Key Insights

The Self-Healing Materials Market is projected to experience significant expansion, with an estimated market size of $109.3 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 31.5%. This growth is underpinned by escalating demand for enhanced material durability, reduced maintenance expenditures, and extended product lifecycles across diverse industries. Key drivers include the increasing emphasis on sustainability, circular economy principles, and the imperative to minimize waste and resource consumption. Advancements in polymer science and nanotechnology are further accelerating the development of sophisticated self-healing mechanisms, facilitating wider adoption. The inherent capability of these materials to autonomously repair damage is addressing critical industry challenges where material integrity is paramount.

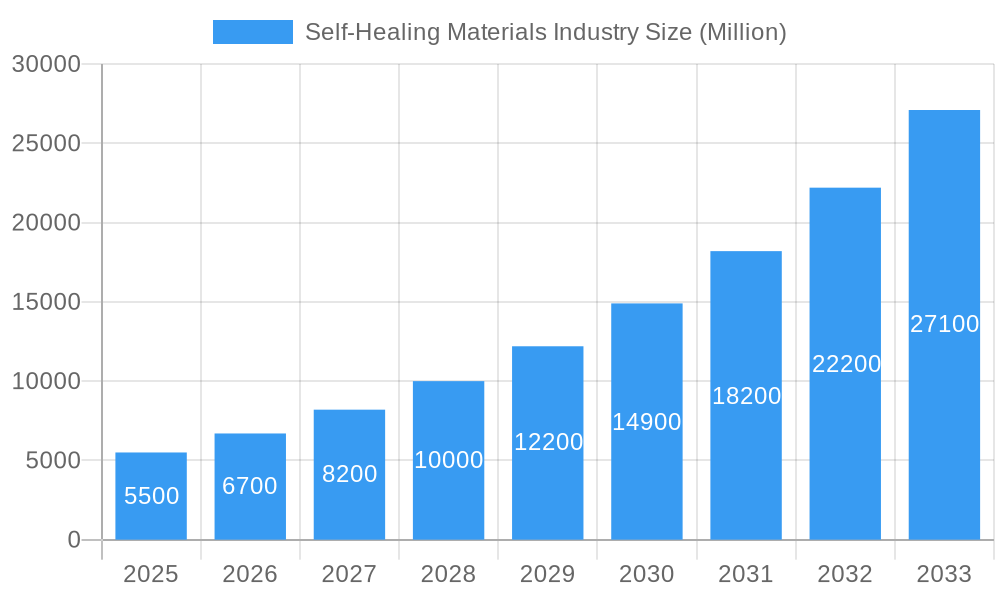

Self-Healing Materials Industry Market Size (In Billion)

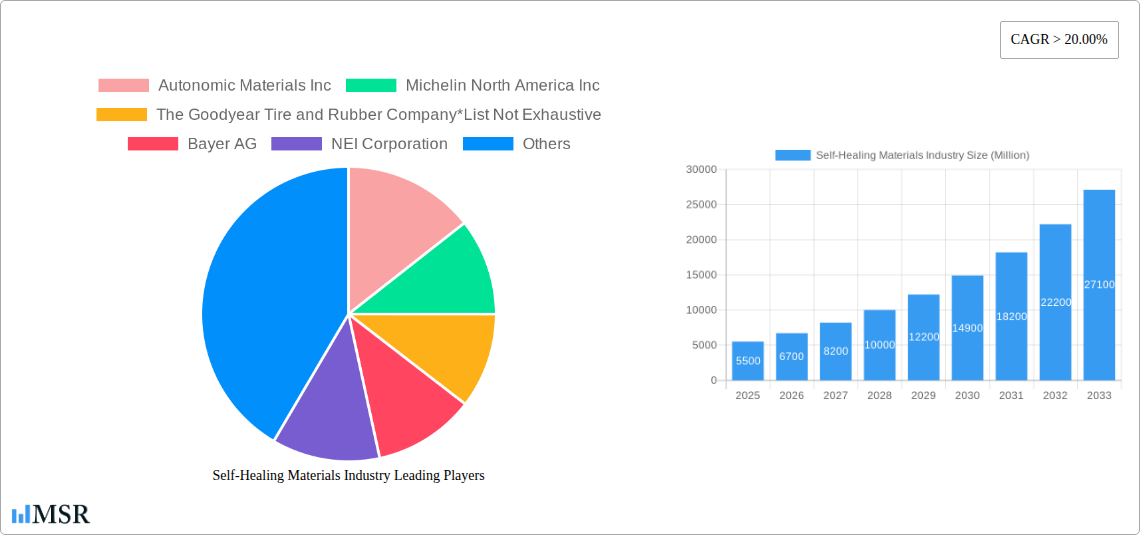

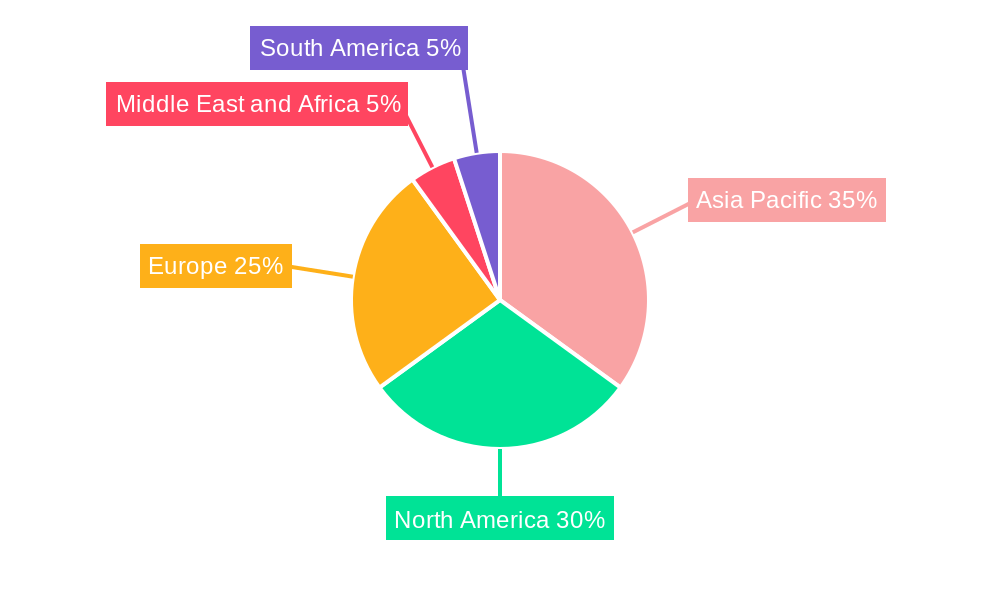

The market is segmented by material type, with Polymers and Composites currently dominating due to their versatility and established use in sectors such as Automotive, Aerospace, and Construction. Significant growth potential exists within Ceramics and Concrete applications, driven by infrastructure resilience and improved longevity requirements. The Healthcare sector is also emerging as a key adopter, leveraging self-healing properties for medical implants and devices. Leading companies like Autonomic Materials Inc., Michelin North America Inc., and The Goodyear Tire and Rubber Company are at the forefront of R&D. Geographically, the Asia Pacific region, particularly China and India, is expected to be a major growth engine due to rapid industrialization. North America and Europe are also strong markets, influenced by stringent regulatory demands and a mature research ecosystem. This trajectory signals a fundamental shift towards materials with inherent repair capabilities as a standard feature.

Self-Healing Materials Industry Company Market Share

Explore groundbreaking advancements and lucrative opportunities in the rapidly expanding Self-Healing Materials industry. This comprehensive analysis details market dynamics, technological innovations, and future growth trajectories within this transformative material science sector. Understand key market drivers and identify emerging trends reshaping industries from automotive and aerospace to healthcare and construction.

Self-Healing Materials Industry Market Concentration & Dynamics

The self-healing materials market exhibits a dynamic concentration, characterized by a blend of established chemical giants and agile, innovation-driven startups. While a few key players hold significant market share, the ecosystem is ripe for disruption through continuous R&D and strategic partnerships. Innovation is heavily driven by academic research translating into commercial applications, creating a fertile ground for new patents and proprietary technologies. Regulatory frameworks are still evolving, focusing on safety, efficacy, and sustainability, particularly for applications in critical infrastructure and healthcare. Substitute products, primarily traditional repair methods, are gradually being outpaced by the inherent advantages of self-healing capabilities, such as extended lifespan and reduced maintenance costs. End-user trends are leaning towards demand for materials with enhanced durability, reduced waste, and lower lifecycle costs. Merger and acquisition (M&A) activities are on the rise as larger corporations seek to integrate cutting-edge self-healing technologies into their portfolios. For instance, the historical period (2019-2024) has seen an estimated XX M&A deals in this niche sector, signaling consolidation and strategic expansion.

Self-Healing Materials Industry Industry Insights & Trends

The self-healing materials industry is poised for exceptional growth, driven by an insatiable demand for materials that can autonomously repair damage, thereby significantly extending product lifespans and reducing maintenance expenditures. The estimated market size for self-healing materials is projected to reach $5,000 Million by the base year 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 18% forecasted for the period 2025–2033. This upward trajectory is fueled by several key factors. Firstly, the escalating need for sustainable solutions and waste reduction is pushing industries to adopt materials that minimize replacement frequency and environmental impact. Secondly, advancements in nanotechnology and material science have unlocked new possibilities in designing intelligent materials capable of complex self-repair mechanisms, ranging from microcrack sealing to complete structural regeneration.

Technological disruptions are at the forefront of this industry's evolution. The development of novel healing agents, embedded microcapsules, vascular networks, and intrinsic reversible bonding chemistries are enabling materials to respond to damage stimuli like mechanical stress, temperature variations, or chemical exposure. These innovations are not just theoretical; they are actively being translated into practical applications across diverse sectors. For example, the automotive industry is exploring self-healing coatings to prevent scratches and corrosion, thereby enhancing vehicle aesthetics and longevity, while the aerospace sector is investing in composites that can autonomously mend minor damages incurred during flight, bolstering safety and reducing costly repairs. The construction industry is witnessing the integration of self-healing concrete to combat infrastructure degradation, leading to more resilient and durable structures. Consumer behavior is also shifting, with a growing appreciation for products that offer superior durability, reduced ownership costs, and a smaller environmental footprint, all of which are inherent benefits of self-healing materials. The market's rapid expansion underscores a paradigm shift towards intelligent, adaptive, and sustainable material solutions that promise to revolutionize product design and lifecycle management.

Key Markets & Segments Leading Self-Healing Materials Industry

The self-healing materials market is currently dominated by the Polymers segment, which represents the largest share due to their versatility, cost-effectiveness, and ease of integration into existing manufacturing processes. This dominance is particularly pronounced in the Automotive and Electrical and Electronics end-user industries.

Polymers: This segment's leadership is driven by innovations in advanced polymers with embedded microcapsules or vascular systems that release healing agents upon damage. Their application in coatings, adhesives, and structural components offers significant advantages in terms of scratch resistance, crack repair, and overall durability, directly impacting product longevity and reducing warranty claims. The Automotive industry is a key driver, utilizing self-healing polymers for scratch-resistant paints and impact-absorbing components. Similarly, the Electrical and Electronics sector benefits from self-healing polymers in flexible displays and protective casings, enhancing resilience against everyday wear and tear.

Composites: Following closely, self-healing composites are gaining substantial traction, especially in demanding sectors like Aerospace and Construction. The ability of these materials to autonomously repair damage in situ without removing them from service is a game-changer. Economic growth and increased infrastructure spending are significant drivers for the adoption of self-healing composites in construction, promising longer-lasting bridges, tunnels, and buildings. In aerospace, the potential for extending the service life of aircraft wings and fuselages through self-repairing composites translates into substantial cost savings and improved safety.

Construction: The Construction industry as an end-user segment is experiencing rapid growth, propelled by the need for more sustainable and resilient infrastructure. The development of self-healing concrete, capable of autonomously sealing cracks caused by environmental factors or stress, is a major technological breakthrough. This innovation addresses critical issues like water ingress and rebar corrosion, significantly increasing the lifespan of concrete structures and reducing the need for frequent and expensive repairs. Government initiatives promoting durable infrastructure and increased investment in smart cities further bolster this segment's growth.

Automotive: As mentioned, the automotive sector is a primary adopter, seeking to enhance the aesthetic appeal and structural integrity of vehicles. Self-healing coatings for car bodies that automatically repair minor scratches, along with self-healing components that can withstand impacts, are becoming increasingly sought after. This segment's dominance is underpinned by consumer demand for vehicles that maintain their appearance and structural integrity over longer periods.

Aerospace: While a smaller market in volume, the aerospace sector's demand for lightweight, high-strength, and highly reliable materials makes it a critical growth area for self-healing composites. The ability to self-repair minor damages sustained during flight is paramount for safety and operational efficiency, driving significant R&D investments.

The market's growth is further supported by the broader economic landscape and the increasing emphasis on materials that offer a superior return on investment through reduced maintenance and replacement cycles.

Self-Healing Materials Industry Product Developments

Recent product developments in the self-healing materials industry are showcasing remarkable leaps in functionality and applicability. A significant advancement occurred in December 2022 when scientists at Riken, Japan, successfully created a self-healing polymer using an off-the-shelf compound. This breakthrough, using readily available building blocks, democratizes the technology and promises wider adoption. Furthermore, in October 2022, North Carolina State University researchers unveiled a novel self-healing composite capable of in-situ repair, eliminating the need for component removal. This innovation is particularly impactful for extending the lifespan of critical structural elements such as wind-turbine blades and aircraft wings, directly addressing a long-standing challenge in material science and offering significant competitive advantages through enhanced durability and reduced lifecycle costs.

Challenges in the Self-Healing Materials Industry Market

Despite its immense potential, the self-healing materials market faces several hurdles. Cost-effectiveness remains a primary concern, as the advanced manufacturing processes and specialized components can lead to higher initial material costs compared to conventional alternatives. Scalability of production for certain complex self-healing mechanisms is another challenge, requiring significant investment in new infrastructure and manufacturing techniques. Furthermore, regulatory approvals, particularly for applications in sensitive sectors like healthcare and aerospace, can be a lengthy and complex process, demanding rigorous testing and validation. Consumer awareness and education about the benefits and proper application of self-healing materials are also crucial for widespread adoption. Finally, performance consistency across varying environmental conditions and damage types needs continuous improvement to ensure reliable and predictable self-repair capabilities. The estimated impact of these challenges could lead to a 5-10% slower adoption rate in specific segments if not adequately addressed.

Forces Driving Self-Healing Materials Industry Growth

The self-healing materials industry is propelled by a confluence of powerful growth drivers. Technological advancements in material science, particularly in areas like nanotechnology and smart materials, are continuously expanding the capabilities and applications of self-healing technologies. The growing global emphasis on sustainability and circular economy principles is a major catalyst, as self-healing materials inherently reduce waste and extend product lifespans. Increased demand for enhanced durability and reduced maintenance costs across various industries, including automotive, aerospace, and construction, is directly fueling market expansion. Government initiatives promoting resilient infrastructure and innovation also play a significant role. For example, the expected market size increase of $5,000 Million by 2025 is largely attributed to these forces.

Challenges in the Self-Healing Materials Industry Market

Long-term growth catalysts for the self-healing materials industry are deeply rooted in continuous innovation and strategic market expansion. The ongoing research into novel healing mechanisms, such as bio-inspired self-healing and dynamic covalent chemistry, promises materials with even more sophisticated and robust repair capabilities. Strategic partnerships and collaborations between material manufacturers, research institutions, and end-user industries are crucial for accelerating the development and commercialization of these advanced materials. Furthermore, the expanding application scope into new markets, such as wearable electronics and advanced medical implants, driven by the inherent biocompatibility and self-repairing properties, represents significant long-term growth potential. The successful penetration of these markets will depend on continued investment in R&D and a proactive approach to addressing market-specific needs.

Emerging Opportunities in Self-Healing Materials Industry

The self-healing materials industry is brimming with emerging opportunities. The development of bio-integrated self-healing materials for biomedical applications, such as regenerative medicine and smart drug delivery systems, represents a significant frontier. The increasing demand for energy-efficient infrastructure is creating opportunities for self-healing concrete and coatings that reduce the need for energy-intensive repairs. Furthermore, the integration of self-healing capabilities into flexible and stretchable electronics is opening doors for more durable and resilient consumer devices and wearable technology. The aerospace and defense sectors continue to present opportunities for lightweight, damage-tolerant materials that enhance safety and reduce maintenance downtime. Emerging economies' infrastructure development also offers a vast untapped market for these advanced materials.

Leading Players in the Self-Healing Materials Industry Sector

- Autonomic Materials Inc

- Michelin North America Inc

- The Goodyear Tire and Rubber Company

- Bayer AG

- NEI Corporation

- Evonik Industries AG

- MacDermid Autotype Ltd

- BASF SE

- Acciona S A

- Covestro AG

- Apple Inc

Key Milestones in Self-Healing Materials Industry Industry

- December 2022: Scientists at Riken, Japan, announced the creation of a self-healing polymer using an off-the-shelf compound, marking a significant step towards more accessible and widely deployable self-healing materials.

- October 2022: Engineering researchers at North Carolina State University developed a new self-healing composite allowing structures to repair themselves in place, a breakthrough that can significantly extend the lifespan of components like wind-turbine blades and aircraft wings by resolving longstanding challenges in self-healing technology.

Strategic Outlook for Self-Healing Materials Industry Market

The strategic outlook for the self-healing materials industry is exceptionally positive, driven by relentless innovation and expanding applications. Key growth accelerators include continued investment in R&D for more efficient and cost-effective healing mechanisms, alongside strategic collaborations to bridge the gap between laboratory discoveries and industrial implementation. The increasing global focus on sustainability and product longevity will further bolster demand across sectors like automotive, construction, and aerospace. The market's future potential lies in its ability to address critical infrastructure needs, enhance product durability, and contribute to a more circular economy, presenting significant strategic opportunities for early adopters and innovators. The projected market growth signifies a transformative shift towards intelligent materials that promise a future of enhanced resilience and reduced lifecycle costs.

Self-Healing Materials Industry Segmentation

-

1. Type

- 1.1. Polymers

- 1.2. Composites

- 1.3. Ceramics

- 1.4. Concrete

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Automotive

- 2.3. Electrical and Electronics

- 2.4. Construction

- 2.5. Aerospace

- 2.6. Other End-user Industries

Self-Healing Materials Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Self-Healing Materials Industry Regional Market Share

Geographic Coverage of Self-Healing Materials Industry

Self-Healing Materials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Development in the Construction Industry; Growing Use of Self-healing Materials in Biomimetics; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of Self-healing Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Construction Inudstry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Healing Materials Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polymers

- 5.1.2. Composites

- 5.1.3. Ceramics

- 5.1.4. Concrete

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics

- 5.2.4. Construction

- 5.2.5. Aerospace

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Self-Healing Materials Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Polymers

- 6.1.2. Composites

- 6.1.3. Ceramics

- 6.1.4. Concrete

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Healthcare

- 6.2.2. Automotive

- 6.2.3. Electrical and Electronics

- 6.2.4. Construction

- 6.2.5. Aerospace

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Self-Healing Materials Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Polymers

- 7.1.2. Composites

- 7.1.3. Ceramics

- 7.1.4. Concrete

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Healthcare

- 7.2.2. Automotive

- 7.2.3. Electrical and Electronics

- 7.2.4. Construction

- 7.2.5. Aerospace

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Self-Healing Materials Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Polymers

- 8.1.2. Composites

- 8.1.3. Ceramics

- 8.1.4. Concrete

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Healthcare

- 8.2.2. Automotive

- 8.2.3. Electrical and Electronics

- 8.2.4. Construction

- 8.2.5. Aerospace

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Self-Healing Materials Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Polymers

- 9.1.2. Composites

- 9.1.3. Ceramics

- 9.1.4. Concrete

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Healthcare

- 9.2.2. Automotive

- 9.2.3. Electrical and Electronics

- 9.2.4. Construction

- 9.2.5. Aerospace

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Self-Healing Materials Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Polymers

- 10.1.2. Composites

- 10.1.3. Ceramics

- 10.1.4. Concrete

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Healthcare

- 10.2.2. Automotive

- 10.2.3. Electrical and Electronics

- 10.2.4. Construction

- 10.2.5. Aerospace

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Autonomic Materials Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Michelin North America Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Goodyear Tire and Rubber Company*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NEI Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evonik Industries AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MacDermid Autotype Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Acciona S A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Covestro AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Autonomic Materials Inc

List of Figures

- Figure 1: Global Self-Healing Materials Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Self-Healing Materials Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Self-Healing Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Self-Healing Materials Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Self-Healing Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Self-Healing Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Self-Healing Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Self-Healing Materials Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Self-Healing Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Self-Healing Materials Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Self-Healing Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Self-Healing Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Self-Healing Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Self-Healing Materials Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Self-Healing Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Self-Healing Materials Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Self-Healing Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Self-Healing Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Self-Healing Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Self-Healing Materials Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Self-Healing Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Self-Healing Materials Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Self-Healing Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Self-Healing Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Self-Healing Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Self-Healing Materials Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Self-Healing Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Self-Healing Materials Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Self-Healing Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Self-Healing Materials Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Self-Healing Materials Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Healing Materials Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Self-Healing Materials Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Self-Healing Materials Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Self-Healing Materials Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Self-Healing Materials Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Self-Healing Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Self-Healing Materials Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Self-Healing Materials Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Self-Healing Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Canada Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Self-Healing Materials Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Self-Healing Materials Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Self-Healing Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Self-Healing Materials Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Self-Healing Materials Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Self-Healing Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Self-Healing Materials Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Self-Healing Materials Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Self-Healing Materials Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Self-Healing Materials Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Healing Materials Industry?

The projected CAGR is approximately 31.5%.

2. Which companies are prominent players in the Self-Healing Materials Industry?

Key companies in the market include Autonomic Materials Inc, Michelin North America Inc, The Goodyear Tire and Rubber Company*List Not Exhaustive, Bayer AG, NEI Corporation, Evonik Industries AG, MacDermid Autotype Ltd, BASF SE, Acciona S A, Covestro AG, Apple Inc.

3. What are the main segments of the Self-Healing Materials Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Development in the Construction Industry; Growing Use of Self-healing Materials in Biomimetics; Other Drivers.

6. What are the notable trends driving market growth?

Construction Inudstry to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost of Self-healing Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Scientists at Riken, Japan, announced that they had created a self-healing polymer using an off-the-shelf compound for the first time. It is reported that the polymer that heals itself is made from readily available building blocks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Healing Materials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Healing Materials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Healing Materials Industry?

To stay informed about further developments, trends, and reports in the Self-Healing Materials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence