Key Insights

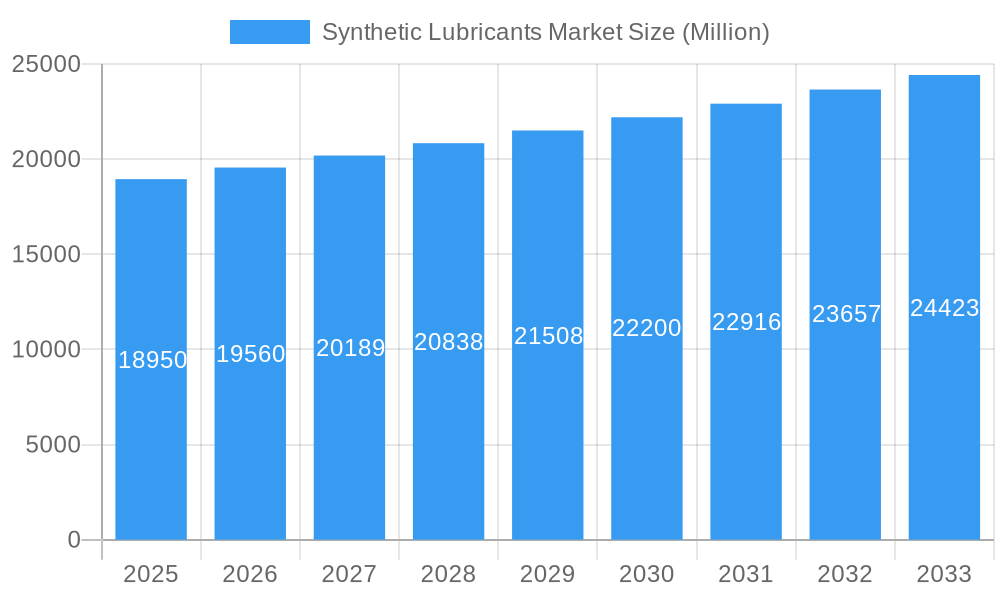

The global Synthetic Lubricants Market is poised for significant expansion, projected to reach an estimated $18.95 billion in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 3.28%, indicating a steady and sustainable upward trajectory for the market throughout the forecast period of 2025-2033. The increasing demand for high-performance lubricants that offer superior protection, extended drain intervals, and enhanced fuel efficiency across various industrial and automotive applications serves as a primary growth driver. Furthermore, stringent environmental regulations and a growing emphasis on reducing operational costs and carbon footprints are propelling the adoption of advanced synthetic lubricant formulations. The market's expansion is also fueled by innovation in product development, catering to specialized needs in sectors like power generation and heavy equipment, where extreme operating conditions necessitate the superior performance characteristics of synthetic oils.

Synthetic Lubricants Market Market Size (In Billion)

The market's structure is characterized by a diverse range of product types, including Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, Metalworking Fluids, and Greases, each catering to specific end-user industries. The automotive sector remains a dominant force, driven by the increasing production of vehicles and the shift towards higher quality engine oils for improved performance and longevity. Similarly, the heavy equipment sector, encompassing mining, construction, and agriculture, presents a substantial growth avenue due to the demanding operational environments and the need for reliable lubrication solutions. Emerging economies, particularly in the Asia Pacific region, are expected to witness the highest growth rates due to rapid industrialization, infrastructure development, and a burgeoning automotive industry. Key players like Shell plc, Exxon Mobil Corporation, and Chevron Corporation are actively investing in research and development to introduce novel synthetic lubricant solutions and expand their global market presence.

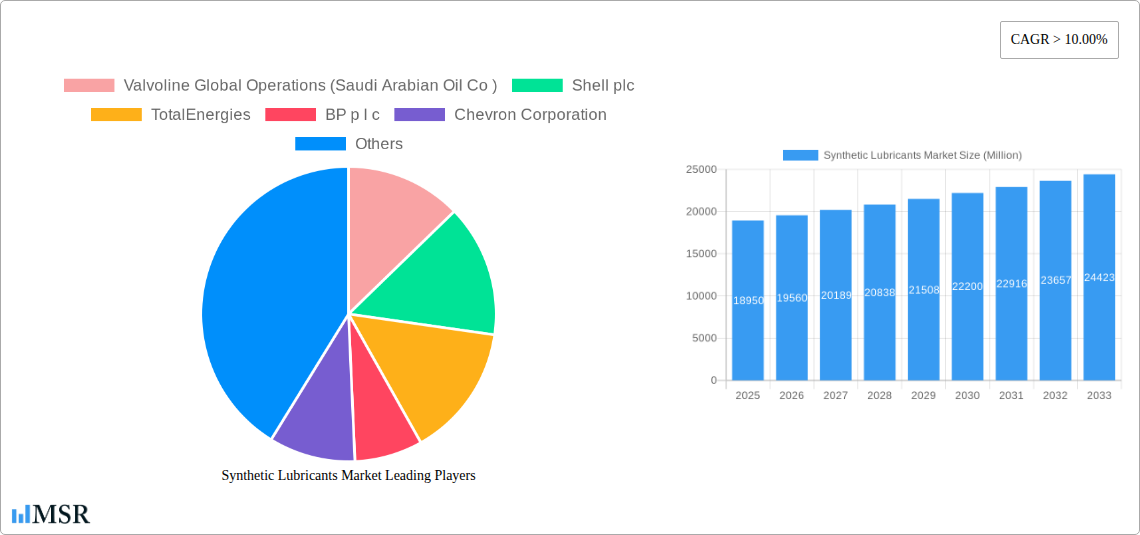

Synthetic Lubricants Market Company Market Share

Synthetic Lubricants Market: Comprehensive Analysis and Forecast 2025-2033

Unlock unparalleled insights into the global synthetic lubricants market with this in-depth, SEO-optimized report. Dive into critical trends, market dynamics, and future opportunities from 2019 through 2033, with a strategic focus on the 2025 base year and forecast period. This indispensable resource caters to industry stakeholders, investors, and strategic planners seeking a competitive edge in the rapidly evolving synthetic lubricants sector.

Synthetic Lubricants Market Market Concentration & Dynamics

The global synthetic lubricants market exhibits a moderate to high concentration, characterized by the strategic dominance of a few multinational giants alongside a growing presence of specialized manufacturers. Innovation ecosystems are vibrant, driven by continuous R&D in high-performance formulations addressing stringent environmental regulations and the demand for extended equipment life. Regulatory frameworks worldwide are increasingly focused on biodegradability, reduced emissions, and enhanced energy efficiency, directly impacting product development and market entry strategies. Substitute products, primarily conventional mineral-based lubricants, continue to face pressure from synthetic alternatives due to superior performance characteristics, particularly in extreme temperature and high-stress applications. End-user trends reveal a strong inclination towards premium synthetic lubricants offering cost savings through reduced maintenance and extended drain intervals. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic expansion. For instance, the USD 53 billion acquisition of Hess Corporation by Chevron Corporation in October 2023 underscores the drive for scale and vertical integration within the broader energy and chemical sectors that underpin lubricant demand. Chevron's acquisition of PDC Energy, Inc. in August 2023, adding over 1 billion barrels of oil equivalent reserves, further exemplifies strategic plays for resource control and production capacity enhancement. The number of significant M&A deals in the lubricant sector has seen a steady increase, reflecting a mature market seeking consolidation and enhanced market share.

Synthetic Lubricants Market Industry Insights & Trends

The global synthetic lubricants market is poised for significant expansion, projected to reach a substantial market size of USD 150 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This impressive growth trajectory is fueled by several interconnected factors. Firstly, the ever-increasing demand for enhanced performance and durability across diverse industrial applications is a primary driver. Modern machinery and engines operate under more demanding conditions, requiring lubricants that can withstand extreme temperatures, higher pressures, and extended operating cycles. Synthetic lubricants, with their superior thermal stability, oxidative resistance, and lower volatility compared to mineral oils, are perfectly positioned to meet these requirements.

Secondly, stringent environmental regulations and the growing emphasis on sustainability are compelling industries to adopt cleaner and more efficient lubricant solutions. Synthetic lubricants often contribute to reduced emissions, improved fuel efficiency, and longer service life, thereby minimizing waste and environmental impact. This aligns with global initiatives to reduce carbon footprints and promote eco-friendly industrial practices.

Technological disruptions are playing a pivotal role. Advancements in nanotechnology and bio-based synthetic lubricants are opening new frontiers for product innovation. Nanoparticle additives, for instance, can significantly enhance lubricating properties, reducing friction and wear to unprecedented levels. Similarly, the development of biodegradable synthetic lubricants derived from renewable resources is catering to the growing demand for environmentally responsible products, particularly in sensitive sectors like agriculture and marine applications.

Evolving consumer behaviors are also shaping the market. End-users are increasingly prioritizing Total Cost of Ownership (TCO) over initial purchase price. The ability of synthetic lubricants to extend equipment life, reduce downtime, and improve energy efficiency translates into significant cost savings over the long term, making them an attractive investment. This shift in perspective is particularly evident in sectors with high operational costs, such as automotive, heavy equipment, and industrial manufacturing. The penetration of electric vehicles (EVs) presents both a challenge and an opportunity. While traditional engine oil demand may decline, specialized synthetic lubricants for EV transmissions, batteries, and thermal management systems are emerging as a significant growth area, requiring tailored formulations for unique operating conditions.

Key Markets & Segments Leading Synthetic Lubricants Market

The Automotive segment is a dominant force within the synthetic lubricants market, driven by stringent OEM specifications, the growing sophistication of vehicle engines, and the increasing adoption of synthetic engine oils for improved performance, fuel economy, and extended drain intervals. The ongoing global transition towards electric vehicles (EVs) is also a significant factor, creating a burgeoning demand for specialized synthetic lubricants for EV powertrains, battery cooling, and other critical components.

Engine Oils represent the largest product category, reflecting their ubiquitous application in internal combustion engines across automotive, heavy-duty vehicles, and industrial machinery. The demand for high-performance synthetic engine oils that offer superior protection against wear, deposits, and oxidation, while also meeting stringent fuel efficiency standards, continues to grow.

Hydraulic Fluids represent another substantial segment, crucial for the efficient operation of hydraulic systems in sectors like manufacturing, construction, and agriculture. The demand for synthetic hydraulic fluids is propelled by their superior performance in extreme temperatures, enhanced fire resistance, and longer service life compared to mineral-based alternatives, contributing to reduced maintenance costs and improved operational reliability.

Heavy Equipment operations, encompassing construction, mining, and agriculture, are significant consumers of synthetic lubricants. These industries require lubricants that can withstand severe operating conditions, including extreme temperatures, heavy loads, and abrasive environments. Synthetic transmission and gear oils, hydraulic fluids, and greases are essential for maintaining the longevity and performance of this high-value machinery.

Power Generation is an increasingly important end-user segment, particularly with the growth of renewable energy sources like wind and solar, which often utilize specialized synthetic lubricants for turbines and gearboxes. The need for lubricants that can perform reliably in diverse climatic conditions and minimize maintenance downtime is paramount in this sector.

Key Growth Drivers by Segment:

- Automotive:

- Increasing vehicle production globally.

- Growing demand for fuel-efficient and high-performance vehicles.

- Rising adoption of electric vehicles and associated specialized lubricant needs.

- Stringent emission standards and OEM performance requirements.

- Engine Oils:

- Technological advancements in engine design demanding superior lubrication.

- Consumer preference for extended drain intervals and reduced maintenance.

- Growing awareness of the benefits of synthetic oils for engine longevity.

- Hydraulic Fluids:

- Expansion of industrial automation and manufacturing processes.

- Demand for lubricants offering improved fire safety and environmental compatibility.

- Requirement for consistent performance across a wide operating temperature range.

- Heavy Equipment:

- Global infrastructure development and construction projects.

- Increased mechanization in mining and agricultural sectors.

- Need for lubricants that ensure equipment reliability in harsh operating environments.

- Power Generation:

- Expansion of renewable energy infrastructure (wind, solar).

- Need for lubricants with extended service life and high operational efficiency.

- Demand for lubricants that perform reliably in remote and challenging locations.

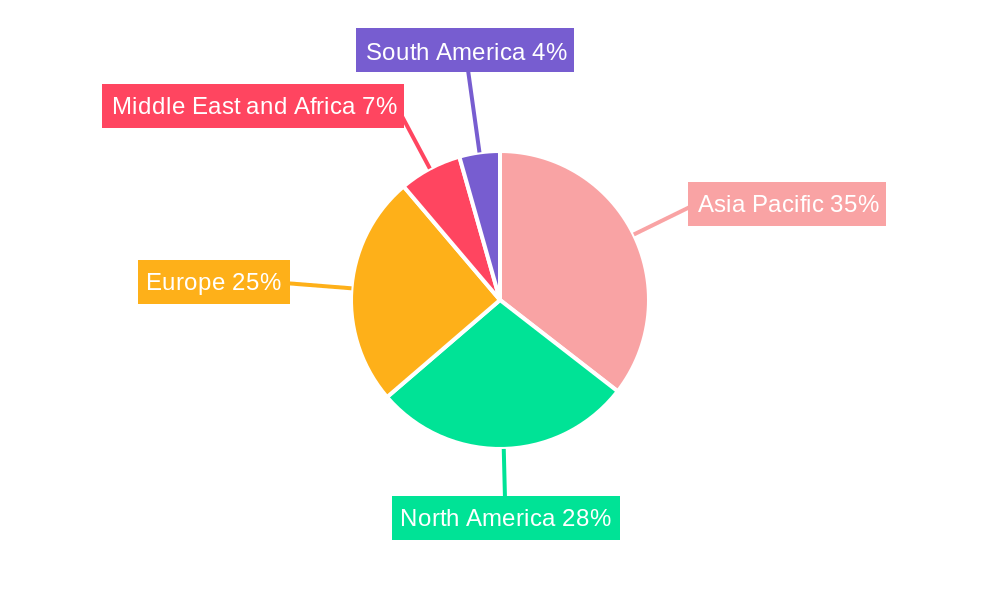

The Asia-Pacific region is anticipated to lead the synthetic lubricants market in terms of both volume and value, driven by rapid industrialization, burgeoning automotive sectors, and substantial infrastructure development in countries like China, India, and Southeast Asian nations.

Synthetic Lubricants Market Product Developments

Product development in the synthetic lubricants market is heavily focused on enhancing performance, sustainability, and specialized applications. Innovations include advanced formulations for electric vehicle (EV) powertrains, offering superior thermal management, electrical insulation, and gear protection. The development of biodegradable and bio-based synthetic lubricants is gaining momentum, catering to increasing environmental consciousness and regulatory pressures in sensitive industries. Furthermore, the integration of nanotechnology is leading to lubricants with exceptionally low friction coefficients and enhanced wear resistance, extending equipment life and improving energy efficiency. These advancements are crucial for meeting the evolving demands of modern machinery and driving competitive advantages in the market.

Challenges in the Synthetic Lubricants Market Market

Despite robust growth, the synthetic lubricants market faces several challenges. High initial cost compared to conventional mineral oils remains a significant barrier for price-sensitive customers, particularly in developing economies. The declining demand for traditional internal combustion engine (ICE) lubricants due to the rise of electric vehicles poses a long-term challenge. Furthermore, complex regulatory landscapes across different regions, with varying standards for environmental impact and performance, can complicate product development and market entry. Supply chain disruptions and volatile raw material prices, particularly for base oils and additives, can impact profitability and market stability.

Forces Driving Synthetic Lubricants Market Growth

Several key forces are propelling the growth of the synthetic lubricants market. Technological advancements in equipment design necessitate lubricants with superior performance characteristics that only synthetics can provide. The increasing demand for fuel efficiency and reduced emissions in the automotive and industrial sectors directly favors synthetic lubricants. Stringent government regulations mandating higher performance standards and environmental protection are also significant drivers. Furthermore, growing awareness among end-users about the long-term cost savings associated with reduced maintenance, extended drain intervals, and improved equipment longevity is a crucial economic catalyst. The expansion of key end-user industries like automotive, heavy equipment, and power generation further fuels demand.

Challenges in the Synthetic Lubricants Market Market

Long-term growth catalysts for the synthetic lubricants market lie in sustained innovation and strategic market penetration. Continued investment in research and development (R&D) to create next-generation lubricants, such as those for extreme temperature applications, high-pressure environments, and advanced robotics, will be critical. Strategic partnerships and collaborations between lubricant manufacturers, equipment OEMs, and research institutions can accelerate the development and adoption of new technologies. Market expansion into emerging economies and the development of tailored solutions for niche applications, like specialized industrial processes and defense equipment, will also contribute to sustained growth. The ongoing evolution of the electric vehicle ecosystem will also present significant opportunities for specialized synthetic lubricant formulations.

Emerging Opportunities in Synthetic Lubricants Market

Emerging opportunities in the synthetic lubricants market are primarily driven by the transition to electric mobility, creating a substantial need for specialized EV fluids that manage thermal control, lubrication, and electrical insulation. The growing emphasis on sustainability and circular economy principles presents opportunities for the development and adoption of bio-based and biodegradable synthetic lubricants. Furthermore, the increasing use of artificial intelligence (AI) and the Internet of Things (IoT) in predictive maintenance will drive demand for high-fidelity lubricant monitoring systems and premium synthetic oils that facilitate optimal equipment performance. Expansion into developing markets with burgeoning industrial sectors and the specialized requirements of aerospace and marine applications also offer significant untapped potential.

Leading Players in the Synthetic Lubricants Market Sector

- Valvoline Global Operations (Saudi Arabian Oil Co )

- Shell plc

- TotalEnergies

- BP p l c

- Chevron Corporation

- Exxon Mobil Corporation

- China Petrochemical Corporation

- PETRONAS Lubricants International

- FUCHS

- JX Nippon Oil & Gas Exploration Corporation

- Indian Oil Corporation Ltd

Key Milestones in Synthetic Lubricants Market Industry

- October 2023: Chevron Corporation entered into a definitive agreement with Hess Corporation to acquire all of Hess's shares in an all-stock transaction valued at USD 53 billion, aiming to increase production and fasten free cash flow. This move signals significant consolidation and strategic resource acquisition within the broader energy sector influencing lubricant demand.

- August 2023: Chevron Corporation completed the acquisition of PDC Energy, Inc. The acquired assets, including extensive acreage in the Denver-Julesburg (DJ) Basin and Permian Basin, add over 1 billion barrels of oil equivalent proved reserves, enhancing Chevron's upstream capabilities and potentially influencing its downstream lubricant production and market presence.

Strategic Outlook for Synthetic Lubricants Market Market

The strategic outlook for the synthetic lubricants market is overwhelmingly positive, characterized by sustained innovation and adaptive strategies. Key growth accelerators include the ongoing electrification of the automotive sector, which necessitates the development of advanced EV fluids with specialized properties. The increasing global focus on sustainability will continue to drive demand for biodegradable and bio-based synthetic lubricants. Furthermore, the integration of digital technologies for predictive maintenance and performance monitoring will create opportunities for premium, high-performance synthetic lubricants that deliver enhanced efficiency and extended equipment life. Strategic investments in R&D, targeted market expansions into high-growth regions, and strategic alliances with equipment manufacturers will be crucial for stakeholders to capitalize on the evolving landscape and maintain a competitive advantage in this dynamic and expanding market.

Synthetic Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Transmission and Gear Oils

- 1.3. Hydraulic Fluids

- 1.4. Metalworking Fluids

- 1.5. Greases

- 1.6. Other Pr

-

2. End User

- 2.1. Power Generation

- 2.2. Automotive

- 2.3. Heavy Equipment

- 2.4. Metallurgy and Metalworking

- 2.5. Other End-user Industries (Oil and Gas, Etc.)

Synthetic Lubricants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Indonesia

- 1.7. Thailand

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Mexico

- 2.3. Canada

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Nigeria

- 5.4. Qatar

- 5.5. Egypt

- 5.6. UAE

- 5.7. Rest of Middle East and Africa

Synthetic Lubricants Market Regional Market Share

Geographic Coverage of Synthetic Lubricants Market

Synthetic Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of High-performance Synthetic Lubricants; Increasing Demand from Automotive Sector Owing to Rising Environmental Concerns; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of High-performance Synthetic Lubricants; Increasing Demand from Automotive Sector Owing to Rising Environmental Concerns; Other Drivers

- 3.4. Market Trends

- 3.4.1. Rising Demand from Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Synthetic Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Transmission and Gear Oils

- 5.1.3. Hydraulic Fluids

- 5.1.4. Metalworking Fluids

- 5.1.5. Greases

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Power Generation

- 5.2.2. Automotive

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy and Metalworking

- 5.2.5. Other End-user Industries (Oil and Gas, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Synthetic Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Engine Oils

- 6.1.2. Transmission and Gear Oils

- 6.1.3. Hydraulic Fluids

- 6.1.4. Metalworking Fluids

- 6.1.5. Greases

- 6.1.6. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Power Generation

- 6.2.2. Automotive

- 6.2.3. Heavy Equipment

- 6.2.4. Metallurgy and Metalworking

- 6.2.5. Other End-user Industries (Oil and Gas, Etc.)

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Synthetic Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Engine Oils

- 7.1.2. Transmission and Gear Oils

- 7.1.3. Hydraulic Fluids

- 7.1.4. Metalworking Fluids

- 7.1.5. Greases

- 7.1.6. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Power Generation

- 7.2.2. Automotive

- 7.2.3. Heavy Equipment

- 7.2.4. Metallurgy and Metalworking

- 7.2.5. Other End-user Industries (Oil and Gas, Etc.)

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Synthetic Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Engine Oils

- 8.1.2. Transmission and Gear Oils

- 8.1.3. Hydraulic Fluids

- 8.1.4. Metalworking Fluids

- 8.1.5. Greases

- 8.1.6. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Power Generation

- 8.2.2. Automotive

- 8.2.3. Heavy Equipment

- 8.2.4. Metallurgy and Metalworking

- 8.2.5. Other End-user Industries (Oil and Gas, Etc.)

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Synthetic Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Engine Oils

- 9.1.2. Transmission and Gear Oils

- 9.1.3. Hydraulic Fluids

- 9.1.4. Metalworking Fluids

- 9.1.5. Greases

- 9.1.6. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Power Generation

- 9.2.2. Automotive

- 9.2.3. Heavy Equipment

- 9.2.4. Metallurgy and Metalworking

- 9.2.5. Other End-user Industries (Oil and Gas, Etc.)

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Synthetic Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Engine Oils

- 10.1.2. Transmission and Gear Oils

- 10.1.3. Hydraulic Fluids

- 10.1.4. Metalworking Fluids

- 10.1.5. Greases

- 10.1.6. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Power Generation

- 10.2.2. Automotive

- 10.2.3. Heavy Equipment

- 10.2.4. Metallurgy and Metalworking

- 10.2.5. Other End-user Industries (Oil and Gas, Etc.)

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Valvoline Global Operations (Saudi Arabian Oil Co )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shell plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TotalEnergies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BP p l c

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chevron Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Exxon Mobil Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Petrochemical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PETRONAS Lubricants International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FUCHS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JX Nippon Oil & Gas Exploration Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Indian Oil Corporation Ltd*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Valvoline Global Operations (Saudi Arabian Oil Co )

List of Figures

- Figure 1: Global Synthetic Lubricants Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Synthetic Lubricants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Synthetic Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Synthetic Lubricants Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: Asia Pacific Synthetic Lubricants Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: Asia Pacific Synthetic Lubricants Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Synthetic Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Synthetic Lubricants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Synthetic Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Synthetic Lubricants Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: North America Synthetic Lubricants Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: North America Synthetic Lubricants Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Synthetic Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Synthetic Lubricants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Synthetic Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Synthetic Lubricants Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Europe Synthetic Lubricants Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Synthetic Lubricants Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Synthetic Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Synthetic Lubricants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Synthetic Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Synthetic Lubricants Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: South America Synthetic Lubricants Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: South America Synthetic Lubricants Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Synthetic Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Synthetic Lubricants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Synthetic Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Synthetic Lubricants Market Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East and Africa Synthetic Lubricants Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Synthetic Lubricants Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Synthetic Lubricants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Synthetic Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Synthetic Lubricants Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Synthetic Lubricants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Synthetic Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Synthetic Lubricants Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Synthetic Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Indonesia Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Thailand Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Synthetic Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global Synthetic Lubricants Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Synthetic Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United States Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Canada Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Synthetic Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: Global Synthetic Lubricants Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 24: Global Synthetic Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Germany Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Italy Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Russia Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: NORDIC Countries Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Turkey Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Synthetic Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Synthetic Lubricants Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global Synthetic Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Brazil Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Argentina Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Colombia Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Synthetic Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 41: Global Synthetic Lubricants Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 42: Global Synthetic Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Saudi Arabia Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Africa Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Nigeria Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Qatar Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Egypt Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: UAE Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East and Africa Synthetic Lubricants Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Synthetic Lubricants Market?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Synthetic Lubricants Market?

Key companies in the market include Valvoline Global Operations (Saudi Arabian Oil Co ), Shell plc, TotalEnergies, BP p l c, Chevron Corporation, Exxon Mobil Corporation, China Petrochemical Corporation, PETRONAS Lubricants International, FUCHS, JX Nippon Oil & Gas Exploration Corporation, Indian Oil Corporation Ltd*List Not Exhaustive.

3. What are the main segments of the Synthetic Lubricants Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of High-performance Synthetic Lubricants; Increasing Demand from Automotive Sector Owing to Rising Environmental Concerns; Other Drivers.

6. What are the notable trends driving market growth?

Rising Demand from Automotive Industry.

7. Are there any restraints impacting market growth?

Increasing Usage of High-performance Synthetic Lubricants; Increasing Demand from Automotive Sector Owing to Rising Environmental Concerns; Other Drivers.

8. Can you provide examples of recent developments in the market?

October 2023: Chevron Corporation entered into a definitive agreement with Hess Corporation. It is to acquire all of the shares of Hess in an all-stock transaction valued at USD 53 billion with an aim to increase production and fasten the free cash flow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Synthetic Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Synthetic Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Synthetic Lubricants Market?

To stay informed about further developments, trends, and reports in the Synthetic Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence