Key Insights

The Mexican passenger vehicle lubricants market is projected for sustained growth, estimated to reach $456.42 million by 2024, with a Compound Annual Growth Rate (CAGR) of 1.5% through 2033. This expansion is driven by an increasing vehicle parc, heightened consumer awareness of vehicle maintenance, and a growing middle class with greater disposable income, fueling demand for premium and specialized lubricants. The market is shifting towards synthetic and semi-synthetic engine oils due to their superior performance, extended drain intervals, and improved fuel efficiency, meeting the demands of modern passenger vehicles and advanced engine technologies. Additionally, stricter emission standards and the need for lubricants that reduce friction and wear are further propelling market advancements.

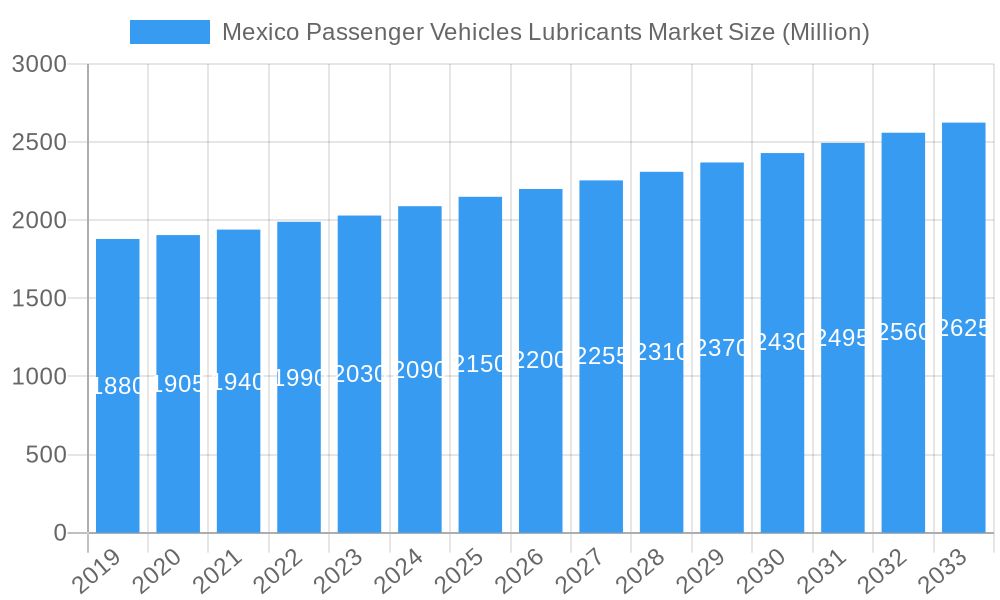

Mexico Passenger Vehicles Lubricants Market Market Size (In Million)

Key factors influencing the Mexican passenger vehicle lubricants market include the consistent introduction of new vehicles and the aging of the existing fleet, both requiring regular lubrication for optimal performance and longevity. The increasing sophistication of automotive technology, such as turbocharged engines and hybrid powertrains, is driving demand for high-performance, specialized lubricants capable of withstanding higher operating temperatures and pressures. Furthermore, a greater emphasis on preventative maintenance and the recognition of lubricants' vital role in extending vehicle lifespan encourage consumers to choose quality products. Challenges include a significant unorganized sector offering lower-priced alternatives and fluctuating raw material costs. Despite these hurdles, the market outlook remains positive, with key players focusing on product innovation, distribution network expansion, and consumer education to enhance market share.

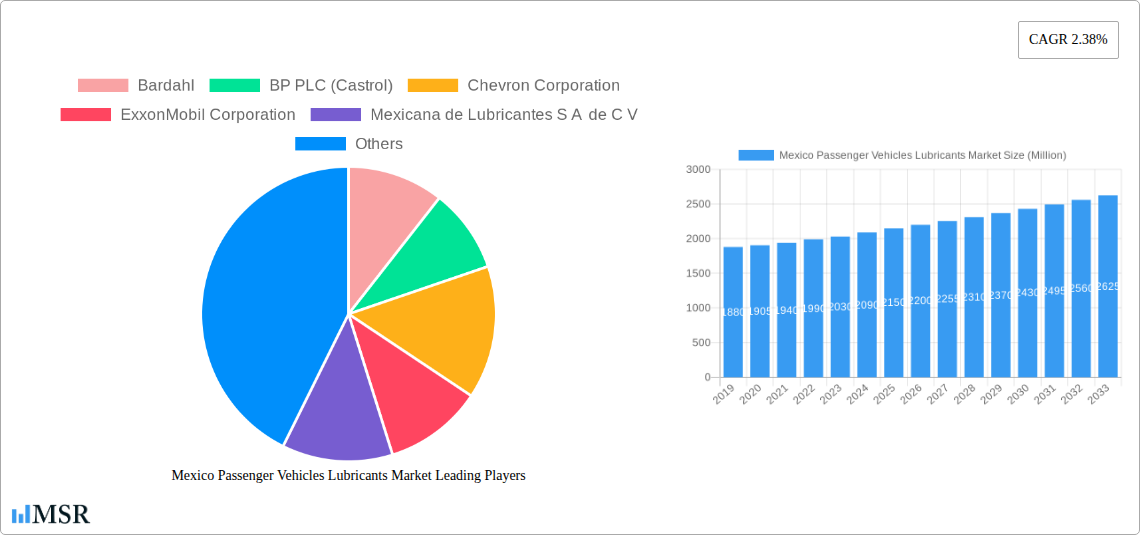

Mexico Passenger Vehicles Lubricants Market Company Market Share

Mexico Passenger Vehicles Lubricants Market Analysis and Forecast (2019-2033)

Explore the dynamic Mexico Passenger Vehicles Lubricants Market with our comprehensive report, providing critical insights for industry stakeholders from 2019 to 2033. This in-depth analysis forecasts the market size at an estimated $456.42 million for 2024, projecting a robust CAGR of 1.5% throughout the forecast period. Uncover key trends, market drivers, competitive landscapes, and future opportunities shaping the Mexican automotive lubricants sector.

Mexico Passenger Vehicles Lubricants Market Market Concentration & Dynamics

The Mexico Passenger Vehicles Lubricants Market exhibits a moderate to high concentration, with a few leading lubricant manufacturers dominating market share. Major players like BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell Plc, and TotalEnergies command a significant portion of the market. Bardahl, Mexicana de Lubricantes S A de C V, Motul, Raloy, and Roshfrans also contribute to a competitive environment. Innovation is driven by a focus on developing advanced formulations, including synthetic and semi-synthetic engine oils, eco-friendly lubricants, and specialized fluids for electric and hybrid vehicles. The Mexican automotive sector's regulatory framework, while evolving, generally supports product quality and safety standards. Substitute products, such as higher mileage vehicles that require less frequent lubrication, pose a minor challenge. End-user trends indicate a growing demand for high-performance, longer-lasting lubricants that enhance fuel efficiency and reduce emissions. Mergers and acquisitions (M&A) activities, while not frequent, have historically played a role in consolidating market positions and expanding product portfolios. The estimated M&A deal count in the historical period (2019-2024) is xx, indicating a preference for organic growth and strategic partnerships. Understanding these dynamics is crucial for navigating the Mexican passenger car lubricant market.

Mexico Passenger Vehicles Lubricants Market Industry Insights & Trends

The Mexico Passenger Vehicles Lubricants Market is poised for significant expansion, driven by a confluence of robust economic growth and an ever-increasing vehicle parc. The market size was an estimated 1,100 Million in 2024 and is projected to reach 1,200 Million by 2025, with a compelling CAGR of 5.5% from 2019 to 2033. This growth trajectory is underpinned by rising disposable incomes and a burgeoning middle class, leading to higher new car sales in Mexico and consequently, increased demand for automotive engine oils, transmission fluids, and other essential lubricants. Technological disruptions are playing a pivotal role, with the accelerating adoption of advanced engine technologies necessitating the use of high-performance, synthetic-based lubricants. The shift towards more fuel-efficient and emission-compliant vehicles further fuels the demand for specialized automotive fluids. Evolving consumer behaviors are also shaping the market; there's a growing awareness among Mexican consumers regarding the importance of regular vehicle maintenance and the use of premium lubricants to extend vehicle lifespan and optimize performance. This trend is particularly noticeable in major urban centers like Mexico City and Guadalajara, where vehicle ownership is high. Furthermore, the increasing popularity of performance and luxury vehicles necessitates the use of specialized lubricants that can withstand higher operating temperatures and pressures, driving innovation in the Mexican lubricant industry. The increasing adoption of electric vehicles (EVs), although nascent, presents a future growth avenue with the introduction of specific e-fluids for electric vehicles. The overall positive outlook for the Mexico automotive aftermarket, including lubricants, indicates a sustained period of growth and opportunity for lubricant suppliers.

Key Markets & Segments Leading Mexico Passenger Vehicles Lubricants Market

Engine Oils are the undisputed leader in the Mexico Passenger Vehicles Lubricants Market, consistently capturing the largest market share due to their ubiquitous application across all internal combustion engine vehicles. This segment's dominance is driven by the sheer volume of passenger cars on Mexican roads, coupled with the inherent need for regular oil changes to maintain engine health and performance.

- Drivers for Engine Oils Dominance:

- Large Vehicle Parc: Mexico boasts a substantial and growing fleet of passenger vehicles, all requiring regular engine oil replenishment.

- Original Equipment Manufacturer (OEM) Recommendations: OEMs widely recommend specific grades and types of engine oils, establishing a clear demand for these products.

- Aftermarket Replenishment: The aftermarket segment for engine oils is substantial, driven by independent repair shops and DIY enthusiasts.

- Technological Advancements: Continuous innovation in engine technology mandates the development of advanced engine oils, such as synthetic and semi-synthetic formulations, to meet higher performance and protection standards.

Transmission & Gear Oils represent another critical segment, experiencing robust growth fueled by the increasing complexity of vehicle transmissions. The rising popularity of automatic and semi-automatic transmissions, alongside the introduction of multi-gear systems, necessitates specialized gear oils that ensure smooth operation and longevity of these vital components. The growth in the Mexican automotive industry, particularly the production and sale of new vehicles, directly correlates with the demand for these fluids.

- Drivers for Transmission & Gear Oils Growth:

- Increasing Automatic Transmission Penetration: A global trend towards automatic transmissions is also evident in Mexico, boosting demand for dedicated transmission fluids.

- Vehicle Durability Requirements: Consumers expect longer vehicle lifespans, driving demand for high-quality gear oils that protect against wear and tear in demanding conditions.

- Performance Enhancements: The pursuit of fuel efficiency and enhanced driving dynamics requires advanced gear oil formulations that reduce friction.

Hydraulic Fluids cater to specific vehicle systems, such as power steering and braking systems, and while their overall market share is smaller than engine oils, their demand is steadily increasing with the proliferation of advanced automotive technologies that rely on hydraulic power.

- Drivers for Hydraulic Fluids Growth:

- Power Steering Systems: The widespread use of power steering in passenger vehicles directly contributes to hydraulic fluid demand.

- Brake Systems: While brake fluid is distinct, certain hydraulic components within the braking system also contribute to the overall demand for hydraulic fluids.

Greases find application in various automotive components like wheel bearings and chassis lubrication. Their demand is relatively stable but is influenced by the overall vehicle production and maintenance cycles.

- Drivers for Greases Growth:

- Chassis Lubrication: Essential for reducing friction and wear in moving parts of the vehicle's chassis.

- Wheel Bearing Lubrication: Crucial for the smooth operation and longevity of wheel bearings.

Mexico Passenger Vehicles Lubricants Market Product Developments

The Mexico Passenger Vehicles Lubricants Market is witnessing significant product innovation, with manufacturers like Motul and Castrol leading the charge. Motul's launch of specific engine oils for classic cars, such as CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, addresses a niche but growing segment of vintage vehicle enthusiasts, showcasing a commitment to diverse automotive needs. Simultaneously, the industry is adapting to the electric vehicle revolution. Castrol's introduction of Castrol ON™, a comprehensive line of e-fluids including e-greases, e-thermal fluids, and e-transmission fluids, highlights a forward-looking approach to cater to the unique lubrication requirements of EVs. These advancements are crucial for maintaining vehicle performance, extending component life, and ensuring efficiency in both traditional and emerging automotive technologies.

Challenges in the Mexico Passenger Vehicles Lubricants Market Market

The Mexico Passenger Vehicles Lubricants Market faces several challenges that impact growth and profitability. Regulatory hurdles, including evolving emissions standards and product registration processes, can create compliance burdens for manufacturers. Supply chain disruptions, exacerbated by global events, can lead to price volatility and availability issues for raw materials and finished products. Intense competitive pressures from both multinational corporations and local players drive down profit margins, necessitating continuous cost optimization and differentiation strategies. Furthermore, the increasing lifespan of modern vehicles and the growing popularity of electric vehicles, which require specialized and potentially lower volumes of traditional lubricants, present long-term strategic challenges. These factors collectively demand adaptability and strategic foresight from market participants.

Forces Driving Mexico Passenger Vehicles Lubricants Market Growth

Several key forces are propelling the growth of the Mexico Passenger Vehicles Lubricants Market. The expanding Mexican automotive industry, characterized by increasing vehicle production and a growing vehicle parc, forms the bedrock of demand. Economic growth and rising disposable incomes in Mexico directly translate to higher new vehicle sales and increased consumer spending on vehicle maintenance, including regular lubricant changes. Technological advancements in engine design and the subsequent demand for high-performance synthetic lubricants and specialized fluids are significant growth accelerators. Furthermore, the growing awareness among consumers regarding the benefits of premium lubricants for enhanced fuel efficiency, reduced emissions, and extended engine life is a critical driver. The regulatory push towards more stringent emission standards also indirectly encourages the use of advanced lubricants that can help vehicles meet these requirements.

Challenges in the Mexico Passenger Vehicles Lubricants Market Market

Long-term growth catalysts for the Mexico Passenger Vehicles Lubricants Market lie in strategic innovation and market expansion. The ongoing transition towards electric vehicles presents both a challenge and a significant opportunity, with the development of specialized e-fluids poised to become a major growth segment. Partnerships and collaborations, such as the one between TotalEnergies and Stellantis, are crucial for driving innovation in lubricant development and securing first-fill recommendations for new vehicle models. Furthermore, the exploration of new market segments, including the increasing demand for lubricants for hybrid vehicles and the potential for expansion into other Latin American markets, offers long-term growth potential. A continued focus on sustainability and the development of eco-friendly lubricant solutions will also be pivotal in navigating future market dynamics.

Emerging Opportunities in Mexico Passenger Vehicles Lubricants Market

Emerging opportunities within the Mexico Passenger Vehicles Lubricants Market are manifold, driven by technological evolution and changing consumer preferences. The burgeoning electric vehicle (EV) market in Mexico, though nascent, represents a significant future growth avenue, demanding specialized e-fluids for thermal management, lubrication, and electrical insulation. The increasing adoption of hybrid vehicles also creates a demand for lubricants compatible with mixed powertrain technologies. Furthermore, the growing demand for high-performance and premium lubricants that enhance fuel efficiency and reduce emissions presents an opportunity for market segmentation and value-added product offerings. The aftermarket segment, particularly for older or classic vehicles, offers niche opportunities for specialized product lines. Finally, an increasing focus on sustainable and biodegradable lubricant solutions aligns with global environmental trends and can open new market segments.

Leading Players in the Mexico Passenger Vehicles Lubricants Market Sector

- Bardahl

- BP PLC (Castrol)

- Chevron Corporation

- ExxonMobil Corporation

- Mexicana de Lubricantes S A de C V

- Motul

- Raloy

- Roshfrans

- Royal Dutch Shell Plc

- TotalEnergie

Key Milestones in Mexico Passenger Vehicles Lubricants Market Industry

- June 2021: TotalEnergies and Stellantis group renewed their partnership for cooperation across different segments. Along with the renewal of partnerships with Peugeot, Citroën, and DS Automobiles, the new collaboration extends to Opel, and Vauxhall as well. This partnership includes the development and innovation of lubricants, first-fill in Stellantis group vehicles, recommendation of Quartz lubricants, and shared usage of charging stations operated by TotalEnergies, among others.

- June 2021: Castrol launched Castrol ON TM, a new line of e-fluids for electric vehicles. It includes e-greases, e-thermal fluids, and e-transmission fluids, all of which are employed in different electrical vehicle applications.

- April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, for classic cars manufactured between the 1970s and 2000s.

Strategic Outlook for Mexico Passenger Vehicles Lubricants Market Market

The strategic outlook for the Mexico Passenger Vehicles Lubricants Market is one of sustained growth and evolving innovation. Key growth accelerators include the continued expansion of the domestic automotive parc, increasing consumer demand for high-performance and fuel-efficient vehicles, and the gradual but significant shift towards electrification. Strategic opportunities lie in developing and marketing specialized lubricants for electric and hybrid vehicles, forging strong partnerships with automotive OEMs for first-fill and recommended lubricants, and enhancing the distribution network to reach a wider consumer base. A focus on premiumization, offering value-added products that provide superior protection, longevity, and environmental benefits, will be crucial for capturing market share and maintaining profitability in this dynamic landscape.

Mexico Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Mexico Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. Mexico

Mexico Passenger Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Mexico Passenger Vehicles Lubricants Market

Mexico Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bardahl

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ExxonMobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mexicana de Lubricantes S A de C V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Motul

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raloy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roshfrans

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Dutch Shell Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bardahl

List of Figures

- Figure 1: Mexico Passenger Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Passenger Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Passenger Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Mexico Passenger Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Mexico Passenger Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Mexico Passenger Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the Mexico Passenger Vehicles Lubricants Market?

Key companies in the market include Bardahl, BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, Mexicana de Lubricantes S A de C V, Motul, Raloy, Roshfrans, Royal Dutch Shell Plc, TotalEnergie.

3. What are the main segments of the Mexico Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 456.42 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2021: TotalEnergies and Stellantis group renewed their partnership for cooperation across different segments. Along with the renewal of partnerships with Peugeot, Citroën, and DS Automobiles, the new collaboration extends to Opel, and Vauxhall as well. This partnership includes the development and innovation of lubricants, first-fill in Stellantis group vehicles, recommendation of Quartz lubricants, and shared usage of charging stations operated by TotalEnergies, among others.June 2021: Castrol launched Castrol ON TM, a new line of e-fluids for electric vehicles. It includes e-greases, e-thermal fluids, and e-transmission fluids, all of which are employed in different electrical vehicle applications.April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, for classic cars manufactured between the 1970s and 2000s.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Mexico Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence