Key Insights

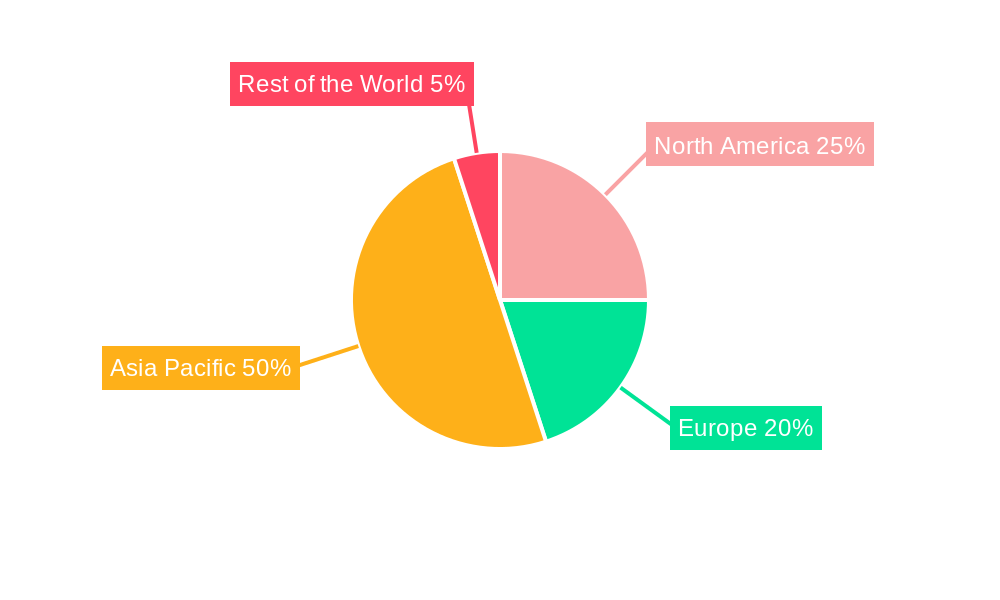

The global antenna market, valued at $23.47 billion in 2025, is projected to experience robust growth, driven by the increasing demand for high-performance connectivity across various devices and applications. The 7.85% CAGR indicates a significant expansion throughout the forecast period (2025-2033). Key growth drivers include the proliferation of smartphones, laptops, tablets, and wearables, each requiring sophisticated antenna systems for optimal performance in diverse wireless communication bands (5G, Wi-Fi 6E, Bluetooth 5.0 and beyond). The miniaturization trend in electronics fuels the demand for advanced antenna technologies like FPC and LDS antennas, which offer space-saving designs and superior performance. Furthermore, the growing adoption of IoT devices and the expansion of 5G networks globally are expected to significantly contribute to market growth. Challenges such as stringent regulatory compliance and the need for cost-effective manufacturing solutions remain key considerations. Segmentation analysis reveals a strong focus on the Asia Pacific region, likely due to the concentration of electronics manufacturing and high consumer demand.

The market is segmented by type (Stamping, FPC, LDS, LCP, MPI antennas), application (main, Bluetooth, Wi-Fi, GPS, NFC antennas), and product (phones, laptops, tablets, wearables, other products). Competition is fierce, with key players such as AAC Technologies, Molex, Luxshare Precision, and Murata Manufacturing vying for market share through technological innovation, strategic partnerships, and geographic expansion. The continued development of advanced antenna technologies, such as beamforming and intelligent antennas, will further shape the competitive landscape and propel market growth. The forecast period will witness a significant shift towards more integrated and intelligent antenna solutions, driven by the demand for higher data rates, improved signal quality, and better energy efficiency. This trend presents opportunities for companies that can offer innovative and cost-effective solutions tailored to the evolving needs of the market.

Antenna Market Report: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global Antenna Market, covering market size, growth drivers, key segments, leading players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors. With a predicted market value exceeding xx Million by 2033, understanding the dynamics within this rapidly evolving sector is crucial for strategic decision-making.

Antenna Market Concentration & Dynamics

The global antenna market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, specialized companies contributes to a dynamic competitive environment. Market concentration is influenced by factors such as technological advancements, M&A activity, and the emergence of new entrants.

- Market Share: Top 5 players hold approximately xx% of the global market share in 2025. This share is projected to slightly decrease to xx% by 2033 due to increased competition and market fragmentation.

- M&A Activity: The number of M&A deals in the antenna market averaged xx per year during the historical period (2019-2024), indicating a moderate level of consolidation. This activity is anticipated to increase in the forecast period driven by the need for technological expansion and market share consolidation.

- Innovation Ecosystems: A robust innovation ecosystem is fostered by collaborative R&D initiatives between established players and startups, leading to continuous advancements in antenna technology.

- Regulatory Frameworks: Government regulations concerning electromagnetic interference (EMI) and radio frequency (RF) compliance significantly impact antenna design and manufacturing, requiring compliance testing and certification.

- Substitute Products: The emergence of novel antenna technologies, such as metamaterials and reconfigurable antennas, offers substitute product options, challenging the dominance of traditional antenna types.

- End-User Trends: The growing demand for high-speed data transmission, improved signal quality, and miniaturization in various electronic devices drives the adoption of advanced antenna technologies across diverse applications.

Antenna Market Industry Insights & Trends

The global antenna market is experiencing robust growth, driven by the increasing demand for wireless connectivity across various sectors. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The proliferation of smartphones, IoT devices, and 5G infrastructure significantly boosts the demand for high-performance antennas. Furthermore, advancements in antenna technologies, such as miniaturization and improved efficiency, contribute to market expansion. Evolving consumer preferences towards seamless connectivity and enhanced user experience further fuel this growth. Technological disruptions such as the adoption of 5G and the growth of the Internet of Things (IoT) are reshaping the market, demanding high-bandwidth, low-latency antenna solutions. Consumer behavior is increasingly influenced by the need for reliable and high-speed connectivity across various devices and locations, driving demand for advanced antenna solutions.

Key Markets & Segments Leading Antenna Market

The Asia-Pacific region is currently dominating the global antenna market, driven by robust economic growth, increasing smartphone penetration, and a burgeoning electronics manufacturing industry. Within the segment breakdown, the following key trends are observed:

- By Type: The FPC (Flexible Printed Circuit) antenna segment holds a dominant share due to its cost-effectiveness, flexibility, and suitability for various applications. The LDS (Laser Direct Structuring) antenna segment is experiencing rapid growth due to its high performance and miniaturization capabilities.

- By Application: The main antenna segment is the largest, driven by its essential role in enabling primary wireless communication in devices. However, the Bluetooth and WiFi antenna segments are growing rapidly, fueled by the proliferation of IoT devices and smart home applications.

- By Product: The smartphone segment continues to be the major consumer of antennas, while the wearables segment exhibits substantial growth potential due to the increasing adoption of smartwatches, fitness trackers, and other wearables.

Drivers for Dominant Regions and Segments:

- Asia-Pacific: High economic growth, burgeoning electronics manufacturing, rising smartphone penetration, and expanding 5G infrastructure.

- North America: Strong R&D investments, early adoption of advanced technologies, and a thriving IoT ecosystem.

- Europe: Focus on smart city initiatives, high demand for high-performance antennas in automotive and industrial applications.

- FPC Antennas: Cost-effectiveness, flexibility, and easy integration in various electronic devices.

- LDS Antennas: High performance, miniaturization capabilities, and suitability for high-frequency applications.

- Main Antennas: Essential role in enabling primary wireless communication.

- Smartphones: High volume production and continuous demand for upgraded connectivity.

Antenna Market Product Developments

Recent product innovations focus on miniaturization, enhanced performance, and integration of multiple functionalities within a single antenna. Advancements in materials science, such as the use of liquid crystal polymers (LCPs), enable the development of smaller, more efficient antennas. The integration of multiple antenna technologies within a single device is also gaining traction, simplifying designs and reducing production costs. These advancements provide competitive edges to manufacturers by delivering superior performance and smaller form factors, catering to the demand for compact and high-performance devices.

Challenges in the Antenna Market Market

The antenna market faces several challenges, including:

- Stringent Regulatory Compliance: Meeting stringent international standards for electromagnetic compatibility (EMC) and radio frequency (RF) necessitates significant investments in testing and certification.

- Supply Chain Disruptions: Dependence on global supply chains makes the industry vulnerable to disruptions caused by geopolitical events or natural disasters. This can lead to increased costs and production delays.

- Intense Competition: The presence of numerous established and emerging players creates intense competition, particularly in the segments offering standardized antenna types.

Forces Driving Antenna Market Growth

Several factors are driving growth in the antenna market, including:

- Technological Advancements: Continuous innovations in antenna design, materials, and manufacturing processes lead to improvements in performance, size, and cost-effectiveness. The emergence of 5G and the Internet of Things (IoT) is a major driving force.

- Economic Growth: Expanding economies, particularly in developing countries, are fostering the demand for electronics and wireless communication devices.

- Favorable Regulatory Environment: Supportive government policies encouraging the adoption of advanced wireless technologies create a positive environment for market expansion.

Long-Term Growth Catalysts in the Antenna Market

Long-term growth in the antenna market will be fueled by ongoing innovation in antenna technologies, strategic partnerships and collaborations, and expansion into new markets. The development of advanced materials, such as metamaterials and novel fabrication techniques, will further enhance antenna performance and miniaturization. Strategic collaborations between antenna manufacturers and device makers will lead to tailored antenna solutions for specific applications. Expansion into emerging markets, such as the automotive and industrial sectors, will also contribute to long-term growth.

Emerging Opportunities in Antenna Market

Emerging opportunities include:

- 5G and beyond: The rollout of 5G and future generations of wireless technologies will drive substantial demand for high-performance antennas.

- IoT expansion: The continued growth of the IoT will require increasingly sophisticated antenna solutions for various applications.

- Smart city initiatives: Deployment of smart city infrastructure will necessitate a wide range of antenna solutions for different communication systems.

Leading Players in the Antenna Market Sector

- AAC Technologies

- Molex LLC

- Huizhou SPEED Wireless Technology Co Ltd

- Luxshare Precision

- Galtronics USA Inc

- Linx Technologie

- HOLITECH Technology Co Ltd

- Sunway Communication

- Amphenol Corporation

- Qualcomm Technologies Inc

- Xinwei Communication

- Texas Instruments Incorporated

- TE Connectivity Ltd

- Fujikura Electronics

- Airgain Inc

- Murata Manufacturing Co Ltd

Key Milestones in Antenna Market Industry

- March 2023: Rohde & Schwarz launched the R&S TSEMF-B2E isotropic antenna, enhancing measurement capabilities.

- April 2023: Ignion and Geocene partnered to develop cutting-edge IoT antenna technology, leveraging virtual antenna technology and cloud-based solutions. This collaboration demonstrates a shift towards cloud-based antenna design and development, streamlining processes and potentially reducing development time.

Strategic Outlook for Antenna Market Market

The antenna market is poised for continued growth, driven by technological advancements, expanding applications, and favorable regulatory environments. Strategic opportunities for market players include investing in R&D to develop innovative antenna solutions, expanding into new and emerging markets, and forming strategic partnerships to enhance market reach and technological capabilities. Focusing on providing customized antenna solutions for specific applications and industries will be crucial for achieving success in this competitive market.

Antenna Market Segmentation

-

1. Type

- 1.1. Stamping Antenna

- 1.2. FPC Antenna

- 1.3. LDS Antenna

- 1.4. LCP Antenna

- 1.5. MPI Antenna

-

2. Application

- 2.1. Main Antenna

- 2.2. Bluetooth Antenna

- 2.3. WiFi Antenna

- 2.4. GPS Antenna

- 2.5. NFC Antenna

-

3. Product

- 3.1. Phone

- 3.2. Laptop

- 3.3. Tablet

- 3.4. Wearables

- 3.5. Other Products

Antenna Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

Antenna Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automation in Developing Countries Across Various Verticals; Penetration of the Internet and the Advent of IoT

- 3.3. Market Restrains

- 3.3.1. Need for Efficiency and Bandwidth Improvements

- 3.4. Market Trends

- 3.4.1. Phone to be the Largest Product Segment in the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antenna Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stamping Antenna

- 5.1.2. FPC Antenna

- 5.1.3. LDS Antenna

- 5.1.4. LCP Antenna

- 5.1.5. MPI Antenna

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Main Antenna

- 5.2.2. Bluetooth Antenna

- 5.2.3. WiFi Antenna

- 5.2.4. GPS Antenna

- 5.2.5. NFC Antenna

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Phone

- 5.3.2. Laptop

- 5.3.3. Tablet

- 5.3.4. Wearables

- 5.3.5. Other Products

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Antenna Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Stamping Antenna

- 6.1.2. FPC Antenna

- 6.1.3. LDS Antenna

- 6.1.4. LCP Antenna

- 6.1.5. MPI Antenna

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Main Antenna

- 6.2.2. Bluetooth Antenna

- 6.2.3. WiFi Antenna

- 6.2.4. GPS Antenna

- 6.2.5. NFC Antenna

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Phone

- 6.3.2. Laptop

- 6.3.3. Tablet

- 6.3.4. Wearables

- 6.3.5. Other Products

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Antenna Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Stamping Antenna

- 7.1.2. FPC Antenna

- 7.1.3. LDS Antenna

- 7.1.4. LCP Antenna

- 7.1.5. MPI Antenna

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Main Antenna

- 7.2.2. Bluetooth Antenna

- 7.2.3. WiFi Antenna

- 7.2.4. GPS Antenna

- 7.2.5. NFC Antenna

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Phone

- 7.3.2. Laptop

- 7.3.3. Tablet

- 7.3.4. Wearables

- 7.3.5. Other Products

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Antenna Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Stamping Antenna

- 8.1.2. FPC Antenna

- 8.1.3. LDS Antenna

- 8.1.4. LCP Antenna

- 8.1.5. MPI Antenna

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Main Antenna

- 8.2.2. Bluetooth Antenna

- 8.2.3. WiFi Antenna

- 8.2.4. GPS Antenna

- 8.2.5. NFC Antenna

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Phone

- 8.3.2. Laptop

- 8.3.3. Tablet

- 8.3.4. Wearables

- 8.3.5. Other Products

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Antenna Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Stamping Antenna

- 9.1.2. FPC Antenna

- 9.1.3. LDS Antenna

- 9.1.4. LCP Antenna

- 9.1.5. MPI Antenna

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Main Antenna

- 9.2.2. Bluetooth Antenna

- 9.2.3. WiFi Antenna

- 9.2.4. GPS Antenna

- 9.2.5. NFC Antenna

- 9.3. Market Analysis, Insights and Forecast - by Product

- 9.3.1. Phone

- 9.3.2. Laptop

- 9.3.3. Tablet

- 9.3.4. Wearables

- 9.3.5. Other Products

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Antenna Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Antenna Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Antenna Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Antenna Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 AAC Technologies

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Molex LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Huizhou SPEED Wireless Technology Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Luxshare Precision

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Galtronics USA Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Linx Technologie

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 HOLITECH Technology Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Sunway Communication

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Amphenol Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Qualcomm Technologies Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Xinwei Communication

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Texas Instruments Incorporated

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 TE Connectivit Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Fujikura Electronics

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Airgain Inc

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 Murata Manufacturing Co Ltd

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 AAC Technologies

List of Figures

- Figure 1: Global Antenna Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Antenna Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Antenna Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Antenna Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Antenna Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Antenna Market Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Antenna Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Antenna Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Antenna Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Antenna Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Antenna Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Antenna Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Antenna Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Antenna Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Antenna Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Antenna Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Antenna Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Antenna Market Revenue (Million), by Product 2024 & 2032

- Figure 31: Asia Antenna Market Revenue Share (%), by Product 2024 & 2032

- Figure 32: Asia Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Antenna Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Australia and New Zealand Antenna Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Australia and New Zealand Antenna Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Australia and New Zealand Antenna Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Australia and New Zealand Antenna Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Australia and New Zealand Antenna Market Revenue (Million), by Product 2024 & 2032

- Figure 39: Australia and New Zealand Antenna Market Revenue Share (%), by Product 2024 & 2032

- Figure 40: Australia and New Zealand Antenna Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Australia and New Zealand Antenna Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Antenna Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Antenna Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Antenna Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Antenna Market Revenue Million Forecast, by Product 2019 & 2032

- Table 5: Global Antenna Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Antenna Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Antenna Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Antenna Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Antenna Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Antenna Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Antenna Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Antenna Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Antenna Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Antenna Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Antenna Market Revenue Million Forecast, by Product 2019 & 2032

- Table 21: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Antenna Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Antenna Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Antenna Market Revenue Million Forecast, by Product 2019 & 2032

- Table 25: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Antenna Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Antenna Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Antenna Market Revenue Million Forecast, by Product 2019 & 2032

- Table 29: Global Antenna Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antenna Market?

The projected CAGR is approximately 7.85%.

2. Which companies are prominent players in the Antenna Market?

Key companies in the market include AAC Technologies, Molex LLC, Huizhou SPEED Wireless Technology Co Ltd, Luxshare Precision, Galtronics USA Inc, Linx Technologie, HOLITECH Technology Co Ltd, Sunway Communication, Amphenol Corporation, Qualcomm Technologies Inc, Xinwei Communication, Texas Instruments Incorporated, TE Connectivit Ltd, Fujikura Electronics, Airgain Inc, Murata Manufacturing Co Ltd.

3. What are the main segments of the Antenna Market?

The market segments include Type, Application, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Automation in Developing Countries Across Various Verticals; Penetration of the Internet and the Advent of IoT.

6. What are the notable trends driving market growth?

Phone to be the Largest Product Segment in the Studied Market.

7. Are there any restraints impacting market growth?

Need for Efficiency and Bandwidth Improvements.

8. Can you provide examples of recent developments in the market?

April 2023: Ignion, a Barcelona-based innovator in IoT antenna technology, announced a strategic partnership with Geocene, a renowned engineering and technology design firm based in California. This collaboration aims to provide robust support for the design and development of cutting-edge IoT devices, leveraging Ignion's Virtual Antenna technology and the cloud-based Antenna Intelligence Cloud. Given the intricacies of IoT development, a proficient engineering team equipped with the latest RF hardware technology is essential to expedite market entry with optimal connectivity and reliability. By joining forces, Geocene and Ignion are merging their personnel and technological expertise to facilitate successful solutions for customers grappling with intricate challenges and adapting to the ever-evolving market demands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antenna Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antenna Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antenna Market?

To stay informed about further developments, trends, and reports in the Antenna Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence