Key Insights

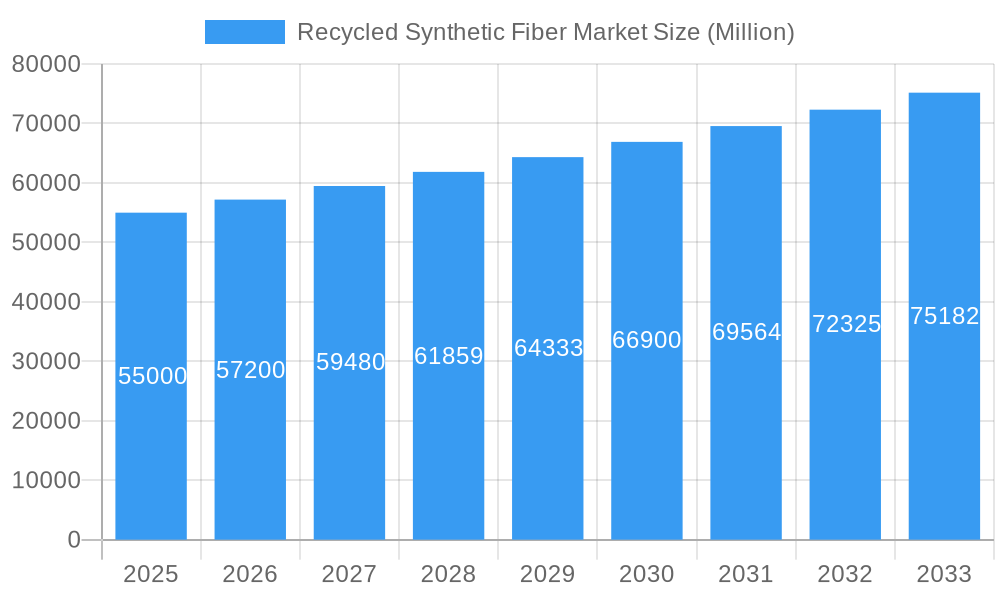

The global Recycled Synthetic Fiber Market is projected for significant expansion, expected to reach $26.31 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 7.6% from 2024. This growth is attributed to rising demand for sustainable materials driven by consumer awareness and environmental regulations. Key sectors like automotive (for components such as carpets, seating, and insulation), apparel (incorporating recycled polyester and nylon for eco-conscious fashion), and medical (for non-woven fabrics in surgical wear) are primary growth drivers. Technological advancements in recycling are enhancing the quality and versatility of recycled fibers, further supporting market adoption.

Recycled Synthetic Fiber Market Market Size (In Billion)

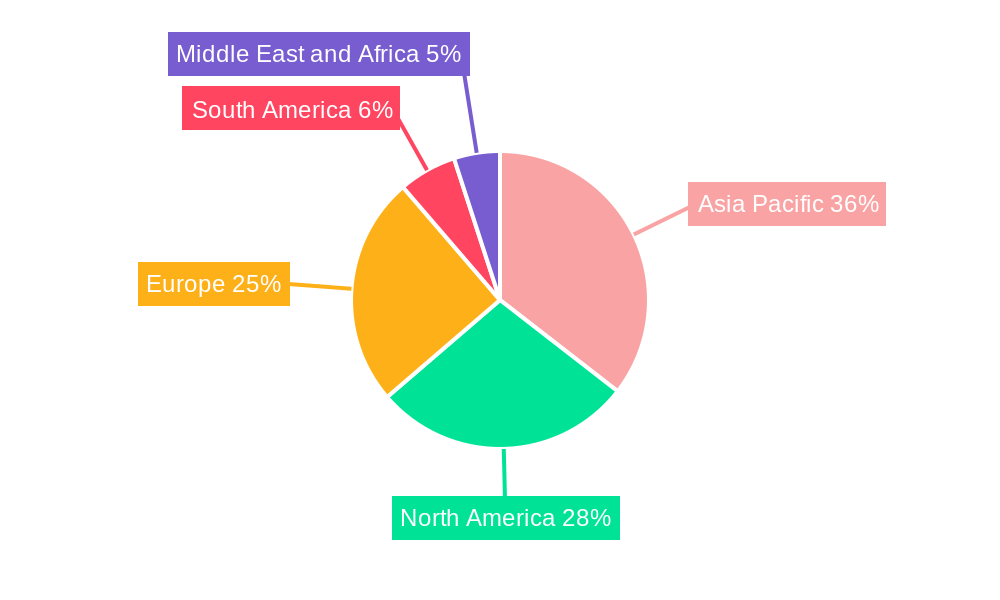

The market's evolution is influenced by circular economy principles, with chemical recycling innovations enabling the production of high-grade fibers from complex synthetic waste. A strong emphasis on reducing plastic waste and carbon footprints is stimulating investment in efficient and cost-effective recycling processes. While initial infrastructure costs and feedstock consistency pose challenges, the long-term outlook is highly positive. The Asia Pacific region, particularly China and India, is anticipated to lead, supported by robust manufacturing and growing environmental consciousness. North America and Europe also represent substantial markets, bolstered by supportive government policies and consumer preference for sustainable products.

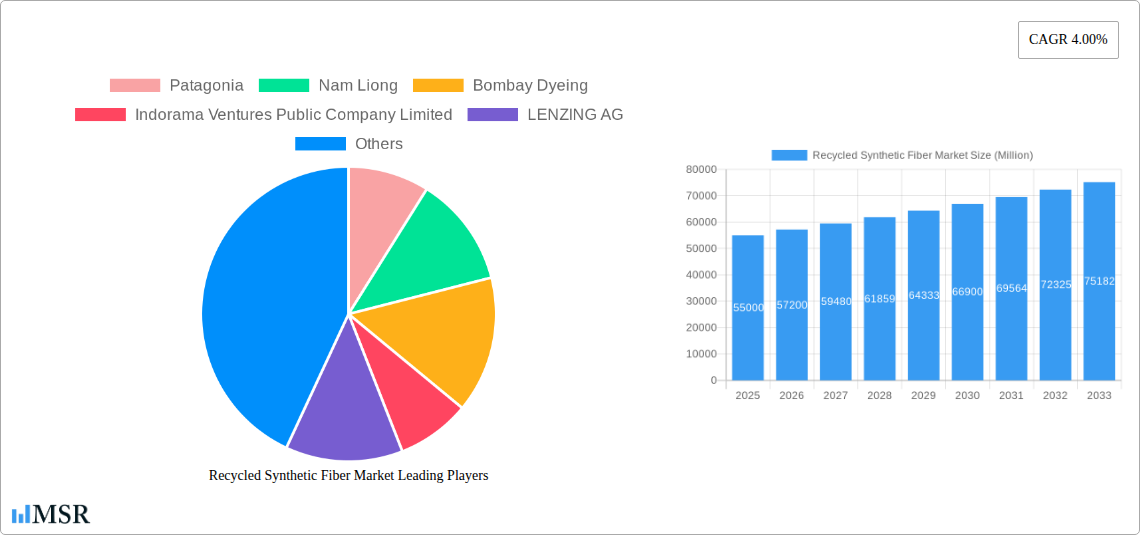

Recycled Synthetic Fiber Market Company Market Share

Recycled Synthetic Fiber Market: Driving Sustainable Solutions for a Circular Economy

Report Description:

Dive deep into the dynamic recycled synthetic fiber market with this comprehensive industry analysis. This report offers an in-depth exploration of the market's trajectory from 2019 to 2033, with a detailed focus on the base year 2025 and a robust forecast period spanning 2025–2033. Discover critical insights into the market size, key growth drivers, emerging trends, and the competitive landscape of recycled polyester, recycled nylon, and other synthetic fiber types. Understand how innovations in chemical recycling, mechanical recycling, and sustainable material development are reshaping industries like apparel, automotive, and home furnishings. This report is an indispensable resource for material manufacturers, brands, investors, and policymakers seeking to navigate the burgeoning circular economy and capitalize on the immense growth potential of the sustainable textiles and recycled plastics sectors.

Recycled Synthetic Fiber Market Market Concentration & Dynamics

The recycled synthetic fiber market exhibits a moderately concentrated landscape, characterized by the presence of both large, established chemical giants and agile specialty recyclers. Innovation ecosystems are rapidly developing, driven by increasing demand for sustainable materials and advancements in recycling technologies, including chemical recycling. Regulatory frameworks are evolving globally, with many regions implementing policies to encourage the use of recycled content and penalize virgin plastic production. Substitute products primarily include virgin synthetic fibers and natural fibers, but their market share is steadily eroding due to growing consumer and corporate sustainability commitments. End-user trends heavily favor products with demonstrable environmental benefits, leading to increased adoption of recycled synthetics across various applications. Mergers and acquisitions (M&A) activities are on the rise as companies seek to secure supply chains, acquire innovative technologies, and expand their market reach. Key M&A deals are anticipated to consolidate market power and accelerate the adoption of circular economy principles within the industry. Market share is increasingly influenced by companies demonstrating robust sustainability credentials and offering high-quality recycled fiber products. The market is witnessing a significant push towards closed-loop recycling systems, further intensifying competition and innovation.

Recycled Synthetic Fiber Market Industry Insights & Trends

The recycled synthetic fiber market is poised for significant expansion, projected to reach an estimated XX million by 2025 and grow at a substantial CAGR of XX% from 2025 to 2033. This robust growth is underpinned by a confluence of powerful market drivers. Foremost among these is the escalating global demand for sustainable materials, propelled by heightened consumer awareness regarding environmental issues and a growing preference for eco-friendly products. This trend is particularly pronounced in the apparel and fashion industry, where brands are actively seeking to reduce their environmental footprint and meet consumer expectations for recycled clothing and ethical sourcing.

Technological disruptions are playing a pivotal role in shaping the market's trajectory. Advancements in both mechanical recycling and chemical recycling are enhancing the quality and versatility of recycled synthetic fibers, making them viable alternatives to virgin materials across a wider range of applications. Chemical recycling, in particular, holds immense promise for breaking down complex plastic waste into its fundamental building blocks, enabling the creation of high-performance recycled fibers with properties comparable to their virgin counterparts. This is crucial for applications requiring stringent performance standards, such as automotive textiles and aerospace components.

Evolving consumer behaviors are a significant catalyst. The younger generation, in particular, is demonstrating a strong willingness to pay a premium for products that align with their values, leading to a surge in demand for recycled polyester fabrics, recycled nylon apparel, and other sustainable textile options. This behavioral shift is influencing purchasing decisions across all demographics, pushing companies to integrate sustainable sourcing and circular economy principles into their core business strategies. The increasing emphasis on waste reduction and resource conservation further fuels the adoption of recycled synthetic fibers, positioning them as a key component of a more sustainable future for the textile and manufacturing industries. The market is also benefiting from increasing government support and initiatives aimed at promoting the use of recycled content.

Key Markets & Segments Leading Recycled Synthetic Fiber Market

The recycled synthetic fiber market is experiencing robust growth across several key regions and segments, driven by a combination of economic development, supportive regulatory environments, and strong consumer demand for sustainable solutions.

Dominant Regions and Countries:

- Asia-Pacific: This region is a powerhouse in the recycled synthetic fiber market, driven by its massive manufacturing base for textiles and plastics, particularly in countries like China, India, and Southeast Asian nations. Economic growth, coupled with increasing government initiatives to promote a circular economy and reduce plastic waste, are major drivers. The large population and growing middle class also contribute to a significant consumer market for sustainable products.

- North America: The North American market, led by the United States, is characterized by a strong emphasis on corporate social responsibility and consumer demand for eco-friendly products. Stringent environmental regulations and a growing awareness of plastic pollution are compelling brands to adopt recycled materials. Significant investment in recycling infrastructure and technology development further bolsters this region's position.

- Europe: European countries, with their well-established sustainability agendas and stringent environmental policies, are at the forefront of recycled synthetic fiber adoption. The European Union's Green Deal and its focus on circular economy initiatives create a favorable environment for the market. High consumer consciousness regarding ethical sourcing and environmental impact drives demand across various applications.

Dominant Segments:

- Type: Polyester: Recycled polyester is the dominant segment within the recycled synthetic fiber market. Its widespread use in apparel, home furnishings, and automotive textiles, coupled with advancements in rPET recycling technology, makes it a prime candidate for circularity. The availability of recycled polyester feedstock and its cost-competitiveness with virgin polyester further solidify its market leadership.

- Drivers: Growing demand for sustainable apparel, widespread availability of rPET bottles as feedstock, cost-effectiveness compared to virgin polyester.

- Application: Clothing: The clothing and apparel sector is the largest consumer of recycled synthetic fibers. Brands are increasingly incorporating recycled polyester and nylon into their product lines to meet consumer demand for sustainable fashion. The ability to produce high-quality, aesthetically pleasing fabrics from recycled materials has made it a mainstream choice.

- Drivers: Consumer preference for sustainable fashion, brand commitments to reduce environmental impact, availability of stylish and durable recycled fabrics.

- Application: Home Furnishing: The home furnishing segment is also a significant growth area for recycled synthetic fibers. Applications include upholstery, bedding, carpets, and curtains, where recycled materials offer an eco-friendly alternative without compromising on aesthetics or performance.

- Drivers: Growing consumer awareness of home sustainability, availability of durable and aesthetically pleasing recycled fabrics for interiors.

- Type: Nylon: While currently smaller than polyester, recycled nylon is experiencing rapid growth, particularly in performance wear, activewear, and other applications where its durability and elasticity are valued. Advancements in chemical recycling are making it more feasible to produce high-quality recycled nylon fibers.

- Drivers: Demand for durable and high-performance recycled textiles in sportswear, advancements in chemical recycling of nylon.

The dominance of these segments is further amplified by ongoing research and development efforts aimed at expanding the applications and improving the performance of recycled synthetic fibers, ensuring their continued growth and market penetration.

Recycled Synthetic Fiber Market Product Developments

Product innovation in the recycled synthetic fiber market is accelerating, driven by advancements in recycling technologies and the demand for high-performance, sustainable materials. Companies are developing novel recycled polyester and recycled nylon yarns and textiles with enhanced properties, such as improved durability, flame resistance, and moisture-wicking capabilities. Chemical recycling technologies are enabling the creation of fibers that are virtually indistinguishable from their virgin counterparts, opening up new application possibilities. These developments are crucial for meeting the stringent requirements of industries like automotive, aerospace, and medical, where material performance is paramount. The focus on closed-loop systems and the utilization of post-consumer and post-industrial waste streams is leading to the development of unique product offerings that resonate with environmentally conscious consumers and brands.

Challenges in the Recycled Synthetic Fiber Market Market

Despite its robust growth, the recycled synthetic fiber market faces several significant challenges. Supply chain volatility for post-consumer and post-industrial waste can impact the availability and consistency of feedstock, leading to price fluctuations and production disruptions. Contamination of recycled materials remains a persistent issue, requiring sophisticated sorting and purification processes that add to the cost. Furthermore, scalability of advanced recycling technologies, particularly chemical recycling, is still a hurdle, with high initial investment costs and energy requirements. Regulatory complexities and the lack of standardized definitions for "recycled content" across different regions can also create market uncertainty. Finally, consumer perception and education regarding the quality and performance of recycled fibers, especially compared to virgin alternatives, require continuous effort.

Forces Driving Recycled Synthetic Fiber Market Growth

The recycled synthetic fiber market is propelled by a powerful confluence of forces. Increasing environmental regulations globally, pushing for waste reduction and circular economy principles, are a primary driver. Growing consumer demand for sustainable products and brand commitments to corporate social responsibility are creating significant market pull. Technological advancements in both mechanical and chemical recycling are improving the quality, versatility, and cost-effectiveness of recycled fibers. Furthermore, the volatility of virgin material prices due to geopolitical factors and supply chain disruptions makes recycled alternatives increasingly attractive. The growing awareness of plastic pollution and its environmental impact is fostering a mindset shift towards resource conservation and the adoption of circular business models, all of which significantly fuel the growth of the recycled synthetic fiber market.

Challenges in the Recycled Synthetic Fiber Market Market

Long-term growth catalysts for the recycled synthetic fiber market lie in the continued innovation and strategic expansion within the industry. The ongoing development and scaling of advanced chemical recycling technologies are critical for unlocking the full potential of plastic waste as a feedstock, enabling the creation of high-value recycled fibers for diverse applications. Strategic partnerships and collaborations between waste management companies, chemical recyclers, fiber manufacturers, and brands are essential for establishing robust and efficient circular supply chains. Furthermore, market expansion into new geographic regions with growing sustainability awareness and supportive policies will unlock significant growth opportunities. The increasing integration of recycled synthetic fibers into premium and high-performance product categories, driven by ongoing R&D, will also solidify their position as a mainstream material choice, ensuring sustained long-term growth.

Emerging Opportunities in Recycled Synthetic Fiber Market

Emerging opportunities in the recycled synthetic fiber market are vast and varied. The development of advanced chemical recycling processes capable of handling mixed plastic waste and producing high-purity monomers presents a significant opportunity for closed-loop systems. The expansion of recycled synthetic fiber applications into new sectors like construction, industrial textiles, and advanced composites, beyond traditional apparel and automotive, offers considerable untapped potential. Consumer preferences are shifting towards traceable and transparent supply chains, creating opportunities for brands that can demonstrate the provenance and sustainability credentials of their recycled fibers. Furthermore, the growing focus on biodegradable and compostable recycled synthetic fibers aligns with the broader circular economy goals and caters to a niche but rapidly expanding market segment.

Leading Players in the Recycled Synthetic Fiber Market Sector

- Patagonia

- Nam Liong

- Bombay Dyeing

- Indorama Ventures Public Company Limited

- LENZING AG

- Reliance Industries Limited

- China Eco Fiber Limited

- Stella

- Diyou Fibre (M) Sdn Bhd

- TORAY INDUSTRIES INC

- Zhejiang Hengyi Group Co Ltd

- Alpek S A B de C V

Key Milestones in Recycled Synthetic Fiber Market Industry

- December 2022: Toray Industries, Inc. announced plans to sell its nylon 6 chemically recycled fiber (N6CR) yarns, textiles, and other products in Japan from March 2023. The products were expected to be produced by applying the company's depolymerization and repolymerization technology to recycled plastics recovered by Refineverse Group, Inc.

- October 2022: Reliance Industries Limited, the world's largest producer of polyester fibers and yarns, enhanced its sustainable edge of well-established fire-resistant polyester, Recron FS, with the help of FRX Innovations' Nofia technology.

Strategic Outlook for Recycled Synthetic Fiber Market Market

The strategic outlook for the recycled synthetic fiber market is overwhelmingly positive, driven by a clear trajectory towards sustainability and circularity. Growth accelerators will include continued investment in innovative recycling technologies, particularly chemical recycling, which promises to unlock higher-value recycled materials. Strategic alliances and partnerships across the value chain, from waste collection to final product manufacturing, will be crucial for building efficient and scalable circular systems. Furthermore, proactive engagement with regulatory bodies to establish standardized frameworks and incentives for recycled content will foster market confidence and encourage widespread adoption. The market is poised for expansion into new applications and geographical regions, driven by increasing consumer demand and corporate sustainability mandates, solidifying its role as a cornerstone of the future circular economy.

Recycled Synthetic Fiber Market Segmentation

-

1. Type

- 1.1. Nylon

- 1.2. Polyester

- 1.3. Polyolefins

- 1.4. Acrylics

- 1.5. Other Synthetic Fibers

-

2. Application

- 2.1. Automotive

- 2.2. Clothing

- 2.3. Medical

- 2.4. Aerospace

- 2.5. Home Furnishing

- 2.6. Filtration

- 2.7. Other Applications

Recycled Synthetic Fiber Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Recycled Synthetic Fiber Market Regional Market Share

Geographic Coverage of Recycled Synthetic Fiber Market

Recycled Synthetic Fiber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness for Sustainable Materials; Other Drivers

- 3.3. Market Restrains

- 3.3.1. The Non-Biodegradability of Synthetic Fiber; Other Restraints

- 3.4. Market Trends

- 3.4.1. Clothing Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recycled Synthetic Fiber Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Nylon

- 5.1.2. Polyester

- 5.1.3. Polyolefins

- 5.1.4. Acrylics

- 5.1.5. Other Synthetic Fibers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Clothing

- 5.2.3. Medical

- 5.2.4. Aerospace

- 5.2.5. Home Furnishing

- 5.2.6. Filtration

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Recycled Synthetic Fiber Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Nylon

- 6.1.2. Polyester

- 6.1.3. Polyolefins

- 6.1.4. Acrylics

- 6.1.5. Other Synthetic Fibers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Clothing

- 6.2.3. Medical

- 6.2.4. Aerospace

- 6.2.5. Home Furnishing

- 6.2.6. Filtration

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Recycled Synthetic Fiber Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Nylon

- 7.1.2. Polyester

- 7.1.3. Polyolefins

- 7.1.4. Acrylics

- 7.1.5. Other Synthetic Fibers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Clothing

- 7.2.3. Medical

- 7.2.4. Aerospace

- 7.2.5. Home Furnishing

- 7.2.6. Filtration

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Recycled Synthetic Fiber Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Nylon

- 8.1.2. Polyester

- 8.1.3. Polyolefins

- 8.1.4. Acrylics

- 8.1.5. Other Synthetic Fibers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Clothing

- 8.2.3. Medical

- 8.2.4. Aerospace

- 8.2.5. Home Furnishing

- 8.2.6. Filtration

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Recycled Synthetic Fiber Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Nylon

- 9.1.2. Polyester

- 9.1.3. Polyolefins

- 9.1.4. Acrylics

- 9.1.5. Other Synthetic Fibers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Clothing

- 9.2.3. Medical

- 9.2.4. Aerospace

- 9.2.5. Home Furnishing

- 9.2.6. Filtration

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Recycled Synthetic Fiber Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Nylon

- 10.1.2. Polyester

- 10.1.3. Polyolefins

- 10.1.4. Acrylics

- 10.1.5. Other Synthetic Fibers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive

- 10.2.2. Clothing

- 10.2.3. Medical

- 10.2.4. Aerospace

- 10.2.5. Home Furnishing

- 10.2.6. Filtration

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Patagonia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nam Liong

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bombay Dyeing

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Indorama Ventures Public Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LENZING AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Reliance Industries Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Eco Fiber Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stella

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Diyou Fibre (M) Sdn Bhd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TORAY INDUSTRIES INC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zhejiang Hengyi Group Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Alpek S A B de C V

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Patagonia

List of Figures

- Figure 1: Global Recycled Synthetic Fiber Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Recycled Synthetic Fiber Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Recycled Synthetic Fiber Market Revenue (billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Recycled Synthetic Fiber Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Recycled Synthetic Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Recycled Synthetic Fiber Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Recycled Synthetic Fiber Market Revenue (billion), by Application 2025 & 2033

- Figure 8: Asia Pacific Recycled Synthetic Fiber Market Volume (K Tons), by Application 2025 & 2033

- Figure 9: Asia Pacific Recycled Synthetic Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Recycled Synthetic Fiber Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Recycled Synthetic Fiber Market Revenue (billion), by Country 2025 & 2033

- Figure 12: Asia Pacific Recycled Synthetic Fiber Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Recycled Synthetic Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Recycled Synthetic Fiber Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Recycled Synthetic Fiber Market Revenue (billion), by Type 2025 & 2033

- Figure 16: North America Recycled Synthetic Fiber Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Recycled Synthetic Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Recycled Synthetic Fiber Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Recycled Synthetic Fiber Market Revenue (billion), by Application 2025 & 2033

- Figure 20: North America Recycled Synthetic Fiber Market Volume (K Tons), by Application 2025 & 2033

- Figure 21: North America Recycled Synthetic Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Recycled Synthetic Fiber Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Recycled Synthetic Fiber Market Revenue (billion), by Country 2025 & 2033

- Figure 24: North America Recycled Synthetic Fiber Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Recycled Synthetic Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Recycled Synthetic Fiber Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Recycled Synthetic Fiber Market Revenue (billion), by Type 2025 & 2033

- Figure 28: Europe Recycled Synthetic Fiber Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Recycled Synthetic Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Recycled Synthetic Fiber Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Recycled Synthetic Fiber Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Europe Recycled Synthetic Fiber Market Volume (K Tons), by Application 2025 & 2033

- Figure 33: Europe Recycled Synthetic Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Recycled Synthetic Fiber Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Recycled Synthetic Fiber Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Recycled Synthetic Fiber Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Recycled Synthetic Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Recycled Synthetic Fiber Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Recycled Synthetic Fiber Market Revenue (billion), by Type 2025 & 2033

- Figure 40: South America Recycled Synthetic Fiber Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Recycled Synthetic Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Recycled Synthetic Fiber Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Recycled Synthetic Fiber Market Revenue (billion), by Application 2025 & 2033

- Figure 44: South America Recycled Synthetic Fiber Market Volume (K Tons), by Application 2025 & 2033

- Figure 45: South America Recycled Synthetic Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Recycled Synthetic Fiber Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Recycled Synthetic Fiber Market Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Recycled Synthetic Fiber Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Recycled Synthetic Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Recycled Synthetic Fiber Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Recycled Synthetic Fiber Market Revenue (billion), by Type 2025 & 2033

- Figure 52: Middle East and Africa Recycled Synthetic Fiber Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Recycled Synthetic Fiber Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Recycled Synthetic Fiber Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Recycled Synthetic Fiber Market Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Recycled Synthetic Fiber Market Volume (K Tons), by Application 2025 & 2033

- Figure 57: Middle East and Africa Recycled Synthetic Fiber Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Recycled Synthetic Fiber Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Recycled Synthetic Fiber Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Recycled Synthetic Fiber Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Recycled Synthetic Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Recycled Synthetic Fiber Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 27: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United States Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Canada Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Mexico Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 39: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Germany Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: France Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: France Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: United Kingdom Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Italy Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of the Europe Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of the Europe Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 52: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Application 2020 & 2033

- Table 54: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 55: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Brazil Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Argentina Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 65: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Application 2020 & 2033

- Table 66: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 67: Global Recycled Synthetic Fiber Market Revenue billion Forecast, by Country 2020 & 2033

- Table 68: Global Recycled Synthetic Fiber Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: South Africa Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Recycled Synthetic Fiber Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Recycled Synthetic Fiber Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recycled Synthetic Fiber Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Recycled Synthetic Fiber Market?

Key companies in the market include Patagonia, Nam Liong, Bombay Dyeing, Indorama Ventures Public Company Limited, LENZING AG, Reliance Industries Limited, China Eco Fiber Limited, Stella, Diyou Fibre (M) Sdn Bhd, TORAY INDUSTRIES INC, Zhejiang Hengyi Group Co Ltd , Alpek S A B de C V.

3. What are the main segments of the Recycled Synthetic Fiber Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness for Sustainable Materials; Other Drivers.

6. What are the notable trends driving market growth?

Clothing Application to Dominate the Market.

7. Are there any restraints impacting market growth?

The Non-Biodegradability of Synthetic Fiber; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Toray Industries, Inc. announced plans to sell its nylon 6 chemically recycled fiber (N6CR) yarns, textiles, and other products in Japan from March 2023. The products were expected to be produced by applying the company's depolymerization and repolymerization technology to recycled plastics recovered by Refineverse Group, Inc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recycled Synthetic Fiber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recycled Synthetic Fiber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recycled Synthetic Fiber Market?

To stay informed about further developments, trends, and reports in the Recycled Synthetic Fiber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence