Key Insights

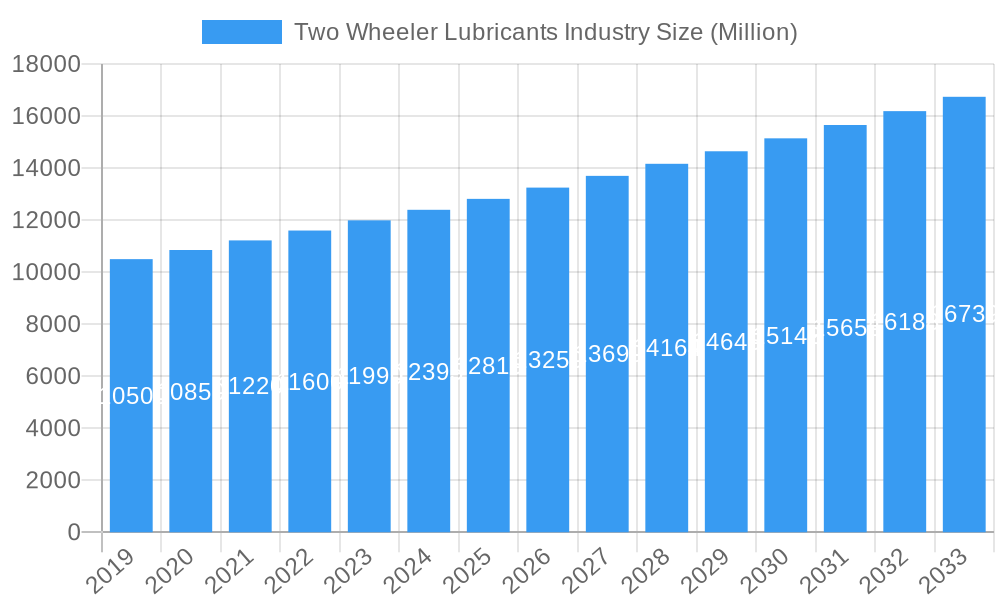

The global Two Wheeler Lubricants market is projected to reach an estimated size of $39.2 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.7%. This expansion is primarily driven by increasing two-wheeler ownership in emerging economies, fueled by rising disposable incomes, urbanization, and the affordability of two-wheelers as a transportation solution. The demand for premium lubricants that enhance engine longevity, fuel efficiency, and reduce emissions, alongside a growing preference for environmentally friendly formulations, also contributes significantly to market growth.

Two Wheeler Lubricants Industry Market Size (In Billion)

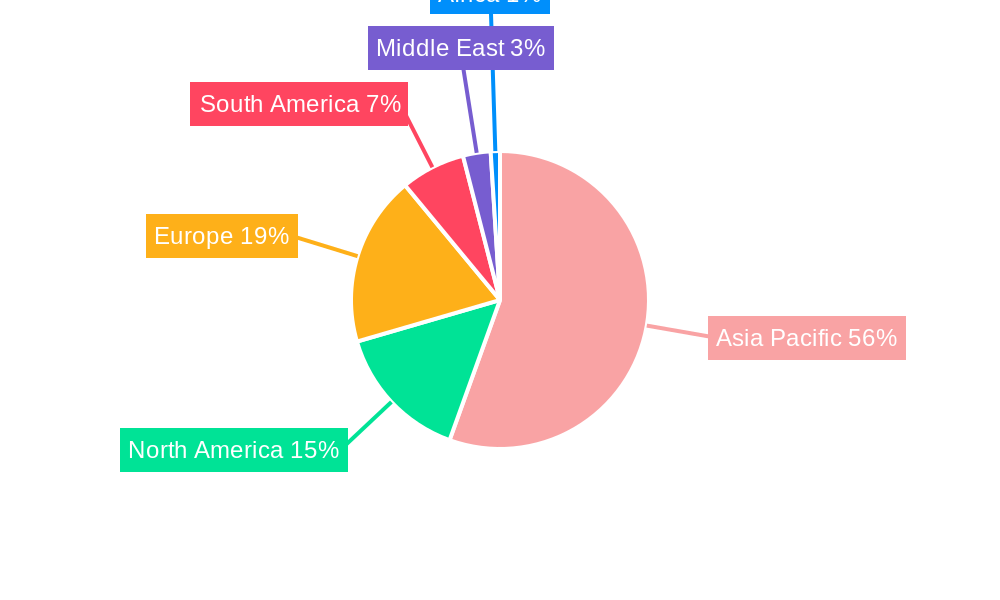

The Two Wheeler Lubricants market is characterized by ongoing product innovation and evolving end-user demands. Engine oil remains the dominant product segment, crucial for engine protection and performance. Specialized lubricants, including hydraulic and brake oils, are experiencing steady growth due to advancements in vehicle technology. Motorcycles and scooters represent the primary end-user segments, reflecting their widespread use for daily commuting. The Asia Pacific region, led by China and India, is anticipated to hold the largest market share due to its extensive two-wheeler fleet. Key emerging trends include the development of advanced synthetic and semi-synthetic lubricants and a focus on biodegradable options. However, the increasing adoption of electric two-wheelers and competition from unorganized market players present potential challenges.

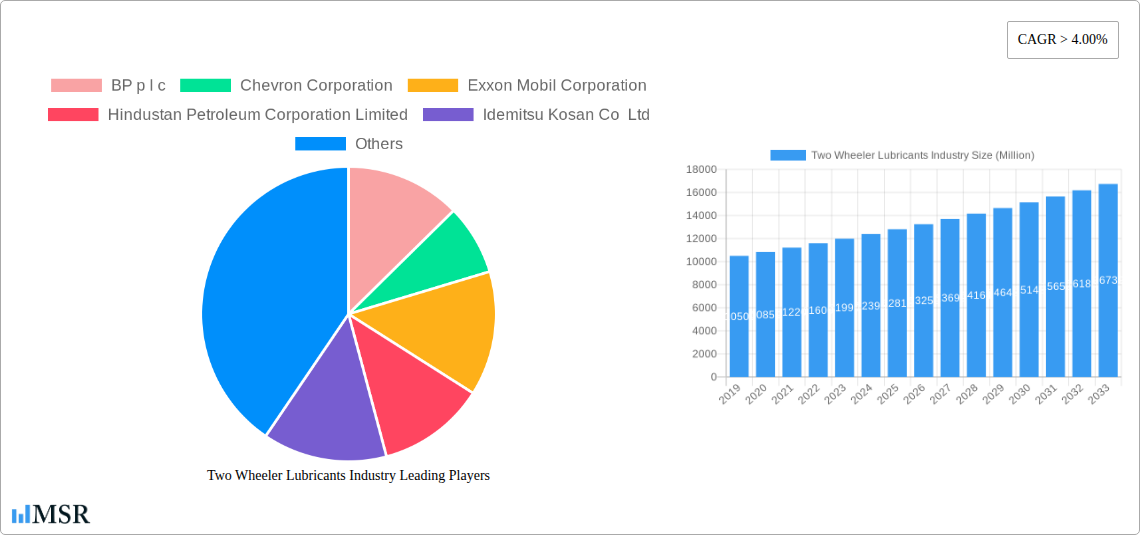

Two Wheeler Lubricants Industry Company Market Share

Global Two Wheeler Lubricants Market: In-depth Analysis and Growth Projections

This comprehensive report provides critical insights into the global Two Wheeler Lubricants market, a sector forecasted to reach substantial value by 2033. Driven by increasing motorcycle and scooter adoption and advancements in lubricant technology, this research is essential for stakeholders seeking to leverage significant growth opportunities.

The report meticulously analyzes market dynamics, innovation, and regulatory landscapes, alongside the impact of substitutes and evolving end-user trends. Our analysis covers the historical period from 2019–2024, with a base year of 2025, and extends to a forecast through 2033.

Explore the market's intricate dynamics, identifying key growth drivers, technological advancements, and shifting consumer behaviors. Understand the leading regions and segments, including Engine Oil, Hydraulic Oil, Brake Oil, and Chain Oil, and their prominence within the Motorcycles and Scooters end-user industries. This report offers actionable strategies, identifies challenges, and forecasts future opportunities, providing a critical roadmap for success in the evolving two wheeler lubricants market.

Two Wheeler Lubricants Industry Market Concentration & Dynamics

The global Two Wheeler Lubricants Industry is characterized by a moderate level of market concentration, with a few dominant players holding significant market share. However, the landscape is continuously shaped by ongoing innovation and the emergence of specialized product offerings. The innovation ecosystem thrives on the development of advanced synthetic and semi-synthetic lubricants designed for enhanced performance, fuel efficiency, and extended drain intervals, directly addressing evolving environmental regulations and consumer demands for sustainable solutions. Regulatory frameworks, particularly concerning emissions standards and product safety, play a crucial role in dictating product development and market entry strategies. The threat of substitute products, while present in the form of electric vehicle lubricants, is currently less impactful in the traditional two-wheeler segment, though its long-term influence warrants continuous monitoring. End-user trends are strongly influenced by the growing middle class in emerging economies, leading to increased demand for personal mobility solutions. Mergers and acquisitions (M&A) are significant strategic levers for companies to expand their geographical reach, product portfolios, and technological capabilities. For instance, the December 2022 acquisition of Allied Reliability by Shell plc exemplifies a strategic move to strengthen its industrial and lubricants business, potentially impacting the broader lubricants market, including two-wheeler applications. While specific deal counts are proprietary, the pattern of consolidation underscores the industry’s drive for scale and competitive advantage.

Two Wheeler Lubricants Industry Industry Insights & Trends

The Two Wheeler Lubricants Industry is experiencing robust growth, driven by a confluence of economic, technological, and societal factors. The global market size, estimated at approximately $XX Billion in the base year of 2025, is projected to expand significantly throughout the forecast period (2025–2033) at a Compound Annual Growth Rate (CAGR) of XX%. This expansion is primarily fueled by the burgeoning demand for personal transportation, especially in developing nations in Asia Pacific and Latin America, where motorcycles and scooters are the preferred modes of commuting due to affordability and agility. Technological disruptions are a key trend, with a growing emphasis on the development of high-performance, synthetic, and semi-synthetic lubricants. These advanced formulations offer superior protection against wear and tear, improved fuel economy, and extended service life, directly aligning with consumer desires for greater efficiency and lower maintenance costs. Furthermore, the industry is witnessing a surge in demand for environmentally friendly lubricants, driven by increasing awareness of sustainability and stricter government regulations. This has led to innovations in biodegradable and low-emission lubricant technologies. Evolving consumer behaviors are also shaping the market; riders are becoming more informed and discerning, seeking premium products that offer tangible benefits. The after-sales service market for two-wheeler lubricants is expanding, with an increasing number of independent repair shops and specialized service centers catering to the needs of two-wheeler owners. The impact of the COVID-19 pandemic has spurred a renewed focus on personal mobility, indirectly benefiting the two-wheeler sector and, by extension, its lubricant segment. The increasing disposable income in emerging economies is also a significant growth driver, enabling more individuals to purchase and maintain two-wheelers. The shift towards urbanization and the need for efficient last-mile connectivity further solidify the demand for two-wheeler lubricants. The industry is also observing a trend towards digitalization, with online platforms becoming increasingly important for product information dissemination, purchasing, and customer engagement.

Key Markets & Segments Leading Two Wheeler Lubricants Industry

The Two Wheeler Lubricants Industry is experiencing dominant growth in the Asia Pacific region, primarily driven by the sheer volume of motorcycle and scooter sales in countries like India, China, Indonesia, and Vietnam. This region accounts for the largest share of the global market, fueled by rapid economic development, a growing middle class, and the indispensable role of two-wheelers in daily commuting and commerce.

Within the Product Type segmentation, Engine Oil remains the cornerstone of the market. Its dominance is attributed to the fundamental requirement for engine protection and performance in virtually all two-wheelers.

- Engine Oil:

- Drivers: High volume sales of motorcycles and scooters, stringent engine protection requirements, and demand for extended drain intervals.

- Dominance Analysis: The continuous evolution of internal combustion engine technology necessitates specialized engine oils that can withstand higher operating temperatures, reduce friction, and minimize wear. Manufacturers are increasingly opting for synthetic and semi-synthetic formulations to meet these demands, driving the market for premium engine oils.

Hydraulic Oil plays a crucial role in scooters and some motorcycles equipped with automatic transmission systems and advanced suspension mechanisms.

- Hydraulic Oil:

- Drivers: Growth in automatic scooter sales, advancements in scooter technology requiring precise hydraulic actuation.

- Dominance Analysis: The increasing preference for automatic scooters, especially in urban environments, directly translates to a rising demand for high-quality hydraulic fluids that ensure smooth operation of transmission and braking systems.

Brake Oil is critical for the safety of all two-wheelers, ensuring reliable braking performance under various conditions.

- Brake Oil:

- Drivers: Emphasis on rider safety, regulatory mandates for braking system efficiency, and the adoption of advanced braking technologies like ABS.

- Dominance Analysis: As safety becomes a paramount concern for riders and regulators alike, the demand for high-performance brake fluids that offer excellent thermal stability and moisture resistance is on the rise. The widespread adoption of Anti-lock Braking Systems (ABS) further necessitates specialized brake fluids.

Chain Oil is essential for the maintenance and longevity of the drive chains in motorcycles and scooters with manual transmissions.

- Chain Oil:

- Drivers: Maintenance requirements for chain-driven two-wheelers, demand for extended chain life and rust prevention.

- Dominance Analysis: While scooters often utilize belt drives or shaft drives, manual transmission motorcycles heavily rely on chain lubrication. The development of specialized chain lubricants that offer superior adhesion, wear protection, and resistance to environmental elements contributes to the sustained demand in this segment.

In terms of End-user Industry, Motorcycles represent a larger segment due to their widespread use across various economic strata and geographies, followed closely by Scooters, which are gaining immense popularity in urban settings.

Motorcycles:

- Drivers: Affordability, fuel efficiency, personal mobility, and leisure riding.

- Dominance Analysis: The sheer volume of motorcycle ownership globally, coupled with their use for commuting, business, and recreational purposes, makes this segment the primary consumer of two-wheeler lubricants.

Scooters:

- Drivers: Convenience, ease of operation, urban mobility, and growing demand in emerging economies.

- Dominance Analysis: The surge in scooter sales, particularly in densely populated urban areas, is a significant growth catalyst. Their user-friendly design and fuel efficiency make them an attractive option for a wide demographic, thereby boosting lubricant consumption.

Two Wheeler Lubricants Industry Product Developments

Recent product developments in the Two Wheeler Lubricants Industry are heavily focused on enhancing performance, extending service life, and meeting stringent environmental standards. Innovations are geared towards synthetic and semi-synthetic formulations that offer superior wear protection, reduced friction for improved fuel economy, and enhanced thermal stability to withstand higher operating temperatures. The industry is also witnessing a rise in the development of eco-friendly lubricants, including biodegradable options and those with reduced emissions profiles, catering to growing consumer and regulatory demand for sustainability. These advancements aim to provide a competitive edge by offering enhanced engine cleanliness, better protection against corrosion, and compatibility with modern engine designs and emission control systems, directly contributing to the longevity and efficiency of two-wheelers.

Challenges in the Two Wheeler Lubricants Industry Market

The Two Wheeler Lubricants Industry faces several key challenges that can impact growth and profitability. Intense Competition from established global players and numerous local manufacturers leads to price pressures and reduced profit margins. Volatile Raw Material Prices, particularly for base oils and additives, can significantly affect production costs and pricing strategies. Stringent Environmental Regulations concerning emissions and biodegradability necessitate continuous investment in research and development for compliant product formulations, which can be costly. Counterfeit Products entering the market pose a threat to brand reputation and consumer safety, leading to potential revenue losses and erosion of trust. The Growing Popularity of Electric Two-Wheelers (E2Ws), while not directly impacting current internal combustion engine (ICE) lubricant demand, represents a long-term disruptive force as E2W technology matures.

Forces Driving Two Wheeler Lubricants Industry Growth

Several key forces are propelling the growth of the Two Wheeler Lubricants Industry. The Rising Demand for Personal Mobility in emerging economies, driven by increasing urbanization and a growing middle class, is a primary catalyst. The Increasing Sales Volume of Motorcycles and Scooters globally directly translates to a higher demand for lubricants. Technological Advancements in lubricant formulations, such as the development of synthetic and semi-synthetic oils offering superior performance, fuel efficiency, and extended drain intervals, are driving upgrades in product adoption. Favorable Government Policies promoting the two-wheeler sector and stricter emission standards, which often necessitate the use of higher-quality lubricants, also contribute to market expansion. Furthermore, the growing emphasis on Vehicle Maintenance and Longevity among consumers encourages the use of appropriate and high-quality lubricants.

Challenges in the Two Wheeler Lubricants Industry Market

The Two Wheeler Lubricants Industry faces persistent challenges that require strategic navigation for sustained growth. Price Sensitivity among consumers, particularly in price-conscious markets, can limit the adoption of premium, higher-margin lubricant products. Supply Chain Disruptions, amplified by geopolitical events and logistical complexities, can lead to stockouts and increased operational costs. Brand Loyalty and Inertia can make it difficult for new entrants to gain market share, as riders often stick to familiar brands. The evolving landscape of engine technology, including the transition towards electric two-wheelers, poses a long-term threat, requiring industry players to adapt their product portfolios and business models. Maintaining consistent quality across a wide distribution network, especially in remote areas, also presents an ongoing operational challenge.

Emerging Opportunities in Two Wheeler Lubricants Industry

The Two Wheeler Lubricants Industry presents several promising emerging opportunities for growth and innovation. The Expansion of the Electric Two-Wheeler (E2W) Market, while a potential long-term disruptor for traditional lubricants, also opens avenues for specialized E2W fluids and coolants. The Growing Demand for High-Performance and Synthetic Lubricants in mature markets, driven by a desire for enhanced engine protection and fuel efficiency, offers opportunities for premium product development. The increasing focus on Sustainability and Eco-Friendly Lubricants presents a significant opportunity for companies investing in biodegradable and low-emission formulations. Furthermore, the Untapped Potential in Emerging Markets in Africa and parts of Southeast Asia, where two-wheeler penetration is still growing, offers substantial market expansion possibilities. Digitalization and e-commerce also present opportunities for direct-to-consumer sales and enhanced customer engagement.

Leading Players in the Two Wheeler Lubricants Industry Sector

- BP p l c

- Chevron Corporation

- Exxon Mobil Corporation

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co Ltd

- PT Pertamina(Persero)

- Petroliam Nasional Berhad (PETRONAS)

- Shell plc

- China Petrochemical Corporation

- TotalEnergies

Key Milestones in Two Wheeler Lubricants Industry Industry

- December 2022: Shell plc acquired Allied Reliability, a provider of industrial products and services, to further expand its North American Lubricants Business. This strategic acquisition strengthens Shell's position in the broader lubricants market, potentially influencing its offerings and competitive strategy in two-wheeler segments.

- November 2022: ENEOS Motor Oil company launched a complete line-up of lubricants for cars and motorcycles to enhance its presence in the Philippines market. This product expansion signifies a targeted effort to capture market share in a key Asian market, responding to local demand and competition.

Strategic Outlook for Two Wheeler Lubricants Industry Market

The strategic outlook for the Two Wheeler Lubricants Industry remains positive, driven by sustained demand from emerging economies and continuous innovation. Key growth accelerators include the further penetration of synthetic and semi-synthetic lubricants, catering to consumer demand for higher performance and extended drain intervals. The industry must also proactively address the long-term implications of electric two-wheeler adoption by exploring opportunities in specialized EV fluids and lubricants. Strategic partnerships and acquisitions will continue to be crucial for market expansion, technological advancement, and competitive positioning. A focus on sustainability and the development of eco-friendly lubricant solutions will not only meet regulatory requirements but also appeal to an increasingly environmentally conscious consumer base, offering a distinct competitive advantage in the evolving two wheeler lubricants market.

Two Wheeler Lubricants Industry Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Hydraulic Oil

- 1.3. Brake Oil

- 1.4. Chain Oil

-

2. End-user Industry

- 2.1. Motorcycles

- 2.2. Scooters

Two Wheeler Lubricants Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Two Wheeler Lubricants Industry Regional Market Share

Geographic Coverage of Two Wheeler Lubricants Industry

Two Wheeler Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Engine Oils from Developing Countries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Engine Oils from Developing Countries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Engine Oils

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Hydraulic Oil

- 5.1.3. Brake Oil

- 5.1.4. Chain Oil

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Motorcycles

- 5.2.2. Scooters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Engine Oil

- 6.1.2. Hydraulic Oil

- 6.1.3. Brake Oil

- 6.1.4. Chain Oil

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Motorcycles

- 6.2.2. Scooters

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Engine Oil

- 7.1.2. Hydraulic Oil

- 7.1.3. Brake Oil

- 7.1.4. Chain Oil

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Motorcycles

- 7.2.2. Scooters

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Engine Oil

- 8.1.2. Hydraulic Oil

- 8.1.3. Brake Oil

- 8.1.4. Chain Oil

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Motorcycles

- 8.2.2. Scooters

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Engine Oil

- 9.1.2. Hydraulic Oil

- 9.1.3. Brake Oil

- 9.1.4. Chain Oil

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Motorcycles

- 9.2.2. Scooters

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Engine Oil

- 10.1.2. Hydraulic Oil

- 10.1.3. Brake Oil

- 10.1.4. Chain Oil

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Motorcycles

- 10.2.2. Scooters

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Engine Oil

- 11.1.2. Hydraulic Oil

- 11.1.3. Brake Oil

- 11.1.4. Chain Oil

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Motorcycles

- 11.2.2. Scooters

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BP p l c

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chevron Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exxon Mobil Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hindustan Petroleum Corporation Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Idemitsu Kosan Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PT Pertamina(Persero)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Petroliam Nasional Berhad (PETRONAS)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Shell plc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 China Petrochemical Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 TotalEnergies*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 BP p l c

List of Figures

- Figure 1: Global Two Wheeler Lubricants Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: North America Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 35: Saudi Arabia Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Saudi Arabia Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Saudi Arabia Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Russia Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: South Africa Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Two Wheeler Lubricants Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Two Wheeler Lubricants Industry?

Key companies in the market include BP p l c, Chevron Corporation, Exxon Mobil Corporation, Hindustan Petroleum Corporation Limited, Idemitsu Kosan Co Ltd, PT Pertamina(Persero), Petroliam Nasional Berhad (PETRONAS), Shell plc, China Petrochemical Corporation, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Two Wheeler Lubricants Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Engine Oils from Developing Countries; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Usage of Engine Oils.

7. Are there any restraints impacting market growth?

Increasing Demand for Engine Oils from Developing Countries; Other Drivers.

8. Can you provide examples of recent developments in the market?

December 2022: Shell acquired Allied Reliability, a provider of industrial products and services, to further expand its North American Lubricants Business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Two Wheeler Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Two Wheeler Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Two Wheeler Lubricants Industry?

To stay informed about further developments, trends, and reports in the Two Wheeler Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence