Key Insights

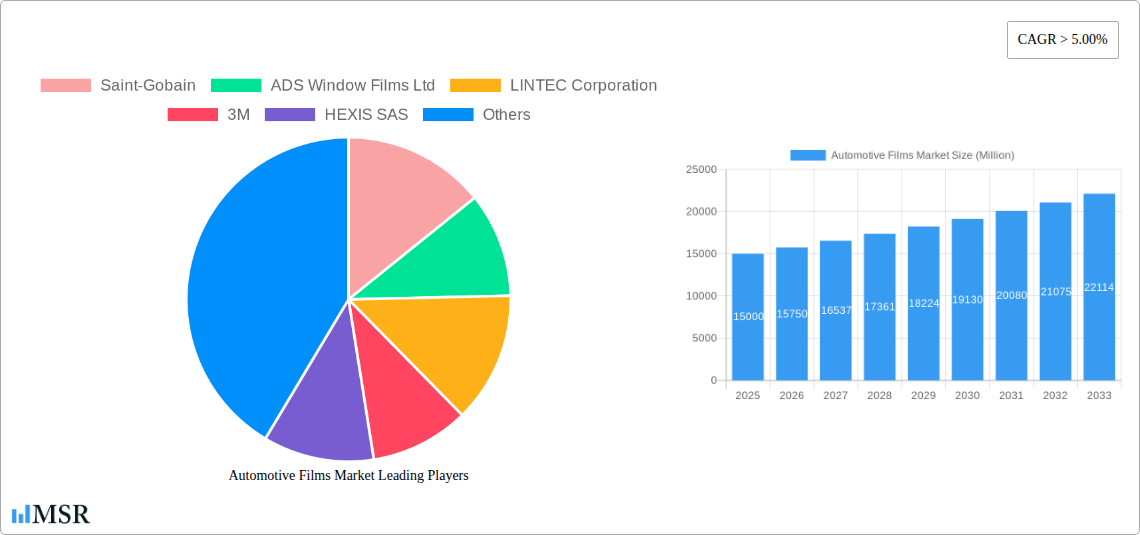

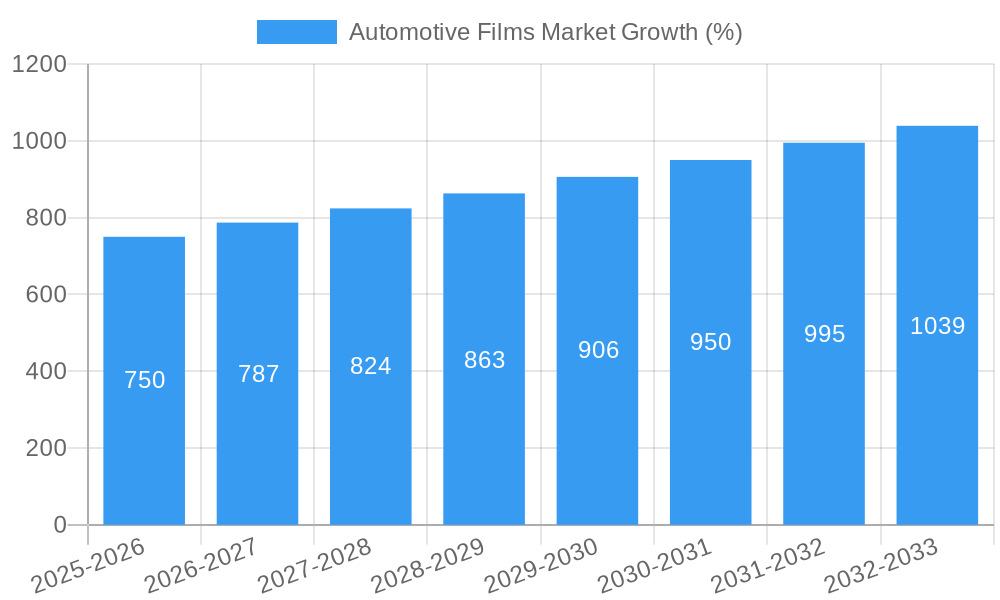

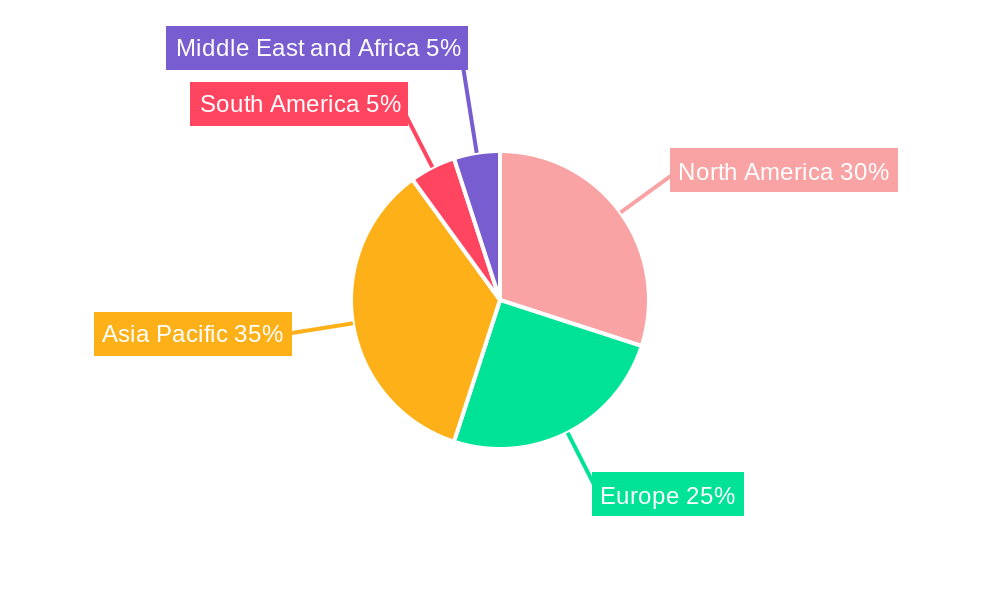

The global automotive films market is experiencing robust growth, driven by increasing demand for enhanced vehicle aesthetics, improved fuel efficiency, and advanced safety features. The market's expansion is fueled by several key factors. Firstly, the rising popularity of customized vehicles and the desire for unique appearances are boosting the demand for automotive paint protection films and wrapping films. Secondly, the increasing awareness of the benefits of window films, such as improved solar heat rejection, glare reduction, and UV protection, is driving significant growth in this segment. The rising adoption of electric vehicles (EVs) also plays a role, as manufacturers increasingly integrate films into vehicle designs to optimize energy efficiency and thermal management. Finally, technological advancements in film manufacturing are leading to the development of innovative products with enhanced performance characteristics, including improved durability, scratch resistance, and self-healing capabilities. The market is segmented by film type (window films/tints, including hybrid and crystalline options, paint protection films, and wrapping films) and vehicle type (passenger and commercial vehicles). While the Asia-Pacific region currently holds a significant market share, driven by robust automotive production in countries like China and India, North America and Europe are also experiencing substantial growth due to high consumer spending and technological advancements. Competition in the market is intense, with major players like 3M, Saint-Gobain, and Avery Dennison competing alongside numerous regional and specialized manufacturers.

The automotive films market’s future trajectory appears promising. Continued innovation in film technology, focusing on sustainability and enhanced performance, will likely drive further market expansion. The increasing integration of films into advanced driver-assistance systems (ADAS) and connected car technologies presents significant opportunities. However, challenges remain, including fluctuating raw material prices and potential supply chain disruptions. Furthermore, the regulatory landscape concerning film standards and environmental regulations may impact market growth. Nevertheless, the long-term outlook remains positive, with the market poised for considerable growth throughout the forecast period (2025-2033), driven by consistent demand from both original equipment manufacturers (OEMs) and aftermarket consumers. The projected CAGR exceeding 5% indicates a sustained period of market expansion.

Automotive Films Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Films Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report unveils the market's dynamic landscape, growth drivers, and future prospects. The study includes detailed segmentation by film type (Window Films/Tints, Other Window Films/Tints (Hybrid, Crystalline, etc.), Automotive Paint Protection Films, Automotive Wrapping Films) and vehicle type (Passenger Vehicles, Commercial Vehicles), providing a granular understanding of market trends and opportunities. Key players such as Saint-Gobain, 3M, Avery Dennison Corporation, and Toray Industries Inc. are analyzed, alongside emerging players, to illuminate the competitive landscape. The report also includes critical market data and projections, expressed in Millions, to facilitate informed decision-making.

Automotive Films Market Concentration & Dynamics

The Automotive Films Market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. However, the presence of numerous smaller players, particularly in niche segments like specialized automotive wrapping films, creates a dynamic competitive landscape. Market share is constantly shifting due to innovation, mergers and acquisitions (M&A), and the introduction of new technologies.

- Market Concentration: The top 5 players account for approximately xx% of the global market share in 2025 (estimated).

- Innovation Ecosystems: Significant R&D investments are driving innovation in film materials, adhesive technologies, and application methods. The development of eco-friendly films is a key area of focus.

- Regulatory Frameworks: Government regulations related to emissions, vehicle safety, and material sustainability are influencing product development and market dynamics. These regulations vary across regions, impacting market growth.

- Substitute Products: The market faces competition from alternative solutions like traditional paint jobs and aftermarket coatings. However, the superior performance and aesthetic advantages of automotive films continue to drive demand.

- End-User Trends: Growing consumer preference for vehicle customization, advanced aesthetics, and enhanced vehicle protection fuels demand. Increasing environmental awareness is also boosting the adoption of eco-friendly films.

- M&A Activities: The number of M&A deals in the automotive films sector has seen a xx% increase in the last five years, indicating consolidation and a pursuit of technological advancements. Recent examples include the February 2023 acquisition of Ai-Red Technology (Dalian) Co., Ltd. by Eastman Chemical Company.

Automotive Films Market Industry Insights & Trends

The Automotive Films Market is experiencing robust growth, driven by several key factors. The global market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by the increasing demand for automotive vehicles globally, especially in developing economies. Technological advancements in film materials, improved application techniques, and the rising preference for customized vehicles are further contributing to market expansion. The rising adoption of eco-friendly films is also playing a significant role.

Key Markets & Segments Leading Automotive Films Market

The Asia-Pacific region is currently the leading market for automotive films, driven by rapid economic growth, rising vehicle sales, and increasing consumer disposable income. However, North America and Europe are also significant markets, exhibiting strong demand for advanced film technologies and eco-friendly solutions.

Dominant Segments:

- Film Type: Window films/tints remain the dominant segment, followed by automotive paint protection films. The market for other window films, such as hybrid and crystalline films, is also witnessing considerable growth.

- Vehicle Type: Passenger vehicles dominate the market due to higher sales volumes. However, the commercial vehicle segment shows promising growth potential.

Growth Drivers:

- Economic Growth: Rising disposable income in developing economies is fueling demand for automotive films.

- Infrastructure Development: Improved infrastructure supporting the automotive industry in several regions is boosting market growth.

- Technological Advancements: Continuous innovations in film materials and application methods are increasing the appeal of automotive films.

Automotive Films Market Product Developments

Recent product innovations focus on enhanced durability, improved scratch resistance, self-healing capabilities, and eco-friendly materials. Manufacturers are developing films with superior UV protection, heat rejection properties, and improved aesthetic appeal. These advancements are creating competitive advantages and driving market growth. The development of solvent-free and water-based coatings, as seen in Toray Industries' recent innovation, is a significant step towards more sustainable manufacturing processes.

Challenges in the Automotive Films Market Market

The Automotive Films Market faces challenges including fluctuating raw material prices, supply chain disruptions, intense competition, and stringent regulatory compliance requirements. These factors can impact profitability and market growth trajectory. For example, supply chain constraints can lead to increased production costs and potential delays in product delivery.

Forces Driving Automotive Films Market Growth

Key growth drivers include technological advancements, such as the development of self-healing and eco-friendly films; increasing consumer preference for vehicle customization and aesthetic enhancements; and supportive government policies promoting sustainable transportation solutions. The growing awareness of the benefits of automotive films for vehicle protection also contributes to market expansion.

Long-Term Growth Catalysts in the Automotive Films Market

Long-term growth will be fueled by continuous innovations in film technology, strategic partnerships between film manufacturers and automotive companies, and expansion into new markets. The increasing adoption of electric vehicles (EVs) and autonomous vehicles could also positively impact market growth in the long term, leading to new application possibilities for automotive films.

Emerging Opportunities in Automotive Films Market

Emerging opportunities lie in the development of specialized films for electric vehicles, autonomous vehicles, and smart cars. The increasing demand for sustainable and eco-friendly products opens avenues for bio-based and recyclable film solutions. Furthermore, advancements in smart films with integrated functionalities, such as anti-fog and self-cleaning properties, present exciting growth prospects.

Leading Players in the Automotive Films Market Sector

- Saint-Gobain

- ADS Window Films Ltd

- LINTEC Corporation

- 3M

- HEXIS SAS

- Sun Tint

- Garware Suncontrol Film

- Eastman Chemical Company

- Avery Dennison Corporation

- TORAY INDUSTRIES INC

- All Pro Window Films

- Johnson Window Films Inc

- FILMTACK PTE LTD

- Nexfil USA

- Global Window Films

Key Milestones in Automotive Films Market Industry

- February 2023: Eastman Chemical Company's acquisition of Ai-Red Technology signifies a strategic move to expand its presence in the Asia-Pacific paint protection and window film market, potentially boosting market share and driving growth.

- December 2022: Toray Industries' development of an eco-friendly PET film demonstrates the industry's commitment to sustainability and could significantly impact the market by increasing the adoption of environmentally conscious automotive films.

Strategic Outlook for Automotive Films Market Market

The Automotive Films Market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and increased focus on sustainability. Strategic opportunities exist in developing innovative film solutions for emerging vehicle technologies, expanding into new geographic markets, and forging strategic partnerships to enhance market penetration and reach. The market's future is bright, with significant potential for growth and innovation.

Automotive Films Market Segmentation

-

1. Film Type

-

1.1. Window Films/Tints

- 1.1.1. Dyed Window Tint

- 1.1.2. Metallized Window Tint

- 1.1.3. Ceramic Window Tint

- 1.1.4. Carbon Window Tint

- 1.1.5. Other Wi

- 1.2. Automotive Paint Protection Films

- 1.3. Automotive Wrapping Films

-

1.1. Window Films/Tints

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

Automotive Films Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Automotive Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Concern for Safety

- 3.2.2 Security

- 3.2.3 and Privacy; Significant Demand for Automotive Films in Asia-Pacific and Europe

- 3.3. Market Restrains

- 3.3.1. Technical Issues with Dyed and Metallized Automotive Window Films; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Passenger Vehicles Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Film Type

- 5.1.1. Window Films/Tints

- 5.1.1.1. Dyed Window Tint

- 5.1.1.2. Metallized Window Tint

- 5.1.1.3. Ceramic Window Tint

- 5.1.1.4. Carbon Window Tint

- 5.1.1.5. Other Wi

- 5.1.2. Automotive Paint Protection Films

- 5.1.3. Automotive Wrapping Films

- 5.1.1. Window Films/Tints

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Film Type

- 6. Asia Pacific Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Film Type

- 6.1.1. Window Films/Tints

- 6.1.1.1. Dyed Window Tint

- 6.1.1.2. Metallized Window Tint

- 6.1.1.3. Ceramic Window Tint

- 6.1.1.4. Carbon Window Tint

- 6.1.1.5. Other Wi

- 6.1.2. Automotive Paint Protection Films

- 6.1.3. Automotive Wrapping Films

- 6.1.1. Window Films/Tints

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Film Type

- 7. North America Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Film Type

- 7.1.1. Window Films/Tints

- 7.1.1.1. Dyed Window Tint

- 7.1.1.2. Metallized Window Tint

- 7.1.1.3. Ceramic Window Tint

- 7.1.1.4. Carbon Window Tint

- 7.1.1.5. Other Wi

- 7.1.2. Automotive Paint Protection Films

- 7.1.3. Automotive Wrapping Films

- 7.1.1. Window Films/Tints

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Film Type

- 8. Europe Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Film Type

- 8.1.1. Window Films/Tints

- 8.1.1.1. Dyed Window Tint

- 8.1.1.2. Metallized Window Tint

- 8.1.1.3. Ceramic Window Tint

- 8.1.1.4. Carbon Window Tint

- 8.1.1.5. Other Wi

- 8.1.2. Automotive Paint Protection Films

- 8.1.3. Automotive Wrapping Films

- 8.1.1. Window Films/Tints

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Film Type

- 9. South America Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Film Type

- 9.1.1. Window Films/Tints

- 9.1.1.1. Dyed Window Tint

- 9.1.1.2. Metallized Window Tint

- 9.1.1.3. Ceramic Window Tint

- 9.1.1.4. Carbon Window Tint

- 9.1.1.5. Other Wi

- 9.1.2. Automotive Paint Protection Films

- 9.1.3. Automotive Wrapping Films

- 9.1.1. Window Films/Tints

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Vehicles

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Film Type

- 10. Middle East and Africa Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Film Type

- 10.1.1. Window Films/Tints

- 10.1.1.1. Dyed Window Tint

- 10.1.1.2. Metallized Window Tint

- 10.1.1.3. Ceramic Window Tint

- 10.1.1.4. Carbon Window Tint

- 10.1.1.5. Other Wi

- 10.1.2. Automotive Paint Protection Films

- 10.1.3. Automotive Wrapping Films

- 10.1.1. Window Films/Tints

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Vehicles

- 10.2.2. Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Film Type

- 11. Asia Pacific Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 India

- 11.1.3 Japan

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 Italy

- 13.1.4 France

- 13.1.5 Rest of Europe

- 14. South America Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Automotive Films Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Saint-Gobain

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ADS Window Films Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 LINTEC Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 3M

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 HEXIS SAS

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Sun Tint

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Garware Suncontrol Film

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Eastman Chemical Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Avery Dennison Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TORAY INDUSTRIES INC *List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 All Pro Window Films

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Johnson Window Films Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 FILMTACK PTE LTD

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Nexfil USA

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Global Window Films

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Saint-Gobain

List of Figures

- Figure 1: Global Automotive Films Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Automotive Films Market Revenue (Million), by Film Type 2024 & 2032

- Figure 13: Asia Pacific Automotive Films Market Revenue Share (%), by Film Type 2024 & 2032

- Figure 14: Asia Pacific Automotive Films Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: Asia Pacific Automotive Films Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: Asia Pacific Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Asia Pacific Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Automotive Films Market Revenue (Million), by Film Type 2024 & 2032

- Figure 19: North America Automotive Films Market Revenue Share (%), by Film Type 2024 & 2032

- Figure 20: North America Automotive Films Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 21: North America Automotive Films Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: North America Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Automotive Films Market Revenue (Million), by Film Type 2024 & 2032

- Figure 25: Europe Automotive Films Market Revenue Share (%), by Film Type 2024 & 2032

- Figure 26: Europe Automotive Films Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 27: Europe Automotive Films Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 28: Europe Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Automotive Films Market Revenue (Million), by Film Type 2024 & 2032

- Figure 31: South America Automotive Films Market Revenue Share (%), by Film Type 2024 & 2032

- Figure 32: South America Automotive Films Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 33: South America Automotive Films Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 34: South America Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Automotive Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Automotive Films Market Revenue (Million), by Film Type 2024 & 2032

- Figure 37: Middle East and Africa Automotive Films Market Revenue Share (%), by Film Type 2024 & 2032

- Figure 38: Middle East and Africa Automotive Films Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Middle East and Africa Automotive Films Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Middle East and Africa Automotive Films Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Automotive Films Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Films Market Revenue Million Forecast, by Film Type 2019 & 2032

- Table 3: Global Automotive Films Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Global Automotive Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Saudi Arabia Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Films Market Revenue Million Forecast, by Film Type 2019 & 2032

- Table 30: Global Automotive Films Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 31: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: China Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: India Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: South Korea Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Automotive Films Market Revenue Million Forecast, by Film Type 2019 & 2032

- Table 38: Global Automotive Films Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Automotive Films Market Revenue Million Forecast, by Film Type 2019 & 2032

- Table 44: Global Automotive Films Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 45: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: France Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Automotive Films Market Revenue Million Forecast, by Film Type 2019 & 2032

- Table 52: Global Automotive Films Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 53: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Argentina Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of South America Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Automotive Films Market Revenue Million Forecast, by Film Type 2019 & 2032

- Table 58: Global Automotive Films Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 59: Global Automotive Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Saudi Arabia Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Automotive Films Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Films Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Automotive Films Market?

Key companies in the market include Saint-Gobain, ADS Window Films Ltd, LINTEC Corporation, 3M, HEXIS SAS, Sun Tint, Garware Suncontrol Film, Eastman Chemical Company, Avery Dennison Corporation, TORAY INDUSTRIES INC *List Not Exhaustive, All Pro Window Films, Johnson Window Films Inc, FILMTACK PTE LTD, Nexfil USA, Global Window Films.

3. What are the main segments of the Automotive Films Market?

The market segments include Film Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concern for Safety. Security. and Privacy; Significant Demand for Automotive Films in Asia-Pacific and Europe.

6. What are the notable trends driving market growth?

Increasing Demand from the Passenger Vehicles Segment.

7. Are there any restraints impacting market growth?

Technical Issues with Dyed and Metallized Automotive Window Films; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia Pacific region. This acquisition demonstrates Eastman's commitment to driving growth in Performance Films and the paint protection and window film markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Films Market?

To stay informed about further developments, trends, and reports in the Automotive Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence