Key Insights

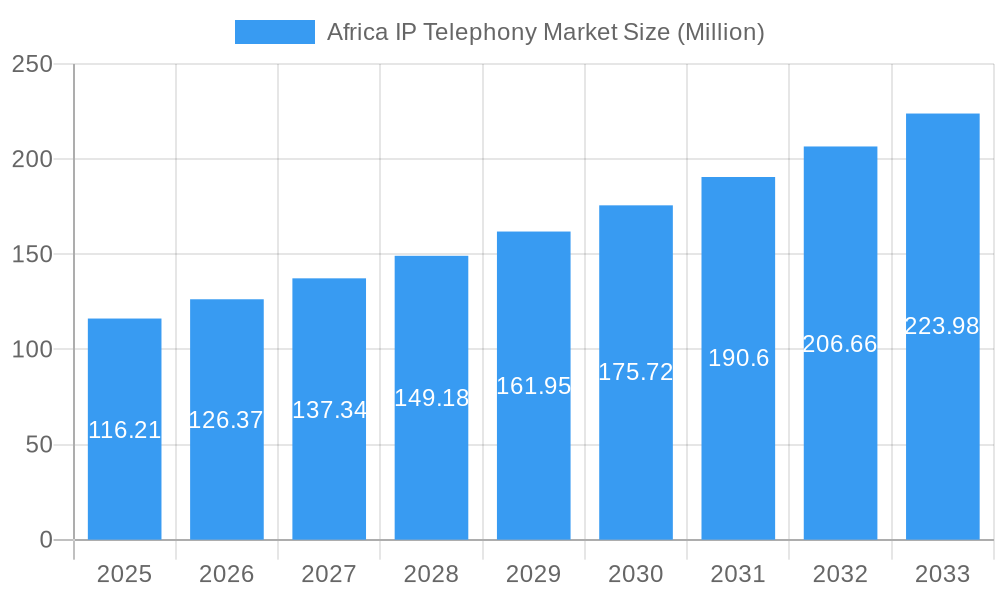

The Africa IP Telephony market, valued at $116.21 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.76% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud-based communication solutions offers cost-effectiveness and scalability, particularly appealing to businesses across Africa's diverse landscape. Furthermore, the growing need for improved communication infrastructure, especially in underserved regions, fuels demand for reliable and efficient IP telephony systems. Rising mobile penetration and expanding internet access further contribute to this market's growth trajectory. Government initiatives promoting digital transformation and technological advancement across the continent are also playing a crucial role. Major players like Cisco, Alcatel-Lucent Enterprise, and Avaya are actively competing in this market, offering a range of solutions tailored to various business needs and budget constraints. However, challenges remain, including inconsistent internet connectivity in certain areas and the need for robust cybersecurity measures to protect sensitive communication data. Despite these limitations, the overall market outlook for IP telephony in Africa remains positive, fueled by consistent technological advancements and a growing demand for sophisticated communication solutions.

Africa IP Telephony Market Market Size (In Million)

The market segmentation within Africa's IP telephony sector is likely diverse, reflecting the continent's varied economic development and technological infrastructure. We can anticipate strong demand for cost-effective solutions in smaller businesses and developing regions, alongside higher demand for advanced features and scalability in larger corporations and metropolitan areas. The competitive landscape is dynamic, with both international giants and local providers vying for market share. Success will hinge on adapting to the unique needs of different African markets, offering flexible pricing and deployment models, and providing excellent customer support. This includes prioritizing solutions that address challenges such as power outages and network instability, common in parts of the continent. The ongoing digital transformation across Africa will create opportunities for innovative solutions, particularly those integrating mobile technology and cloud-based services, further enhancing market expansion in the coming years.

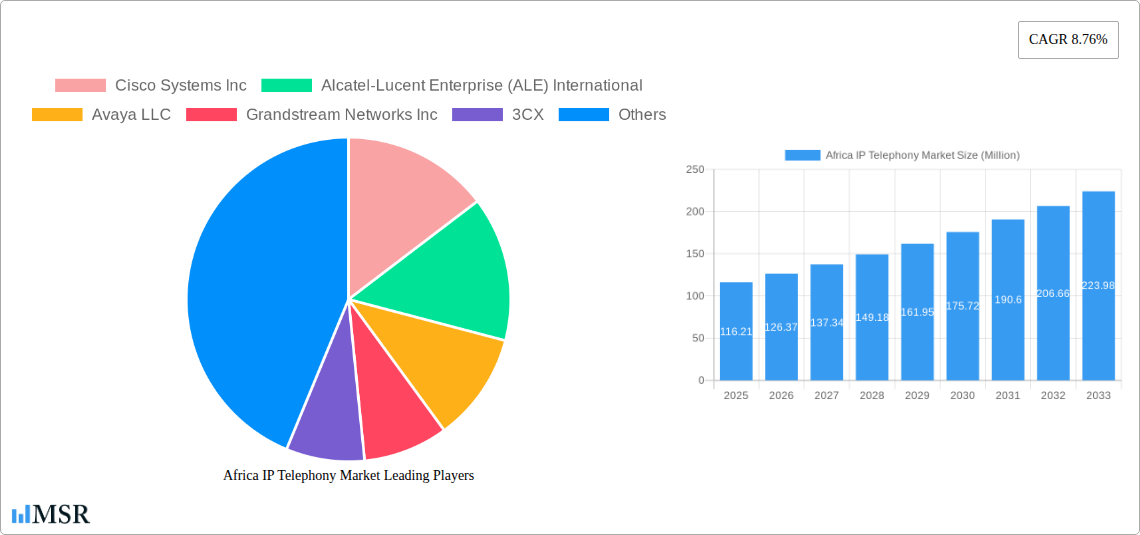

Africa IP Telephony Market Company Market Share

Africa IP Telephony Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa IP Telephony Market, covering market dynamics, industry trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The market is estimated to be valued at xx Million in 2025 and is projected to experience significant growth during the forecast period.

Africa IP Telephony Market Market Concentration & Dynamics

The Africa IP Telephony market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also characterized by a dynamic competitive environment with ongoing innovation, mergers and acquisitions (M&A), and evolving regulatory frameworks. Market share data for 2024 suggests that Cisco Systems Inc. and Alcatel-Lucent Enterprise hold the largest shares, with others like Avaya LLC and Grandstream Networks Inc. also commanding substantial portions.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market.

- Innovation Ecosystems: The market witnesses strong innovation driven by the need for affordable and reliable communication solutions. This leads to the development of cost-effective IP telephony systems, cloud-based solutions and integration with mobile networks.

- Regulatory Frameworks: Varying regulatory landscapes across different African nations influence market growth and adoption rates. Harmonization of regulations is crucial for fostering wider market penetration.

- Substitute Products: Mobile telephony and VoIP services pose some level of competition. However, the need for advanced features and reliable business communications ensures a continued demand for IP telephony systems.

- End-User Trends: The increasing adoption of cloud-based solutions and unified communications platforms is driving market growth, particularly among businesses and enterprises.

- M&A Activities: The number of M&A deals in the sector from 2019-2024 averaged xx per year, indicating a moderate level of consolidation.

Africa IP Telephony Market Industry Insights & Trends

The Africa IP Telephony Market is experiencing robust growth, driven by increasing urbanization, rising internet penetration, and the expanding adoption of cloud-based solutions across various sectors. The market size is projected to reach xx Million by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors contribute to this growth: the increasing demand for advanced communication solutions from businesses, the expansion of 4G and 5G networks, and the growing adoption of unified communications as businesses seek to improve operational efficiency and communication integration. Technological disruptions such as the rise of Software as a Service (SaaS) models and the integration of Artificial Intelligence (AI) features within IP telephony systems are further boosting market expansion. Consumer behavior is shifting towards preference for flexible, scalable, and cost-effective communication solutions, favoring cloud-based models over traditional on-premise systems. The integration of IP telephony with other communication channels, such as video conferencing and instant messaging, is also driving growth.

Key Markets & Segments Leading Africa IP Telephony Market

While the entire African continent shows promising growth, certain regions and segments are leading the charge. South Africa, Egypt, and Nigeria are currently the dominant markets, driven by robust economic growth, better developed infrastructure, and higher internet penetration. The enterprise segment represents a significant portion of the market, driven by the need for advanced communication solutions to enhance operational efficiency and customer service. Smaller businesses are also increasingly adopting IP telephony, propelled by cost-effectiveness and the accessibility of cloud-based solutions.

- Drivers in Leading Markets:

- South Africa: Strong economic growth, advanced infrastructure, and high internet penetration.

- Egypt: Expanding business sector, government initiatives promoting digital transformation, and improving ICT infrastructure.

- Nigeria: Large and growing population, increasing smartphone adoption, and expanding business activities.

- Segment Dominance: The enterprise segment accounts for the largest market share due to its demand for advanced features and reliable communications.

Africa IP Telephony Market Product Developments

Recent product innovations emphasize cloud-based solutions, unified communications, and the integration of AI and Machine Learning (ML) for enhanced features like call routing, sentiment analysis, and automated transcription. These advancements are providing competitive advantages, improving operational efficiency, and offering enhanced user experiences. The market is also seeing increased focus on solutions designed for specific industries, like healthcare and finance, to meet specialized communication needs.

Challenges in the Africa IP Telephony Market Market

The Africa IP Telephony market faces several challenges. High initial investment costs for infrastructure and equipment can be a barrier to entry for smaller players. Uneven internet connectivity across the continent, particularly in rural areas, impacts the widespread adoption of IP telephony solutions. Supply chain disruptions can also cause delays and increase costs. Finally, intense competition among vendors, leading to pricing pressures, represents another significant hurdle. The lack of skilled workforce also limits the growth in some regions. These factors collectively impose a negative impact on market growth in certain regions, estimated at xx Million in 2024.

Forces Driving Africa IP Telephony Market Growth

Several factors are driving market growth: increasing government investments in ICT infrastructure, the expansion of 4G and 5G networks, improving digital literacy rates, and the increasing affordability of internet access. The growing adoption of cloud-based solutions, particularly SaaS models, offers scalable and cost-effective solutions for businesses of all sizes. Furthermore, government policies promoting digital transformation and regulatory frameworks that encourage investment in ICT infrastructure are further accelerating market expansion.

Challenges in the Africa IP Telephony Market Market

Long-term growth will depend on sustained investment in ICT infrastructure, particularly in underserved areas. The development of localized solutions that address unique market challenges, such as language barriers and varying levels of technical expertise, is critical. Strategic partnerships between technology providers, telecom operators, and governments will be essential for facilitating widespread adoption and overcoming the challenges of digital inclusion.

Emerging Opportunities in Africa IP Telephony Market

Significant opportunities exist in expanding into rural and underserved areas through the development of affordable and robust IP telephony solutions tailored to low-bandwidth environments. The integration of IP telephony with other digital services, such as mobile money platforms and e-commerce applications, presents a substantial growth avenue. Furthermore, the rising demand for specialized solutions in healthcare, education, and agriculture offers promising prospects for market expansion.

Leading Players in the Africa IP Telephony Market Sector

- Cisco Systems Inc

- Alcatel-Lucent Enterprise (ALE) International

- Avaya LLC

- Grandstream Networks Inc

- 3CX

- Google Inc

- Logitech South Africa

- Yealink SA

- Comms Partner (Pty) Ltd

- AVICOM

- Unify (Mitel)

- List Not Exhaustive

Key Milestones in Africa IP Telephony Market Industry

- May 2024: Launch of the Next-Gen Infrastructure Company (NGIC) in Ghana, signifying a major step towards expanding 5G infrastructure and enhancing mobile broadband services, impacting the overall telecommunications landscape and potentially boosting IP telephony adoption.

- April 2024: Unveiling of the MTN Group Technology Innovation Lab, focusing on 5G, AI, and cloud computing, indicating a strong commitment to technological advancements that directly benefit the IP telephony sector by providing enhanced infrastructure and capabilities.

Strategic Outlook for Africa IP Telephony Market Market

The Africa IP Telephony Market holds immense future potential, driven by ongoing technological advancements, increasing investment in infrastructure, and rising demand for efficient communication solutions. Strategic partnerships, the development of innovative and cost-effective solutions, and a focus on digital inclusion will be crucial for unlocking the market's full potential. Companies focusing on cloud-based solutions, unified communications, and the integration of AI will be best positioned for success in this rapidly evolving market.

Africa IP Telephony Market Segmentation

-

1. Enterprise Size

- 1.1. Small an

- 1.2. Large Enterprises (more than 500 employees)

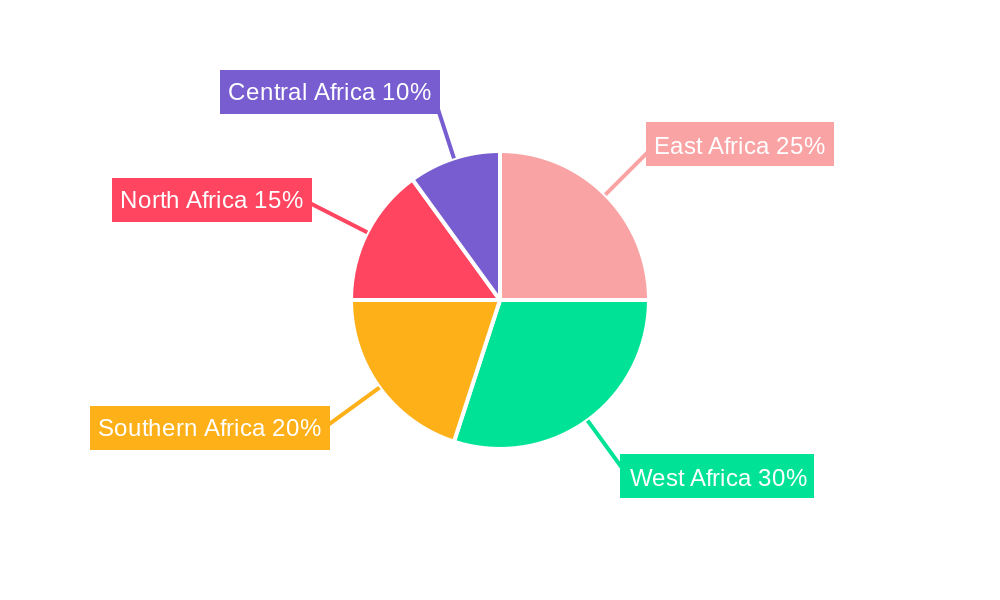

Africa IP Telephony Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa IP Telephony Market Regional Market Share

Geographic Coverage of Africa IP Telephony Market

Africa IP Telephony Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration

- 3.3. Market Restrains

- 3.3.1. Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration

- 3.4. Market Trends

- 3.4.1. Rising Demand for Audio and Video Conferencing Solutions is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa IP Telephony Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Small an

- 5.1.2. Large Enterprises (more than 500 employees)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alcatel-Lucent Enterprise (ALE) International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avaya LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grandstream Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3CX

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Logitech South Africa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yealink SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Comms Partner (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVICOM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unify (Mitel)*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Africa IP Telephony Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa IP Telephony Market Share (%) by Company 2025

List of Tables

- Table 1: Africa IP Telephony Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 2: Africa IP Telephony Market Volume Million Forecast, by Enterprise Size 2020 & 2033

- Table 3: Africa IP Telephony Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa IP Telephony Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Africa IP Telephony Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 6: Africa IP Telephony Market Volume Million Forecast, by Enterprise Size 2020 & 2033

- Table 7: Africa IP Telephony Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Africa IP Telephony Market Volume Million Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Nigeria Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 11: South Africa Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Africa Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 13: Egypt Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Egypt Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: Kenya Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ethiopia Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Morocco Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Morocco Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Ghana Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ghana Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Algeria Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Algeria Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Tanzania Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Tanzania Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Ivory Coast Africa IP Telephony Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Ivory Coast Africa IP Telephony Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa IP Telephony Market?

The projected CAGR is approximately 8.76%.

2. Which companies are prominent players in the Africa IP Telephony Market?

Key companies in the market include Cisco Systems Inc, Alcatel-Lucent Enterprise (ALE) International, Avaya LLC, Grandstream Networks Inc, 3CX, Google Inc, Logitech South Africa, Yealink SA, Comms Partner (Pty) Ltd, AVICOM, Unify (Mitel)*List Not Exhaustive.

3. What are the main segments of the Africa IP Telephony Market?

The market segments include Enterprise Size .

4. Can you provide details about the market size?

The market size is estimated to be USD 116.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration.

6. What are the notable trends driving market growth?

Rising Demand for Audio and Video Conferencing Solutions is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration.

8. Can you provide examples of recent developments in the market?

May 2024: Ascend Digital, K-NET, Radisys, Nokia, and Tech Mahindra, in collaboration with the Government of Ghana and MNOs (mobile network operators) AT Ghana and Telecel Ghana, unveiled their joint venture, the Next-Gen Infrastructure Company (NGIC). This strategic partnership aims to democratize 5G mobile broadband services in Ghana. NGIC secured its 5G license and is slated to roll out 5G services nationwide in Ghana by the end of 2024, with plans for subsequent expansion into other African regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa IP Telephony Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa IP Telephony Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa IP Telephony Market?

To stay informed about further developments, trends, and reports in the Africa IP Telephony Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence