Key Insights

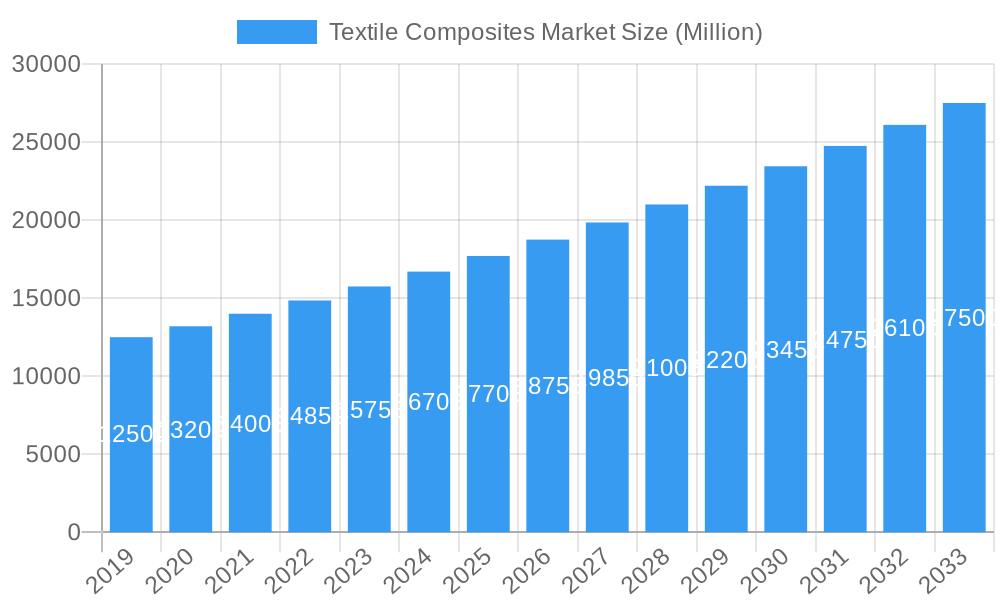

The global Textile Composites Market is set for substantial growth, with a projected market size of US$ 10.57 billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 12.1%. This expansion is fueled by escalating demand across key sectors. Aerospace & Defense and Electrical & Electronics are prominent, prioritizing lightweight, high-strength materials. The construction industry is also a significant consumer, utilizing textile composites for enhanced structural integrity and durability. The renewable energy sector, particularly wind energy, is a major contributor, with textile composites integral to the manufacturing of larger, more efficient wind turbine blades. These superior properties, including exceptional strength-to-weight ratios, corrosion resistance, and design flexibility, make textile composites increasingly preferred over traditional materials like metals and plastics.

Textile Composites Market Market Size (In Billion)

Key market trends include advancements in fiber technology, such as the increasing adoption of carbon and aramid fibers for their unparalleled performance. Innovations in manufacturing processes and the development of novel composite structures are also driving market penetration. Leading players are investing heavily in research and development to expand their product portfolios and meet evolving industry demands. While high production costs for certain advanced textile composites and the need for specialized manufacturing expertise present restraints, the growing emphasis on sustainability, fuel efficiency in transportation, and the integration of smart textiles are expected to create new opportunities and propel sustained growth within the Textile Composites Market.

Textile Composites Market Company Market Share

This comprehensive report analyzes the dynamic Textile Composites Market, projecting a market size of US$ 10.57 billion by 2033, with a significant CAGR of 12.1% from the base year 2025. Covering historical data from 2019-2024 and estimated figures for 2025, this analysis is vital for stakeholders seeking to leverage the growing demand for high-performance advanced textile composites. Explore critical segments such as Carbon Fiber Composites, Glass Fiber Composites, and Aramid Fiber Composites, and their impact across diverse applications including Aerospace & Defense composites, Automotive composites, Wind Energy composites, Construction composites, and Electrical & Electronics composites. Understand the primary growth drivers and evolving market trends shaping the future of technical textiles and composite materials.

Textile Composites Market Market Concentration & Dynamics

The Textile Composites Market exhibits a moderate to high market concentration, with key players continuously investing in research and development to gain a competitive edge. Innovation ecosystems are thriving, fueled by collaborations between material manufacturers, research institutions, and end-users. Regulatory frameworks, particularly concerning safety and environmental standards in sectors like aerospace and defense, play a significant role in shaping product development and adoption. The emergence of substitute products, while present, often struggles to match the unique performance-to-weight ratios offered by advanced textile composites. End-user trends are increasingly favoring lightweight, durable, and sustainable materials, pushing manufacturers to innovate. Mergers and acquisitions (M&A) activities are a recurring theme, with companies like TORAY INDUSTRIES INC and Dupont strategically expanding their portfolios and market reach. For instance, recent M&A deal counts indicate a consolidated effort to secure market share and integrate advanced manufacturing capabilities.

Textile Composites Market Industry Insights & Trends

The Textile Composites Market is poised for substantial expansion driven by an escalating demand for lightweight and high-strength materials across various industries. Technological disruptions, such as advancements in 3D weaving and automated fiber placement, are revolutionizing manufacturing processes, leading to enhanced efficiency and reduced costs. The growing emphasis on sustainability is also a significant trend, with a focus on developing recyclable and bio-based composite materials. Evolving consumer behaviors, particularly in sectors like sporting goods and automotive, are pushing for innovative solutions that offer improved performance, fuel efficiency, and aesthetic appeal. The market size is projected to witness significant growth, with key growth drivers including increasing adoption in the wind energy sector for larger and more efficient turbine blades, and in the aerospace and defense sector for lighter aircraft components that contribute to fuel savings. Furthermore, the expanding infrastructure development, especially in emerging economies, is creating new avenues for construction composites. The railways sector is also witnessing a surge in demand for these materials to reduce train weight and improve energy efficiency. The marine industry's adoption of textile composites for boat hulls and structures, owing to their corrosion resistance and lightweight properties, further contributes to market expansion.

Key Markets & Segments Leading Textile Composites Market

The Textile Composites Market is currently dominated by the Carbon Fiber segment within the Fiber Type category. The unparalleled strength-to-weight ratio of carbon fiber makes it indispensable for high-performance applications, particularly in the Aerospace & Defense sector. This segment's dominance is further amplified by ongoing technological advancements and a relentless pursuit of weight reduction in aircraft and defense systems. In terms of application, Aerospace & Defense consistently leads, driven by stringent performance requirements and significant R&D investments. The economic growth in key regions and the continuous need for enhanced structural integrity and fuel efficiency in aircraft manufacturing directly translate to a robust demand for aerospace composites.

Fiber Type Dominance:

- Carbon Fiber: Unrivaled strength-to-weight ratio, leading to widespread adoption in demanding applications.

- Glass Fiber: Cost-effectiveness and versatility make it a strong contender in applications like construction and automotive.

- Aramid Fiber: Excellent impact resistance and thermal stability, crucial for protective gear and specialized defense applications.

- Others: Emerging fibers offering unique properties, catering to niche markets.

Application Dominance:

- Aerospace & Defense: Driven by stringent performance needs, lightweighting initiatives, and significant R&D. Economic growth in major aerospace manufacturing nations fuels this segment.

- Wind Energy: Essential for manufacturing larger, more efficient turbine blades, with global renewable energy targets acting as a strong catalyst.

- Automotive: Increasing adoption for lightweighting, improving fuel efficiency, and enhancing vehicle safety and performance.

- Construction: Growing use in structural reinforcements, bridge components, and architectural elements due to durability and corrosion resistance.

- Electrical & Electronics: Applications in insulation, casings, and structural components requiring high dielectric strength and durability.

- Sporting Goods: Revolutionizing equipment design for enhanced performance, including bicycles, rackets, and protective gear.

- Railways: Contributing to reduced train weight, improved energy efficiency, and enhanced passenger safety.

- Marine: Ideal for boat hulls and structures due to excellent corrosion resistance and lightweight properties.

Textile Composites Market Product Developments

Product innovations in the Textile Composites Market are characterized by the development of novel fiber architectures, advanced resin systems, and integrated manufacturing processes. These advancements lead to enhanced material properties such as improved fracture toughness, superior thermal resistance, and tailored electromagnetic shielding capabilities. The integration of smart functionalities, like embedded sensors for structural health monitoring, is also a key development. For example, the creation of pre-impregnated fabrics with enhanced shelf life and improved processing characteristics by companies like Teijin Limited offers a significant competitive edge.

Challenges in the Textile Composites Market Market

The Textile Composites Market faces several challenges that can hinder its growth trajectory. High initial manufacturing costs for certain advanced textile composites, particularly those involving carbon fiber, can be a significant barrier for widespread adoption in cost-sensitive applications. Complex supply chain logistics for specialized raw materials, coupled with potential bottlenecks, can impact production timelines and costs. Stringent regulatory hurdles in specific industries, such as aerospace, require extensive testing and certification, adding to development time and expense. Furthermore, competition from traditional materials that are more established and cost-effective in certain applications remains a persistent challenge.

Forces Driving Textile Composites Market Growth

The primary forces driving growth in the Textile Composites Market are the escalating demand for lightweight and high-strength materials across critical sectors. Technological advancements in composite manufacturing, leading to improved performance and reduced production costs, are significant catalysts. The global push towards sustainability and energy efficiency, particularly in the transportation and energy sectors, directly favors the adoption of textile composites. Furthermore, supportive government initiatives and increasing investments in infrastructure development are creating substantial market opportunities.

Challenges in the Textile Composites Market Market

Long-term growth catalysts for the Textile Composites Market lie in continuous innovation and strategic market expansion. The development of more sustainable and recyclable composite materials will be crucial for aligning with global environmental goals. Strategic partnerships and collaborations between raw material suppliers, composite manufacturers, and end-users will foster faster product development and market penetration. Furthermore, expanding into emerging economies and exploring new application areas, such as additive manufacturing of composite structures, will unlock significant future potential.

Emerging Opportunities in Textile Composites Market

Emerging opportunities in the Textile Composites Market are abundant, driven by advancements in material science and evolving industry needs. The development of novel bio-composites derived from natural fibers presents a significant opportunity for sustainable solutions. The increasing integration of artificial intelligence and automation in composite design and manufacturing promises enhanced efficiency and product customization. The growing demand for advanced materials in sectors like electric vehicles (EVs), medical devices, and 3D printing applications offers substantial untapped potential for technical textiles and composite materials.

Leading Players in the Textile Composites Market Sector

- KERMEL

- Teijin Limited

- Advanced Textile Composites

- Dupont

- HUVIS Corporation

- Yantai Tayho Advanced Materials Co Ltd

- China National Bluestar (Group) Co Ltd

- Hyosung

- TORAY INDUSTRIES INC

- Lectra

- Kolon Industries Inc

- HINDOOSTAN MILLS

- Composite Fabrics of America

Key Milestones in Textile Composites Market Industry

- 2022: Launch of advanced carbon fiber prepregs with enhanced cure profiles by a leading manufacturer, reducing processing times in aerospace applications.

- 2023: Significant investment by a major player in expanding glass fiber production capacity to meet rising demand in the wind energy sector.

- 2023: Introduction of a novel aramid fiber composite for enhanced ballistic protection in defense applications.

- 2024: Strategic partnership formed to develop sustainable and recyclable textile composites for the automotive industry.

- 2024: Approval of new composite materials for use in critical railway infrastructure projects, highlighting their durability and safety benefits.

Strategic Outlook for Textile Composites Market Market

The strategic outlook for the Textile Composites Market is highly optimistic, driven by sustained innovation and a widening array of applications. Future growth will be accelerated by the continued push for lightweighting in transportation, the expansion of renewable energy infrastructure, and increasing adoption in construction and electronics. Companies that focus on developing sustainable composite solutions, leveraging advanced manufacturing technologies, and forging strategic alliances will be best positioned to capitalize on the immense market potential and secure a leading position in this rapidly evolving industry.

Textile Composites Market Segmentation

-

1. Fiber Type

- 1.1. Carbon

- 1.2. Glass

- 1.3. Aramid

- 1.4. Others

-

2. Application

- 2.1. Aerospace & Defense

- 2.2. Electrical & Electronics

- 2.3. Construction

- 2.4. Sporting Goods

- 2.5. Railways

- 2.6. Marine

- 2.7. Wind

- 2.8. Others

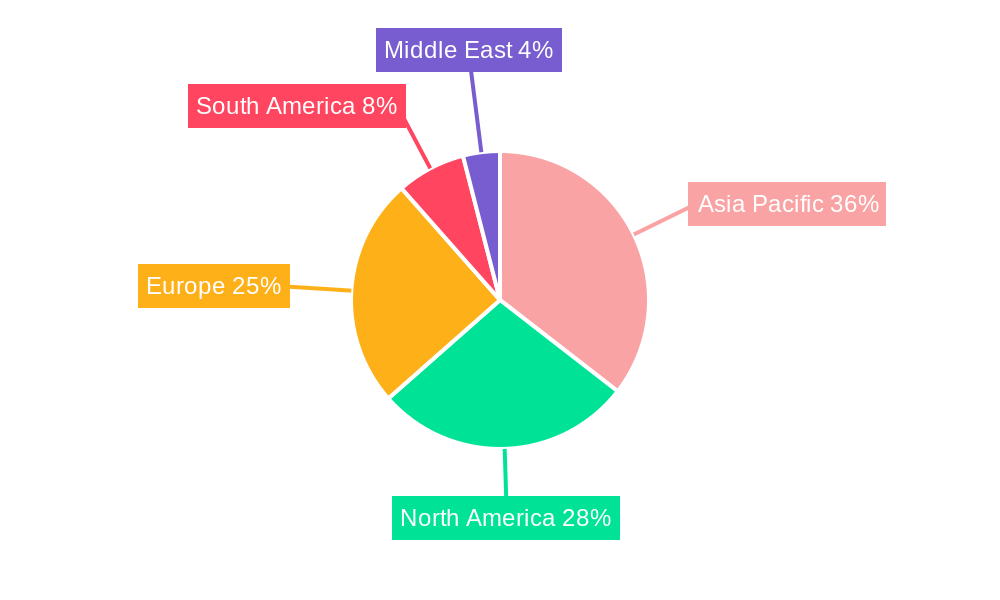

Textile Composites Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Textile Composites Market Regional Market Share

Geographic Coverage of Textile Composites Market

Textile Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand From the Aerospace Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Low Resistance to Impact; Other Restraints

- 3.4. Market Trends

- 3.4.1. Electrical & Electronics Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fiber Type

- 5.1.1. Carbon

- 5.1.2. Glass

- 5.1.3. Aramid

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aerospace & Defense

- 5.2.2. Electrical & Electronics

- 5.2.3. Construction

- 5.2.4. Sporting Goods

- 5.2.5. Railways

- 5.2.6. Marine

- 5.2.7. Wind

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Fiber Type

- 6. Asia Pacific Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fiber Type

- 6.1.1. Carbon

- 6.1.2. Glass

- 6.1.3. Aramid

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Aerospace & Defense

- 6.2.2. Electrical & Electronics

- 6.2.3. Construction

- 6.2.4. Sporting Goods

- 6.2.5. Railways

- 6.2.6. Marine

- 6.2.7. Wind

- 6.2.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Fiber Type

- 7. North America Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fiber Type

- 7.1.1. Carbon

- 7.1.2. Glass

- 7.1.3. Aramid

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Aerospace & Defense

- 7.2.2. Electrical & Electronics

- 7.2.3. Construction

- 7.2.4. Sporting Goods

- 7.2.5. Railways

- 7.2.6. Marine

- 7.2.7. Wind

- 7.2.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Fiber Type

- 8. Europe Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fiber Type

- 8.1.1. Carbon

- 8.1.2. Glass

- 8.1.3. Aramid

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Aerospace & Defense

- 8.2.2. Electrical & Electronics

- 8.2.3. Construction

- 8.2.4. Sporting Goods

- 8.2.5. Railways

- 8.2.6. Marine

- 8.2.7. Wind

- 8.2.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Fiber Type

- 9. South America Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fiber Type

- 9.1.1. Carbon

- 9.1.2. Glass

- 9.1.3. Aramid

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Aerospace & Defense

- 9.2.2. Electrical & Electronics

- 9.2.3. Construction

- 9.2.4. Sporting Goods

- 9.2.5. Railways

- 9.2.6. Marine

- 9.2.7. Wind

- 9.2.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Fiber Type

- 10. Middle East Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fiber Type

- 10.1.1. Carbon

- 10.1.2. Glass

- 10.1.3. Aramid

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Aerospace & Defense

- 10.2.2. Electrical & Electronics

- 10.2.3. Construction

- 10.2.4. Sporting Goods

- 10.2.5. Railways

- 10.2.6. Marine

- 10.2.7. Wind

- 10.2.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Fiber Type

- 11. Saudi Arabia Textile Composites Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fiber Type

- 11.1.1. Carbon

- 11.1.2. Glass

- 11.1.3. Aramid

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Aerospace & Defense

- 11.2.2. Electrical & Electronics

- 11.2.3. Construction

- 11.2.4. Sporting Goods

- 11.2.5. Railways

- 11.2.6. Marine

- 11.2.7. Wind

- 11.2.8. Others

- 11.1. Market Analysis, Insights and Forecast - by Fiber Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 KERMEL

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Teijin Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Advanced Textile Composites

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dupont

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HUVIS Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Yantai Tayho Advanced Materials Co Ltd*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 China National Bluestar (Group) Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hyosung

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 TORAY INDUSTRIES INC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Lectra

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Kolon Industries Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 HINDOOSTAN MILLS

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Composite Fabrics of America

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 KERMEL

List of Figures

- Figure 1: Global Textile Composites Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Textile Composites Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 3: Asia Pacific Textile Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 4: Asia Pacific Textile Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Textile Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Textile Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Textile Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Textile Composites Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 9: North America Textile Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 10: North America Textile Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Textile Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Textile Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Textile Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Textile Composites Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 15: Europe Textile Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 16: Europe Textile Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Textile Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Textile Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Textile Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Textile Composites Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 21: South America Textile Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 22: South America Textile Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Textile Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Textile Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Textile Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Textile Composites Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 27: Middle East Textile Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 28: Middle East Textile Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Textile Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Textile Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Textile Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Textile Composites Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 33: Saudi Arabia Textile Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 34: Saudi Arabia Textile Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 35: Saudi Arabia Textile Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Saudi Arabia Textile Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Saudi Arabia Textile Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 2: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Textile Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 5: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Textile Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 14: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Textile Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Canada Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 20: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Textile Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 28: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Textile Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 34: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Global Textile Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Textile Composites Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 37: Global Textile Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Textile Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: South Africa Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Textile Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Composites Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Textile Composites Market?

Key companies in the market include KERMEL, Teijin Limited, Advanced Textile Composites, Dupont, HUVIS Corporation, Yantai Tayho Advanced Materials Co Ltd*List Not Exhaustive, China National Bluestar (Group) Co Ltd, Hyosung, TORAY INDUSTRIES INC, Lectra, Kolon Industries Inc, HINDOOSTAN MILLS, Composite Fabrics of America.

3. What are the main segments of the Textile Composites Market?

The market segments include Fiber Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.57 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand From the Aerospace Sector; Other Drivers.

6. What are the notable trends driving market growth?

Electrical & Electronics Application to Dominate the Market.

7. Are there any restraints impacting market growth?

; Low Resistance to Impact; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Composites Market?

To stay informed about further developments, trends, and reports in the Textile Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence