Key Insights

The Mexico paints and coatings market is projected for substantial growth, estimated to reach 2.2 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. Key growth drivers include a robust construction sector, fueled by residential and commercial development, and a resurgent automotive industry. Increased infrastructure investment and rising middle-class demand for enhanced living standards and aesthetics are also significant contributors. The protective coatings segment is experiencing heightened demand for asset durability in industrial, marine, and automotive applications, with a focus on advanced finishes and corrosion resistance. The market is also witnessing a growing preference for eco-friendly, low-VOC solutions, driving innovation in water-borne and powder coating technologies.

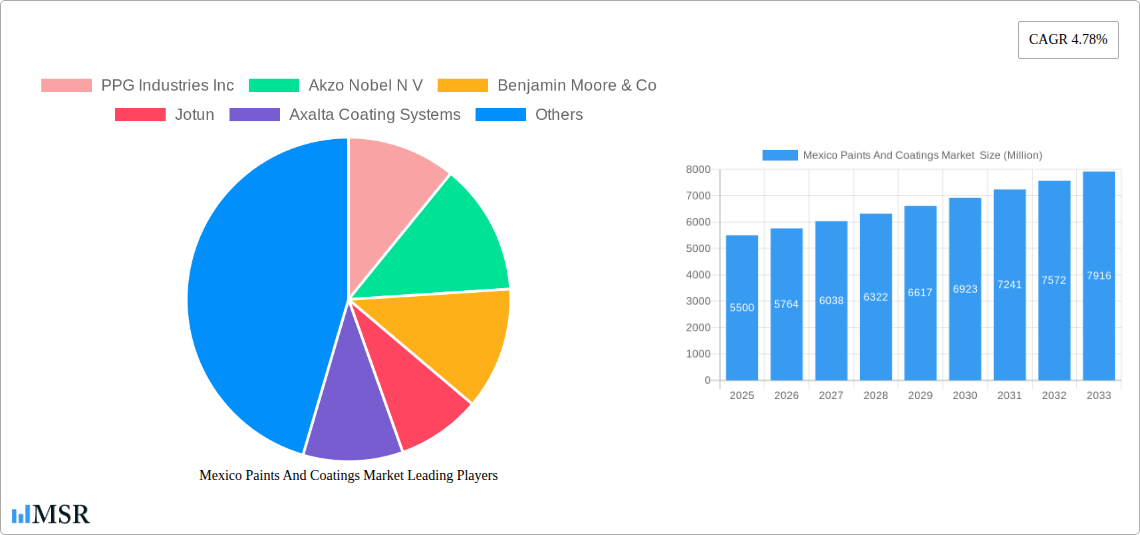

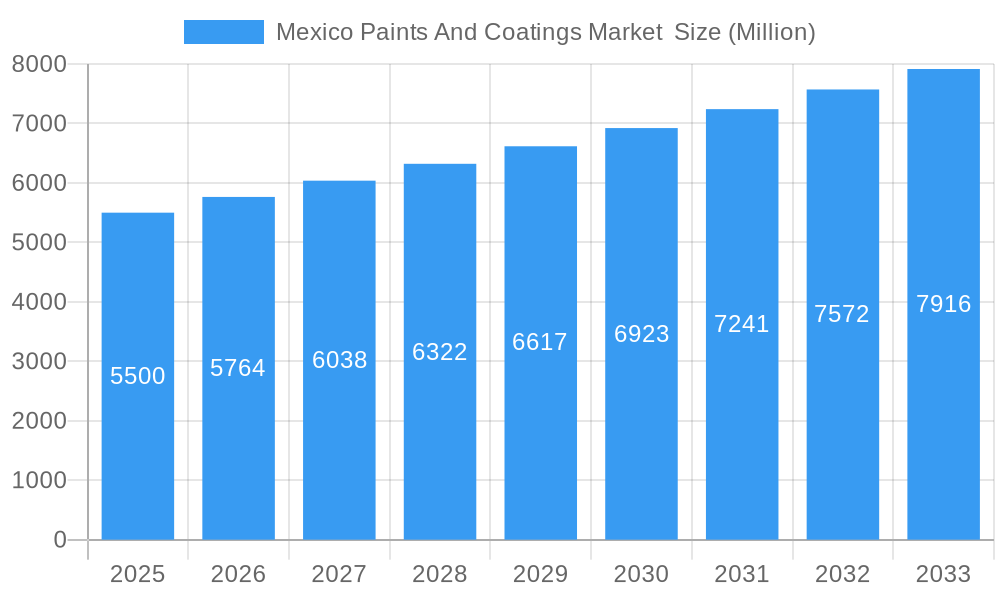

Mexico Paints And Coatings Market Market Size (In Billion)

Key market segments include acrylic and polyurethane resins, valued for their versatility and performance in architectural and automotive applications, respectively. Water-borne technologies are becoming dominant, driven by environmental regulations and consumer demand for sustainable products. The architectural segment, encompassing decorative and functional coatings for buildings, holds the largest market share, supported by urbanization and renovation. The automotive sector, including OEM and refinish coatings, is a significant contributor due to increasing vehicle production and the demand for high-performance, aesthetically pleasing finishes. Challenges include fluctuating raw material prices and intense competition, necessitating strategic pricing and product differentiation.

Mexico Paints And Coatings Market Company Market Share

Gain comprehensive insights into the dynamic Mexican paints and coatings market with our expert analysis. This report delivers critical data, actionable strategies, and future projections for stakeholders aiming to thrive in this sector. Covering the historical period from 2019 to 2024 and forecasting through 2033, with a base year of 2024, this document provides a detailed strategic roadmap. We meticulously analyze market size, growth drivers, segmentation, competitive landscape, and emerging opportunities, making it an essential resource for manufacturers, suppliers, distributors, and investors.

Mexico Paints And Coatings Market Market Concentration & Dynamics

The Mexico paints and coatings market exhibits a moderate level of concentration, with a few dominant players holding significant market share, alongside a robust ecosystem of smaller, specialized manufacturers. Innovation is driven by a continuous pursuit of sustainable and high-performance solutions, spurred by evolving environmental regulations and increasing consumer demand for eco-friendly products. Key innovation hubs are emerging in regions with strong industrial bases and access to skilled research and development talent. The regulatory framework, while supportive of industry growth, places increasing emphasis on VOC reduction and waste management, influencing product formulation and manufacturing processes. Substitute products, such as wallpapers and other surface treatments, present a minor challenge, but the inherent durability and protective qualities of paints and coatings maintain their widespread appeal. End-user trends are characterized by a growing preference for aesthetically pleasing, long-lasting, and easy-to-apply coatings, particularly in the architectural and automotive sectors. Merger and acquisition (M&A) activities are observed as key players seek to expand their product portfolios, geographical reach, and technological capabilities. While specific M&A deal counts are proprietary, the strategic rationale often involves consolidation and integration of specialized expertise. Market share is influenced by factors such as product innovation, brand reputation, distribution networks, and pricing strategies.

Mexico Paints And Coatings Market Industry Insights & Trends

The Mexico paints and coatings market is poised for significant expansion, driven by robust economic growth and increasing demand across diverse end-user industries. The market size is projected to reach an estimated USD 4,500 Million in 2025, with a compound annual growth rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. This impressive growth trajectory is underpinned by several key factors. A burgeoning construction sector, fueled by government infrastructure projects and residential development, directly translates into increased demand for architectural coatings. The automotive industry, a vital contributor to Mexico's economy, continues to drive innovation in automotive coatings, emphasizing durability, aesthetics, and environmental compliance. Furthermore, the protective coatings segment, essential for industrial infrastructure, oil & gas, and marine applications, is experiencing steady growth due to the need for corrosion resistance and extended asset lifespan. Technological advancements are playing a pivotal role, with a discernible shift towards water-borne and powder coatings, driven by stringent environmental regulations aimed at reducing Volatile Organic Compound (VOC) emissions. These sustainable technologies not only offer environmental benefits but also often provide superior performance characteristics. Evolving consumer behaviors are also shaping the market, with a growing awareness and preference for low-VOC, eco-friendly, and durable paint solutions. The demand for specialized coatings that offer enhanced functionalities, such as antimicrobial properties, fire resistance, and self-cleaning capabilities, is also on the rise. The report delves deeper into these insights, providing granular analysis of market dynamics, key influencers, and future growth prospects, enabling stakeholders to make informed strategic decisions.

Key Markets & Segments Leading Mexico Paints And Coatings Market

The Architectural end-user industry stands as the dominant force in the Mexico paints and coatings market, propelled by Mexico's sustained urban development and a growing middle class with increasing disposable income. This segment benefits significantly from economic growth and infrastructure development, driving demand for both decorative and functional paints for residential, commercial, and public buildings. The Resin Type segment is led by Acrylic resins, owing to their versatility, excellent durability, and cost-effectiveness, making them ideal for a wide range of architectural and general industrial applications. They offer superior adhesion, flexibility, and weather resistance. In terms of Technology, Water-borne coatings are increasingly capturing market share due to their lower VOC content and reduced environmental impact, aligning with global sustainability trends and stricter regulatory frameworks.

Drivers for Architectural Dominance:

- Infrastructure Development: Government investments in new housing, public spaces, and commercial complexes.

- Urbanization: Migration to cities and the subsequent need for new construction and renovation.

- Disposable Income: Rising consumer spending power leading to increased demand for home improvement and beautification.

- Renovation and Retrofitting: Aging building stock requiring regular maintenance and upgrades.

Dominance of Acrylic Resins:

- Versatility: Suitable for interior and exterior applications, offering a wide range of finishes.

- Performance: Excellent weatherability, UV resistance, and color retention.

- Cost-Effectiveness: Competitive pricing compared to some other high-performance resin types.

- Environmental Profile: Easier to formulate into low-VOC water-borne systems.

Rise of Water-borne Technology:

- Environmental Regulations: Stringent government policies on VOC emissions.

- Health and Safety: Consumer preference for healthier indoor environments.

- Performance Enhancements: Continuous innovation leading to improved durability and application properties.

- Ease of Use: Faster drying times and easier clean-up compared to solvent-borne alternatives.

The Automotive and Protective Coating segments also represent significant growth avenues, driven by the strength of Mexico's manufacturing and industrial sectors, respectively. The automotive industry's demand for high-performance coatings that offer superior aesthetics, scratch resistance, and corrosion protection, coupled with the stringent requirements for industrial protective coatings against harsh environments, contribute substantially to the market's overall dynamism.

Mexico Paints And Coatings Market Product Developments

Product innovation in the Mexico paints and coatings market is characterized by a strong emphasis on sustainability and enhanced performance. Manufacturers are actively developing advanced formulations that reduce environmental impact while improving application efficiency and durability. This includes the introduction of low-VOC and zero-VOC paints, bio-based coatings derived from renewable resources, and coatings with self-healing or antimicrobial properties. For instance, the development of high-solids and water-borne alternatives to traditional solvent-borne coatings is a significant trend, offering improved air quality and worker safety. Innovations in powder coatings are also gaining traction, particularly for industrial applications, due to their excellent durability and minimal waste generation. These advancements are driven by evolving regulatory landscapes, increasing consumer demand for eco-friendly products, and the pursuit of competitive advantage through superior product offerings. The market relevance of these developments lies in their ability to meet emerging industry standards, address specific end-user needs for enhanced functionality, and contribute to a more sustainable manufacturing ecosystem within Mexico.

Challenges in the Mexico Paints And Coatings Market Market

The Mexico paints and coatings market faces several significant challenges that can impede growth. Fluctuations in raw material prices, particularly petrochemical derivatives, can impact profitability and pricing strategies. Stringent and evolving environmental regulations, while driving innovation, also necessitate substantial investment in research and development and production upgrades, posing a challenge for smaller manufacturers. Supply chain disruptions, exacerbated by global events, can lead to delays in raw material procurement and finished product delivery, affecting operational efficiency. Intense competition, both from domestic players and international imports, puts pressure on profit margins and demands continuous innovation and cost optimization. Furthermore, the informal sector and counterfeit products can undermine legitimate market players and erode consumer trust.

Forces Driving Mexico Paints And Coatings Market Growth

Several powerful forces are propelling the growth of the Mexico paints and coatings market. Economic Expansion and Infrastructure Development are primary catalysts, fueling demand in construction and manufacturing. The Increasing Focus on Sustainability and Environmental Regulations is a significant driver, pushing innovation towards eco-friendly water-borne and powder coatings. Technological Advancements in formulation and application techniques are enhancing product performance and efficiency. The Growth of Key End-user Industries like automotive, construction, and packaging, supported by Mexico's strong industrial base, provides a consistent demand stream. Finally, Rising Consumer Awareness and Demand for High-Quality, Durable, and Aesthetically Pleasing Coatings are shaping product development and market trends.

Challenges in the Mexico Paints And Coatings Market Market

Long-term growth catalysts for the Mexico paints and coatings market are intricately linked to ongoing innovation and strategic market expansion. The continuous development of high-performance, specialized coatings with unique functionalities, such as enhanced corrosion resistance, fire retardancy, or self-cleaning properties, will attract premium pricing and create new market niches. Strategic partnerships and collaborations between raw material suppliers, paint manufacturers, and end-users can foster tailored solutions and streamline product development cycles. Furthermore, expanding into underserved regions within Mexico and exploring export opportunities to neighboring markets can unlock significant growth potential. Embracing digital technologies for enhanced customer engagement, streamlined distribution, and data-driven decision-making will also be crucial for sustained competitive advantage.

Emerging Opportunities in Mexico Paints And Coatings Market

Emerging opportunities in the Mexico paints and coatings market are abundant and diverse. The burgeoning renewable energy sector, particularly solar and wind power, presents significant demand for protective coatings for infrastructure and equipment. The growing adoption of smart home technologies is creating opportunities for coatings with integrated functionalities, such as temperature regulation or air purification. The circular economy initiatives are driving demand for coatings that facilitate easier disassembly and recycling of products. Furthermore, the increasing focus on health and wellness is creating a market for antimicrobial and VOC-free coatings in residential, healthcare, and educational facilities. The potential for developing bio-based and biodegradable coatings from agricultural waste or other sustainable sources offers a substantial competitive advantage and caters to a growing environmentally conscious consumer base.

Leading Players in the Mexico Paints And Coatings Market Sector

- PPG Industries Inc

- Akzo Nobel N V

- Benjamin Moore & Co

- Jotun

- Axalta Coating Systems

- Nippon Paint Holdings Co Ltd

- BASF SE

- WEG SA

- PINTURAS OSEL S A DE C V

- Barel S A

Key Milestones in Mexico Paints And Coatings Market Industry

- May 2023: PPG declared an investment of about USD 44 million with a view to expand its powder coatings offerings and increase global production to meet growing customer demand for sustainably advantaged products. This strategic investment underscores PPG's commitment to sustainable growth and meeting evolving market needs.

- May 2022: Akzo Nobel India launched its breakthrough product in the floor coatings market by introducing Dulux Floor Plus. It is a water-based acrylic emulsion specifically developed to protect and beautify flooring, including interlock paver blocks, walkways, terraces, and cemented and concrete surfaces. This launch highlights Akzo Nobel's focus on innovative, water-based solutions for diverse applications.

Strategic Outlook for Mexico Paints And Coatings Market Market

The strategic outlook for the Mexico paints and coatings market is exceptionally positive, characterized by sustained growth driven by innovation and market adaptation. Future success will hinge on a commitment to developing advanced, eco-friendly coatings that meet evolving regulatory standards and consumer preferences for sustainability and performance. Investment in research and development, particularly in water-borne and powder coating technologies, will be paramount. Strategic partnerships and collaborations across the value chain, from raw material suppliers to end-users, will foster the development of tailored solutions and unlock new market opportunities. Furthermore, companies that embrace digital transformation for enhanced customer engagement, operational efficiency, and data-driven insights will be well-positioned to lead. Expansion into emerging segments like renewable energy infrastructure and health-focused coatings presents significant growth accelerators, solidifying Mexico's position as a key player in the global paints and coatings landscape.

Mexico Paints And Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Powder Coatings

- 2.4. Other Technologies

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Protective Coating

- 3.5. General Industrial

- 3.6. Transportation

- 3.7. Packaging

Mexico Paints And Coatings Market Segmentation By Geography

- 1. Mexico

Mexico Paints And Coatings Market Regional Market Share

Geographic Coverage of Mexico Paints And Coatings Market

Mexico Paints And Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing construction activities due to rising population

- 3.2.2 increased urbanization

- 3.2.3 and industrialization; Growth in Furniture market

- 3.3. Market Restrains

- 3.3.1 Increasing construction activities due to rising population

- 3.3.2 increased urbanization

- 3.3.3 and industrialization; Growth in Furniture market

- 3.4. Market Trends

- 3.4.1. Architectural Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Powder Coatings

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Protective Coating

- 5.3.5. General Industrial

- 5.3.6. Transportation

- 5.3.7. Packaging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PPG Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Akzo Nobel N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Benjamin Moore & Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axalta Coating Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Paint Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WEG SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PINTURAS OSEL S A DE C V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Barel S A *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PPG Industries Inc

List of Figures

- Figure 1: Mexico Paints And Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Paints And Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Mexico Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Mexico Paints And Coatings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Mexico Paints And Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Mexico Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: Mexico Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Mexico Paints And Coatings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Mexico Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Paints And Coatings Market ?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Mexico Paints And Coatings Market ?

Key companies in the market include PPG Industries Inc, Akzo Nobel N V, Benjamin Moore & Co, Jotun, Axalta Coating Systems, Nippon Paint Holdings Co Ltd, BASF SE, WEG SA, PINTURAS OSEL S A DE C V, Barel S A *List Not Exhaustive.

3. What are the main segments of the Mexico Paints And Coatings Market ?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing construction activities due to rising population. increased urbanization. and industrialization; Growth in Furniture market.

6. What are the notable trends driving market growth?

Architectural Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing construction activities due to rising population. increased urbanization. and industrialization; Growth in Furniture market.

8. Can you provide examples of recent developments in the market?

In May 2023, PPG declared an investment of about USD 44 million with a view to expand its powder coatings offerings and increase global production to meet growing customer demand for sustainably advantaged products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Paints And Coatings Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Paints And Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Paints And Coatings Market ?

To stay informed about further developments, trends, and reports in the Mexico Paints And Coatings Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence