Key Insights

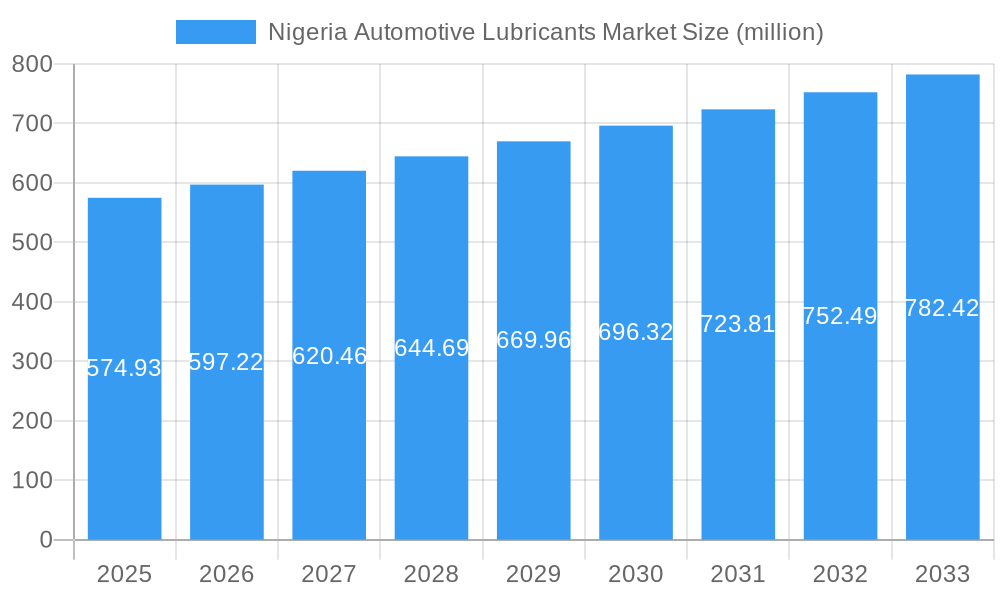

The Nigerian automotive lubricants market is poised for steady expansion, projected to reach USD 574.93 million in 2025, with a compound annual growth rate (CAGR) of 3.89% anticipated over the forecast period of 2025-2033. This growth is primarily driven by an increasing fleet of vehicles, including commercial vehicles, passenger cars, and motorcycles, necessitating regular maintenance and fluid replacement. The burgeoning logistics and transportation sector, coupled with a rising middle class fueling demand for personal vehicles, are significant contributors to this upward trajectory. Furthermore, the increasing adoption of advanced engine technologies in both new and existing vehicles often requires specialized, high-performance lubricants, creating opportunities for market players offering premium products. The market is also influenced by government initiatives aimed at improving road infrastructure and promoting domestic automotive manufacturing, which, in turn, boosts the demand for automotive lubricants.

Nigeria Automotive Lubricants Market Market Size (In Million)

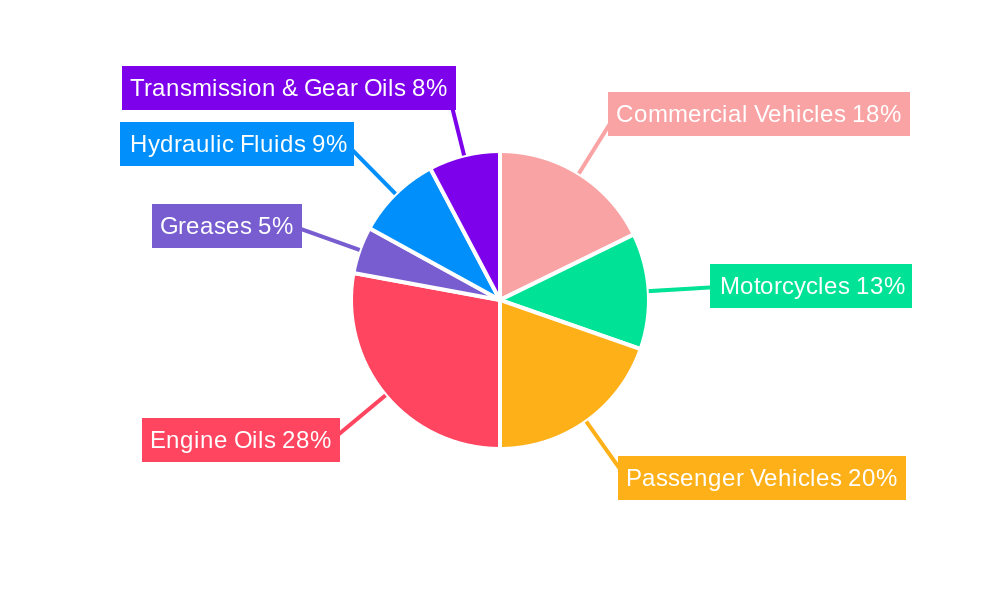

The market segmentation reveals diverse opportunities across different product types, with Engine Oils expected to dominate due to their essential role in vehicle operation. However, the growing demand for Hydraulic Fluids in commercial and construction equipment, and Transmission & Gear Oils for smoother gear shifts and improved fuel efficiency, also presents substantial growth avenues. While the market is largely driven by the need for essential automotive maintenance, several factors are expected to influence its trajectory. Increased adoption of electric vehicles, though currently nascent in Nigeria, could pose a long-term restraint on the demand for traditional engine oils. However, the substantial existing internal combustion engine (ICE) vehicle fleet ensures continued demand for lubricants for the foreseeable future. Regulatory frameworks concerning lubricant quality and environmental impact will also shape product development and market strategies, pushing towards more sustainable and efficient lubrication solutions.

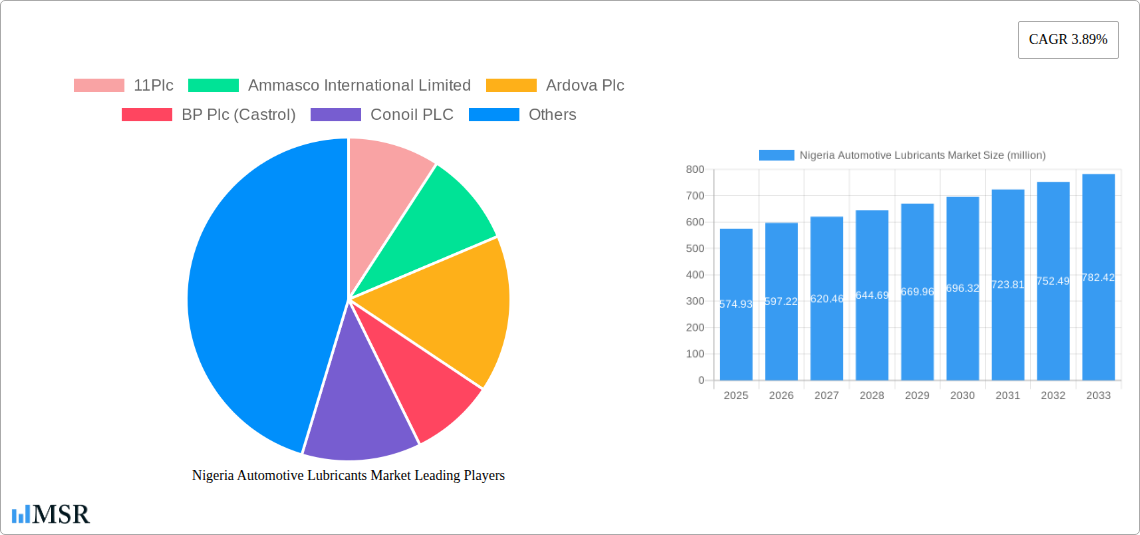

Nigeria Automotive Lubricants Market Company Market Share

Dive deep into the dynamic Nigeria automotive lubricants market with this comprehensive report. Explore critical market dynamics, industry trends, and growth drivers that are reshaping the Nigerian automotive landscape. This analysis covers the period from 2019 to 2033, with a detailed focus on the base year 2025 and the forecast period 2025–2033. Gain actionable intelligence on vehicle type segments like commercial vehicles, motorcycles, and passenger vehicles, alongside product type breakdowns including engine oils, greases, hydraulic fluids, and transmission & gear oils. Discover key company strategies, product developments, and emerging opportunities within this rapidly evolving sector.

Nigeria Automotive Lubricants Market Market Concentration & Dynamics

The Nigeria automotive lubricants market is characterized by moderate to high concentration, with leading players vying for significant market share. In 2025, the market size is estimated to be in the range of 350 to 400 million USD. Major companies like 11Plc, Ammasco International Limited, Ardova Plc, BP Plc (Castrol), Conoil PLC, Eterna Plc, MRS OIL NIGERIA PLC, Oando PLC, Royal Dutch Shell Plc, and TotalEnergie hold substantial positions, contributing to a competitive yet consolidated environment. Innovation ecosystems are growing, driven by the need for higher performance lubricants and solutions for evolving vehicle technologies. Regulatory frameworks are in place, though adherence and enforcement can present challenges. The presence of substitute products, such as alternative fuels or longer-drain interval oils, influences market dynamics. End-user trends are increasingly leaning towards premium, high-performance lubricants that offer extended engine life and improved fuel efficiency. Mergers and acquisitions (M&A) are key strategic moves; for instance, the November 2021 acquisition of Enyo Retail & Supply Limited by Ardova Plc, which added 95 retail stations to Ardova's network, highlights consolidation efforts and expands market reach. The market anticipates approximately 2-3 significant M&A deals within the forecast period.

Nigeria Automotive Lubricants Market Industry Insights & Trends

The Nigeria automotive lubricants market is poised for robust growth, driven by several compelling factors throughout the study period 2019–2033. The market size in 2025 is projected to be between 350 and 400 million USD, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 5.5% to 7.0% during the forecast period 2025–2033. A primary growth driver is the expanding automotive fleet in Nigeria, fueled by a growing population, increasing urbanization, and a rising middle class. The commercial vehicle segment, in particular, is a significant contributor due to its crucial role in logistics and transportation, necessitating regular maintenance and lubricant replacement. Technological advancements in engine design, leading to higher operating temperatures and pressures, are driving demand for advanced, high-performance engine oils and transmission & gear oils. The aftermarket segment remains a cornerstone, with a steady demand for lubricants from independent workshops and retail outlets. Furthermore, increased consumer awareness regarding vehicle maintenance and the benefits of using quality lubricants for longevity and optimal performance is a key trend. The push towards more environmentally friendly and fuel-efficient lubricants is also gaining traction, although the adoption rate might be slower compared to developed markets. The historical period 2019–2024 has laid the groundwork for this expansion, witnessing consistent demand despite economic fluctuations. The estimated year 2025 serves as a pivotal point for forecasting future trajectories, highlighting the market's resilience and potential.

Key Markets & Segments Leading Nigeria Automotive Lubricants Market

The Nigeria automotive lubricants market is dominated by several key segments that are expected to drive significant growth.

Vehicle Type Dominance:

- Commercial Vehicles: This segment is a leading force in the Nigerian automotive lubricants market. The increasing demand for goods transportation, driven by a growing population and expanding economy, necessitates a large fleet of trucks, buses, and other commercial vehicles. These vehicles typically operate under heavy loads and demanding conditions, requiring robust and high-performance engine oils and transmission & gear oils for optimal operation and longevity. Economic growth and infrastructure development projects further boost the need for commercial transport, directly impacting lubricant consumption.

- Passenger Vehicles: With a rising middle class and increasing disposable income, the demand for passenger cars is on an upward trend. This segment contributes significantly to the engine oils and transmission & gear oils market. Urbanization and improved road networks also play a role in the increased usage of passenger vehicles.

- Motorcycles: Motorcycles remain a popular and affordable mode of transportation in Nigeria, particularly in urban and semi-urban areas. This segment is a consistent consumer of engine oils and some specialized lubricants. Their high usage frequency ensures a steady demand for lubricant replacements.

Product Type Dominance:

- Engine Oils: This is the largest and most critical product category within the Nigerian automotive lubricants market. All internal combustion engine vehicles, from motorcycles to heavy-duty trucks, rely heavily on engine oils for lubrication, cooling, cleaning, and protection. The sheer volume of vehicles, coupled with the need for regular oil changes, makes engine oils the primary revenue generator. The demand is further segmented by different viscosity grades and performance specifications to cater to diverse engine types and operating conditions.

- Transmission & Gear Oils: As the automotive fleet expands, so does the demand for transmission and gear oils. These are essential for the smooth functioning of gearboxes and differentials in all types of vehicles. The increasing complexity of modern transmissions, including automatic and manual gearboxes, requires specialized formulations, driving market growth.

- Hydraulic Fluids: Primarily used in heavy-duty commercial vehicles, construction equipment, and industrial machinery, hydraulic fluids are crucial for power transmission and operational efficiency. The ongoing infrastructure development and the expansion of the logistics sector contribute to the steady demand for hydraulic fluids.

- Greases: While smaller in volume compared to engine oils, greases are vital for lubricating joints, bearings, and other moving parts that require more persistent lubrication. They find application across all vehicle types and industrial equipment.

Nigeria Automotive Lubricants Market Product Developments

Product development in the Nigeria automotive lubricants market is increasingly focused on meeting the evolving demands of modern vehicles and environmental regulations. Companies are investing in advanced formulations that offer enhanced wear protection, improved fuel efficiency, and extended drain intervals. The recent launch of Castrol's Castrol ON range, featuring e-gear oils, e-coolants, and e-greases specifically designed for electric vehicles (EVs) in March 2021, signals a forward-looking approach to cater to the nascent EV market in Nigeria. This proactive move by a key player demonstrates an understanding of future trends and a commitment to innovation, providing a competitive edge in anticipation of EV adoption.

Challenges in the Nigeria Automotive Lubricants Market Market

The Nigeria automotive lubricants market faces several significant challenges that can impact growth and profitability. Counterfeit lubricants pose a substantial threat, eroding market share for legitimate brands and compromising vehicle performance. Regulatory hurdles, including import duties, standardization issues, and enforcement complexities, can create an uneven playing field and increase operational costs. Supply chain disruptions, exacerbated by infrastructure limitations and foreign exchange volatility, can lead to stockouts and price fluctuations. Intense competitive pressure from both international and local players, often engaging in price wars, can squeeze profit margins. Furthermore, the underdeveloped aftermarket infrastructure in some regions can limit access to genuine products and skilled servicing, affecting consumer confidence. The cost of raw materials, particularly base oils and additives, which are often imported, is highly sensitive to global market trends and currency fluctuations, presenting a continuous challenge.

Forces Driving Nigeria Automotive Lubricants Market Growth

Several powerful forces are propelling the Nigeria automotive lubricants market forward. The continuously expanding automotive fleet, driven by population growth and economic development, is a fundamental growth catalyst. Increasing disposable incomes and a growing middle class are leading to higher vehicle ownership and replacement rates. The critical role of commercial vehicles in the nation's economy, supporting trade and logistics, ensures a consistent demand for lubricants. Technological advancements in engine design, necessitating higher-performance lubricants to meet stringent emission standards and improve fuel efficiency, are driving innovation. Furthermore, a growing awareness among consumers about the importance of regular maintenance and the use of quality lubricants for vehicle longevity and optimal performance is a significant driver. Government initiatives aimed at boosting industrial growth and infrastructure development indirectly fuel the demand for lubricants in construction and transportation sectors.

Challenges in the Nigeria Automotive Lubricants Market Market

Long-term growth catalysts for the Nigeria automotive lubricants market are rooted in strategic developments and evolving market needs. The ongoing digitalization and adoption of fleet management systems, as exemplified by the partnership between Total Nigeria PLC and Moove Africa in April 2021, are improving efficiency and creating opportunities for value-added services. The gradual, albeit slow, adoption of electric vehicles (EVs) presents a long-term opportunity for specialized EV lubricants. Strategic partnerships and collaborations between lubricant manufacturers, automotive OEMs, and service providers can enhance market penetration and brand loyalty. Expanding the distribution network into underserved rural areas will unlock significant untapped potential. Investing in local manufacturing capabilities can reduce reliance on imports, mitigate currency risks, and create local employment. The development of biodegradable and sustainable lubricant options aligns with global environmental trends and can capture a niche market segment.

Emerging Opportunities in Nigeria Automotive Lubricants Market

Emerging opportunities within the Nigeria automotive lubricants market are multifaceted and offer significant growth potential. The burgeoning e-commerce and online retail channels provide a new avenue for lubricant sales, increasing accessibility for consumers across the country. The growing demand for specialty lubricants for specific applications, such as industrial machinery and off-road vehicles, presents a niche market ripe for exploitation. The increasing interest in lubricant recycling and re-refining aligns with global sustainability trends and offers an opportunity for cost-effective and environmentally friendly solutions. As the government continues to invest in infrastructure development, the demand for lubricants in construction equipment and heavy-duty vehicles will surge. The growing adoption of modern vehicle technologies, including advanced engine systems and hybrid powertrains, creates a need for sophisticated, high-performance lubricant formulations.

Leading Players in the Nigeria Automotive Lubricants Market Sector

- 11Plc

- Ammasco International Limited

- Ardova Plc

- BP Plc (Castrol)

- Conoil PLC

- Eterna Plc

- MRS OIL NIGERIA PLC

- Oando PLC

- Royal Dutch Shell Plc

- TotalEnergie

Key Milestones in Nigeria Automotive Lubricants Market Industry

- November 2021: Ardova PLC acquired Enyo Retail & Supply Limited in 2021. This acquisition adds Enyo's 95 retail stations to Ardova's existing 450 stations, growing its portfolio to 545 stations nationwide, significantly expanding its retail footprint and market reach.

- April 2021: Total Nigeria PLC and Moove Africa signed a Memorandum of Understanding to form a partnership. This collaboration aims to improve the welfare of Moove vehicle drivers by providing access to a fleet management system, premium services, and price reductions on lubricants and other essential services, fostering a more integrated ecosystem.

- March 2021: Castrol announced the launch of Castrol ON, a specialized range of e-fluids including e-gear oils, e-coolants, and e-greases. This product innovation is specifically designed for electric vehicles, marking a proactive step towards catering to the emerging EV market and demonstrating a commitment to future mobility solutions.

Strategic Outlook for Nigeria Automotive Lubricants Market Market

The strategic outlook for the Nigeria automotive lubricants market is one of sustained growth and increasing sophistication. Key growth accelerators include the continued expansion of the automotive sector, driven by demographic and economic trends. Manufacturers will need to focus on developing and promoting high-performance, fuel-efficient, and environmentally friendly lubricant solutions to meet evolving vehicle technologies and consumer preferences. Strategic partnerships with automotive original equipment manufacturers (OEMs) and a robust distribution network, including a strong online presence, will be crucial for market penetration. Addressing the challenge of counterfeit lubricants through robust brand protection strategies and consumer education will be paramount. Furthermore, investing in local blending plants and research and development capabilities can enhance competitiveness and reduce import dependency, paving the way for a more resilient and sustainable future for the Nigerian automotive lubricants industry.

Nigeria Automotive Lubricants Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Transmission & Gear Oils

Nigeria Automotive Lubricants Market Segmentation By Geography

- 1. Niger

Nigeria Automotive Lubricants Market Regional Market Share

Geographic Coverage of Nigeria Automotive Lubricants Market

Nigeria Automotive Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Automotive Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Transmission & Gear Oils

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 11Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ammasco International Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ardova Plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BP Plc (Castrol)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conoil PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eterna Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MRS OIL NIGERIA PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oando PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Dutch Shell Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 11Plc

List of Figures

- Figure 1: Nigeria Automotive Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Nigeria Automotive Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Automotive Lubricants Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Nigeria Automotive Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Nigeria Automotive Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Nigeria Automotive Lubricants Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Nigeria Automotive Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Nigeria Automotive Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Automotive Lubricants Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Nigeria Automotive Lubricants Market?

Key companies in the market include 11Plc, Ammasco International Limited, Ardova Plc, BP Plc (Castrol), Conoil PLC, Eterna Plc, MRS OIL NIGERIA PLC, Oando PLC, Royal Dutch Shell Plc, TotalEnergie.

3. What are the main segments of the Nigeria Automotive Lubricants Market?

The market segments include Vehicle Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 574.93 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Commercial Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2021: Ardova PLC acquired Enyo Retail & Supply Limited in 2021. This acquisition adds Enyo's 95 retail stations to Ardova's existing 450 stations, growing its portfolio to 545 stations nationwide.April 2021: Total Nigeria PLC and Moove Africa signed a Memorandum of Understanding to form a partnership that would improve the welfare of Moove vehicle drivers by providing access to the fleet management system, as well as premium services and price reductions on lubricants and other services.March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Automotive Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Automotive Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Automotive Lubricants Market?

To stay informed about further developments, trends, and reports in the Nigeria Automotive Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence