Key Insights

The United Kingdom architectural coatings market is projected for substantial growth, propelled by increased construction and renovation activities in both residential and commercial sectors. The market, estimated to reach £83.68 billion by 2033, is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.41% from the base year of 2025. This expansion is driven by evolving consumer demand for aesthetically pleasing, durable finishes, and a growing preference for sustainable, low-VOC coating solutions. The rising demand for waterborne coatings aligns with environmental regulations and increased consumer awareness of eco-friendly building materials. Leading companies are investing in R&D to introduce innovative, environmentally responsible products with enhanced performance and ease of application.

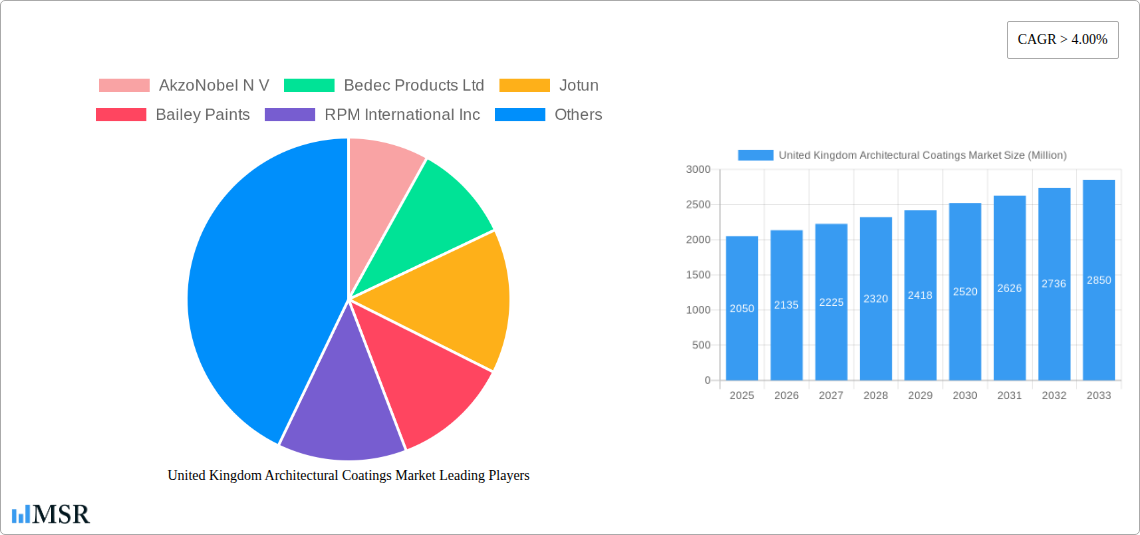

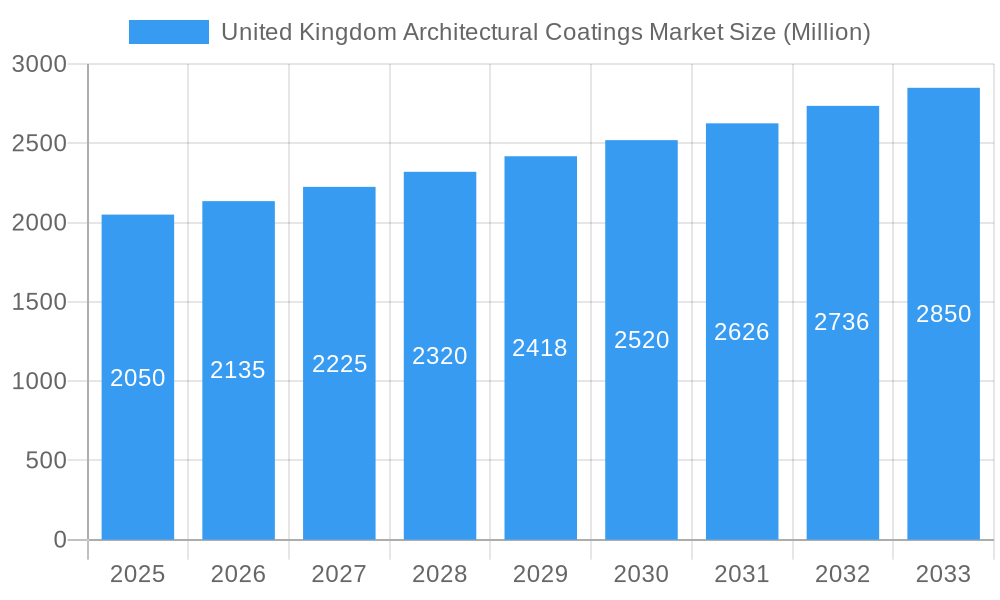

United Kingdom Architectural Coatings Market Market Size (In Billion)

The UK architectural coatings market features diverse resin types and technologies, with acrylic and polyurethane resins dominating due to their superior durability, flexibility, and weather resistance. Government initiatives promoting energy efficiency and urban regeneration further fuel market growth by necessitating advanced coatings for insulation and protection. While opportunities are strong, fluctuating raw material prices and intense competition require strategic pricing and product differentiation. The market outlook is positive, driven by continuous innovation and strong demand for high-performance, eco-conscious architectural coatings.

United Kingdom Architectural Coatings Market Company Market Share

This report provides a comprehensive analysis of the United Kingdom architectural coatings market, offering critical insights for industry stakeholders. Covering the study period from 2019 to 2033, with a base year of 2025, this report examines market dynamics, key trends, the competitive landscape, and future growth opportunities. Key data includes market size of £83.68 billion, with a CAGR of 9.41%. Explore the impact of solventborne and waterborne technologies, the dominance of acrylic, alkyd, epoxy, polyester, and polyurethane resins, and the specific needs of commercial and residential sub-end users. Uncover the latest industry developments shaping the future of UK architectural coatings.

United Kingdom Architectural Coatings Market Market Concentration & Dynamics

The United Kingdom architectural coatings market exhibits a moderate to high concentration, with a few key players holding significant market share. This is driven by substantial investment in research and development, brand recognition, and extensive distribution networks. The innovation ecosystem is robust, with companies continuously striving to introduce advanced formulations that offer enhanced durability, environmental sustainability, and ease of application. Regulatory frameworks, primarily driven by EU directives and UK-specific environmental policies, play a crucial role in shaping product development, favoring low-VOC and waterborne coatings. The presence of substitute products, such as wallpapers and alternative wall finishes, necessitates constant innovation and competitive pricing strategies. End-user trends are shifting towards aesthetically pleasing, durable, and eco-friendly solutions, particularly in the residential sector, while the commercial segment demands high-performance coatings for specific applications like fire resistance and hygiene. Mergers and acquisitions (M&A) activities are moderately prevalent, indicating a strategic consolidation trend as larger entities seek to expand their product portfolios and geographical reach. The number of M&A deals in the historical period (2019-2024) is estimated to be in the low double digits, reflecting a mature market with ongoing strategic realignments. Market share among leading players is dynamic, with top companies typically holding between 10% and 20% of the market, and the top 5-7 players collectively accounting for over 60% of the total market value.

United Kingdom Architectural Coatings Market Industry Insights & Trends

The United Kingdom architectural coatings market is poised for consistent growth, driven by several interconnected factors. The market size in the historical period (2019-2024) is estimated to have reached approximately £1,500 million in 2024. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be around 4.5%, indicating a healthy expansion trajectory. This growth is underpinned by a rising demand for renovation and refurbishment projects, fueled by an aging building stock across the UK and increasing consumer preference for home improvement. The residential segment continues to be a significant driver, with homeowners investing in premium finishes that enhance aesthetic appeal and property value. The commercial segment is also experiencing growth, driven by new construction projects in sectors like healthcare, education, and hospitality, all of which require specialized, high-performance coatings.

Technological disruptions are profoundly impacting the market. The increasing adoption of waterborne coatings is a major trend, driven by stringent environmental regulations concerning volatile organic compounds (VOCs) and a growing consumer awareness of health and safety. This shift is pushing manufacturers to innovate in areas like faster drying times, improved durability, and enhanced color retention for water-based formulations. Advancements in resin technology, particularly in acrylic and polyurethane chemistries, are enabling the development of coatings with superior performance characteristics, including enhanced weather resistance, scratch resistance, and antimicrobial properties. The integration of smart technologies, such as self-cleaning or air-purifying coatings, represents an emerging frontier, catering to a demand for healthier and more sustainable living and working environments.

Evolving consumer behaviors are also shaping market dynamics. There is a growing preference for DIY (Do-It-Yourself) projects, leading to a demand for easy-to-use and user-friendly products. Consumers are increasingly informed about product ingredients and environmental impact, driving demand for eco-label certified and sustainable options. Furthermore, the digitalization of the retail experience, including online purchasing and virtual color visualization tools, is influencing how consumers interact with and select architectural coatings. The emphasis on aesthetics and personalization is leading to a broader color palette and custom tinting services. The estimated market size for 2025 is projected to be £1,670 million.

Key Markets & Segments Leading United Kingdom Architectural Coatings Market

The United Kingdom architectural coatings market is characterized by the dominance of specific segments and technologies, driven by distinct economic and demographic factors.

By Sub End User:

Residential: This segment is a leading force in the UK architectural coatings market.

- Drivers: High rates of homeownership, a strong culture of home renovation and improvement, and increasing disposable incomes contribute significantly. The desire for aesthetic enhancement and property value appreciation are primary motivators. Government initiatives aimed at improving energy efficiency in homes indirectly boost demand for facade coatings.

- Dominance Analysis: The sheer volume of dwelling units and the consistent demand for decorative paints and protective finishes for both interior and exterior applications solidify the residential sector's leading position. DIY trends further bolster this segment, as homeowners increasingly undertake their own painting projects, seeking user-friendly and aesthetically pleasing products.

Commercial: While smaller in volume compared to residential, the commercial segment is a vital contributor, driven by large-scale projects and specialized requirements.

- Drivers: New construction and refurbishment of commercial buildings, including offices, retail spaces, hotels, and educational institutions, are key. Specific performance requirements such as fire retardancy, durability in high-traffic areas, and anti-microbial properties for healthcare facilities are crucial.

- Dominance Analysis: Although the number of projects is fewer than in the residential sector, the larger surface areas involved and the higher unit value of specialized coatings make this segment economically significant. The increasing focus on sustainable building design and retrofitting existing commercial properties also drives demand for advanced architectural coatings.

By Technology:

Waterborne: This technology segment is experiencing the most substantial growth and is set to dominate the market in the long term.

- Drivers: Stringent environmental regulations (e.g., VOC limits), growing consumer awareness regarding health and environmental impacts, and ongoing technological advancements making waterborne coatings more performant and versatile.

- Dominance Analysis: The shift away from solventborne alternatives due to environmental and health concerns is a definitive trend. Manufacturers are investing heavily in R&D to enhance the properties of waterborne coatings, making them competitive in terms of durability, finish, and application ease across various substrates. The forecast indicates a continued and accelerated adoption of waterborne technologies.

Solventborne: While historically dominant, this segment is facing a gradual decline.

- Drivers: Established performance characteristics in specific applications and legacy infrastructure where existing application methods are optimized for solventborne products.

- Dominance Analysis: Despite their performance advantages in certain niche applications (e.g., extreme durability requirements), environmental regulations and the increasing availability of high-performance waterborne alternatives are limiting their growth. Their market share is expected to shrink in favor of more sustainable options.

By Resin Type:

Acrylic: Acrylic resins are a cornerstone of the UK architectural coatings market, particularly within the waterborne segment.

- Drivers: Excellent UV resistance, weatherability, flexibility, and good adhesion make them ideal for a wide range of interior and exterior applications. Their versatility and cost-effectiveness further enhance their appeal.

- Dominance Analysis: Acrylic-based paints are the go-to choice for a vast majority of decorative and protective coatings in both residential and commercial settings due to their balance of performance and affordability.

Polyurethane: Polyurethane resins are crucial for high-performance applications where superior durability and resistance are paramount.

- Drivers: Exceptional hardness, chemical resistance, abrasion resistance, and flexibility. Used in demanding commercial and industrial architectural applications.

- Dominance Analysis: While not as widely used as acrylics in general decorative applications, polyurethanes are indispensable for flooring, high-traffic areas, and protective coatings that require enhanced longevity and resilience.

Alkyd: Alkyd resins remain relevant, particularly in traditional formulations and certain niche markets.

- Drivers: Good gloss retention, durability, and ease of application have ensured their continued use, especially in some primer and topcoat formulations.

- Dominance Analysis: Alkyds are gradually being replaced by more environmentally friendly alternatives, but their established performance in specific applications ensures a continued, albeit declining, market presence.

Epoxy: Epoxy resins are vital for high-performance protective coatings.

- Drivers: Superior adhesion, chemical resistance, and toughness, making them ideal for demanding environments like industrial floors, garages, and protective coatings for infrastructure.

- Dominance Analysis: Essential for specialized applications, epoxy coatings are a significant segment within the high-performance architectural coatings niche.

United Kingdom Architectural Coatings Market Product Developments

Recent product developments in the UK architectural coatings market highlight a strong focus on innovation and sustainability. For example, the introduction of Hammerite Ultima in April 2022 represents a significant advancement. This water-based exterior paint can be applied directly to any metal surface without a primer, streamlining application and reducing project time and cost. This innovation aims to broaden the customer base by offering a user-friendly, high-performance solution for metal protection and decoration. These developments are critical for companies to expand their market reach and meet the evolving demands of both DIY enthusiasts and professional contractors seeking efficient and effective coating solutions. The emphasis is on creating products that are not only durable and aesthetically pleasing but also environmentally conscious and easy to use, reflecting a commitment to technological progress and customer-centric solutions.

Challenges in the United Kingdom Architectural Coatings Market Market

The United Kingdom architectural coatings market faces several challenges that can impact growth and profitability. Regulatory hurdles, particularly evolving environmental standards and VOC restrictions, necessitate significant R&D investment and product reformulation, which can be costly. Supply chain disruptions, exacerbated by global events, can lead to raw material shortages and price volatility, affecting production costs and lead times. Furthermore, intense competitive pressures from both established global players and emerging local manufacturers drive down profit margins and demand continuous innovation and cost optimization. The rising cost of raw materials, including pigments, resins, and solvents, poses a significant challenge to maintaining competitive pricing while ensuring product quality. Additionally, the economic sensitivity of the construction and renovation sectors means that market performance can be heavily influenced by broader economic downturns and fluctuating consumer confidence.

Forces Driving United Kingdom Architectural Coatings Market Growth

Several key forces are propelling the growth of the United Kingdom architectural coatings market. The sustained demand for renovation and refurbishment projects is a primary driver, fueled by an aging housing stock and a desire among homeowners to enhance property aesthetics and value. Government initiatives promoting energy efficiency in buildings, including grants for insulation and facade upgrades, indirectly boost the demand for exterior coatings. Technological advancements in coating formulations, particularly the development of high-performance, eco-friendly waterborne systems, are expanding application possibilities and consumer appeal. Growing environmental consciousness among consumers and professionals is creating a strong preference for sustainable, low-VOC products. Furthermore, the resilience of the construction sector, despite economic fluctuations, and the ongoing need for protective and decorative finishes in both residential and commercial new builds provide a consistent market base.

Challenges in the United Kingdom Architectural Coatings Market Market

The United Kingdom architectural coatings market is driven by long-term growth catalysts stemming from innovation and strategic market positioning. The increasing demand for sustainable and eco-friendly building materials is a significant catalyst, pushing manufacturers to develop and promote low-VOC and water-based formulations. Advancements in nanotechnology are enabling the creation of coatings with enhanced properties like self-cleaning, anti-microbial, and improved UV resistance, opening up new market opportunities. The ongoing focus on energy efficiency in buildings continues to drive demand for specialized facade coatings that contribute to insulation and thermal performance. Furthermore, the urbanization and infrastructure development projects across the UK create sustained demand for durable and protective coatings for public and commercial spaces. Strategic partnerships and collaborations between coating manufacturers and construction firms can also accelerate market penetration and product adoption.

Emerging Opportunities in United Kingdom Architectural Coatings Market

Emerging opportunities in the United Kingdom architectural coatings market are diverse and driven by evolving consumer preferences and technological advancements. The growing demand for smart coatings, such as those with air-purifying or anti-microbial properties, presents a significant growth avenue, particularly in healthcare and educational facilities. The increasing interest in DIY projects opens up opportunities for user-friendly, easy-application coatings and innovative packaging. The push for sustainable construction and retrofitting creates a strong market for coatings made from recycled materials or with a reduced environmental footprint. Furthermore, the development of coatings with enhanced aesthetic features, such as texture effects and digital printing compatibility, caters to the growing demand for personalized interior design. Opportunities also exist in the specialty coatings niche, serving sectors with unique requirements like marine, industrial, or heritage building restoration.

Leading Players in the United Kingdom Architectural Coatings Market Sector

- AkzoNobel N V

- Bedec Products Ltd

- Jotun

- Bailey Paints

- RPM International Inc

- The Sherwin-Williams Company

- DAW SE

- PPG Industries Inc

- Beckers Group

- GLIXTONE

- Hempel A/S

- DGH Manufacturing Ltd (Andura Coatings)

- SACAL INTERNATIONAL GROUP LTD

Key Milestones in United Kingdom Architectural Coatings Market Industry

- April 2022: Hammerite Ultima was introduced in several markets. It is a water-based exterior paint that can be applied directly to any metal surface without the need for a primer, designed to help the company expand its customer base.

- January 2022: A key company increased powder coating capacity at its site in Como, Italy, to strengthen its market position and sharpen its focus on greener manufacturing.

- September 2021: Hempel inaugurated its new campus, which features a newly constructed office building and a state-of-the-art R&D facility, emphasizing investment in innovation and future growth.

Strategic Outlook for United Kingdom Architectural Coatings Market Market

The strategic outlook for the United Kingdom architectural coatings market is characterized by a strong emphasis on innovation, sustainability, and customer-centric solutions. Continued investment in research and development for waterborne and low-VOC coatings will be crucial to meet stringent environmental regulations and growing consumer demand for eco-friendly products. The market will likely witness further consolidation through M&A activities as leading players seek to expand their product portfolios and market reach. Embracing digitalization, including e-commerce platforms and virtual visualization tools, will be essential for enhancing customer engagement and streamlining the purchasing process. The focus on high-performance coatings with enhanced durability, protective qualities, and aesthetic versatility will continue to drive product development. Furthermore, companies that can effectively leverage sustainable manufacturing practices and offer products with a lower environmental impact will gain a competitive advantage. The market presents significant opportunities for growth by catering to the evolving needs of both the residential and commercial sectors, with a particular eye on specialized applications and emerging technologies.

United Kingdom Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

United Kingdom Architectural Coatings Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Architectural Coatings Market Regional Market Share

Geographic Coverage of United Kingdom Architectural Coatings Market

United Kingdom Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant Growth in Detergents and Cleaning Agents; Increased Demand for Sustainable Surfactants; The rising demand for personal care products

- 3.3. Market Restrains

- 3.3.1. The Stringent Enviornmental Regulations; The Availability of Other Substitutes

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AkzoNobel N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bedec Products Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bailey Paints

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RPM International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Sherwin-Williams Compan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DAW SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PPG Industries Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beckers Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GLIXTONE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hempel A/S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DGH Manufacturing Ltd (Andura Coatings)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SACAL INTERNATIONAL GROUP LTD

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 AkzoNobel N V

List of Figures

- Figure 1: United Kingdom Architectural Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 2: United Kingdom Architectural Coatings Market Volume liter Forecast, by Sub End User 2020 & 2033

- Table 3: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: United Kingdom Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 6: United Kingdom Architectural Coatings Market Volume liter Forecast, by Resin 2020 & 2033

- Table 7: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: United Kingdom Architectural Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 10: United Kingdom Architectural Coatings Market Volume liter Forecast, by Sub End User 2020 & 2033

- Table 11: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: United Kingdom Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 14: United Kingdom Architectural Coatings Market Volume liter Forecast, by Resin 2020 & 2033

- Table 15: United Kingdom Architectural Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Architectural Coatings Market?

The projected CAGR is approximately 9.41%.

2. Which companies are prominent players in the United Kingdom Architectural Coatings Market?

Key companies in the market include AkzoNobel N V, Bedec Products Ltd, Jotun, Bailey Paints, RPM International Inc, The Sherwin-Williams Compan, DAW SE, PPG Industries Inc, Beckers Group, GLIXTONE, Hempel A/S, DGH Manufacturing Ltd (Andura Coatings), SACAL INTERNATIONAL GROUP LTD.

3. What are the main segments of the United Kingdom Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Significant Growth in Detergents and Cleaning Agents; Increased Demand for Sustainable Surfactants; The rising demand for personal care products.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

The Stringent Enviornmental Regulations; The Availability of Other Substitutes.

8. Can you provide examples of recent developments in the market?

April 2022: Hammerite Ultima was introduced in several markets. It is a water-based exterior paint that can be applied directly to any metal surface without the need for a primer, which was designed to help the company expand its customer base.January 2022: The company increased powder coating capacity at its site in Como, Italy, to strengthen its market position and sharpen its focus on greener manufacturing.September 2021: Hempel inaugurated its new campus, which features a newly constructed office building and a state-of-the-art R&D facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the United Kingdom Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence