Key Insights

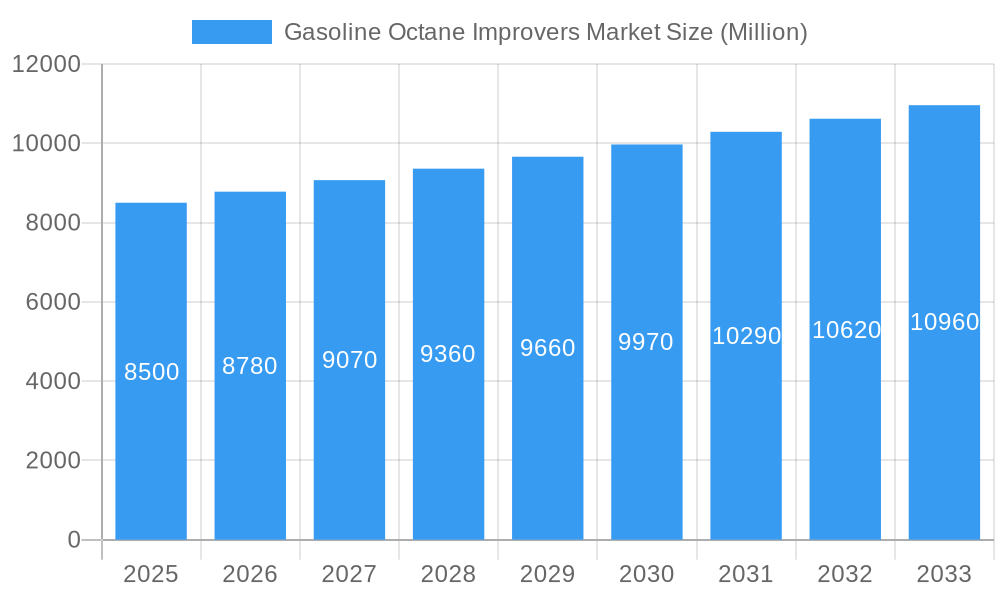

The global Gasoline Octane Improvers Market is poised for significant expansion, projected to reach a substantial market size by 2033. Driven by a robust CAGR exceeding 3.00%, the market's value is expected to grow steadily from an estimated USD 8,500 million in 2025 to over USD 11,500 million by 2033. This growth is primarily fueled by the increasing demand for high-performance fuels, stringent emission regulations, and the continuous need for engine efficiency improvements. As consumers and regulatory bodies alike prioritize cleaner and more efficient combustion, the role of octane enhancers becomes paramount. The market is witnessing a dynamic interplay between established improver types and emerging alternatives, each vying for market share based on cost-effectiveness, environmental impact, and performance characteristics.

Gasoline Octane Improvers Market Market Size (In Billion)

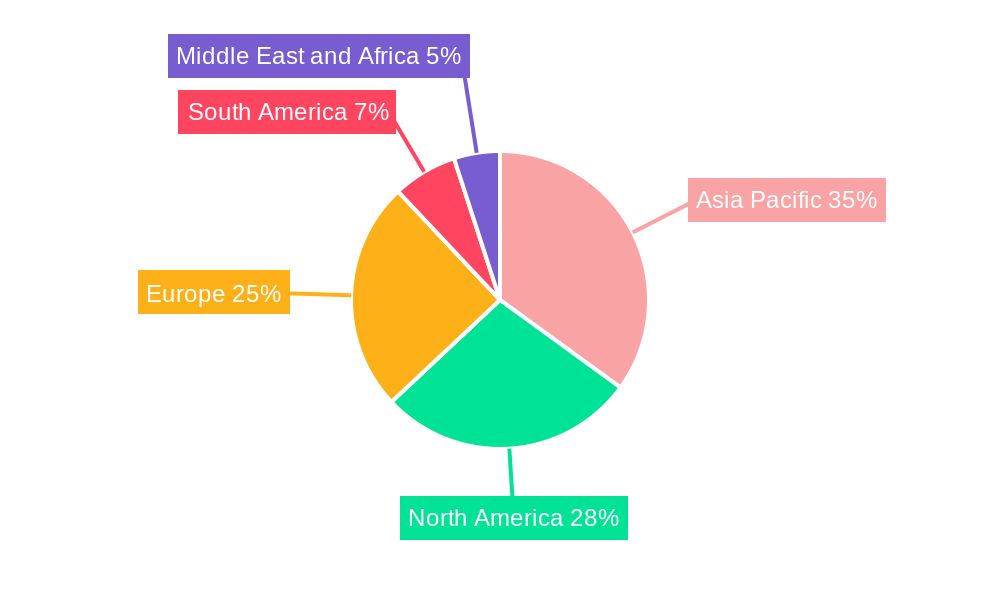

The market's segmentation reveals key areas of focus and opportunity. Ethanol and Methyl Tertiary Butyl Ether (MTBE) are leading improver types, catering to diverse applications in gasoline, racing fuels, and aviation fuels. While MTBE has faced regulatory scrutiny in some regions due to environmental concerns, its cost-effectiveness and blending properties continue to ensure its relevance. Ethanol, being a renewable and domestically sourced option in many countries, presents a strong growth trajectory, aligning with global sustainability initiatives. The application segment of gasoline remains the largest contributor, driven by the vast global automotive fleet. However, niche applications like racing fuels and aviation fuels, demanding premium octane ratings, are also exhibiting notable growth. Geographically, the Asia Pacific region, with its rapidly expanding automotive sector and increasing disposable incomes, is expected to be a dominant force. North America and Europe, despite being mature markets, will continue to contribute significantly due to established fuel standards and technological advancements. Restraints, such as fluctuating raw material prices and potential shifts in government policies regarding fuel additives, will require strategic navigation by market players.

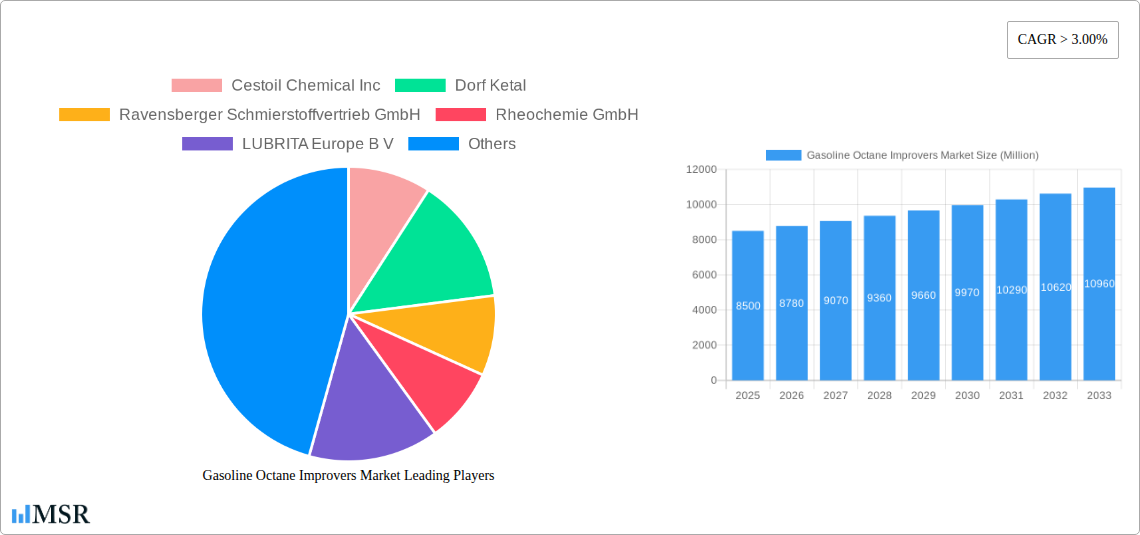

Gasoline Octane Improvers Market Company Market Share

Unlock the Power of Performance: The Definitive Gasoline Octane Improvers Market Report 2024-2033

This comprehensive report delivers deep insights into the dynamic Gasoline Octane Improvers Market, forecasting robust growth and illuminating key trends from 2019 to 2033. Explore critical market drivers, segment analysis, leading players, and strategic opportunities within the global octane enhancement landscape. Discover how innovative fuel additives, including Ethanol, MTBE, and MMT, are shaping the future of gasoline, racing fuels, and aviation fuels. This essential resource is vital for chemical manufacturers, fuel suppliers, automotive companies, and investors seeking to capitalize on this expanding market.

Gasoline Octane Improvers Market Market Concentration & Dynamics

The Gasoline Octane Improvers Market exhibits a moderate to high concentration, with a few dominant players holding significant market share, particularly in the production of key additives like Ethanol and MTBE. The innovation ecosystem is characterized by ongoing research into more efficient and environmentally friendly octane enhancers, alongside advancements in blending technologies. Regulatory frameworks, particularly concerning emissions and fuel composition standards in major economies like North America and Europe, profoundly influence product development and market access. Substitute products, such as higher octane base fuels and advanced engine technologies that optimize combustion, present ongoing challenges. End-user trends are shifting towards higher-performance fuels for specialized applications like racing fuels and a growing demand for cleaner combustion across all gasoline applications. Mergers and acquisitions (M&A) activities are observed as key companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies and geographical markets. For instance, several strategic alliances and acquisitions have occurred in the historical period (2019-2024) aimed at bolstering R&D capabilities and increasing production capacities for octane boosters. The market share of leading octane improver producers is estimated to be in the range of 15-25% for the top three entities.

Gasoline Octane Improvers Market Industry Insights & Trends

The global Gasoline Octane Improvers Market is poised for significant expansion, driven by a confluence of technological advancements, evolving regulatory landscapes, and increasing demand for higher-performance fuels. The market size was valued at approximately $8,500 Million in the base year 2025 and is projected to reach over $12,000 Million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 4.5% during the forecast period (2025-2033). Key growth drivers include the relentless pursuit of enhanced fuel efficiency and engine performance in the automotive sector, necessitating higher octane ratings for modern internal combustion engines. Technological disruptions are centered around the development of novel chemical formulations and the optimization of existing octane enhancers to meet stringent environmental standards. For example, research into bio-based octane boosters and cleaner alternatives to traditional additives like MTBE is gaining traction. Evolving consumer behaviors, influenced by a desire for superior driving experiences and increased vehicle longevity, also contribute to the demand for premium fuels enhanced with octane improvers. The aviation sector's requirement for high-octane aviation fuels, particularly for piston-engine aircraft, remains a consistent demand source. Furthermore, the burgeoning popularity of motorsports and specialized racing fuels directly fuels the demand for potent octane-boosting additives. The gasoline segment continues to dominate the market due to its widespread use, but niche applications are showing rapid growth. Supply chain resilience and the cost-effectiveness of production also play crucial roles in shaping market dynamics.

Key Markets & Segments Leading Gasoline Octane Improvers Market

The Gasoline Octane Improvers Market is experiencing significant growth across various regions and segments, with North America currently leading in terms of market share due to its substantial automotive industry and established infrastructure for fuel additives. The United States, in particular, represents a major consumption hub for octane boosters.

Dominant Segments:

Improver Type:

- Ethanol: This bio-derived additive is a significant contributor to the market, driven by government mandates and its renewable nature. Its widespread use in gasoline blends contributes to substantial market volume.

- Methyl Tertiary Butyl Ether (MTBE): While facing regulatory scrutiny in some regions due to environmental concerns, MTBE remains a cost-effective and efficient octane enhancer, particularly in specific industrial applications and markets with less stringent regulations. Its market presence is still substantial due to its efficacy and historical widespread adoption.

- Methylcyclopentadienyl Manganese Tricarbonyl (MMT): MMT is a key organometallic compound widely used to boost octane. Its effectiveness in small quantities makes it attractive, though regulatory acceptance varies globally.

- Ethyl Tertiary Butyl Ether (ETBE): Similar to MTBE, ETBE is an ether-based octane enhancer, often favored in regions where MTBE has faced restrictions, offering a balance of performance and environmental considerations.

- Ferrocene: This organometallic compound also serves as an effective octane booster, particularly in specialized applications where high performance is paramount.

- Others: This category encompasses emerging and less common octane improvers, as well as proprietary blends that cater to specific performance requirements.

Application:

- Gasoline: This segment represents the largest share of the market, driven by the vast global consumption of standard automotive gasoline. The demand for improved fuel efficiency and engine protection in everyday vehicles fuels this segment.

- Racing Fuels: The high-performance demands of motorsports make this a high-value segment. Racing fuels often require significantly higher octane ratings, leading to a concentrated use of potent octane improvers.

- Aviation Fuels: While a smaller segment compared to gasoline, aviation fuels, particularly for piston-engine aircraft, have stringent octane requirements to ensure safe and efficient operation, contributing a consistent demand.

Drivers of Dominance:

- Economic Growth & Disposable Income: Strong economic performance in key regions translates to increased vehicle ownership and fuel consumption, directly impacting the demand for octane improvers.

- Automotive Industry Expansion: Growing vehicle production globally, especially in emerging economies, necessitates a corresponding increase in fuel production and the additives used to enhance it.

- Technological Advancements in Engine Design: Modern engines are designed to operate with higher octane fuels to maximize performance and efficiency, creating a sustained demand for octane improvers.

- Regulatory Support for Biofuels: Government incentives and mandates promoting the use of biofuels like ethanol positively influence the demand for bio-based octane enhancers.

- Infrastructure Development: Well-established fuel distribution networks and refining capacities in developed regions facilitate the widespread adoption and blending of octane improvers.

Gasoline Octane Improvers Market Product Developments

Product innovation in the Gasoline Octane Improvers Market is primarily focused on developing more efficient, environmentally friendly, and cost-effective additives. Companies are investing in R&D to create fuel additives that not only boost octane but also offer additional benefits such as reduced emissions, improved engine cleanliness, and enhanced fuel stability. For instance, the development of advanced synthetic compounds and optimized formulations of existing additives like MMT and ethers is crucial for meeting evolving regulatory standards and performance demands. The market relevance of these innovations lies in their ability to provide a competitive edge, enable compliance with stringent environmental regulations, and cater to the growing demand for high-performance fuels in sectors like racing fuels and premium gasoline. The focus remains on delivering superior octane enhancement while minimizing the environmental footprint.

Challenges in the Gasoline Octane Improvers Market Market

The Gasoline Octane Improvers Market faces several significant challenges that can impede growth. Regulatory hurdles are a primary concern, with increasing environmental scrutiny on certain additives like MTBE, leading to bans or restrictions in various jurisdictions. This necessitates continuous adaptation and the development of compliant alternatives. Supply chain disruptions, influenced by geopolitical factors, raw material availability, and logistical complexities, can impact production costs and product availability. The volatile pricing of raw materials, such as crude oil and agricultural commodities for Ethanol production, presents a constant challenge for cost management. Furthermore, intense competition among established players and the emergence of new entrants can lead to price pressures and reduced profit margins. The ongoing shift towards electric vehicles, while a long-term trend, also poses a challenge to the sustained growth of the gasoline additives market. Quantifiable impacts include potential market share loss for restricted additives and increased R&D expenditure to address regulatory compliance.

Forces Driving Gasoline Octane Improvers Market Growth

The Gasoline Octane Improvers Market is propelled by a robust set of growth drivers. Technologically, advancements in internal combustion engine design necessitate higher octane fuels to optimize performance and efficiency, thereby increasing the demand for effective octane boosters. Economically, rising global vehicle ownership, particularly in emerging economies, directly correlates with increased gasoline consumption and the need for octane enhancement. Regulatory factors also play a crucial role; while some regulations restrict certain additives, others promote the use of cleaner-burning fuels, indirectly benefiting octane improvers that contribute to cleaner combustion. For example, mandates for higher ethanol blends in gasoline provide a significant boost to the Ethanol segment of the octane improvers market. The sustained demand for high-performance fuels in niche applications like racing fuels and aviation also acts as a consistent growth force.

Challenges in the Gasoline Octane Improvers Market Market

Long-term growth catalysts in the Gasoline Octane Improvers Market are deeply intertwined with innovation and strategic market expansion. The continuous development of novel, high-performance octane enhancers that meet increasingly stringent environmental regulations is a key driver. Partnerships and collaborations between chemical manufacturers, fuel refiners, and automotive OEMs are crucial for co-developing advanced fuel solutions tailored to future engine technologies. Expanding market reach into rapidly developing economies with growing automotive sectors offers significant growth potential. Moreover, the exploration of new applications for octane improvers beyond traditional gasoline, such as in specialty fuels or industrial processes, can unlock unforeseen market opportunities. Strategic investments in sustainable production methods for additives like Ethanol will also be vital for long-term market viability and consumer acceptance.

Emerging Opportunities in Gasoline Octane Improvers Market

Emerging opportunities in the Gasoline Octane Improvers Market are ripe for exploration. The growing demand for ultra-high-performance fuels in motorsports and specialized automotive sectors presents a lucrative niche for advanced octane improvers like Ferrocene and proprietary formulations. Furthermore, the increasing focus on sustainable chemistry opens avenues for the development and adoption of bio-based or recycled-content octane enhancers, aligning with global environmental initiatives. As regions with developing economies continue to see an increase in vehicle ownership, there is a substantial opportunity to establish market presence and cater to the rising demand for enhanced gasoline. The potential for additive synergies, where octane improvers are blended with other fuel additives to provide multi-functional benefits, also represents a significant trend.

Leading Players in the Gasoline Octane Improvers Market Sector

- Cestoil Chemical Inc

- Dorf Ketal

- Ravensberger Schmierstoffvertrieb GmbH

- Rheochemie GmbH

- LUBRITA Europe B V

- BITA Trading GmbH

- LyondellBasell Industries Holdings B V

- KENNOL Performance Oil

- Energizer Auto

- LIQUI MOLY GmbH

- Total

- Innospec

- Afton Chemical

- Penrite Oil

Key Milestones in Gasoline Octane Improvers Market Industry

- 2019: Increased global focus on emissions reduction leads to renewed research into cleaner octane-boosting technologies.

- 2020: Several key players announce significant investments in R&D for bio-based fuel additives.

- 2021: Stringent fuel quality standards implemented in major European markets drive demand for advanced octane improvers.

- 2022: Strategic partnerships emerge between chemical companies and automotive manufacturers to develop next-generation fuel formulations.

- 2023: The market witnesses consolidation through key acquisitions aimed at expanding product portfolios and market reach.

- 2024: Growing interest in sustainable aviation fuels spurs research into octane enhancers suitable for this segment.

Strategic Outlook for Gasoline Octane Improvers Market Market

The strategic outlook for the Gasoline Octane Improvers Market is one of continued innovation and adaptation. Key growth accelerators include the relentless pursuit of higher fuel efficiency in internal combustion engines, the increasing demand for premium and specialized fuels, and the ongoing development of environmentally compliant octane enhancers. Companies that invest in sustainable production methods, explore synergies with other fuel additives, and strategically expand into high-growth emerging markets are best positioned for success. The market will likely see a bifurcation, with continued demand for cost-effective, widely-used additives and a rising premium for high-performance, environmentally advanced solutions. Strategic partnerships and targeted acquisitions will remain crucial for navigating the evolving competitive landscape and capitalizing on future opportunities.

Gasoline Octane Improvers Market Segmentation

-

1. Improver Type

- 1.1. Ethanol

- 1.2. Methyl Tertiary Butyl Ether (MTBE)

- 1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 1.5. Ferrocene

- 1.6. Others

-

2. Application

- 2.1. Gasoline

- 2.2. Racing Fuels

- 2.3. Aviation Fuels

- 2.4. Others

Gasoline Octane Improvers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Gasoline Octane Improvers Market Regional Market Share

Geographic Coverage of Gasoline Octane Improvers Market

Gasoline Octane Improvers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand For Ethanol-Blended Fuels; Increasing Demand for High-Performance Fuels

- 3.3. Market Restrains

- 3.3.1. ; Unfavourable Conditions Arising Due to the COVID-19 Outbreak; Stringent Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Growing Demand for Ethanol-Blended Fuels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gasoline Octane Improvers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Improver Type

- 5.1.1. Ethanol

- 5.1.2. Methyl Tertiary Butyl Ether (MTBE)

- 5.1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 5.1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 5.1.5. Ferrocene

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gasoline

- 5.2.2. Racing Fuels

- 5.2.3. Aviation Fuels

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Improver Type

- 6. Asia Pacific Gasoline Octane Improvers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Improver Type

- 6.1.1. Ethanol

- 6.1.2. Methyl Tertiary Butyl Ether (MTBE)

- 6.1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 6.1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 6.1.5. Ferrocene

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gasoline

- 6.2.2. Racing Fuels

- 6.2.3. Aviation Fuels

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Improver Type

- 7. North America Gasoline Octane Improvers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Improver Type

- 7.1.1. Ethanol

- 7.1.2. Methyl Tertiary Butyl Ether (MTBE)

- 7.1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 7.1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 7.1.5. Ferrocene

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gasoline

- 7.2.2. Racing Fuels

- 7.2.3. Aviation Fuels

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Improver Type

- 8. Europe Gasoline Octane Improvers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Improver Type

- 8.1.1. Ethanol

- 8.1.2. Methyl Tertiary Butyl Ether (MTBE)

- 8.1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 8.1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 8.1.5. Ferrocene

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gasoline

- 8.2.2. Racing Fuels

- 8.2.3. Aviation Fuels

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Improver Type

- 9. South America Gasoline Octane Improvers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Improver Type

- 9.1.1. Ethanol

- 9.1.2. Methyl Tertiary Butyl Ether (MTBE)

- 9.1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 9.1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 9.1.5. Ferrocene

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gasoline

- 9.2.2. Racing Fuels

- 9.2.3. Aviation Fuels

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Improver Type

- 10. Middle East and Africa Gasoline Octane Improvers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Improver Type

- 10.1.1. Ethanol

- 10.1.2. Methyl Tertiary Butyl Ether (MTBE)

- 10.1.3. Methylcyclopentadienyl Manganese Tricarbonyl (MMT)

- 10.1.4. Ethyl Tertiary Butyl Ether (ETBE)

- 10.1.5. Ferrocene

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gasoline

- 10.2.2. Racing Fuels

- 10.2.3. Aviation Fuels

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Improver Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cestoil Chemical Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dorf Ketal

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ravensberger Schmierstoffvertrieb GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rheochemie GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LUBRITA Europe B V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BITA Trading GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LyondellBasell Industries Holdings B V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KENNOL Performance Oil

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Energizer Auto

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LIQUI MOLY GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Total*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Innospec

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Afton Chemical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Penrite Oil

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Cestoil Chemical Inc

List of Figures

- Figure 1: Global Gasoline Octane Improvers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Gasoline Octane Improvers Market Revenue (Million), by Improver Type 2025 & 2033

- Figure 3: Asia Pacific Gasoline Octane Improvers Market Revenue Share (%), by Improver Type 2025 & 2033

- Figure 4: Asia Pacific Gasoline Octane Improvers Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Gasoline Octane Improvers Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Gasoline Octane Improvers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Gasoline Octane Improvers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Gasoline Octane Improvers Market Revenue (Million), by Improver Type 2025 & 2033

- Figure 9: North America Gasoline Octane Improvers Market Revenue Share (%), by Improver Type 2025 & 2033

- Figure 10: North America Gasoline Octane Improvers Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Gasoline Octane Improvers Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Gasoline Octane Improvers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Gasoline Octane Improvers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Gasoline Octane Improvers Market Revenue (Million), by Improver Type 2025 & 2033

- Figure 15: Europe Gasoline Octane Improvers Market Revenue Share (%), by Improver Type 2025 & 2033

- Figure 16: Europe Gasoline Octane Improvers Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Gasoline Octane Improvers Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Gasoline Octane Improvers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Gasoline Octane Improvers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Gasoline Octane Improvers Market Revenue (Million), by Improver Type 2025 & 2033

- Figure 21: South America Gasoline Octane Improvers Market Revenue Share (%), by Improver Type 2025 & 2033

- Figure 22: South America Gasoline Octane Improvers Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Gasoline Octane Improvers Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Gasoline Octane Improvers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Gasoline Octane Improvers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Gasoline Octane Improvers Market Revenue (Million), by Improver Type 2025 & 2033

- Figure 27: Middle East and Africa Gasoline Octane Improvers Market Revenue Share (%), by Improver Type 2025 & 2033

- Figure 28: Middle East and Africa Gasoline Octane Improvers Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Gasoline Octane Improvers Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Gasoline Octane Improvers Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Gasoline Octane Improvers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Improver Type 2020 & 2033

- Table 2: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Improver Type 2020 & 2033

- Table 5: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Improver Type 2020 & 2033

- Table 13: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Improver Type 2020 & 2033

- Table 19: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Improver Type 2020 & 2033

- Table 27: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Improver Type 2020 & 2033

- Table 33: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Gasoline Octane Improvers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Gasoline Octane Improvers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gasoline Octane Improvers Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Gasoline Octane Improvers Market?

Key companies in the market include Cestoil Chemical Inc, Dorf Ketal, Ravensberger Schmierstoffvertrieb GmbH, Rheochemie GmbH, LUBRITA Europe B V, BITA Trading GmbH, LyondellBasell Industries Holdings B V, KENNOL Performance Oil, Energizer Auto, LIQUI MOLY GmbH, Total*List Not Exhaustive, Innospec, Afton Chemical, Penrite Oil.

3. What are the main segments of the Gasoline Octane Improvers Market?

The market segments include Improver Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand For Ethanol-Blended Fuels; Increasing Demand for High-Performance Fuels.

6. What are the notable trends driving market growth?

Growing Demand for Ethanol-Blended Fuels.

7. Are there any restraints impacting market growth?

; Unfavourable Conditions Arising Due to the COVID-19 Outbreak; Stringent Environmental Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gasoline Octane Improvers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gasoline Octane Improvers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gasoline Octane Improvers Market?

To stay informed about further developments, trends, and reports in the Gasoline Octane Improvers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence