Key Insights

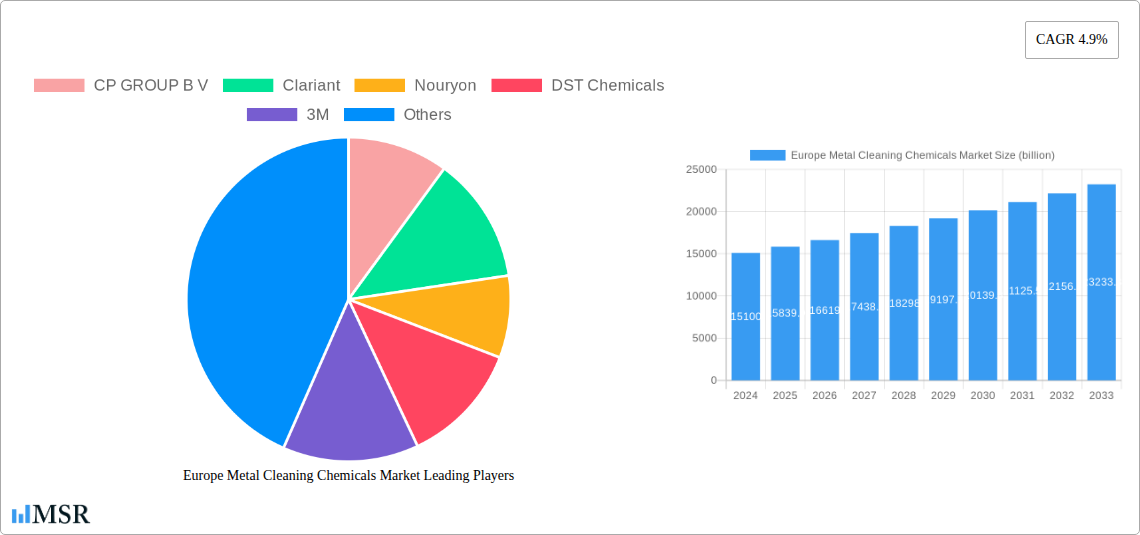

The European Metal Cleaning Chemicals Market is poised for robust expansion, with a market size of approximately USD 15.1 billion in 2024. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033, indicating sustained upward momentum. The market's vitality is driven by increasing industrial activity across key sectors, particularly in transportation and electrical & electronics, which rely heavily on effective metal cleaning for quality and performance. Furthermore, the stringent environmental regulations in Europe are fostering a shift towards more sustainable and high-performance metal cleaning solutions, creating opportunities for innovative product development. The demand for specialized chemicals that offer enhanced efficiency, reduced environmental impact, and improved safety profiles will continue to shape market dynamics.

Europe Metal Cleaning Chemicals Market Market Size (In Billion)

The market's segmentation reveals diverse opportunities, with aqueous-based metal cleaning chemicals dominating due to their eco-friendly attributes and widespread applicability. Within the functional additives segment, surfactants are crucial for improving wetting and emulsification, while corrosion inhibitors play a vital role in protecting metal surfaces post-cleaning. The chemical and pharmaceutical industries, alongside oil and gas, are significant end-users, demanding precise and reliable cleaning processes. While the market benefits from strong industrial demand, potential restraints include fluctuating raw material costs and the complexity of regulatory compliance across different European nations. However, the continuous innovation in formulations, including the development of biodegradable and low-VOC (Volatile Organic Compound) options, is expected to mitigate these challenges and propel the market forward.

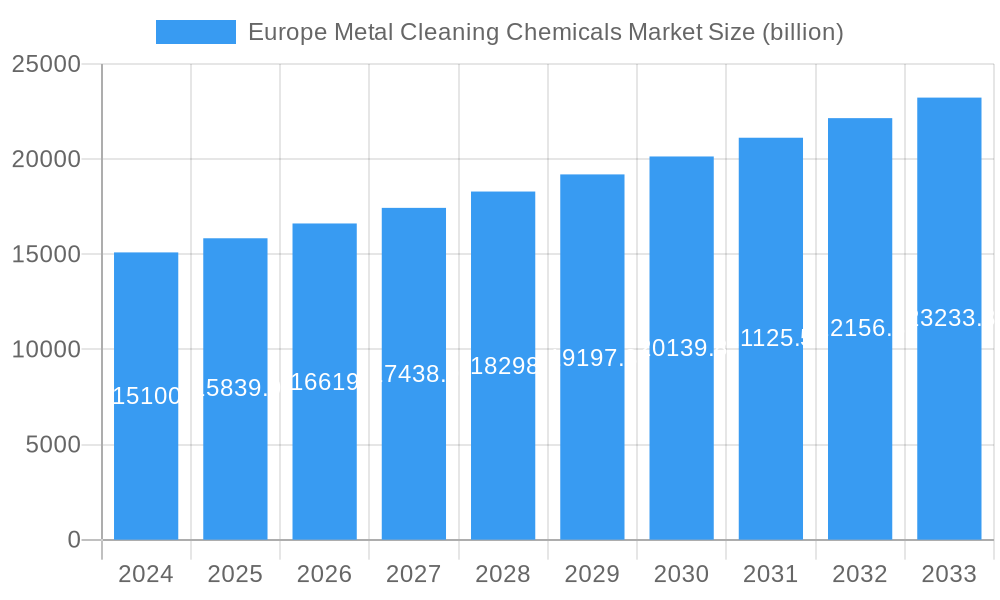

Europe Metal Cleaning Chemicals Market Company Market Share

The Europe Metal Cleaning Chemicals Market is poised for significant expansion, driven by burgeoning demand across key industrial sectors and advancements in sustainable cleaning solutions. This comprehensive report delves into the market dynamics, segmentation, and future outlook, providing actionable insights for stakeholders seeking to capitalize on this evolving landscape. The study period spans from 2019 to 2033, with a base year of 2025, and a forecast period from 2025 to 2033. Historical data from 2019-2024 is also analyzed. The Europe Metal Cleaning Chemicals Market size is projected to reach a value of over $15 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period.

Europe Metal Cleaning Chemicals Market Market Concentration & Dynamics

The Europe Metal Cleaning Chemicals Market exhibits a moderately concentrated landscape, with key players like CP GROUP B V, Clariant, Nouryon, and BASF SE holding significant market shares. Innovation is a critical driver, fueled by an active ecosystem of chemical manufacturers, research institutions, and end-user industries collaborating to develop high-performance, eco-friendly cleaning solutions. Regulatory frameworks, particularly stringent environmental directives from the European Union, are increasingly influencing product development, pushing for the adoption of low-VOC and biodegradable formulations. Substitute products, such as mechanical cleaning methods and ultrasonic cleaning, pose a competitive challenge, but the superior efficacy and cost-effectiveness of chemical cleaning in many applications ensure its continued dominance. End-user trends favor specialized cleaning chemistries for advanced materials and intricate component cleaning, particularly within the Electrical and Electronics and Transportation sectors. Mergers and Acquisitions (M&A) are a notable dynamic, with recent deals like MKS Instruments' acquisition of Atotech in August 2022 and Element Solutions Inc.'s acquisition of Coventya Holding SAS in September 2021 significantly consolidating market presence and expanding product portfolios. These M&A activities underscore a strategic push for market leadership and enhanced technological capabilities within the Europe Metal Cleaning Chemicals Market.

Europe Metal Cleaning Chemicals Market Industry Insights & Trends

The Europe Metal Cleaning Chemicals Market is experiencing robust growth, propelled by a confluence of escalating industrial activity, technological advancements, and a growing emphasis on sustainability. The market size, estimated to be around $10.5 billion in 2025, is projected to surge to over $15 billion by 2033, reflecting a healthy CAGR of approximately 5.5%. Key growth drivers include the increasing demand for high-performance metal components in sophisticated applications, such as automotive manufacturing, aerospace, and the burgeoning renewable energy sector. The stringent quality control requirements across these industries necessitate highly effective cleaning processes to ensure optimal product performance and longevity.

Technological disruptions are playing a pivotal role, with a significant shift towards aqueous-based cleaning solutions. These are favored for their lower environmental impact compared to solvent-based alternatives, aligning with Europe's commitment to green chemistry. Innovations in surfactant technology, corrosion inhibitors, and chelating agents are leading to the development of more efficient and specialized cleaning formulations. The integration of smart technologies for process monitoring and optimization further enhances the appeal of advanced metal cleaning chemicals.

Evolving consumer behaviors, particularly the demand for durable and high-quality manufactured goods, indirectly fuel the metal cleaning chemicals market. Consumers expect products to be free from surface defects and contaminants, placing a premium on effective pre-treatment and cleaning stages in manufacturing. Furthermore, the circular economy initiatives gaining traction across Europe are prompting manufacturers to invest in processes that facilitate material recovery and recycling, where effective cleaning is often a prerequisite. The Chemical and Pharmaceutical industry's need for sterile and contaminant-free equipment also contributes to sustained demand. The growing sophistication in manufacturing processes within the Oil and Gas sector, especially for offshore equipment maintenance, further bolsters the market.

The rise of electric vehicles (EVs) and the associated battery manufacturing processes present a significant new avenue for growth, requiring specialized metal cleaning for intricate components. Similarly, the continuous advancements in the Electrical and Electronics sector, demanding miniaturization and higher precision, create a need for advanced cleaning chemistries to remove microscopic contaminants. The Transportation sector, encompassing automotive, aerospace, and marine, remains a dominant end-user, driven by stringent quality standards and the constant need for performance enhancement. The Other End-user Industries, including metal fabrication, industrial machinery, and general manufacturing, also contribute substantially to the overall market volume.

Key Markets & Segments Leading Europe Metal Cleaning Chemicals Market

The Europe Metal Cleaning Chemicals Market is characterized by the dominance of Aqueous formulations, which are increasingly preferred due to their environmental friendliness and compliance with stringent European regulations. These solutions are gaining significant traction across various end-user industries, driven by their efficacy in removing a wide range of contaminants without the harshness associated with solvent-based alternatives.

Dominant Form:

- Aqueous: This segment is the largest and fastest-growing, propelled by the push for sustainable manufacturing practices and reduced volatile organic compound (VOC) emissions. The Transportation sector, in particular, is a major adopter of aqueous cleaners for engine parts, chassis, and body components. The Electrical and Electronics industry also relies heavily on aqueous solutions for printed circuit board (PCB) cleaning and component preparation, where precision and residue-free finishes are paramount.

- Solvent: While still holding a significant market share, the solvent segment is witnessing a slower growth rate compared to aqueous alternatives. It remains crucial for applications requiring aggressive degreasing and for specific niche markets where aqueous solutions might not offer the desired performance.

Dominant Type:

- Basic: Basic metal cleaning chemicals are widely used for their strong degreasing capabilities, particularly effective in removing organic contaminants like oils, greases, and waxes. The Oil and Gas industry extensively utilizes basic cleaners for equipment maintenance and degreasing in exploration and production facilities.

- Acidic: Acidic cleaners are essential for removing rust, scale, and oxides from metal surfaces. They find extensive application in the Chemical and Pharmaceutical industry for cleaning reactors and processing equipment, as well as in metal fabrication for surface preparation prior to coating or plating.

- Neutral: Neutral cleaners offer a milder yet effective cleaning action, suitable for sensitive metal surfaces or when a broad pH range is undesirable. They are increasingly used across multiple end-user industries where a balance between cleaning power and material compatibility is required.

Dominant Functional Additives:

- Surfactants: These are indispensable across all types of metal cleaning chemicals, facilitating the emulsification and removal of oils, greases, and other hydrophobic soils. Innovations in bio-based and low-foaming surfactants are key trends.

- Corrosion Inhibitors: Crucial for protecting metal surfaces from rust and corrosion during and after the cleaning process, especially in aqueous systems. This is vital for the Transportation and Electrical and Electronics sectors.

- Chelating Agents: These additives enhance the cleaning power of formulations by sequestering metal ions, preventing their redeposition and improving the removal of scale and mineral deposits.

Dominant End-user Industries:

- Transportation: This sector is the largest consumer of metal cleaning chemicals, driven by the stringent requirements for component quality, surface preparation for coatings, and maintenance of vehicles, aircraft, and marine vessels. Economic growth and the continuous demand for new vehicles fuel this segment.

- Electrical and Electronics: The relentless drive for miniaturization and higher performance in electronic devices necessitates highly effective cleaning solutions to remove flux residues, particulate matter, and organic contaminants. The growth in the semiconductor industry and consumer electronics significantly contributes to this segment.

- Chemical and Pharmaceutical: The need for sterile and residue-free equipment in the production of pharmaceuticals and chemicals drives consistent demand for specialized cleaning agents.

- Oil and Gas: Maintenance and cleaning of exploration, extraction, and refining equipment in this sector require robust cleaning solutions to ensure operational efficiency and safety.

- Other End-user Industries: This broad category includes metal fabrication, industrial machinery manufacturing, and general metalworking, all of which rely on metal cleaning chemicals for various stages of production and maintenance.

Europe Metal Cleaning Chemicals Market Product Developments

Product developments in the Europe Metal Cleaning Chemicals Market are heavily focused on enhancing performance while minimizing environmental impact. Innovations include the formulation of high-efficiency, low-temperature aqueous cleaners that reduce energy consumption. Advanced biodegradable surfactants and eco-friendly corrosion inhibitors are being integrated into formulations to meet stringent regulatory demands. The development of specialized cleaning chemistries for advanced alloys and complex geometries in the aerospace and automotive sectors is also a key area of innovation. Furthermore, the market is witnessing the emergence of multi-functional cleaners that combine degreasing, rust removal, and surface preparation properties, offering greater convenience and cost-effectiveness to end-users. These advancements are crucial for maintaining a competitive edge and addressing the evolving needs of diverse industries.

Challenges in the Europe Metal Cleaning Chemicals Market Market

The Europe Metal Cleaning Chemicals Market faces several challenges that could impede its growth trajectory. Stringent environmental regulations, particularly concerning VOC emissions and the use of hazardous substances, necessitate continuous R&D investment in developing compliant and sustainable alternatives. Supply chain disruptions, geopolitical instability, and fluctuating raw material prices can impact production costs and availability. Intense competition among established players and the emergence of new entrants offering potentially lower-cost solutions also exert pressure on profit margins. The high cost of developing and obtaining regulatory approval for new formulations can be a significant barrier to entry for smaller companies. Furthermore, the shift towards greener alternatives may require substantial re-tooling and process adjustments for some end-users, leading to initial resistance.

Forces Driving Europe Metal Cleaning Chemicals Market Growth

The Europe Metal Cleaning Chemicals Market is propelled by several key forces. The robust growth of the Transportation sector, particularly with the expansion of electric vehicles and advanced automotive manufacturing, is a significant driver. Increasing demand for high-performance and durable manufactured goods across industries like Electrical and Electronics and aerospace necessitates effective cleaning processes for component integrity. Advancements in chemical technology, leading to the development of more efficient, sustainable, and specialized cleaning formulations, are creating new market opportunities. Furthermore, stringent quality control standards and the growing emphasis on surface finishing and preparation for coatings and adhesion are crucial market stimulants. Government initiatives promoting green manufacturing and reducing industrial pollution also favor the adoption of eco-friendly metal cleaning chemicals.

Challenges in the Europe Metal Cleaning Chemicals Market Market

Long-term growth catalysts for the Europe Metal Cleaning Chemicals Market lie in continuous innovation and strategic market expansion. The development of next-generation cleaning chemistries that offer superior performance with even lower environmental footprints will be critical. This includes advanced bio-based formulations, intelligent cleaning systems that optimize chemical usage, and solutions tailored for emerging materials and manufacturing processes. Strategic partnerships between chemical manufacturers and end-users can foster collaborative R&D, leading to tailored solutions and faster market penetration. Furthermore, exploring new geographical markets within Europe and expanding into niche industrial applications will provide sustained growth avenues. The increasing focus on the circular economy and the need for efficient cleaning in recycling processes also present long-term opportunities.

Emerging Opportunities in Europe Metal Cleaning Chemicals Market

Emerging opportunities in the Europe Metal Cleaning Chemicals Market are abundant and diverse. The rapidly expanding electric vehicle (EV) battery manufacturing sector presents a significant demand for specialized cleaning solutions for battery components and manufacturing equipment. The growing adoption of additive manufacturing (3D printing) in various industries creates a need for post-processing cleaning of intricate parts. The increasing emphasis on industrial IoT (Internet of Things) and smart manufacturing is driving demand for cleaning chemicals that integrate with automated systems and provide real-time performance monitoring. Furthermore, the trend towards ultra-low VOC and water-based cleaning solutions is opening up new markets for manufacturers prioritizing sustainable product development. The demand for advanced cleaning in the medical device and pharmaceutical manufacturing sectors, driven by stringent sterilization and biocompatibility requirements, also represents a growing opportunity.

Leading Players in the Europe Metal Cleaning Chemicals Market Sector

- CP GROUP B V

- Clariant

- Nouryon

- DST Chemicals

- 3M

- Hubbard-Hall

- MKS Instruments

- BASF SE

- Dow

- Eastman Chemical Company

- Elmer Wallace Ltd

- Evonik industries

- Stepan Company

- KYZEN CORPORATION

- Quaker Chemical Corporation

- BP

Key Milestones in Europe Metal Cleaning Chemicals Market Industry

- August 2022: MKS Instruments completed the acquisition of Atotech, a global player in producing surface treatment and processing chemicals for various metals. The acquisition may strengthen the position of MKS Instruments in the metal cleaning market across the world, including Europe, by enhancing its product portfolio and market reach.

- September 2021: Element Solutions Inc. completed the acquisition of Coventya Holding SAS, a global supplier of specialty chemicals for the surface finishing industry, including metal cleaning. Coventya Holding SAS operates in 60 countries, including Europe. This acquisition aided Element Solutions Inc. in extending its reach to automotive, construction, electronic, consumer goods, energy, and aerospace/defense end markets, significantly expanding its presence and offerings within the European metal cleaning sector.

Strategic Outlook for Europe Metal Cleaning Chemicals Market Market

The strategic outlook for the Europe Metal Cleaning Chemicals Market is highly positive, driven by innovation and a growing demand for sustainable solutions. Key growth accelerators include continued investment in research and development for eco-friendly and high-performance formulations, particularly aqueous-based cleaners. Strategic partnerships and collaborations with end-user industries will be crucial for developing tailored solutions and gaining market share. The increasing regulatory push towards greener chemistries will further favor companies with strong R&D capabilities in this area. Expansion into emerging applications such as EV battery manufacturing and additive manufacturing presents significant future potential. Companies that focus on offering integrated cleaning solutions, combining chemical products with process optimization and technical support, are likely to achieve sustained growth and market leadership.

Europe Metal Cleaning Chemicals Market Segmentation

-

1. Form

- 1.1. Aqueous

- 1.2. Solvent

-

2. Type

- 2.1. Acidic

- 2.2. Basic

- 2.3. Neutral

-

3. Functional Additives

- 3.1. Surfactants

- 3.2. Corrosion Inhibitors

- 3.3. Chelating Agents

- 3.4. PH Regulators

-

4. End-user Industries

- 4.1. Transportation

- 4.2. Electrical and Electronics

- 4.3. Chemical and Pharmaceutical

- 4.4. Oil and Gas

- 4.5. Other End-user Industries

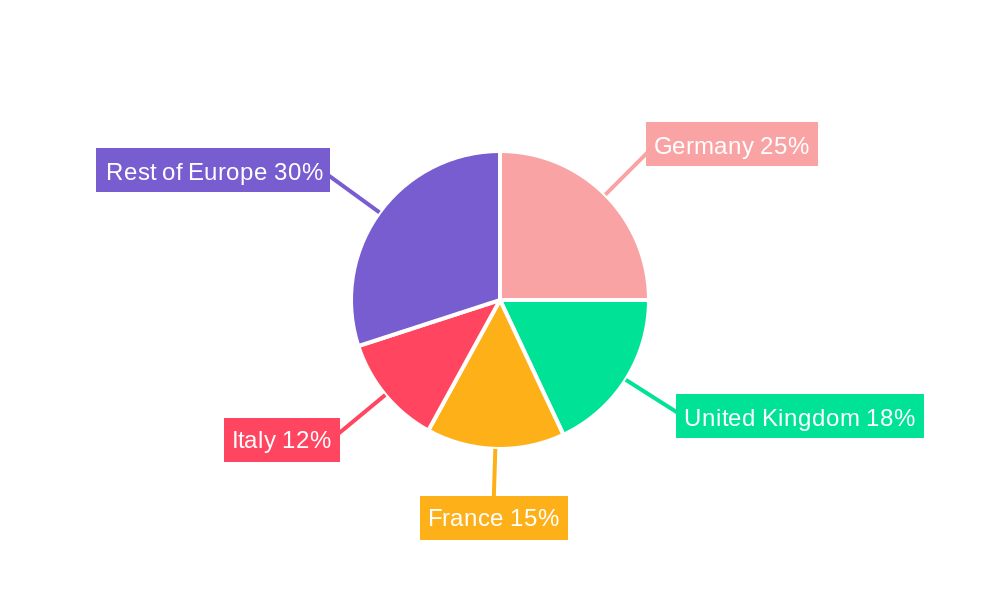

Europe Metal Cleaning Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Metal Cleaning Chemicals Market Regional Market Share

Geographic Coverage of Europe Metal Cleaning Chemicals Market

Europe Metal Cleaning Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Environments Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Aqueous

- 5.1.2. Solvent

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acidic

- 5.2.2. Basic

- 5.2.3. Neutral

- 5.3. Market Analysis, Insights and Forecast - by Functional Additives

- 5.3.1. Surfactants

- 5.3.2. Corrosion Inhibitors

- 5.3.3. Chelating Agents

- 5.3.4. PH Regulators

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Transportation

- 5.4.2. Electrical and Electronics

- 5.4.3. Chemical and Pharmaceutical

- 5.4.4. Oil and Gas

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Aqueous

- 6.1.2. Solvent

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Acidic

- 6.2.2. Basic

- 6.2.3. Neutral

- 6.3. Market Analysis, Insights and Forecast - by Functional Additives

- 6.3.1. Surfactants

- 6.3.2. Corrosion Inhibitors

- 6.3.3. Chelating Agents

- 6.3.4. PH Regulators

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Transportation

- 6.4.2. Electrical and Electronics

- 6.4.3. Chemical and Pharmaceutical

- 6.4.4. Oil and Gas

- 6.4.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. United Kingdom Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Aqueous

- 7.1.2. Solvent

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Acidic

- 7.2.2. Basic

- 7.2.3. Neutral

- 7.3. Market Analysis, Insights and Forecast - by Functional Additives

- 7.3.1. Surfactants

- 7.3.2. Corrosion Inhibitors

- 7.3.3. Chelating Agents

- 7.3.4. PH Regulators

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Transportation

- 7.4.2. Electrical and Electronics

- 7.4.3. Chemical and Pharmaceutical

- 7.4.4. Oil and Gas

- 7.4.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. France Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Aqueous

- 8.1.2. Solvent

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Acidic

- 8.2.2. Basic

- 8.2.3. Neutral

- 8.3. Market Analysis, Insights and Forecast - by Functional Additives

- 8.3.1. Surfactants

- 8.3.2. Corrosion Inhibitors

- 8.3.3. Chelating Agents

- 8.3.4. PH Regulators

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Transportation

- 8.4.2. Electrical and Electronics

- 8.4.3. Chemical and Pharmaceutical

- 8.4.4. Oil and Gas

- 8.4.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Italy Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Aqueous

- 9.1.2. Solvent

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Acidic

- 9.2.2. Basic

- 9.2.3. Neutral

- 9.3. Market Analysis, Insights and Forecast - by Functional Additives

- 9.3.1. Surfactants

- 9.3.2. Corrosion Inhibitors

- 9.3.3. Chelating Agents

- 9.3.4. PH Regulators

- 9.4. Market Analysis, Insights and Forecast - by End-user Industries

- 9.4.1. Transportation

- 9.4.2. Electrical and Electronics

- 9.4.3. Chemical and Pharmaceutical

- 9.4.4. Oil and Gas

- 9.4.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Rest of Europe Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Aqueous

- 10.1.2. Solvent

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Acidic

- 10.2.2. Basic

- 10.2.3. Neutral

- 10.3. Market Analysis, Insights and Forecast - by Functional Additives

- 10.3.1. Surfactants

- 10.3.2. Corrosion Inhibitors

- 10.3.3. Chelating Agents

- 10.3.4. PH Regulators

- 10.4. Market Analysis, Insights and Forecast - by End-user Industries

- 10.4.1. Transportation

- 10.4.2. Electrical and Electronics

- 10.4.3. Chemical and Pharmaceutical

- 10.4.4. Oil and Gas

- 10.4.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CP GROUP B V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nouryon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DST Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubbard-Hall

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MKS Instruments

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dow

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eastman Chemical Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Elmer Wallace Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Evonik industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stepan Company*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KYZEN CORPORATION

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Quaker Chemical Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 BP

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 CP GROUP B V

List of Figures

- Figure 1: Europe Metal Cleaning Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Metal Cleaning Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 4: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 5: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 7: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 9: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 10: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 12: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 14: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 17: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 19: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 20: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 22: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 24: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 25: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 27: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 29: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 30: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Cleaning Chemicals Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Metal Cleaning Chemicals Market?

Key companies in the market include CP GROUP B V, Clariant, Nouryon, DST Chemicals, 3M, Hubbard-Hall, MKS Instruments, BASF SE, Dow, Eastman Chemical Company, Elmer Wallace Ltd, Evonik industries, Stepan Company*List Not Exhaustive, KYZEN CORPORATION, Quaker Chemical Corporation, BP.

3. What are the main segments of the Europe Metal Cleaning Chemicals Market?

The market segments include Form, Type, Functional Additives, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries.

6. What are the notable trends driving market growth?

Increasing Usage in the Transportation Industry.

7. Are there any restraints impacting market growth?

Stringent Environments Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: MKS Instruments completed the acquisition of Atotech, a global player in producing surface treatment and processing chemicals for various metals. The acquisition may strengthen the position of MKS Instruments in the metal cleaning market across the world, including Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Cleaning Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Cleaning Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Cleaning Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Metal Cleaning Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence