Key Insights

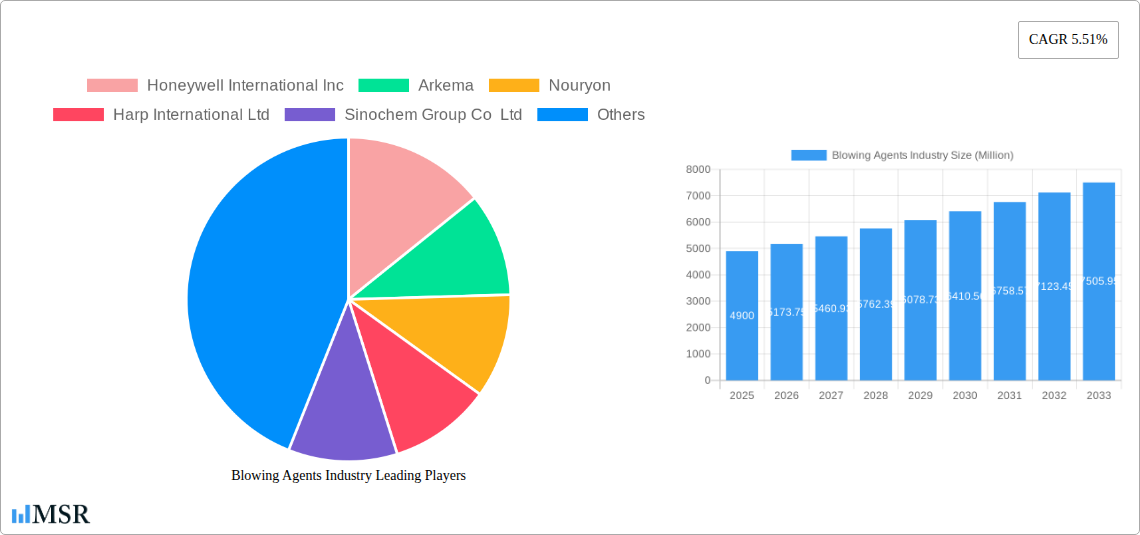

The global Blowing Agents market is poised for significant expansion, projected to reach approximately \$4.90 billion in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.51% throughout the forecast period (2025-2033). This growth trajectory is underpinned by several key drivers. Increasing demand from the building and construction sector for insulation materials that enhance energy efficiency is a primary catalyst. Furthermore, the burgeoning automotive industry, with its growing use of lightweight foamed plastics for enhanced fuel efficiency and passenger safety, contributes substantially to market momentum. The bedding and furniture sector also continues to be a strong consumer, driven by evolving consumer preferences for comfort and durability in foam-based products. Emerging economies in the Asia Pacific region, particularly China and India, are expected to be major growth engines due to rapid industrialization and increasing disposable incomes, leading to higher adoption of products utilizing blowing agents.

Blowing Agents Industry Market Size (In Billion)

However, the market is not without its restraints. Stringent environmental regulations concerning the use of certain blowing agents with high global warming potential (GWP) and ozone depletion potential (ODP) are a significant challenge. This has led to a strong industry trend towards the development and adoption of more environmentally friendly alternatives, such as Hydrofluoroolefins (HFOs) and hydrocarbons. Technological advancements in foam production processes, aimed at improving efficiency and reducing environmental impact, also play a crucial role in shaping market dynamics. The competitive landscape features a mix of established global players and regional manufacturers, all vying for market share through product innovation, strategic partnerships, and a focus on sustainable solutions.

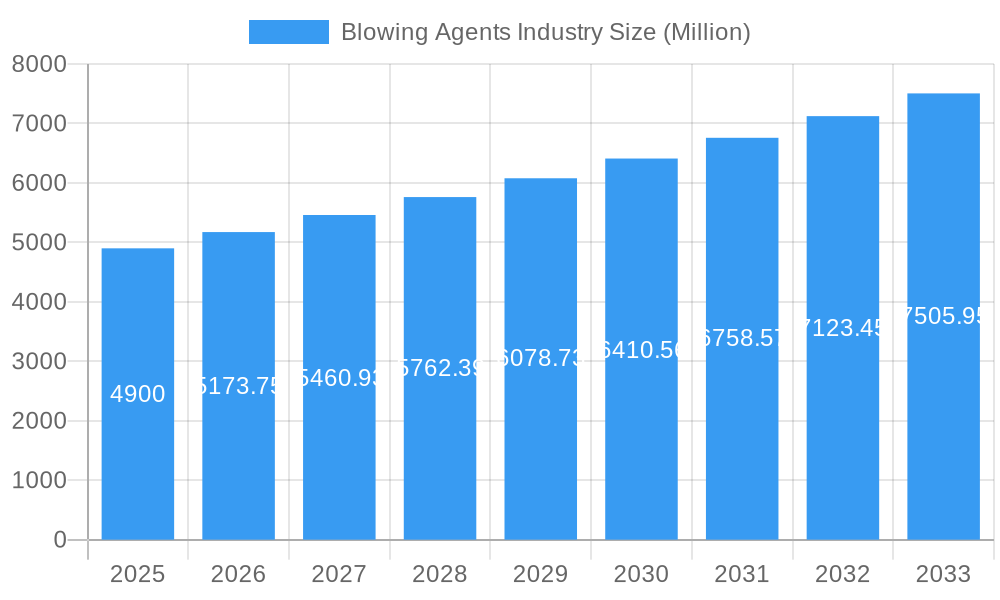

Blowing Agents Industry Company Market Share

Blowing Agents Industry: Revolutionizing Insulation and Beyond (2025-2033)

Unlock critical insights into the dynamic global blowing agents market. This comprehensive report, spanning from 2019-2033 with a base year of 2025, delivers in-depth analysis, market sizing, and strategic recommendations for stakeholders navigating the evolving landscape of foam production. With a focus on sustainable solutions and high-performance applications, discover the key drivers, challenges, and emerging opportunities shaping the future of blowing agents.

Blowing Agents Industry Market Concentration & Dynamics

The blowing agents industry exhibits a moderate to high market concentration, driven by significant capital investment in research, development, and production. Key players like Honeywell International Inc., Arkema, and Solvay dominate with substantial market share, leveraging proprietary technologies and extensive distribution networks. The innovation ecosystem is vibrant, with a strong emphasis on developing environmentally friendly blowing agents such as Hydrofluoroolefins (HFOs) to meet stringent global regulations. Regulatory frameworks, particularly the phase-out of Hydrochlorofluorocarbons (HCFCs) and the gradual reduction of Hydrofluorocarbons (HFCs) under international agreements like the Kigali Amendment, are profoundly influencing product development and market dynamics. The threat of substitute products, while present in niche applications, is less impactful in core areas like insulation where specific performance criteria are paramount. End-user trends are leaning towards energy efficiency and sustainability, driving demand for advanced blowing agents in building and construction, appliances, and automotive sectors. Merger and acquisition (M&A) activities are notable, with companies seeking to consolidate market positions, acquire innovative technologies, or expand their geographical reach. For instance, recent M&A activities are expected to account for approximately 15% of market consolidation by 2025.

Blowing Agents Industry Industry Insights & Trends

The global blowing agents market is projected to witness robust growth, estimated at a market size of USD 12,500 Million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period of 2025–2033. This expansion is primarily fueled by escalating demand for energy-efficient insulation materials across various end-use industries, including building and construction, automotive, and appliances. The ongoing shift towards sustainable and low-global warming potential (GWP) blowing agents, such as HFOs, is a significant market trend, driven by increasing environmental consciousness and stringent regulatory mandates. Technological advancements are continuously introducing innovative blowing agent formulations with improved thermal performance, reduced flammability, and enhanced safety profiles. The increasing adoption of polyurethane foam and polystyrene foam in diverse applications further bolsters market growth. Furthermore, the burgeoning packaging sector's demand for lightweight and protective materials contributes to the overall market expansion. The historical period (2019-2024) saw steady growth, laying a strong foundation for future projections. Key growth drivers include government initiatives promoting energy conservation, rising disposable incomes in developing economies leading to increased construction and appliance purchases, and technological innovations enabling cost-effective production of eco-friendly blowing agents. The market's trajectory is set to be shaped by both established players and emerging innovators, creating a competitive yet opportunity-rich environment.

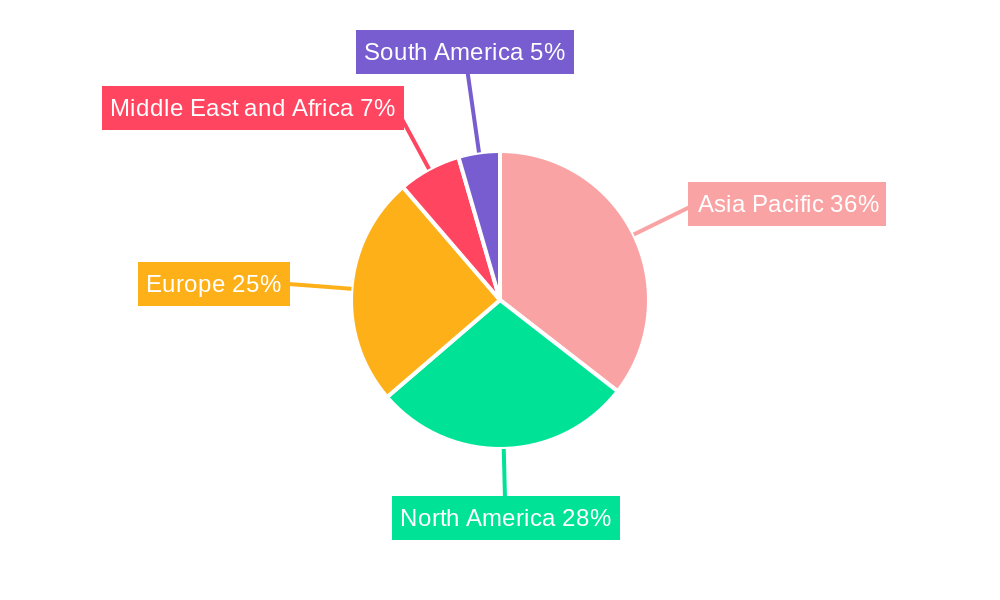

Key Markets & Segments Leading Blowing Agents Industry

The Asia Pacific region is emerging as a dominant force in the global blowing agents industry, driven by rapid industrialization, significant infrastructure development, and a burgeoning middle class in countries like China and India.

Product Type Dominance:

- Hydrofluoroolefins (HFOs): Experiencing exceptional growth due to their low GWP and excellent performance, making them the future of sustainable blowing agents. Drivers include stringent regulations against HFCs and growing consumer preference for environmentally responsible products.

- Hydrocarbons (HCs): Continuing to hold a significant market share, particularly in cost-sensitive applications and regions where regulatory pressures are less intense. Their effectiveness and widespread availability remain key advantages.

- Hydrofluorocarbons (HFCs): While facing gradual phase-downs, HFCs remain crucial in many existing applications, with their market share expected to decline gradually over the forecast period.

- Hydrochlorofluorocarbons (HCFCs): Their usage is significantly diminished due to Montreal Protocol regulations, with minimal market presence expected.

Foam Type Dominance:

- Polyurethane Foam: Remains the largest segment by volume, widely used in insulation, furniture, and automotive applications, owing to its versatile properties and excellent thermal performance. Economic growth and construction activity are primary drivers.

- Polystyrene Foam: Also a significant segment, particularly for insulation in buildings and packaging, benefiting from its cost-effectiveness and ease of processing. Infrastructure spending directly impacts its demand.

- Phenolic Foam: Gains traction in specialized high-performance insulation applications requiring superior fire resistance.

Application Dominance:

- Building and Construction: The largest and fastest-growing application segment, driven by increasing demand for energy-efficient buildings and stringent building codes mandating improved insulation. Infrastructure development projects worldwide are significant contributors.

- Appliances: Growing demand for energy-efficient refrigerators, freezers, and other cooling appliances fuels the need for high-performance blowing agents.

- Automotive: Used for lightweighting vehicles, enhancing insulation, and improving safety features, contributing to fuel efficiency and passenger comfort.

Blowing Agents Industry Product Developments

Product development in the blowing agents industry is characterized by a strong focus on sustainability and enhanced performance. The introduction of next-generation Hydrofluoroolefins (HFOs) like HFO-1233zd by companies such as Arkema and Honeywell is a major technological advancement. These low-GWP agents offer excellent thermal insulation properties, comparable to or exceeding traditional HFCs, while minimizing environmental impact. Nouryon's innovation with Expancel microspheres, acting as lightweight fillers and blowing agents, showcases a trend towards multi-functional additives that reduce material density and improve product characteristics, particularly in coatings and specialty applications. These developments are driven by regulatory pressures and the industry's commitment to circular economy principles.

Challenges in the Blowing Agents Industry Market

The blowing agents industry faces several significant challenges. Stringent and evolving regulatory landscapes worldwide, particularly concerning GWP limits and phase-out schedules for certain chemicals, necessitate continuous product innovation and investment in compliance. Supply chain volatilities and rising raw material costs can impact profitability and product availability. Furthermore, intense competition from both established players and emerging niche manufacturers exerts downward pressure on prices. The transition costs associated with shifting from established technologies to newer, sustainable blowing agents can be a barrier for smaller manufacturers and end-users, estimated to add up to 10-15% to initial production costs.

Forces Driving Blowing Agents Industry Growth

Several key forces are propelling the growth of the blowing agents industry. The growing global emphasis on energy efficiency and sustainability is a paramount driver, leading to increased demand for high-performance insulation materials in residential, commercial, and industrial sectors. Favorable government policies and incentives promoting green building and energy conservation further accelerate this trend. Technological advancements in developing eco-friendly blowing agents with low GWP and improved thermal insulation capabilities are creating new market opportunities. The increasing urbanization and infrastructure development globally, particularly in emerging economies, directly translates into higher demand for insulating materials.

Challenges in the Blowing Agents Industry Market

Long-term growth catalysts for the blowing agents industry lie in continued innovation in sustainable chemistries, particularly the development of next-generation blowing agents with even lower environmental impact and enhanced safety profiles. Strategic partnerships and collaborations between raw material suppliers, blowing agent manufacturers, and end-users can foster faster adoption of new technologies and create integrated solutions. Market expansion into emerging economies and the development of specialized blowing agents for niche applications also represent significant long-term growth opportunities, driven by growing industrial sectors and increasing consumer awareness of product performance and environmental impact.

Emerging Opportunities in Blowing Agents Industry

Emerging opportunities in the blowing agents industry are centered around the development of bio-based and recycled blowing agents, aligning with the circular economy. The growing demand for specialty foams in advanced applications like aerospace, marine, and electronics presents niche markets for tailored blowing agent solutions. Furthermore, the increasing focus on indoor air quality and health is driving the demand for blowing agents with low VOC (Volatile Organic Compound) emissions. The expansion of smart cities and sustainable construction initiatives will continue to create robust demand for high-performance insulation, further stimulating innovation and market growth in this sector.

Leading Players in the Blowing Agents Industry Sector

- Honeywell International Inc.

- Arkema

- Nouryon

- Harp International Ltd

- Sinochem Group Co Ltd

- Zeon Corporation

- Solvay

- Form Supplies Inc (FSI)

- HCS Group GmbH

- Huntsman International LLC

- The Chemours Company

- A-Gas

- The Linde Group

- Americhem

- Lanxess

Key Milestones in Blowing Agents Industry Industry

- June 2021: Arkema announced a USD 60 million expansion of its HFO-1233zd production capacity in Calvert City, Kentucky (USA) and a contract with Aofan for 5 kilotons per year in China by 2022, enhancing its global supply of low-GWP blowing agents.

- November 2020: Nouryon launched a new version of its Expancel expandable microspheres, a versatile filler and blowing agent that enhances product lightness and cost-efficiency, finding major applications in specialty thin coatings.

Strategic Outlook for Blowing Agents Industry Market

The strategic outlook for the blowing agents industry is overwhelmingly positive, characterized by a strong push towards environmentally responsible solutions and enhanced performance. Companies that invest in research and development of low-GWP blowing agents, particularly HFOs and other next-generation technologies, will be best positioned for future growth. Strategic partnerships, vertical integration, and expansion into rapidly developing geographical markets will be crucial for sustained competitive advantage. The increasing demand for energy-efficient insulation across all sectors presents a significant long-term growth accelerator. Furthermore, focusing on circular economy principles and developing solutions for emerging applications will unlock new revenue streams and solidify market leadership.

Blowing Agents Industry Segmentation

-

1. Product Type

- 1.1. Hydrochlorofluorocarbons (HCFCs)

- 1.2. Hydrofluorocarbons (HFCs)

- 1.3. Hydrocarbons (HCs)

- 1.4. Hydrofluoroolefin (HFO)

- 1.5. Other Product Types

-

2. Foam Type

- 2.1. Polyurethane Foam

- 2.2. Polystyrene Foam

- 2.3. Phenolic Foam

- 2.4. Polypropylene Foam

- 2.5. Polyethylene Foam

- 2.6. Other Foam Types

-

3. Application

- 3.1. Building and Construction

- 3.2. Automotive

- 3.3. Bedding and Furniture

- 3.4. Appliances

- 3.5. Packaging

- 3.6. Other Applications

Blowing Agents Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Blowing Agents Industry Regional Market Share

Geographic Coverage of Blowing Agents Industry

Blowing Agents Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in Demand for Polymeric Insulation Foams for Buildings

- 3.2.2 Automotive

- 3.2.3 and Appliances; Increasing Demand for Foam Blowing Agents in the Manufacturing of Polyurethane Foams

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations Regarding Blowing Agents; Impact of COVID-; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blowing Agents Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hydrochlorofluorocarbons (HCFCs)

- 5.1.2. Hydrofluorocarbons (HFCs)

- 5.1.3. Hydrocarbons (HCs)

- 5.1.4. Hydrofluoroolefin (HFO)

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Foam Type

- 5.2.1. Polyurethane Foam

- 5.2.2. Polystyrene Foam

- 5.2.3. Phenolic Foam

- 5.2.4. Polypropylene Foam

- 5.2.5. Polyethylene Foam

- 5.2.6. Other Foam Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Building and Construction

- 5.3.2. Automotive

- 5.3.3. Bedding and Furniture

- 5.3.4. Appliances

- 5.3.5. Packaging

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Blowing Agents Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hydrochlorofluorocarbons (HCFCs)

- 6.1.2. Hydrofluorocarbons (HFCs)

- 6.1.3. Hydrocarbons (HCs)

- 6.1.4. Hydrofluoroolefin (HFO)

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Foam Type

- 6.2.1. Polyurethane Foam

- 6.2.2. Polystyrene Foam

- 6.2.3. Phenolic Foam

- 6.2.4. Polypropylene Foam

- 6.2.5. Polyethylene Foam

- 6.2.6. Other Foam Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Building and Construction

- 6.3.2. Automotive

- 6.3.3. Bedding and Furniture

- 6.3.4. Appliances

- 6.3.5. Packaging

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Blowing Agents Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hydrochlorofluorocarbons (HCFCs)

- 7.1.2. Hydrofluorocarbons (HFCs)

- 7.1.3. Hydrocarbons (HCs)

- 7.1.4. Hydrofluoroolefin (HFO)

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Foam Type

- 7.2.1. Polyurethane Foam

- 7.2.2. Polystyrene Foam

- 7.2.3. Phenolic Foam

- 7.2.4. Polypropylene Foam

- 7.2.5. Polyethylene Foam

- 7.2.6. Other Foam Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Building and Construction

- 7.3.2. Automotive

- 7.3.3. Bedding and Furniture

- 7.3.4. Appliances

- 7.3.5. Packaging

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Blowing Agents Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hydrochlorofluorocarbons (HCFCs)

- 8.1.2. Hydrofluorocarbons (HFCs)

- 8.1.3. Hydrocarbons (HCs)

- 8.1.4. Hydrofluoroolefin (HFO)

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Foam Type

- 8.2.1. Polyurethane Foam

- 8.2.2. Polystyrene Foam

- 8.2.3. Phenolic Foam

- 8.2.4. Polypropylene Foam

- 8.2.5. Polyethylene Foam

- 8.2.6. Other Foam Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Building and Construction

- 8.3.2. Automotive

- 8.3.3. Bedding and Furniture

- 8.3.4. Appliances

- 8.3.5. Packaging

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Blowing Agents Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hydrochlorofluorocarbons (HCFCs)

- 9.1.2. Hydrofluorocarbons (HFCs)

- 9.1.3. Hydrocarbons (HCs)

- 9.1.4. Hydrofluoroolefin (HFO)

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Foam Type

- 9.2.1. Polyurethane Foam

- 9.2.2. Polystyrene Foam

- 9.2.3. Phenolic Foam

- 9.2.4. Polypropylene Foam

- 9.2.5. Polyethylene Foam

- 9.2.6. Other Foam Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Building and Construction

- 9.3.2. Automotive

- 9.3.3. Bedding and Furniture

- 9.3.4. Appliances

- 9.3.5. Packaging

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Blowing Agents Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hydrochlorofluorocarbons (HCFCs)

- 10.1.2. Hydrofluorocarbons (HFCs)

- 10.1.3. Hydrocarbons (HCs)

- 10.1.4. Hydrofluoroolefin (HFO)

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Foam Type

- 10.2.1. Polyurethane Foam

- 10.2.2. Polystyrene Foam

- 10.2.3. Phenolic Foam

- 10.2.4. Polypropylene Foam

- 10.2.5. Polyethylene Foam

- 10.2.6. Other Foam Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Building and Construction

- 10.3.2. Automotive

- 10.3.3. Bedding and Furniture

- 10.3.4. Appliances

- 10.3.5. Packaging

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nouryon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Harp International Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sinochem Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zeon Corporation*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Solvay

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Form Supplies Inc (FSI)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HCS Group GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huntsman International LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Chemours Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 A-Gas

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The Linde Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Americhem

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lanxess

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Blowing Agents Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Blowing Agents Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Blowing Agents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Blowing Agents Industry Revenue (Million), by Foam Type 2025 & 2033

- Figure 5: Asia Pacific Blowing Agents Industry Revenue Share (%), by Foam Type 2025 & 2033

- Figure 6: Asia Pacific Blowing Agents Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Blowing Agents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Blowing Agents Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Blowing Agents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Blowing Agents Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: North America Blowing Agents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: North America Blowing Agents Industry Revenue (Million), by Foam Type 2025 & 2033

- Figure 13: North America Blowing Agents Industry Revenue Share (%), by Foam Type 2025 & 2033

- Figure 14: North America Blowing Agents Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Blowing Agents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Blowing Agents Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Blowing Agents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Blowing Agents Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe Blowing Agents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Blowing Agents Industry Revenue (Million), by Foam Type 2025 & 2033

- Figure 21: Europe Blowing Agents Industry Revenue Share (%), by Foam Type 2025 & 2033

- Figure 22: Europe Blowing Agents Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Blowing Agents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Blowing Agents Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Blowing Agents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Blowing Agents Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Blowing Agents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Blowing Agents Industry Revenue (Million), by Foam Type 2025 & 2033

- Figure 29: South America Blowing Agents Industry Revenue Share (%), by Foam Type 2025 & 2033

- Figure 30: South America Blowing Agents Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Blowing Agents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Blowing Agents Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Blowing Agents Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Blowing Agents Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Blowing Agents Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Blowing Agents Industry Revenue (Million), by Foam Type 2025 & 2033

- Figure 37: Middle East and Africa Blowing Agents Industry Revenue Share (%), by Foam Type 2025 & 2033

- Figure 38: Middle East and Africa Blowing Agents Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Blowing Agents Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Blowing Agents Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Blowing Agents Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blowing Agents Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Blowing Agents Industry Revenue Million Forecast, by Foam Type 2020 & 2033

- Table 3: Global Blowing Agents Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Blowing Agents Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Blowing Agents Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Blowing Agents Industry Revenue Million Forecast, by Foam Type 2020 & 2033

- Table 7: Global Blowing Agents Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Blowing Agents Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Blowing Agents Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Global Blowing Agents Industry Revenue Million Forecast, by Foam Type 2020 & 2033

- Table 16: Global Blowing Agents Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Blowing Agents Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Blowing Agents Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Blowing Agents Industry Revenue Million Forecast, by Foam Type 2020 & 2033

- Table 23: Global Blowing Agents Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Blowing Agents Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Blowing Agents Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 31: Global Blowing Agents Industry Revenue Million Forecast, by Foam Type 2020 & 2033

- Table 32: Global Blowing Agents Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Blowing Agents Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Blowing Agents Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Blowing Agents Industry Revenue Million Forecast, by Foam Type 2020 & 2033

- Table 39: Global Blowing Agents Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Blowing Agents Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Blowing Agents Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blowing Agents Industry?

The projected CAGR is approximately 5.51%.

2. Which companies are prominent players in the Blowing Agents Industry?

Key companies in the market include Honeywell International Inc, Arkema, Nouryon, Harp International Ltd, Sinochem Group Co Ltd, Zeon Corporation*List Not Exhaustive, Solvay, Form Supplies Inc (FSI), HCS Group GmbH, Huntsman International LLC, The Chemours Company, A-Gas, The Linde Group, Americhem, Lanxess.

3. What are the main segments of the Blowing Agents Industry?

The market segments include Product Type, Foam Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Polymeric Insulation Foams for Buildings. Automotive. and Appliances; Increasing Demand for Foam Blowing Agents in the Manufacturing of Polyurethane Foams.

6. What are the notable trends driving market growth?

Increasing Demand from the Building and Construction Industry.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations Regarding Blowing Agents; Impact of COVID-; Other Restraints.

8. Can you provide examples of recent developments in the market?

In June 2021, Arkema has announced to increase in the production capacity of the insulation foam-blowing agent hydro-fluoro olefin 1233zd (HFO-1233zd) in the China and United States. Specifically, the company has planned to spend USD 60 million to add 15 kilotons per year of capacity for the HFO at its plant in Calvert City, Kentucky of United States. Moreover, the company will contract with Aofan to produce 5 kilotons per year in China by 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blowing Agents Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blowing Agents Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blowing Agents Industry?

To stay informed about further developments, trends, and reports in the Blowing Agents Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence