Key Insights

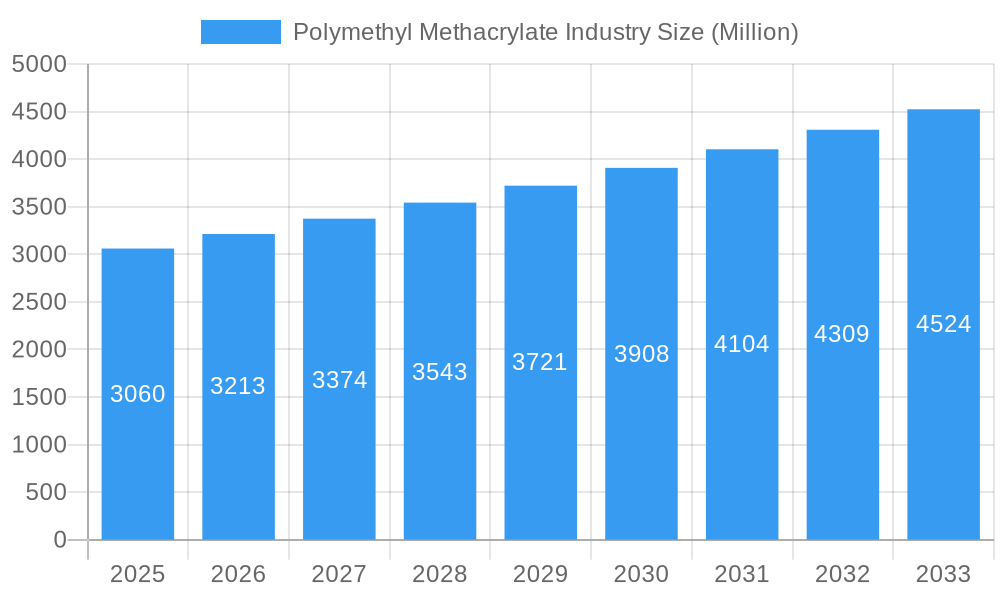

The Polymethyl Methacrylate (PMMA) market is poised for robust expansion, projected to reach an estimated market size of USD 3.06 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.97%. This steady growth trajectory is anticipated to continue through 2033. The primary drivers fueling this ascent are the increasing demand for lightweight, durable, and aesthetically pleasing materials across a multitude of industries. Notably, the automotive sector's shift towards weight reduction for improved fuel efficiency and the burgeoning aerospace industry's need for high-performance transparent materials are significant contributors. Furthermore, the construction industry's adoption of PMMA for architectural glazing, signage, and lighting solutions, owing to its excellent weatherability and impact resistance, is a key growth catalyst. The electrical and electronics sector also plays a crucial role, leveraging PMMA for displays, lighting components, and optical lenses.

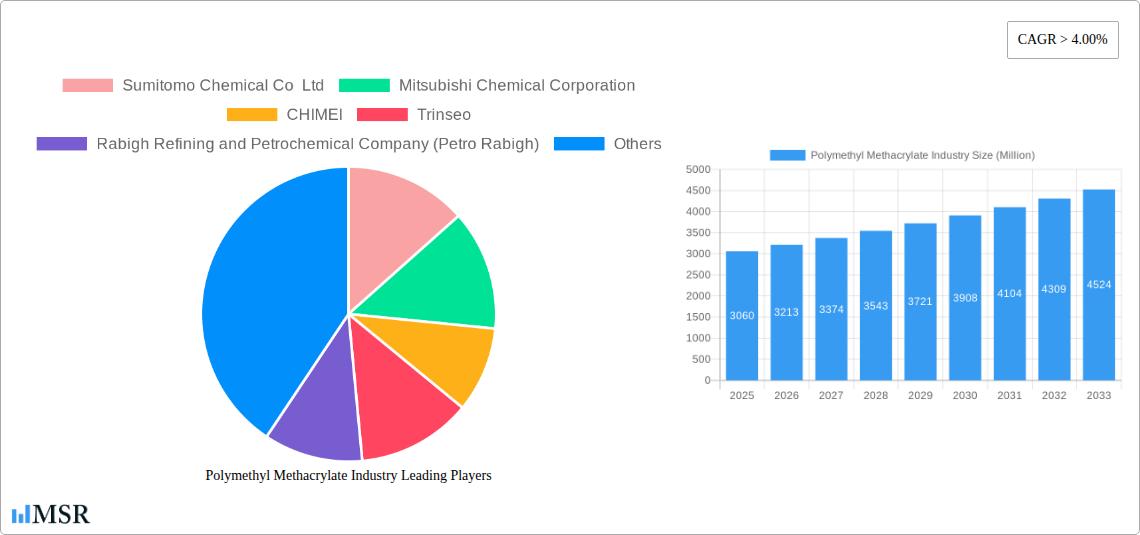

Polymethyl Methacrylate Industry Market Size (In Billion)

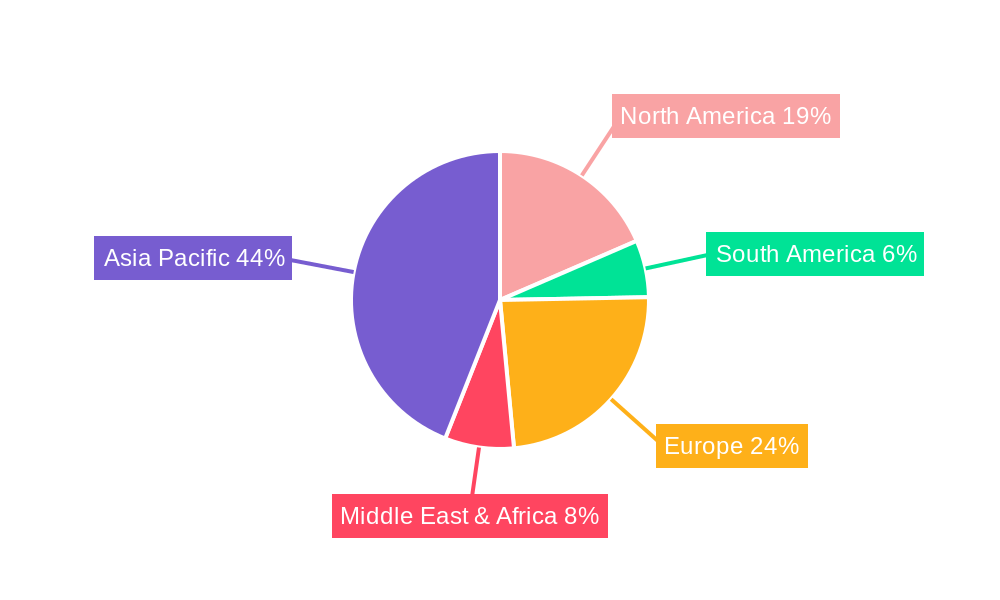

Emerging trends such as the development of advanced PMMA grades with enhanced optical properties and UV resistance, alongside growing investments in sustainable production methods, are shaping the market landscape. The increasing emphasis on recycling and the circular economy within the plastics industry is also expected to influence manufacturing processes and product development. However, the market faces certain restraints, including fluctuating raw material prices, particularly for methyl methacrylate (MMA), and the presence of substitute materials in specific applications. Geographically, Asia Pacific is expected to dominate the market share due to rapid industrialization, a growing manufacturing base, and increasing consumer demand. North America and Europe remain significant markets, driven by technological advancements and stringent quality standards. Key players like Sumitomo Chemical Co. Ltd., Mitsubishi Chemical Corporation, and CHIMEI are at the forefront, investing in R&D and capacity expansion to meet the escalating global demand for Polymethyl Methacrylate.

Polymethyl Methacrylate Industry Company Market Share

Polymethyl Methacrylate (PMMA) Industry Report: Unlocking Growth and Innovation in a Versatile Polymer Market (2019-2033)

Gain unparalleled insights into the dynamic global Polymethyl Methacrylate (PMMA) industry with this comprehensive report. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves deep into market concentration, industry trends, key segments, product developments, challenges, growth drivers, emerging opportunities, leading players, and strategic outlook. Discover the critical factors shaping the PMMA market size, forecast CAGR, and the impact of key players like Sumitomo Chemical Co Ltd, Mitsubishi Chemical Corporation, CHIMEI, Trinseo, and Röhm GmbH. This report is essential for PMMA manufacturers, polymer suppliers, chemical distributors, end-user industry stakeholders in automotive, building and construction, aerospace, electrical and electronics, and industrial machinery, and investors seeking to capitalize on the evolving methacrylate market.

Polymethyl Methacrylate Industry Market Concentration & Dynamics

The Polymethyl Methacrylate (PMMA) industry exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant portion of global production. These leading companies, including Sumitomo Chemical Co Ltd, Mitsubishi Chemical Corporation, CHIMEI, Trinseo, and Röhm GmbH, drive innovation through substantial investments in research and development. The innovation ecosystem is characterized by a focus on developing advanced PMMA grades with enhanced properties such as improved weatherability, scratch resistance, and optical clarity, catering to increasingly sophisticated end-user demands. Regulatory frameworks, particularly concerning environmental impact and product safety, play a crucial role in shaping manufacturing processes and material development. The threat of substitute products, such as polycarbonate and acrylic sheets made from other materials, is present, but PMMA’s unique combination of transparency, rigidity, and processability continues to secure its market position. End-user trends, including the growing demand for lightweight and durable materials in the automotive and aerospace sectors, as well as sustainable building solutions, are significant market influencers. Mergers and acquisitions (M&A) activities, while not always high in volume, can significantly alter market dynamics, consolidating market share and expanding geographical reach. For instance, the acquisition of Röhm GmbH by Advent International in recent years signaled a strategic move to enhance its competitive standing in the global PMMA market.

Polymethyl Methacrylate Industry Industry Insights & Trends

The global Polymethyl Methacrylate (PMMA) industry is poised for robust growth, driven by a confluence of escalating demand from key end-user sectors and continuous technological advancements. The estimated market size for PMMA in 2025 is projected to be in the region of \$X.XX billion, with a projected Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period of 2025–2033. This upward trajectory is significantly fueled by the expanding applications of PMMA in the automotive industry, where its use in vehicle lighting, interior components, and glazing contributes to weight reduction and aesthetic appeal. Similarly, the building and construction sector benefits from PMMA's superior optical clarity, weather resistance, and design flexibility for architectural glazing, skylights, and signage, propelling its adoption in both residential and commercial projects. The electrical and electronics industry increasingly leverages PMMA for its excellent transparency and insulating properties in display screens, light guides, and electronic housings. Furthermore, advancements in PMMA resin formulations, including the development of specialized grades with enhanced UV resistance and impact strength, are opening new avenues for innovation and market penetration. The increasing focus on sustainability and recyclability within the chemical industry is also influencing PMMA production and application development, with a growing emphasis on eco-friendly manufacturing processes and the exploration of recycled PMMA feedstocks. The methacrylate market is also experiencing disruptions from emerging technologies, such as advanced polymerization techniques and the development of high-performance PMMA composites, which are enabling the creation of materials with tailored properties for niche applications. Evolving consumer preferences, particularly the demand for visually appealing and durable products, further bolster the growth of the PMMA market. The PMMA market report highlights that innovation in processing technologies, such as injection molding and extrusion, is also enhancing manufacturing efficiency and cost-effectiveness, making PMMA a more attractive material choice across a wider spectrum of industries. The overall outlook for the PMMA market remains exceptionally positive, driven by its inherent material advantages and the relentless pursuit of innovation by industry leaders.

Key Markets & Segments Leading Polymethyl Methacrylate Industry

The Polymethyl Methacrylate (PMMA) market is characterized by the significant dominance of specific regions and end-user industries, each contributing to the overall growth and shaping market dynamics.

- Automotive: This segment is a primary driver of PMMA demand. The increasing emphasis on vehicle lightweighting to improve fuel efficiency and reduce emissions, coupled with the growing trend towards advanced automotive lighting systems (e.g., LED and OLED integration) and customizable interior designs, strongly favors the use of PMMA. Its excellent optical properties, weatherability, and impact resistance make it an ideal material for taillights, headlamp lenses, instrument clusters, and interior trim components.

- Building and Construction: This sector represents another substantial market for PMMA. The inherent clarity, UV resistance, and durability of PMMA make it a preferred choice for architectural glazing, skylights, conservatories, sound barriers, and decorative panels. The growing global urbanization and infrastructure development projects, particularly in emerging economies, are key economic growth factors boosting demand. Furthermore, the aesthetic flexibility and ability to be molded into various shapes allow for innovative architectural designs, driving its adoption.

- Electrical and Electronics: PMMA's superior transparency, scratch resistance, and electrical insulation properties make it indispensable in the electronics industry. It is extensively used in display screens for televisions, smartphones, and tablets, as well as in light guide plates for LCDs, touch panels, and protective covers for electronic devices. The rapid growth of the consumer electronics market and the continuous innovation in display technologies are significant drivers for PMMA consumption in this segment.

- Aerospace: While a smaller segment in terms of volume compared to automotive or construction, the aerospace industry demands high-performance materials. PMMA's lightweight nature, excellent optical clarity, and resistance to UV radiation make it suitable for aircraft windows, cabin interiors, and lighting fixtures. The stringent safety and performance requirements in this sector underscore the value of high-quality PMMA grades.

- Industrial and Machinery: In this segment, PMMA finds applications in machine guards, displays, control panels, and signage due to its durability, impact resistance, and transparency. The need for safe and functional operational environments in industrial settings contributes to its demand.

- Other End-user Industries: This broad category includes applications in medical devices (e.g., diagnostic equipment components), signage and advertising, household goods, and optical lenses. The versatility of PMMA allows it to cater to a wide array of specialized needs, contributing to its overall market presence.

The dominance of the automotive and building and construction sectors is a testament to PMMA's adaptability and cost-effectiveness in large-scale applications. Economic growth, coupled with technological advancements and evolving consumer preferences for aesthetics and functionality, will continue to propel these segments forward, solidifying their leading positions in the global PMMA market.

Polymethyl Methacrylate Industry Product Developments

Recent product developments in the Polymethyl Methacrylate (PMMA) industry are focused on enhancing material performance and expanding application possibilities. Innovations include the development of specialty PMMA molding compounds with improved scratch resistance and UV stability, crucial for demanding outdoor applications and automotive components. Furthermore, advancements in optical grades of PMMA are enabling clearer and more efficient light transmission, vital for the rapidly growing LED lighting and display markets. The industry is also seeing a rise in PMMA grades designed for improved recyclability and bio-based alternatives, aligning with global sustainability initiatives and addressing the demand for eco-friendly polymers.

Challenges in the Polymethyl Methacrylate Industry Market

The Polymethyl Methacrylate (PMMA) industry faces several challenges that can impact its growth trajectory. Volatility in raw material prices, particularly for acrylic monomers, can affect production costs and profit margins. Increasing competition from substitute materials like polycarbonate and other transparent polymers poses a constant threat, necessitating continuous innovation and differentiation. Stringent environmental regulations regarding chemical production and waste management can lead to increased compliance costs. Supply chain disruptions, as witnessed in recent years, can impact the availability and timely delivery of PMMA resins, affecting downstream manufacturing processes.

Forces Driving Polymethyl Methacrylate Industry Growth

Several key forces are propelling the growth of the Polymethyl Methacrylate (PMMA) industry. The relentless demand from the automotive sector for lightweight and aesthetically pleasing components is a significant driver. Similarly, the building and construction industry's need for durable, transparent, and weather-resistant materials for architectural applications fuels demand. Technological advancements in PMMA formulations, leading to enhanced properties such as superior optical clarity, impact resistance, and UV stability, are expanding its application scope. Growing consumer electronics markets and the increasing use of PMMA in displays and protective covers also contribute substantially to market expansion.

Challenges in the Polymethyl Methacrylate Industry Market

Long-term growth catalysts for the Polymethyl Methacrylate (PMMA) market lie in continuous innovation and strategic market expansion. The development of high-performance PMMA grades tailored for niche applications, such as specialized medical devices or advanced optical components, will unlock new revenue streams. Partnerships and collaborations between PMMA manufacturers and end-users can foster the development of customized solutions, thereby strengthening market positions. Furthermore, strategic investments in emerging markets with growing industrial and construction sectors offer significant potential for long-term growth and diversification.

Emerging Opportunities in Polymethyl Methacrylate Industry

Emerging opportunities in the Polymethyl Methacrylate (PMMA) industry are abundant, driven by evolving consumer preferences and technological advancements. The increasing demand for sustainable and recyclable materials presents a significant opportunity for the development and commercialization of bio-based or recycled PMMA. The burgeoning electric vehicle (EV) market, with its emphasis on lightweighting and advanced lighting solutions, offers a fertile ground for PMMA adoption. Furthermore, the growing use of PMMA in additive manufacturing (3D printing) for prototyping and specialized component production is another area of significant potential. Expansion into new geographical markets with developing infrastructure and manufacturing capabilities also represents a key opportunity.

Leading Players in the Polymethyl Methacrylate Industry Sector

- Sumitomo Chemical Co Ltd

- Mitsubishi Chemical Corporation

- CHIMEI

- Trinseo

- Rabigh Refining and Petrochemical Company (Petro Rabigh)

- Saudi Methacrylates Company (SAMAC)

- Röhm GmbH

- Wanhu

- LX MMA

- LOTTE MCC Corp

Key Milestones in Polymethyl Methacrylate Industry Industry

- July 2022: Röhm GmbH announced plans to expand its production capacity of PLEXIGLAS, a PMMA special molding compound, in Shanghai, to strengthen its market position in China.

- July 2022: Röhm GmbH announced plans to expand its production capacity of PLEXIGLAS, a PMMA molding compound, in Worms, Germany, due to high global demand for its branded polymethyl methacrylate (PMMA).

- August 2021: Röhm GmbH announced plans to open a new technology center in Shanghai, China, and Connecticut, United States, with an aim to become a technology leader in methacrylates and offer modern technical applications and development labs for innovative applications.

Strategic Outlook for Polymethyl Methacrylate Industry Market

The strategic outlook for the Polymethyl Methacrylate (PMMA) market is one of sustained growth and innovation. Key growth accelerators include continued investment in research and development to create high-value PMMA grades with superior performance characteristics and unique functionalities. Companies are expected to focus on expanding their global manufacturing footprint and strengthening their distribution networks to cater to diverse regional demands. The integration of sustainable practices, including the development of recycled and bio-based PMMA, will be crucial for long-term competitiveness. Furthermore, strategic collaborations with downstream industries to co-develop innovative applications will unlock significant future market potential, solidifying PMMA's position as a versatile and indispensable polymer in the global chemical landscape.

Polymethyl Methacrylate Industry Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Other End-user Industries

Polymethyl Methacrylate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Polymethyl Methacrylate Industry Regional Market Share

Geographic Coverage of Polymethyl Methacrylate Industry

Polymethyl Methacrylate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application of PFA Resin in the Semiconductor Industry; Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications

- 3.3. Market Restrains

- 3.3.1. Environmental and Health Hazards Associated With PFA; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polymethyl Methacrylate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Polymethyl Methacrylate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Building and Construction

- 6.1.4. Electrical and Electronics

- 6.1.5. Industrial and Machinery

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Polymethyl Methacrylate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Building and Construction

- 7.1.4. Electrical and Electronics

- 7.1.5. Industrial and Machinery

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Polymethyl Methacrylate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Building and Construction

- 8.1.4. Electrical and Electronics

- 8.1.5. Industrial and Machinery

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Polymethyl Methacrylate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Building and Construction

- 9.1.4. Electrical and Electronics

- 9.1.5. Industrial and Machinery

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Polymethyl Methacrylate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Aerospace

- 10.1.2. Automotive

- 10.1.3. Building and Construction

- 10.1.4. Electrical and Electronics

- 10.1.5. Industrial and Machinery

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sumitomo Chemical Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Chemical Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CHIMEI

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trinseo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rabigh Refining and Petrochemical Company (Petro Rabigh)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saudi Methacrylates Company (SAMAC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Röhm GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wanhu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LX MMA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LOTTE MCC Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Global Polymethyl Methacrylate Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Polymethyl Methacrylate Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 3: North America Polymethyl Methacrylate Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Polymethyl Methacrylate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Polymethyl Methacrylate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Polymethyl Methacrylate Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 7: South America Polymethyl Methacrylate Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: South America Polymethyl Methacrylate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America Polymethyl Methacrylate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polymethyl Methacrylate Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 11: Europe Polymethyl Methacrylate Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Polymethyl Methacrylate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Polymethyl Methacrylate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Polymethyl Methacrylate Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 15: Middle East & Africa Polymethyl Methacrylate Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Middle East & Africa Polymethyl Methacrylate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa Polymethyl Methacrylate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polymethyl Methacrylate Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 19: Asia Pacific Polymethyl Methacrylate Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific Polymethyl Methacrylate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Polymethyl Methacrylate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 4: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 9: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 14: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 25: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 33: Global Polymethyl Methacrylate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Polymethyl Methacrylate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polymethyl Methacrylate Industry?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Polymethyl Methacrylate Industry?

Key companies in the market include Sumitomo Chemical Co Ltd, Mitsubishi Chemical Corporation, CHIMEI, Trinseo, Rabigh Refining and Petrochemical Company (Petro Rabigh), Saudi Methacrylates Company (SAMAC), Röhm GmbH, Wanhu, LX MMA, LOTTE MCC Corp.

3. What are the main segments of the Polymethyl Methacrylate Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application of PFA Resin in the Semiconductor Industry; Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Environmental and Health Hazards Associated With PFA; Other Restraints.

8. Can you provide examples of recent developments in the market?

July 2022: Rohm GmbH announced plans to expand its production capacity of PLEXIGLAS, a PMMA special molding compound, in Shanghai, to strengthen its market position in China.July 2022: Rohm GmbH announced plans to expand its production capacity of PLEXIGLAS, a PMMA molding compound, in Worms, Germany, due to high global demand for its branded polymethyl methacrylate (PMMA).August 2021: Rohm GmbH announced plans to open a new technology center in Shanghai, China, and Connecticut, United States, with an aim to become a technology leader in methacrylates and offer modern technical applications and development labs for innovative applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polymethyl Methacrylate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polymethyl Methacrylate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polymethyl Methacrylate Industry?

To stay informed about further developments, trends, and reports in the Polymethyl Methacrylate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence