Key Insights

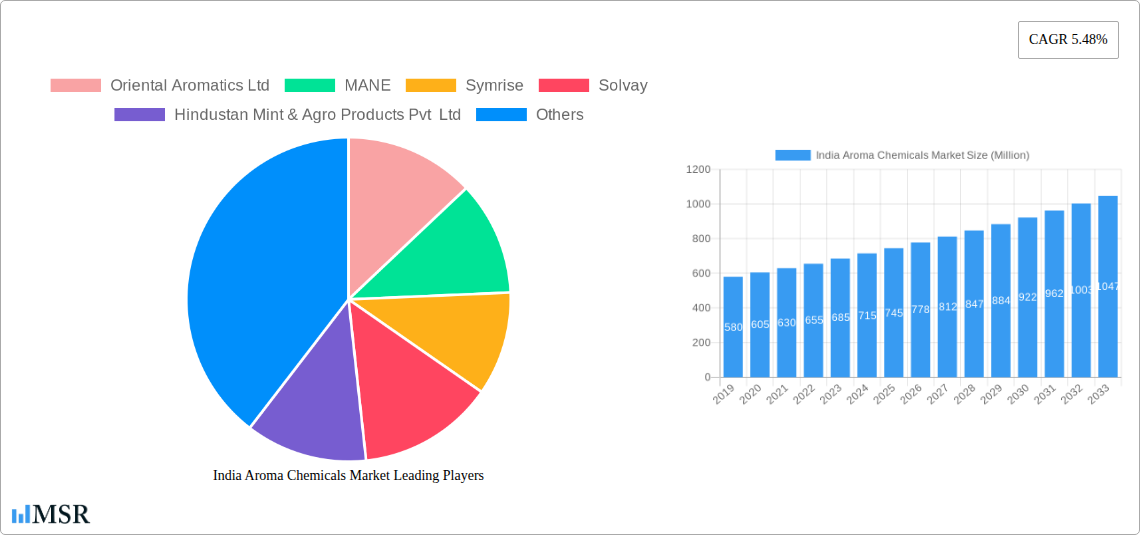

The Indian Aroma Chemicals Market is projected for significant expansion, expected to reach a market size of $291.3 million by 2025, with a robust CAGR of 5.54% during the forecast period. This growth is propelled by increasing demand for fragrances and flavors across key sectors including soaps and detergents, cosmetics, fine fragrances, household products, and food and beverages. Rising disposable incomes, evolving consumer preference for premium and sophisticated scents, and a growing demand for natural and sustainable aroma ingredients are key drivers. The expanding middle class further fuels demand for a wider range of scented products.

India Aroma Chemicals Market Market Size (In Million)

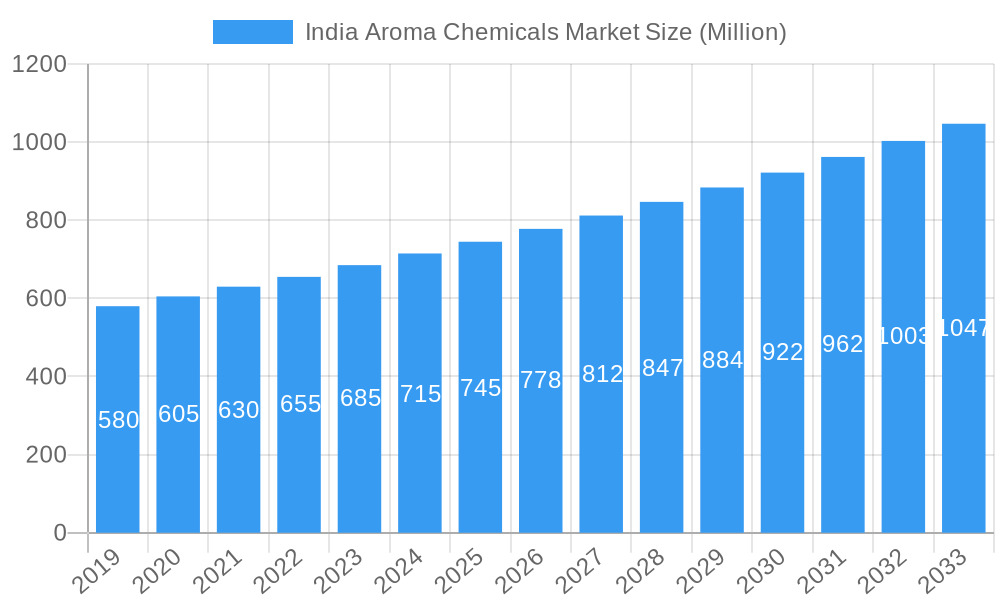

The market is segmented, with Terpenes and Benzenoids currently dominating due to their broad application spectrum, while Musk Chemicals are gaining traction. Soap and Detergents and Cosmetics and Toiletries applications represent the largest share, driven by daily usage and product innovation. The trend towards natural and organic ingredients is also influencing demand. Leading players like International Flavors & Fragrances Inc., Symrise, and BASF SE are investing in R&D and capacity expansion. Emerging companies such as Oriental Aromatics Ltd. and S H Kelkar And Company Limited are focusing on specialized offerings and cost-effective solutions. India's strategic advantages bolster its role in the global aroma chemicals supply chain.

India Aroma Chemicals Market Company Market Share

India Aroma Chemicals Market: A Comprehensive Growth & Opportunity Report (2019-2033)

Unlock the potential of the burgeoning Indian aroma chemicals market with this in-depth industry analysis. Spanning 2019 to 2033, with a detailed focus on the base year 2025 and a robust forecast period, this report provides critical insights into market dynamics, key trends, leading players, and future opportunities. Discover the driving forces behind the estimated XX Million market size in 2025 and the projected XX% CAGR.

India Aroma Chemicals Market Market Concentration & Dynamics

The India aroma chemicals market exhibits a moderate to high concentration, with a significant share held by key global and domestic players. Innovation ecosystems are rapidly developing, driven by increasing R&D investments and a growing demand for novel fragrance and flavor ingredients. The regulatory framework, while evolving, is becoming more stringent, particularly concerning product safety and sustainability. Substitute products, though present, often struggle to replicate the unique sensory profiles and performance characteristics of natural and synthetic aroma chemicals. End-user trends are shifting towards natural, sustainable, and ethically sourced ingredients, influencing product development and manufacturing processes. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate market presence, expand product portfolios, and gain access to new technologies and distribution channels. Key M&A deal counts are projected to increase by xx% over the forecast period, signifying strategic consolidation within the Indian fragrance ingredients market. Market share analysis reveals leading companies are investing in expanding their production capacities and R&D capabilities to cater to the growing demand for specialty aroma chemicals.

India Aroma Chemicals Market Industry Insights & Trends

The India aroma chemicals market is poised for substantial growth, driven by a confluence of powerful economic, social, and technological factors. The Indian fragrance and flavor market is experiencing an upward trajectory, directly fueling the demand for aroma chemicals. Rising disposable incomes and an expanding middle class are leading to increased consumer spending on personal care products, fine fragrances, and processed foods and beverages, all of which rely heavily on aroma chemicals. The cosmetics and toiletries segment, in particular, is a significant growth engine, with consumers seeking premium and innovative scented products. Technological advancements in synthesis and extraction techniques are enabling the development of more cost-effective, sustainable, and diverse aroma chemical portfolios. Furthermore, the growing preference for natural and organic ingredients is pushing manufacturers to explore bio-based and naturally derived aroma compounds, creating new avenues for innovation and market expansion within the natural aroma chemicals India landscape. The food and beverage industry's demand for complex flavor profiles and enhanced sensory experiences also contributes significantly to market growth. The estimated market size for aroma chemicals in India is projected to reach approximately XX Million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust growth is underpinned by a consistent historical growth of XX% from 2019 to 2024, reflecting the market's inherent resilience and dynamism. The evolving landscape of fragrance raw materials India and essential oils India further indicates a maturing and diversifying market.

Key Markets & Segments Leading India Aroma Chemicals Market

The India aroma chemicals market is characterized by the dominance of specific segments and applications, driven by distinct market forces.

Dominant Segment by Type:

- Terpenes: This segment holds a commanding position due to their widespread use as natural and synthetic building blocks for various fragrance and flavor compounds. Their cost-effectiveness and versatility make them indispensable in a wide range of applications, from household products to fine fragrances. The growing consumer preference for natural ingredients further amplifies the demand for terpene-based aroma chemicals.

- Benzenoids: While perhaps not as dominant as terpenes, benzenoids are crucial for their characteristic floral and sweet notes, making them essential for fine fragrances and cosmetics. The increasing sophistication of Indian perfumery and the rising demand for premium personal care products are key drivers for this segment.

- Musk Chemicals: These synthetic compounds, known for their long-lasting and sensual notes, are indispensable in fine fragrances and are witnessing steady growth driven by evolving consumer preferences for sophisticated scents.

- Other Types (Esters, Ketones, etc.): This broad category encompasses a diverse range of aroma chemicals that are critical for imparting specific fruity, spicy, or woody notes. Their application spans across food and beverage, household products, and cosmetics, making them a vital component of the overall market.

Dominant Segment by Application:

- Soap and Detergents: This sector remains a cornerstone for aroma chemical consumption, driven by the sheer volume of products manufactured and the consistent demand for pleasant, long-lasting scents to enhance consumer experience. Economic growth and increased hygiene consciousness further bolster this segment.

- Cosmetics and Toileteries: This is a high-growth application area, fueled by India's young demographic, rising disposable incomes, and a growing awareness of personal grooming. The demand for premium, designer, and natural scented cosmetic products is a significant driver.

- Fine Fragrances: The luxury segment of perfumes and colognes is experiencing a surge in demand, with consumers seeking unique and sophisticated olfactory experiences. This drives the need for high-quality and niche aroma chemicals.

- Household Products: Beyond detergents, this segment includes air fresheners, cleaning agents, and fabric softeners, all of which incorporate aroma chemicals to provide a pleasant ambiance and a sense of cleanliness.

- Food and Beverage: The expanding processed food and beverage industry in India, coupled with a growing demand for exotic and diverse flavors, makes this a critical application segment for aroma chemicals.

The dominance of these segments is underpinned by factors such as rapid urbanization, increasing brand consciousness, and the proliferation of organized retail, which collectively boost consumer access to and demand for scented products and flavored consumables.

India Aroma Chemicals Market Product Developments

The India aroma chemicals market is witnessing significant product innovation, driven by advancements in green chemistry and a growing consumer demand for sustainable and natural ingredients. Companies are actively developing novel aroma molecules and exploring advanced extraction techniques to enhance the purity and olfactory profiles of their offerings. Innovations in encapsulation technologies are enabling longer-lasting fragrance release in various applications, from detergents to fine fragrances. The focus on bio-based and biodegradable aroma chemicals is also gaining momentum, aligning with global sustainability trends and regulatory pressures. These developments are crucial for maintaining a competitive edge and catering to evolving consumer preferences for healthier and environmentally conscious products. The market relevance of these innovations is high, directly impacting product formulation and consumer appeal across diverse sectors.

Challenges in the India Aroma Chemicals Market Market

The India aroma chemicals market faces several significant challenges that can impede its growth trajectory. Regulatory hurdles, particularly concerning the import and use of certain synthetic compounds and stringent compliance with evolving environmental standards, pose a considerable restraint. Supply chain disruptions, amplified by geopolitical factors and logistical complexities within India, can lead to price volatility and availability issues for key raw materials. Intense competitive pressures from both domestic and international players, coupled with pricing sensitivities in certain application segments, necessitate continuous innovation and cost optimization. Furthermore, the increasing demand for natural ingredients, while an opportunity, also presents challenges in terms of sourcing consistency, scalability, and cost compared to synthetic alternatives. These factors collectively contribute to a dynamic and challenging market environment.

Forces Driving India Aroma Chemicals Market Growth

Several key forces are propelling the growth of the India aroma chemicals market. The burgeoning Indian consumer market, characterized by a growing middle class with increasing disposable incomes, is a primary driver. This demographic shift is fueling demand for premium personal care products, fine fragrances, and processed foods and beverages. Technological advancements in synthesis and extraction are enabling the development of innovative, cost-effective, and sustainable aroma chemicals. The expanding food and beverage industry and the increasing adoption of scented household products further contribute to market expansion. Furthermore, government initiatives promoting the "Make in India" campaign and favorable trade policies are also expected to stimulate domestic production and export opportunities for Indian aroma chemical manufacturers.

Challenges in the India Aroma Chemicals Market Market

Beyond immediate challenges, the India aroma chemicals market faces long-term growth catalysts that shape its future. Continued investment in research and development for novel, sustainable, and bio-based aroma compounds is crucial to meet evolving consumer demands and regulatory landscapes. Strategic partnerships and collaborations between raw material suppliers, manufacturers, and end-users can foster innovation and streamline the development of new applications. Market expansions into tier-2 and tier-3 cities, coupled with increasing penetration of e-commerce platforms, will unlock new consumer bases and drive demand. The focus on enhancing supply chain resilience through diversification and localized sourcing will be critical for sustained growth.

Emerging Opportunities in India Aroma Chemicals Market

The India aroma chemicals market presents a wealth of emerging opportunities. The rising popularity of naturals and organics is creating a significant demand for natural aroma chemicals and essential oils, leading to growth in segments like organic essential oils and plant-derived aroma compounds. The burgeoning wellness and aromatherapy sectors are opening new avenues for specialized aroma chemicals with therapeutic properties. The increasing adoption of sustainable packaging and clean label trends is driving innovation in biodegradable and eco-friendly aroma solutions. Furthermore, the growing export potential for Indian aroma chemicals to global markets, leveraging competitive manufacturing costs and skilled labor, represents a significant untapped opportunity.

Leading Players in the India Aroma Chemicals Market Sector

- Oriental Aromatics Ltd

- MANE

- Symrise

- Solvay

- Hindustan Mint & Agro Products Pvt Ltd

- International Flavors & Fragrances Inc

- The Anthea Group

- Takasago International Corporation

- BASF SE

- S H Kelkar And Company Limited

- Eternis Fine Chemicals Limited

- Robertet

- Privi Speciality Chemicals Limited

Key Milestones in India Aroma Chemicals Market Industry

- 2019: Increased focus on R&D for synthetic musk chemicals to cater to evolving fragrance trends.

- 2020: Growing adoption of advanced distillation techniques for higher purity essential oils.

- 2021: Significant investments in expanding production capacity for key aroma chemicals like terpenes and benzenoids.

- 2022: Rise in M&A activities, with larger players acquiring niche manufacturers to broaden product portfolios.

- 2023: Enhanced regulatory scrutiny and implementation of stricter quality control measures for aroma chemicals.

- 2024: Increased emphasis on sustainable sourcing and the development of bio-based aroma ingredients.

Strategic Outlook for India Aroma Chemicals Market Market

The strategic outlook for the India aroma chemicals market is overwhelmingly positive, driven by sustained demand from key end-use industries and favorable macroeconomic factors. Growth accelerators include the increasing demand for innovative and sustainable fragrance and flavor solutions, particularly in the cosmetics and toiletries and food and beverage sectors. The government's supportive policies for manufacturing and exports will further bolster the industry's potential. Companies that focus on technological advancements, product diversification, and strategic partnerships will be well-positioned to capitalize on emerging opportunities in both domestic and international markets. The trend towards natural and organic ingredients presents a significant growth avenue, demanding innovation in sourcing and production.

India Aroma Chemicals Market Segmentation

-

1. Type

- 1.1. Terpenes

- 1.2. Benzenoids

- 1.3. Musk Chemicals

- 1.4. Other Types (Esters, Ketones, etc.)

-

2. Application

- 2.1. Soap and Detergents

- 2.2. Cosmetics and Toileteries

- 2.3. Fine Fragrances

- 2.4. Household Products

- 2.5. Food and Beverage

- 2.6. Other

India Aroma Chemicals Market Segmentation By Geography

- 1. India

India Aroma Chemicals Market Regional Market Share

Geographic Coverage of India Aroma Chemicals Market

India Aroma Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage in the Food and Beverage Industry; Growing Demand for Fine Fragrances; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Research and Development Costs; Other Restraints

- 3.4. Market Trends

- 3.4.1. Terpenes to Dominate the India Aroma Chemicals Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aroma Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Terpenes

- 5.1.2. Benzenoids

- 5.1.3. Musk Chemicals

- 5.1.4. Other Types (Esters, Ketones, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Soap and Detergents

- 5.2.2. Cosmetics and Toileteries

- 5.2.3. Fine Fragrances

- 5.2.4. Household Products

- 5.2.5. Food and Beverage

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oriental Aromatics Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MANE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Symrise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hindustan Mint & Agro Products Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Flavors & Fragrances Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Anthea Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takasago International Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BASF SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 S H Kelkar And Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eternis Fine Chemicals Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Robertet

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Privi Speciality Chemicals Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Oriental Aromatics Ltd

List of Figures

- Figure 1: India Aroma Chemicals Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Aroma Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: India Aroma Chemicals Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: India Aroma Chemicals Market Volume milliliters Forecast, by Type 2020 & 2033

- Table 3: India Aroma Chemicals Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: India Aroma Chemicals Market Volume milliliters Forecast, by Application 2020 & 2033

- Table 5: India Aroma Chemicals Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Aroma Chemicals Market Volume milliliters Forecast, by Region 2020 & 2033

- Table 7: India Aroma Chemicals Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: India Aroma Chemicals Market Volume milliliters Forecast, by Type 2020 & 2033

- Table 9: India Aroma Chemicals Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: India Aroma Chemicals Market Volume milliliters Forecast, by Application 2020 & 2033

- Table 11: India Aroma Chemicals Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Aroma Chemicals Market Volume milliliters Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aroma Chemicals Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the India Aroma Chemicals Market?

Key companies in the market include Oriental Aromatics Ltd, MANE, Symrise, Solvay, Hindustan Mint & Agro Products Pvt Ltd, International Flavors & Fragrances Inc, The Anthea Group, Takasago International Corporation, BASF SE, S H Kelkar And Company Limited, Eternis Fine Chemicals Limited, Robertet, Privi Speciality Chemicals Limited.

3. What are the main segments of the India Aroma Chemicals Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 291.3 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage in the Food and Beverage Industry; Growing Demand for Fine Fragrances; Other Drivers.

6. What are the notable trends driving market growth?

Terpenes to Dominate the India Aroma Chemicals Market.

7. Are there any restraints impacting market growth?

High Research and Development Costs; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in milliliters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aroma Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aroma Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aroma Chemicals Market?

To stay informed about further developments, trends, and reports in the India Aroma Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence