Key Insights

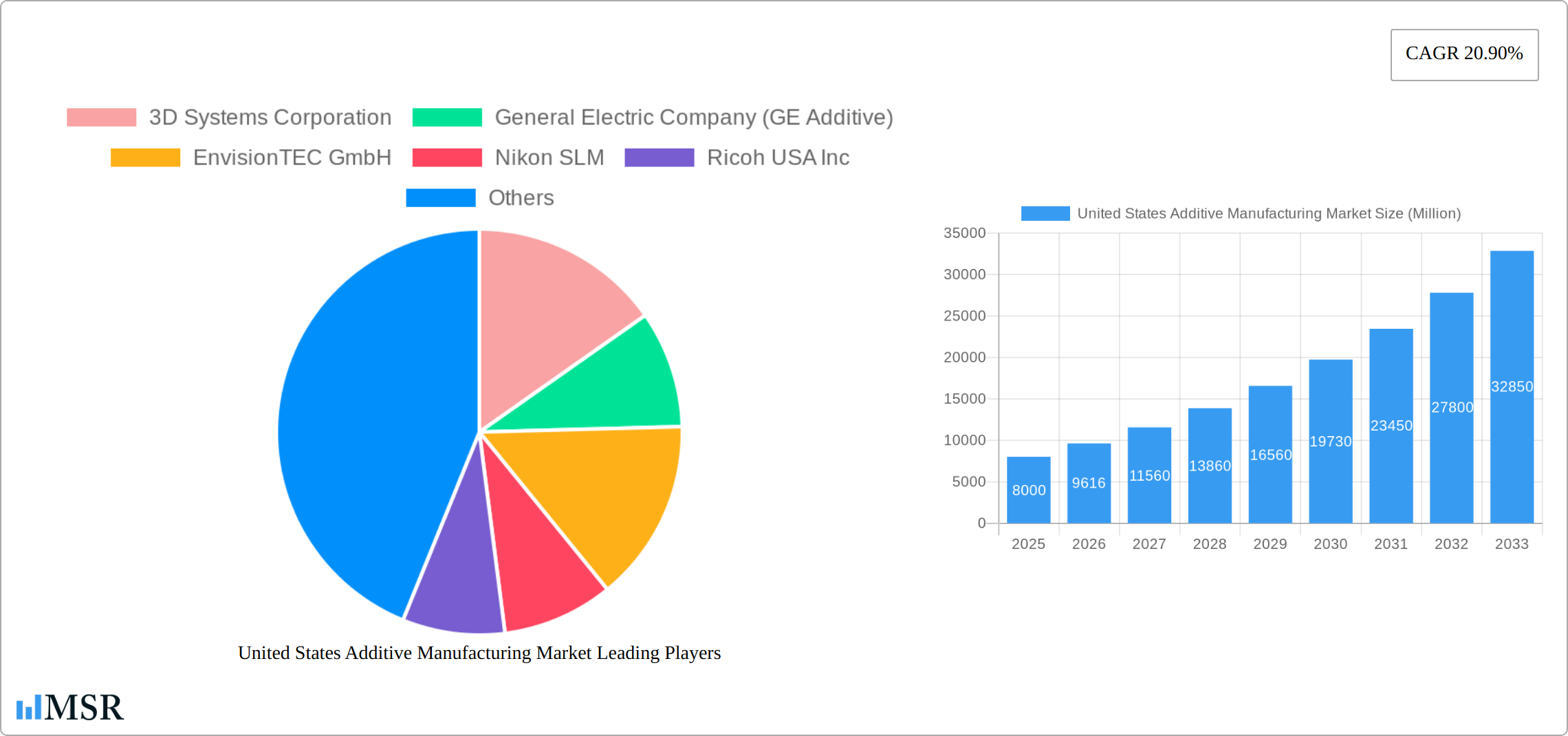

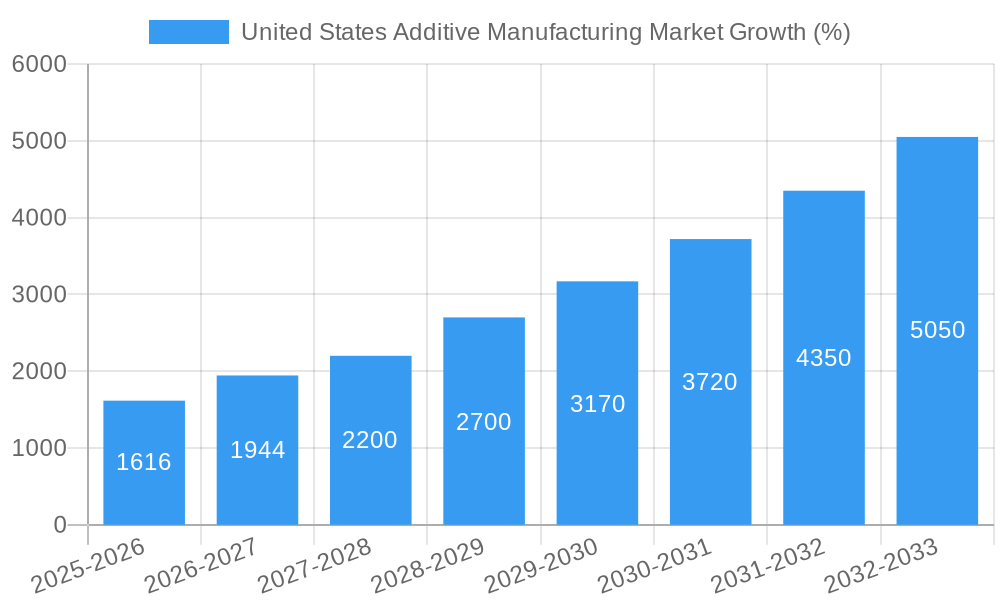

The United States additive manufacturing (AM) market is experiencing robust growth, projected to reach a significant market size driven by increasing adoption across diverse sectors. The 20.90% Compound Annual Growth Rate (CAGR) from 2019 to 2024, as stated, indicates a strong upward trajectory. While the exact 2025 market value isn't specified, extrapolating from the 5.32 million value unit (presumably in millions of USD) at an earlier point and applying the CAGR suggests substantial growth. Key drivers include the rising demand for customized products, the need for rapid prototyping and reduced lead times, and increasing investments in research and development within the AM sector. Furthermore, advancements in materials science, enabling the creation of more complex and durable parts, are fueling market expansion. Industries such as aerospace, automotive, healthcare, and consumer goods are significant contributors to this growth, leveraging AM for streamlined production processes and the creation of innovative products. The market is segmented based on technology (e.g., Fused Deposition Modeling, Stereolithography, Selective Laser Melting), material used, and application.

However, despite its remarkable potential, the US additive manufacturing market faces certain restraints. High initial investment costs for equipment can be a barrier to entry for smaller companies. Concerns regarding the scalability and overall cost-effectiveness of AM for mass production also persist. Furthermore, skill gaps in operating and maintaining AM systems need addressing through focused training and education initiatives. Despite these challenges, the long-term outlook remains positive. Continuous technological advancements, increasing awareness of AM's capabilities, and government support are anticipated to mitigate these constraints and propel market growth throughout the forecast period (2025-2033). The competitive landscape is populated by both established players and emerging companies, fostering innovation and driving down costs.

United States Additive Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Additive Manufacturing market, offering actionable insights for industry stakeholders. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report covers market size, growth drivers, technological advancements, key players, and emerging trends, helping you navigate the dynamic landscape of 3D printing in the US. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Additive Manufacturing Market Market Concentration & Dynamics

The United States additive manufacturing market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller companies and startups fosters a dynamic competitive environment. Innovation ecosystems are robust, driven by government initiatives, academic research, and private investments. Regulatory frameworks, while evolving, generally support the growth of additive manufacturing. Substitute technologies pose some level of competitive pressure, particularly in specific applications. End-user trends are shifting toward greater adoption of additive manufacturing across diverse sectors, notably aerospace, healthcare, and automotive. M&A activity has been moderate but significant, with a focus on consolidating technological capabilities and market reach.

- Market Share: Top 5 players hold approximately xx% of the market share (2024 estimate).

- M&A Deal Count: xx major M&A deals were recorded between 2019 and 2024.

- Innovation Ecosystem: Strong presence of research institutions, startups, and industry consortiums.

- Regulatory Landscape: Favorable regulations encourage the adoption of AM technologies, with ongoing adjustments to address specific safety and quality concerns.

United States Additive Manufacturing Market Industry Insights & Trends

The US additive manufacturing market is experiencing robust growth, fueled by several key factors. Technological advancements, particularly in materials science and printing processes, are continuously expanding the capabilities of AM technologies. This is complemented by increasing demand across diverse sectors, driven by the need for customized solutions, faster prototyping, and on-demand production. Evolving consumer behaviors, favoring personalized products and sustainable manufacturing practices, further propel market growth. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033.

Key Markets & Segments Leading United States Additive Manufacturing Market

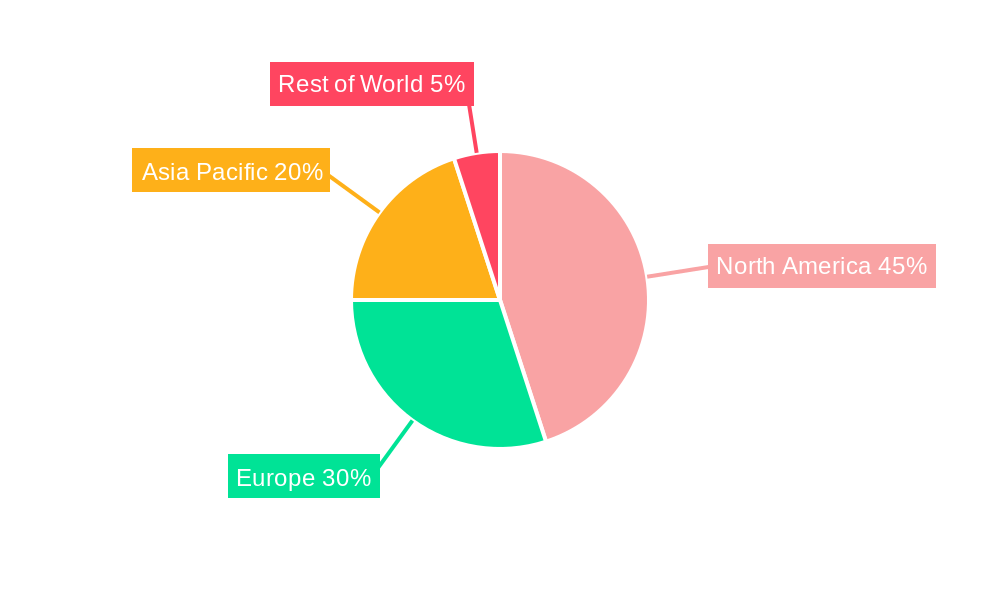

The aerospace and defense sectors dominate the US additive manufacturing market, followed by the medical and automotive industries. This dominance is attributed to the ability of AM to produce complex, lightweight parts with high precision and reduced lead times. Specific regional strengths vary, but states with strong manufacturing bases and government support for technology development tend to show higher adoption rates.

- Key Market Drivers:

- Strong government investments in R&D and manufacturing.

- Growing demand for lightweight, high-performance components.

- Adoption of Industry 4.0 principles and digitalization of manufacturing processes.

- Focus on reducing lead times and production costs.

United States Additive Manufacturing Market Product Developments

Recent product innovations focus on enhancing the speed, precision, and materials compatibility of additive manufacturing systems. New materials, such as high-temperature alloys and biocompatible polymers, are expanding the range of applications. The integration of artificial intelligence and machine learning in additive manufacturing processes is optimizing production efficiency and improving part quality. This combination of technological advancement and market relevance positions AM for continued growth.

Challenges in the United States Additive Manufacturing Market Market

The US additive manufacturing market faces several challenges, including the relatively high cost of some AM systems, potential supply chain disruptions for specialized materials, and intense competition among established players and new entrants. Regulatory hurdles concerning material certification and part qualification add complexity. The need for skilled workforce also adds to the challenges. These factors collectively impact the rate of market expansion, though not significantly hindering its overall growth.

Forces Driving United States Additive Manufacturing Market Growth

Several factors are propelling the growth of the US additive manufacturing market. Firstly, continuous technological advancements lead to improved printing speeds, materials, and functionalities. Secondly, economic incentives, including tax credits and grants for AM adoption, are driving market expansion. Thirdly, supportive regulations and industry standards are paving the way for wider acceptance and adoption of AM technologies across diverse sectors.

Challenges in the United States Additive Manufacturing Market Market

Long-term growth catalysts include strategic partnerships between AM technology providers and end-user industries, driving innovation and expanding the applications of additive manufacturing. Ongoing research and development efforts towards new materials and processes will further fuel the market's potential. The expansion into new markets, such as customized consumer goods and construction, also represents a significant growth catalyst.

Emerging Opportunities in United States Additive Manufacturing Market

Emerging opportunities lie in the development of new materials with enhanced properties, expanding the applications of additive manufacturing. The integration of AM with other advanced technologies, such as artificial intelligence and robotics, presents significant opportunities for increased efficiency and automation. Additionally, exploring new market segments, such as personalized healthcare solutions and sustainable construction materials, offers considerable growth potential.

Leading Players in the United States Additive Manufacturing Market Sector

- 3D Systems Corporation (3D Systems Corporation)

- General Electric Company (GE Additive) (GE Additive)

- EnvisionTEC GmbH

- Nikon SLM (Nikon SLM)

- Ricoh USA Inc (Ricoh USA Inc)

- EOS GmbH (EOS GmbH)

- Exone Company

- MCOR Technology Ltd

- Materialise NV (Materialise NV)

- Optomec Inc

- Stratasys Ltd (Stratasys Ltd)

- SLM Solutions Group AG (SLM Solutions Group AG)

- List Not Exhaustive

Key Milestones in United States Additive Manufacturing Market Industry

- June 2024: Nikon SLM Solutions AG commenced production of its NXG XII 600 metal AM machine in the US, boosting domestic manufacturing capabilities for aerospace, defense, automotive, and energy sectors.

- June 2024: Ricoh USA Inc. launched RICOH All-In 3D Print, a fully managed on-site 3D printing solution, streamlining prototype production and accelerating additive manufacturing adoption.

- April 2024: Meltio and Accufacture introduced the Alchemist 1, a large-scale robotic DED 3D printing work cell, expanding capabilities for large-scale metal part production.

Strategic Outlook for United States Additive Manufacturing Market Market

The US additive manufacturing market is poised for continued strong growth, driven by technological advancements, increasing demand across various sectors, and supportive government policies. Strategic opportunities exist for companies to focus on developing innovative materials, expanding into new application areas, and forging strategic partnerships to accelerate market penetration. The long-term outlook remains positive, reflecting the transformative potential of additive manufacturing across numerous industries.

United States Additive Manufacturing Market Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Desktop 3D Printer

- 1.1.2. Industrial 3D Printer

-

1.2. Software

- 1.2.1. Design Software

- 1.2.2. Inspection Software

- 1.2.3. Scanning Software

- 1.3. Services

-

1.1. Hardware

-

2. Material

- 2.1. Polymer

- 2.2. Metal

- 2.3. Ceramic

-

3. Technology

- 3.1. Stereo Lithography

- 3.2. Selective Laser Sintering

- 3.3. Fused Deposition Modelling

- 3.4. Binder Jetting Printing

- 3.5. Other Technologies

-

4. End-user Vertical

- 4.1. Automotive

- 4.2. Aerospace and Defense

- 4.3. Healthcare

- 4.4. Consumer Electronics

- 4.5. Power and Energy

- 4.6. Fashion and Jewelry

- 4.7. Dentistry

- 4.8. Other End-user Verticals

United States Additive Manufacturing Market Segmentation By Geography

- 1. United States

United States Additive Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Customization

- 3.2.2 Personalization

- 3.2.3 Complex Geometries

- 3.2.4 and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation

- 3.3. Market Restrains

- 3.3.1 Customization

- 3.3.2 Personalization

- 3.3.3 Complex Geometries

- 3.3.4 and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation

- 3.4. Market Trends

- 3.4.1. The Selective Laser Sintering Segment is Expected to Hold a Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Additive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Desktop 3D Printer

- 5.1.1.2. Industrial 3D Printer

- 5.1.2. Software

- 5.1.2.1. Design Software

- 5.1.2.2. Inspection Software

- 5.1.2.3. Scanning Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polymer

- 5.2.2. Metal

- 5.2.3. Ceramic

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Stereo Lithography

- 5.3.2. Selective Laser Sintering

- 5.3.3. Fused Deposition Modelling

- 5.3.4. Binder Jetting Printing

- 5.3.5. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Automotive

- 5.4.2. Aerospace and Defense

- 5.4.3. Healthcare

- 5.4.4. Consumer Electronics

- 5.4.5. Power and Energy

- 5.4.6. Fashion and Jewelry

- 5.4.7. Dentistry

- 5.4.8. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 3D Systems Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Electric Company (GE Additive)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EnvisionTEC GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nikon SLM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ricoh USA Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EOS GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Exone Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MCOR Technology Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Materialise NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Optomec Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stratasys Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SLM Solutions Group AG*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 3D Systems Corporation

List of Figures

- Figure 1: United States Additive Manufacturing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Additive Manufacturing Market Share (%) by Company 2024

List of Tables

- Table 1: United States Additive Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Additive Manufacturing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Additive Manufacturing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: United States Additive Manufacturing Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: United States Additive Manufacturing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: United States Additive Manufacturing Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: United States Additive Manufacturing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: United States Additive Manufacturing Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 9: United States Additive Manufacturing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: United States Additive Manufacturing Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 11: United States Additive Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: United States Additive Manufacturing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: United States Additive Manufacturing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 14: United States Additive Manufacturing Market Volume Billion Forecast, by Component 2019 & 2032

- Table 15: United States Additive Manufacturing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 16: United States Additive Manufacturing Market Volume Billion Forecast, by Material 2019 & 2032

- Table 17: United States Additive Manufacturing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 18: United States Additive Manufacturing Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 19: United States Additive Manufacturing Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: United States Additive Manufacturing Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 21: United States Additive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States Additive Manufacturing Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Additive Manufacturing Market?

The projected CAGR is approximately 20.90%.

2. Which companies are prominent players in the United States Additive Manufacturing Market?

Key companies in the market include 3D Systems Corporation, General Electric Company (GE Additive), EnvisionTEC GmbH, Nikon SLM, Ricoh USA Inc, EOS GmbH, Exone Company, MCOR Technology Ltd, Materialise NV, Optomec Inc, Stratasys Ltd, SLM Solutions Group AG*List Not Exhaustive.

3. What are the main segments of the United States Additive Manufacturing Market?

The market segments include Component, Material, Technology, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Customization. Personalization. Complex Geometries. and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation.

6. What are the notable trends driving market growth?

The Selective Laser Sintering Segment is Expected to Hold a Significant Share of the Market.

7. Are there any restraints impacting market growth?

Customization. Personalization. Complex Geometries. and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation.

8. Can you provide examples of recent developments in the market?

June 2024: Nikon SLM Solutions AG commenced the production of its NXG XII 600 metal Additive Manufacturing machine in the United States. The expansion of its manufacturing capabilities provides North American customers with a fully ‘American Made’ metal AM machine. The manufacturing unit has the ability to meet the increasing demand for its metal additive manufacturing solutions across key industries, including aerospace, defense, automotive, and energy.June 2024: Ricoh USA Inc. announced the launch of its fully managed on-site 3D printing solution, RICOH All-In 3D Print. Designed to streamline the production of 3D-printed product prototypes and other additive manufacturing uses, this complete XaaS solution for additive manufacturing includes necessary components, such as printing hardware, advanced 3D production software, specialized Ricoh labor, and essential supplies to propel businesses’ manufacturing capabilities forward with the power of rapid prototyping.April 2024: Meltio, a 3D printer manufacturer, and Accufacture, a Michigan-based industrial automation company, introduced the Alchemist 1, a new large-scale robotic DED 3D printing work cell made in the United States. Powered by Meltio’s laser metal deposition (LMD) 3D printing technology, Alchemist 1 is optimized for producing large-scale, fully dense metal parts. The robotic additive manufacturing work cell is also designed to be easily integrated into existing production lines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Additive Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Additive Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Additive Manufacturing Market?

To stay informed about further developments, trends, and reports in the United States Additive Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence