Key Insights

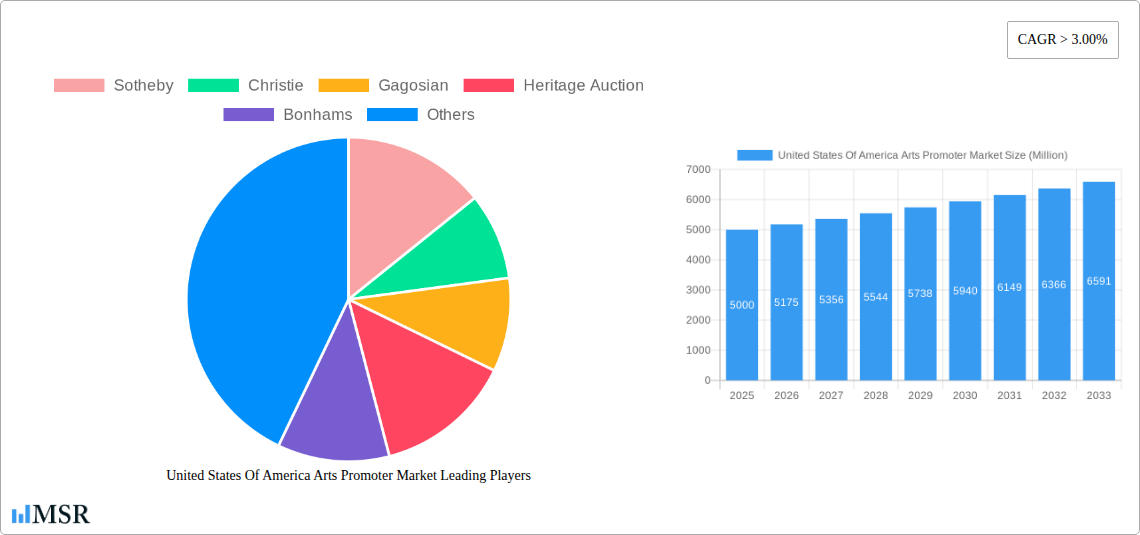

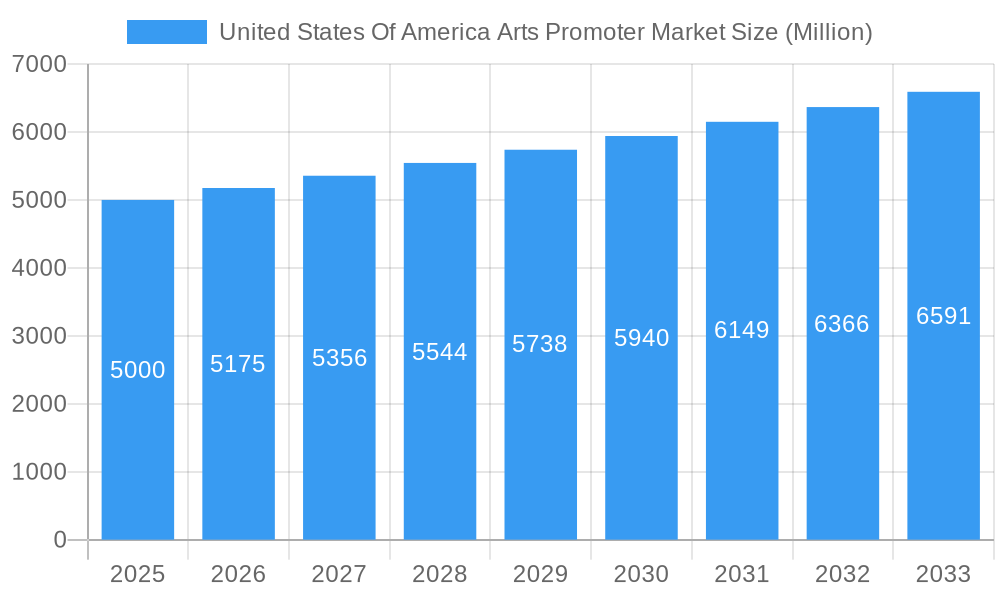

The United States arts promoter market, a dynamic sector encompassing galleries, auction houses, online platforms, and agencies, is experiencing robust growth. Driven by increasing high-net-worth individual wealth, a rising appreciation for art as an investment asset, and the expanding reach of digital art platforms, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. Key players such as Sotheby's, Christie's, Gagosian, and Heritage Auctions continue to dominate the traditional auction and gallery segments, while innovative companies like Artsy and Artnet are leveraging technology to expand market access and democratize art collecting. Growth is fueled by diverse trends, including the increasing popularity of contemporary art, the rise of non-fungible tokens (NFTs) and digital art, and the diversification of art collecting demographics. However, challenges remain, including economic volatility affecting high-end spending, concerns regarding art market transparency and authenticity, and the competitive landscape amongst established players and new entrants. The market segmentation reveals significant activity across various art forms, with contemporary art likely leading the charge due to its appeal to younger collectors and the potential for higher returns. Regional data, although not specified, suggests a concentration of market activity in major metropolitan areas with established art scenes, such as New York City, Los Angeles, and Miami. The overall outlook for the US arts promoter market remains positive, projecting substantial expansion throughout the forecast period.

United States Of America Arts Promoter Market Market Size (In Billion)

While precise market sizing data is unavailable, we can estimate a reasonable range based on the provided CAGR and industry reports. Assuming a 2025 market size of approximately $5 billion (a conservative estimate given the involvement of major international players and high-value transactions), and applying a CAGR of 3.5% (slightly above the given minimum), the market would likely reach approximately $7 billion by 2033. This represents considerable growth, indicating the continuing significance and expansion of the US arts and culture sector. This growth is primarily due to the factors listed above, particularly the ongoing integration of digital technologies and the broader accessibility they provide to the art market.

United States Of America Arts Promoter Market Company Market Share

United States Of America Arts Promoter Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Arts Promoter Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It analyzes market concentration, key trends, leading players, and emerging opportunities, providing a 360-degree view of this lucrative market projected to reach xx Million by 2033, with a CAGR of xx% during the forecast period.

United States Of America Arts Promoter Market Market Concentration & Dynamics

The US Arts Promoter market exhibits a moderately concentrated structure, with key players like Sotheby's, Christie's, and Gagosian holding significant market share. However, the emergence of online platforms like Artsy and Artnet, along with the rise of NFT marketplaces, is increasing competition and driving market fragmentation. Innovation is a crucial element, with continuous advancements in digital art, virtual exhibitions, and online auction technologies shaping market dynamics. The regulatory landscape, while generally supportive of the arts, faces evolving challenges regarding intellectual property rights in the digital sphere and taxation of online art sales. Substitute products, including alternative forms of entertainment and investment vehicles, exert some influence on market growth. End-user trends indicate a growing preference for experiential art engagement and personalized art experiences, impacting the strategies of promoters. M&A activity in the sector has seen a steady increase in recent years, with a recorded xx number of deals in 2024. This activity is primarily driven by the consolidation of market share and expansion into new segments.

- Market Share: Sotheby's and Christie's hold approximately xx% combined market share in the high-value art segment.

- M&A Activity: xx M&A deals recorded in 2024, predominantly focused on digital art platforms and gallery acquisitions.

- Innovation Ecosystems: Strong presence of art tech startups fostering innovation in areas such as VR/AR art experiences and blockchain-based authentication.

- Regulatory Frameworks: Ongoing discussions surrounding NFT taxation and intellectual property rights for digital art are influencing market dynamics.

United States Of America Arts Promoter Market Industry Insights & Trends

The US Arts Promoter market is experiencing robust growth, driven by several key factors. The increasing affluence of high-net-worth individuals fuels demand for high-value art pieces, while growing interest in art as an investment asset further propels market expansion. Technological disruptions, particularly the integration of digital platforms and NFTs, have broadened market access and redefined art consumption. Evolving consumer behaviors show a preference for personalized art experiences, virtual exhibitions, and immersive art installations. The market size reached xx Million in 2024, and is projected to reach xx Million by 2033. This growth is driven by increasing digital art sales, growing institutional investment in art, and increasing accessibility through online platforms. The shift towards digital art and NFTs has introduced significant disruptions, altering traditional auction formats and introducing new challenges and opportunities for arts promoters.

Key Markets & Segments Leading United States Of America Arts Promoter Market

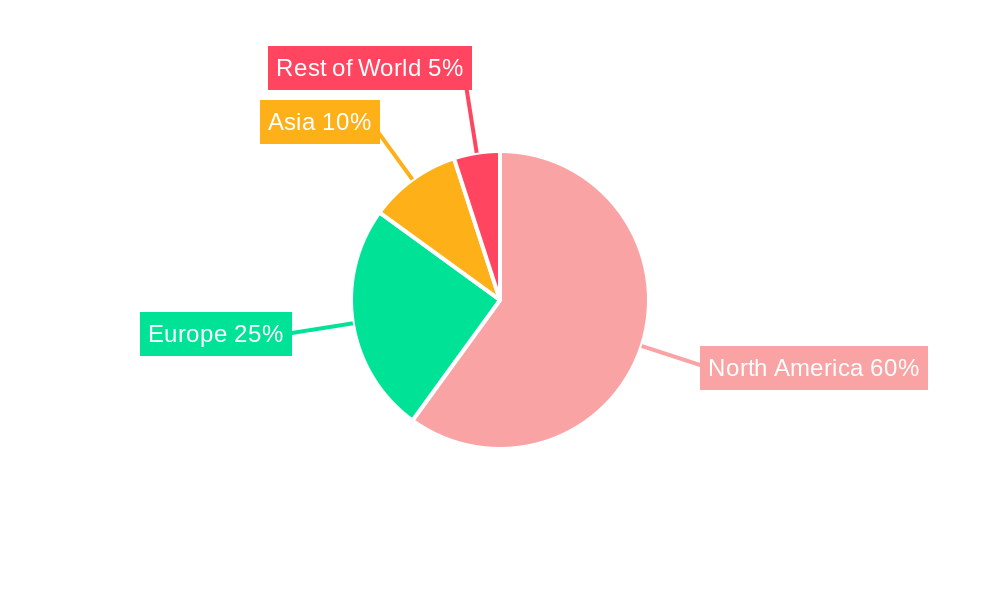

The US remains the dominant market for art promotion, driven by a strong collector base and established infrastructure. Major metropolitan areas like New York, Los Angeles, and Miami serve as hubs for art sales and exhibitions. The high-value segment (artworks exceeding USD 1 Million) constitutes the largest revenue contributor, followed by the mid-range and lower-value segments.

- Drivers for US Market Dominance:

- Strong Collector Base: High concentration of high-net-worth individuals and established art collecting culture.

- Robust Infrastructure: Presence of major auction houses, galleries, museums, and art fairs.

- Economic Strength: Stable economy and high disposable incomes support art investment.

- Dominance Analysis: The concentration of major auction houses and galleries in New York City solidifies its position as the central hub, attracting both domestic and international buyers and sellers.

United States Of America Arts Promoter Market Product Developments

Recent product innovations in the arts promotion sector encompass the use of AR/VR technologies for virtual gallery experiences, AI-powered art appraisal tools, and enhanced online auction platforms offering improved user experience and security. These advancements aim to create immersive art experiences and streamline the sales process, thereby increasing efficiency and broadening access for both artists and collectors. The integration of blockchain technology for NFT sales and art authentication is also gaining traction, enhancing transparency and reducing the risk of fraud.

Challenges in the United States Of America Arts Promoter Market Market

The US Arts Promoter market faces challenges stemming from economic downturns, which can impact discretionary spending on art. Supply chain disruptions can affect the availability of artworks and exhibition materials. The increasing competition from online platforms and digital art marketplaces requires promoters to adapt their strategies and embrace new technologies. Regulatory uncertainties around NFT taxation and intellectual property rights for digital artworks also present obstacles. Furthermore, forgeries and fraudulent activities pose a significant threat to the market's integrity.

Forces Driving United States Of America Arts Promoter Market Growth

Several factors are driving market growth, including increasing high-net-worth individuals' wealth, fueling demand for luxury art and collectibles. Technological advancements like virtual exhibitions and NFT marketplaces expand access to a wider audience, driving sales growth. Favorable government policies and regulations that support the arts sector further encourage market expansion. Growing institutional investment in art further propels the growth of this market.

Challenges in the United States Of America Arts Promoter Market Market

Long-term growth hinges on continuous innovation in technologies, enhancing the online art experience. Strategic partnerships between galleries, auction houses, and technology companies are crucial for broadening market reach. Expansion into new and emerging art markets and diversification of offerings can fuel long-term growth.

Emerging Opportunities in United States Of America Arts Promoter Market

Emerging opportunities lie in the growth of the digital art market and the integration of NFTs. The metaverse and virtual reality offer new platforms for art exhibitions and sales. Personalized art experiences tailored to individual preferences are gaining traction. The increasing popularity of sustainable and ethically sourced art also presents significant opportunities for promoters.

Leading Players in the United States Of America Arts Promoter Market Sector

- Sotheby's

- Christie's

- Gagosian

- Heritage Auction

- Bonhams

- Artsy

- Artnet

- Art Basel

- MTArt Agency

- ColorWheel Art

Key Milestones in United States Of America Arts Promoter Market Industry

- June 2023: Sotheby's "Grails" sale featuring 40 digital artworks from 3AC, with Cherniak's "Ringers#879" selling for USD 6.2 Million, highlighting the growing importance of digital art in the market.

- March 2023: The Metropolitan Museum of Art's partnership with Sulwhaso showcases the growing collaboration between art institutions and corporate sponsors, influencing audience engagement strategies.

Strategic Outlook for United States Of America Arts Promoter Market Market

The US Arts Promoter market holds significant future potential, driven by technological advancements and evolving consumer preferences. Strategic opportunities lie in leveraging digital technologies to enhance the art experience, expanding into new markets, and forging partnerships to broaden reach. Focusing on sustainable practices and ethical sourcing will also be crucial for long-term success in the sector.

United States Of America Arts Promoter Market Segmentation

-

1. Type

- 1.1. Fine Arts

- 1.2. Antiques

- 1.3. Collectables

- 1.4. Abstract Arts

- 1.5. Digital Art

- 1.6. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

-

3. End-User

- 3.1. Individual

- 3.2. Companies

-

4. Channel

- 4.1. Online

- 4.2. Offline

United States Of America Arts Promoter Market Segmentation By Geography

- 1. United States

United States Of America Arts Promoter Market Regional Market Share

Geographic Coverage of United States Of America Arts Promoter Market

United States Of America Arts Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales

- 3.3. Market Restrains

- 3.3.1. Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales

- 3.4. Market Trends

- 3.4.1. Digital Art Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Of America Arts Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fine Arts

- 5.1.2. Antiques

- 5.1.3. Collectables

- 5.1.4. Abstract Arts

- 5.1.5. Digital Art

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Individual

- 5.3.2. Companies

- 5.4. Market Analysis, Insights and Forecast - by Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sotheby

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gagosian

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heritage Auction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bonhams

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Artsy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Artnet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Art Basel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MTArt Agency

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ColorWheel Art**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sotheby

List of Figures

- Figure 1: United States Of America Arts Promoter Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Of America Arts Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: United States Of America Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Of America Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 3: United States Of America Arts Promoter Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: United States Of America Arts Promoter Market Revenue undefined Forecast, by Channel 2020 & 2033

- Table 5: United States Of America Arts Promoter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United States Of America Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: United States Of America Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 8: United States Of America Arts Promoter Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 9: United States Of America Arts Promoter Market Revenue undefined Forecast, by Channel 2020 & 2033

- Table 10: United States Of America Arts Promoter Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Of America Arts Promoter Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the United States Of America Arts Promoter Market?

Key companies in the market include Sotheby, Christie, Gagosian, Heritage Auction, Bonhams, Artsy, Artnet, Art Basel, MTArt Agency, ColorWheel Art**List Not Exhaustive.

3. What are the main segments of the United States Of America Arts Promoter Market?

The market segments include Type, Revenue Source, End-User, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales.

6. What are the notable trends driving market growth?

Digital Art Driving The Market.

7. Are there any restraints impacting market growth?

Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales.

8. Can you provide examples of recent developments in the market?

June 2023: Sotheby's conducted its second part of the "Grails" sale, focusing on artworks owned by 3AC, featuring 40 digital artworks. The highlight of the auction was Cherniak's highly coveted piece, "Ringers#879," affectionately known as "The Goose" due to its uncanny resemblance to a bird, which appeared to defy the algorithm's randomized logic. This remarkable artwork was sold for a staggering USD 6.2 million to the 6529 NFT Fund.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Of America Arts Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Of America Arts Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Of America Arts Promoter Market?

To stay informed about further developments, trends, and reports in the United States Of America Arts Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence