Key Insights

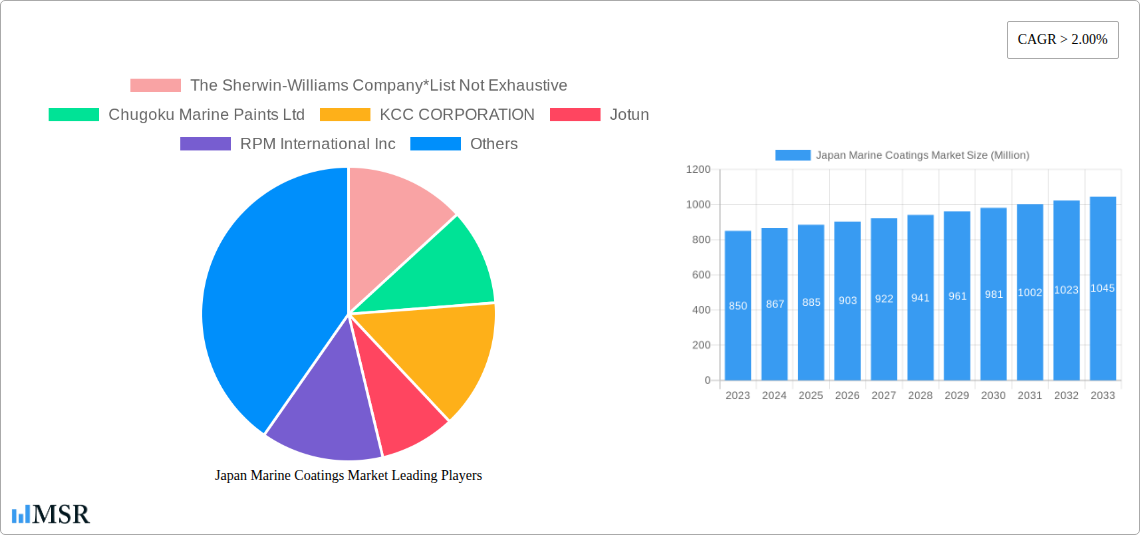

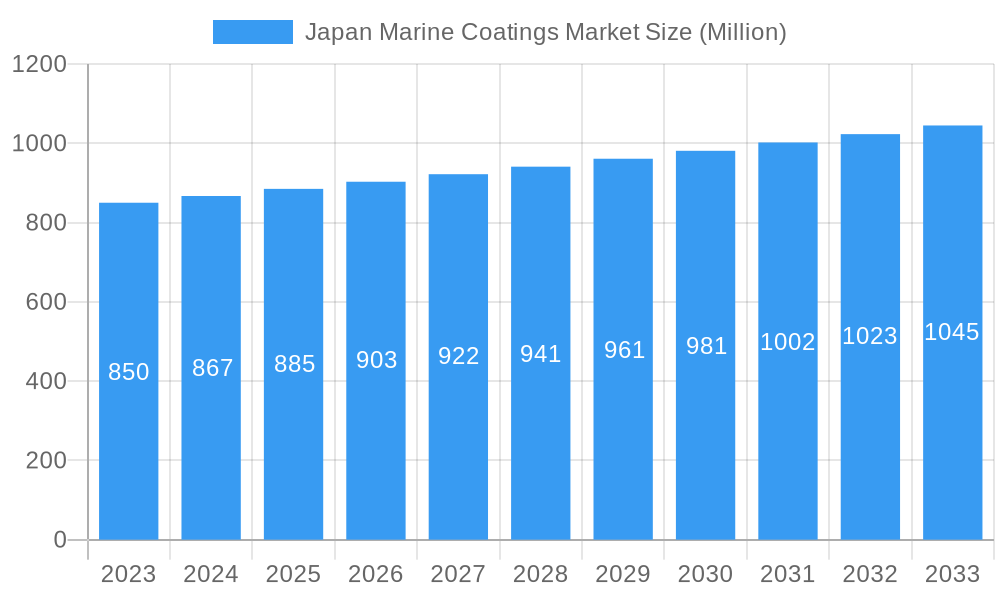

The Japan Marine Coatings Market is poised for steady expansion, projected to reach a significant valuation in the coming years. With a Compound Annual Growth Rate (CAGR) exceeding 2.00%, this growth is underpinned by robust demand across various segments, particularly in the "Anti-corrosion" and "Antifouling" functions, essential for protecting valuable marine assets. The thriving marine industry in Japan, encompassing both new vessel construction (OEM) and ongoing maintenance (Aftermarket), acts as a primary economic engine for this market. Furthermore, advancements in coating technologies, such as the increasing adoption of "Water-borne" solutions driven by environmental regulations and a growing preference for eco-friendly alternatives, are shaping market dynamics. The Epoxy resin segment, known for its exceptional durability and protective qualities, is anticipated to maintain a dominant position, while Polyurethane and Acrylic resins will also witness substantial uptake due to their performance characteristics.

Japan Marine Coatings Market Market Size (In Million)

The market's trajectory is influenced by several key drivers, including sustained investments in shipbuilding and repair activities, coupled with the continuous need to prolong the lifespan of vessels through effective corrosion and fouling prevention. Government initiatives promoting maritime trade and infrastructure development further bolster demand. However, the market faces certain restraints, such as fluctuating raw material prices and the stringent regulatory landscape concerning VOC emissions, which may necessitate higher R&D investments for compliant product development. Despite these challenges, the inherent resilience of the maritime sector and the persistent demand for high-performance protective coatings suggest a positive outlook for the Japan Marine Coatings Market. Leading companies are actively engaged in product innovation and strategic collaborations to capture market share and address evolving customer needs.

Japan Marine Coatings Market Company Market Share

This comprehensive report provides an in-depth analysis of the Japan Marine Coatings Market, a vital sector for maritime infrastructure and vessel protection. Navigating a dynamic landscape, this study offers actionable insights for industry stakeholders, from manufacturers and suppliers to shipbuilders and regulatory bodies. With a meticulous examination spanning the historical period of 2019–2024, the base year of 2025, and extending through a forecast period of 2025–2033, this report equips you with the knowledge to capitalize on current trends and anticipate future market shifts. Our expert analysis dives deep into critical segments, including anti-corrosion, antifouling, and other marine coatings, alongside key resin types like Epoxy, Polyurethane, Acrylic, Alkyd, and Others. We also dissect the impact of technology, differentiating between Water-borne, Solvent-borne, and Other solutions, and assess their adoption across Marine OEM and Marine Aftermarket applications.

The report features a detailed market size estimation for 2025 at approximately XX Million USD, with an anticipated CAGR of XX% during the forecast period. Discover the key players shaping this market, including The Sherwin-Williams Company, Chugoku Marine Paints Ltd, KCC CORPORATION, Jotun, RPM International Inc, Kansai Paint Marine Co Ltd, Axalta Coating Systems, Hempel A/S, Akzo Nobel N V, PPG Industries, and NIPSEA GROUP. This report is your indispensable guide to understanding the competitive dynamics, growth drivers, challenges, and emerging opportunities within the Japanese marine coatings industry.

Japan Marine Coatings Market Market Concentration & Dynamics

The Japan Marine Coatings Market exhibits a moderate to high market concentration, with a few key global players holding significant market share, alongside established domestic manufacturers like Chugoku Marine Paints and Kansai Paint Marine. The innovation ecosystem is characterized by ongoing research and development focused on sustainable solutions, such as low-VOC and water-borne marine coatings, driven by stringent environmental regulations and increasing demand for eco-friendly products. The regulatory frameworks, particularly those concerning emissions and hazardous substances, play a crucial role in shaping product development and market entry strategies. Substitute products, primarily in the form of alternative protection methods or materials, are present but have limited impact due to the specialized performance requirements of marine environments. End-user trends are heavily influenced by shipbuilding activity, vessel maintenance cycles, and the increasing demand for high-performance coatings that offer extended service life and reduced operational costs. Mergers & Acquisitions (M&A) activities, while not pervasive, are strategic, aimed at expanding product portfolios, enhancing technological capabilities, or gaining access to new geographical markets within the Japanese maritime sector. For instance, the acquisition of a specialized marine coatings technology could see market share shifts among the top players. The estimated number of significant M&A deals impacting the market in the historical period was around 0-2.

Japan Marine Coatings Market Industry Insights & Trends

The Japan Marine Coatings Market is poised for significant growth, driven by a confluence of economic, technological, and regulatory factors. The estimated market size for 2025 is XX Million USD, projected to expand considerably over the forecast period. A key growth driver is the robust demand for anti-corrosion and antifouling coatings, essential for protecting vessels from harsh marine environments and improving fuel efficiency. The increasing focus on sustainability is fueling the adoption of water-borne marine coatings, which offer reduced VOC emissions compared to traditional solvent-borne alternatives. This shift is further encouraged by government initiatives promoting environmentally responsible manufacturing and shipping practices. Technological advancements are leading to the development of more durable, bio-fouling resistant, and easier-to-apply coatings, catering to the evolving needs of the Marine OEM and Marine Aftermarket segments. Innovations in nanotechnology and advanced resin formulations are contributing to enhanced performance characteristics, such as improved abrasion resistance and longer lifespan. The aging global fleet also presents a substantial opportunity for the Marine Aftermarket, as regular maintenance and repainting are crucial for extending vessel life and ensuring compliance with international maritime regulations. Furthermore, the growing importance of smart coatings with self-healing properties or integrated sensors for real-time performance monitoring is an emerging trend. The increasing complexity of vessel designs, including specialized offshore structures and large container ships, necessitates tailored coating solutions, thus driving innovation and market expansion. The global shift towards greener shipping practices, including the use of alternative fuels and stricter environmental standards, indirectly bolsters the demand for advanced marine coatings that can withstand these evolving operational conditions. The sustained investment in shipbuilding and repair activities, particularly in the Asia-Pacific region, provides a consistent demand base for marine coatings.

Key Markets & Segments Leading Japan Marine Coatings Market

The Japan Marine Coatings Market is predominantly influenced by the robust demand from the Marine OEM segment, closely followed by the significant contributions from the Marine Aftermarket. Within functional applications, Anti-corrosion coatings represent the largest segment, critical for safeguarding vessels against the relentless corrosive effects of saltwater and atmospheric elements. This dominance is propelled by the inherent need to preserve the structural integrity and longevity of ships, thus minimizing costly repairs and downtime. Economic growth and increased global trade activities directly fuel new vessel construction, thereby boosting the Marine OEM demand for these protective layers.

The Resin segment is largely led by Epoxy resins, valued for their superior adhesion, chemical resistance, and durability, making them ideal for demanding marine applications. Polyurethane coatings also hold a significant share, offering excellent flexibility, UV resistance, and aesthetic appeal, particularly for topcoats.

In terms of Technology, Solvent-borne coatings have historically dominated due to their proven performance and cost-effectiveness. However, Water-borne coatings are rapidly gaining traction, driven by stringent environmental regulations and a growing preference for sustainable solutions. This transition represents a key trend in the market.

The Application landscape sees Marine OEM leading due to new shipbuilding projects, while the Marine Aftermarket is crucial for the maintenance and repair of existing fleets, showing consistent growth. The drivers for dominance in these segments include:

- Economic Growth & Global Trade: Increased international commerce necessitates a larger and more robust shipping fleet, directly impacting new vessel construction and thus the Marine OEM segment.

- Infrastructure Development: Investment in ports and maritime infrastructure indirectly supports the shipping industry and, consequently, the demand for marine coatings.

- Regulatory Compliance: International maritime safety and environmental regulations mandate the use of specific types of coatings to ensure vessel integrity and minimize pollution, driving demand for advanced anti-corrosion and antifouling solutions.

- Technological Advancements: Innovations in coating formulations, such as self-polishing or low-friction antifouling technologies, enhance vessel performance and reduce fuel consumption, making them attractive to ship owners and operators, thereby driving adoption across both OEM and Aftermarket.

- Aging Fleet & Maintenance Cycles: The substantial size of the existing global fleet requires regular maintenance and repainting, ensuring a steady demand for the Marine Aftermarket segment, particularly for anti-corrosion and protective coatings.

Japan Marine Coatings Market Product Developments

Product innovations in the Japan Marine Coatings Market are primarily focused on enhancing sustainability and performance. Manufacturers are actively developing advanced water-borne marine coatings with reduced volatile organic compounds (VOCs), meeting stricter environmental regulations. Innovations also include high-performance antifouling coatings that minimize bio-fouling, thereby improving fuel efficiency and reducing the need for frequent dry-docking. The development of durable anti-corrosion solutions with extended service lives, utilizing advanced resin technologies like high-solids epoxies and polyurethanes, is another key area. Furthermore, the market is witnessing the introduction of specialized coatings for specific vessel types and operational conditions, including those designed for ice-going vessels or vessels operating in extreme temperatures. These developments underscore the industry's commitment to providing environmentally responsible and performance-driven solutions to the maritime sector.

Challenges in the Japan Marine Coatings Market Market

The Japan Marine Coatings Market faces several significant challenges that can impact growth and profitability. Regulatory hurdles, particularly concerning environmental standards and the classification of certain chemical compounds, can necessitate costly product reformulation and compliance efforts. Supply chain disruptions, as witnessed in recent global events, can lead to raw material price volatility and availability issues, affecting production schedules and cost structures. Intense competitive pressures from both global and local players drive down margins and require continuous innovation to maintain market share. The high cost of R&D for advanced, sustainable coatings can also be a barrier, especially for smaller manufacturers. Furthermore, the fluctuating nature of shipbuilding orders and global economic uncertainties create demand volatility, making long-term forecasting and investment planning challenging. The impact of these challenges is quantifiable through increased production costs, delayed product launches, and potential loss of market share for companies unable to adapt quickly.

Forces Driving Japan Marine Coatings Market Growth

Several key forces are propelling the growth of the Japan Marine Coatings Market. The increasing global demand for shipping services, driven by international trade and e-commerce, directly translates into higher new vessel construction and a greater need for protective coatings in the Marine OEM segment. The aging global fleet necessitates extensive maintenance and repair, providing a sustained demand for the Marine Aftermarket. Environmental regulations are a significant catalyst, pushing the adoption of water-borne marine coatings and eco-friendly formulations. Technological advancements, such as self-polishing antifouling and durable anti-corrosion systems, offer enhanced performance and operational efficiencies, making them attractive to ship owners. The growing emphasis on sustainability within the maritime industry is also driving demand for coatings that reduce environmental impact and improve fuel economy.

Challenges in the Japan Marine Coatings Market Market

Long-term growth catalysts in the Japan Marine Coatings Market are rooted in continuous innovation and strategic market expansion. The ongoing research into advanced materials, such as nano-coatings and smart coatings with self-healing capabilities, presents significant future potential. Partnerships and collaborations between coating manufacturers, shipyards, and research institutions are crucial for accelerating the development and adoption of these next-generation solutions. Furthermore, the increasing emphasis on lifecycle cost optimization for vessels is driving demand for high-durability coatings that require less frequent application, thereby reducing operational expenses for ship owners. The development of specialized coatings for emerging maritime sectors, like offshore wind energy installation vessels and cruise ships with enhanced passenger amenities, also represents a key growth avenue.

Emerging Opportunities in Japan Marine Coatings Market

Emerging opportunities in the Japan Marine Coatings Market are abundant and diverse. The increasing global focus on decarbonization in shipping is creating a demand for specialized coatings that enhance fuel efficiency and are compatible with alternative fuels. The expansion of the cruise ship industry and the growing demand for luxury yachts present opportunities for high-aesthetic and durable coatings. Furthermore, the development of coatings for autonomous vessels and the integration of smart technologies for predictive maintenance offer new avenues for innovation and market penetration. The growing emphasis on the circular economy within the maritime sector is also driving interest in coatings that are easier to remove and recycle, presenting a unique opportunity for forward-thinking manufacturers.

Leading Players in the Japan Marine Coatings Market Sector

- The Sherwin-Williams Company

- Chugoku Marine Paints Ltd

- KCC CORPORATION

- Jotun

- RPM International Inc

- Kansai Paint Marine Co Ltd

- Axalta Coating Systems

- Hempel A/S

- Akzo Nobel N V

- PPG Industries

- NIPSEA GROUP

Key Milestones in Japan Marine Coatings Market Industry

- 2019: Increased regulatory scrutiny on VOC emissions globally, driving R&D for water-borne marine coatings.

- 2020: Significant impact of global supply chain disruptions on raw material availability and pricing.

- 2021: Launch of new high-performance antifouling technologies by leading players to improve fuel efficiency.

- 2022: Growing adoption of digital solutions for coating application and monitoring in the Marine OEM and Marine Aftermarket.

- 2023: Increased investment in sustainable marine solutions and bio-based coating research.

- 2024: Anticipated further tightening of environmental regulations, accelerating the shift towards eco-friendly marine coatings.

Strategic Outlook for Japan Marine Coatings Market Market

The strategic outlook for the Japan Marine Coatings Market is one of sustained innovation and adaptation to evolving environmental and technological landscapes. Growth accelerators will be driven by the continued demand for high-performance anti-corrosion and antifouling solutions, with a strong emphasis on sustainable and low-VOC offerings, particularly water-borne technologies. The Marine Aftermarket is expected to remain a stable revenue generator due to ongoing fleet maintenance needs. Companies that invest in advanced R&D for bio-based materials, smart coatings, and specialized applications for emerging maritime sectors will be well-positioned for long-term success. Strategic partnerships and acquisitions to enhance technological capabilities and market reach will be crucial for maintaining a competitive edge in this dynamic market.

Japan Marine Coatings Market Segmentation

-

1. Function

- 1.1. Anti-corrosion

- 1.2. Antifouling

- 1.3. Others

-

2. Resin

- 2.1. Epoxy

- 2.2. Polyurethane

- 2.3. Acrylic

- 2.4. Alkyd

- 2.5. Others

-

3. Technology

- 3.1. Water-borne

- 3.2. Solvent-borne

- 3.3. Others

-

4. Application

- 4.1. Marine OEM

- 4.2. Marine Aftermarket

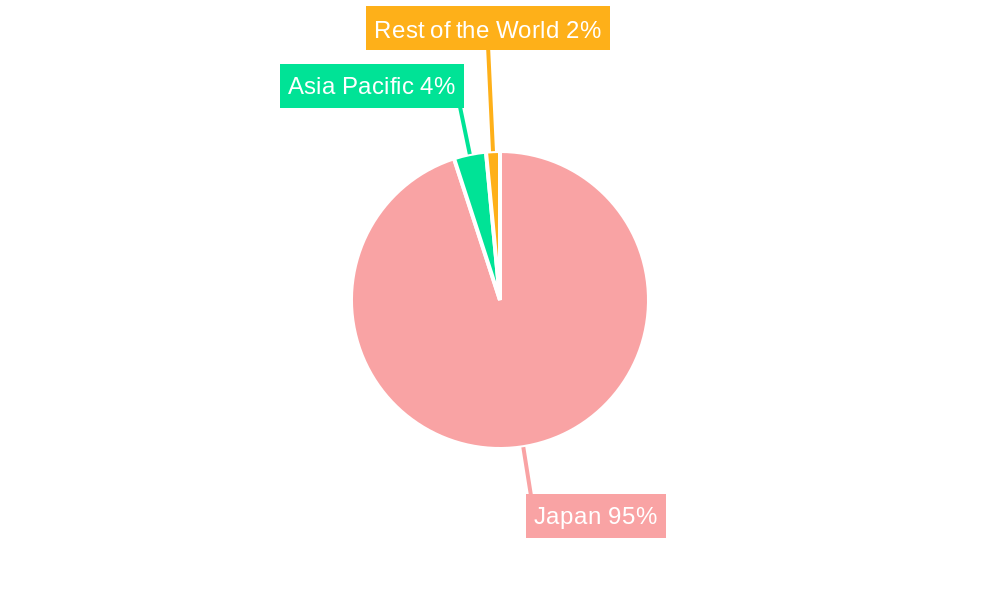

Japan Marine Coatings Market Segmentation By Geography

- 1. Japan

Japan Marine Coatings Market Regional Market Share

Geographic Coverage of Japan Marine Coatings Market

Japan Marine Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Push for Increased Ship Orders; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Anti-Fouling Coatings are Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Marine Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Anti-corrosion

- 5.1.2. Antifouling

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Resin

- 5.2.1. Epoxy

- 5.2.2. Polyurethane

- 5.2.3. Acrylic

- 5.2.4. Alkyd

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Water-borne

- 5.3.2. Solvent-borne

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Marine OEM

- 5.4.2. Marine Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chugoku Marine Paints Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KCC CORPORATION

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RPM International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kansai Paint Marine Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Axalta Coating Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hempel A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Akzo Nobel N V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PPG Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 NIPSEA GROUP

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: Japan Marine Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Marine Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Marine Coatings Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Japan Marine Coatings Market Volume liter per unit Forecast, by Function 2020 & 2033

- Table 3: Japan Marine Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 4: Japan Marine Coatings Market Volume liter per unit Forecast, by Resin 2020 & 2033

- Table 5: Japan Marine Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Japan Marine Coatings Market Volume liter per unit Forecast, by Technology 2020 & 2033

- Table 7: Japan Marine Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Japan Marine Coatings Market Volume liter per unit Forecast, by Application 2020 & 2033

- Table 9: Japan Marine Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Japan Marine Coatings Market Volume liter per unit Forecast, by Region 2020 & 2033

- Table 11: Japan Marine Coatings Market Revenue Million Forecast, by Function 2020 & 2033

- Table 12: Japan Marine Coatings Market Volume liter per unit Forecast, by Function 2020 & 2033

- Table 13: Japan Marine Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 14: Japan Marine Coatings Market Volume liter per unit Forecast, by Resin 2020 & 2033

- Table 15: Japan Marine Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 16: Japan Marine Coatings Market Volume liter per unit Forecast, by Technology 2020 & 2033

- Table 17: Japan Marine Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Japan Marine Coatings Market Volume liter per unit Forecast, by Application 2020 & 2033

- Table 19: Japan Marine Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Japan Marine Coatings Market Volume liter per unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Marine Coatings Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Japan Marine Coatings Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, Chugoku Marine Paints Ltd, KCC CORPORATION, Jotun, RPM International Inc, Kansai Paint Marine Co Ltd, Axalta Coating Systems, Hempel A/S, Akzo Nobel N V, PPG Industries, NIPSEA GROUP.

3. What are the main segments of the Japan Marine Coatings Market?

The market segments include Function, Resin, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Push for Increased Ship Orders; Other Drivers.

6. What are the notable trends driving market growth?

Anti-Fouling Coatings are Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter per unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Marine Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Marine Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Marine Coatings Market?

To stay informed about further developments, trends, and reports in the Japan Marine Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence