Key Insights

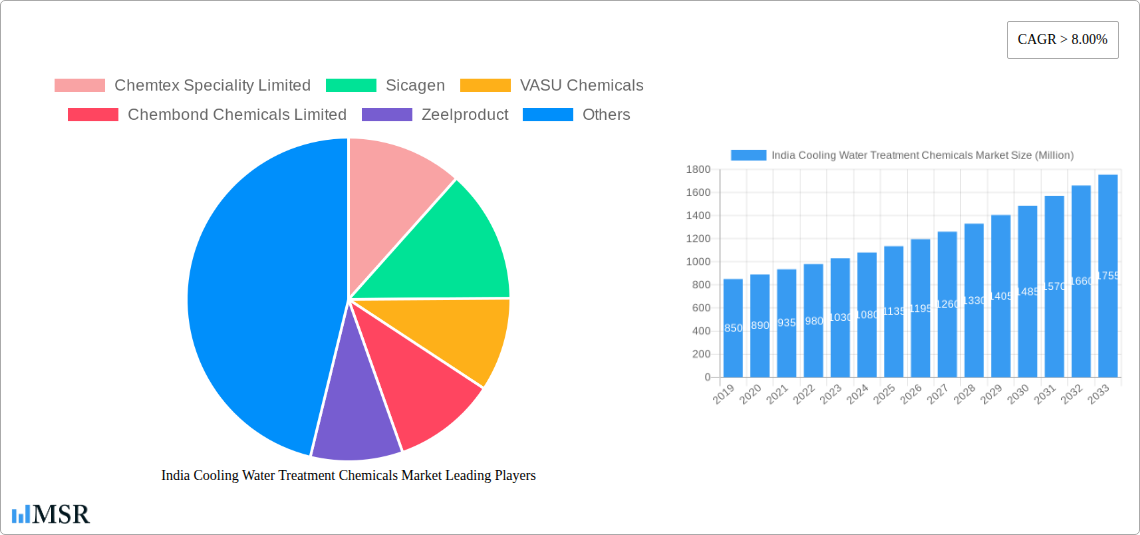

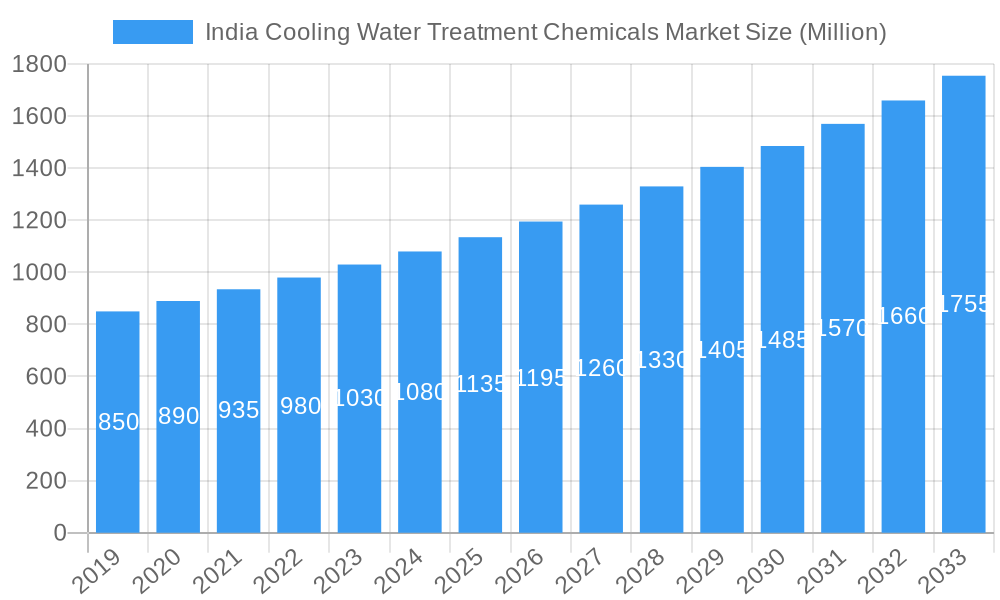

The India cooling water treatment chemicals market is projected for significant growth, estimated to reach USD 3.06 billion by 2025 and maintain a Compound Annual Growth Rate (CAGR) of over 8% through 2033. This expansion is driven by escalating demand from key industries including power generation, steel manufacturing, mining & metallurgy, and the rapidly growing petrochemical and oil & gas sectors. As these industries advance and invest in infrastructure, the need for efficient cooling systems, necessitating effective water treatment against corrosion, scaling, and biological fouling, increases. Furthermore, industries are increasingly recognizing the long-term cost benefits of optimized water treatment, such as reduced downtime, extended equipment lifespan, and improved operational efficiency. Government initiatives promoting industrial growth and sustainable practices also encourage the adoption of advanced cooling water treatment solutions.

India Cooling Water Treatment Chemicals Market Market Size (In Billion)

The market is segmented by product type, featuring corrosion inhibitors, scale inhibitors, and biocides, alongside specialized chemicals. Corrosion inhibitors and scale inhibitors are expected to experience robust demand due to their crucial role in preserving the integrity and performance of cooling systems across various industrial applications. Geographically, India presents a dynamic market landscape. Regions with high industrial concentrations, such as Western and Southern India, are anticipated to dominate market share. Leading companies like Chemtex Speciality Limited, Ecolab, and ION EXCHANGE are influencing the market through innovation and expansion. A notable trend is the increasing demand for eco-friendly and sustainable water treatment solutions, prompting manufacturers to invest in research and development for greener chemical formulations.

India Cooling Water Treatment Chemicals Market Company Market Share

Gain critical insights into the India Cooling Water Treatment Chemicals Market with our comprehensive report. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025–2033, this analysis delves into market dynamics, growth drivers, challenges, and emerging opportunities. Identify key players, product innovations, and segment-specific trends shaping this essential industry. This report is indispensable for chemical manufacturers, end-users, investors, and strategists aiming to capitalize on the substantial potential within India's cooling water treatment sector.

India Cooling Water Treatment Chemicals Market Market Concentration & Dynamics

The India Cooling Water Treatment Chemicals Market is characterized by a moderate to high market concentration, with a mix of large multinational corporations and established domestic players vying for market share. Leading companies such as Ecolab, Kemira, Solenis, Suez, ION EXCHANGE, Chembond Chemicals Limited, Sicagen, VASU Chemicals, Chemtex Speciality Limited, and Zeelproduct are actively engaged in innovation and strategic collaborations. The innovation ecosystem is driven by the increasing demand for eco-friendly and high-performance chemical solutions, leading to significant R&D investments in sustainable formulations. Regulatory frameworks, particularly those concerning environmental discharge and water conservation, are becoming more stringent, influencing product development and market entry strategies. Substitute products, such as advanced filtration technologies and non-chemical treatment methods, pose a growing competitive threat, necessitating continuous product improvement and cost-effectiveness. End-user trends are strongly influenced by industrial growth, water scarcity concerns, and a push towards operational efficiency. Merger and acquisition (M&A) activities, while not extensively documented, are expected to increase as larger players seek to expand their product portfolios and geographical reach. For instance, past M&A activities in the global market by players like Solenis indicate a consolidation trend that could extend to India.

India Cooling Water Treatment Chemicals Market Industry Insights & Trends

The India Cooling Water Treatment Chemicals Market is poised for significant expansion, driven by robust industrialization, increasing urbanization, and a growing emphasis on efficient water management across various sectors. The market size for cooling water treatment chemicals in India is projected to reach approximately $1,500 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Firstly, the power generation sector, a major consumer of cooling water treatment chemicals, is expanding rapidly to meet India's escalating energy demands. Thermal power plants, in particular, rely heavily on effective cooling water treatment to prevent scaling, corrosion, and biofouling, thereby ensuring optimal operational efficiency and equipment longevity. Secondly, the steel, mining, and metallurgy industries are witnessing sustained growth, fueled by infrastructure development and increasing domestic consumption. These industries require substantial amounts of cooling water for various processes, making water treatment chemicals indispensable for maintaining production cycles and minimizing environmental impact.

Furthermore, the petrochemical and oil & gas sector is another significant driver, with ongoing investments in refining and chemical production facilities demanding reliable cooling water solutions. The food & beverage industry is also a growing segment, where water quality is paramount for product safety and processing efficiency, necessitating the use of specialized treatment chemicals. The textiles & dyes industry, despite facing environmental scrutiny, continues to be a key consumer of cooling water treatment chemicals for its extensive processing needs. Technological disruptions are playing a crucial role, with a growing trend towards the adoption of "green" and sustainable chemical formulations. Manufacturers are increasingly focusing on developing biocides, corrosion inhibitors, and scale inhibitors that are biodegradable, low in toxicity, and compliant with stringent environmental regulations. This shift is driven by both regulatory pressures and evolving consumer preferences for environmentally responsible solutions. The adoption of smart water management technologies, including real-time monitoring and predictive analytics, is also gaining traction, allowing for more precise and efficient application of treatment chemicals, thereby optimizing costs and minimizing chemical usage. The government's focus on "Make in India" and initiatives promoting water conservation and efficient industrial practices are further bolstering the demand for advanced cooling water treatment solutions.

Key Markets & Segments Leading India Cooling Water Treatment Chemicals Market

The India Cooling Water Treatment Chemicals Market exhibits strong dominance across several key segments, driven by specific industrial needs and growth trajectories.

Dominant End-User Industries:

- Power Sector: This segment represents a cornerstone of the Indian cooling water treatment chemicals market. The relentless expansion of power generation capacity, primarily through thermal and increasingly through renewable sources that require thermal components for efficient operation, necessitates vast quantities of treated cooling water.

- Drivers: Escalating energy demand, government initiatives for power sector growth, need for operational efficiency and equipment lifespan extension in power plants.

- Steel, Mining, & Metallurgy: These foundational industries are critical to India's economic development and are major consumers of cooling water. The continuous demand for metals and minerals for infrastructure and manufacturing fuels their growth.

- Drivers: Robust infrastructure development, increasing automotive and construction sectors, government policies supporting domestic manufacturing.

- Petrochemicals and Oil & Gas: India's expanding refining capacity and the growing downstream chemical industry create a significant demand for reliable cooling water treatment solutions to maintain operational integrity and prevent costly downtime.

- Drivers: Government focus on energy security, increasing domestic refining capabilities, growing demand for petrochemical products.

Dominant Product Types:

- Corrosion Inhibitors: Essential for protecting cooling systems from degradation, corrosion inhibitors are critical across all major industrial sectors. Their ability to extend equipment life and prevent costly repairs makes them a staple in water treatment programs.

- Drivers: Aging infrastructure requiring maintenance, stringent operational standards, and the need to prevent system failures.

- Scale Inhibitors: Preventing mineral deposit buildup (scaling) is crucial for maintaining heat transfer efficiency and preventing blockages in cooling towers and associated equipment. This is particularly important in regions with hard water.

- Drivers: Water hardness variations across regions, need for optimized heat exchange efficiency, and reduction in energy consumption.

- Biocides: Controlling microbial growth (biofouling) is vital for preventing system inefficiencies, corrosion, and health hazards. The warm and humid climate in many parts of India makes biocide treatment a necessity.

- Drivers: Favorable conditions for microbial growth in industrial water systems, need for maintaining water quality and preventing biological contamination.

The geographical dominance of the market is concentrated in regions with a high density of industrial activity, particularly in Western and Southern India, due to the presence of major power plants, steel mills, petrochemical complexes, and manufacturing hubs.

India Cooling Water Treatment Chemicals Market Product Developments

Recent product developments in the India Cooling Water Treatment Chemicals Market are focused on enhancing efficacy, sustainability, and cost-effectiveness. Innovations include the introduction of low-toxicity biocides that are more environmentally friendly, alongside advanced multifunctional corrosion and scale inhibitors offering broader protection. The market is also witnessing the development of "green" chemical formulations derived from renewable resources and biodegradable components, aligning with increasing environmental regulations and corporate sustainability goals. Furthermore, there is a growing emphasis on specialty chemicals tailored for specific industrial challenges, such as those encountered in food processing or pharmaceutical manufacturing, where water purity is paramount. These advancements aim to provide superior performance while minimizing environmental impact and operational costs for end-users.

Challenges in the India Cooling Water Treatment Chemicals Market Market

The India Cooling Water Treatment Chemicals Market faces several significant challenges that could impede its growth trajectory. Stringent environmental regulations regarding water discharge and chemical usage necessitate substantial investment in compliant product development and implementation, which can be a barrier for smaller players. Fluctuations in raw material prices, particularly for key chemical precursors, can impact manufacturing costs and profit margins, leading to price volatility for end-users. Intensifying competition, both from domestic and international players, puts pressure on pricing and requires continuous innovation to maintain market share. Furthermore, lack of awareness and technical expertise in certain smaller industrial units can lead to suboptimal application of treatment chemicals, reducing their effectiveness and potentially causing system damage. Supply chain disruptions, amplified by logistical complexities and geopolitical factors, can affect the availability and timely delivery of essential chemicals, impacting industrial operations. The overall impact of these challenges could lead to slower adoption rates in specific segments and increased operational costs for end-users.

Forces Driving India Cooling Water Treatment Chemicals Market Growth

Several potent forces are propelling the growth of the India Cooling Water Treatment Chemicals Market. The "Make in India" initiative and the overall thrust towards industrial expansion across sectors like manufacturing, power, and infrastructure are creating sustained demand for cooling water treatment solutions. Increasing environmental consciousness and stricter regulations concerning water usage and pollution are driving the adoption of advanced and sustainable water treatment chemicals. Furthermore, the rising cost of water in many industrial regions incentivizes efficient water management, which in turn boosts the demand for effective treatment chemicals that optimize water reuse and reduce consumption. Technological advancements in chemical formulations and application methods, leading to higher efficiency and lower environmental impact, are also key growth catalysts. The growing awareness among industries about the long-term economic benefits of proactive water treatment, such as reduced maintenance costs and extended equipment lifespan, is further solidifying market growth.

Challenges in the India Cooling Water Treatment Chemicals Market Market

Long-term growth catalysts for the India Cooling Water Treatment Chemicals Market are rooted in continuous innovation and strategic market expansion. The increasing demand for specialized and high-performance chemicals tailored to specific industrial needs, such as those in the pharmaceutical or electronics sectors, presents a significant opportunity for growth. The development and adoption of digital water management solutions, integrating real-time monitoring and data analytics with chemical treatment programs, will enhance efficiency and provide new service-based revenue streams for chemical providers. Furthermore, the growing trend towards circular economy principles and the need for water reuse and recycling in industrial processes will drive demand for advanced treatment technologies and chemicals that can ensure water quality for multiple cycles. Strategic partnerships and collaborations between chemical manufacturers, equipment providers, and end-users will also be crucial for driving innovation and market penetration.

Emerging Opportunities in India Cooling Water Treatment Chemicals Market

Emerging opportunities in the India Cooling Water Treatment Chemicals Market are significant and diverse. The expansion of renewable energy infrastructure, particularly solar and wind farms with thermal components, will create new avenues for cooling water treatment chemicals. The growing automotive sector, with its substantial manufacturing footprint, requires robust water treatment solutions for its extensive cooling systems. The increasing focus on water conservation and wastewater treatment by industries, driven by both regulatory pressures and corporate social responsibility, presents a strong opportunity for advanced chemical solutions. Furthermore, the untapped potential in small and medium-sized enterprises (SMEs) across various industries, which may currently have basic water treatment practices, offers a fertile ground for introducing more efficient and sustainable chemical solutions. The development of biodegradable and eco-friendly chemical alternatives will continue to gain traction, offering a competitive edge to companies investing in sustainable product portfolios.

Leading Players in the India Cooling Water Treatment Chemicals Market Sector

- Chemtex Speciality Limited

- Sicagen

- VASU Chemicals

- Chembond Chemicals Limited

- Zeelproduct

- ION EXCHANGE

- Ecolab

- Kemira

- Solenis

- Suez

Key Milestones in India Cooling Water Treatment Chemicals Market Industry

- 2019-2024 (Historical Period): Consistent growth in demand driven by infrastructure projects and increasing industrial output. Increased regulatory scrutiny on water discharge quality.

- 2022/2023: Growing emphasis on sustainable and "green" chemical formulations due to rising environmental awareness.

- Ongoing: Development and adoption of smart water monitoring technologies integrated with chemical treatment.

- 2025 (Base & Estimated Year): Market projected to reach approximately $1,500 Million, indicating robust growth from the historical period.

- 2025–2033 (Forecast Period): Expected to witness continued double-digit growth fueled by industrial expansion and technological advancements.

Strategic Outlook for India Cooling Water Treatment Chemicals Market Market

The strategic outlook for the India Cooling Water Treatment Chemicals Market is highly positive, characterized by sustained growth and evolving industry demands. The market will witness an increasing emphasis on sustainable and eco-friendly chemical solutions, driving innovation and investment in R&D for biodegradable and low-toxicity products. Digitalization and smart water management technologies will become integral, offering opportunities for value-added services and predictive maintenance solutions. Strategic partnerships between chemical manufacturers and end-users will be crucial for developing tailored solutions and ensuring effective implementation. Companies that can offer a comprehensive portfolio of high-performance, cost-effective, and environmentally compliant water treatment chemicals, coupled with strong technical support and service, will be best positioned to capitalize on the immense growth potential in this dynamic market. The focus will shift towards integrated solutions that optimize water usage, minimize operational costs, and ensure long-term asset protection.

India Cooling Water Treatment Chemicals Market Segmentation

-

1. Product Type

- 1.1. Corrosion Inhibitors

- 1.2. Scale Inhibitors

- 1.3. Biocides

- 1.4. Others

-

2. End-user Industry

- 2.1. Power

- 2.2. Steel, Mining, & Metallurgy

- 2.3. Petrochemicals and oil & gas

- 2.4. Food & Beverage

- 2.5. Textiles & Dyes

- 2.6. Others

India Cooling Water Treatment Chemicals Market Segmentation By Geography

- 1. India

India Cooling Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of India Cooling Water Treatment Chemicals Market

India Cooling Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing demand from the power industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing demand from the power industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Corrosion Inhibitors to account for the highest market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Cooling Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Corrosion Inhibitors

- 5.1.2. Scale Inhibitors

- 5.1.3. Biocides

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Steel, Mining, & Metallurgy

- 5.2.3. Petrochemicals and oil & gas

- 5.2.4. Food & Beverage

- 5.2.5. Textiles & Dyes

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chemtex Speciality Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sicagen

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VASU Chemicals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chembond Chemicals Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zeelproduct

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ION EXCHANGE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ecolab

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kemira

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solenis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suez*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chemtex Speciality Limited

List of Figures

- Figure 1: India Cooling Water Treatment Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Cooling Water Treatment Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: India Cooling Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: India Cooling Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Cooling Water Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Cooling Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: India Cooling Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Cooling Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Cooling Water Treatment Chemicals Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the India Cooling Water Treatment Chemicals Market?

Key companies in the market include Chemtex Speciality Limited, Sicagen, VASU Chemicals, Chembond Chemicals Limited, Zeelproduct, ION EXCHANGE, Ecolab, Kemira, Solenis, Suez*List Not Exhaustive.

3. What are the main segments of the India Cooling Water Treatment Chemicals Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.06 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing demand from the power industry; Other Drivers.

6. What are the notable trends driving market growth?

Corrosion Inhibitors to account for the highest market share.

7. Are there any restraints impacting market growth?

; Increasing demand from the power industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Cooling Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Cooling Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Cooling Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the India Cooling Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence