Key Insights

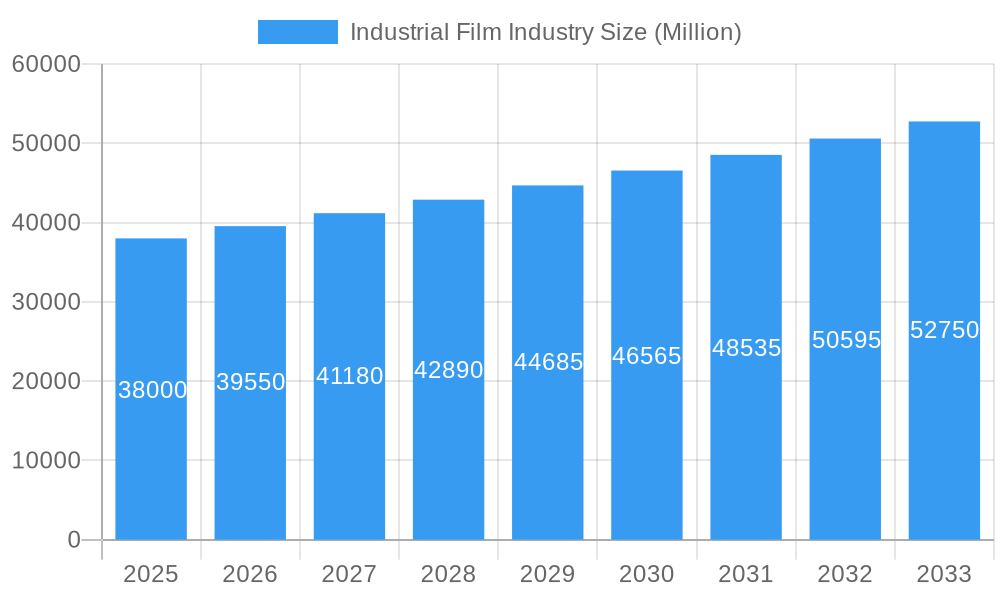

The global Industrial Film Market is poised for robust expansion, projected to reach a substantial market size of approximately $38,000 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00% throughout the study period of 2019-2033. This dynamic growth is primarily fueled by the escalating demand across diverse end-user industries. Agriculture, a significant contributor, benefits from advanced silage films, greenhouse coverings, and crop protection solutions that enhance yield and efficiency. Industrial packaging, a cornerstone of the market, relies heavily on flexible and durable films for safe transportation and storage of goods, driven by the rise in e-commerce and global trade. The building and construction sector is increasingly adopting industrial films for insulation, waterproofing, and protective barriers, contributing to more sustainable and energy-efficient structures. Furthermore, the healthcare industry's need for sterile packaging and specialized films for medical devices further propels market growth.

Industrial Film Industry Market Size (In Billion)

Key drivers for this upward trajectory include technological advancements in film manufacturing, leading to enhanced properties such as increased strength, barrier protection, and recyclability, aligning with growing environmental consciousness. Innovations in material science are also enabling the development of specialized films tailored to specific application requirements. The market is characterized by a diverse range of product types, with Linear Low Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), and High-Density Polyethylene (HDPE) dominating due to their versatility and cost-effectiveness. Polypropylene (PP) and Polyethylene Terephthalate (PET) also hold significant shares owing to their distinct properties, suitable for specific packaging and industrial applications. Emerging economies, particularly in the Asia Pacific region, are expected to be significant growth engines, driven by rapid industrialization, urbanization, and increasing consumer spending on packaged goods. However, the market faces restraints such as fluctuating raw material prices, particularly crude oil, and increasing regulatory scrutiny regarding plastic waste management and sustainability initiatives. The competitive landscape is characterized by the presence of several key players, including Cosmo Films Ltd, Dunmore, and Polyplex, who are actively engaged in research and development, strategic collaborations, and capacity expansions to cater to evolving market demands and maintain a competitive edge.

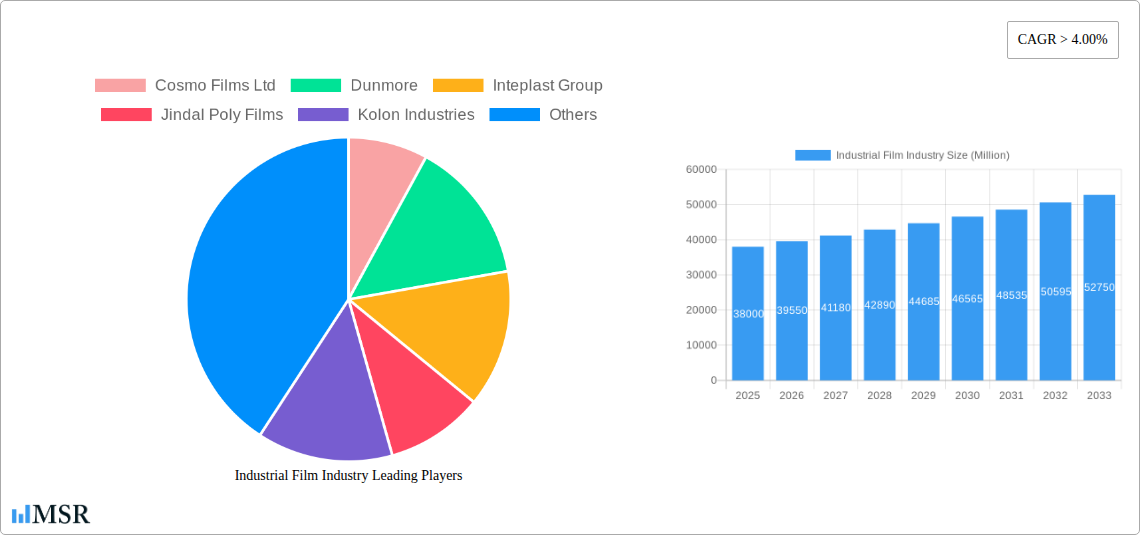

Industrial Film Industry Company Market Share

Industrial Film Industry Market Analysis: A Comprehensive Report (2019–2033)

This in-depth market research report provides a strategic overview of the global Industrial Film Industry, covering market dynamics, key trends, leading segments, and future growth prospects. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers critical insights for stakeholders looking to navigate the evolving landscape of industrial film applications and innovations.

Industrial Film Industry Market Concentration & Dynamics

The global Industrial Film Industry exhibits a dynamic market concentration, characterized by a blend of large-scale, established players and agile innovators. The competitive landscape is shaped by significant investments in research and development, driving continuous product enhancement and the creation of specialized films for diverse applications. Innovation ecosystems are thriving, with advancements in material science and manufacturing processes leading to higher performance films, increased sustainability, and cost-effectiveness. Regulatory frameworks globally are increasingly emphasizing environmental sustainability, influencing material choices and production methods, particularly in regions with stringent recycling and waste management policies. The threat of substitute products, while present in certain niche applications, is largely mitigated by the superior performance and tailored properties of specialized industrial films. End-user trends are a critical determinant of market dynamics, with a growing demand for lightweight, durable, and environmentally friendly packaging solutions across sectors like industrial packaging, agriculture, and healthcare. Mergers and acquisitions (M&A) activities are moderately active as companies seek to consolidate market share, expand their product portfolios, and gain access to new technologies and geographical markets. For instance, the number of M&A deals in the past five years is estimated to be around xx, indicating strategic consolidation and growth. Market share for leading players varies significantly, with the top 5 companies holding an estimated xx% of the global market, showcasing a moderately concentrated yet competitive environment.

Industrial Film Industry Industry Insights & Trends

The Industrial Film Industry is poised for significant growth, driven by a confluence of economic, technological, and societal factors. The projected market size for the Industrial Film Industry is expected to reach $xx Million by 2033, with a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is largely fueled by the escalating demand from the industrial packaging sector, which accounts for a substantial portion of global consumption due to the rise in e-commerce and the need for secure and protective transport of goods. Technological disruptions are playing a pivotal role, with advancements in polymer science leading to the development of thinner, stronger, and more versatile films. Innovations such as enhanced barrier properties for food preservation, improved puncture resistance for heavy-duty applications, and biodegradable or compostable film options are gaining traction. Furthermore, the integration of smart technologies, including active and intelligent packaging films with indicators for spoilage or temperature, is an emerging trend that will redefine product integrity and consumer trust. Evolving consumer behaviors, particularly the heightened awareness of environmental impact, are compelling manufacturers to prioritize sustainable film solutions. This includes a growing preference for recyclable, reusable, and bio-based industrial films, driving innovation in material composition and end-of-life management. The historical period (2019–2024) witnessed steady growth, laying the foundation for the accelerated expansion projected in the coming years. The base year of 2025 serves as a critical benchmark, with the estimated market size for the year being $xx Million. The increasing adoption of industrial films in sectors beyond traditional packaging, such as building and construction for insulation and protective coverings, and in healthcare for sterile packaging and medical devices, further underscores the industry’s expanding reach and potential. The focus on reducing material usage without compromising performance, coupled with advancements in film manufacturing technologies like blown and cast film extrusion, will continue to shape the industry's trajectory.

Key Markets & Segments Leading Industrial Film Industry

The Industrial Film Industry is experiencing robust growth across various segments and end-user industries, with Industrial Packaging emerging as the dominant end-user segment, contributing an estimated xx% to the global market in 2025. This dominance is propelled by the burgeoning e-commerce sector, the increasing global trade, and the inherent need for protective and secure packaging solutions for a wide array of industrial goods. Economic growth and infrastructure development in key regions are significant drivers for this segment.

Linear Low Density Polyethylene (LLDPE) is a leading film type, holding an estimated xx% market share in 2025. Its versatility, excellent puncture resistance, and cost-effectiveness make it a preferred choice for various packaging applications, including stretch films, heavy-duty sacks, and agricultural films.

- Drivers for LLDPE Dominance:

- High tensile strength and elongation properties.

- Cost-effectiveness compared to other high-performance films.

- Versatility in manufacturing flexible packaging.

- Growing demand in stretch wrap and agricultural film markets.

Polyethylene Terephthalate (PET) is another critical segment, particularly in applications requiring high clarity, good barrier properties, and rigidity, such as in food and beverage packaging and certain industrial components. The market for PET films is expected to grow at a CAGR of xx% from 2025 to 2033.

- Drivers for PET Dominance:

- Excellent optical clarity and gloss.

- Good gas and moisture barrier properties.

- High tensile strength and dimensional stability.

- Wide application in food packaging, labels, and industrial tapes.

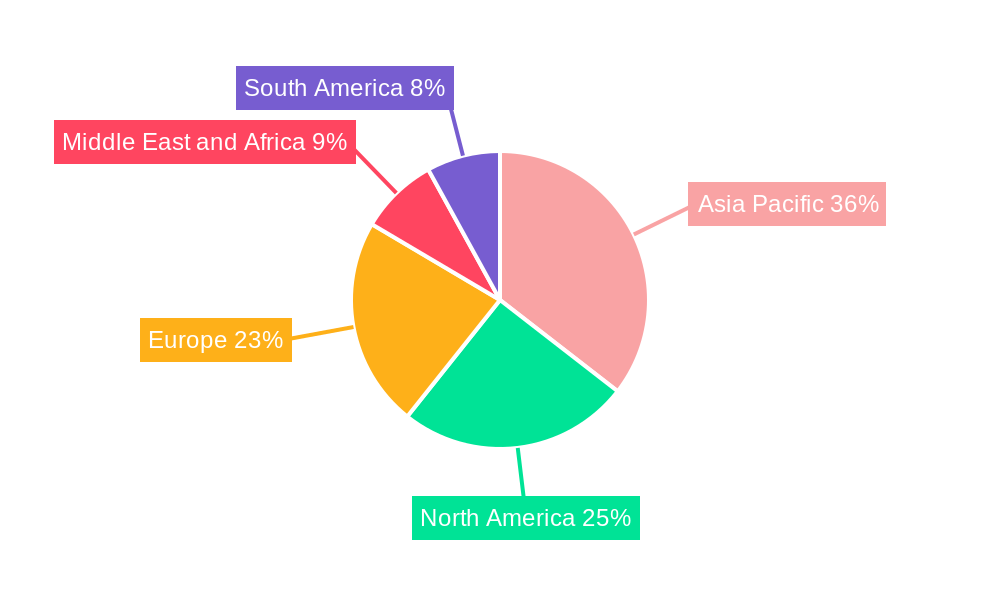

Geographically, Asia-Pacific is the leading region for the Industrial Film Industry, accounting for an estimated xx% of the global market in 2025. This leadership is attributed to rapid industrialization, a burgeoning manufacturing base, expanding infrastructure projects, and a large consumer population across countries like China, India, and Southeast Asian nations. The region's significant contribution to global trade further bolsters the demand for industrial packaging films.

- Drivers for Asia-Pacific Dominance:

- Rapid economic growth and increasing disposable incomes.

- Significant investments in manufacturing and infrastructure.

- Growth of the e-commerce and logistics sectors.

- Favorable government policies supporting industrial development.

The Building & Construction end-user industry is also a significant growth area, driven by global urbanization and the demand for protective films for insulation, moisture barriers, and temporary surface protection during construction projects. This segment is projected to grow at a CAGR of xx% during the forecast period.

- Drivers for Building & Construction Growth:

- Global urbanization and increased construction activities.

- Demand for durable and weather-resistant building materials.

- Need for protective films during construction and renovation.

Industrial Film Industry Product Developments

Product innovation in the Industrial Film Industry is centered on enhancing performance, sustainability, and functionality. Advancements include the development of high-barrier films with improved oxygen and moisture resistance for extended product shelf-life in food and pharmaceutical packaging. The industry is also witnessing a surge in biodegradable and compostable films, driven by environmental regulations and consumer demand for eco-friendly solutions. Smart films incorporating active packaging technologies, such as antimicrobial properties or freshness indicators, are emerging as key differentiators. Furthermore, the focus on lightweighting and increased strength in films is reducing material consumption and transportation costs, offering competitive advantages across various applications, from heavy-duty industrial wrapping to specialized medical films.

Challenges in the Industrial Film Industry Market

The Industrial Film Industry faces several challenges that impact market growth and profitability. Fluctuating raw material prices, primarily driven by petrochemical feedstock costs, can lead to significant price volatility and impact profit margins for manufacturers. Stringent environmental regulations concerning plastic waste and emissions are compelling companies to invest in sustainable alternatives and advanced recycling technologies, requiring substantial capital expenditure. Intense competition among a large number of players, both global and regional, puts pressure on pricing and necessitates continuous innovation to maintain market share. Furthermore, supply chain disruptions, as experienced in recent years, can affect the availability and timely delivery of raw materials and finished products. The estimated impact of these challenges on market growth is approximately xx% reduction in potential expansion.

Forces Driving Industrial Film Industry Growth

The Industrial Film Industry is propelled by a potent combination of technological advancements, economic expansion, and evolving regulatory landscapes. The continuous innovation in polymer science and manufacturing processes leads to the development of high-performance films with enhanced properties like superior strength, improved barrier capabilities, and greater sustainability. The robust growth of key end-user industries, particularly industrial packaging driven by e-commerce and global trade, and the building & construction sector fueled by urbanization, are major demand catalysts. Additionally, increasing government initiatives promoting recycling, the circular economy, and the use of sustainable materials are creating new market opportunities and driving the adoption of eco-friendly industrial films.

Challenges in the Industrial Film Industry Market

Beyond immediate challenges, long-term growth catalysts for the Industrial Film Industry lie in strategic innovation and market expansion. The development of advanced biodegradable and compostable films that meet performance demands and compete on cost will be crucial for long-term sustainability. Partnerships between raw material suppliers, film manufacturers, and end-users will foster collaborative innovation and accelerate the adoption of new technologies. Expanding into emerging geographical markets with rapidly industrializing economies and addressing the growing demand for specialized films in sectors like renewable energy and electronics represent significant long-term growth opportunities.

Emerging Opportunities in Industrial Film Industry

The Industrial Film Industry is ripe with emerging opportunities, particularly in the realm of sustainable and functional films. The increasing global focus on reducing plastic waste presents a significant opportunity for the development and widespread adoption of biodegradable, compostable, and recyclable industrial films. Advancements in nanotechnology are paving the way for the creation of "smart" films with embedded functionalities, such as self-healing properties, antimicrobial coatings, or enhanced UV protection, catering to niche but high-value applications. The growing demand for specialized films in the renewable energy sector, for applications like solar panel protection and wind turbine blades, and in the electronics industry for insulation and protective packaging, represents a significant avenue for diversification and growth.

Leading Players in the Industrial Film Industry Sector

- Cosmo Films Ltd

- Dunmore

- Inteplast Group

- Jindal Poly Films

- Kolon Industries

- Mitsui Chemicals Tohcello Inc

- Polyplex

- Raven Industries Inc

- Saint-Gobain Performance Plastics

- Sigma Plastics Group

- Solvay

- Toyobo Co LTD

- Treofan Group

- Trioplast Industrier AB

Key Milestones in Industrial Film Industry Industry

- 2019: Launch of new bio-based LLDPE film alternatives by several key manufacturers, responding to growing environmental concerns.

- 2020: Increased demand for industrial films for medical packaging and personal protective equipment due to the global pandemic.

- 2021: Significant investments in R&D for advanced barrier films to enhance food preservation and reduce spoilage.

- 2022: Adoption of enhanced recycling technologies and partnerships for closed-loop systems by major players.

- 2023: Introduction of thinner, yet stronger, industrial films with improved performance metrics, driving material efficiency.

- 2024: Growing emphasis on the integration of digital technologies for supply chain traceability and smart packaging solutions.

Strategic Outlook for Industrial Film Industry Market

The strategic outlook for the Industrial Film Industry is exceptionally positive, characterized by sustained growth driven by innovation and expanding applications. Key growth accelerators include the relentless pursuit of sustainable film solutions, including biodegradable and recycled content films, which are increasingly becoming a prerequisite for market access and consumer acceptance. Further investment in R&D for high-performance, specialized films catering to emerging sectors like electric vehicles, advanced electronics, and renewable energy will unlock new revenue streams. Strategic collaborations and partnerships across the value chain will be crucial for accelerating product development, market penetration, and the establishment of circular economy models, ensuring long-term profitability and environmental responsibility.

Industrial Film Industry Segmentation

-

1. Type

- 1.1. Linear Low Density Polyethylene (LLDPE)

- 1.2. Low-Density Polyethylene (LDPE)

- 1.3. High-Density Polyethylene (HDPE)

- 1.4. Polyethylene Terephthalate (PET)

- 1.5. Polypropylene (PP)

- 1.6. Polyvinyl Chloride (PVC)

- 1.7. Polyamide

- 1.8. Others

-

2. End-user Industry

- 2.1. Agriculture

- 2.2. Industrial Packaging

- 2.3. Building & Construction

- 2.4. Healthcare

- 2.5. Transportation

- 2.6. Others

Industrial Film Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Industrial Film Industry Regional Market Share

Geographic Coverage of Industrial Film Industry

Industrial Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Packaging in Food Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Packaging in Food Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing demand from Agriculture Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Linear Low Density Polyethylene (LLDPE)

- 5.1.2. Low-Density Polyethylene (LDPE)

- 5.1.3. High-Density Polyethylene (HDPE)

- 5.1.4. Polyethylene Terephthalate (PET)

- 5.1.5. Polypropylene (PP)

- 5.1.6. Polyvinyl Chloride (PVC)

- 5.1.7. Polyamide

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Agriculture

- 5.2.2. Industrial Packaging

- 5.2.3. Building & Construction

- 5.2.4. Healthcare

- 5.2.5. Transportation

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Linear Low Density Polyethylene (LLDPE)

- 6.1.2. Low-Density Polyethylene (LDPE)

- 6.1.3. High-Density Polyethylene (HDPE)

- 6.1.4. Polyethylene Terephthalate (PET)

- 6.1.5. Polypropylene (PP)

- 6.1.6. Polyvinyl Chloride (PVC)

- 6.1.7. Polyamide

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Agriculture

- 6.2.2. Industrial Packaging

- 6.2.3. Building & Construction

- 6.2.4. Healthcare

- 6.2.5. Transportation

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Linear Low Density Polyethylene (LLDPE)

- 7.1.2. Low-Density Polyethylene (LDPE)

- 7.1.3. High-Density Polyethylene (HDPE)

- 7.1.4. Polyethylene Terephthalate (PET)

- 7.1.5. Polypropylene (PP)

- 7.1.6. Polyvinyl Chloride (PVC)

- 7.1.7. Polyamide

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Agriculture

- 7.2.2. Industrial Packaging

- 7.2.3. Building & Construction

- 7.2.4. Healthcare

- 7.2.5. Transportation

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Linear Low Density Polyethylene (LLDPE)

- 8.1.2. Low-Density Polyethylene (LDPE)

- 8.1.3. High-Density Polyethylene (HDPE)

- 8.1.4. Polyethylene Terephthalate (PET)

- 8.1.5. Polypropylene (PP)

- 8.1.6. Polyvinyl Chloride (PVC)

- 8.1.7. Polyamide

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Agriculture

- 8.2.2. Industrial Packaging

- 8.2.3. Building & Construction

- 8.2.4. Healthcare

- 8.2.5. Transportation

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Linear Low Density Polyethylene (LLDPE)

- 9.1.2. Low-Density Polyethylene (LDPE)

- 9.1.3. High-Density Polyethylene (HDPE)

- 9.1.4. Polyethylene Terephthalate (PET)

- 9.1.5. Polypropylene (PP)

- 9.1.6. Polyvinyl Chloride (PVC)

- 9.1.7. Polyamide

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Agriculture

- 9.2.2. Industrial Packaging

- 9.2.3. Building & Construction

- 9.2.4. Healthcare

- 9.2.5. Transportation

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Linear Low Density Polyethylene (LLDPE)

- 10.1.2. Low-Density Polyethylene (LDPE)

- 10.1.3. High-Density Polyethylene (HDPE)

- 10.1.4. Polyethylene Terephthalate (PET)

- 10.1.5. Polypropylene (PP)

- 10.1.6. Polyvinyl Chloride (PVC)

- 10.1.7. Polyamide

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Agriculture

- 10.2.2. Industrial Packaging

- 10.2.3. Building & Construction

- 10.2.4. Healthcare

- 10.2.5. Transportation

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cosmo Films Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dunmore

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inteplast Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jindal Poly Films

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kolon Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsui Chemicals Tohcello Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Polyplex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Raven Industries Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saint-Gobain Performance Plastics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sigma Plastics Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Solvay

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Toyobo Co LTD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Treofan Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Trioplast Industrier AB*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Cosmo Films Ltd

List of Figures

- Figure 1: Global Industrial Film Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Industrial Film Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Film Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Industrial Film Industry?

Key companies in the market include Cosmo Films Ltd, Dunmore, Inteplast Group, Jindal Poly Films, Kolon Industries, Mitsui Chemicals Tohcello Inc, Polyplex, Raven Industries Inc, Saint-Gobain Performance Plastics, Sigma Plastics Group, Solvay, Toyobo Co LTD, Treofan Group, Trioplast Industrier AB*List Not Exhaustive.

3. What are the main segments of the Industrial Film Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Packaging in Food Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing demand from Agriculture Industry.

7. Are there any restraints impacting market growth?

; Increasing Demand for Packaging in Food Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Film Industry?

To stay informed about further developments, trends, and reports in the Industrial Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence