. UAE United Arab Emirates Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia United Arab Emirates Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. South Africa United Arab Emirates Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of Middle East United Arab Emirates Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Al Buhaira National Insurance Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al Dhafra Insurance Company**List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Union Insurance Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sukoon Insurance

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Emirates Insurance Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Assicurazioni Generali S P A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Islamic Arab Insurance Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 National General Insurance Co (P S C)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Abu Dhabi National Insurance Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Orient Insurance PJSC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Al Buhaira National Insurance Co

List of Figures

- Figure 1: United Arab Emirates Motor Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Motor Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 3: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE United Arab Emirates Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia United Arab Emirates Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Africa United Arab Emirates Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Middle East United Arab Emirates Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 12: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Motor Insurance Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the United Arab Emirates Motor Insurance Market?

Key companies in the market include Al Buhaira National Insurance Co, Al Dhafra Insurance Company**List Not Exhaustive, Union Insurance Co, Sukoon Insurance, Emirates Insurance Company, Assicurazioni Generali S P A, Islamic Arab Insurance Company, National General Insurance Co (P S C), Abu Dhabi National Insurance Company, Orient Insurance PJSC.

3. What are the main segments of the United Arab Emirates Motor Insurance Market?

The market segments include Type of Insurance, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiative is Expected to Drive the Growth of the Market; Increasing Sales of Vehicle Across UAE is Driving the Market.

6. What are the notable trends driving market growth?

Growth of Fintech in UAE is Diving the UAE Motor Insurance Market.

7. Are there any restraints impacting market growth?

Strict Regulatory Landscape is Expected to Restrain the Growth of the Market; High Costs of Product.

8. Can you provide examples of recent developments in the market?

September 2023: Allianz entered into a binding agreement to sell its 51% stake in Allianz Saudi Fransi to Abu Dhabi National Insurance Company (ADNIC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Motor Insurance Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence