Key Insights

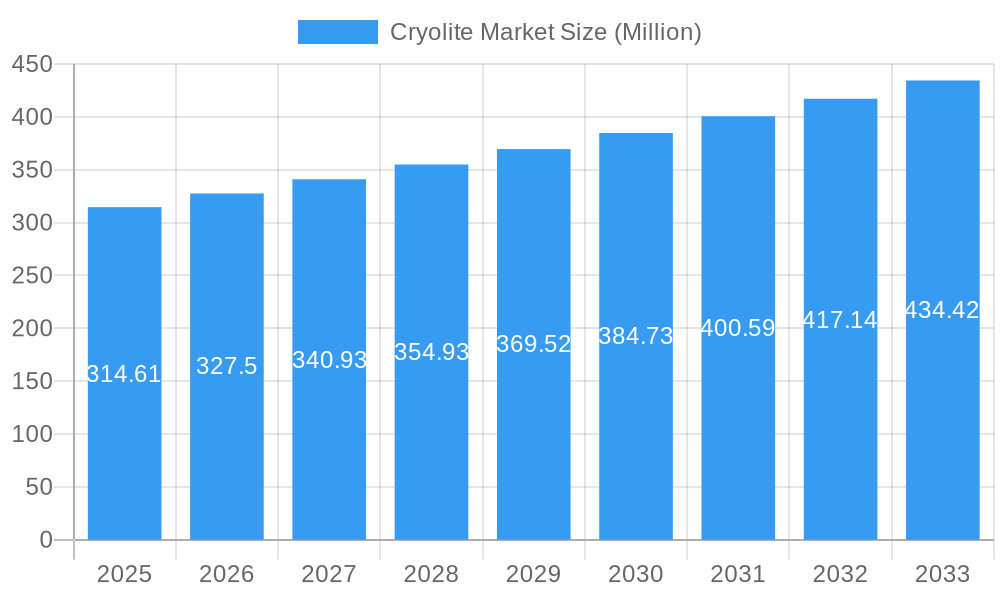

The global Cryolite Market is poised for robust growth, projected to reach USD 314.61 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.18% through 2033. This expansion is primarily fueled by the indispensable role of cryolite in aluminum smelting, where it acts as a flux to lower the melting point of alumina, significantly reducing energy consumption. The burgeoning demand for aluminum in various sectors, including automotive, construction, and aerospace, directly translates into increased cryolite consumption. Furthermore, the abrasive production industry leverages cryolite's hardness and abrasive properties for grinding and polishing applications, contributing to market growth. Emerging applications in metal surface treatment and the production of enamel and glass frits are also expected to play a significant role in driving market expansion, offering new avenues for revenue generation.

Cryolite Market Market Size (In Million)

While the cryolite market exhibits strong growth potential, certain factors could influence its trajectory. The stringent environmental regulations surrounding the production and disposal of cryolite-containing by-products may pose challenges, necessitating investment in sustainable practices and advanced waste management solutions. Additionally, fluctuations in the price of raw materials, particularly fluorspar, a key precursor for cryolite synthesis, could impact profit margins for manufacturers. The market is also witnessing a trend towards the development of synthetic cryolite alternatives with improved environmental profiles, which could compete with natural cryolite in certain applications. However, the established cost-effectiveness and proven performance of natural cryolite in its primary applications are likely to ensure its continued dominance in the foreseeable future. The market is characterized by a fragmented landscape with both established global players and emerging regional manufacturers, leading to competitive pricing and a focus on product innovation.

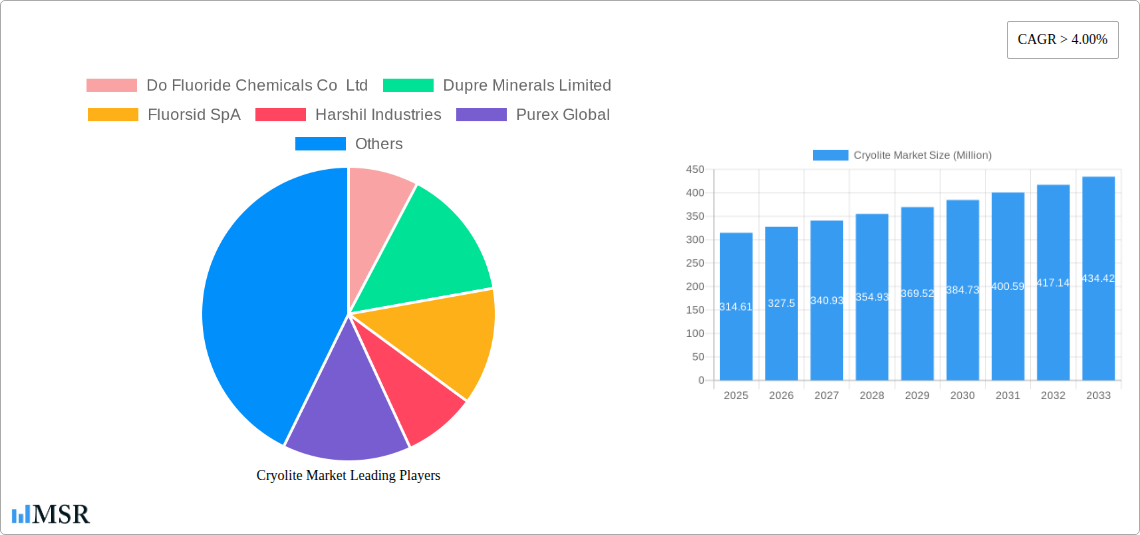

Cryolite Market Company Market Share

Cryolite Market Report: Unveiling Opportunities in Aluminum Smelting and Beyond (2019-2033)

This comprehensive Cryolite Market report provides an in-depth analysis of the global cryolite industry from 2019 to 2033, with a base year of 2025. Discover market concentration, key trends, dominant segments, product innovations, challenges, growth drivers, emerging opportunities, and leading players. This report is your essential guide to navigating the evolving landscape of cryolite demand, particularly its critical role in aluminum smelting, abrasive production, and other vital industrial applications.

Cryolite Market Market Concentration & Dynamics

The global cryolite market exhibits a moderate to high level of concentration, with a few key players holding significant market share, particularly in the production of synthetic cryolite for aluminum smelting. Leading companies like Solvay and Do Fluoride Chemicals Co Ltd are at the forefront, leveraging their established production capacities and extensive distribution networks. The innovation ecosystem is characterized by continuous efforts to improve production efficiency, reduce environmental impact, and explore new applications. Regulatory frameworks, primarily focused on environmental emissions and worker safety, significantly influence manufacturing processes and raw material sourcing. Substitute products, such as aluminum fluoride, pose a competitive threat, especially in niche applications, but cryolite remains indispensable for primary aluminum production due to its electrochemical properties. End-user trends show a sustained demand from the aluminum industry, driven by global infrastructure development and the automotive sector's shift towards lighter materials. Mergers and acquisitions (M&A) activities, while not as frequent as in some other chemical sectors, are strategic moves aimed at consolidating market presence and acquiring specialized technologies. For instance, historical M&A activities indicate a trend towards vertical integration.

- Market Concentration: Moderate to High

- Key Players: Solvay, Do Fluoride Chemicals Co Ltd, Fluorsid SpA

- Innovation Focus: Production efficiency, environmental sustainability, new applications

- Regulatory Influence: Environmental compliance, safety standards

- Substitute Products: Aluminum fluoride

- End-User Trends: Growth in aluminum demand, automotive lightweighting

- M&A Activities: Strategic consolidation, technology acquisition

Cryolite Market Industry Insights & Trends

The Cryolite Market is poised for steady growth, driven by escalating demand from its primary application – aluminum smelting. The global market size for cryolite is estimated to reach approximately $1,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 4.5% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Firstly, the burgeoning global demand for aluminum, fueled by rapid industrialization in emerging economies and the increasing use of aluminum in the automotive, aerospace, and construction sectors, directly translates to higher cryolite consumption. Aluminum smelting, which accounts for over 80% of the total cryolite market, relies heavily on cryolite as a molten solvent and electrolyte to reduce alumina to aluminum. Technological disruptions are primarily focused on enhancing the efficiency of cryolite production processes and minimizing their environmental footprint. Research and development efforts are directed towards optimizing cryolite particle size, purity, and flowability to improve energy efficiency in aluminum smelters. Evolving consumer behaviors, such as the growing preference for sustainable and lightweight materials, further boost the demand for aluminum, consequently impacting the cryolite market positively. Furthermore, the increasing adoption of recycled aluminum also requires cryolite in its secondary smelting processes, contributing to market expansion.

Key Markets & Segments Leading Cryolite Market

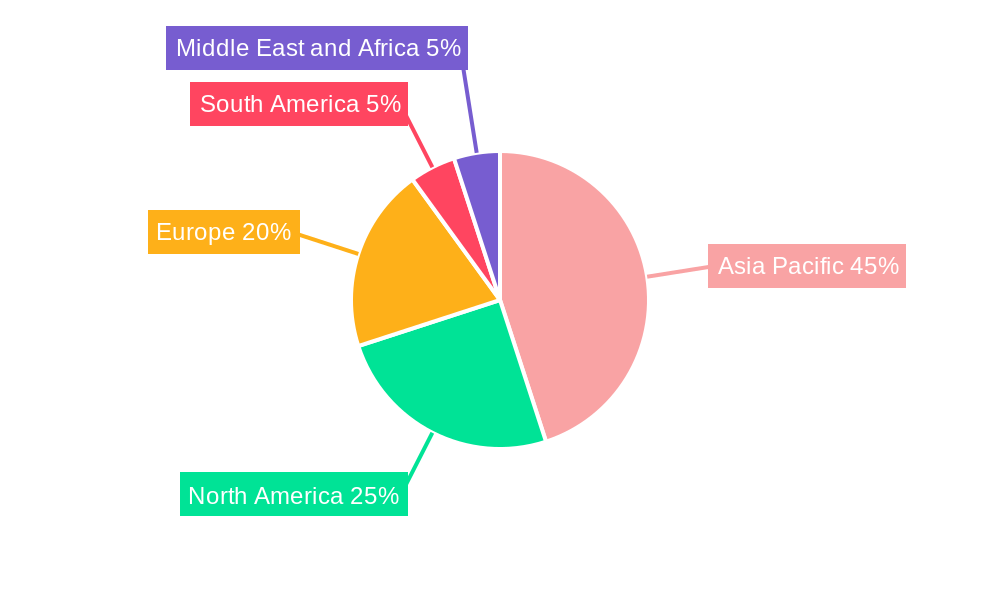

The dominant region driving the cryolite market is Asia-Pacific, with China leading the charge due to its massive aluminum production capacity and extensive manufacturing base. Countries like India and Southeast Asian nations also contribute significantly to regional demand. Within the application segments, Aluminum Smelting unequivocally leads the cryolite market, commanding over 80% of the global demand. This dominance is intrinsically linked to the expanding global aluminum industry, which is a cornerstone of modern infrastructure, transportation, and consumer goods manufacturing.

- Dominant Region: Asia-Pacific (led by China)

- Primary Application Segment: Aluminum Smelting

Drivers for Aluminum Smelting Dominance:

- Economic Growth & Infrastructure Development: Rapid urbanization and infrastructure projects worldwide necessitate large quantities of aluminum, directly driving cryolite demand.

- Automotive Lightweighting: The automotive industry's focus on fuel efficiency and emissions reduction is leading to increased use of aluminum in vehicle manufacturing.

- Aerospace Industry Expansion: The aerospace sector's continuous growth also contributes to the demand for high-purity aluminum, requiring substantial cryolite input.

- Growing Demand for Consumer Electronics: The proliferation of electronic devices, many of which utilize aluminum components, further bolsters the market.

The other segments, while smaller in comparison, represent significant growth avenues. Abrasive Production utilizes cryolite for its hardness and abrasive properties in grinding wheels and sandpapers. The increasing demand for high-performance abrasives in industrial applications and metal fabrication supports this segment. Metal Surface Treatment employs cryolite for its fluxing and cleaning properties in preparing metal surfaces for subsequent processes like plating and painting. The automotive and electronics industries are key end-users here. Enamel and Glass Frits benefit from cryolite's fluxing capabilities, lowering the melting point of glass and enamels, making them suitable for coatings and decorative applications. Welding Agents utilize cryolite as a component in fluxes to improve weld quality by preventing oxidation. While this is a niche application, consistent demand exists from the welding and fabrication industries. The "Others" segment encompasses miscellaneous industrial uses, which contribute incrementally to the overall market.

Cryolite Market Product Developments

Recent product developments in the cryolite market are largely focused on improving purity, optimizing particle size distribution, and enhancing the environmental sustainability of production. Manufacturers are investing in advanced processing techniques to achieve higher grades of synthetic cryolite that offer superior performance in aluminum smelting, leading to increased energy efficiency and reduced emissions. Innovations also include the development of specialized cryolite formulations tailored for specific industrial applications beyond aluminum, such as in advanced ceramics and specialty glass manufacturing, thereby expanding its market relevance and competitive edge.

Challenges in the Cryolite Market Market

The cryolite market faces several challenges that can impact its growth trajectory. Regulatory hurdles concerning the environmental impact of cryolite production, particularly regarding emissions of greenhouse gases like perfluorocarbons (PFCs) during aluminum smelting, necessitate significant investment in abatement technologies. Supply chain disruptions, including the availability and cost of raw materials like fluorspar, can lead to price volatility. Intense competition from substitute materials, although currently limited in primary aluminum smelting, requires continuous innovation to maintain market share in other applications.

Forces Driving Cryolite Market Growth

Several key forces are driving the growth of the cryolite market. The relentless global demand for aluminum, propelled by expanding infrastructure and the automotive industry's shift towards lightweighting, remains the primary growth engine. Technological advancements in cryolite production, focusing on energy efficiency and reduced environmental impact, are making its use more sustainable and economically viable. Furthermore, growing investments in emerging economies, particularly in Asia-Pacific, are fostering industrial expansion and consequently increasing the need for cryolite in various manufacturing processes.

Challenges in the Cryolite Market Market

Long-term growth catalysts for the cryolite market lie in strategic innovations and market expansions. The development of novel cryolite-based materials with enhanced properties for specialized applications in advanced ceramics, optics, and electronics presents significant potential. Partnerships and collaborations between cryolite manufacturers and end-users, especially in the aluminum industry, can lead to the co-development of customized solutions that optimize production processes and reduce operational costs. Furthermore, exploring untapped markets and developing sustainable production methods will be crucial for sustained growth.

Emerging Opportunities in Cryolite Market

Emerging opportunities in the cryolite market are centered around sustainable production and diversification of applications. The increasing global focus on sustainability and circular economy principles is creating opportunities for cryolite recycling and the development of eco-friendly production processes. Furthermore, research into new applications for cryolite beyond traditional uses, such as in battery technologies or specialized chemical syntheses, could unlock significant market potential. The growing demand for high-purity cryolite in niche sectors like advanced optics and specialized coatings also presents lucrative avenues for market expansion.

Leading Players in the Cryolite Market Sector

- Do Fluoride Chemicals Co Ltd

- Dupre Minerals Limited

- Fluorsid SpA

- Harshil Industries

- Purex Global

- S B Chemicals

- Sanyo Corporation of America

- Skyline Chemical Corporation

- Solvay

- Xinhai Chemicals Co

- Yuzhou Deyi Chemical Co

Key Milestones in Cryolite Market Industry

- 2019: Increased focus on environmental regulations impacting cryolite production globally.

- 2020: COVID-19 pandemic leads to temporary disruptions in supply chains and reduced industrial activity.

- 2021: Renewed demand for aluminum as economies recover, driving cryolite consumption.

- 2022: Investments in R&D for more energy-efficient cryolite production processes.

- 2023: Growing interest in the use of cryolite in secondary aluminum recycling processes.

- 2024: Anticipation of stricter environmental standards affecting aluminum smelting operations.

- 2025 (Estimated): Projected stabilization and steady growth in the global cryolite market size.

Strategic Outlook for Cryolite Market Market

The strategic outlook for the cryolite market is positive, driven by the enduring demand from the aluminum sector and emerging opportunities in diversified applications. Growth accelerators will include continued investment in research and development for enhancing production efficiency and sustainability, alongside strategic partnerships to cater to specific end-user needs. The market is expected to witness a steady expansion, with a focus on high-purity products and environmentally conscious manufacturing practices to meet evolving global demands and regulatory landscapes.

Cryolite Market Segmentation

-

1. Application

- 1.1. Aluminum Smelting

- 1.2. Abrasive Production

- 1.3. Metal Surface treatment

- 1.4. Enamel and Glass Frits

- 1.5. Welding Agent

- 1.6. Others

Cryolite Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Cryolite Market Regional Market Share

Geographic Coverage of Cryolite Market

Cryolite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for Aluminium Smelting and Abrasive Production; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Rising Demand for Aluminium Smelting and Abrasive Production; Other Drivers

- 3.4. Market Trends

- 3.4.1. Aluminum Smelting to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cryolite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aluminum Smelting

- 5.1.2. Abrasive Production

- 5.1.3. Metal Surface treatment

- 5.1.4. Enamel and Glass Frits

- 5.1.5. Welding Agent

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Cryolite Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aluminum Smelting

- 6.1.2. Abrasive Production

- 6.1.3. Metal Surface treatment

- 6.1.4. Enamel and Glass Frits

- 6.1.5. Welding Agent

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Cryolite Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aluminum Smelting

- 7.1.2. Abrasive Production

- 7.1.3. Metal Surface treatment

- 7.1.4. Enamel and Glass Frits

- 7.1.5. Welding Agent

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cryolite Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aluminum Smelting

- 8.1.2. Abrasive Production

- 8.1.3. Metal Surface treatment

- 8.1.4. Enamel and Glass Frits

- 8.1.5. Welding Agent

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Cryolite Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aluminum Smelting

- 9.1.2. Abrasive Production

- 9.1.3. Metal Surface treatment

- 9.1.4. Enamel and Glass Frits

- 9.1.5. Welding Agent

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Cryolite Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aluminum Smelting

- 10.1.2. Abrasive Production

- 10.1.3. Metal Surface treatment

- 10.1.4. Enamel and Glass Frits

- 10.1.5. Welding Agent

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Do Fluoride Chemicals Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dupre Minerals Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fluorsid SpA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Harshil Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Purex Global

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 S B Chemicals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanyo Corporation of America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Skyline Chemical Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Solvay

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xinhai Chemicals Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yuzhou Deyi Chemical Co *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Do Fluoride Chemicals Co Ltd

List of Figures

- Figure 1: Global Cryolite Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Cryolite Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Cryolite Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Cryolite Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Cryolite Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Cryolite Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Cryolite Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Cryolite Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Cryolite Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cryolite Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Cryolite Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Cryolite Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Cryolite Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Cryolite Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Cryolite Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Cryolite Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Cryolite Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Cryolite Market Revenue (undefined), by Application 2025 & 2033

- Figure 19: Middle East and Africa Cryolite Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Cryolite Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Cryolite Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cryolite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Cryolite Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Cryolite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Cryolite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Cryolite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Cryolite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Cryolite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Cryolite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: France Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Italy Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Cryolite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Cryolite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Cryolite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Cryolite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Cryolite Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cryolite Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Cryolite Market?

Key companies in the market include Do Fluoride Chemicals Co Ltd, Dupre Minerals Limited, Fluorsid SpA, Harshil Industries, Purex Global, S B Chemicals, Sanyo Corporation of America, Skyline Chemical Corporation, Solvay, Xinhai Chemicals Co, Yuzhou Deyi Chemical Co *List Not Exhaustive.

3. What are the main segments of the Cryolite Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for Aluminium Smelting and Abrasive Production; Other Drivers.

6. What are the notable trends driving market growth?

Aluminum Smelting to Dominate the Market.

7. Are there any restraints impacting market growth?

; Rising Demand for Aluminium Smelting and Abrasive Production; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cryolite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cryolite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cryolite Market?

To stay informed about further developments, trends, and reports in the Cryolite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence