Key Insights

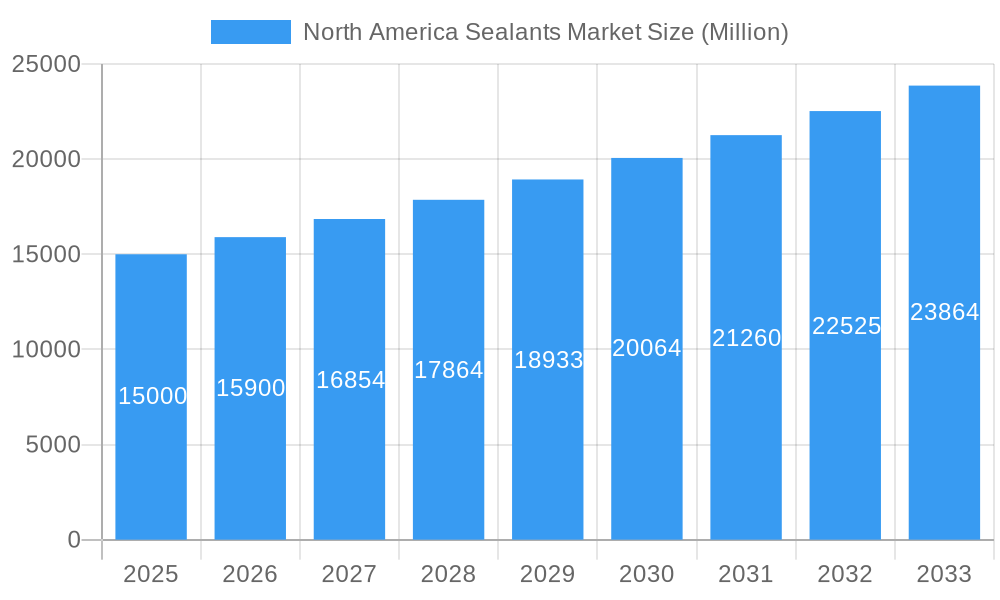

The North America sealants market is set for significant expansion, projected to reach a market size of $77.08 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6% through 2033. Key growth drivers include escalating demand from the aerospace sector for lightweight, durable sealing solutions and the automotive industry's focus on fuel efficiency and performance enhancement. The construction sector's investment in energy-efficient buildings and infrastructure further fuels sealant consumption, alongside emerging applications in healthcare for sterile, biocompatible sealants. Market dynamics are characterized by innovation in formulations offering superior adhesion, flexibility, and environmental resistance.

North America Sealants Market Market Size (In Billion)

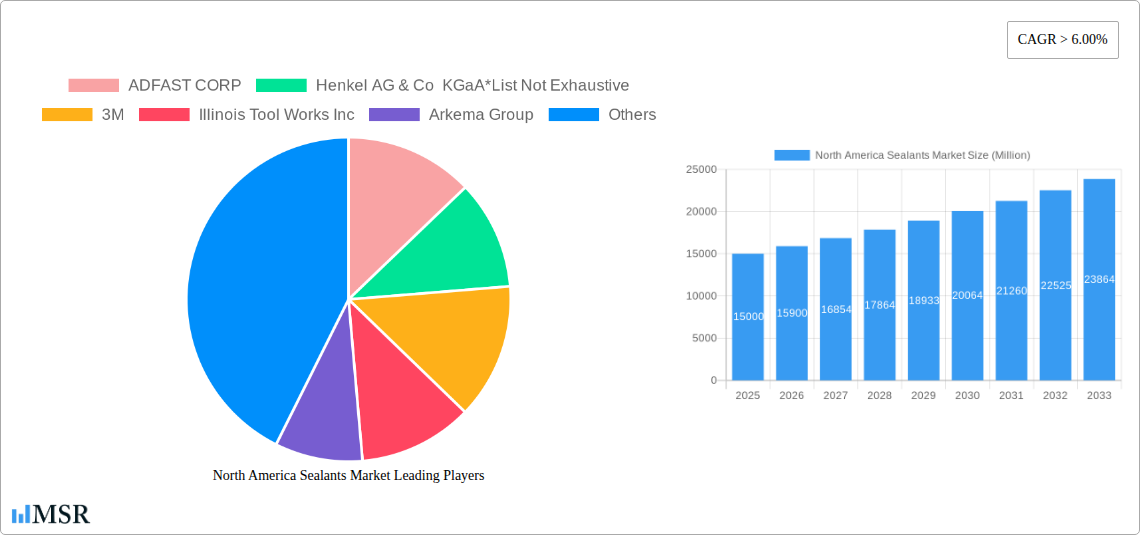

The competitive landscape features major players like 3M, Henkel AG & Co. KGaA, and Sika AG, who are advancing high-performance sealants across acrylic, epoxy, and polyurethane types. Potential restraints include volatile raw material prices and stringent environmental regulations on volatile organic compounds (VOCs). Despite these challenges, the trend favors sustainable and advanced sealant solutions. The United States is expected to dominate market share, followed by Canada and Mexico, presenting substantial opportunities for growth and innovation throughout North America.

North America Sealants Market Company Market Share

North America Sealants Market Market Concentration & Dynamics

The North America Sealants Market exhibits a moderate to high market concentration, with several global players vying for significant market share. Leading companies like 3M, Dow, Sika AG, and Henkel AG & Co KGaA dominate the landscape through extensive product portfolios, robust R&D investments, and established distribution networks. Innovation ecosystems are thriving, driven by the continuous development of advanced sealant formulations for specialized applications, particularly in the burgeoning building and construction and automotive sectors. Regulatory frameworks, primarily focused on environmental impact and safety standards (e.g., VOC emissions), play a crucial role in shaping product development and market entry. The presence of substitute products, such as tapes and mechanical fasteners, necessitates a focus on superior performance characteristics like adhesion, durability, and sealing capabilities. End-user trends indicate a growing demand for sustainable, high-performance, and easy-to-apply sealants. Mergers and acquisitions (M&A) activities are also a notable aspect of market dynamics, with companies strategically acquiring smaller players to expand their technological capabilities or geographical reach. For instance, the procurement of a chemical manufacturing facility by RPM International Inc. underscores a strategic move to bolster manufacturing capacity and supply chain resilience. M&A deal counts remain steady, reflecting the industry's pursuit of consolidation and synergistic growth.

North America Sealants Market Industry Insights & Trends

The North America Sealants Market is poised for significant expansion, with an estimated market size of USD 12.5 Billion in 2025, projected to reach USD 18.2 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period (2025-2033). This robust growth trajectory is underpinned by several key factors. The building and construction sector remains a primary demand driver, fueled by ongoing infrastructure development, renovation projects, and the increasing adoption of energy-efficient building practices that necessitate advanced sealing solutions for improved insulation and weatherproofing. The automotive industry is another significant contributor, driven by the trend towards lightweight vehicle construction, where sealants play a critical role in bonding dissimilar materials, enhancing structural integrity, and reducing noise, vibration, and harshness (NVH). Furthermore, the growing demand for electric vehicles (EVs) presents new opportunities for specialized sealants with enhanced thermal management properties and flame retardancy. Technological disruptions are continuously reshaping the market, with a focus on developing low-VOC (Volatile Organic Compound) and water-based sealants to meet stringent environmental regulations and consumer preferences for healthier living and working spaces. Advancements in silicone and polyurethane sealant technologies are offering superior durability, flexibility, and resistance to extreme temperatures and weathering, catering to demanding applications in both industrial and consumer markets. Evolving consumer behaviors are emphasizing sustainability, product longevity, and ease of application. This has led to a rise in demand for pre-packaged, user-friendly sealant solutions and a greater emphasis on lifecycle assessment and eco-friendly manufacturing processes. The healthcare sector, while smaller, presents a niche but growing demand for sterile and biocompatible sealants in medical devices and infrastructure. The aerospace industry also contributes, requiring high-performance sealants that can withstand extreme conditions. The other end-user industries segment, encompassing sectors like electronics and consumer goods, further diversifies the market's demand profile.

Key Markets & Segments Leading North America Sealants Market

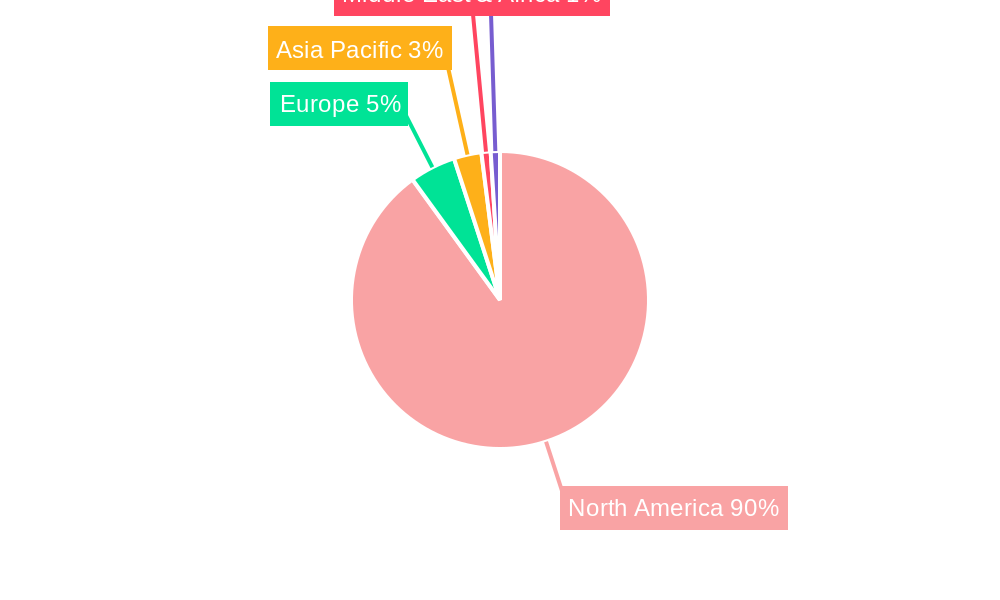

The United States stands as the dominant geography in the North America Sealants Market, accounting for a substantial share of the total market value. Its leadership is driven by a confluence of factors, including a large and mature construction industry, a robust automotive manufacturing base, and significant investments in infrastructure development. Economic growth, coupled with favorable government initiatives supporting construction and manufacturing, further bolsters demand for a wide array of sealants.

- Dominant End-User Industry: Building and Construction emerges as the leading end-user industry.

- Drivers: Increasing urbanization, demand for sustainable and energy-efficient buildings, extensive renovation and remodeling activities, and rising infrastructure spending are key growth catalysts. The need for weatherproofing, acoustic insulation, and structural integrity in residential, commercial, and industrial buildings fuels the demand for high-performance sealants.

- Dominant Resin Type: Polyurethane and Silicone sealants are leading resin types within the market.

- Drivers (Polyurethane): Excellent adhesion to a variety of substrates, flexibility, and good weathering resistance make them ideal for construction and automotive applications. Their versatility allows for use in both structural bonding and gap-filling.

- Drivers (Silicone): Superior UV resistance, high-temperature performance, and excellent flexibility are crucial for applications exposed to harsh environmental conditions, such as facade sealing, window glazing, and automotive engine seals.

- Dominant Geography: United States

- Drivers: The strong economic performance, extensive manufacturing capabilities, and continuous technological advancements in the US are major contributors. The sheer volume of construction projects and the high adoption rate of advanced materials propel the sealant market forward.

- Significant Contributions from Other Segments:

- Automotive: The growing trend of lightweight vehicle designs and the increasing production of EVs are driving demand for specialized adhesives and sealants that offer robust bonding solutions.

- Aerospace: This sector requires highly specialized sealants with exceptional performance characteristics to meet stringent safety and operational requirements.

- Healthcare: The demand for biocompatible and sterile sealants in medical devices and facilities is steadily increasing.

- Other End-user Industries: This broad category encompasses diverse applications in electronics, consumer goods, and industrial maintenance, contributing to market diversification.

- Acrylic and Epoxy Resin Types: While polyurethane and silicone lead, acrylic sealants are popular for their cost-effectiveness and ease of use in general construction, while epoxy sealants are favored for their strength and chemical resistance in industrial applications.

- Canada and Mexico: These countries represent significant markets with growing construction and manufacturing sectors, contributing to the overall North American demand.

North America Sealants Market Product Developments

The North America Sealants Market is characterized by continuous innovation, with a strong emphasis on developing high-performance, sustainable, and user-friendly products. Companies are actively investing in R&D to create sealants with improved adhesion to diverse substrates, enhanced durability, and superior resistance to environmental factors like UV radiation, extreme temperatures, and chemical exposure. Product developments are increasingly focused on low-VOC formulations and water-based technologies to comply with stringent environmental regulations and cater to the growing demand for eco-friendly solutions. Advancements in silicone and polyurethane technologies are yielding sealants with exceptional flexibility, weatherability, and thermal performance, suitable for demanding applications in the building and construction and automotive industries. The introduction of specialized sealants for electric vehicles, addressing thermal management and battery enclosure sealing, signifies a key area of innovation.

Challenges in the North America Sealants Market Market

The North America Sealants Market faces several challenges that can impact its growth trajectory. Regulatory hurdles, particularly concerning volatile organic compound (VOC) emissions and the use of certain chemicals, necessitate ongoing product reformulation and compliance efforts, increasing R&D costs. Supply chain disruptions, exacerbated by geopolitical factors and raw material availability fluctuations, can lead to price volatility and affect product delivery timelines. Intense competitive pressure from established global players and emerging regional manufacturers can limit pricing power and necessitate continuous investment in product differentiation and marketing. The presence of substitute products like tapes and mechanical fasteners requires sealant manufacturers to consistently demonstrate superior performance and cost-effectiveness. Furthermore, the increasing cost of raw materials, such as petrochemical derivatives, poses a significant challenge to maintaining profitability margins.

Forces Driving North America Sealants Market Growth

Several key forces are propelling the North America Sealants Market forward. The robust growth in the construction sector, driven by urbanization, infrastructure development, and renovation activities, is a primary growth accelerator. The automotive industry's evolution, with the increasing adoption of lightweight materials and the shift towards electric vehicles, demands advanced sealing solutions for structural integrity and performance enhancement. Technological advancements in sealant formulations, leading to improved performance characteristics like enhanced adhesion, durability, and environmental resistance, are opening up new application possibilities. Furthermore, favorable government policies and regulations promoting energy efficiency in buildings and stricter safety standards in transportation indirectly boost the demand for high-performance sealants. The increasing consumer awareness and preference for sustainable and eco-friendly products are also driving the development and adoption of low-VOC and water-based sealants.

Challenges in the North America Sealants Market Market

Addressing long-term growth catalysts within the North America Sealants Market involves overcoming inherent challenges and capitalizing on evolving industry dynamics. The increasing cost of raw materials, primarily derived from petrochemicals, can significantly impact production expenses and necessitate price adjustments, potentially affecting market accessibility for some segments. The stringent and evolving regulatory landscape, particularly concerning environmental impact and worker safety, requires continuous investment in research and development to ensure product compliance and sustainability, which can be a substantial barrier for smaller players. Supply chain volatility, influenced by global events and raw material availability, poses a risk to consistent production and timely delivery, demanding robust inventory management and strategic sourcing. Furthermore, the perceived complexity of application for certain high-performance sealants may limit their adoption in DIY markets or by less experienced contractors, necessitating ongoing efforts in product education and user-friendly formulations.

Emerging Opportunities in North America Sealants Market

The North America Sealants Market is ripe with emerging opportunities driven by technological innovation and evolving market demands. The rapid expansion of the electric vehicle (EV) market presents a significant opportunity for specialized sealants designed for thermal management, battery pack sealing, and electromagnetic shielding. The growing emphasis on sustainable construction practices is fueling demand for eco-friendly, low-VOC, and bio-based sealants, creating a niche for manufacturers focused on green solutions. The increasing need for smart buildings and advanced infrastructure is driving the development of intelligent sealants with self-healing properties or integrated sensor capabilities. Furthermore, the growing trend of modular construction and prefabrication in the building sector creates opportunities for high-performance, fast-curing sealants that can streamline assembly processes. The repair and maintenance (MRO) sector for both industrial and residential applications also offers a steady and growing demand for reliable and easy-to-use sealant solutions.

Leading Players in the North America Sealants Market Sector

- ADFAST CORP

- Henkel AG & Co KGaA

- 3M

- Illinois Tool Works Inc

- Arkema Group

- Dow

- H B Fuller Company

- MAPEI S p A

- Pecora Corporation

- Sika AG

- RPM International

Key Milestones in North America Sealants Market Industry

- July 2021: RPM International Inc. procured a 178,000-square-foot chemical manufacturing facility in Texas to act as a manufacturing campus owned and operated by RPM's Tremco Construction Products Group to meet customer demand and strengthen its supply chain. This strategic acquisition enhances RPM's production capabilities and bolsters its supply chain resilience in the North American market.

- January 2022: H.B. Fuller Company introduced a new range of Gorilla professional-grade adhesives and sealants for MRO industrial applications. This product launch expands H.B. Fuller's portfolio and caters to the growing demand for high-performance, reliable sealing solutions in industrial maintenance and repair operations.

Strategic Outlook for North America Sealants Market Market

The strategic outlook for the North America Sealants Market is overwhelmingly positive, driven by sustained demand from key end-user industries and continuous technological advancements. Future growth will likely be accelerated by a focus on sustainable formulations, including low-VOC and water-based sealants, aligning with increasing environmental consciousness and regulatory pressures. The burgeoning electric vehicle sector presents a significant avenue for innovation in specialized sealants for thermal management and battery safety. Furthermore, strategic partnerships and acquisitions will continue to play a vital role in consolidating market share, expanding product portfolios, and gaining access to new technologies and geographical regions. The market's trajectory indicates a strong emphasis on product differentiation through enhanced performance characteristics like superior adhesion, durability, and ease of application, ensuring a robust and dynamic future for the North America Sealants Market.

North America Sealants Market Segmentation

-

1. End-User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Healthcare

- 1.5. Other End-user Industries

-

2. Resin Type

- 2.1. Acrylic

- 2.2. Epoxy

- 2.3. Polyurethane

- 2.4. Silicone

- 2.5. Other Resin Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Sealants Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Sealants Market Regional Market Share

Geographic Coverage of North America Sealants Market

North America Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from Building and Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Strict Regulations on the Usage of VOC-free Contents; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Building and Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sealants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Healthcare

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Acrylic

- 5.2.2. Epoxy

- 5.2.3. Polyurethane

- 5.2.4. Silicone

- 5.2.5. Other Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. United States North America Sealants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Building and Construction

- 6.1.4. Healthcare

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Resin Type

- 6.2.1. Acrylic

- 6.2.2. Epoxy

- 6.2.3. Polyurethane

- 6.2.4. Silicone

- 6.2.5. Other Resin Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Canada North America Sealants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Building and Construction

- 7.1.4. Healthcare

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Resin Type

- 7.2.1. Acrylic

- 7.2.2. Epoxy

- 7.2.3. Polyurethane

- 7.2.4. Silicone

- 7.2.5. Other Resin Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Mexico North America Sealants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Building and Construction

- 8.1.4. Healthcare

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Resin Type

- 8.2.1. Acrylic

- 8.2.2. Epoxy

- 8.2.3. Polyurethane

- 8.2.4. Silicone

- 8.2.5. Other Resin Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Rest of North America North America Sealants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Building and Construction

- 9.1.4. Healthcare

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Resin Type

- 9.2.1. Acrylic

- 9.2.2. Epoxy

- 9.2.3. Polyurethane

- 9.2.4. Silicone

- 9.2.5. Other Resin Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ADFAST CORP

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Henkel AG & Co KGaA*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 3M

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Illinois Tool Works Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Arkema Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dow

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 H B Fuller Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 MAPEI S p A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pecora Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sika AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 RPM International

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ADFAST CORP

List of Figures

- Figure 1: North America Sealants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sealants Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sealants Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 2: North America Sealants Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 3: North America Sealants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Sealants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Sealants Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: North America Sealants Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 7: North America Sealants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Sealants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Sealants Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 10: North America Sealants Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 11: North America Sealants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Sealants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Sealants Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 14: North America Sealants Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 15: North America Sealants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Sealants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Sealants Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 18: North America Sealants Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 19: North America Sealants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Sealants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sealants Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Sealants Market?

Key companies in the market include ADFAST CORP, Henkel AG & Co KGaA*List Not Exhaustive, 3M, Illinois Tool Works Inc, Arkema Group, Dow, H B Fuller Company, MAPEI S p A, Pecora Corporation, Sika AG, RPM International.

3. What are the main segments of the North America Sealants Market?

The market segments include End-User Industry, Resin Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from Building and Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Building and Construction Sector.

7. Are there any restraints impacting market growth?

Strict Regulations on the Usage of VOC-free Contents; Other Restraints.

8. Can you provide examples of recent developments in the market?

In July 2021, RPM International Inc. procured a 178,000-square-foot chemical manufacturing facility in Texas to act as a manufacturing campus owned and operated by RPM's Tremco Construction Products Group to meet customer demand and strengthen its supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sealants Market?

To stay informed about further developments, trends, and reports in the North America Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence