Key Insights

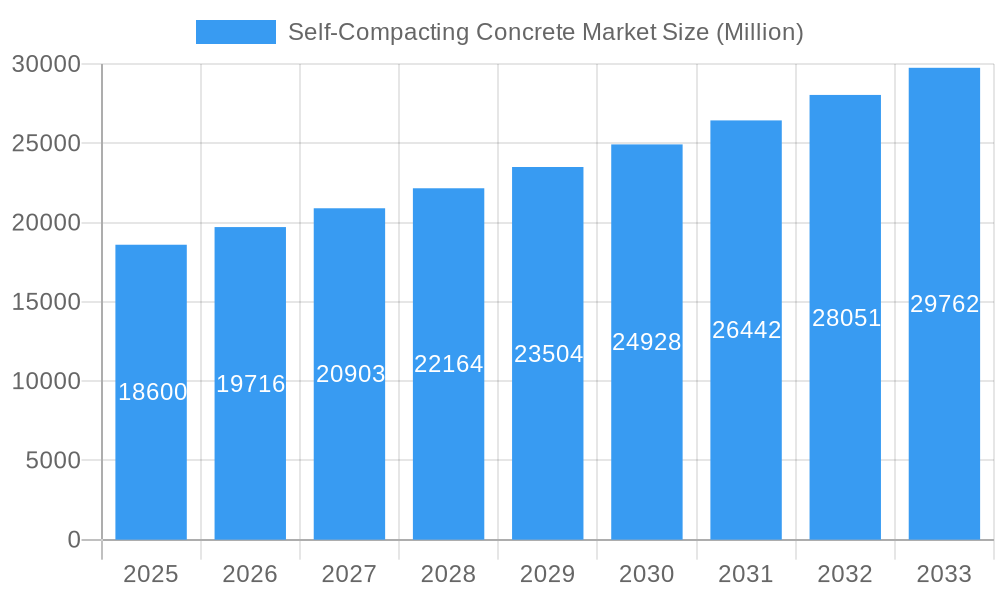

The global Self-Compacting Concrete (SCC) market is projected for significant expansion, with an estimated market size of $13.23 billion by 2025. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 7.5%. Key drivers include SCC's superior workability, reduced labor needs, enhanced durability, and aesthetic advantages, making it a preferred choice for complex construction projects and congested reinforcement areas. Growing demand for sustainable building practices and accelerated construction timelines further propel SCC adoption. Rapid urbanization and infrastructure development in emerging economies, particularly in the Asia Pacific region, are also contributing to substantial market growth.

Self-Compacting Concrete Market Market Size (In Billion)

Leading industry players such as HEIDELBERGCEMENT AG, LafargeHolcim, CEMEX S A B de C V, and Ultratech Concrete are actively investing in research and development to improve SCC performance and broaden product offerings. While the initial cost of SCC may be higher than conventional concrete, its long-term benefits, including reduced construction time, improved structural integrity, and lower lifecycle costs, are increasingly recognized. Technological advancements in admixtures and production techniques are expected to further enhance SCC properties and expand its application scope, ensuring sustained market expansion.

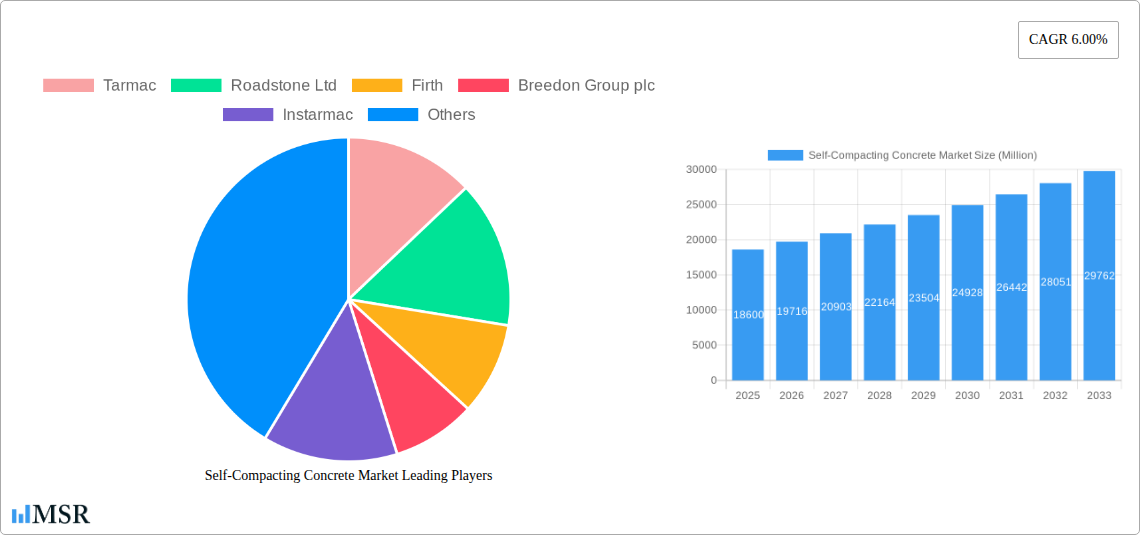

Self-Compacting Concrete Market Company Market Share

Gain comprehensive insights into the Self-Compacting Concrete Market. This analysis, covering 2019–2033 with a base year of 2025, details market dynamics across Residential, Commercial, Infrastructural, Industrial, and Other segments. Essential for stakeholders in the concrete market, construction materials, building and infrastructure development, and specialty chemicals, this report identifies lucrative opportunities and strategic approaches within the burgeoning SCC industry.

Self-Compacting Concrete Market Market Concentration & Dynamics

The Self-Compacting Concrete Market is characterized by a moderate level of market concentration, with key players like HEIDELBERGCEMENT AG, LafargeHolcim, and CEMEX S A B de C V holding significant market share. The innovation ecosystem is vibrant, driven by continuous research and development in admixture technology and material science, leading to enhanced SCC performance and wider applications. Regulatory frameworks are gradually evolving to support the adoption of advanced materials like SCC, with a focus on sustainability and performance standards. Substitute products, primarily conventional concrete, are facing increasing competition due to SCC's advantages in complex structural elements and reduced labor requirements. End-user trends highlight a growing demand for faster construction times, improved aesthetics, and enhanced durability, all of which favor SCC. Merger and acquisition (M&A) activities are on the rise as larger players seek to expand their product portfolios and geographic reach. Approximately 15 significant M&A deals were recorded between 2019 and 2024, with an estimated total deal value exceeding $1,500 Million. This indicates a strategic consolidation within the industry to capture market share and foster innovation.

Self-Compacting Concrete Market Industry Insights & Trends

The Global Self-Compacting Concrete Market is poised for substantial growth, driven by a confluence of technological advancements, increasing infrastructure investments, and a growing preference for efficient construction methods. The market size was estimated at approximately $8,500 Million in 2024 and is projected to reach an impressive $16,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5%. This robust expansion is fueled by key market growth drivers, including the rising demand for complex architectural designs that necessitate the flowable and self-consolidating properties of SCC, and the significant global push for modernizing and expanding existing infrastructure. Technological disruptions, such as advancements in superplasticizer formulations and the development of specialized SCC mixes for extreme environmental conditions, are further enhancing its appeal. Evolving consumer behaviors, particularly the increasing emphasis on sustainable construction practices and reduced construction timelines, are also contributing to SCC adoption. The drive for enhanced durability and reduced maintenance costs in construction projects further solidifies SCC's position as a preferred material. The shift towards precast concrete construction, where SCC offers significant advantages in terms of mold filling and surface finish, is another critical trend.

Key Markets & Segments Leading Self-Compacting Concrete Market

The Infrastructural segment stands as a dominant force in the Self-Compacting Concrete Market, driven by substantial government investments in public works and transportation networks worldwide. Regions experiencing rapid urbanization and significant infrastructure development, such as Asia-Pacific, are leading the charge.

- Drivers of Infrastructural Dominance:

- Economic Growth and Urbanization: Rapid economic expansion in emerging economies fuels the need for new roads, bridges, tunnels, and public buildings, all prime applications for SCC.

- Government Stimulus Packages: Significant government spending on infrastructure projects directly translates to increased demand for construction materials, including SCC.

- Technological Advancements in Civil Engineering: The ability of SCC to fill complex formwork and achieve high-quality finishes is crucial for modern, large-scale infrastructure projects.

- Durability and Longevity Requirements: Infrastructure demands materials that can withstand harsh environmental conditions and heavy usage, making SCC's superior performance a key advantage.

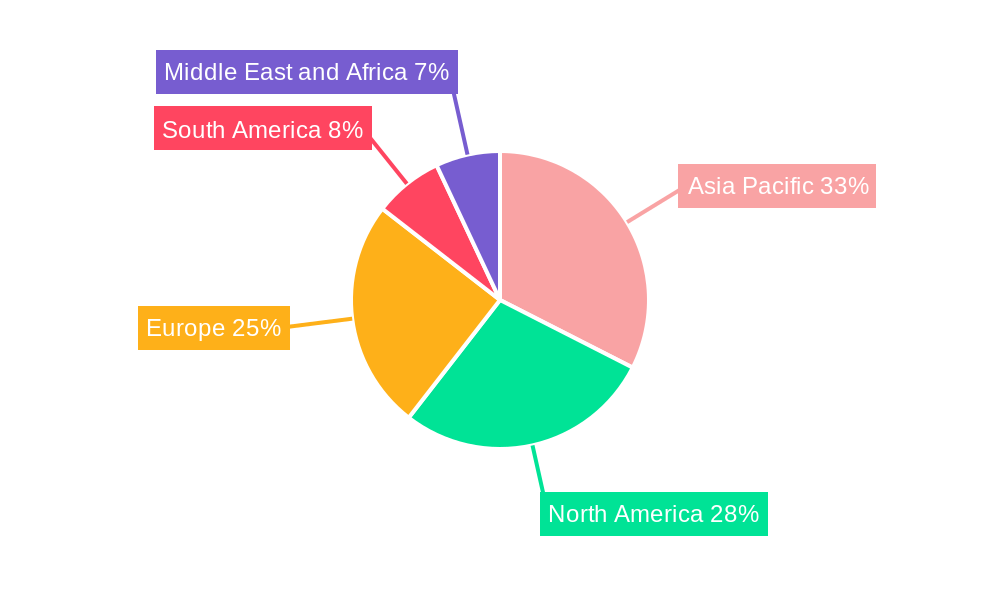

The Commercial sector also represents a significant and growing market for SCC. The construction of high-rise buildings, shopping malls, and office complexes benefits immensely from SCC's ability to create dense, aesthetically pleasing structures with minimal voids. The Residential segment is witnessing steady growth, particularly in urban areas where space constraints and design complexities are more prevalent. The Industrial segment, encompassing factories, power plants, and manufacturing facilities, also utilizes SCC for its structural integrity and ease of placement in challenging environments. The "Others" segment, including applications in marine structures and specialized civil engineering projects, contributes to the overall market diversification. The Asia-Pacific region, led by countries like China and India, is expected to maintain its leadership due to aggressive infrastructure development plans and a burgeoning construction industry, with an estimated market share of over 35% in 2025.

Self-Compacting Concrete Market Product Developments

Product innovations in the Self-Compacting Concrete Market are centered on enhancing performance, sustainability, and ease of use. Key developments include the formulation of SCC with recycled aggregates, reducing environmental impact and offering a cost-effective solution. Advancements in admixture technology have led to SCC with improved rheology, slump flow retention, and resistance to segregation, catering to a wider range of challenging applications. The introduction of self-curing SCC and high-performance SCC for extreme conditions further expands its market relevance. These innovations provide a competitive edge by meeting the evolving demands for greener, more efficient, and durable construction materials.

Challenges in the Self-Compacting Concrete Market Market

Despite its advantages, the Self-Compacting Concrete Market faces several challenges. The higher initial cost compared to conventional concrete remains a significant barrier for some segments. Ensuring consistent quality and adequate technical expertise for proper mixing and placement across diverse construction sites is crucial. Supply chain disruptions for specialized admixtures and raw materials can impact availability and pricing. Furthermore, a lack of widespread understanding and training among some construction professionals can hinder adoption. Regulatory hurdles in some regions, with outdated standards not fully accommodating SCC, also present a restraint.

Forces Driving Self-Compacting Concrete Market Growth

Several key forces are propelling the growth of the Self-Compacting Concrete Market. Technological advancements in concrete admixtures, particularly superplasticizers, have dramatically improved SCC's workability and performance. Increasing global investments in infrastructure development, including transportation networks and urban renewal projects, create substantial demand. The growing emphasis on sustainable construction practices and the need for reduced construction timelines and labor costs further favor SCC. Additionally, the demand for aesthetically pleasing and structurally sound buildings, especially in complex architectural designs, is a significant growth driver.

Challenges in the Self-Compacting Concrete Market Market

Long-term growth catalysts for the Self-Compacting Concrete Market lie in continued innovation and market expansion. The development of more eco-friendly SCC formulations, utilizing supplementary cementitious materials and recycled content, will be critical for meeting stringent environmental regulations and consumer preferences. Strategic partnerships between SCC manufacturers, admixture suppliers, and construction firms can foster wider adoption and tailor-made solutions. Expansion into emerging markets with developing infrastructure and increasing urbanization will also fuel sustained growth.

Emerging Opportunities in Self-Compacting Concrete Market

Emerging opportunities in the Self-Compacting Concrete Market are diverse and promising. The growing trend towards modular and precast construction presents a significant avenue for SCC, offering superior finishes and faster production cycles. Innovations in 3D printing with concrete are also opening new possibilities for complex structural elements. The increasing focus on resilient infrastructure, capable of withstanding climate change impacts, will drive demand for high-performance SCC. Furthermore, the development of smart concrete, incorporating sensors for structural health monitoring, represents a future frontier for SCC applications.

Leading Players in the Self-Compacting Concrete Market Sector

- Tarmac

- Roadstone Ltd

- Firth

- Breedon Group plc

- Instarmac

- HEIDELBERGCEMENT AG

- Ultratech Concrete

- LafargeHolcim

- CEMEX S A B de C V

- Sika Limited

- BASF Group

Key Milestones in Self-Compacting Concrete Market Industry

- 2019: Increased adoption of SCC in high-rise residential projects in emerging economies.

- 2020: Development of novel admixture formulations leading to improved segregation resistance.

- 2021: Growing interest in sustainable SCC solutions incorporating recycled materials.

- 2022: Significant infrastructure project wins utilizing SCC in Europe and North America.

- 2023: Enhanced focus on R&D for SCC in challenging environmental conditions.

- 2024: Expansion of SCC applications in precast concrete manufacturing.

Strategic Outlook for Self-Compacting Concrete Market Market

The Self-Compacting Concrete Market is set for a strategic expansion driven by its inherent advantages in efficiency, quality, and design flexibility. Growth accelerators include ongoing technological advancements in admixture formulations, leading to enhanced performance and sustainability. The increasing global emphasis on infrastructure modernization and urban development will continue to be a primary demand driver. Strategic opportunities lie in expanding SCC applications in precast construction, exploring novel uses in 3D printed structures, and catering to the demand for resilient and sustainable building materials. Collaboration among industry players to standardize SCC applications and provide comprehensive technical support will further unlock market potential.

Self-Compacting Concrete Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Infrastructural

- 1.4. Industrial

- 1.5. Others

Self-Compacting Concrete Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Self-Compacting Concrete Market Regional Market Share

Geographic Coverage of Self-Compacting Concrete Market

Self-Compacting Concrete Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Growing Demand from the Residential Sector; Increasing Infrastructure Activities and Construction of Complex

- 3.2.2 High-rise Structures; Reduces Labor Costs and Eliminates the Use of Vibration Processes

- 3.3. Market Restrains

- 3.3.1. ; Higher Raw Material Costs; Unfavourable Conditions Arising Due to the COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Growing Demand form the Residential Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Compacting Concrete Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Infrastructural

- 5.1.4. Industrial

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Self-Compacting Concrete Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Infrastructural

- 6.1.4. Industrial

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Self-Compacting Concrete Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Infrastructural

- 7.1.4. Industrial

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Self-Compacting Concrete Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Infrastructural

- 8.1.4. Industrial

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Self-Compacting Concrete Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Infrastructural

- 9.1.4. Industrial

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Self-Compacting Concrete Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Infrastructural

- 10.1.4. Industrial

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tarmac

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roadstone Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Firth

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Breedon Group plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Instarmac

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HEIDELBERGCEMENT AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ultratech Concrete*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LafargeHolcim

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CEMEX S A B de C V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sika Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Tarmac

List of Figures

- Figure 1: Global Self-Compacting Concrete Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Self-Compacting Concrete Market Revenue (billion), by Application 2025 & 2033

- Figure 3: Asia Pacific Self-Compacting Concrete Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Self-Compacting Concrete Market Revenue (billion), by Country 2025 & 2033

- Figure 5: Asia Pacific Self-Compacting Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Self-Compacting Concrete Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Self-Compacting Concrete Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Self-Compacting Concrete Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Self-Compacting Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Self-Compacting Concrete Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Self-Compacting Concrete Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Self-Compacting Concrete Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Self-Compacting Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Self-Compacting Concrete Market Revenue (billion), by Application 2025 & 2033

- Figure 15: South America Self-Compacting Concrete Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Self-Compacting Concrete Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Self-Compacting Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Self-Compacting Concrete Market Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Self-Compacting Concrete Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Self-Compacting Concrete Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Self-Compacting Concrete Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Compacting Concrete Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Self-Compacting Concrete Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Self-Compacting Concrete Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Self-Compacting Concrete Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: India Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Japan Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Korea Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Self-Compacting Concrete Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Self-Compacting Concrete Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Canada Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Self-Compacting Concrete Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Self-Compacting Concrete Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Self-Compacting Concrete Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Self-Compacting Concrete Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Brazil Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Argentina Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Self-Compacting Concrete Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Self-Compacting Concrete Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Self-Compacting Concrete Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Compacting Concrete Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Self-Compacting Concrete Market?

Key companies in the market include Tarmac, Roadstone Ltd, Firth, Breedon Group plc, Instarmac, HEIDELBERGCEMENT AG, Ultratech Concrete*List Not Exhaustive, LafargeHolcim, CEMEX S A B de C V, Sika Limited, BASF Group.

3. What are the main segments of the Self-Compacting Concrete Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.23 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from the Residential Sector; Increasing Infrastructure Activities and Construction of Complex. High-rise Structures; Reduces Labor Costs and Eliminates the Use of Vibration Processes.

6. What are the notable trends driving market growth?

Growing Demand form the Residential Sector.

7. Are there any restraints impacting market growth?

; Higher Raw Material Costs; Unfavourable Conditions Arising Due to the COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Compacting Concrete Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Compacting Concrete Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Compacting Concrete Market?

To stay informed about further developments, trends, and reports in the Self-Compacting Concrete Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence