Key Insights

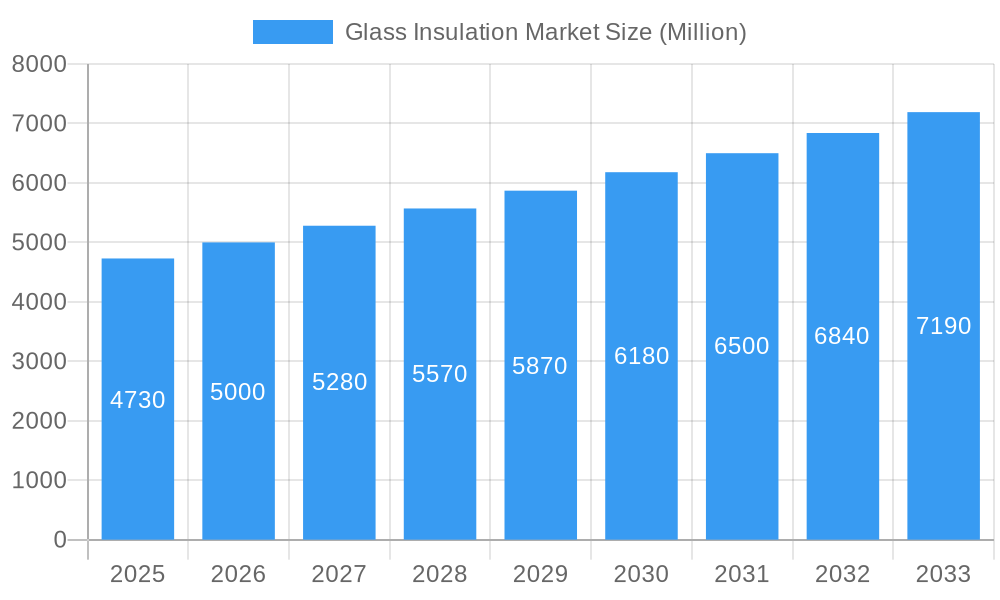

The global Glass Insulation Market is poised for significant expansion, projected to reach $4.73 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 5.7% through 2033. This upward trajectory is primarily fueled by escalating global demand for energy-efficient building solutions, driven by stringent environmental regulations and rising energy costs. The increasing adoption of green building practices and the growing awareness of the long-term cost savings associated with superior insulation are significant drivers. Furthermore, technological advancements in insulation materials, leading to enhanced performance and ease of installation, are also contributing to market growth. The residential construction segment, in particular, is experiencing a surge in demand as homeowners prioritize comfort and sustainability, making glass insulation a preferred choice.

Glass Insulation Market Market Size (In Billion)

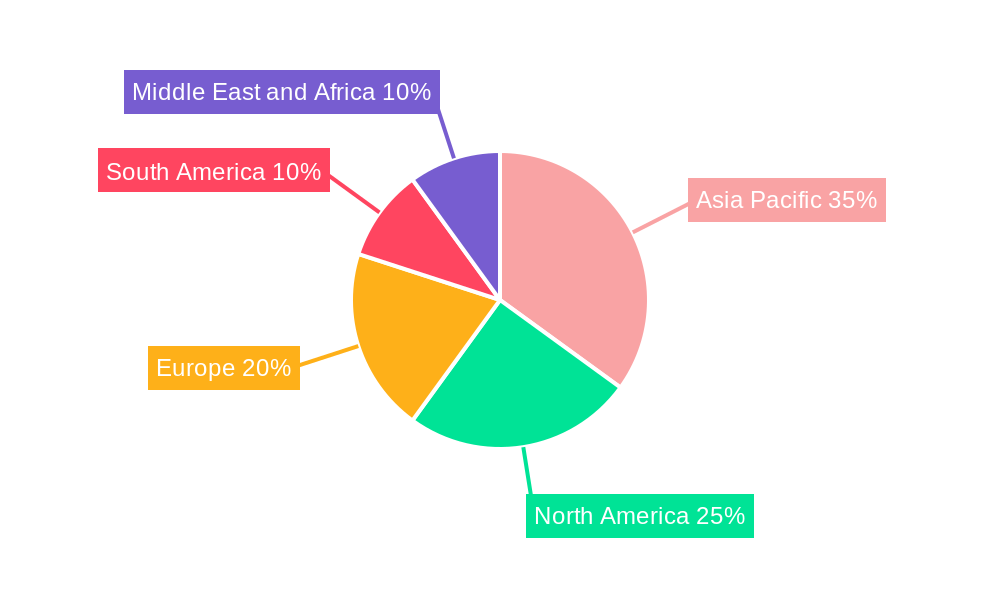

The market's growth is further bolstered by its application across various sectors, including non-residential construction, industrial facilities, and HVAC systems, all of which benefit from improved thermal performance and reduced energy consumption. While the market exhibits strong growth potential, it faces certain restraints. These include the initial cost of installation compared to traditional insulation methods, and potential supply chain disruptions affecting raw material availability. However, the long-term benefits of energy savings and environmental impact reduction are increasingly outweighing these challenges. The Asia Pacific region, led by China and India, is expected to be a key growth engine due to rapid urbanization and infrastructure development, while North America and Europe continue to be significant markets driven by established sustainability initiatives. Key players like Saint-Gobain, Owens Corning, and Knauf Insulation are actively investing in product innovation and expanding their manufacturing capacities to cater to this growing demand.

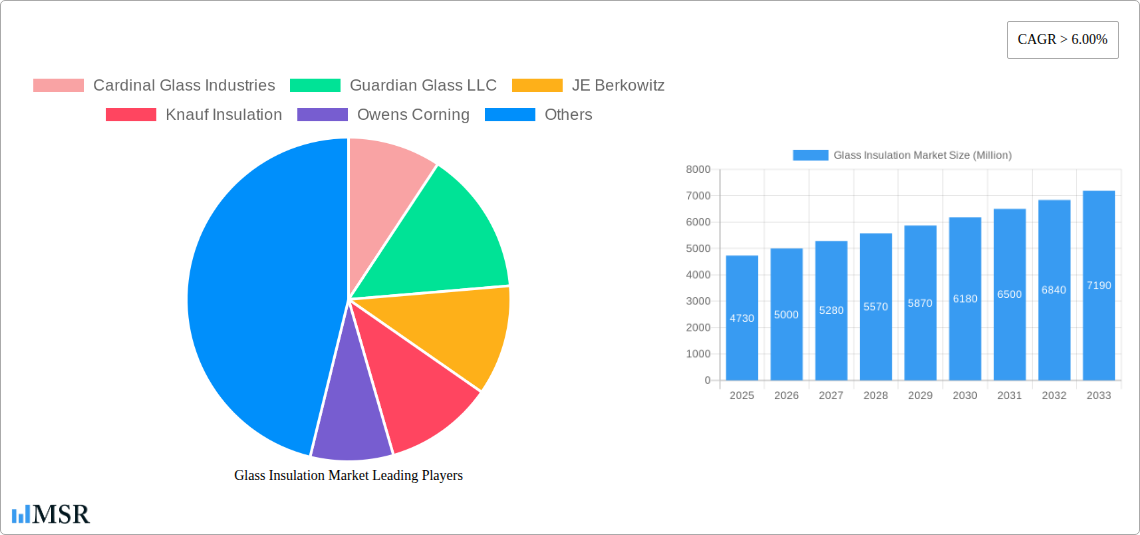

Glass Insulation Market Company Market Share

Here is an SEO-optimized and engaging report description for the Glass Insulation Market, incorporating all your specified details and adhering to the requested structure and word counts.

Title: Global Glass Insulation Market Report 2025-2033: Growth Drivers, Trends, Key Players, and Emerging Opportunities

Description: Gain a comprehensive understanding of the global glass insulation market with this in-depth report. Explore the insulating glass units, cellular glass, and glass wool segments, analyze applications in residential construction, non-residential construction, industrial, and HVAC, and discover industry developments. This report provides critical insights into market dynamics, innovation, regulatory landscapes, and future growth trajectories. Leading players like Cardinal Glass Industries, Guardian Glass LLC, Knauf Insulation, Owens Corning, PPG Industries Inc, Saint-Gobain, and Viracon are analyzed. The study period spans 2019–2033, with 2025 as the base and estimated year. Uncover market concentration, industry trends, key markets, product developments, challenges, growth drivers, and emerging opportunities driving the energy-efficient building materials market. Essential for manufacturers, suppliers, investors, and stakeholders in the construction materials industry and sustainable building solutions.

Glass Insulation Market Market Concentration & Dynamics

The glass insulation market exhibits a moderate to high level of concentration, with several prominent global players dominating the landscape. Key companies such as Saint-Gobain, Guardian Glass LLC, and Owens Corning are recognized for their significant market share, driven by extensive product portfolios, robust distribution networks, and continuous innovation. The innovation ecosystem within the market is characterized by a strong emphasis on developing advanced insulation materials that offer superior thermal performance, fire resistance, and acoustic properties. Regulatory frameworks, particularly those related to energy efficiency standards and building codes in regions like North America and Europe, play a crucial role in shaping market dynamics by mandating the use of effective insulation solutions. The threat of substitute products, such as traditional mineral wool and foam-based insulations, remains a factor, though the unique benefits of glass-based insulation, like its non-combustibility and recyclability, provide a competitive edge. End-user trends are increasingly leaning towards sustainable and energy-saving solutions, directly impacting demand for glass insulation in both residential and commercial sectors. Mergers and acquisitions (M&A) activities, while not as frequent as in some other industries, are strategically employed by larger players to consolidate market presence, acquire new technologies, or expand into new geographical regions. For instance, past M&A deals have focused on integrating specialized glass insulation technologies or expanding production capacities to meet growing demand.

Glass Insulation Market Industry Insights & Trends

The global glass insulation market is poised for significant expansion, driven by a confluence of economic, environmental, and technological factors. The market size is estimated to reach approximately $25.5 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period of 2025–2033. This robust growth is fueled by an escalating global awareness of energy conservation and the need to reduce carbon footprints. Governments worldwide are implementing stringent energy efficiency regulations for buildings, directly stimulating the demand for high-performance insulation materials like those offered by the glass insulation sector. Technological disruptions are playing a pivotal role, with ongoing research and development efforts leading to the creation of advanced insulating glass units (IGUs) that offer enhanced thermal break capabilities and reduced heat transfer. Innovations in cellular glass are yielding products with exceptional durability, moisture resistance, and suitability for demanding industrial applications. Furthermore, advancements in glass wool production are improving its thermal and acoustic insulation properties, making it a preferred choice for residential and non-residential construction. Evolving consumer behaviors are also contributing to market growth, as homeowners and businesses increasingly prioritize properties that offer lower energy bills and a more comfortable indoor environment. The push towards sustainable construction practices and the growing popularity of green building certifications are further accelerating the adoption of glass insulation solutions. The industrial sector's demand for reliable insulation in processes involving high temperatures or cryogenic conditions also presents a steady revenue stream. The HVAC application segment is benefiting from the drive to optimize building energy performance, with efficient insulation being a critical component. The market is witnessing a steady shift towards products that offer a better balance of performance, cost-effectiveness, and environmental sustainability, positioning glass insulation favorably against alternative materials.

Key Markets & Segments Leading Glass Insulation Market

The glass insulation market is experiencing dominant growth in several key regions and segments, propelled by distinct economic and infrastructural drivers.

Dominant Regions and Countries:

North America: This region consistently leads the glass insulation market, driven by strong government initiatives promoting energy-efficient buildings, substantial investments in construction and renovation projects, and a high consumer awareness regarding the benefits of thermal insulation. The presence of major manufacturers and robust R&D infrastructure further solidifies its leadership.

- United States: The largest market within North America, characterized by stringent building codes, a significant volume of new construction and retrofitting activities in both residential and non-residential sectors, and a strong emphasis on sustainable building practices. Economic growth and increasing disposable incomes also support demand for energy-efficient homes.

- Canada: Similar to the US, Canada benefits from favorable regulations, a cold climate necessitating effective insulation, and a growing construction industry.

Europe: This region is another significant player, driven by the European Union's ambitious energy efficiency targets and directives aimed at reducing carbon emissions. The renovation wave initiative is particularly boosting the demand for insulation solutions in existing buildings.

- Germany: A frontrunner in sustainable construction and energy efficiency, Germany's strong industrial base and commitment to environmental standards make it a key market for glass insulation.

- United Kingdom: Post-Brexit, the UK continues to focus on improving building energy performance, leading to sustained demand for insulation materials.

Leading Segments:

Type: Insulating Glass Units (IGUs)

- Drivers: Growing demand for energy-efficient windows and facades in buildings, advancements in IGU technology for improved thermal and acoustic performance, and the aesthetic appeal offered by modern window designs.

- Dominance Analysis: IGUs are paramount in the market due to their direct integration into building envelopes. Their ability to reduce heat loss/gain and mitigate condensation makes them indispensable for modern architectural designs, particularly in the residential and non-residential construction segments. Manufacturers are continuously innovating to enhance their performance, leading to higher market penetration.

Application: Residential Construction

- Drivers: Increasing homeownership, rising energy costs, government incentives for energy-efficient homes, and growing consumer preference for comfortable and sustainable living environments.

- Dominance Analysis: Residential construction represents a massive and consistently growing application for glass insulation. The need to meet energy efficiency standards and reduce household energy bills makes it a prime market. Both new builds and renovations contribute significantly to the demand for insulation materials like glass wool and IGUs.

Application: Non-Residential Construction

- Drivers: Urbanization, infrastructure development, demand for energy-efficient commercial buildings (offices, retail spaces, hospitals, educational institutions), and corporate sustainability initiatives.

- Dominance Analysis: This segment is characterized by large-scale projects where the long-term cost savings from energy efficiency are a major consideration. The requirement for high-performance insulation to maintain stable internal environments and reduce operational expenses makes glass insulation a crucial component.

Type: Glass Wool

- Drivers: Cost-effectiveness, excellent thermal and acoustic insulation properties, fire resistance, and ease of installation.

- Dominance Analysis: Glass wool remains a workhorse insulation material, widely adopted across residential, non-residential, and industrial applications due to its balanced performance and affordability. Its versatility in various forms (batts, rolls, boards) makes it suitable for a broad range of building structures.

Glass Insulation Market Product Developments

Product innovation in the glass insulation market is primarily focused on enhancing thermal performance, improving sustainability, and expanding application versatility. Manufacturers are developing advanced insulating glass units (IGUs) with enhanced low-E coatings and gas fills to maximize energy savings. Cellular glass insulation is seeing advancements in its mechanical strength and fire resistance, making it suitable for more demanding industrial and infrastructure projects. Glass wool products are being refined for improved moisture resistance and enhanced acoustic dampening capabilities. These developments are driven by market demand for materials that contribute to green building certifications, reduce operational costs, and offer superior comfort and safety in buildings. The competitive edge is increasingly gained through the introduction of products with a lower environmental impact, including those made from recycled glass content and designed for easier end-of-life recycling.

Challenges in the Glass Insulation Market Market

Despite strong growth prospects, the glass insulation market faces several challenges that could impede its full potential.

- Price Volatility of Raw Materials: Fluctuations in the cost of key raw materials, such as sand, soda ash, and limestone, can impact the profitability of manufacturers and influence pricing strategies.

- Competition from Alternative Insulation Materials: While glass insulation offers unique benefits, it faces sustained competition from other insulation types like mineral wool, foam boards (XPS, EPS, PUR/PIR), and natural fiber insulations, which may offer lower initial costs in certain applications.

- Energy-Intensive Manufacturing Processes: The production of glass insulation requires significant energy, which can lead to higher production costs and a larger carbon footprint if not powered by renewable energy sources.

- Perception and Awareness Gaps: In some developing regions, there might be a lack of widespread awareness regarding the long-term economic and environmental benefits of premium glass insulation solutions compared to cheaper, less effective alternatives.

- Installation Complexity and Labor Costs: Certain specialized glass insulation products may require specific installation techniques and trained labor, potentially increasing project timelines and overall construction costs.

Forces Driving Glass Insulation Market Growth

Several powerful forces are propelling the glass insulation market forward.

- Global Push for Energy Efficiency: Increasing mandates from governments worldwide for stricter building energy codes and performance standards are a primary driver. Initiatives like the EU's Energy Performance of Buildings Directive and similar regulations in North America necessitate the use of high-performance insulation.

- Growing Demand for Sustainable Construction: The rise of green building certifications (e.g., LEED, BREEAM) and an increasing consumer preference for environmentally friendly and healthy living spaces are boosting the adoption of recyclable and energy-saving materials.

- Rising Energy Prices: Escalating costs of electricity and fossil fuels make energy efficiency a more attractive investment for building owners, leading to higher demand for effective insulation solutions to reduce operational expenses.

- Technological Advancements: Continuous innovation in the manufacturing of insulating glass units, cellular glass, and glass wool is creating products with improved thermal resistance, durability, and specialized properties, broadening their application scope.

- Urbanization and Infrastructure Development: The ongoing global trend of urbanization fuels new construction projects, particularly in emerging economies, creating significant demand for building materials, including glass insulation.

Challenges in the Glass Insulation Market Market

The glass insulation market is primed for sustained long-term growth, with several catalysts underpinning this expansion. The increasing focus on climate change mitigation and the need to reduce the built environment's carbon footprint are driving significant investments in energy-efficient technologies. This includes a greater emphasis on high-performance insulation materials that can drastically cut down on heating and cooling energy consumption. Furthermore, advancements in material science are enabling the development of lighter, more efficient, and more sustainable glass insulation products. Innovations in manufacturing processes that reduce energy consumption and increase the recycled content of glass insulation will further enhance its appeal. Strategic partnerships and collaborations between glass manufacturers, construction companies, and research institutions are fostering the development and adoption of cutting-edge insulation solutions. Market expansion into developing economies, where energy efficiency is becoming an increasingly important consideration, also presents a substantial long-term growth opportunity. The growing trend towards smart buildings and connected homes also integrates insulation as a key passive component for optimized energy management.

Emerging Opportunities in Glass Insulation Market

Emerging opportunities in the glass insulation market are diverse and represent significant growth potential.

- Renovation and Retrofitting Market: With a large existing building stock worldwide requiring upgrades for energy efficiency, the renovation and retrofitting sector presents a massive untapped opportunity for glass insulation solutions.

- Passive House and Net-Zero Energy Buildings: The growing popularity of extremely energy-efficient building standards like Passive House and the global push for net-zero energy buildings create a strong demand for the highest performing insulation materials available, a niche where advanced glass insulation excels.

- Development of Bio-based and Recycled Glass Insulations: Increasing environmental consciousness is driving innovation towards more sustainable insulation options, including those made from a higher percentage of recycled glass and exploring bio-based binders.

- Growth in Emerging Economies: Rapid urbanization and a growing middle class in Asia-Pacific and Latin America are creating new markets for construction materials, including energy-efficient glass insulation, as these regions increasingly adopt global building standards.

- Smart Building Integration: As smart building technologies evolve, there's an opportunity for glass insulation manufacturers to collaborate and develop integrated solutions that contribute to holistic building energy management systems.

Leading Players in the Glass Insulation Market Sector

- Cardinal Glass Industries

- Guardian Glass LLC

- JE Berkowitz

- Knauf Insulation

- Owens Corning

- PPG Industries Inc

- Saint-Gobain

- Sipla Solutions

- Twiga

- Viracon

Key Milestones in Glass Insulation Market Industry

- 2019: Increased focus on sustainability and recycled content in glass manufacturing, leading to new product lines.

- 2020: Heightened awareness of indoor air quality and thermal comfort due to global events, boosting demand for high-performance IGUs.

- 2021: Significant investment in R&D for advanced coatings on IGUs to further enhance thermal performance.

- 2022: Several companies announce strategic expansions of manufacturing facilities to meet growing global demand for glass wool.

- 2023: Growing regulatory pressure for energy-efficient building materials in emerging economies, opening new market opportunities.

- 2024: Introduction of innovative cellular glass formulations with enhanced fire resistance for specialized industrial applications.

Strategic Outlook for Glass Insulation Market Market

The strategic outlook for the glass insulation market is highly positive, driven by an intensifying global focus on energy efficiency and sustainable construction practices. Manufacturers are strategically investing in research and development to introduce next-generation insulation products with superior performance characteristics and reduced environmental impact. Expansion into burgeoning markets in Asia-Pacific and Latin America represents a key growth accelerator. Furthermore, companies are focusing on optimizing their supply chains and manufacturing processes to enhance cost-competitiveness and meet increasing demand. Strategic alliances and partnerships with construction firms and architects are crucial for driving the adoption of advanced glass insulation solutions in large-scale projects and encouraging their integration into future building designs. The market is expected to witness continued innovation in insulating glass units, cellular glass, and glass wool, catering to diverse application needs across residential, non-residential, and industrial sectors, solidifying its position as a vital component of the modern, sustainable built environment.

Glass Insulation Market Segmentation

-

1. Type

- 1.1. Insulating Glass Units

- 1.2. Cellular Glass

- 1.3. Glass Wool

-

2. Application

- 2.1. Residential Construction

- 2.2. Non-Residential Construction

- 2.3. Industrial

- 2.4. HVAC

- 2.5. Others

Glass Insulation Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Glass Insulation Market Regional Market Share

Geographic Coverage of Glass Insulation Market

Glass Insulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rapidly Growing Construction Activities in the Asia-Pacific Region; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Rapidly Growing Construction Activities in the Asia-Pacific Region; Other Drivers

- 3.4. Market Trends

- 3.4.1. Non-residential Construction Application to Dominate the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glass Insulation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insulating Glass Units

- 5.1.2. Cellular Glass

- 5.1.3. Glass Wool

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential Construction

- 5.2.2. Non-Residential Construction

- 5.2.3. Industrial

- 5.2.4. HVAC

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Glass Insulation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insulating Glass Units

- 6.1.2. Cellular Glass

- 6.1.3. Glass Wool

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential Construction

- 6.2.2. Non-Residential Construction

- 6.2.3. Industrial

- 6.2.4. HVAC

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Glass Insulation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insulating Glass Units

- 7.1.2. Cellular Glass

- 7.1.3. Glass Wool

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential Construction

- 7.2.2. Non-Residential Construction

- 7.2.3. Industrial

- 7.2.4. HVAC

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Glass Insulation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insulating Glass Units

- 8.1.2. Cellular Glass

- 8.1.3. Glass Wool

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential Construction

- 8.2.2. Non-Residential Construction

- 8.2.3. Industrial

- 8.2.4. HVAC

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Glass Insulation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insulating Glass Units

- 9.1.2. Cellular Glass

- 9.1.3. Glass Wool

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential Construction

- 9.2.2. Non-Residential Construction

- 9.2.3. Industrial

- 9.2.4. HVAC

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Glass Insulation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insulating Glass Units

- 10.1.2. Cellular Glass

- 10.1.3. Glass Wool

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential Construction

- 10.2.2. Non-Residential Construction

- 10.2.3. Industrial

- 10.2.4. HVAC

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cardinal Glass Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Guardian Glass LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JE Berkowitz

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Knauf Insulation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PPG Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Saint-Gobain

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sipla Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Twiga

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Viracon*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cardinal Glass Industries

List of Figures

- Figure 1: Global Glass Insulation Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Glass Insulation Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Glass Insulation Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Glass Insulation Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Glass Insulation Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Glass Insulation Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Glass Insulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Glass Insulation Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Glass Insulation Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Glass Insulation Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Glass Insulation Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Glass Insulation Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Glass Insulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Glass Insulation Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Glass Insulation Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Glass Insulation Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Glass Insulation Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Glass Insulation Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Glass Insulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Glass Insulation Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Glass Insulation Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Glass Insulation Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Glass Insulation Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Glass Insulation Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Glass Insulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Glass Insulation Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Glass Insulation Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Glass Insulation Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Glass Insulation Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Glass Insulation Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Glass Insulation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glass Insulation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Glass Insulation Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Glass Insulation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Glass Insulation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Glass Insulation Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Glass Insulation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Glass Insulation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Glass Insulation Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Glass Insulation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Glass Insulation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Glass Insulation Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Glass Insulation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Glass Insulation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Glass Insulation Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Glass Insulation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Glass Insulation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Glass Insulation Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Glass Insulation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Glass Insulation Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Insulation Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Glass Insulation Market?

Key companies in the market include Cardinal Glass Industries, Guardian Glass LLC, JE Berkowitz, Knauf Insulation, Owens Corning, PPG Industries Inc, Saint-Gobain, Sipla Solutions, Twiga, Viracon*List Not Exhaustive.

3. What are the main segments of the Glass Insulation Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rapidly Growing Construction Activities in the Asia-Pacific Region; Other Drivers.

6. What are the notable trends driving market growth?

Non-residential Construction Application to Dominate the Demand.

7. Are there any restraints impacting market growth?

; Rapidly Growing Construction Activities in the Asia-Pacific Region; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glass Insulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glass Insulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glass Insulation Market?

To stay informed about further developments, trends, and reports in the Glass Insulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence