Key Insights

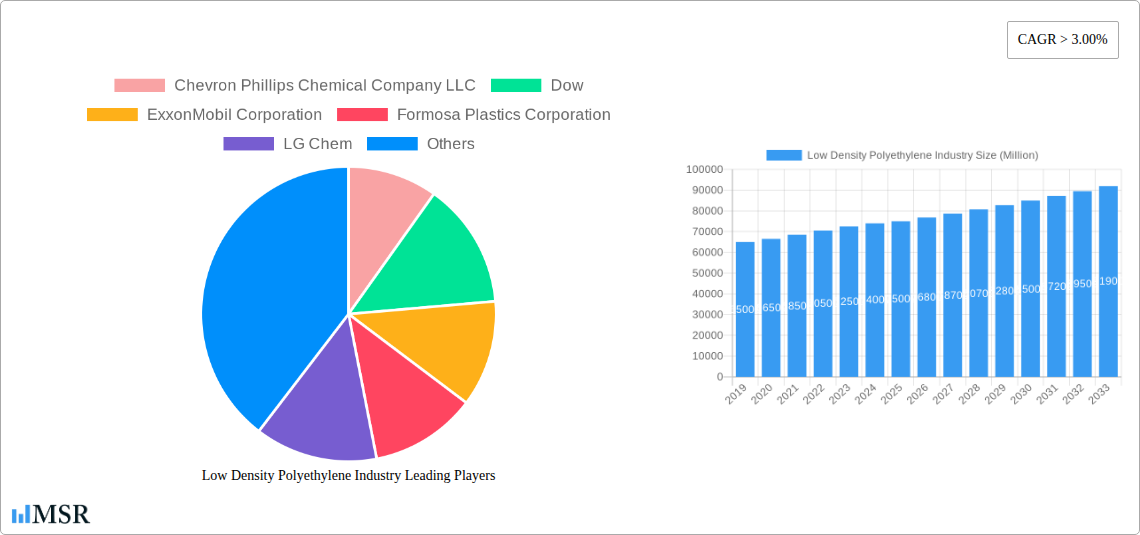

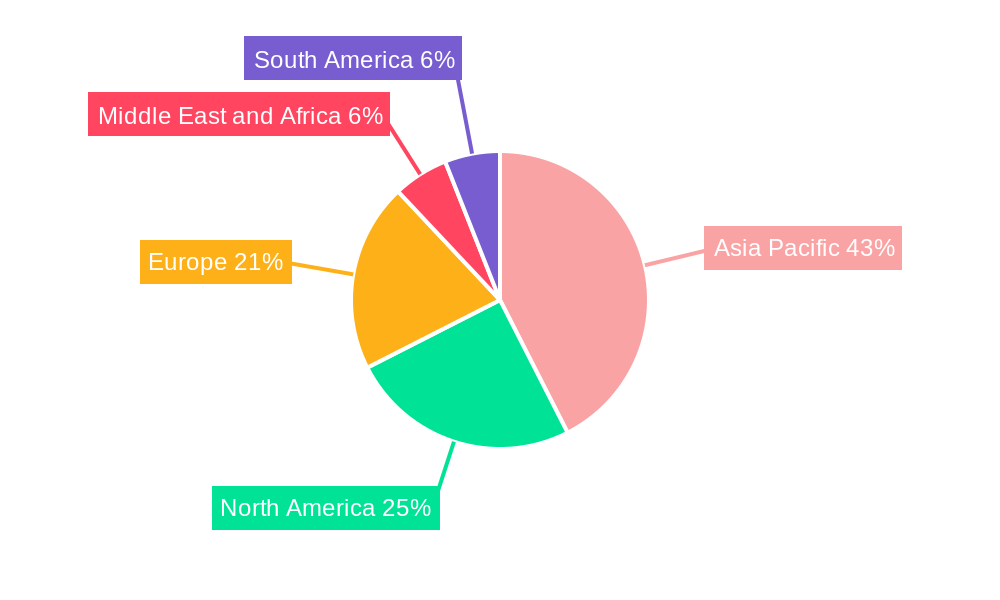

The global Low Density Polyethylene (LDPE) market is forecast to reach $49.3 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 4.4% through 2033. Driven by substantial demand from the packaging sector, the market benefits from LDPE's inherent flexibility, clarity, and moisture barrier properties. The expansion of e-commerce and the persistent need for effective food and beverage packaging are significant growth catalysts. Additionally, the construction industry's reliance on LDPE for protective films, piping, and insulation further stimulates market vitality. The Asia Pacific region, led by China and India, is anticipated to spearhead this growth, fueled by rapid industrialization, rising consumer spending power, and substantial infrastructure investments.

Low Density Polyethylene Industry Market Size (In Billion)

Despite a positive growth outlook, the LDPE market faces certain challenges. Growing environmental concerns and stricter regulations on plastic waste are encouraging the adoption of sustainable alternatives and recycled materials, potentially impacting virgin LDPE production. Volatility in crude oil prices, a key feedstock, also presents a risk, influencing production costs and overall market competitiveness. However, ongoing product innovation, including the development of enhanced barrier films and specialized LDPE grades, coupled with advancements in recycling technologies, are expected to offset these constraints. Leading companies such as Dow, ExxonMobil Corporation, and LyondellBasell Industries are actively investing in R&D, expanding manufacturing capabilities, and pursuing strategic alliances to adapt to evolving market demands and maintain a competitive advantage.

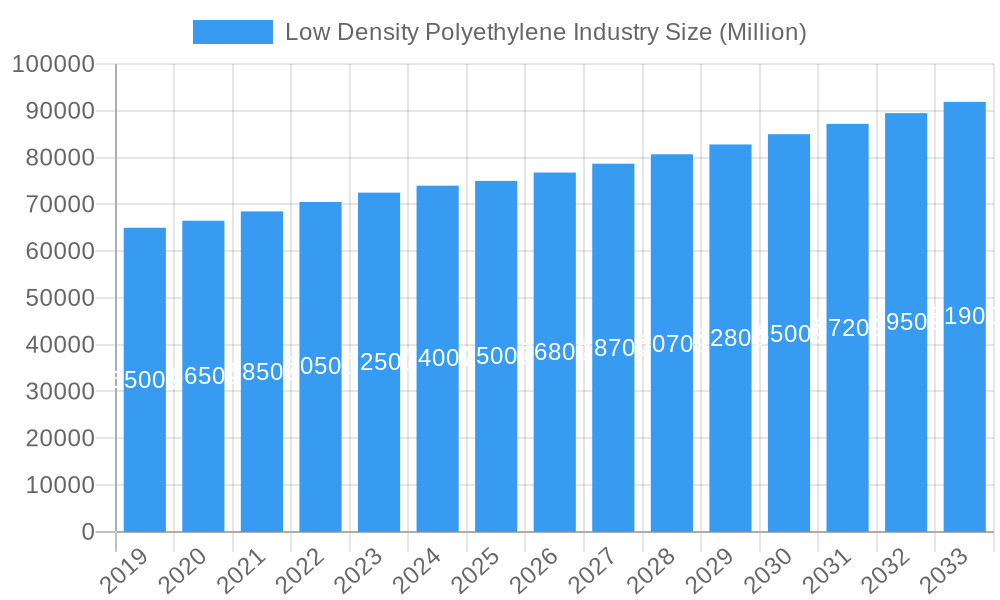

Low Density Polyethylene Industry Company Market Share

Global Low Density Polyethylene (LDPE) Market Analysis: Trends, Size, and Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the dynamic Low Density Polyethylene (LDPE) market, a fundamental material in global manufacturing. It offers critical insights into the LDPE market size, CAGR, and future projections, empowering chemical manufacturers, plastic converters, packaging companies, and investors with essential data for strategic planning. Covering the historical period 2019–2024 and a detailed forecast period 2025–2033, this report delivers a definitive analysis of LDPE production, applications, and global market trends. Explore key segments including Blow Molded LDPE, LDPE Films, Injection Molded LDPE, LDPE Sheets, and Other LDPE products, serving vital end-user industries such as Agriculture, Electrical and Electronics, Packaging, Construction, and Other End-user Industries.

Low Density Polyethylene Industry Market Concentration & Dynamics

The Low Density Polyethylene (LDPE) industry exhibits a moderate to high market concentration, with key players like Chevron Phillips Chemical Company LLC, Dow, ExxonMobil Corporation, Formosa Plastics Corporation, LG Chem, LyondellBasell Industries Holdings BV, NOVA Chemicals Corporate, PetroChina, Reliance Industries Limited, and Westlake Corporation dominating global LDPE production capacity. Innovation ecosystems are driven by advancements in LDPE manufacturing technologies, sustainability initiatives, and the development of specialized LDPE grades for niche applications. Regulatory frameworks, particularly concerning environmental impact and recyclability, are increasingly shaping LDPE market dynamics. The threat of substitute products, such as other polyolefins and bio-based alternatives, is present but currently limited by cost-effectiveness and performance characteristics of conventional LDPE. End-user trends, such as the growing demand for flexible packaging and sustainable solutions, are significant growth drivers. Mergers and acquisitions (M&A) activities, exemplified by LyondellBasell's strategic investments in the circular economy, are actively consolidating market share and expanding capabilities in recycled LDPE. The market is characterized by significant capital investment in LDPE plants and a focus on operational efficiency to maintain competitive pricing.

Low Density Polyethylene Industry Industry Insights & Trends

The global Low Density Polyethylene (LDPE) market is experiencing robust growth, projected to reach a significant LDPE market size by the end of the forecast period 2025–2033. The Compound Annual Growth Rate (CAGR) is expected to be substantial, fueled by a confluence of factors including escalating demand from the packaging sector, driven by e-commerce growth and the need for protective and flexible solutions. Advancements in LDPE technology are enabling the production of higher-performance grades with improved properties, expanding their application scope. Consumer behavior is increasingly favoring convenience and product preservation, directly boosting the demand for LDPE films and flexible packaging solutions. Furthermore, the construction industry's reliance on LDPE for insulation, vapor barriers, and protective sheeting contributes to market expansion. Technological disruptions, such as the development of more efficient polymerization processes and innovative recycling technologies, are playing a crucial role in shaping the LDPE landscape. The electrical and electronics sector also presents a growing market for LDPE due to its excellent dielectric properties, utilized in wire and cable insulation. The overall trend points towards increased consumption of versatile and cost-effective LDPE materials across a broad spectrum of applications.

Key Markets & Segments Leading Low Density Polyethylene Industry

The packaging segment stands as the undisputed leader within the Low Density Polyethylene (LDPE) industry, consistently driving the highest demand for LDPE materials. This dominance is primarily attributed to the pervasive need for flexible, durable, and cost-effective packaging solutions across various consumer and industrial goods. Within this segment, LDPE films are paramount, used extensively in food packaging, shrink wraps, stretch films, and carrier bags. The Asia-Pacific region, particularly China and India, emerges as a key market for LDPE consumption, propelled by rapid economic growth, a burgeoning middle class, and significant expansion in manufacturing and retail sectors.

Dominant Segments and their Drivers:

Product Type:

- Films: The primary driver is the vast and growing food and beverage packaging industry, along with the e-commerce boom necessitating protective shipping materials. The demand for flexible packaging solutions that offer extended shelf life and product protection is a key contributor.

- Injection Molded: Significant demand stems from the consumer goods sector for products like caps, closures, and housewares, and from the electrical and electronics industry for components and housings.

- Blow Molded: Essential for creating bottles and containers for consumer products, including household chemicals and personal care items, driven by convenience and product safety requirements.

- Sheets: Crucial for the construction industry (e.g., damp-proof membranes, protective coverings) and for agricultural applications (e.g., greenhouse films, mulching films), supported by infrastructure development and agricultural modernization.

End-user Industry:

- Packaging: Unquestionably the largest consumer of LDPE, driven by global trade, retail growth, and the need for efficient product protection and preservation.

- Agriculture: Increasing demand for greenhouse films, mulch films, and irrigation systems to enhance crop yields and water management, especially in regions focusing on food security.

- Construction: Use in roofing membranes, vapor barriers, protective sheeting, and pipe linings, benefiting from infrastructure development and urbanization trends.

- Electrical and Electronics: Growing demand for LDPE's insulating properties in cables, wires, and electronic components, driven by the expansion of the digital economy and renewable energy infrastructure.

The interplay of these segments, supported by favorable economic conditions and evolving consumer preferences for convenient and safe products, solidifies LDPE's position as a critical material in modern industry.

Low Density Polyethylene Industry Product Developments

Recent product developments in the Low Density Polyethylene (LDPE) industry are heavily focused on enhancing sustainability and performance. Innovations include the development of higher-strength LDPE films with reduced material usage, improved barrier properties for extended product shelf life, and specialized grades for advanced manufacturing processes. The increasing emphasis on the circular economy has spurred advancements in recycled LDPE (rLDPE), with improved processing techniques yielding higher quality materials suitable for a wider range of applications. Furthermore, the exploration of bio-based and biodegradable alternatives continues, though traditional LDPE maintains its stronghold due to cost-effectiveness and established performance.

Challenges in the Low Density Polyethylene Industry Market

The Low Density Polyethylene (LDPE) market faces several challenges that impact its growth trajectory. Paramount among these are escalating environmental concerns and regulatory pressures surrounding plastic waste, leading to increased scrutiny and the imposition of stricter recycling mandates and single-use plastic bans in various regions. Fluctuations in raw material prices, particularly crude oil and natural gas, directly affect LDPE production costs and pricing stability. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can hinder the timely delivery of LDPE resins and finished products. Intense competition from alternative materials and other polyolefins also presents a continuous challenge, requiring manufacturers to innovate and differentiate their offerings. The cost of implementing advanced recycling technologies and the development of robust collection and sorting infrastructure for LDPE waste remain significant hurdles to achieving a truly circular economy.

Forces Driving Low Density Polyethylene Industry Growth

Several powerful forces are propelling the Low Density Polyethylene (LDPE) industry forward. The relentless growth of the global packaging sector, fueled by e-commerce expansion and an increasing demand for convenient, protective, and shelf-stable consumer goods, is a primary driver. Economic development in emerging markets is leading to increased consumption of manufactured goods that rely on LDPE for their packaging and components. Technological advancements in LDPE production processes are enhancing efficiency and enabling the creation of specialized grades with superior properties, expanding their application reach. Furthermore, government initiatives promoting infrastructure development, particularly in the construction sector, directly boost demand for LDPE in building materials. The inherent versatility, durability, and cost-effectiveness of LDPE continue to make it a preferred material for a wide array of applications.

Challenges in the Low Density Polyethylene Industry Market

The Low Density Polyethylene (LDPE) industry is poised for sustained long-term growth, driven by fundamental market dynamics and ongoing innovation. Key growth catalysts include the continuous evolution of the packaging industry, which requires increasingly sophisticated and sustainable material solutions. The expansion of the electrical and electronics sector, driven by digitalization and the growing demand for advanced consumer electronics and renewable energy infrastructure, presents significant opportunities for LDPE's insulating properties. Furthermore, the ongoing urbanization and infrastructure development across emerging economies will continue to fuel demand for LDPE in construction applications. Strategic partnerships aimed at developing advanced recycling technologies and creating closed-loop systems are crucial for addressing environmental concerns and ensuring the long-term viability of LDPE as a sustainable material choice.

Emerging Opportunities in Low Density Polyethylene Industry

Emerging opportunities within the Low Density Polyethylene (LDPE) industry are largely centered around sustainability and specialized applications. The growing global push for a circular economy is creating significant demand for high-quality recycled LDPE (rLDPE), presenting lucrative opportunities for companies investing in advanced recycling technologies and collection infrastructure. The development of biodegradable and compostable LDPE alternatives, while still nascent, represents a future growth frontier driven by consumer preference for eco-friendly products. Furthermore, advancements in material science are enabling the creation of high-performance LDPE grades with enhanced properties, opening doors to new applications in specialized packaging for sensitive goods, advanced medical devices, and sophisticated agricultural films. The increasing focus on lightweighting in the automotive and transportation sectors also presents opportunities for LDPE's use in interior components and protective films.

Leading Players in the Low Density Polyethylene Industry Sector

- Chevron Phillips Chemical Company LLC

- Dow

- ExxonMobil Corporation

- Formosa Plastics Corporation

- LG Chem

- LyondellBasell Industries Holdings BV

- NOVA Chemicals Corporate

- PetroChina

- Reliance Industries Limited

- Westlake Corporation

Key Milestones in Low Density Polyethylene Industry Industry

- October 2023: LyondellBasell acquired a 50% stake in Rodepa Vastgoed BV, the holding company of De Paauw Sustainable Resources (DPSR). DPSR specializes in sourcing, processing, and trading plastic packaging waste, transforming it into recycled polypropylene (PP) and low-density polyethylene (LDPE) materials. This partnership enables LyondellBasell to broaden its CirculenRecover portfolio of mechanically recycled polymers, enhancing the solutions offered to its customers.

- November 2022: Shell Chemical Appalachia LLC, a subsidiary of Shell PLC, commenced operations at its Pennsylvania Chemical project, known as Shell Polymers Monaca (SPM). This facility marks the Northeastern United States' inaugural major polyethylene manufacturing complex, boasting a designed annual output of 1.6 million tonnes. The commencement of operations at Shell Polymers Monaca underscored Shell's commitment to expanding its chemicals business, aligning with its overarching Powering Progress strategy.

- January 2022: ExxonMobil and SABIC launched a new venture, Gulf Coast Growth Ventures, by setting up a manufacturing facility in San Patricio County, Texas. The facility was planned to house two polyethylene units, boasting a combined production capacity of 1.3 million tonnes annually. This strategic move positioned the companies to cater to the rising global demand for performance products and underscored their significant investment in the US Gulf Coast.

Strategic Outlook for Low Density Polyethylene Industry Market

The strategic outlook for the Low Density Polyethylene (LDPE) industry is characterized by a strong emphasis on sustainability, innovation, and market expansion. Growth accelerators will include the continued integration of recycled LDPE (rLDPE) into value chains, driven by regulatory mandates and corporate sustainability goals. Investments in advanced LDPE recycling technologies and the development of robust collection and sorting infrastructure will be critical for unlocking this potential. Furthermore, the ongoing demand for high-performance LDPE grades in specialized applications, such as advanced packaging and durable consumer goods, will fuel innovation and market diversification. Strategic partnerships and collaborations across the value chain, from resin producers to converters and end-users, will be instrumental in navigating market complexities and capitalizing on emerging opportunities, ensuring the continued relevance and growth of the LDPE market.

Low Density Polyethylene Industry Segmentation

-

1. Product Type

- 1.1. Blow Molded

- 1.2. Films

- 1.3. Injection Molded

- 1.4. Sheets

- 1.5. Other Pr

-

2. End-user Industry

- 2.1. Agriculture

- 2.2. Electrical and Electronics

- 2.3. Packaging

- 2.4. Construction

- 2.5. Other En

Low Density Polyethylene Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Qatar

- 5.3. United Arab Emirates

- 5.4. Nigeria

- 5.5. Egypt

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Low Density Polyethylene Industry Regional Market Share

Geographic Coverage of Low Density Polyethylene Industry

Low Density Polyethylene Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Packaging Industry; Surging Demand for Film and Sheets; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from the Packaging Industry; Surging Demand for Film and Sheets; Other Drivers

- 3.4. Market Trends

- 3.4.1. Packaging Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Density Polyethylene Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Blow Molded

- 5.1.2. Films

- 5.1.3. Injection Molded

- 5.1.4. Sheets

- 5.1.5. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Agriculture

- 5.2.2. Electrical and Electronics

- 5.2.3. Packaging

- 5.2.4. Construction

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Low Density Polyethylene Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Blow Molded

- 6.1.2. Films

- 6.1.3. Injection Molded

- 6.1.4. Sheets

- 6.1.5. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Agriculture

- 6.2.2. Electrical and Electronics

- 6.2.3. Packaging

- 6.2.4. Construction

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Low Density Polyethylene Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Blow Molded

- 7.1.2. Films

- 7.1.3. Injection Molded

- 7.1.4. Sheets

- 7.1.5. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Agriculture

- 7.2.2. Electrical and Electronics

- 7.2.3. Packaging

- 7.2.4. Construction

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Low Density Polyethylene Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Blow Molded

- 8.1.2. Films

- 8.1.3. Injection Molded

- 8.1.4. Sheets

- 8.1.5. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Agriculture

- 8.2.2. Electrical and Electronics

- 8.2.3. Packaging

- 8.2.4. Construction

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Low Density Polyethylene Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Blow Molded

- 9.1.2. Films

- 9.1.3. Injection Molded

- 9.1.4. Sheets

- 9.1.5. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Agriculture

- 9.2.2. Electrical and Electronics

- 9.2.3. Packaging

- 9.2.4. Construction

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Low Density Polyethylene Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Blow Molded

- 10.1.2. Films

- 10.1.3. Injection Molded

- 10.1.4. Sheets

- 10.1.5. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Agriculture

- 10.2.2. Electrical and Electronics

- 10.2.3. Packaging

- 10.2.4. Construction

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chevron Phillips Chemical Company LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dow

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ExxonMobil Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Formosa Plastics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LG Chem

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LyondellBasell Industries Holdings BV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NOVA Chemicals Corporate

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PetroChina

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Reliance Industries Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Westlake Corporation*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Chevron Phillips Chemical Company LLC

List of Figures

- Figure 1: Global Low Density Polyethylene Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Low Density Polyethylene Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Low Density Polyethylene Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Low Density Polyethylene Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Low Density Polyethylene Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Low Density Polyethylene Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Low Density Polyethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Low Density Polyethylene Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: North America Low Density Polyethylene Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Low Density Polyethylene Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Low Density Polyethylene Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Low Density Polyethylene Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Low Density Polyethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Low Density Polyethylene Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Low Density Polyethylene Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Low Density Polyethylene Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Low Density Polyethylene Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Low Density Polyethylene Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Low Density Polyethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Low Density Polyethylene Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Low Density Polyethylene Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Low Density Polyethylene Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Low Density Polyethylene Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Low Density Polyethylene Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Low Density Polyethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Low Density Polyethylene Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Low Density Polyethylene Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Low Density Polyethylene Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Low Density Polyethylene Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Low Density Polyethylene Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Low Density Polyethylene Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Low Density Polyethylene Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Low Density Polyethylene Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Low Density Polyethylene Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Low Density Polyethylene Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Low Density Polyethylene Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Low Density Polyethylene Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Thailand Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Low Density Polyethylene Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Low Density Polyethylene Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Low Density Polyethylene Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Low Density Polyethylene Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Low Density Polyethylene Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Low Density Polyethylene Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: NORDIC Countries Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Turkey Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Low Density Polyethylene Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Low Density Polyethylene Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Low Density Polyethylene Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Colombia Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Global Low Density Polyethylene Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Global Low Density Polyethylene Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Low Density Polyethylene Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Qatar Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Arab Emirates Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Nigeria Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Egypt Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Africa Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Low Density Polyethylene Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Density Polyethylene Industry?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Low Density Polyethylene Industry?

Key companies in the market include Chevron Phillips Chemical Company LLC, Dow, ExxonMobil Corporation, Formosa Plastics Corporation, LG Chem, LyondellBasell Industries Holdings BV, NOVA Chemicals Corporate, PetroChina, Reliance Industries Limited, Westlake Corporation*List Not Exhaustive.

3. What are the main segments of the Low Density Polyethylene Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Packaging Industry; Surging Demand for Film and Sheets; Other Drivers.

6. What are the notable trends driving market growth?

Packaging Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand from the Packaging Industry; Surging Demand for Film and Sheets; Other Drivers.

8. Can you provide examples of recent developments in the market?

October 2023: LyondellBasell acquired a 50% stake in Rodepa Vastgoed BV, the holding company of De Paauw Sustainable Resources (DPSR). DPSR specializes in sourcing, processing, and trading plastic packaging waste, transforming it into recycled polypropylene (PP) and low-density polyethylene (LDPE) materials. This partnership enables LyondellBasell to broaden its CirculenRecover portfolio of mechanically recycled polymers, enhancing the solutions offered to its customers.November 2022: Shell Chemical Appalachia LLC, a subsidiary of Shell PLC, commenced operations at its Pennsylvania Chemical project, known as Shell Polymers Monaca (SPM). This facility marks the Northeastern United States' inaugural major polyethylene manufacturing complex, boasting a designed annual output of 1.6 million tonnes. The commencement of operations at Shell Polymers Monaca underscored Shell's commitment to expanding its chemicals business, aligning with its overarching Powering Progress strategy.January 2022: ExxonMobil and SABIC launched a new venture, Gulf Coast Growth Ventures, by setting up a manufacturing facility in San Patricio County, Texas. The facility was planned to house two polyethylene units, boasting a combined production capacity of 1.3 million tonnes annually. This strategic move positioned the companies to cater to the rising global demand for performance products and underscored their significant investment in the US Gulf Coast.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Density Polyethylene Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Density Polyethylene Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Density Polyethylene Industry?

To stay informed about further developments, trends, and reports in the Low Density Polyethylene Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence