Key Insights

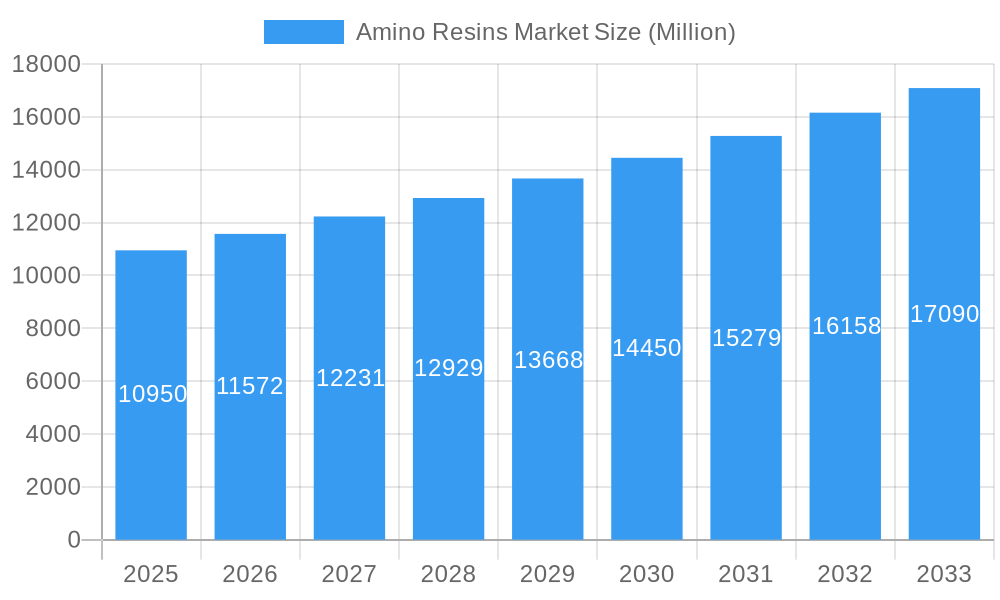

The global Amino Resins market is poised for robust expansion, projected to reach USD 10,950 million in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 5.5% through 2033. This significant growth is propelled by a confluence of strong market drivers, including the escalating demand from the paints and coatings industry, where amino resins are integral for their excellent adhesion, durability, and chemical resistance. The textile sector also contributes substantially, utilizing these resins for finishing treatments to enhance fabric properties like wrinkle resistance and dimensional stability. Furthermore, the adhesives and sealants segment benefits from the versatility and bonding strength offered by amino resins in various construction and manufacturing applications. Emerging applications in engineered wood products and molding compounds are also contributing to the market's upward trajectory.

Amino Resins Market Market Size (In Billion)

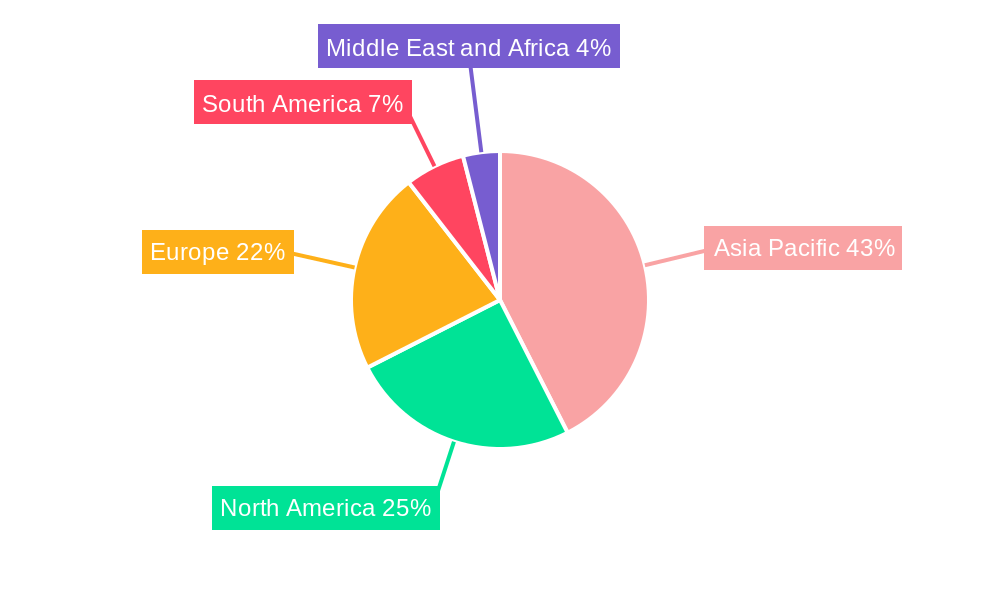

The market's dynamic landscape is further shaped by key trends such as the increasing focus on developing formaldehyde-free or low-formaldehyde emitting amino resins, driven by environmental regulations and consumer preferences for healthier products. Innovations in thermosetting resins, particularly Melamine-Formaldehyde (MF) and Melamine-Urea Formaldehyde (MUF) resins, are enhancing performance characteristics, making them suitable for more demanding applications. The Asia Pacific region, led by China and India, is expected to dominate the market, owing to rapid industrialization, burgeoning construction activities, and a growing manufacturing base. While the market presents substantial opportunities, restraints such as the volatility in raw material prices, particularly for formaldehyde and urea, and stringent environmental regulations concerning formaldehyde emissions, necessitate strategic supply chain management and technological advancements to ensure sustained growth and profitability.

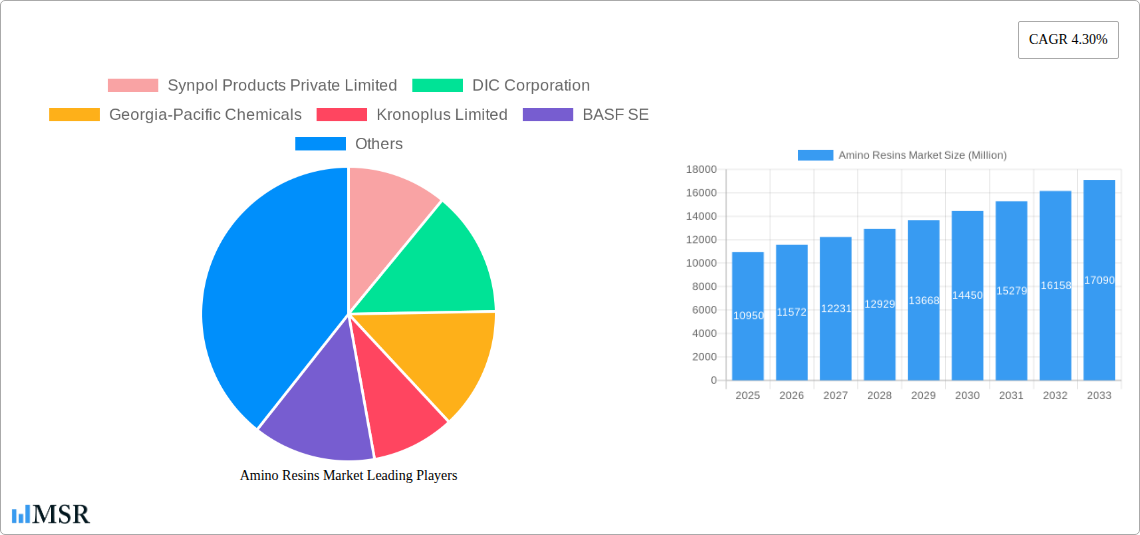

Amino Resins Market Company Market Share

Amino Resins Market: Global Analysis & Forecast (2019-2033)

This comprehensive report delves into the dynamic global amino resins market, providing an in-depth analysis of market size, segmentation, key players, and future trends. Spanning the historical period of 2019-2024, with a base year of 2025 and an extensive forecast period of 2025-2033, this study offers invaluable insights for stakeholders seeking to navigate the evolving landscape of urea-formaldehyde (UF) resins, melamine-formaldehyde (MF) resins, and melamine-urea formaldehyde (MUF) resins. The market's significant role in paints and coatings, textiles, and adhesives and sealants is thoroughly examined, alongside other crucial applications.

Amino Resins Market Market Concentration & Dynamics

The amino resins market exhibits a moderate concentration, with a blend of large multinational corporations and specialized regional players. Innovation is a key differentiator, driven by ongoing research and development in resin chemistry and application technologies. Regulatory frameworks, particularly concerning environmental impact and formaldehyde emissions, play a significant role in shaping product development and market access. The availability and cost-effectiveness of raw materials like urea and formaldehyde are critical determinants of market stability. Substitute products, though present in certain applications, often struggle to match the cost-performance ratio of amino resins. End-user trends, such as the demand for sustainable and high-performance materials, are influencing product formulation and innovation. Mergers and acquisition (M&A) activities, while not as prevalent as in some other chemical sectors, are strategic moves by key players to expand their product portfolios and market reach. For instance, a few significant M&A deals in the past five years have consolidated market share among top players, with an estimated XX M&A deal count in the historical period. Market share for the top 5 players is estimated to be around xx% in the base year of 2025.

Amino Resins Market Industry Insights & Trends

The amino resins market is poised for robust growth, projected to reach an estimated USD 18,500 million by 2033, expanding at a compound annual growth rate (CAGR) of 4.8% during the forecast period of 2025–2033. This growth is underpinned by several critical factors. The escalating demand for high-performance materials in the paints and coatings industry, driven by the construction and automotive sectors, is a primary growth driver. Amino resins, particularly MF and MUF, offer excellent hardness, scratch resistance, and chemical durability, making them indispensable in protective and decorative coatings. The textile industry's continuous need for durable finishes, wrinkle resistance, and colorfastness also fuels demand. Furthermore, the expanding applications in adhesives and sealants, especially for wood-based panels and laminates, contribute significantly to market expansion. Technological advancements, such as the development of low-formaldehyde emission resins and water-based formulations, are addressing environmental concerns and opening new market avenues. Evolving consumer preferences for sustainable and eco-friendly products are also influencing manufacturers to invest in bio-based and renewable raw material alternatives. The global market size for amino resins was estimated at USD 13,200 million in the base year of 2025.

Key Markets & Segments Leading Amino Resins Market

The Asia Pacific region is the dominant force in the amino resins market, propelled by rapid industrialization, robust infrastructure development, and a burgeoning manufacturing base across key economies like China and India. Within this region, China holds the largest market share, fueled by its extensive wood panel production, significant paints and coatings industry, and a substantial textile sector.

Dominant Segments:

Type:

- Urea-Formaldehyde (UF) Resin: This segment commands a substantial market share due to its cost-effectiveness and widespread use in wood adhesives, particleboard, and MDF production. Economic growth and increased construction activity are key drivers for UF resin consumption.

- Melamine-Formaldehyde (MF) Resin: MF resins are pivotal in high-performance applications such as laminates, molding compounds, and surface coatings, offering superior hardness, heat resistance, and durability. Growth in the furniture and automotive industries directly impacts the MF resin market.

- Melamine-Urea Formaldehyde (MUF) Resin: MUF resins offer a balanced performance profile, bridging the gap between UF and MF resins. Their versatility makes them suitable for a range of applications, including engineered wood products and laminates.

End User Industry:

- Paints and Coatings: This industry represents the largest end-use sector for amino resins, driven by the demand for durable, high-gloss, and weather-resistant coatings in construction, automotive, and industrial applications. Economic expansion and infrastructure projects are significant catalysts.

- Textile: Amino resins are critical for imparting properties like wrinkle resistance, shrinkage control, and enhanced dyeability to fabrics. The growing global apparel market and demand for performance textiles contribute to this segment's growth.

- Adhesives and Sealants: The burgeoning wood products industry, including furniture manufacturing and construction, relies heavily on amino resin-based adhesives for bonding wood panels, laminates, and other substrates.

- Other Applications: This segment includes diverse applications such as paper treatment, molding compounds, and agricultural uses, contributing to the overall market demand.

Amino Resins Market Product Developments

Recent product developments in the amino resins market focus on enhancing sustainability and performance. Innovations include the introduction of low-formaldehyde emission resins, addressing stringent environmental regulations and consumer demand for healthier indoor environments. Manufacturers are also exploring bio-based raw materials and water-borne formulations to reduce the environmental footprint of amino resins. Advanced applications in areas like advanced composites and flame-retardant materials are also being developed, pushing the boundaries of resin technology and creating competitive advantages for innovative players.

Challenges in the Amino Resins Market Market

The amino resins market faces several challenges that can impede growth. Stringent environmental regulations regarding formaldehyde emissions and volatile organic compounds (VOCs) necessitate continuous investment in R&D for compliance, increasing production costs. Fluctuations in the prices of key raw materials, such as urea, methanol, and melamine, can impact profitability. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to shortages and price volatility. Intense competition from alternative adhesive and coating technologies also presents a continuous challenge, requiring ongoing innovation to maintain market share. Quantifiable impacts include an estimated xx% increase in production costs due to regulatory compliance in the historical period.

Forces Driving Amino Resins Market Growth

Several forces are propelling the growth of the amino resins market. The robust expansion of the global construction industry, particularly in emerging economies, drives demand for wood-based panels and laminates, which utilize amino resins extensively. The automotive sector's need for durable and aesthetically pleasing coatings further fuels consumption. Advancements in resin technology, leading to improved performance characteristics like enhanced durability, scratch resistance, and heat resistance, are widening the application scope. The increasing focus on sustainability is also creating opportunities for eco-friendly amino resin formulations, such as those with reduced formaldehyde content and bio-based alternatives.

Challenges in the Amino Resins Market Market

Long-term growth catalysts for the amino resins market are intrinsically linked to innovation and market adaptation. The ongoing shift towards circular economy principles presents an opportunity for developing amino resins from recycled feedstocks or designing them for easier recycling. Strategic partnerships and collaborations, such as those focused on developing biomass-balanced amino resins, are crucial for market expansion and demonstrating commitment to sustainability. The exploration of novel applications in advanced materials, including lightweight composites for aerospace and automotive industries, can unlock new high-value markets. Furthermore, continuous efforts to enhance energy efficiency in the production of amino resins will improve cost competitiveness and environmental performance.

Emerging Opportunities in Amino Resins Market

Emerging opportunities in the amino resins market lie in several key areas. The growing demand for sustainable building materials presents a significant opportunity for bio-based and low-emission amino resins in construction applications. The increasing use of amino resins in functional textiles, such as those with antimicrobial or flame-retardant properties, is another promising avenue. Furthermore, advancements in 3D printing technologies could open up new applications for specialized amino resin formulations. The potential for using amino resins in advanced agricultural applications, such as coatings for controlled-release fertilizers, also represents a nascent but growing opportunity.

Leading Players in the Amino Resins Market Sector

- Synpol Products Private Limited

- DIC Corporation

- Georgia-Pacific Chemicals

- Kronoplus Limited

- BASF SE

- Ercros SA

- Eastman Chemical Company

- Hexion

- LRBG Chemicals Inc

- Wanhua Ecoboard Co Ltd

- Dynea AS

- Chemique Adhesives & Sealants Ltd

- Acron

- Uniform Synthetics

- Arclin Inc

Key Milestones in Amino Resins Market Industry

- April 2023: BASF SE announced a collaboration with SWISS KRONO Group to launch a portfolio of amino resins as biomass-balanced to replace fossil-based materials with renewable ones in BASF's raw material mix. This development significantly boosts the market's focus on sustainable sourcing.

- May 2021: BASF Digital Farming and Pessl Instruments signed an agreement to collaborate globally on R&D activities to improve pest management in fruits and vegetables and thus boost production. Amino resin, also known as melamine formaldehyde resin, is a type of synthetic resin that has various applications in agriculture, including as a coating for controlled-release fertilizers. This highlights a growing application in agriculture.

Strategic Outlook for Amino Resins Market Market

The strategic outlook for the amino resins market is one of sustained growth and evolving innovation. Key growth accelerators include the continued demand from core industries like construction and automotive, coupled with an increasing emphasis on sustainable and high-performance materials. Manufacturers will likely focus on developing advanced formulations that meet stringent environmental regulations and offer enhanced functionalities. Strategic partnerships and collaborations will be crucial for driving innovation, expanding market reach, and addressing emerging trends such as the circular economy. The market is expected to witness a gradual shift towards higher-value, specialized amino resin applications, offering lucrative opportunities for players adept at technological advancement and market adaptation.

Amino Resins Market Segmentation

-

1. Type

- 1.1. Urea-Formaldehyde (UF)

- 1.2. Melamine-Formaldehyde (MF)

- 1.3. Melamine-Urea Formaldehyde (MUF)

-

2. End User Industry

- 2.1. Paints and Coatings

- 2.2. Textile

- 2.3. Adhesives and Sealants

- 2.4. Other Applications

Amino Resins Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Amino Resins Market Regional Market Share

Geographic Coverage of Amino Resins Market

Amino Resins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Paints and Coatings Industries; Increasing Demand for Amino Resins in the Production of Adhesives for Particleboard and Hardwood Plywood; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Hazardous Air Pollutants Produced During the Manufacture of Amino Resin; Increasing Demand for Bio-based Resin Systems

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Adhesives and Sealants Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amino Resins Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Urea-Formaldehyde (UF)

- 5.1.2. Melamine-Formaldehyde (MF)

- 5.1.3. Melamine-Urea Formaldehyde (MUF)

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Paints and Coatings

- 5.2.2. Textile

- 5.2.3. Adhesives and Sealants

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Amino Resins Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Urea-Formaldehyde (UF)

- 6.1.2. Melamine-Formaldehyde (MF)

- 6.1.3. Melamine-Urea Formaldehyde (MUF)

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Paints and Coatings

- 6.2.2. Textile

- 6.2.3. Adhesives and Sealants

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Amino Resins Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Urea-Formaldehyde (UF)

- 7.1.2. Melamine-Formaldehyde (MF)

- 7.1.3. Melamine-Urea Formaldehyde (MUF)

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Paints and Coatings

- 7.2.2. Textile

- 7.2.3. Adhesives and Sealants

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Amino Resins Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Urea-Formaldehyde (UF)

- 8.1.2. Melamine-Formaldehyde (MF)

- 8.1.3. Melamine-Urea Formaldehyde (MUF)

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Paints and Coatings

- 8.2.2. Textile

- 8.2.3. Adhesives and Sealants

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Amino Resins Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Urea-Formaldehyde (UF)

- 9.1.2. Melamine-Formaldehyde (MF)

- 9.1.3. Melamine-Urea Formaldehyde (MUF)

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Paints and Coatings

- 9.2.2. Textile

- 9.2.3. Adhesives and Sealants

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Amino Resins Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Urea-Formaldehyde (UF)

- 10.1.2. Melamine-Formaldehyde (MF)

- 10.1.3. Melamine-Urea Formaldehyde (MUF)

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Paints and Coatings

- 10.2.2. Textile

- 10.2.3. Adhesives and Sealants

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Synpol Products Private Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DIC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Georgia-Pacific Chemicals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kronoplus Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ercros SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eastman Chemical Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexion

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LRBG Chemicals Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wanhua Ecoboard Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dynea AS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chemique Adhesives & Sealants Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Acron

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Uniform Synthetics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Arclin Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Synpol Products Private Limited

List of Figures

- Figure 1: Global Amino Resins Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Amino Resins Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Amino Resins Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Amino Resins Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 5: Asia Pacific Amino Resins Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: Asia Pacific Amino Resins Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Amino Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Amino Resins Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Amino Resins Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Amino Resins Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 11: North America Amino Resins Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: North America Amino Resins Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Amino Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Amino Resins Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Amino Resins Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Amino Resins Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 17: Europe Amino Resins Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 18: Europe Amino Resins Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Amino Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Amino Resins Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Amino Resins Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Amino Resins Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 23: South America Amino Resins Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 24: South America Amino Resins Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Amino Resins Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Amino Resins Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Amino Resins Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Amino Resins Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 29: Middle East and Africa Amino Resins Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 30: Middle East and Africa Amino Resins Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Amino Resins Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Amino Resins Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Amino Resins Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 3: Global Amino Resins Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Amino Resins Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Amino Resins Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 6: Global Amino Resins Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Amino Resins Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Amino Resins Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 14: Global Amino Resins Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Amino Resins Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Amino Resins Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 20: Global Amino Resins Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Amino Resins Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Amino Resins Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 28: Global Amino Resins Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Amino Resins Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Amino Resins Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 34: Global Amino Resins Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Amino Resins Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amino Resins Market?

The projected CAGR is approximately 11.34%.

2. Which companies are prominent players in the Amino Resins Market?

Key companies in the market include Synpol Products Private Limited, DIC Corporation, Georgia-Pacific Chemicals, Kronoplus Limited, BASF SE, Ercros SA, Eastman Chemical Company, Hexion, LRBG Chemicals Inc, Wanhua Ecoboard Co Ltd*List Not Exhaustive, Dynea AS, Chemique Adhesives & Sealants Ltd, Acron, Uniform Synthetics, Arclin Inc.

3. What are the main segments of the Amino Resins Market?

The market segments include Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Paints and Coatings Industries; Increasing Demand for Amino Resins in the Production of Adhesives for Particleboard and Hardwood Plywood; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Adhesives and Sealants Industry.

7. Are there any restraints impacting market growth?

Hazardous Air Pollutants Produced During the Manufacture of Amino Resin; Increasing Demand for Bio-based Resin Systems.

8. Can you provide examples of recent developments in the market?

April 2023: BASF SE announced a collaboration with SWISS KRONO Group to launch a portfolio of amino resins as biomass-balanced to replace fossil-based materials with renewable ones in BASF's raw material mix.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amino Resins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amino Resins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amino Resins Market?

To stay informed about further developments, trends, and reports in the Amino Resins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence