Key Insights

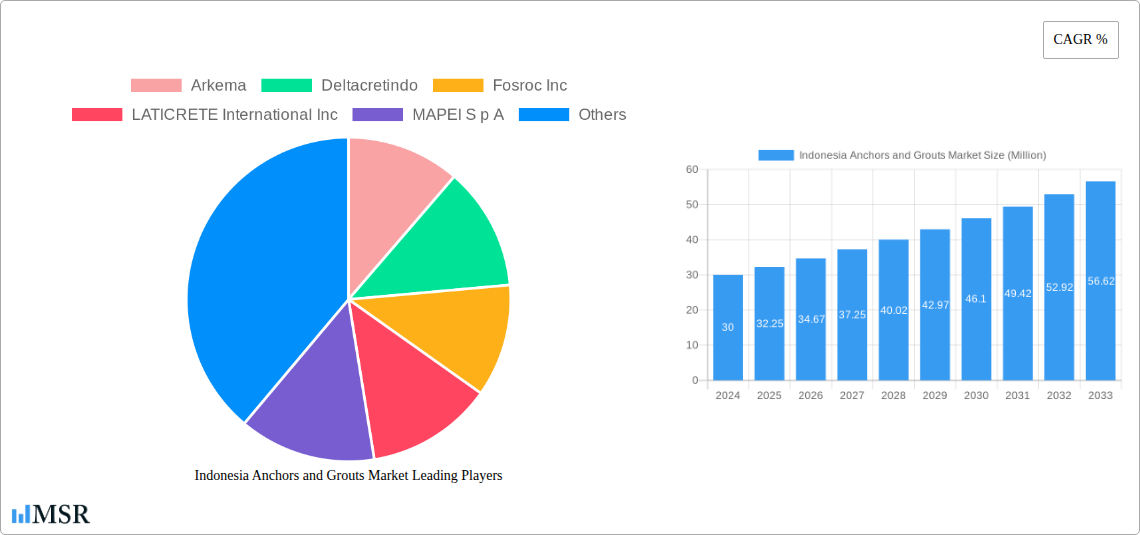

The Indonesian anchors and grouts market is poised for significant expansion, projected to reach USD 30 million in 2024. This robust growth is underpinned by a compelling CAGR of 7.5%, indicating a healthy and sustained upward trajectory. The market's dynamism is fueled by several key drivers. Rapid urbanization and increasing infrastructure development across Indonesia are creating a sustained demand for high-performance anchoring and grouting solutions. The construction of new residential, commercial, and industrial facilities, alongside upgrades to existing infrastructure such as bridges and transportation networks, necessitates reliable and durable anchoring and grouting products for structural integrity and longevity. Furthermore, the growing awareness among construction professionals regarding the benefits of advanced grouting technologies, such as epoxy and polyurethane variants, which offer superior strength, chemical resistance, and ease of application, is also a significant growth catalyst. This trend is particularly evident in specialized applications within the industrial and infrastructure sectors.

Indonesia Anchors and Grouts Market Market Size (In Million)

The market is segmented across various end-use sectors, with Commercial, Industrial and Institutional, Infrastructure, and Residential segments all contributing to the overall market size. Within sub-products, Cementitious Fixing, Resin Fixing (including Epoxy Grout and Polyurethane (PU) Grout), and Other Types represent key areas of demand. Resin-based grouts, owing to their advanced properties, are experiencing notable adoption. Key players such as Arkema, Deltacretindo, Fosroc Inc, LATICRETE International Inc, MAPEI S p A, MBCC Group, Normet, Saint-Gobain, Sika AG, and Ultrachem Construction Chemical are actively participating in this evolving market, introducing innovative products and expanding their distribution networks to cater to the growing demand. While the market demonstrates strong growth potential, potential restraints such as fluctuations in raw material prices and the availability of skilled labor for specialized applications could influence market dynamics. Nevertheless, the overall outlook for the Indonesian anchors and grouts market remains highly positive.

Indonesia Anchors and Grouts Market Company Market Share

Dive deep into the burgeoning Indonesia Anchors and Grouts Market with our meticulously researched report, covering the study period 2019–2033, with the base year 2025 and forecast period 2025–2033. This in-depth analysis provides critical insights into market size, CAGR, key drivers, challenges, and emerging opportunities, essential for stakeholders seeking to capitalize on this dynamic sector. Explore the competitive landscape, strategic alliances, and groundbreaking industry developments shaping the future of construction chemical solutions in Indonesia.

Indonesia Anchors and Grouts Market Market Concentration & Dynamics

The Indonesia Anchors and Grouts Market exhibits moderate concentration, with key players like Sika AG, MBCC Group, Arkema, and Saint-Gobain holding significant market shares. The innovation ecosystem is driven by continuous product development in high-performance resins and advanced cementitious formulations. Regulatory frameworks, while evolving to encourage sustainable construction practices, generally favor established product certifications. Substitute products, primarily traditional fastening methods, are gradually being displaced by superior anchors and grouts due to enhanced durability, speed of application, and seismic resistance. End-user trends are shifting towards demand for solutions that offer longevity and minimize maintenance across commercial, industrial, institutional, infrastructure, and residential sectors. Mergers and acquisitions (M&A) are becoming increasingly pivotal, as evidenced by the significant May 2023 acquisition of MBCC Group by Sika AG, signaling a consolidation trend aimed at expanding product portfolios and market reach. While precise M&A deal counts are proprietary, this activity underscores a strategic consolidation phase within the Indonesian anchors and grouts industry.

Indonesia Anchors and Grouts Market Industry Insights & Trends

The Indonesia Anchors and Grouts Market is poised for substantial expansion, projected to reach a market size of over $100 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This robust growth is primarily fueled by Indonesia's ongoing infrastructure development boom, driven by government initiatives to enhance connectivity and urban expansion. The increasing adoption of advanced construction techniques, emphasizing speed, efficiency, and structural integrity, is a significant market driver. Technological disruptions are manifesting in the form of high-performance epoxy and polyurethane (PU) grouts, offering superior chemical resistance, load-bearing capacity, and faster curing times compared to traditional cementitious options. Evolving consumer behaviors, particularly in the residential and commercial sectors, lean towards durable, low-maintenance building materials and solutions that ensure long-term structural safety, especially in seismically active regions. The growth of the industrial and institutional segments is directly correlated with increased manufacturing activity and the development of specialized facilities. The market is also witnessing a growing preference for eco-friendly and low-VOC (Volatile Organic Compound) anchoring and grouting solutions, reflecting a global shift towards sustainable construction.

Key Markets & Segments Leading Indonesia Anchors and Grouts Market

The Infrastructure end-use sector is a dominant force in the Indonesia Anchors and Grouts Market, propelled by substantial government investment in transportation networks, power generation facilities, and public utilities. This segment's growth is further bolstered by the need for robust anchoring and grouting solutions capable of withstanding heavy loads and extreme environmental conditions, essential for bridges, tunnels, dams, and offshore wind turbine foundations.

- Drivers for Infrastructure Dominance:

- Significant government spending on national development projects.

- Increasing demand for seismic-resistant structures.

- Expansion of renewable energy projects, particularly offshore wind farms.

The Residential segment is also a significant contributor, fueled by a rapidly growing population and urbanization trends. The demand for reliable and aesthetically pleasing anchoring and grouting products for various construction applications, from structural reinforcement to tile fixing, is consistently high.

- Drivers for Residential Growth:

- Rapid urbanization and a burgeoning middle class.

- Increasing disposable incomes leading to higher demand for quality housing.

- Growth in renovation and retrofitting projects.

In terms of sub-products, Cementitious Fixing solutions continue to hold a substantial market share due to their cost-effectiveness and widespread application. However, Resin Fixing, particularly Epoxy Grout and Polyurethane (PU) Grout, is experiencing accelerated growth. These advanced resin-based solutions are increasingly favored in demanding applications requiring high strength, chemical resistance, and faster setting times, such as in industrial flooring, concrete repair, and structural bonding. The superior performance of resin-based grouts in challenging environments, including those with high moisture or chemical exposure, is a key factor driving their adoption.

- Drivers for Resin Fixing Growth:

- Demand for high-performance and specialized applications.

- Technological advancements leading to improved product formulations.

- Increased awareness of the long-term benefits of durable resin-based solutions.

Indonesia Anchors and Grouts Market Product Developments

Product development in the Indonesia Anchors and Grouts Market is characterized by a focus on enhanced performance, sustainability, and ease of application. Manufacturers are actively innovating in areas such as fast-curing epoxy and polyurethane grouts for rapid infrastructure repairs and the development of high-strength, low-shrinkage cementitious grouts for critical structural applications. There is also a growing emphasis on developing anchoring and grouting solutions with improved environmental profiles, including low-VOC formulations and those derived from recycled materials, aligning with global sustainability trends in the construction industry. These advancements are crucial for meeting the stringent requirements of modern construction projects and expanding the applicability of these essential building materials.

Challenges in the Indonesia Anchors and Grouts Market Market

The Indonesia Anchors and Grouts Market faces several challenges that could temper growth. Intense price competition among numerous local and international players can compress profit margins. Ensuring consistent product quality across a fragmented market and combating the prevalence of counterfeit products remain significant concerns. Furthermore, a shortage of skilled labor proficient in applying advanced anchoring and grouting systems can hinder adoption. Fluctuations in raw material prices, particularly for resins and cementitious components, can impact cost structures and pricing strategies. Navigating complex and sometimes inconsistent local building codes and regulations adds another layer of difficulty for market participants.

Forces Driving Indonesia Anchors and Grouts Market Growth

The Indonesia Anchors and Grouts Market is propelled by robust economic growth and a burgeoning construction sector. Significant government investment in infrastructure development, including transportation networks, energy projects, and urban renewal, is a primary growth catalyst. The increasing demand for high-rise buildings and complex architectural designs necessitates advanced anchoring and grouting solutions for structural integrity and seismic resistance. Furthermore, growing awareness among construction professionals and end-users regarding the benefits of modern anchoring and grouting systems, such as enhanced durability, speed of installation, and improved load-bearing capacities, is driving market adoption. The rising trend towards urbanization and a growing middle class further fuels residential construction, creating sustained demand.

Challenges in the Indonesia Anchors and Grouts Market Market

While growth is evident, long-term sustainability in the Indonesia Anchors and Grouts Market hinges on addressing key challenges. The development of innovative, cost-effective solutions that cater to the specific needs of the Indonesian market, particularly in remote or developing regions, is crucial. Strengthening distribution networks to ensure wider product availability and accessibility across the archipelago is essential. Fostering partnerships with local construction firms and educational institutions to enhance technical expertise and promote best practices in the application of anchoring and grouting systems will be vital for sustained market penetration. Continued investment in research and development to create more sustainable and high-performance products will be a key differentiator.

Emerging Opportunities in Indonesia Anchors and Grouts Market

Emerging opportunities in the Indonesia Anchors and Grouts Market are diverse and promising. The increasing focus on disaster resilience and earthquake-resistant construction presents a significant avenue for high-strength anchoring and specialized grouting systems. The booming renewable energy sector, particularly the development of offshore wind farms, requires specialized grout formulations for foundation stability. Furthermore, the growing trend of modular construction and prefabrication offers opportunities for innovative anchoring solutions that facilitate rapid assembly. There is also a burgeoning demand for aesthetically integrated anchoring and grouting solutions in architectural applications, as well as a growing market for eco-friendly and sustainable products, driven by global environmental consciousness and government incentives.

Leading Players in the Indonesia Anchors and Grouts Market Sector

- Arkema

- Deltacretindo

- Fosroc Inc

- LATICRETE International Inc

- MAPEI S p A

- MBCC Group

- Normet

- Saint-Gobain

- Sika AG

- Ultrachem Construction Chemical

Key Milestones in Indonesia Anchors and Grouts Market Industry

- May 2023: Sika AG, a global leader in construction chemicals, acquired the MBCC Group, significantly expanding its portfolio in waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with strategic exclusions in concrete admixture operations. This merger consolidates market presence and enhances competitive capabilities.

- February 2023: Master Builders Solutions, a brand under the MBCC Group, inaugurated a new offshore grout production plant in Taichung, Taiwan. This strategic investment addresses the escalating demand from the offshore wind turbine market, positioning the company to capitalize on this growing sector.

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. This acquisition strengthens Saint-Gobain's market position by integrating GCP's extensive expertise in cement additives, concrete admixtures, and building materials for infrastructure, commercial, and residential applications, fostering synergies and expanding its global platform.

Strategic Outlook for Indonesia Anchors and Grouts Market Market

The strategic outlook for the Indonesia Anchors and Grouts Market is exceptionally positive, characterized by sustained demand driven by robust infrastructure development and urbanization. Key growth accelerators will include the continued adoption of advanced resin-based grouts and specialized anchoring systems for high-performance applications and disaster resilience. Strategic opportunities lie in expanding product offerings to cater to the renewable energy sector, particularly offshore wind, and in developing more sustainable and eco-friendly solutions. Enhancing distribution networks, providing technical training, and forging strategic partnerships with local stakeholders will be critical for market penetration and long-term success. The market is expected to witness further consolidation and innovation as major players vie for market leadership.

Indonesia Anchors and Grouts Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

- 2.1. Cementitious Fixing

-

2.2. Resin Fixing

-

2.2.1. By Technology

- 2.2.1.1. Epoxy Grout

- 2.2.1.2. Polyurethane (PU) Grout

-

2.2.1. By Technology

- 2.3. Other Types

Indonesia Anchors and Grouts Market Segmentation By Geography

- 1. Indonesia

Indonesia Anchors and Grouts Market Regional Market Share

Geographic Coverage of Indonesia Anchors and Grouts Market

Indonesia Anchors and Grouts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Anchors and Grouts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Cementitious Fixing

- 5.2.2. Resin Fixing

- 5.2.2.1. By Technology

- 5.2.2.1.1. Epoxy Grout

- 5.2.2.1.2. Polyurethane (PU) Grout

- 5.2.2.1. By Technology

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deltacretindo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fosroc Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LATICRETE International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAPEI S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MBCC Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Normet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saint-Gobain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ultrachem Construction Chemical

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Indonesia Anchors and Grouts Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Anchors and Grouts Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 2: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 3: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 5: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 6: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Anchors and Grouts Market?

The projected CAGR is approximately 6.77%.

2. Which companies are prominent players in the Indonesia Anchors and Grouts Market?

Key companies in the market include Arkema, Deltacretindo, Fosroc Inc, LATICRETE International Inc, MAPEI S p A, MBCC Group, Normet, Saint-Gobain, Sika AG, Ultrachem Construction Chemical.

3. What are the main segments of the Indonesia Anchors and Grouts Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.February 2023: Master Builders Solutions, an MBCC Group brand, inaugurated a new offshore grout production plant in Taichung, Taiwan, in order to meet the ongoing demand of the offshore wind turbine market.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Anchors and Grouts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Anchors and Grouts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Anchors and Grouts Market?

To stay informed about further developments, trends, and reports in the Indonesia Anchors and Grouts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence