Key Insights

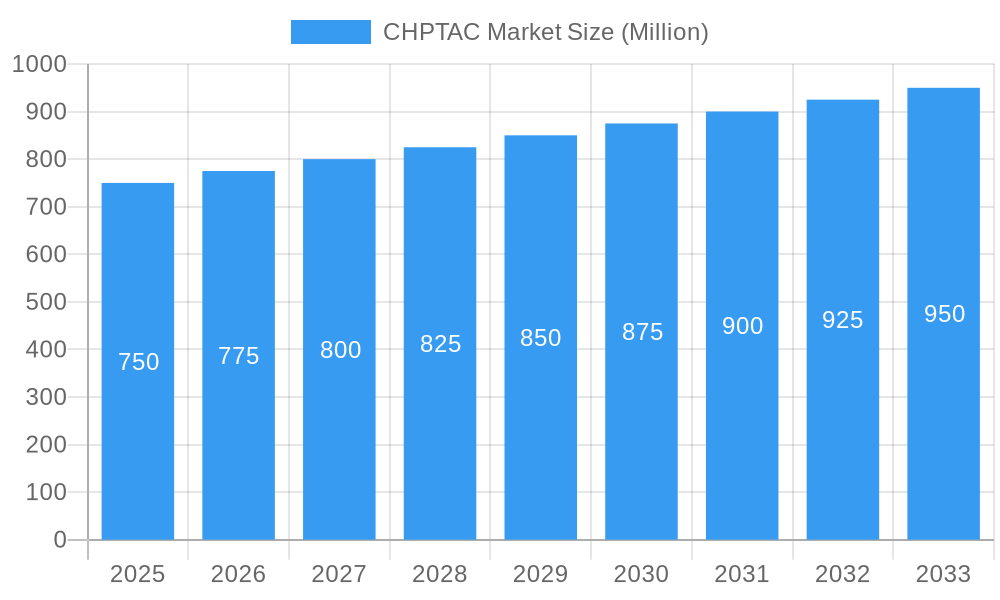

The global CHPTAC (3-Chloro-2-hydroxypropyltrimethylammonium chloride) market is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This growth trajectory is fueled by escalating demand across diverse industrial applications, particularly in the paper, textile, and water treatment sectors. CHPTAC's unique properties as a cationic monomer and a key intermediate in the synthesis of guar derivatives and other functional polymers make it indispensable for enhancing product performance, such as improving paper strength, dye fixation in textiles, and flocculation in water purification. The market is expected to reach a significant valuation in millions of US dollars by 2025, with continued expansion driven by increasing industrialization, a growing focus on sustainable water management, and the continuous innovation in specialty chemical applications.

CHPTAC Market Market Size (In Million)

Key drivers contributing to this market expansion include the rising global population, which consequently increases the demand for paper products and treated water. Furthermore, the textile industry's persistent need for efficient dyeing and finishing processes, where CHPTAC plays a crucial role in improving color yield and fastness, will continue to be a major growth stimulant. While the market benefits from these strong demand drivers, it also faces certain restraints. Fluctuations in raw material prices, particularly for epichlorohydrin and trimethylamine, can impact production costs and profitability. Additionally, stringent environmental regulations concerning chemical manufacturing and usage in certain regions might necessitate advanced compliance measures, potentially adding to operational expenses. Nevertheless, the market's inherent value proposition, coupled with ongoing research and development for novel applications, positions the CHPTAC market for sustained and robust growth in the foreseeable future.

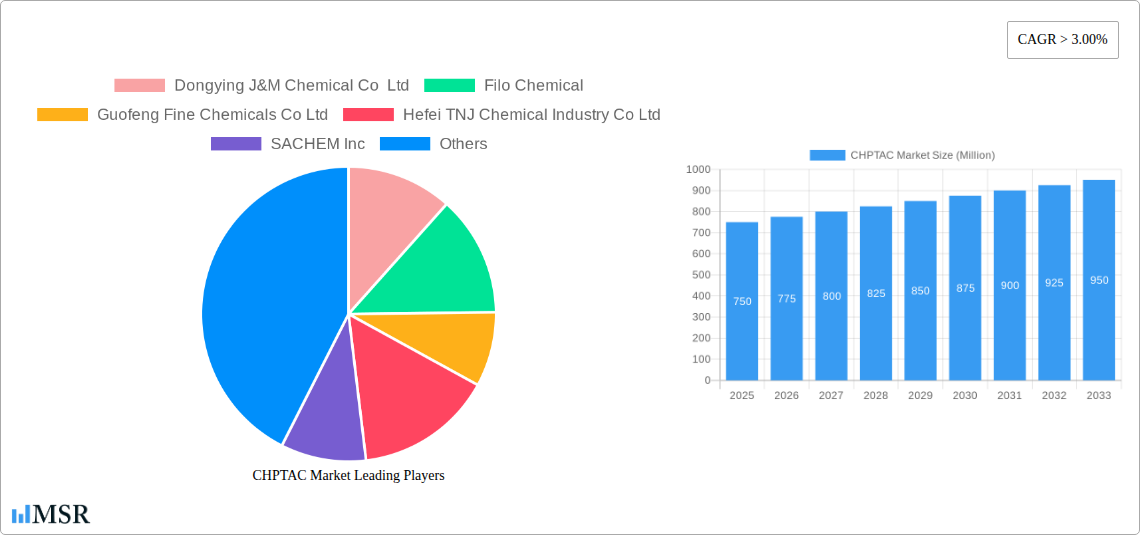

CHPTAC Market Company Market Share

This in-depth CHPTAC market report provides a critical analysis of the Chloropropyltrimethylammonium Chloride (CHPTAC) industry from 2019 to 2033, with a base year of 2025. It delves into market dynamics, key segments, leading players, and future opportunities, offering actionable insights for industry stakeholders. The report covers the global CHPTAC market size, CAGR, and projected growth trajectory, crucial for understanding CHPTAC applications, CHPTAC manufacturers, and CHPTAC market trends.

CHPTAC Market Concentration & Dynamics

The global CHPTAC market exhibits a moderate level of concentration, with several key players contributing significantly to market share. Leading companies such as Dongying J&M Chemical Co Ltd, Filo Chemical, Guofeng Fine Chemicals Co Ltd, Hefei TNJ Chemical Industry Co Ltd, SACHEM Inc, Shandong Tiancheng Wanfeng Chemcial Co Ltd, Shubham Starch Chem, Merck KGaA, SKW Quab Chemicals Inc, and Weifang Greatland Paper and Chemicals Co Ltd are prominent. Innovation ecosystems are characterized by ongoing R&D focused on improving CHPTAC production efficiency and exploring new application avenues. Regulatory frameworks, while varying by region, generally support the safe and effective use of CHPTAC in its primary applications. The threat of substitute products is relatively low due to CHPTAC's unique performance characteristics in sectors like paper and textiles. End-user trends, particularly the demand for enhanced paper properties and sustainable textile manufacturing, are significant drivers. Mergers and acquisitions (M&A) activities, though not extensively detailed in public domain, are anticipated to play a role in consolidating market presence and expanding technological capabilities. Based on our analysis, M&A deal counts have been steady, reflecting strategic consolidation.

CHPTAC Market Industry Insights & Trends

The CHPTAC market is poised for robust growth, driven by escalating demand from key end-use industries. The estimated market size for 2025 is projected to be approximately $XXX Million, with a Compound Annual Growth Rate (CAGR) of xx% anticipated during the forecast period of 2025–2033. This expansion is underpinned by several pivotal factors. Foremost among these is the surging demand for high-quality paper products, including packaging materials, specialty papers, and tissue, where CHPTAC acts as a crucial wet-strength agent and retention aid, improving paper strength and reducing fiber loss. The textile industry's continuous need for enhanced fabric performance, including improved dyeing efficiency, wrinkle resistance, and antistatic properties, further fuels CHPTAC consumption. Technological disruptions are also shaping the market, with advancements in CHPTAC synthesis leading to more cost-effective and environmentally friendly production methods. Evolving consumer behaviors, such as the growing preference for sustainable and high-performance materials, indirectly benefit the CHPTAC market by encouraging the use of chemicals that impart these desired attributes. The oil and gas sector's requirement for drilling fluid additives and water treatment solutions that improve operational efficiency and minimize environmental impact also contributes to market expansion. The personal care industry's interest in specialized ingredients for hair and skin care products presents another avenue for growth. The historical performance from 2019–2024 indicates a steady upward trend, establishing a strong foundation for future growth.

Key Markets & Segments Leading CHPTAC Market

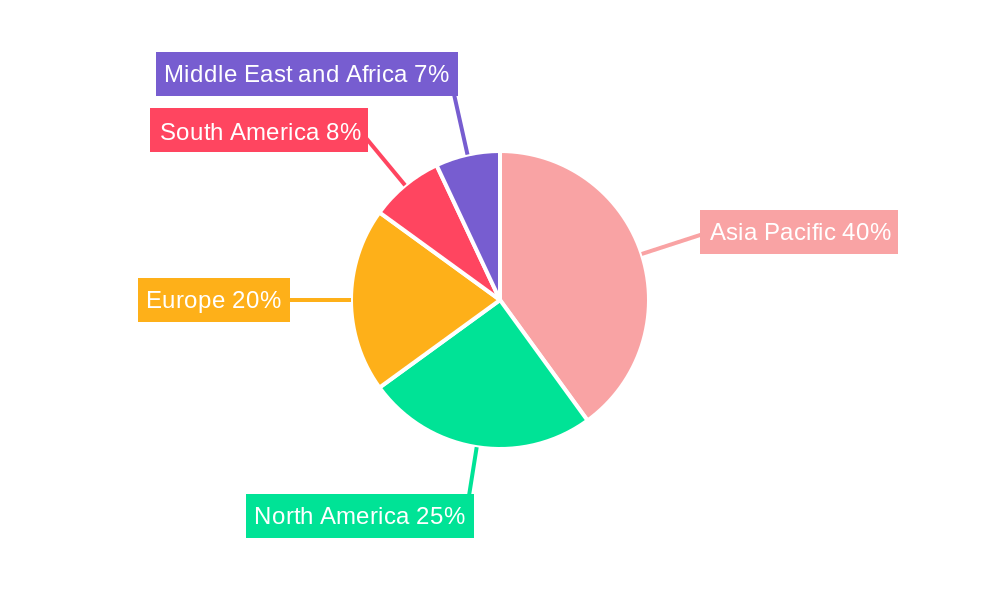

The CHPTAC market is dominated by specific regions and application segments, demonstrating varied growth trajectories.

Dominant Region: Asia-Pacific currently leads the CHPTAC market, driven by rapid industrialization, a burgeoning manufacturing sector, and increasing domestic consumption of paper, textiles, and personal care products.

- Drivers in Asia-Pacific:

- Strong economic growth across key economies like China and India.

- Significant investments in paper and pulp production capacity.

- Expanding textile manufacturing hubs catering to global demand.

- Growing awareness and adoption of advanced chemical solutions in industrial processes.

- Infrastructure development enhancing logistics and supply chains.

- Drivers in Asia-Pacific:

Dominant Application Segment: The Paper application segment is the largest contributor to the CHPTAC market. CHPTAC's role as a vital wet-strength agent and retention aid in papermaking significantly enhances the physical properties of paper, leading to improved tear strength, burst strength, and fold endurance. This is crucial for the production of high-quality packaging boards, printing papers, and sanitary products.

- Drivers for Paper Segment Dominance:

- Explosive growth in the e-commerce sector, driving demand for robust packaging materials.

- Increasing consumption of tissue and hygiene products globally.

- Technological advancements in papermaking machinery and processes that leverage CHPTAC's capabilities.

- Stringent quality requirements for paper products in various industries.

- Drivers for Paper Segment Dominance:

Emerging & Growing Segments:

- Textile: CHPTAC finds application in textile processing for improving dye fixation, enhancing fabric softness, and conferring antistatic properties. The global demand for high-performance textiles, coupled with a focus on sustainable manufacturing, presents significant growth opportunities.

- Water Treatment: Growing concerns over water scarcity and the need for efficient wastewater treatment are driving the use of CHPTAC as a flocculant and coagulant in industrial and municipal water treatment plants.

- Personal Care: While a smaller segment, the use of CHPTAC as a conditioning agent and cationic polymer in shampoos, conditioners, and other personal care products is on the rise, catering to consumer demand for enhanced hair and skin feel.

- Oil and Gas: CHPTAC is utilized in drilling fluids to improve shale inhibition and rheology control, contributing to more efficient and safer drilling operations, particularly in complex geological formations.

CHPTAC Market Product Developments

Recent product developments in the CHPTAC market are focused on enhancing performance and expanding application scope. Innovations in CHPTAC synthesis are yielding higher purity grades and improved solubility, directly benefiting end-users in the paper and textile industries. These advancements translate to better wet strength in paper products and more efficient dye uptake in textiles. Furthermore, research is exploring novel formulations of CHPTAC for specialized applications, such as its use in advanced water treatment processes for removing recalcitrant contaminants and in the development of bio-based polymers. The competitive edge lies in creating CHPTAC derivatives with tailored properties to meet the specific demands of niche markets, thereby driving market relevance and adoption.

Challenges in the CHPTAC Market Market

Despite its robust growth potential, the CHPTAC market faces several challenges. Regulatory compliance, particularly concerning environmental impact and handling of chemical substances, can pose a hurdle for manufacturers and end-users. Fluctuations in raw material prices, such as epichlorohydrin and trimethylamine, can impact production costs and profit margins. Supply chain disruptions, exacerbated by global events, can affect the availability and timely delivery of CHPTAC. Furthermore, the presence of alternative chemistries, though not direct substitutes in all applications, exerts competitive pressure. Quantifiable impacts of these challenges are often seen in increased operational costs and potential delays in market penetration for new applications.

Forces Driving CHPTAC Market Growth

Several key forces are propelling the CHPTAC market forward. Technological advancements in chemical synthesis are leading to more efficient and cost-effective production of CHPTAC, making it more accessible for a wider range of applications. The increasing global demand for sustainable and high-performance materials across industries like paper and textiles acts as a significant economic driver. Growing environmental consciousness and the need for advanced water treatment solutions are also boosting demand for CHPTAC. Regulatory support for chemicals that enhance resource efficiency, such as in papermaking, further fuels market expansion.

Challenges in the CHPTAC Market Market

Long-term growth catalysts for the CHPTAC market are rooted in continuous innovation and strategic market expansion. Ongoing research into new applications, particularly in emerging fields like biodegradable materials and advanced coatings, promises to open up new revenue streams. Strategic partnerships between CHPTAC manufacturers and end-users can lead to the co-development of tailored solutions, fostering greater market penetration. Expanding into underserved geographical regions with growing industrial bases will also be crucial for sustained growth. Furthermore, the development of more environmentally friendly production processes will be a key factor in maintaining market competitiveness.

Emerging Opportunities in CHPTAC Market

Emerging opportunities in the CHPTAC market are diverse and promising. The increasing focus on circular economy principles presents an opportunity for CHPTAC-based solutions in advanced recycling processes for paper and textiles. Advancements in nanotechnology could lead to novel applications of CHPTAC in composite materials and functional coatings. The burgeoning personal care market, with its demand for innovative and high-efficacy ingredients, offers scope for CHPTAC-based formulations. Furthermore, the growing need for efficient and sustainable solutions in agriculture, such as soil conditioning and controlled release of fertilizers, could unlock new market segments for CHPTAC.

Leading Players in the CHPTAC Market Sector

- Dongying J&M Chemical Co Ltd

- Filo Chemical

- Guofeng Fine Chemicals Co Ltd

- Hefei TNJ Chemical Industry Co Ltd

- SACHEM Inc

- Shandong Tiancheng Wanfeng Chemcial Co Ltd

- Shubham Starch Chem

- Merck KGaA

- SKW Quab Chemicals Inc

- Weifang Greatland Paper and Chemicals Co Ltd

Key Milestones in CHPTAC Market Industry

- 2019-2024: Continuous research and development in improving CHPTAC synthesis efficiency.

- 2020: Increased adoption of CHPTAC in sustainable packaging solutions due to growing e-commerce.

- 2021: Emergence of novel CHPTAC formulations for enhanced textile dyeing processes.

- 2022: Growing interest in CHPTAC for advanced water treatment applications due to stricter environmental regulations.

- 2023: Increased focus on bio-based alternatives and sustainable production methods for CHPTAC.

Strategic Outlook for CHPTAC Market Market

The strategic outlook for the CHPTAC market is highly positive, driven by consistent demand from established sectors and the exploration of new application frontiers. Growth accelerators will include continued innovation in product performance, particularly in areas of sustainability and biodegradability, alongside aggressive market penetration strategies in emerging economies. The development of cost-optimized and environmentally benign production technologies will be paramount. Strategic partnerships and collaborations will further unlock market potential, leading to the creation of tailored solutions for evolving industry needs. The CHPTAC market is well-positioned for sustained expansion, offering significant opportunities for stakeholders focused on innovation and strategic market positioning.

CHPTAC Market Segmentation

-

1. Application

- 1.1. Paper

- 1.2. Textile

- 1.3. Oil and Gas

- 1.4. Personal Care

- 1.5. Water Treatment

- 1.6. Others

CHPTAC Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

CHPTAC Market Regional Market Share

Geographic Coverage of CHPTAC Market

CHPTAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Paper Industry; Increasing Application in Water Treatment Industry

- 3.3. Market Restrains

- 3.3.1. ; Growing Paper Industry; Increasing Application in Water Treatment Industry

- 3.4. Market Trends

- 3.4.1. Paper Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CHPTAC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Paper

- 5.1.2. Textile

- 5.1.3. Oil and Gas

- 5.1.4. Personal Care

- 5.1.5. Water Treatment

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific CHPTAC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Paper

- 6.1.2. Textile

- 6.1.3. Oil and Gas

- 6.1.4. Personal Care

- 6.1.5. Water Treatment

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America CHPTAC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Paper

- 7.1.2. Textile

- 7.1.3. Oil and Gas

- 7.1.4. Personal Care

- 7.1.5. Water Treatment

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe CHPTAC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Paper

- 8.1.2. Textile

- 8.1.3. Oil and Gas

- 8.1.4. Personal Care

- 8.1.5. Water Treatment

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America CHPTAC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Paper

- 9.1.2. Textile

- 9.1.3. Oil and Gas

- 9.1.4. Personal Care

- 9.1.5. Water Treatment

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa CHPTAC Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Paper

- 10.1.2. Textile

- 10.1.3. Oil and Gas

- 10.1.4. Personal Care

- 10.1.5. Water Treatment

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dongying J&M Chemical Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Filo Chemical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guofeng Fine Chemicals Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hefei TNJ Chemical Industry Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SACHEM Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shandong Tiancheng Wanfeng Chemcial Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shubham Starch Chem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merck KGaA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SKW Quab Chemicals Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Weifang Greatland Paper and Chemicals Co Ltd *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dongying J&M Chemical Co Ltd

List of Figures

- Figure 1: Global CHPTAC Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific CHPTAC Market Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific CHPTAC Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific CHPTAC Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Asia Pacific CHPTAC Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America CHPTAC Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America CHPTAC Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America CHPTAC Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America CHPTAC Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe CHPTAC Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe CHPTAC Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe CHPTAC Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe CHPTAC Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America CHPTAC Market Revenue (Million), by Application 2025 & 2033

- Figure 15: South America CHPTAC Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America CHPTAC Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America CHPTAC Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa CHPTAC Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa CHPTAC Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa CHPTAC Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa CHPTAC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global CHPTAC Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global CHPTAC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global CHPTAC Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global CHPTAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: India CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Japan CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Korea CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global CHPTAC Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global CHPTAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Canada CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global CHPTAC Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global CHPTAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global CHPTAC Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global CHPTAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global CHPTAC Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global CHPTAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa CHPTAC Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CHPTAC Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the CHPTAC Market?

Key companies in the market include Dongying J&M Chemical Co Ltd, Filo Chemical, Guofeng Fine Chemicals Co Ltd, Hefei TNJ Chemical Industry Co Ltd, SACHEM Inc, Shandong Tiancheng Wanfeng Chemcial Co Ltd, Shubham Starch Chem, Merck KGaA, SKW Quab Chemicals Inc, Weifang Greatland Paper and Chemicals Co Ltd *List Not Exhaustive.

3. What are the main segments of the CHPTAC Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Paper Industry; Increasing Application in Water Treatment Industry.

6. What are the notable trends driving market growth?

Paper Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Growing Paper Industry; Increasing Application in Water Treatment Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CHPTAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CHPTAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CHPTAC Market?

To stay informed about further developments, trends, and reports in the CHPTAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence