Key Insights

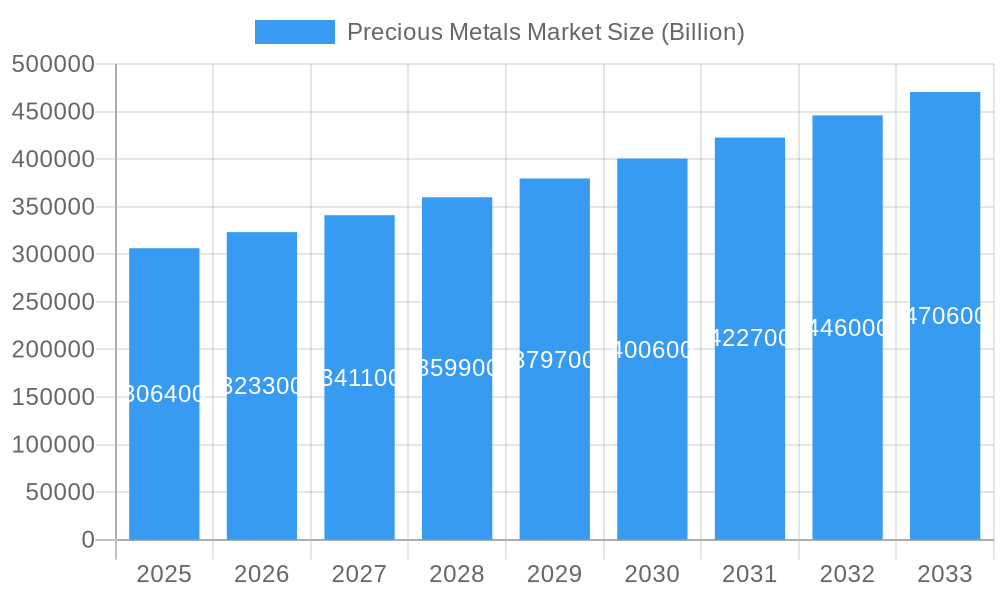

The global precious metals market is poised for robust expansion, projected to reach USD 306.4 Billion by 2025, and is expected to grow at a compound annual growth rate (CAGR) of 5.5% during the forecast period of 2025-2033. This significant growth trajectory is fueled by a confluence of powerful drivers, including the escalating demand for precious metals in the automotive sector for catalytic converters, driven by increasingly stringent emission regulations worldwide. The pharmaceutical industry also presents a substantial growth avenue, leveraging precious metals as catalysts and in advanced medical devices. Furthermore, the petrochemical sector's ongoing need for efficient catalysts in refining and chemical production underpins sustained demand. Emerging trends such as the increasing adoption of electric vehicles (EVs), which utilize precious metals in their components and batteries, and the growing investment in precious metals as a safe-haven asset amidst economic uncertainties are further propelling market expansion.

Precious Metals Market Market Size (In Billion)

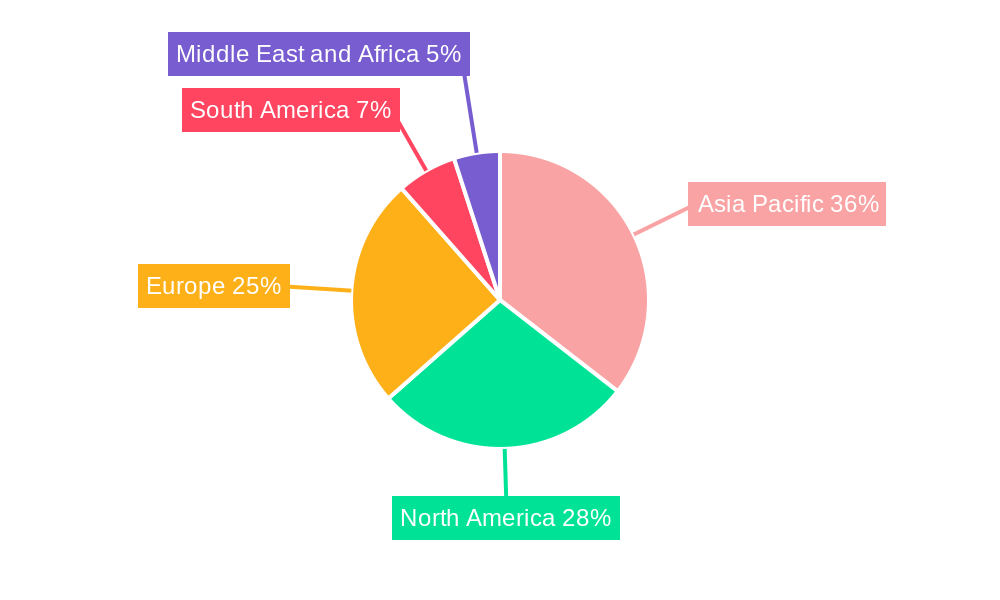

Despite the optimistic outlook, certain restraints could temper the market's growth. Volatility in precious metal prices, influenced by geopolitical events, global economic conditions, and speculative trading, can impact investment decisions and production costs. Supply chain disruptions, exacerbated by mining challenges and geopolitical instability in key producing regions, also pose a threat to consistent availability. However, the market is demonstrating resilience and adaptability. Key segments like Platinum and Palladium are anticipated to witness particularly strong demand due to their critical roles in emissions control and electronics. Regionally, Asia Pacific is emerging as a dominant force, driven by rapid industrialization in China and India, coupled with advancements in manufacturing and technology sectors across the region. North America and Europe remain significant markets, supported by established automotive and industrial bases, while South America and the Middle East & Africa are showing promising growth potential.

Precious Metals Market Company Market Share

Precious Metals Market: Comprehensive Analysis and Strategic Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global precious metals market, projecting a market size of $XXX Billion by 2025 and a compound annual growth rate (CAGR) of XX.XX% during the forecast period of 2025–2033. Covering a historical period from 2019–2024 and a base year of 2025, this research delves into market dynamics, key trends, segment-specific performance, product innovations, challenges, growth drivers, and strategic opportunities. The report meticulously examines the roles of Platinum, Palladium, Rhodium, Iridium, and Ruthenium, and their applications across critical sectors including Automotive, Pharmaceutical, and Petrochemicals. With a focus on actionable insights, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving precious metals landscape.

Precious Metals Market Market Concentration & Dynamics

The precious metals market exhibits a dynamic interplay of concentration and fragmentation, with key players like Heraeus Holding, Umicore Galvanotechnik GmbH, Johnson Matthey, and BASF SE holding significant market shares, estimated to be in the billions of dollars. These dominant entities influence market trends through substantial investments in research and development, driving innovation ecosystems focused on sustainable sourcing and advanced refining techniques. Regulatory frameworks surrounding mining, environmental impact, and trade policies play a crucial role in shaping market entry and operational strategies, particularly concerning responsible sourcing initiatives. The emergence of substitute materials in certain niche applications, while not yet posing a significant threat to core demand, necessitates continuous innovation from established players. End-user trends, especially the increasing demand for catalysts in emission control and the growing use in electronic components, are directly influencing product development and market expansion. Mergers and acquisition (M&A) activities, with an estimated XX major deals in the historical period, continue to consolidate market power and expand capabilities, as seen with potential acquisitions aimed at securing supply chains or gaining access to proprietary technologies. Analyzing these M&A deal counts alongside market share data reveals a landscape ripe for strategic consolidation and partnership opportunities.

Precious Metals Market Industry Insights & Trends

The precious metals market is experiencing robust growth, driven by a confluence of technological advancements, increasing industrial demand, and a growing emphasis on sustainability. The estimated market size for the base year of 2025 stands at a significant $XXX Billion, with a projected CAGR of XX.XX% throughout the forecast period (2025–2033). Key market growth drivers include the escalating demand for platinum group metals (PGMs) in automotive catalytic converters, crucial for meeting stringent emission standards globally. The pharmaceutical sector's reliance on precious metals for catalysts in drug synthesis and as components in medical devices further bolsters demand. Petrochemical industries continue to utilize these metals in refining processes, contributing to sustained market activity. Technological disruptions are evident in the development of more efficient recycling processes, reducing reliance on primary mining and promoting a circular economy. Innovations in nanotechnology are also opening new avenues for precious metal applications in electronics, energy storage, and advanced materials. Evolving consumer behaviors, such as the growing preference for electric vehicles (EVs) and a heightened awareness of ethical sourcing, are indirectly influencing the demand for specific precious metals and the methods of their extraction and processing. The growing adoption of advanced materials science research and development within companies like American Elements, Stanford Advanced Materials, and Alfa Aesar Thermo Fisher Scientific is instrumental in identifying and commercializing novel applications. The continuous pursuit of enhanced performance and miniaturization in electronic devices is also a significant contributor to the consistent demand for these high-value metals. The global shift towards cleaner energy solutions and the development of sophisticated medical treatments will continue to underpin the long-term growth trajectory of the precious metals market.

Key Markets & Segments Leading Precious Metals Market

The precious metals market is dominated by specific regions and segments that are crucial to its overall performance. Among the Type segments, Platinum and Palladium are currently leading due to their extensive use in the automotive industry, particularly in catalytic converters designed to reduce harmful emissions. The Automotive application segment represents the largest market share, driven by stricter environmental regulations and the increasing global vehicle production. Economic growth and infrastructure development in emerging economies are significant drivers for this dominance, as they lead to higher vehicle sales.

- Automotive: This segment's growth is propelled by government mandates for emission control, such as Euro 7 standards in Europe and similar regulations in North America and Asia. The transition towards hybrid and internal combustion engine vehicles still requires substantial platinum and palladium for their exhaust systems.

- Pharmaceutical: While smaller in volume compared to automotive, the pharmaceutical segment is characterized by high-value applications. The demand for rhodium and iridium in specialized chemical synthesis and catalysis for drug development is steadily increasing. This is driven by the discovery of new drugs and the need for highly efficient and selective catalytic processes.

- Petrochemicals: This segment's demand for precious metals, particularly platinum and ruthenium, is linked to their role in various refining and cracking processes. Global energy demand and the need for efficient fuel production maintain a steady, albeit less dynamic, demand for these metals.

Geographically, Asia Pacific, particularly China and India, is emerging as a significant growth hub due to its rapidly expanding automotive manufacturing base and increasing industrialization. North America and Europe remain crucial markets, driven by advanced automotive technology and a strong pharmaceutical sector. The ongoing investments in cutting-edge research by companies like Shaanxi kaida chemical co LTD, Clariant, and Kaili Catalyst New Materials CO LTD are crucial for identifying and expanding into these high-growth segments. The steady demand from these key applications underscores the intrinsic value and indispensable nature of precious metals in modern industrial processes.

Precious Metals Market Product Developments

Product innovation in the precious metals market is largely focused on enhancing the efficiency, recyclability, and application scope of these valuable materials. Companies are actively developing advanced catalytic converters utilizing optimized PGM loadings to meet evolving emission standards while reducing costs. Research into novel alloys and composite materials incorporating precious metals is expanding their use in electronics, particularly in miniaturized components for consumer devices and advanced semiconductor manufacturing. Furthermore, significant advancements are being made in precious metal recovery and refining technologies, enabling higher yields from spent catalysts and electronic waste, thereby promoting a more sustainable supply chain. These technological advancements are critical for maintaining a competitive edge and addressing the growing demand for sustainable sourcing.

Challenges in the Precious Metals Market Market

The precious metals market faces several significant challenges that impact its growth and operational efficiency. Volatile price fluctuations, driven by geopolitical instability and speculative trading, create uncertainty for both producers and consumers. Supply chain disruptions, stemming from mining complexities, extraction difficulties, and geopolitical tensions in key producing regions, pose a constant threat to availability. Stringent environmental regulations associated with mining and refining processes require substantial investments in compliance and sustainable practices, increasing operational costs. Furthermore, the development of alternative materials or technologies in some applications, while still nascent, represents a long-term competitive pressure. The high capital expenditure required for exploration, extraction, and refining also acts as a barrier to entry for new market participants.

Forces Driving Precious Metals Market Growth

Several powerful forces are propelling the growth of the precious metals market. The global automotive industry's relentless pursuit of cleaner emissions is a primary driver, necessitating the increased use of platinum and palladium in catalytic converters. The burgeoning pharmaceutical sector's demand for precious metal catalysts in drug synthesis and manufacturing also contributes significantly. Advancements in electronics, including the development of sophisticated sensors, high-performance chips, and conductive inks, are creating new avenues for precious metal applications. Furthermore, the growing emphasis on sustainable practices and the circular economy is driving innovation in precious metal recycling technologies, making them more economically viable and environmentally friendly. Economic expansion and industrial development in emerging markets further fuel demand across various sectors.

Challenges in the Precious Metals Market Market

Long-term growth catalysts for the precious metals market are intrinsically linked to innovation and strategic market expansion. Continued research and development into novel applications for platinum group metals in areas such as hydrogen fuel cells, advanced battery technologies, and specialized medical treatments will unlock significant future demand. Strategic partnerships between precious metal suppliers and end-user industries, like collaborations between Evonik Industries AG and automotive manufacturers, foster co-development of next-generation materials and technologies. Market expansions into rapidly industrializing regions, coupled with investments in refining and recycling infrastructure, will ensure a consistent and reliable supply chain. The increasing focus on ethical sourcing and sustainability will also favor companies that can demonstrate transparent and responsible practices, creating a competitive advantage and driving long-term market penetration.

Emerging Opportunities in Precious Metals Market

Emerging opportunities within the precious metals market are abundant, driven by technological advancements and evolving global priorities. The burgeoning hydrogen economy presents a significant opportunity, with platinum serving as a crucial catalyst in fuel cells for clean energy generation and transportation. The development of advanced medical implants and diagnostic tools utilizing precious metal alloys is another area of considerable potential. Furthermore, the increasing adoption of smart devices and the expansion of the Internet of Things (IoT) are driving demand for precious metals in specialized electronic components. The focus on sustainable mining practices and the development of efficient precious metal recycling technologies from e-waste and spent catalysts are also creating new business models and revenue streams, aligning with global sustainability goals and consumer preferences.

Leading Players in the Precious Metals Market Sector

- Heraeus Holding

- Shaanxi kaida chemical co LTD

- Clariant

- Kaili Catalyst New Materials CO LTD

- Umicore Galvanotechnik GmbH

- American Elements

- CHIMET

- Evonik Industries AG

- Sabin Metal Corporation

- Souvenier Chemicals

- ReMetall Deutschland AG

- BASF SE

- Stanford Advanced Materials

- Catalytic Products International

- J&J Materials Inc

- Alfa Aesar Thermo Fisher Scientific

- Johnson Matthey

- ALS Limited

Key Milestones in Precious Metals Market Industry

- Recent developments in the market studied will be covered in the final report.

Strategic Outlook for Precious Metals Market Market

The strategic outlook for the precious metals market remains highly positive, with growth accelerators centered on innovation and diversification. Continued investment in research and development for applications in the burgeoning hydrogen economy, advanced battery technologies, and sustainable energy solutions will be paramount. Strategic partnerships with key end-user industries will drive the co-creation of specialized materials and the expansion of market reach. Developing robust and transparent recycling infrastructures will not only address supply chain concerns but also appeal to environmentally conscious stakeholders. Furthermore, proactive engagement with regulatory bodies to shape favorable policies for responsible mining and precious metal utilization will be crucial for sustained market expansion and long-term growth potential.

Precious Metals Market Segmentation

-

1. Type

- 1.1. Platinum

- 1.2. Palladium

- 1.3. Rhodium

- 1.4. Iridium

- 1.5. Ruthenium

- 1.6. Other Types

-

2. Application

- 2.1. Automotive

- 2.2. Pharmaceutical

- 2.3. Petrochemicals

- 2.4. Other Applications

Precious Metals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Precious Metals Market Regional Market Share

Geographic Coverage of Precious Metals Market

Precious Metals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Accelerating Demand for High-Performance Transportation Fuel; Increasing Investment in Refineries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Production Costs; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Precious Metals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Platinum

- 5.1.2. Palladium

- 5.1.3. Rhodium

- 5.1.4. Iridium

- 5.1.5. Ruthenium

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Pharmaceutical

- 5.2.3. Petrochemicals

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Precious Metals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Platinum

- 6.1.2. Palladium

- 6.1.3. Rhodium

- 6.1.4. Iridium

- 6.1.5. Ruthenium

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Pharmaceutical

- 6.2.3. Petrochemicals

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Precious Metals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Platinum

- 7.1.2. Palladium

- 7.1.3. Rhodium

- 7.1.4. Iridium

- 7.1.5. Ruthenium

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Pharmaceutical

- 7.2.3. Petrochemicals

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Precious Metals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Platinum

- 8.1.2. Palladium

- 8.1.3. Rhodium

- 8.1.4. Iridium

- 8.1.5. Ruthenium

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Pharmaceutical

- 8.2.3. Petrochemicals

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Precious Metals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Platinum

- 9.1.2. Palladium

- 9.1.3. Rhodium

- 9.1.4. Iridium

- 9.1.5. Ruthenium

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Pharmaceutical

- 9.2.3. Petrochemicals

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Precious Metals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Platinum

- 10.1.2. Palladium

- 10.1.3. Rhodium

- 10.1.4. Iridium

- 10.1.5. Ruthenium

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive

- 10.2.2. Pharmaceutical

- 10.2.3. Petrochemicals

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heraeus Holding

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shaanxi kaida chemical co LTD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clariant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kaili Catalyst New Materials CO LTD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Umicore Galvanotechnik GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 American Elements

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CHIMET

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sabin Metal Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Souvenier Chemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ReMetall Deutschland AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BASF SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stanford Advanced Materials

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Catalytic Products International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 J&J Materials Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Alfa Aesar Thermo Fisher Scientific

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Johnson Matthey

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ALS Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Heraeus Holding

List of Figures

- Figure 1: Global Precious Metals Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global Precious Metals Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Precious Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Precious Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Precious Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Precious Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Precious Metals Market Revenue (Billion), by Application 2025 & 2033

- Figure 8: Asia Pacific Precious Metals Market Volume (K Tons), by Application 2025 & 2033

- Figure 9: Asia Pacific Precious Metals Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Precious Metals Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Precious Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 12: Asia Pacific Precious Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Precious Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Precious Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Precious Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 16: North America Precious Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Precious Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Precious Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Precious Metals Market Revenue (Billion), by Application 2025 & 2033

- Figure 20: North America Precious Metals Market Volume (K Tons), by Application 2025 & 2033

- Figure 21: North America Precious Metals Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Precious Metals Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Precious Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 24: North America Precious Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Precious Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Precious Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Precious Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 28: Europe Precious Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Precious Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Precious Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Precious Metals Market Revenue (Billion), by Application 2025 & 2033

- Figure 32: Europe Precious Metals Market Volume (K Tons), by Application 2025 & 2033

- Figure 33: Europe Precious Metals Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Precious Metals Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Precious Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 36: Europe Precious Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Precious Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Precious Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Precious Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 40: South America Precious Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Precious Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Precious Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Precious Metals Market Revenue (Billion), by Application 2025 & 2033

- Figure 44: South America Precious Metals Market Volume (K Tons), by Application 2025 & 2033

- Figure 45: South America Precious Metals Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Precious Metals Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Precious Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 48: South America Precious Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Precious Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Precious Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Precious Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 52: Middle East and Africa Precious Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Precious Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Precious Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Precious Metals Market Revenue (Billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Precious Metals Market Volume (K Tons), by Application 2025 & 2033

- Figure 57: Middle East and Africa Precious Metals Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Precious Metals Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Precious Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Precious Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Precious Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Precious Metals Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Precious Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 2: Global Precious Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Precious Metals Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 4: Global Precious Metals Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Precious Metals Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global Precious Metals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Precious Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 8: Global Precious Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Precious Metals Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 10: Global Precious Metals Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Precious Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 12: Global Precious Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: China Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: India Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: ASEAN Countries Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: ASEAN Countries Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Global Precious Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 26: Global Precious Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Global Precious Metals Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 28: Global Precious Metals Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Global Precious Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 30: Global Precious Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: United States Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 32: United States Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Canada Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: Canada Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Mexico Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 36: Mexico Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global Precious Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 38: Global Precious Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Global Precious Metals Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 40: Global Precious Metals Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 41: Global Precious Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 42: Global Precious Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: Germany Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 44: Germany Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: United Kingdom Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 48: Italy Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: France Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: France Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Precious Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 54: Global Precious Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 55: Global Precious Metals Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 56: Global Precious Metals Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 57: Global Precious Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 58: Global Precious Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 59: Brazil Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 60: Brazil Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Argentina Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 62: Argentina Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 64: Rest of South America Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Global Precious Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 66: Global Precious Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 67: Global Precious Metals Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 68: Global Precious Metals Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 69: Global Precious Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 70: Global Precious Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: South Africa Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Precious Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Precious Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Precious Metals Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Precious Metals Market?

Key companies in the market include Heraeus Holding, Shaanxi kaida chemical co LTD, Clariant, Kaili Catalyst New Materials CO LTD, Umicore Galvanotechnik GmbH, American Elements, CHIMET, Evonik Industries AG, Sabin Metal Corporation, Souvenier Chemicals, ReMetall Deutschland AG, BASF SE, Stanford Advanced Materials, Catalytic Products International, J&J Materials Inc, Alfa Aesar Thermo Fisher Scientific, Johnson Matthey, ALS Limited.

3. What are the main segments of the Precious Metals Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 306.4 Billion as of 2022.

5. What are some drivers contributing to market growth?

Accelerating Demand for High-Performance Transportation Fuel; Increasing Investment in Refineries; Other Drivers.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Production Costs; Other Restraints.

8. Can you provide examples of recent developments in the market?

Recent developments in the market studied will be covered in the final report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Precious Metals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Precious Metals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Precious Metals Market?

To stay informed about further developments, trends, and reports in the Precious Metals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence