Key Insights

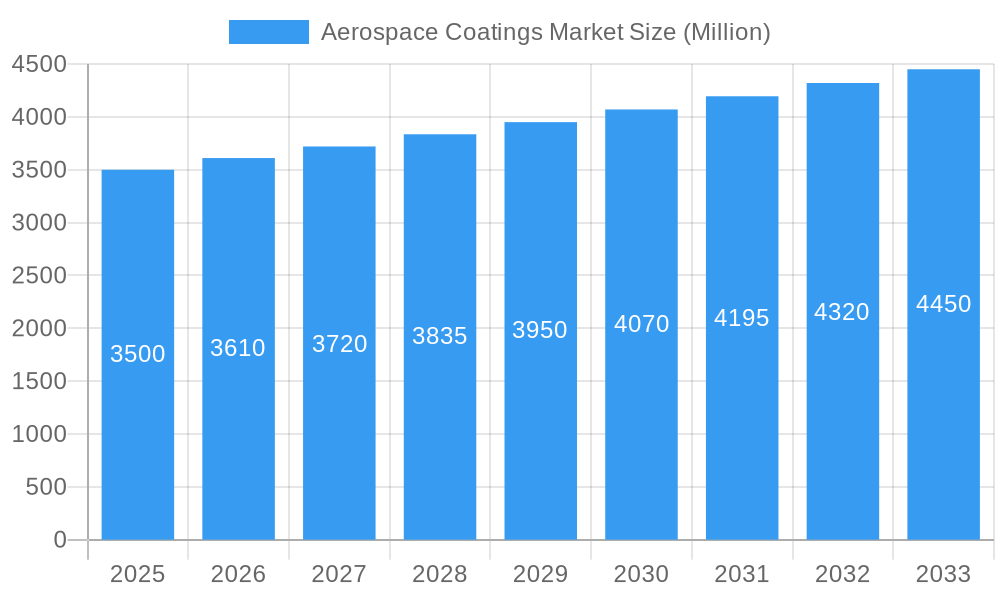

The global Aerospace Coatings Market is poised for robust expansion, driven by escalating demand for new aircraft production and a burgeoning aftermarket for maintenance, repair, and operations (MRO). With an estimated market size of approximately USD 3,500 million and a projected Compound Annual Growth Rate (CAGR) exceeding 3.00%, the market signifies a healthy and expanding sector within the aerospace industry. The primary drivers for this growth include the increasing global passenger traffic, necessitating fleet expansions and consequently, the demand for advanced coatings that offer superior durability, corrosion resistance, and aesthetic appeal. Furthermore, stringent regulatory requirements for aircraft safety and performance, coupled with the continuous development of innovative coating technologies like environmentally friendly waterborne and advanced composite coatings, are contributing significantly to market dynamism. The prevalence of high-search-volume keywords such as "aerospace coatings market size," "aerospace paint CAGR," and "aircraft coating solutions" underscores the industry's focus on performance, sustainability, and long-term asset protection.

Aerospace Coatings Market Market Size (In Billion)

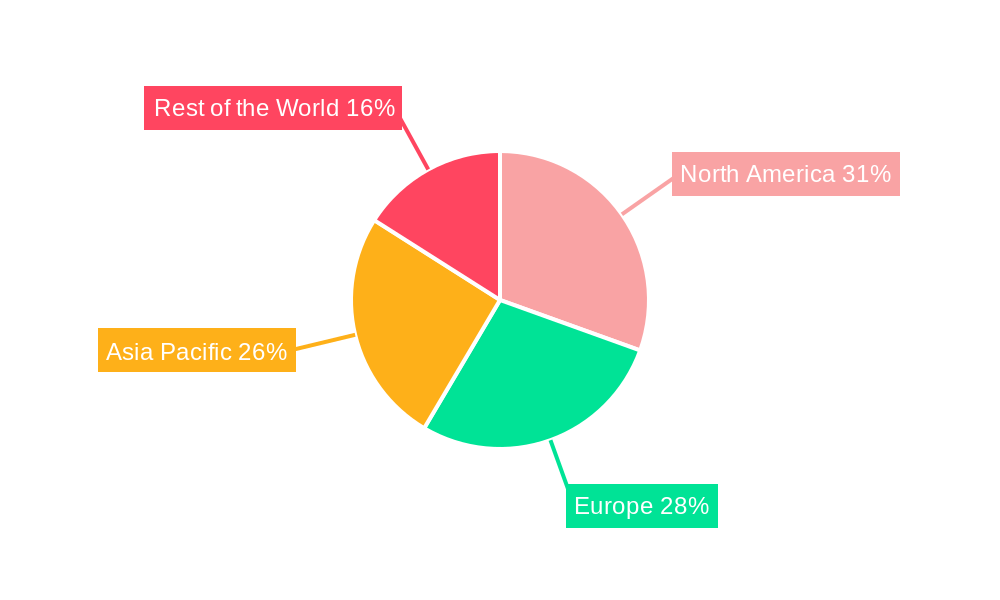

The market segmentation reveals key areas of opportunity and development. Epoxy and Polyurethane resin types are anticipated to dominate due to their exceptional adhesion, chemical resistance, and flexibility, crucial for the harsh operational environments aircraft endure. Waterborne technologies are gaining traction, reflecting the industry's broader shift towards sustainable and low-VOC (Volatile Organic Compound) solutions, driven by environmental regulations and corporate sustainability initiatives. The Original Equipment Manufacturer (OEM) segment is expected to maintain a significant market share, fueled by new aircraft deliveries. However, the Maintenance, Repair, and Operations (MRO) segment is witnessing accelerated growth, as airlines invest in extending the lifespan of their existing fleets through refurbishment and protective coating applications. Geographically, the Asia Pacific region, particularly China and India, is emerging as a high-growth hub, driven by rapid industrialization and substantial investments in aviation infrastructure. North America and Europe, with their well-established aerospace industries, will continue to be significant markets, focusing on advanced technological integrations and MRO services. Leading companies like The Sherwin-Williams Company, PPG Industries Inc., and Axalta Coating Systems are at the forefront, innovating to meet these evolving market demands.

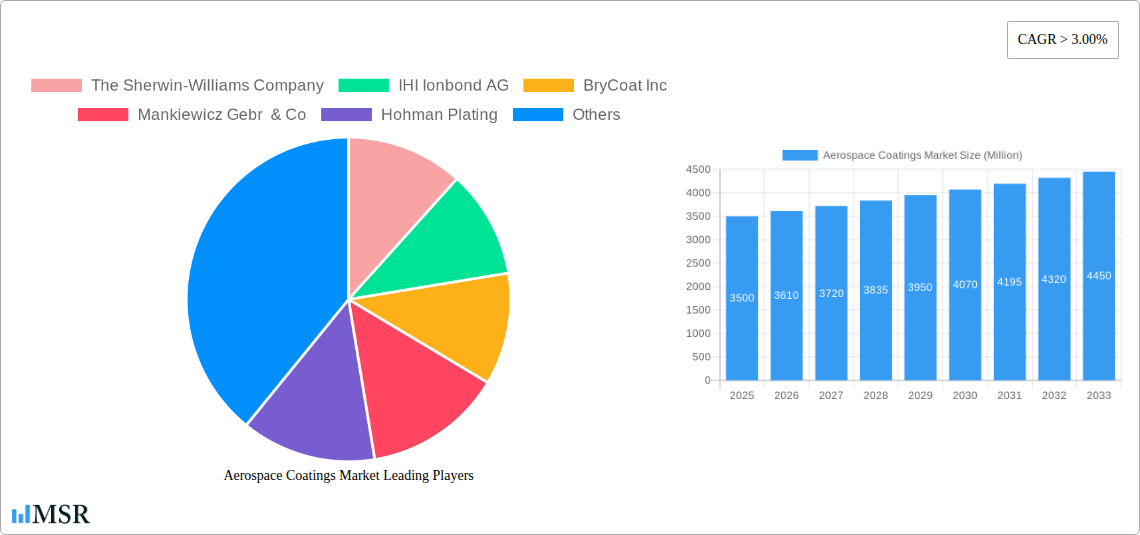

Aerospace Coatings Market Company Market Share

Here is an SEO-optimized and engaging report description for the Aerospace Coatings Market, adhering to all your specifications:

This comprehensive report delves into the dynamic global Aerospace Coatings Market, a critical sector supporting the aviation industry's demand for advanced protective and functional surface treatments. Covering the historical period from 2019 to 2024 and projecting significant growth from 2025 to 2033, this analysis provides actionable insights into market size, trends, and future trajectories. Our aerospace coatings market analysis offers an in-depth look at key segments including resin types (Epoxy, Acrylic, Polyurethane), technologies (Waterborne, Solvent-borne), and end-users (OEM, MRO), across Commercial Aviation, Military Aviation, and General Aviation. Discover how innovations in aircraft coatings, aviation paints, and aerospace surface treatments are shaping the future of aircraft longevity, fuel efficiency, and aesthetic appeal.

Aerospace Coatings Market Market Concentration & Dynamics

The Aerospace Coatings Market exhibits a moderate level of concentration, characterized by a blend of large, established players and specialized niche providers. Innovation ecosystems are vibrant, driven by stringent regulatory requirements and the continuous pursuit of enhanced aircraft performance. Key drivers of market dynamics include the development of environmentally friendly aerospace coatings and advanced functionalities such as anti-corrosion and self-healing properties. Regulatory frameworks, particularly those related to VOC emissions and material safety, significantly influence product development and market entry. The threat of substitute products is relatively low due to the highly specialized performance demands of aviation. End-user trends are shifting towards sustainable and lightweight solutions, impacting R&D priorities. Mergers and acquisitions (M&A) activities are a notable feature, with recent deals underscoring the consolidation and strategic expansion within the market. For instance, the acquisition of Mapaero by Akzo Nobel in 2019 highlights the strategic importance of this sector.

- Market Share: Dominated by a few key players, with a significant portion held by leading chemical and paint manufacturers.

- Innovation Ecosystems: Fueled by R&D in lightweight materials, sustainable formulations, and enhanced protective properties.

- Regulatory Frameworks: Driven by environmental regulations (e.g., VOC limits) and aviation safety standards.

- Substitute Products: Limited due to the unique performance requirements of aerospace applications.

- End-User Trends: Increasing demand for eco-friendly, durable, and lightweight coatings.

- M&A Activities: Strategic acquisitions and partnerships to expand product portfolios and geographical reach.

Aerospace Coatings Market Industry Insights & Trends

The Aerospace Coatings Market is poised for robust expansion, driven by the burgeoning global aviation industry and an increasing emphasis on aircraft maintenance and lifecycle management. The market size was estimated at approximately $3,000 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Technological disruptions are at the forefront, with significant advancements in waterborne coatings, advanced composite treatments, and functional coatings that offer enhanced UV resistance, corrosion protection, and stealth capabilities. The evolving consumer behavior, particularly from airlines and MRO providers, centers on reducing operational costs, extending aircraft lifespan, and minimizing environmental impact. This has led to a greater demand for high-performance, long-lasting aerospace paints and coatings. The increasing fleet size of both commercial and military aircraft globally, coupled with the need for regular maintenance, repair, and overhaul (MRO) activities, acts as a significant market stimulant. Furthermore, the growing trend towards outsourcing MRO services by airlines further propels the demand for specialized aerospace surface treatments. The industry is also witnessing a push towards digitalization in coating application processes, enhancing efficiency and precision.

Key Markets & Segments Leading Aerospace Coatings Market

The Aerospace Coatings Market is segmented by resin type, technology, and aviation type, with specific segments exhibiting pronounced leadership and growth potential.

Resin Type Dominance:

- Epoxy resins are a cornerstone in the aerospace coatings market, widely adopted for their exceptional adhesion, chemical resistance, and durability, making them ideal for primary structural components and fuselage exteriors. Their robust performance ensures protection against harsh environmental conditions encountered during flight.

- Acrylic resins are gaining traction, particularly for their excellent UV resistance and flexibility, often used in topcoats and cabin interiors where aesthetic appeal and color retention are paramount.

- Polyurethane resins offer a balanced blend of flexibility, abrasion resistance, and chemical stability, finding applications in areas subjected to mechanical stress and weathering.

- Other Resin Types, including specialized fluoropolymers and silicones, are carving out niches for applications requiring extreme temperature resistance or specific functional properties.

Technology Leadership:

- The shift towards Waterborne technologies is a dominant trend, driven by stringent environmental regulations and a growing industry commitment to sustainability. These coatings significantly reduce VOC emissions, offering a safer and more eco-friendly alternative to traditional solvent-borne systems.

- Solvent-borne coatings, while historically prevalent due to their ease of application and performance characteristics, are gradually being phased out in certain applications but remain critical for specific high-performance requirements.

- Other Technologies, such as powder coatings and UV-curable coatings, are emerging for specialized applications, offering faster curing times and enhanced durability.

End User Influence:

- The Original Equipment Manufacturer (OEM) segment is a primary driver, accounting for the largest share of the market due to the extensive use of coatings during aircraft manufacturing.

- The Maintenance Repair and Operations (MRO) segment is experiencing robust growth as airlines focus on extending aircraft lifespan and maintaining fleet appearance and functionality.

Aviation Type Dominance:

- Commercial Aviation represents the largest and fastest-growing segment, fueled by increasing global air travel demand and a vast fleet requiring regular coating maintenance.

- Military Aviation is a significant consumer, demanding high-performance coatings for corrosion resistance, stealth capabilities, and extreme environmental protection.

- General Aviation contributes a steady demand, albeit smaller in volume, for aircraft used in private, recreational, and business purposes.

Aerospace Coatings Market Product Developments

Recent product developments in the Aerospace Coatings Market have focused on enhancing sustainability, performance, and application efficiency. Innovations include the introduction of low-VOC and chrome-free primers and topcoats, aligning with stricter environmental mandates. Advanced functionalities such as self-healing coatings that can repair minor scratches, anti-icing coatings, and coatings with improved UV and corrosion resistance are also gaining prominence. The development of specialized coatings for composite materials, essential for lightweight aircraft structures, is another key area of innovation, offering improved adhesion and protection. Furthermore, advancements in application technologies, including robotic application and faster curing systems, are contributing to reduced turnaround times and operational costs for MRO providers.

Challenges in the Aerospace Coatings Market Market

The Aerospace Coatings Market faces several challenges that impact growth and operational efficiency. Stringent and evolving regulatory requirements concerning volatile organic compounds (VOCs) and hazardous substances necessitate continuous reformulation and compliance efforts, increasing R&D costs. Supply chain disruptions, particularly for raw materials, can lead to price volatility and production delays. The high cost of specialized aerospace coatings and the extensive testing and certification processes required before market entry represent significant barriers. Intense competition among established players and emerging niche manufacturers also puts pressure on pricing and innovation.

- Regulatory Hurdles: Compliance with evolving environmental and safety standards.

- Supply Chain Volatility: Fluctuations in raw material availability and pricing.

- High Certification Costs: Extensive testing and approval processes for new formulations.

- Competitive Pressures: Intense market competition impacting pricing strategies.

Forces Driving Aerospace Coatings Market Growth

Several forces are propelling the growth of the Aerospace Coatings Market. The sustained increase in global air traffic and the resulting expansion of commercial airline fleets are primary drivers. The growing emphasis on aircraft lifecycle management, including enhanced maintenance, repair, and overhaul (MRO) services, fuels demand for high-performance coatings. Technological advancements in aerospace manufacturing, such as the increasing use of composite materials, require specialized coating solutions. Furthermore, a growing awareness and commitment to environmental sustainability are driving the adoption of eco-friendly coatings, creating new market opportunities. The defense sector's ongoing need for advanced protective coatings for military aircraft also contributes significantly to market expansion.

Challenges in the Aerospace Coatings Market Market

Long-term growth catalysts in the Aerospace Coatings Market are rooted in continuous innovation and strategic market adaptation. The development of novel, high-performance coatings that offer enhanced durability, weight reduction, and advanced functionalities like anti-microbial or energy-harvesting properties will be crucial. Strategic partnerships between coating manufacturers and aircraft OEMs, as well as MRO providers, will foster collaborative R&D and market penetration. The expansion into emerging aviation markets, including the growth of regional aviation and specialized aircraft segments, presents significant untapped potential. Furthermore, the ongoing advancements in application technologies and automation will streamline processes, reduce costs, and improve the overall efficiency of coating application.

Emerging Opportunities in Aerospace Coatings Market

Emerging trends and opportunities in the Aerospace Coatings Market are shaping its future trajectory. The increasing demand for lightweight and fuel-efficient aircraft presents a significant opportunity for innovative coating solutions that reduce overall aircraft weight without compromising on protection. The growing focus on sustainability is driving the development and adoption of bio-based and recyclable coatings. The expansion of space tourism and commercial space exploration necessitates specialized coatings capable of withstanding extreme space environments. Furthermore, the integration of smart coatings with sensing capabilities for real-time performance monitoring and diagnostics offers a new frontier for innovation and value creation within the market. Digitalization in coating application and maintenance processes also presents opportunities for efficiency gains and new service models.

Leading Players in the Aerospace Coatings Market Sector

- The Sherwin-Williams Company

- IHI Ionbond AG

- BryCoat Inc

- Mankiewicz Gebr & Co

- Hohman Plating

- PPG Industries Inc

- ZIRCOTEC

- BASF SE

- Socomore

- Axalta Coating Systems

- Akzo Nobel N V

- Hentzen Coatings Inc

Key Milestones in Aerospace Coatings Market Industry

- July 2022: PPG partnered with UK airline brand and design consultancy Aerobrand to provide airline customers with a unique service integrating paint supply with livery design. This initiative aims to enhance brand consistency and streamline the aircraft customization process.

- July 2022: Akzo Nobel announced a total of EUR 15 million (USD 17.7 Million) investment in the company's aerospace coatings facility in Pamiers, which Mapaero acquired in 2019. Production capacity is expected to be increased by 50%, indicating a strong commitment to expanding market presence and meeting growing demand.

Strategic Outlook for Aerospace Coatings Market Market

The strategic outlook for the Aerospace Coatings Market is characterized by sustained growth driven by innovation and evolving industry demands. Key growth accelerators include the continued development and adoption of sustainable, low-VOC aerospace coatings, addressing environmental concerns and regulatory pressures. Investments in R&D for advanced functionalities such as self-healing, anti-icing, and lightweight coatings will be critical for competitive advantage. Strategic partnerships and collaborations between coating manufacturers, aircraft OEMs, and MRO providers are expected to foster innovation and streamline product development cycles. The expanding global aviation fleet, particularly in emerging economies, will provide substantial market potential. Furthermore, the increasing focus on extending aircraft lifecycles and reducing operational costs will drive demand for durable and high-performance aviation paints and surface treatments. The market is poised for significant evolution, driven by technological advancements and a commitment to environmental responsibility.

Aerospace Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Polyurethane

- 1.4. Other Resin Types

-

2. Technology

- 2.1. Waterborne

- 2.2. Solvent-borne

- 2.3. Other Technologies

-

3. End User

- 3.1. Original Equipment Manufacturer (OEM)

- 3.2. Maintenance Repair and Operations (MRO)

-

4. Aviation Type

- 4.1. Commercial Aviation

- 4.2. Military Aviation

- 4.3. General Aviation

Aerospace Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Spain

- 3.6. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Aerospace Coatings Market Regional Market Share

Geographic Coverage of Aerospace Coatings Market

Aerospace Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Composites in Aircraft Manufacturing; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Rising Prices of Raw Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Aerospace Coatings for Maintenance Repair and Operations (MRO)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Polyurethane

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solvent-borne

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Original Equipment Manufacturer (OEM)

- 5.3.2. Maintenance Repair and Operations (MRO)

- 5.4. Market Analysis, Insights and Forecast - by Aviation Type

- 5.4.1. Commercial Aviation

- 5.4.2. Military Aviation

- 5.4.3. General Aviation

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Acrylic

- 6.1.3. Polyurethane

- 6.1.4. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Waterborne

- 6.2.2. Solvent-borne

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Original Equipment Manufacturer (OEM)

- 6.3.2. Maintenance Repair and Operations (MRO)

- 6.4. Market Analysis, Insights and Forecast - by Aviation Type

- 6.4.1. Commercial Aviation

- 6.4.2. Military Aviation

- 6.4.3. General Aviation

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Acrylic

- 7.1.3. Polyurethane

- 7.1.4. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Waterborne

- 7.2.2. Solvent-borne

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Original Equipment Manufacturer (OEM)

- 7.3.2. Maintenance Repair and Operations (MRO)

- 7.4. Market Analysis, Insights and Forecast - by Aviation Type

- 7.4.1. Commercial Aviation

- 7.4.2. Military Aviation

- 7.4.3. General Aviation

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Acrylic

- 8.1.3. Polyurethane

- 8.1.4. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Waterborne

- 8.2.2. Solvent-borne

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Original Equipment Manufacturer (OEM)

- 8.3.2. Maintenance Repair and Operations (MRO)

- 8.4. Market Analysis, Insights and Forecast - by Aviation Type

- 8.4.1. Commercial Aviation

- 8.4.2. Military Aviation

- 8.4.3. General Aviation

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Rest of the World Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Acrylic

- 9.1.3. Polyurethane

- 9.1.4. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Waterborne

- 9.2.2. Solvent-borne

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Original Equipment Manufacturer (OEM)

- 9.3.2. Maintenance Repair and Operations (MRO)

- 9.4. Market Analysis, Insights and Forecast - by Aviation Type

- 9.4.1. Commercial Aviation

- 9.4.2. Military Aviation

- 9.4.3. General Aviation

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Sherwin-Williams Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IHI Ionbond AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BryCoat Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mankiewicz Gebr & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hohman Plating

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PPG Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ZIRCOTEC*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BASF SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Socomore

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Axalta Coating Systems

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Akzo Nobel N V

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hentzen Coatings Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 The Sherwin-Williams Company

List of Figures

- Figure 1: Global Aerospace Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Aerospace Coatings Market Volume Breakdown (Kilo Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 5: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 6: Asia Pacific Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 7: Asia Pacific Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 8: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 9: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Asia Pacific Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 11: Asia Pacific Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 12: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 13: Asia Pacific Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Asia Pacific Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 15: Asia Pacific Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 16: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 17: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 18: Asia Pacific Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 19: Asia Pacific Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 21: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 23: North America Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 24: North America Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 25: North America Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 26: North America Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 27: North America Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 28: North America Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 29: North America Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: North America Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: North America Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 32: North America Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 33: North America Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: North America Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 35: North America Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 36: North America Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 37: North America Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 38: North America Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 39: North America Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 40: North America Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 41: North America Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: North America Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Europe Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 44: Europe Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 45: Europe Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 46: Europe Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 47: Europe Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 48: Europe Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 49: Europe Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 50: Europe Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 51: Europe Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 52: Europe Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 53: Europe Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Europe Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Europe Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 56: Europe Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 57: Europe Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 58: Europe Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 59: Europe Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Europe Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 61: Europe Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of the World Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 64: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 65: Rest of the World Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 66: Rest of the World Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 67: Rest of the World Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 69: Rest of the World Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Rest of the World Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: Rest of the World Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 72: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 73: Rest of the World Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 74: Rest of the World Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 75: Rest of the World Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 76: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 77: Rest of the World Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 78: Rest of the World Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 79: Rest of the World Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 81: Rest of the World Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of the World Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 3: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 5: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 7: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 8: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 9: Global Aerospace Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Region 2020 & 2033

- Table 11: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 13: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 15: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 17: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 18: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 19: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 21: China Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 23: India Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 25: Japan Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 27: South Korea Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 31: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 32: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 33: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 34: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 35: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 36: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 37: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 38: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 39: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 41: United States Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: United States Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 43: Canada Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Canada Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 45: Mexico Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Mexico Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 47: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 48: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 49: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 50: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 51: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 53: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 54: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 55: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 57: Germany Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Germany Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 59: France Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: France Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 61: United Kingdom Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: United Kingdom Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 63: Italy Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Italy Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 65: Spain Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Spain Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 67: Rest of Europe Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Europe Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 69: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 70: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 71: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 72: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 73: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 74: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 75: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 76: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 77: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 79: South America Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South America Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 81: Middle East and Africa Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Middle East and Africa Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Coatings Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Aerospace Coatings Market?

Key companies in the market include The Sherwin-Williams Company, IHI Ionbond AG, BryCoat Inc, Mankiewicz Gebr & Co, Hohman Plating, PPG Industries Inc, ZIRCOTEC*List Not Exhaustive, BASF SE, Socomore, Axalta Coating Systems, Akzo Nobel N V, Hentzen Coatings Inc.

3. What are the main segments of the Aerospace Coatings Market?

The market segments include Resin Type, Technology, End User, Aviation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Composites in Aircraft Manufacturing; Other Drivers.

6. What are the notable trends driving market growth?

Aerospace Coatings for Maintenance Repair and Operations (MRO).

7. Are there any restraints impacting market growth?

Rising Prices of Raw Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

July 2022: PPG partnered with UK airline brand and design consultancy Aerobrand to provide airline customers with a unique service integrating paint supply with livery design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kilo Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Coatings Market?

To stay informed about further developments, trends, and reports in the Aerospace Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence