Key Insights

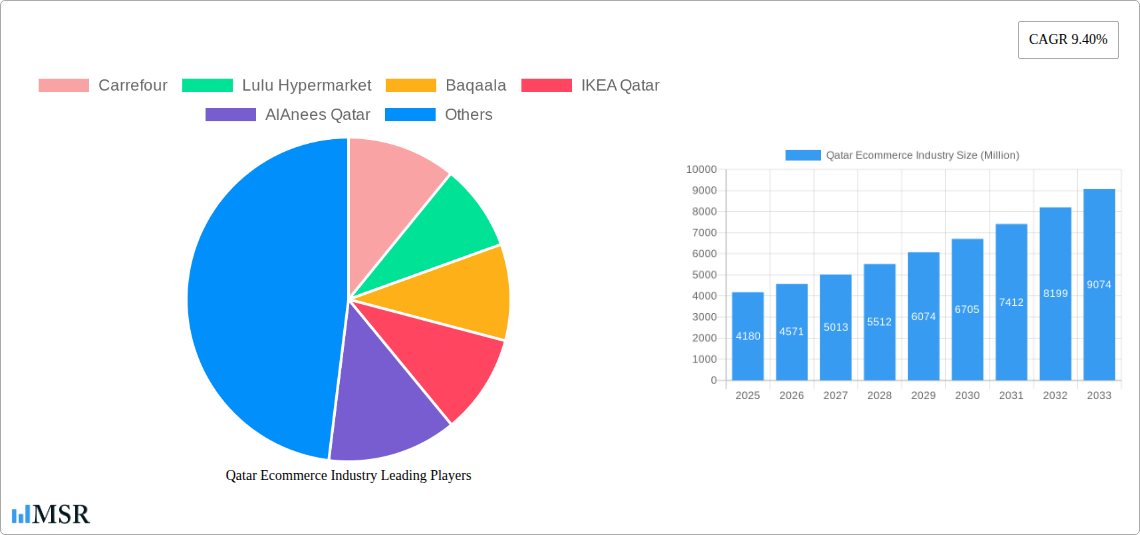

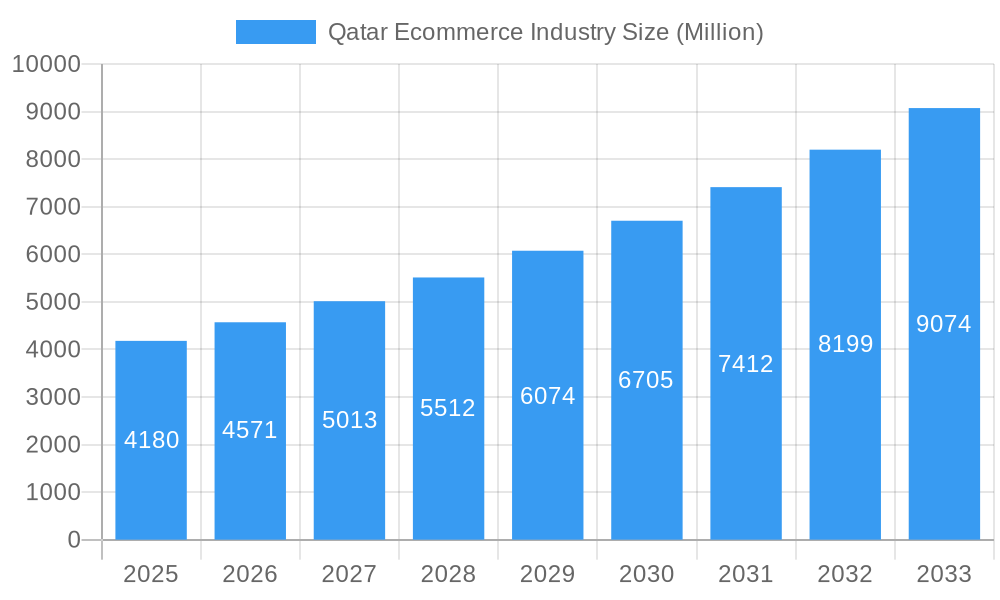

The Qatari e-commerce market, valued at $4.18 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.40% from 2025 to 2033. This expansion is fueled by several key drivers. Rising smartphone penetration and internet access across all demographics are creating a larger pool of potential online shoppers. The Qatari government's initiatives to foster digital transformation and improve infrastructure further bolster this growth. Increasing consumer preference for convenience and the wider availability of diverse products online are also significant factors. The market is segmented by B2C (Business-to-Consumer) and B2B (Business-to-Business) e-commerce, with B2C dominating due to the rising popularity of online retail among consumers. Key players such as Carrefour, Lulu Hypermarket, and Amazon.com Inc. are actively competing within this dynamic landscape, constantly innovating to capture market share. The rising adoption of mobile commerce and the increasing popularity of social commerce platforms are significant trends shaping the industry's future. Potential restraints include concerns about online payment security and the relatively small size of the Qatari population, which limits the overall addressable market. However, the ongoing investments in logistics and e-payment infrastructure are mitigating these challenges.

Qatar Ecommerce Industry Market Size (In Billion)

The forecast period of 2025-2033 reveals promising growth opportunities for e-commerce businesses in Qatar. Market segmentation by application (e.g., fashion, electronics, groceries) will likely reveal differing growth rates, influenced by consumer spending habits and product availability. The competitive landscape is characterized by both international giants and local players, creating a blend of established brands and emerging startups. Maintaining a strong customer focus, investing in robust logistics, and leveraging the increasing adoption of mobile payments will be crucial for success within this burgeoning market. Understanding the nuances of the Qatari consumer base, including preferences and purchasing behaviors, is essential for targeted marketing and competitive differentiation. Future growth will largely depend on the continued development of a sophisticated and reliable e-commerce ecosystem in Qatar, including logistics, payment gateways, and robust consumer protection measures.

Qatar Ecommerce Industry Company Market Share

Qatar Ecommerce Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar ecommerce industry, covering market size, key players, emerging trends, and future growth projections from 2019 to 2033. It’s an essential resource for businesses, investors, and stakeholders seeking to understand and capitalize on the dynamic opportunities within this rapidly expanding market. The report utilizes a robust methodology, incorporating historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) to provide actionable insights.

Qatar Ecommerce Industry Market Concentration & Dynamics

The Qatar ecommerce market exhibits a moderately concentrated landscape, with a few dominant players like Carrefour and Lulu Hypermarket commanding significant market share. However, the presence of numerous smaller players and international entrants like AliExpress and Amazon introduces a degree of competition. Innovation is driven by investments in logistics, digital payments, and localized e-commerce platforms catering to specific consumer needs. Qatar's government actively supports e-commerce growth through favorable regulatory frameworks. Substitute products, primarily traditional brick-and-mortar retail, still hold considerable market share but face increasing pressure from the convenience and wider selection offered by online channels. End-user trends show a strong preference for mobile commerce, reflecting Qatar's high smartphone penetration. Mergers and acquisitions (M&A) activity within the sector is relatively low, with xx M&A deals recorded between 2019 and 2024, suggesting a preference for organic growth among established players. This, however, may change as consolidation strategies evolve. The overall market share distribution is as follows (estimated 2025):

- Carrefour: xx%

- Lulu Hypermarket: xx%

- Baqaala: xx%

- Other Players: xx%

Qatar Ecommerce Industry Industry Insights & Trends

The Qatar ecommerce market is experiencing robust growth, fueled by increasing internet and smartphone penetration, rising disposable incomes, and a young, tech-savvy population. The market size (GMV) for B2C ecommerce is estimated at $xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by the expansion of logistics infrastructure, the adoption of advanced payment systems, and the increasing preference for online shopping among consumers across various demographics. The B2B ecommerce sector is also witnessing significant expansion, with a projected market size of $xx Million in 2025, demonstrating a growing demand for digital solutions in the business-to-business environment. Technological disruptions, including the rise of mobile commerce, the use of artificial intelligence (AI) for personalized recommendations and advanced analytics, and increased focus on omnichannel strategies are transforming the industry. Consumer behavior is shifting towards convenience, with a strong demand for same-day and next-day deliveries, influencing the strategic investments of players in their logistics capabilities.

Key Markets & Segments Leading Qatar Ecommerce Industry

The dominant segment within the Qatar ecommerce market is B2C, particularly in the grocery and consumer electronics sectors, reflecting a significant shift in consumer purchasing habits. The market is largely concentrated in the urban areas of Doha and other major cities, but there's potential for growth in smaller towns and cities as digital infrastructure improves.

Drivers of B2C Ecommerce Growth:

- Economic Growth: Rising disposable incomes and a burgeoning middle class fuel online spending.

- Infrastructure Development: Improvements in logistics and payment systems enhance online shopping convenience.

- Technological Advancements: Mobile commerce and user-friendly platforms drive market penetration.

Drivers of B2B Ecommerce Growth:

- Government Initiatives: Focus on digital transformation within the public and private sectors.

- Business Process Optimization: E-commerce solutions improve operational efficiency.

- Increased Supply Chain Transparency: Digital platforms facilitate seamless supply chain management.

Qatar Ecommerce Industry Product Developments

Recent product innovations include the rise of mobile-first platforms, personalized shopping experiences leveraging AI, and the integration of augmented reality (AR) and virtual reality (VR) technologies to enhance the online shopping experience. The market has witnessed advancements in logistics with the incorporation of automated warehouses and drone delivery systems in some cases, which are increasingly improving the efficiency and speed of deliveries. These technological advancements create a competitive edge for businesses.

Challenges in the Qatar Ecommerce Industry Market

The Qatar ecommerce industry faces challenges including regulatory hurdles concerning data protection and cross-border transactions, coupled with supply chain complexities and increased logistics costs which impact delivery times and costs. Intense competition from both domestic and international players, especially from established international giants, also poses a significant obstacle to smaller players. These factors collectively impact profitability and market share.

Forces Driving Qatar Ecommerce Industry Growth

Key growth drivers include the government's ongoing investment in digital infrastructure, a proactive regulatory environment facilitating e-commerce growth, and the increasing adoption of digital payment methods. The rising popularity of online grocery shopping and the expanding adoption of mobile commerce further fuel this growth. Specific examples include the Qatar National Vision 2030 initiatives that aim to digitize the economy.

Long-Term Growth Catalysts in the Qatar Ecommerce Industry

Long-term growth will be propelled by strategic partnerships between retailers and logistics providers to enhance supply chain efficiency and customer experience. Innovations in areas such as AI-powered personalization and the expansion into new product categories will be significant. Furthermore, the continued improvement of digital infrastructure, both in the public and private sectors, will support increased market penetration.

Emerging Opportunities in Qatar Ecommerce Industry

Emerging opportunities include the growth of social commerce platforms leveraging the popularity of social media in Qatar, increased adoption of omnichannel strategies that seamlessly integrate online and offline shopping experiences, and the potential for expansion into niche market segments catering to specific demographic or product needs. The potential of targeted advertising and the use of data analytics for personalized promotions presents another avenue for expansion.

Leading Players in the Qatar Ecommerce Industry Sector

- Carrefour

- Lulu Hypermarket

- Baqaala

- IKEA Qatar

- AlAnees Qatar

- AliExpress.com

- Amazon.com Inc

- Next Qatar

- Ubuy Qatar

- Jarir Bookstore

- Ourshopee Qatar

Key Milestones in Qatar Ecommerce Industry Industry

- January 2023: Qatar Post reduced medication delivery charges to QR 30 for HMC and PHCC patients, boosting access to healthcare services.

- February 2023: Tesco planned to expand its rapid Woosh delivery service to 800 additional stores, enhancing same-day grocery delivery options.

- March 2023: Al Meera launched its first automated checkout-free store, signifying a move towards innovative retail experiences.

Strategic Outlook for Qatar Ecommerce Industry Market

The Qatar ecommerce market is poised for significant growth over the next decade, driven by favorable government policies, technological advancements, and evolving consumer preferences. Businesses that adapt to the rapidly changing market dynamics, invest in innovative technologies, and focus on customer experience will be best positioned to capture market share and achieve sustainable growth within this dynamic sector. Strategic partnerships and investments in logistics and technology will be crucial for success.

Qatar Ecommerce Industry Segmentation

-

1. Type

- 1.1. B2C E-commerce

- 1.2. B2B E-commerce

Qatar Ecommerce Industry Segmentation By Geography

- 1. Qatar

Qatar Ecommerce Industry Regional Market Share

Geographic Coverage of Qatar Ecommerce Industry

Qatar Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Fashion and Beauty to hold significant growth in Qatar

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Ecommerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2C E-commerce

- 5.1.2. B2B E-commerce

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carrefour

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu Hypermarket

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baqaala

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IKEA Qatar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlAnees Qatar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AliExpress com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Next Qatar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ubuy Qatar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jarir Bookstore

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ourshopee Qatar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Carrefour

List of Figures

- Figure 1: Qatar Ecommerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Qatar Ecommerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Qatar Ecommerce Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Qatar Ecommerce Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Qatar Ecommerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Qatar Ecommerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Qatar Ecommerce Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Qatar Ecommerce Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Qatar Ecommerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Qatar Ecommerce Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Ecommerce Industry?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the Qatar Ecommerce Industry?

Key companies in the market include Carrefour, Lulu Hypermarket, Baqaala, IKEA Qatar, AlAnees Qatar, AliExpress com, Amazon com Inc, Next Qatar, Ubuy Qatar, Jarir Bookstore, Ourshopee Qatar.

3. What are the main segments of the Qatar Ecommerce Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Fashion and Beauty to hold significant growth in Qatar.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

March 2023 - Al Meera, a Consumer goods retailer, launched the Al Meera Smart store, its first fully automated checkout-free store. For a trial run, the store will be accessible to its Meera Rewards members initially, and the services will be rolled out to other members slowly in the next phase. Initially, the process applies to credit card holders only.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Qatar Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence