Key Insights

The Indonesian payments infrastructure market is experiencing robust growth, projected to reach \$98.30 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.33% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Indonesia, coupled with increasing smartphone penetration and a young, tech-savvy population, is driving the adoption of digital payment methods. Government initiatives promoting financial inclusion and digital transformation are further accelerating market growth. The market is segmented by component (hardware, software, services) and end-user application (healthcare, automotive, retail & marketing, residential). The retail and marketing sector is currently the largest segment, driven by the high volume of online transactions and the need for efficient point-of-sale (POS) systems. However, growth in the healthcare and automotive sectors is anticipated to significantly contribute to overall market expansion in the coming years, as these sectors increasingly adopt digital payment solutions for improved efficiency and security. Competitive pressures from numerous players, including both established international companies and local Indonesian firms such as PT Jalin Pembayaran Nusantara, GHL Indonesia, and Moka POS, contribute to market dynamism and innovation. While challenges exist, such as infrastructure limitations in certain regions and concerns regarding cybersecurity, the overall outlook for the Indonesian payments infrastructure market remains highly positive.

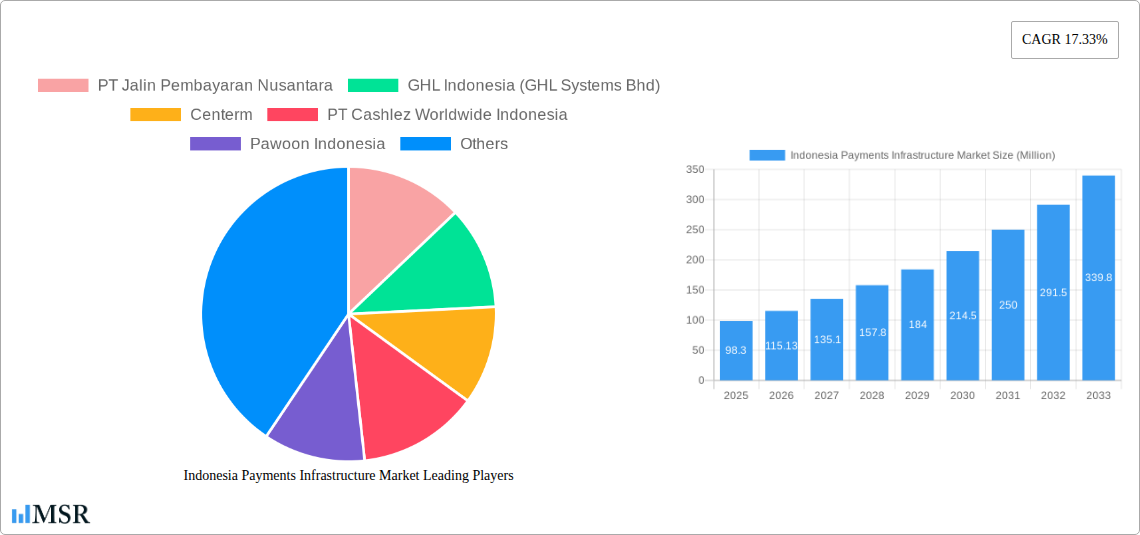

Indonesia Payments Infrastructure Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued strong growth, driven by ongoing technological advancements, expansion of digital financial services, and increasing government support. The hardware segment will likely maintain significant market share due to the continued demand for POS terminals and other payment processing devices. However, the software and services segments are poised for rapid growth, fueled by the increasing adoption of cloud-based solutions and the need for sophisticated payment processing capabilities. The competitive landscape will likely remain dynamic, with mergers, acquisitions, and strategic partnerships playing a crucial role in shaping market dynamics. Furthermore, the increasing focus on regulatory compliance and data security will be key factors influencing market trends in the coming years. Companies will need to invest in robust security measures and comply with evolving regulations to maintain consumer trust and avoid potential legal issues.

Indonesia Payments Infrastructure Market Company Market Share

Indonesia Payments Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia payments infrastructure market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. From market size and growth projections to key players and emerging trends, this report delivers actionable intelligence covering the period 2019-2033, with a focus on 2025. The study encompasses detailed segmentation by component (hardware, software, services) and end-user application (healthcare, automotive, retail & marketing, residential), revealing market dynamics and opportunities across diverse sectors. The report is enriched with real-world examples and quantifiable data, empowering informed decision-making.

Indonesia Payments Infrastructure Market Market Concentration & Dynamics

The Indonesian payments infrastructure market exhibits a moderately concentrated landscape, with a few dominant players alongside numerous smaller, specialized firms. Market share data for 2025 (estimated) indicates that the top 5 players account for approximately xx% of the market, while the remaining share is distributed among a larger number of companies. This concentration is influenced by factors such as established brand recognition, extensive network reach, and access to capital. However, the market also displays a vibrant innovation ecosystem, with fintech startups and established players continuously introducing new products and services.

The regulatory framework, while evolving, plays a crucial role in shaping market dynamics. Recent policy changes aimed at promoting digital financial inclusion have spurred innovation and investment. Competition is intense, with substitute products such as mobile wallets and peer-to-peer (P2P) transfer platforms posing challenges to traditional payment methods. End-user trends heavily favor digital and contactless transactions, driven by increasing smartphone penetration and a growing preference for convenience. M&A activity remains significant. In 2024, there were approximately xx M&A deals in this sector, reflecting consolidation and strategic expansion efforts.

- Key Metrics (2025 Estimated):

- Top 5 Players Market Share: xx%

- Number of M&A Deals in 2024: xx

- Market Growth Rate: xx%

Indonesia Payments Infrastructure Market Industry Insights & Trends

The Indonesian payments infrastructure market is experiencing robust growth, fueled by several key factors. The rising adoption of digital payments, driven by increasing smartphone penetration and expanding internet access, is a primary driver. E-commerce expansion has further accelerated the demand for secure and efficient payment solutions. The market size is estimated to reach xx Million in 2025, with a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly the widespread adoption of contactless payments and mobile wallets, are reshaping the industry. Evolving consumer behaviors, characterized by a preference for convenience and seamless digital experiences, are also shaping market trends. Further growth is projected as financial inclusion initiatives broaden access to formal financial services, especially in underserved rural areas. This expansion is anticipated to be further bolstered by government support for digital transformation and investments in payment infrastructure.

Key Markets & Segments Leading Indonesia Payments Infrastructure Market

The Retail and Marketing segment currently dominates the Indonesian payments infrastructure market by end-user application, driven by the rapid growth of e-commerce and the increasing prevalence of digital transactions in various retail settings. The software component is a leading segment by component, propelled by the demand for advanced payment processing systems and solutions that enable secure and efficient transactions. Jakarta and other major urban centers exhibit the highest market concentration.

Drivers for Retail and Marketing Segment:

- Rapid Growth of E-commerce

- Increased adoption of digital payments

- Government initiatives supporting digital transactions

Drivers for Software Component:

- Demand for advanced payment processing systems

- Growing need for secure and efficient transaction solutions

- Development of innovative fintech solutions.

Dominance Analysis: The retail and marketing sector's dominance stems from the high volume of transactions, while the software segment's leading position reflects the crucial role of software in enabling seamless and secure payments across various platforms. Growth in both segments is mutually reinforcing, with advances in software leading to greater adoption of digital payments in the retail sector.

Indonesia Payments Infrastructure Market Product Developments

Recent product innovations reflect a strong focus on enhancing security, convenience, and efficiency. The introduction of contactless payment terminals, sophisticated point-of-sale (POS) systems, and mobile payment applications signifies a shift towards streamlined and user-friendly solutions. These advancements provide a significant competitive edge for companies offering cutting-edge technologies, enhancing their market position and driving increased adoption rates among consumers and businesses. The integration of biometric authentication and enhanced security features is further strengthening the reliability and trustworthiness of the market's offerings.

Challenges in the Indonesia Payments Infrastructure Market Market

The Indonesian payments infrastructure market faces several challenges. Regulatory hurdles, including complex licensing requirements and evolving compliance standards, can impede market entry and expansion. Supply chain disruptions can affect the availability of crucial hardware components, impacting businesses' ability to meet demand. Intense competition among established players and emerging fintechs puts pressure on pricing and profitability. These factors, alongside concerns regarding cybersecurity threats and data privacy, pose considerable obstacles to market growth. For example, xx% of businesses in the retail sector reported supply chain issues impacting their operations in 2024, while xx% cited regulatory uncertainty as a major obstacle.

Forces Driving Indonesia Payments Infrastructure Market Growth

Several factors are driving growth in the Indonesian payments infrastructure market. Government initiatives promoting financial inclusion and digitalization are significantly accelerating adoption of digital payments. Rising smartphone penetration and increased internet access are empowering consumers to embrace digital transactions. Technological advancements, such as the introduction of new payment technologies, are improving the efficiency and convenience of payment systems. The expanding e-commerce sector is fueling demand for secure and robust payment solutions.

Long-Term Growth Catalysts in the Indonesia Payments Infrastructure Market

Long-term growth will be fueled by continued investment in infrastructure, particularly expanding internet access in underserved areas. Strategic partnerships between fintech companies, banks, and telecommunication providers will play a critical role in expanding financial inclusion and enhancing the overall payment ecosystem. Innovations in areas such as blockchain technology and artificial intelligence offer opportunities for greater security and efficiency, fostering further growth.

Emerging Opportunities in Indonesia Payments Infrastructure Market

Emerging opportunities include the expansion of mobile payment services into rural areas, leveraging advancements in mobile network coverage. The growth of super apps offering integrated payment solutions alongside other services is presenting significant opportunities. Focus on improving cybersecurity and data privacy will be critical in attracting more consumers to digital transactions. The integration of payment systems with other technologies, such as IoT and AI, presents further possibilities.

Leading Players in the Indonesia Payments Infrastructure Market Sector

- PT Jalin Pembayaran Nusantara

- GHL Indonesia (GHL Systems Bhd)

- Centerm

- PT Cashlez Worldwide Indonesia

- Pawoon Indonesia

- Moka POS (Go-Jek)

- Xendit

- Edgeworks Solutions Pte Ltd

- Olsera com

- Equip POS (HashMicro Pte Ltd)

- Inti Prima Mandiri Utama (iPaymu)

- Pax Technology (Pax Technology)

- PT indopay merchant services

- Ingenico (Ingenico)

Key Milestones in Indonesia Payments Infrastructure Market Industry

- March 2021: PAX Technology introduced the IM10, a new unattended payment device boosting QR code and contactless payment usage.

- May 2021: Gojek and Tokopedia merged to form GoTo Group, planning an IPO in New York and Jakarta. This merger significantly impacted the market by creating a dominant player in the Indonesian digital payments landscape.

Strategic Outlook for Indonesia Payments Infrastructure Market Market

The Indonesian payments infrastructure market presents significant long-term growth potential. Strategic partnerships, technological innovation, and government support for digitalization will be key drivers of future expansion. Companies focused on enhancing security, convenience, and affordability will be best positioned to capitalize on market opportunities. Continued expansion into underserved areas and the integration of payments with other digital services will shape the future of the market.

Indonesia Payments Infrastructure Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Payments Infrastructure Market Segmentation By Geography

- 1. Indonesia

Indonesia Payments Infrastructure Market Regional Market Share

Geographic Coverage of Indonesia Payments Infrastructure Market

Indonesia Payments Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing adoption of smart mirrors in the automotive sector; Growing investment in R&D to improve product portfolio

- 3.3. Market Restrains

- 3.3.1. Hight Cost and Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Electronic Data Capture (EDC)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Payments Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Jalin Pembayaran Nusantara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GHL Indonesia (GHL Systems Bhd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Centerm

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Cashlez Worldwide Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pawoon Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moka POS (Go-Jek)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xendit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Edgeworks Solutions Pte Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Olsera com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Equip POS (HashMicro Pte Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Inti Prima Mandiri Utama (iPaymu)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Pax Technology

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT indopay merchant services

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ingenico

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 PT Jalin Pembayaran Nusantara

List of Figures

- Figure 1: Indonesia Payments Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Payments Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Payments Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Payments Infrastructure Market?

The projected CAGR is approximately 17.33%.

2. Which companies are prominent players in the Indonesia Payments Infrastructure Market?

Key companies in the market include PT Jalin Pembayaran Nusantara, GHL Indonesia (GHL Systems Bhd), Centerm, PT Cashlez Worldwide Indonesia, Pawoon Indonesia, Moka POS (Go-Jek), Xendit, Edgeworks Solutions Pte Ltd, Olsera com, Equip POS (HashMicro Pte Ltd), Inti Prima Mandiri Utama (iPaymu), Pax Technology, PT indopay merchant services, Ingenico.

3. What are the main segments of the Indonesia Payments Infrastructure Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing adoption of smart mirrors in the automotive sector; Growing investment in R&D to improve product portfolio.

6. What are the notable trends driving market growth?

Electronic Data Capture (EDC).

7. Are there any restraints impacting market growth?

Hight Cost and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

March 2021- PAX Technology introduced the IM10, the latest unattended payment device that will drive the usage of QR codes and contactless payments in any touchless environment. The IM10 is the newest addition to the IM Series, an all-in-one payment device with a small footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Payments Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Payments Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Payments Infrastructure Market?

To stay informed about further developments, trends, and reports in the Indonesia Payments Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence