Key Insights

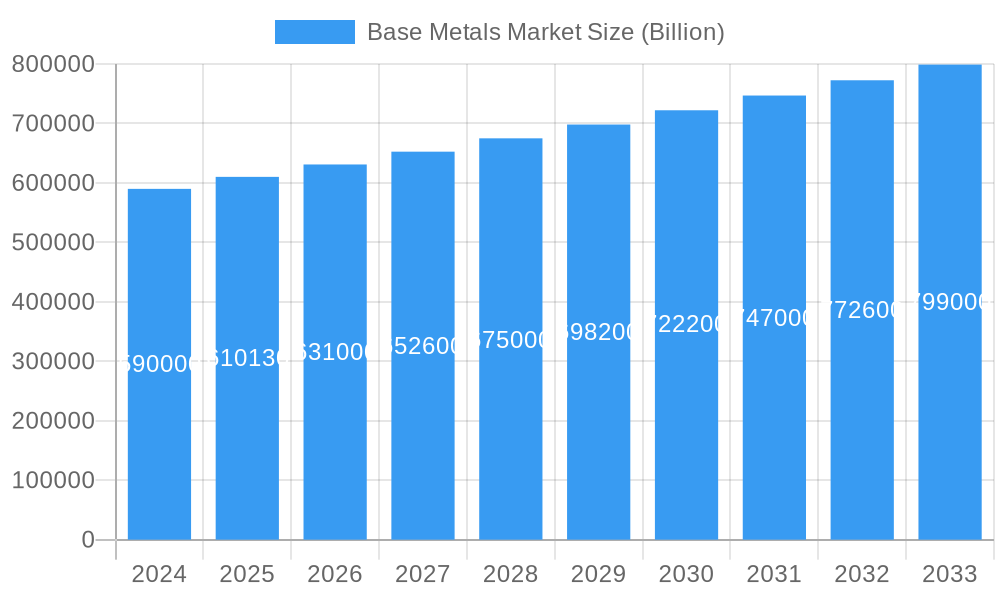

The global Base Metals Market is experiencing robust growth, projected to reach USD 610.13 Billion by 2025, with a compound annual growth rate (CAGR) of 3.72% during the forecast period of 2025-2033. This expansion is fueled by the indispensable role of base metals such as copper, zinc, lead, nickel, aluminum, and tin in a wide array of burgeoning industries. The construction sector, driven by rapid urbanization and infrastructure development across Asia Pacific and developing economies, continues to be a primary consumer. Simultaneously, the automotive industry's transition towards electric vehicles (EVs) is significantly boosting demand for copper and aluminum for batteries and lightweight components. The burgeoning electrical and electronics sector, propelled by the proliferation of smart devices and advanced technologies, further solidifies the market's upward trajectory.

Base Metals Market Market Size (In Billion)

Emerging trends such as increased investment in renewable energy infrastructure, including wind turbines and solar panels, which are heavily reliant on copper and aluminum, are expected to provide sustained impetus to market growth. Furthermore, advancements in recycling technologies and a growing emphasis on sustainable sourcing are shaping the competitive landscape. However, the market faces certain challenges. Price volatility of key base metals, influenced by global supply-demand dynamics and geopolitical factors, can impact profitability and investment decisions. Stringent environmental regulations and the high energy costs associated with mining and processing can also act as restraints. Despite these hurdles, the persistent demand from critical end-user industries and the ongoing technological innovations are poised to ensure a dynamic and expanding Base Metals Market in the coming years.

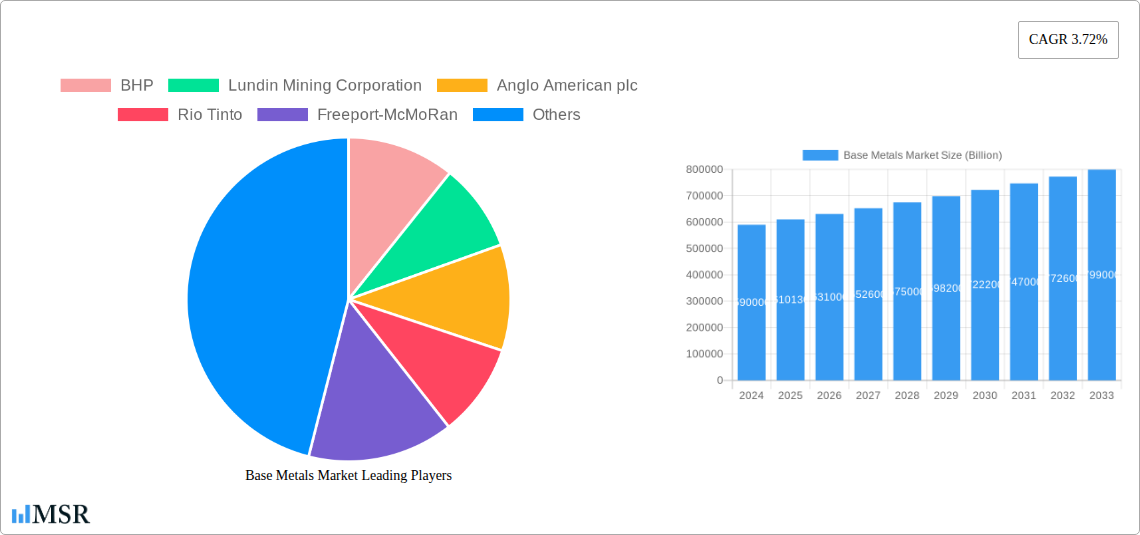

Base Metals Market Company Market Share

Base Metals Market Report: Unlocking Opportunities in a Transforming Global Industry (2019–2033)

This comprehensive Base Metals Market report delivers critical insights into the dynamic global landscape of copper, zinc, lead, nickel, aluminum, and tin. Analyzing from 2019–2024 (historical) through 2025 (base/estimated) to 2033 (forecast), this in-depth study empowers mining companies, industrial manufacturers, investors, and policymakers with actionable intelligence. Discover key growth drivers, emerging opportunities, and strategic imperatives for navigating market shifts across vital end-user industries like construction, automotive and transportation, electrical and electronics, consumer products, and medical devices. With an estimated market size of XX Billion and a CAGR of XX% during the forecast period, this report is your definitive guide to maximizing returns in the essential base metals sector.

Base Metals Market Market Concentration & Dynamics

The global base metals market exhibits a moderately concentrated landscape, with several dominant players such as BHP, Rio Tinto, Glencore, Vale, and Freeport-McMoRan holding significant market share. These mining giants leverage extensive geological reserves, advanced extraction technologies, and integrated supply chains. The innovation ecosystem is primarily driven by advancements in mining efficiency, sustainable extraction practices, and material science, aimed at enhancing the properties and applications of base metals. Regulatory frameworks are increasingly focused on environmental stewardship, ethical sourcing, and trade policies, influencing operational strategies and market access. Substitute products, while present in certain niche applications, generally struggle to match the cost-effectiveness and performance of primary base metals for large-scale industrial use. End-user trends reveal a growing demand for lightweight materials in automotive and transportation, advanced conductivity in electrical and electronics, and durable solutions in construction, all heavily reliant on base metals. Mergers and acquisitions (M&A) activity remains a key dynamic, with companies strategically acquiring assets to consolidate market position, secure supply chains, and gain access to new technologies. For instance, recent M&A deals have targeted ESG-compliant operations and exploration assets in high-demand regions, reflecting a strategic shift towards sustainability and future resource security. The market share of key players fluctuates based on production volumes, commodity prices, and geopolitical influences. M&A deal counts have seen a steady increase as companies seek to optimize portfolios and expand their global footprint.

Base Metals Market Industry Insights & Trends

The base metals market is undergoing a profound transformation, driven by a confluence of technological advancements, evolving economic landscapes, and shifting consumer preferences. The estimated market size of XX Billion in the 2025 base year is projected to witness robust growth, fueled by a Compound Annual Growth Rate (CAGR) of XX% throughout the 2025–2033 forecast period. A primary growth driver is the global energy transition, which is spurring unprecedented demand for copper in electric vehicles (EVs), renewable energy infrastructure (solar panels, wind turbines), and grid modernization. Nickel is also experiencing surging demand for high-performance EV battery cathodes, while aluminum's lightweight properties are critical for improving fuel efficiency and range in the automotive sector. Furthermore, the rapid expansion of electrical and electronics industries, particularly in emerging economies, necessitates significant volumes of copper, zinc, and tin for wiring, components, and solder. The construction industry, a perennial major consumer, continues to drive demand for copper, aluminum, and zinc in building materials, plumbing, and electrical systems, especially with ongoing urbanization and infrastructure development projects worldwide. Technological disruptions are manifesting in several key areas. Advanced exploration techniques, including AI-powered geological analysis and drone-based surveying, are enhancing resource discovery and reducing exploration costs. In mining operations, automation and robotics are improving safety, efficiency, and sustainability, leading to optimized extraction and processing. Innovations in recycling technologies are also becoming increasingly crucial, reducing reliance on virgin materials and contributing to a circular economy, thereby mitigating environmental impact and ensuring long-term resource availability. Evolving consumer behaviors are indirectly influencing the base metals market. A growing emphasis on sustainability and ethical sourcing is pushing companies to adopt transparent supply chains and invest in environmentally responsible mining practices. The demand for smart devices and advanced consumer products further amplifies the need for high-quality, reliably sourced base metals. The economic recovery post-pandemic, coupled with significant government investments in infrastructure and green technologies, is providing a strong tailwind for the entire base metals value chain. The strategic importance of these metals in underpinning modern economies and facilitating technological progress positions the base metals market for sustained and significant expansion.

Key Markets & Segments Leading Base Metals Market

The global base metals market is characterized by the dominance of specific regions and segments, each contributing uniquely to its overall growth trajectory. Copper stands out as a leading segment within the Type classification, driven by its indispensable role in the electrical and electronics and automotive and transportation industries. The surge in electric vehicle adoption and the expansion of renewable energy infrastructure are creating sustained, high demand for copper wiring, components, and energy transmission systems. In the End-user Industry landscape, construction consistently represents a significant market driver. Robust infrastructure development projects across both developed and developing economies, coupled with ongoing urbanization, fuel demand for copper, aluminum, and zinc in building materials, piping, and electrical systems.

Dominant Segments & Drivers:

- Copper: Driven by the exponential growth of the electric vehicle market, renewable energy infrastructure (solar, wind), and the continuous demand from the electrical and electronics sector for its superior conductivity.

- Aluminum: Its lightweight properties make it crucial for the automotive and transportation sector to improve fuel efficiency and increase EV range. It is also vital in packaging and the construction industry for its durability and corrosion resistance.

- Zinc: Essential for galvanizing steel in the construction industry to prevent corrosion, and also used in die-casting for automotive components and in batteries.

- Nickel: A critical component in stainless steel production and increasingly in high-performance batteries for EVs.

- Lead: Continues to be significant for traditional automotive batteries, although its use is gradually shifting towards specialized applications and recycling.

- Tin: Primarily used in solder for the electrical and electronics industry and for tin plating in food packaging.

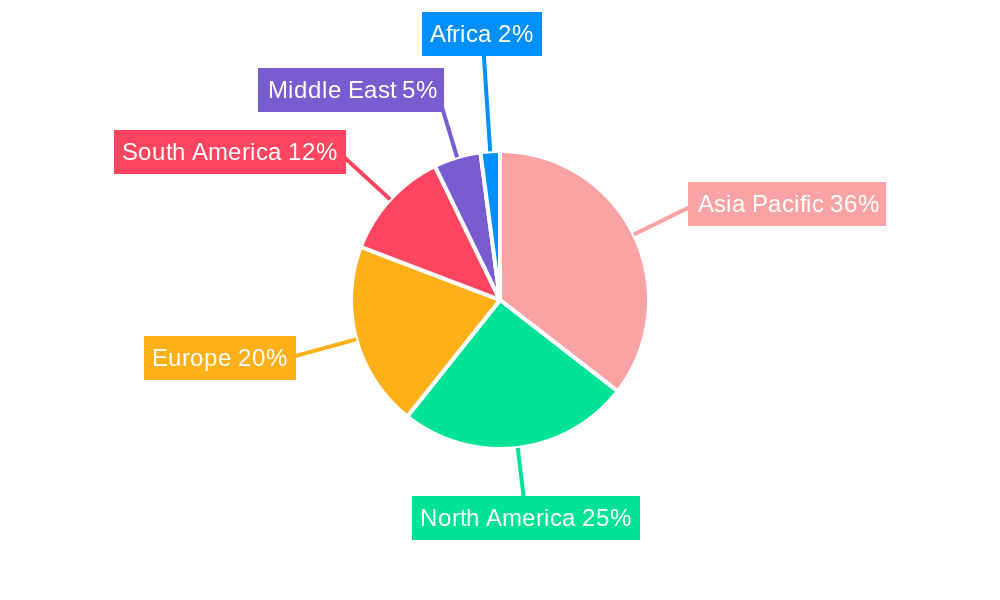

Geographic Dominance: Asia-Pacific, particularly China, remains the largest consumer and producer of base metals, owing to its vast manufacturing base, extensive infrastructure development, and rapidly growing automotive and electronics sectors. North America and Europe are significant markets driven by technological innovation, the push for green energy, and the automotive industry's transition to EVs.

End-User Industry Dominance:

- Construction: Underpins demand for a wide array of base metals due to infrastructure projects, residential and commercial building, and renovation activities.

- Automotive and Transportation: Experiencing rapid growth driven by lightweighting initiatives, EV adoption, and the expansion of public transportation systems.

- Electrical and Electronics: A consistent and growing demand for copper and tin due to the proliferation of consumer electronics, telecommunications, and advanced computing.

The interplay of these dominant segments and end-user industries, supported by strategic regional consumption and production patterns, defines the leading edge of the base metals market.

Base Metals Market Product Developments

Product developments in the base metals market are increasingly focused on enhancing sustainability, improving performance, and expanding applications. Innovations in advanced alloys are yielding lighter, stronger, and more corrosion-resistant materials, particularly for the automotive and aerospace sectors. The development of high-purity metals is crucial for the semiconductor and advanced electronics industries. Furthermore, there's a significant push towards circular economy solutions, with advancements in recycling technologies enabling higher recovery rates and purity of recycled base metals like aluminum and copper. These developments enhance the environmental profile of base metals and ensure their continued relevance in a resource-constrained world, providing a competitive edge for companies investing in R&D.

Challenges in the Base Metals Market Market

The base metals market faces several significant challenges that can impact growth and profitability. Volatility in commodity prices remains a perennial concern, directly affecting revenue streams and investment decisions. Supply chain disruptions, exacerbated by geopolitical tensions, logistical bottlenecks, and natural disasters, can lead to production delays and increased costs. Increasingly stringent environmental regulations and the push for sustainable mining practices necessitate substantial capital investment in new technologies and operational changes, potentially increasing operational expenditures. Labor shortages in skilled mining professions and the increasing cost of labor further add to operational complexities. Competition from substitute materials in specific applications, while not universally threatening, can erode market share in certain sectors. The geopolitical landscape also presents risks, with resource nationalism and trade disputes impacting market access and investment security.

Forces Driving Base Metals Market Growth

Several powerful forces are propelling the growth of the base metals market. The global energy transition is a monumental driver, fueling demand for copper in EVs and renewable energy infrastructure and nickel for advanced battery technologies. The ongoing urbanization and infrastructure development worldwide require substantial quantities of copper, aluminum, and zinc for construction and transportation projects. The relentless expansion of the electrical and electronics industries, driven by digitalization and consumer demand for advanced devices, ensures sustained demand for conductive and solder materials. Technological advancements in mining and processing, including automation and AI, are improving efficiency and reducing costs, making production more viable. Furthermore, the growing emphasis on sustainability and circular economy principles is driving innovation in recycling and responsible sourcing, creating new market opportunities and enhancing the long-term viability of base metals.

Challenges in the Base Metals Market Market

Long-term growth catalysts for the base metals market are deeply intertwined with global megatrends. The ongoing digital transformation and the proliferation of smart devices continue to drive demand for critical metals like copper and tin in electronics. The commitment to decarbonization and sustainable development globally is creating a sustained need for materials essential to green technologies, such as copper and nickel. Advancements in material science are enabling the development of novel alloys and composites incorporating base metals, expanding their utility in high-performance applications. Strategic partnerships and collaborations between mining companies, technology providers, and end-user industries are fostering innovation and streamlining the adoption of new technologies. Moreover, the exploration and development of new mining frontiers and the application of advanced geological survey techniques are crucial for securing future supply and meeting escalating demand.

Emerging Opportunities in Base Metals Market

Emerging opportunities in the base metals market are abundant and diverse, driven by innovation and evolving global needs. The burgeoning hydrogen economy presents a significant opportunity for metals used in electrolyzers and fuel cells. Advancements in 3D printing (additive manufacturing) are creating new avenues for custom-designed components utilizing various base metals, particularly aluminum and copper alloys. The increasing focus on urban mining and recycling technologies is unlocking substantial value from existing waste streams, offering a sustainable and cost-effective source of metals. Growth in the medical device sector, with its demand for biocompatible and durable materials, presents niche but valuable opportunities for specific base metals. Furthermore, the development of smart infrastructure, incorporating sensor networks and advanced materials, will require a consistent supply of conductive and structural metals. The trend towards localization of supply chains for critical minerals also creates opportunities for regions with significant untapped reserves and processing capabilities.

Leading Players in the Base Metals Market Sector

- BHP

- Lundin Mining Corporation

- Anglo American plc

- Rio Tinto

- Freeport-McMoRan

- Glencore

- Jiangxi Copper Corporation

- Vale

- Vedanta Resources Limited

- Alcoa Corporation

Key Milestones in Base Metals Market Industry

- 2019: Launch of advanced AI-driven exploration programs by major mining companies.

- 2020: Significant increase in investment in nickel mining due to rising EV battery demand.

- 2021: Major advancements in copper recycling efficiency reported by leading metal refiners.

- 2022: Several large-scale infrastructure projects announced globally, boosting demand for construction metals.

- 2023: Increased focus on ESG compliance and transparent supply chains across the industry.

- 2024: Significant breakthroughs reported in the development of next-generation aluminum alloys for automotive applications.

- 2025 (Est.): Projected acceleration in demand for base metals driven by global green energy initiatives and infrastructure spending.

- 2026–2033 (Forecast): Continued robust growth anticipated with sustained demand from EVs, renewable energy, and advanced electronics.

Strategic Outlook for Base Metals Market Market

The strategic outlook for the base metals market is exceptionally positive, underpinned by long-term demand drivers and technological advancements. Key growth accelerators include the continued expansion of the electric vehicle market, requiring massive quantities of copper and nickel, and the global push for renewable energy infrastructure, which significantly boosts copper and aluminum demand. Investments in smart grid modernization and the digitalization of economies will also sustain demand for electrical and electronic components. Strategic opportunities lie in the development and adoption of advanced recycling technologies to promote a circular economy, reducing reliance on virgin resources and mitigating environmental impact. Furthermore, companies that prioritize sustainable mining practices, ethical sourcing, and robust ESG frameworks will be best positioned to attract investment and secure market share in the evolving global landscape. The focus on material innovation, particularly in developing high-performance alloys and lightweighting solutions for transportation and construction, will unlock new applications and value.

Base Metals Market Segmentation

-

1. Type

- 1.1. Copper

- 1.2. Zinc

- 1.3. Lead

- 1.4. Nickel

- 1.5. Aluminum

- 1.6. Tin

-

2. End-user Industry

- 2.1. Construction

- 2.2. Automotive and Transportation

- 2.3. Electrical and Electronics

- 2.4. Consumer Products

- 2.5. Medical Devices

- 2.6. Other End-user Industries

Base Metals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. Qatar

- 6.2. United Arab Emirates

- 6.3. Nigeria

- 6.4. Egypt

- 6.5. South Africa

- 6.6. Rest of Middle East

Base Metals Market Regional Market Share

Geographic Coverage of Base Metals Market

Base Metals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Industry; High Demand for Lightweight Vehicles; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Emission of Greenhouse Gases; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Copper

- 5.1.2. Zinc

- 5.1.3. Lead

- 5.1.4. Nickel

- 5.1.5. Aluminum

- 5.1.6. Tin

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Automotive and Transportation

- 5.2.3. Electrical and Electronics

- 5.2.4. Consumer Products

- 5.2.5. Medical Devices

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Copper

- 6.1.2. Zinc

- 6.1.3. Lead

- 6.1.4. Nickel

- 6.1.5. Aluminum

- 6.1.6. Tin

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Automotive and Transportation

- 6.2.3. Electrical and Electronics

- 6.2.4. Consumer Products

- 6.2.5. Medical Devices

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Copper

- 7.1.2. Zinc

- 7.1.3. Lead

- 7.1.4. Nickel

- 7.1.5. Aluminum

- 7.1.6. Tin

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Automotive and Transportation

- 7.2.3. Electrical and Electronics

- 7.2.4. Consumer Products

- 7.2.5. Medical Devices

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Copper

- 8.1.2. Zinc

- 8.1.3. Lead

- 8.1.4. Nickel

- 8.1.5. Aluminum

- 8.1.6. Tin

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Automotive and Transportation

- 8.2.3. Electrical and Electronics

- 8.2.4. Consumer Products

- 8.2.5. Medical Devices

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Copper

- 9.1.2. Zinc

- 9.1.3. Lead

- 9.1.4. Nickel

- 9.1.5. Aluminum

- 9.1.6. Tin

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Automotive and Transportation

- 9.2.3. Electrical and Electronics

- 9.2.4. Consumer Products

- 9.2.5. Medical Devices

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Copper

- 10.1.2. Zinc

- 10.1.3. Lead

- 10.1.4. Nickel

- 10.1.5. Aluminum

- 10.1.6. Tin

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Automotive and Transportation

- 10.2.3. Electrical and Electronics

- 10.2.4. Consumer Products

- 10.2.5. Medical Devices

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Base Metals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Copper

- 11.1.2. Zinc

- 11.1.3. Lead

- 11.1.4. Nickel

- 11.1.5. Aluminum

- 11.1.6. Tin

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Construction

- 11.2.2. Automotive and Transportation

- 11.2.3. Electrical and Electronics

- 11.2.4. Consumer Products

- 11.2.5. Medical Devices

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BHP

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lundin Mining Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Anglo American plc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Rio Tinto

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Freeport-McMoRan

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Glencore

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Jiangxi Copper Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vale

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Vedanta Resources Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Alcoa Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 BHP

List of Figures

- Figure 1: Global Base Metals Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global Base Metals Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Base Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Base Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Base Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Base Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Base Metals Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Base Metals Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Base Metals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Base Metals Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Base Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 12: Asia Pacific Base Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Base Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Base Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Base Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 16: North America Base Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Base Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Base Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Base Metals Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 20: North America Base Metals Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: North America Base Metals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Base Metals Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Base Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 24: North America Base Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Base Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Base Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Base Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 28: Europe Base Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Base Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Base Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Base Metals Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 32: Europe Base Metals Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe Base Metals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Base Metals Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Base Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 36: Europe Base Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Base Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Base Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Base Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 40: South America Base Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Base Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Base Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Base Metals Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 44: South America Base Metals Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: South America Base Metals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South America Base Metals Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South America Base Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 48: South America Base Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Base Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Base Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Base Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 52: Middle East Base Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East Base Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East Base Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East Base Metals Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 56: Middle East Base Metals Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 57: Middle East Base Metals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East Base Metals Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East Base Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 60: Middle East Base Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East Base Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Base Metals Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Saudi Arabia Base Metals Market Revenue (Billion), by Type 2025 & 2033

- Figure 64: Saudi Arabia Base Metals Market Volume (K Tons), by Type 2025 & 2033

- Figure 65: Saudi Arabia Base Metals Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Saudi Arabia Base Metals Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Saudi Arabia Base Metals Market Revenue (Billion), by End-user Industry 2025 & 2033

- Figure 68: Saudi Arabia Base Metals Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 69: Saudi Arabia Base Metals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Saudi Arabia Base Metals Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Saudi Arabia Base Metals Market Revenue (Billion), by Country 2025 & 2033

- Figure 72: Saudi Arabia Base Metals Market Volume (K Tons), by Country 2025 & 2033

- Figure 73: Saudi Arabia Base Metals Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Saudi Arabia Base Metals Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 2: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Base Metals Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global Base Metals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 8: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Base Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 12: Global Base Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: China Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: India Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Malaysia Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Thailand Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: Thailand Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Vietnam Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 32: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 33: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Base Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 36: Global Base Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: United States Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 38: United States Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Canada Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 40: Canada Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Mexico Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 42: Mexico Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 44: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 45: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Base Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 48: Global Base Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Germany Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: France Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 54: France Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Italy Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 56: Italy Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Spain Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 58: Spain Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: NORDIC Countries Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 60: NORDIC Countries Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Turkey Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Russia Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 64: Russia Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Rest of Europe Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 68: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 69: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 70: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 71: Global Base Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 72: Global Base Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 73: Brazil Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Argentina Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 77: Colombia Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 78: Colombia Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 81: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 82: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 83: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 84: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 85: Global Base Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 86: Global Base Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 87: Global Base Metals Market Revenue Billion Forecast, by Type 2020 & 2033

- Table 88: Global Base Metals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 89: Global Base Metals Market Revenue Billion Forecast, by End-user Industry 2020 & 2033

- Table 90: Global Base Metals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 91: Global Base Metals Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 92: Global Base Metals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 93: Qatar Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 94: Qatar Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 95: United Arab Emirates Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 96: United Arab Emirates Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 97: Nigeria Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 98: Nigeria Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 99: Egypt Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 100: Egypt Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 101: South Africa Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 102: South Africa Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 103: Rest of Middle East Base Metals Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Middle East Base Metals Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Base Metals Market?

The projected CAGR is approximately 3.72%.

2. Which companies are prominent players in the Base Metals Market?

Key companies in the market include BHP, Lundin Mining Corporation, Anglo American plc, Rio Tinto, Freeport-McMoRan, Glencore, Jiangxi Copper Corporation, Vale, Vedanta Resources Limited, Alcoa Corporation.

3. What are the main segments of the Base Metals Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 610.13 Billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Industry; High Demand for Lightweight Vehicles; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

Increasing Emission of Greenhouse Gases; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Base Metals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Base Metals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Base Metals Market?

To stay informed about further developments, trends, and reports in the Base Metals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence