Key Insights

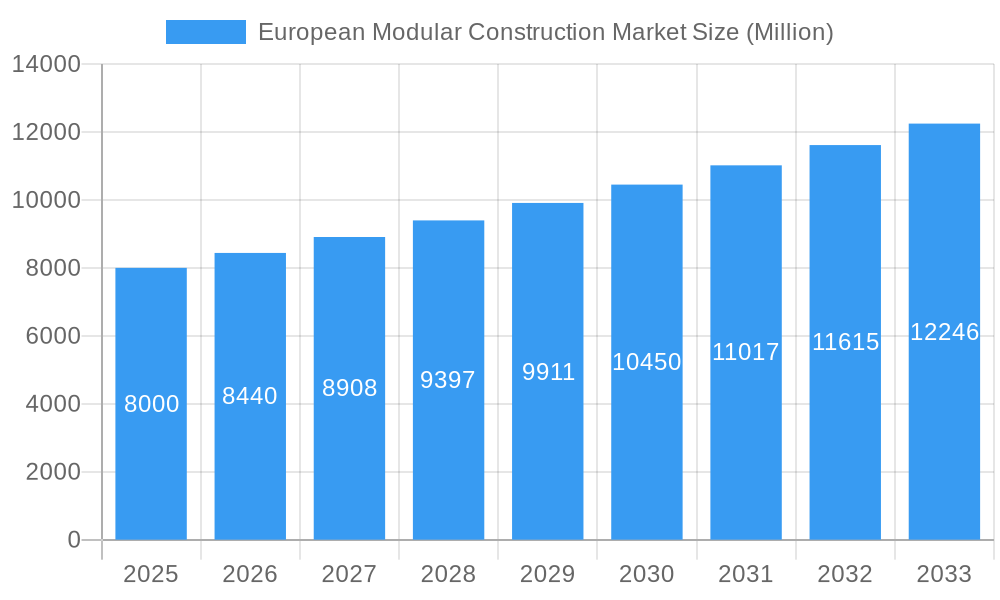

The European modular construction market is experiencing robust growth, driven by increasing demand for sustainable and efficient building solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 5% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors: a growing focus on sustainability in the construction industry, the need for faster project completion times to meet housing demands, and cost-effectiveness compared to traditional construction methods. Furthermore, advancements in modular building technologies, including prefabrication and improved design capabilities, are enhancing the quality and versatility of modular structures, leading to wider adoption across various sectors, from residential to commercial and industrial. The rising popularity of sustainable building materials and the increasing need for quicker construction turnaround times are further propelling the market’s expansion.

European Modular Construction Market Market Size (In Billion)

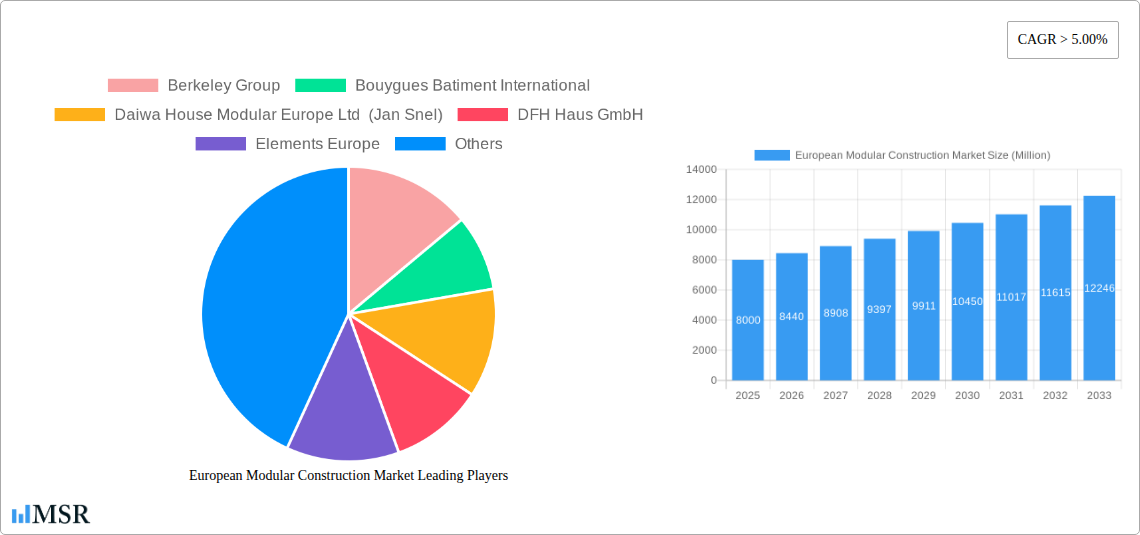

Several prominent players dominate the European modular construction landscape, including Berkeley Group, Bouygues Batiment International, and others listed in the provided data. These companies are actively contributing to market expansion through innovation, strategic partnerships, and expansion into new geographical areas. While challenges such as regulatory hurdles and overcoming public perceptions associated with modular construction persist, the overall market outlook remains positive. The continued focus on sustainable practices, technological advancements, and the growing need for rapid construction solutions suggest a sustained period of expansion for the European modular construction market, leading to a substantial market size projected well beyond 2033. We estimate the 2025 market size, given the 5%+ CAGR and considering industry reports on similar markets, to be around €8 billion. Further expansion is expected based on projected growth and expansion into new segments within the construction and infrastructure sectors.

European Modular Construction Market Company Market Share

European Modular Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European modular construction market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report unveils market dynamics, growth drivers, challenges, and future opportunities within this rapidly evolving sector. The report leverages extensive data analysis to predict a market size of xx Million by 2033, demonstrating a robust CAGR of xx%.

European Modular Construction Market Market Concentration & Dynamics

The European modular construction market exhibits a moderately concentrated landscape, with several key players vying for market share. While a precise market share breakdown for each company is currently unavailable, leading players such as Berkeley Group, Bouygues Batiment International, Daiwa House Modular Europe Ltd (Jan Snel), DFH Haus GmbH, Elements Europe, Karmod Prefabricated Technologies, Laing O'Rourke Corpt Ltd, Modulaire Group, Modubuild, Moelven Industrier ASA, and Skanska AB (list not exhaustive) significantly influence market dynamics.

- Market Concentration: Moderate, with a few dominant players and numerous smaller specialized firms. Further consolidation through mergers and acquisitions (M&A) is anticipated.

- Innovation Ecosystems: A vibrant ecosystem of technology providers, material suppliers, and design firms fuels innovation in modular construction techniques and materials.

- Regulatory Frameworks: Varying building codes and regulations across European nations create both opportunities and challenges for market expansion. Harmonization efforts are underway but present ongoing complexities.

- Substitute Products: Traditional construction methods remain a significant competitor; however, modular construction offers compelling advantages in terms of speed, cost-effectiveness, and sustainability.

- End-User Trends: Growing demand for sustainable and efficient construction solutions from both residential and commercial sectors is driving market growth.

- M&A Activities: The past few years have witnessed a moderate number of M&A deals (xx in the historical period), reflecting consolidation efforts and expansion strategies within the sector. The trend is expected to continue, further shaping the market landscape.

European Modular Construction Market Industry Insights & Trends

The European modular construction market is experiencing robust growth, driven by several key factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025. Increased demand for sustainable and efficient building solutions, coupled with technological advancements in modular construction techniques, is fueling this expansion. The market's CAGR during the forecast period (2025-2033) is estimated to be xx%. This growth is also being facilitated by government initiatives promoting sustainable construction practices and investment in infrastructure projects across various European nations. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and advanced manufacturing techniques like 3D printing, are revolutionizing the modular construction process, leading to improved efficiency, precision, and reduced construction timelines. Evolving consumer preferences, particularly a preference for faster construction times and more sustainable building materials, further underpin market growth.

Key Markets & Segments Leading European Modular Construction Market

While data on specific segment dominance is unavailable, the UK, Germany, and France are expected to be leading markets due to significant infrastructure projects and a robust construction industry. The residential sector is likely the largest segment, followed by commercial and industrial applications.

- Drivers for Dominant Regions:

- Strong Economic Growth: Countries with stable economies and high construction activity will see increased adoption of modular techniques.

- Government Infrastructure Investments: Large-scale infrastructure projects create high demand for efficient and cost-effective construction methods.

- Favorable Regulatory Environment: Supportive government policies and streamlined approval processes accelerate modular construction projects.

- High Population Density: Urban areas with limited space benefit from modular solutions that optimize land use.

European Modular Construction Market Product Developments

Recent years have witnessed significant innovations in modular construction products, including prefabricated modules with improved insulation, sustainable materials, and integrated smart home technologies. These advancements enhance energy efficiency, reduce construction waste, and improve the overall quality of the built environment. The focus on prefabrication and offsite manufacturing also ensures improved quality control and reduced on-site construction time. This creates a competitive edge for modular construction firms, making them increasingly attractive to developers and contractors seeking to minimize project delays and maximize cost efficiencies.

Challenges in the European Modular Construction Market Market

The European modular construction market faces several challenges, including regulatory hurdles, supply chain disruptions, and intense competition from traditional construction methods. These factors can lead to project delays, increased costs, and reduced profit margins. Specifically, inconsistencies in building codes across different European countries add complexity and create barriers to seamless market expansion. Supply chain bottlenecks, particularly in securing key materials, can impact project timelines and budgets. The ongoing competition from established construction firms, accustomed to traditional building methods, presents a persistent challenge to the wider adoption of modular construction.

Forces Driving European Modular Construction Market Growth

Several key factors are driving the growth of the European modular construction market. These include increased demand for sustainable building solutions, advancements in prefabrication technology, government support for sustainable construction, and growing urbanization. Technological advancements, such as the integration of BIM and digital tools, improve design efficiency and construction precision. Government incentives and regulations that prioritize sustainable and efficient building practices also fuel market expansion. The increasing demand for housing in densely populated urban areas necessitates innovative and space-saving solutions, making modular construction an attractive option.

Challenges in the European Modular Construction Market Market

Long-term growth in the European modular construction market hinges on addressing several factors. Continued innovation in modular design and construction techniques, coupled with strategic partnerships between developers, manufacturers, and technology providers, will be crucial. Expansion into new markets and the development of standardized building codes across Europe are key to unlocking greater market potential. Overcoming existing perceptions and demonstrating the long-term cost and environmental benefits of modular construction will be critical for sustained growth.

Emerging Opportunities in European Modular Construction Market

Emerging trends and opportunities in the European modular construction market include the increasing demand for sustainable and resilient buildings, the growing adoption of offsite manufacturing, and the integration of smart building technologies. Expansion into new geographic markets with significant infrastructure development presents promising growth avenues. The development of innovative modular designs for diverse building applications, such as healthcare facilities and educational buildings, presents significant opportunities. Advancements in sustainable materials and construction methods will also create competitive advantages.

Leading Players in the European Modular Construction Market Sector

- Berkeley Group

- Bouygues Batiment International

- Daiwa House Modular Europe Ltd (Jan Snel)

- DFH Haus GmbH

- Elements Europe

- Karmod Prefabricated Technologies

- Laing O'Rourke Corpt Ltd

- Modulaire Group

- Modubuild

- Moelven Industrier ASA

- Skanska AB

- *List Not Exhaustive

Key Milestones in European Modular Construction Market Industry

- October 2022: Daiwa House's joint venture with Capital Bay to deliver modular construction across Europe signifies a significant expansion of modular construction capabilities and market reach. This partnership is expected to drive substantial growth in the sector.

- June 2022: Laing O'Rourke's contract to build HS2's Interchange Station showcases the increasing adoption of modular construction for large-scale infrastructure projects. This project demonstrates the scalability and capabilities of modular construction in high-profile projects.

Strategic Outlook for European Modular Construction Market Market

The future of the European modular construction market is bright, characterized by robust growth potential driven by technological innovation, increasing demand for sustainable building solutions, and supportive government policies. Strategic partnerships, investments in research and development, and a focus on overcoming regulatory and supply chain challenges are key to maximizing future market potential. The continued adoption of modular construction for both residential and commercial projects, along with expansion into new markets, will shape the sector's trajectory in the coming years.

European Modular Construction Market Segmentation

-

1. Type

- 1.1. Permanent

- 1.2. Relocatable

-

2. Material

- 2.1. Steel

- 2.2. Concrete

- 2.3. Wood

- 2.4. Plastic

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Industrial/Institutional

- 3.3. Residential

European Modular Construction Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

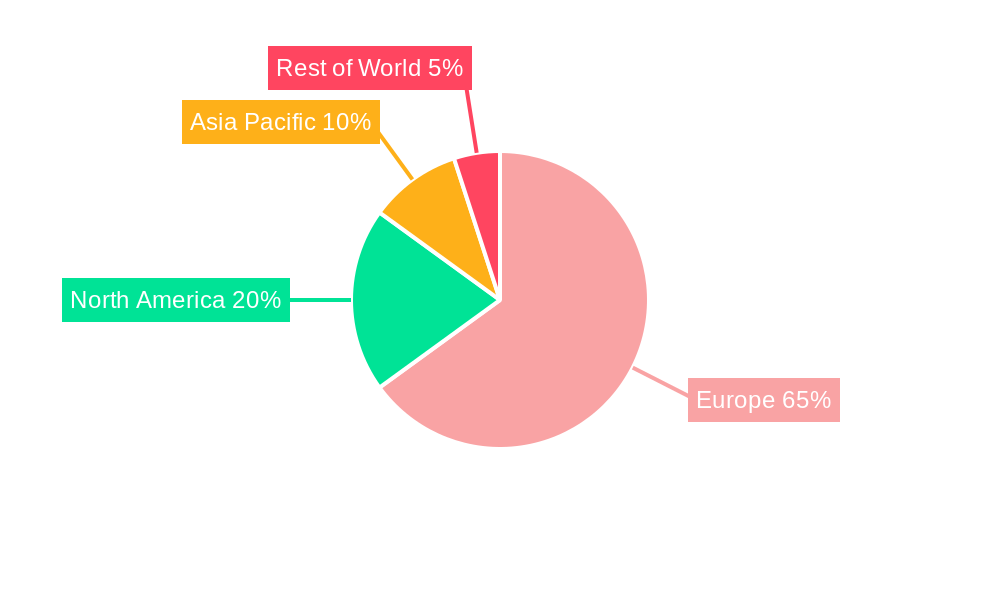

European Modular Construction Market Regional Market Share

Geographic Coverage of European Modular Construction Market

European Modular Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality

- 3.2.2 Eco-friendly Homes

- 3.3. Market Restrains

- 3.3.1 Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality

- 3.3.2 Eco-friendly Homes

- 3.4. Market Trends

- 3.4.1. Commercial Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Permanent

- 5.1.2. Relocatable

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Steel

- 5.2.2. Concrete

- 5.2.3. Wood

- 5.2.4. Plastic

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Industrial/Institutional

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Permanent

- 6.1.2. Relocatable

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Steel

- 6.2.2. Concrete

- 6.2.3. Wood

- 6.2.4. Plastic

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Industrial/Institutional

- 6.3.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Permanent

- 7.1.2. Relocatable

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Steel

- 7.2.2. Concrete

- 7.2.3. Wood

- 7.2.4. Plastic

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Industrial/Institutional

- 7.3.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Permanent

- 8.1.2. Relocatable

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Steel

- 8.2.2. Concrete

- 8.2.3. Wood

- 8.2.4. Plastic

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Industrial/Institutional

- 8.3.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Permanent

- 9.1.2. Relocatable

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Steel

- 9.2.2. Concrete

- 9.2.3. Wood

- 9.2.4. Plastic

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Industrial/Institutional

- 9.3.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe European Modular Construction Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Permanent

- 10.1.2. Relocatable

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Steel

- 10.2.2. Concrete

- 10.2.3. Wood

- 10.2.4. Plastic

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Industrial/Institutional

- 10.3.3. Residential

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berkeley Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bouygues Batiment International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daiwa House Modular Europe Ltd (Jan Snel)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DFH Haus GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Elements Europe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Karmod Prefabricated Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laing O'Rourke Corpt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Modulaire Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Modubuild

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moelven Industrier ASA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Skanska AB*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Berkeley Group

List of Figures

- Figure 1: Global European Modular Construction Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Germany European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Germany European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Germany European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 5: Germany European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: Germany European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Germany European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Germany European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Germany European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Kingdom European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: United Kingdom European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: United Kingdom European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 13: United Kingdom European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: United Kingdom European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: United Kingdom European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: United Kingdom European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: United Kingdom European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: France European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: France European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: France European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 21: France European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: France European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: France European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: France European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: France European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Italy European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Italy European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Italy European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 29: Italy European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Italy European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Italy European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Italy European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Italy European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Europe European Modular Construction Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Rest of Europe European Modular Construction Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Rest of Europe European Modular Construction Market Revenue (undefined), by Material 2025 & 2033

- Figure 37: Rest of Europe European Modular Construction Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Rest of Europe European Modular Construction Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Rest of Europe European Modular Construction Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of Europe European Modular Construction Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of Europe European Modular Construction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 3: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global European Modular Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 7: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 11: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 15: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 19: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global European Modular Construction Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global European Modular Construction Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 23: Global European Modular Construction Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global European Modular Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Modular Construction Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the European Modular Construction Market?

Key companies in the market include Berkeley Group, Bouygues Batiment International, Daiwa House Modular Europe Ltd (Jan Snel), DFH Haus GmbH, Elements Europe, Karmod Prefabricated Technologies, Laing O'Rourke Corpt Ltd, Modulaire Group, Modubuild, Moelven Industrier ASA, Skanska AB*List Not Exhaustive.

3. What are the main segments of the European Modular Construction Market?

The market segments include Type, Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality. Eco-friendly Homes.

6. What are the notable trends driving market growth?

Commercial Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Modular Construction in Commercial Segment; Rising Demand for Higher-quality. Eco-friendly Homes.

8. Can you provide examples of recent developments in the market?

October 2022 : Japan's largest homebuilder, Daiwa House, announced their joint venture with Capital Bay to deliver modular construction across Europe. The JV will result in Capital Bay using modular construction units for its own projects and operator brands, but will also be offered to third-party customers in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Modular Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Modular Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Modular Construction Market?

To stay informed about further developments, trends, and reports in the European Modular Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence