Key Insights

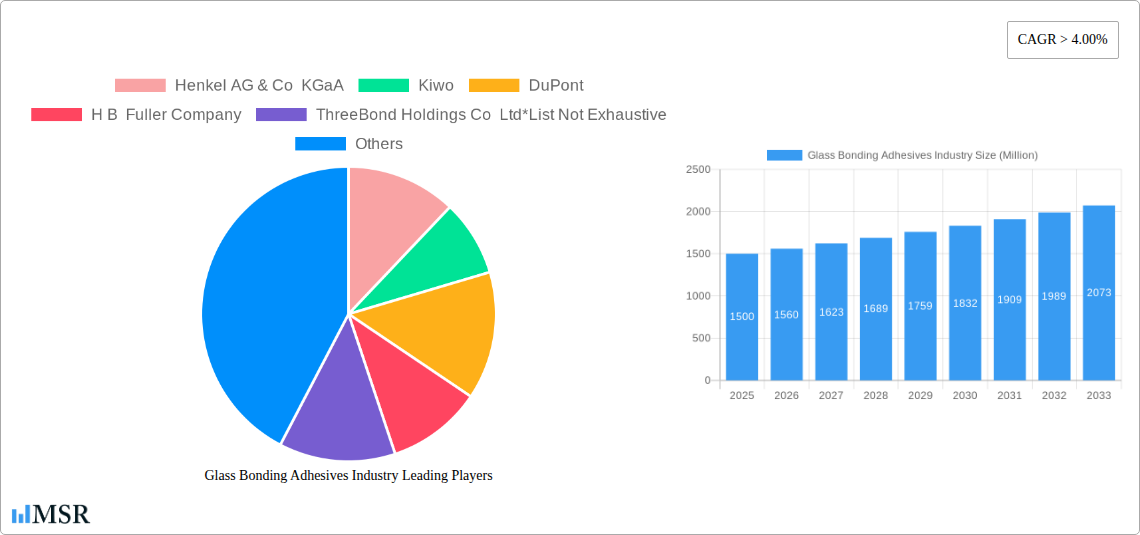

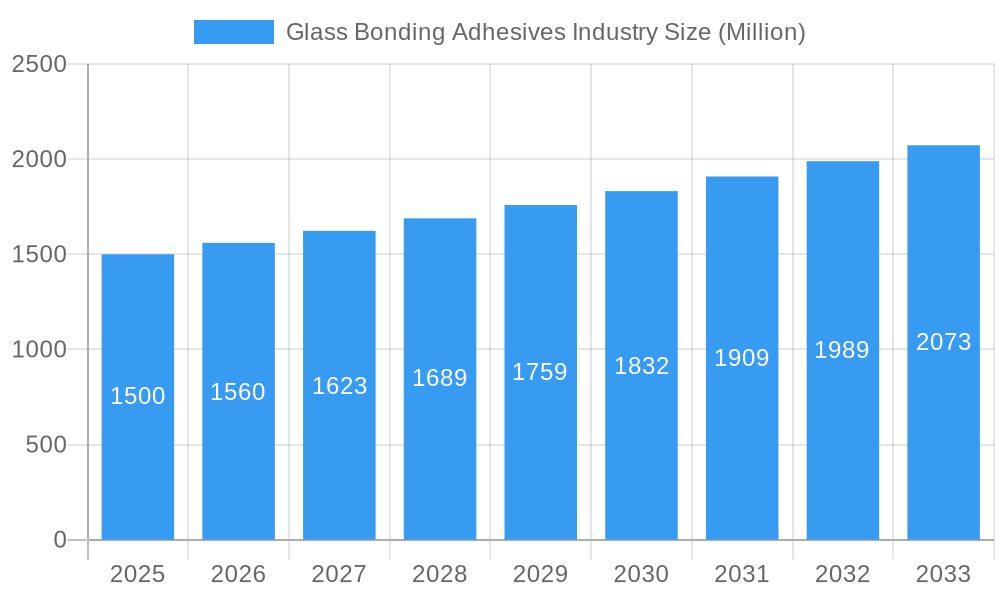

The global Glass Bonding Adhesives market is poised for significant expansion, projected to reach a substantial market size by 2033, driven by a consistent Compound Annual Growth Rate (CAGR) exceeding 4.00%. This robust growth is underpinned by escalating demand across diverse end-user industries. The furniture sector, with its increasing preference for contemporary designs that incorporate glass elements, is a key contributor. Simultaneously, the healthcare industry's need for sterile and durable bonding solutions for medical devices, coupled with the burgeoning electrical and electronics sector's reliance on advanced encapsulation and sealing technologies, further fuels market momentum. The automotive and transportation industry is witnessing a paradigm shift towards lighter and more fuel-efficient vehicles, where structural bonding of glass is becoming integral for enhanced safety and design flexibility. Moreover, the building and construction industry continues to be a major consumer, with architects and builders increasingly utilizing glass for aesthetic appeal and energy efficiency in both residential and commercial projects. This broad application spectrum underscores the indispensable role of glass bonding adhesives in modern manufacturing and infrastructure development.

Glass Bonding Adhesives Industry Market Size (In Billion)

The market is characterized by a dynamic interplay of technological advancements and evolving industry needs. Key drivers include the development of high-performance adhesive formulations offering superior strength, durability, and environmental resistance, alongside enhanced application techniques that improve efficiency and reduce manufacturing costs. Trends such as the rising adoption of UV-cured adhesives for rapid curing and reduced energy consumption are gaining traction. Furthermore, the growing emphasis on sustainable manufacturing practices is spurring innovation in eco-friendly adhesive solutions. However, the market faces certain restraints, including the volatility of raw material prices, particularly for petrochemical-based components, and stringent regulatory compliances concerning VOC emissions and material safety. Intense competition among established players like Henkel AG & Co KGaA, H.B. Fuller Company, and 3M, alongside emerging specialized manufacturers, necessitates continuous innovation and strategic pricing to maintain market share. The market is segmented by adhesive type, with Epoxy, Silicone, and Polyurethane adhesives dominating due to their versatile properties, while UV-cured adhesives are witnessing rapid adoption for specific applications.

Glass Bonding Adhesives Industry Company Market Share

Explore the dynamic Glass Bonding Adhesives Market, a critical sector experiencing robust growth driven by advancements in material science and escalating demand across diverse industries. This comprehensive report delves into the intricate landscape of glass bonding solutions, providing unparalleled insights for stakeholders seeking to capitalize on emerging opportunities. With a market size projected to reach XX Million by 2025, and a projected CAGR of XX% during the forecast period (2025-2033), this study offers a definitive roadmap for success.

Glass Bonding Adhesives Industry Market Concentration & Dynamics

The Glass Bonding Adhesives Industry exhibits a moderate to high level of market concentration, with a few dominant players holding significant market share. Leading entities like Henkel AG & Co KGaA, DuPont, and Sika AG are at the forefront, driving innovation and shaping market trends through substantial investments in research and development. The innovation ecosystem is characterized by a continuous stream of new product introductions, focusing on enhanced adhesion, improved durability, and eco-friendly formulations. Regulatory frameworks, particularly concerning environmental compliance and safety standards, play a crucial role in product development and market access. The threat of substitute products, such as mechanical fasteners, is present but is gradually diminishing due to the superior performance and aesthetic advantages offered by advanced bonding adhesives. End-user trends indicate a strong preference for lightweight, high-strength solutions, especially in the automotive and construction sectors. Mergers and acquisitions (M&A) activities are a key feature, with XX M&A deals recorded between 2019-2024, aimed at consolidating market position and expanding technological capabilities.

Glass Bonding Adhesives Industry Industry Insights & Trends

The Glass Bonding Adhesives Industry is poised for substantial expansion, fueled by a confluence of factors including rapid industrialization, technological advancements, and evolving consumer preferences. The global market size for glass bonding adhesives was estimated at XX Million in the base year 2025, with projections indicating a significant upward trajectory. Key growth drivers include the increasing adoption of glass in architectural designs for aesthetic appeal and energy efficiency, the burgeoning automotive sector's demand for lightweight and impact-resistant materials, and the growing use of specialized glass in electronics and healthcare devices. Technological disruptions, such as the development of high-performance UV-cured adhesives offering rapid curing times and superior bond strength, are transforming application methodologies. Furthermore, the increasing focus on sustainability is driving the demand for solvent-free, low-VOC (Volatile Organic Compound) adhesives. Evolving consumer behaviors, emphasizing product durability, safety, and sophisticated design, further bolster the market for advanced glass bonding solutions. The market is characterized by a healthy CAGR, driven by these persistent trends.

Key Markets & Segments Leading Glass Bonding Adhesives Industry

The Glass Bonding Adhesives Industry is witnessing dominant performance across several key markets and segments.

- Dominant End-User Industry: The Automotive & Transportation sector is a significant growth engine, driven by the increasing use of glass in vehicle bodies for weight reduction, improved aerodynamics, and enhanced safety features. The integration of advanced driver-assistance systems (ADAS) often relies on precise glass bonding for sensor integration.

- Drivers: Stringent fuel efficiency regulations, demand for electric vehicles (EVs) requiring lightweighting, and advancements in automotive design.

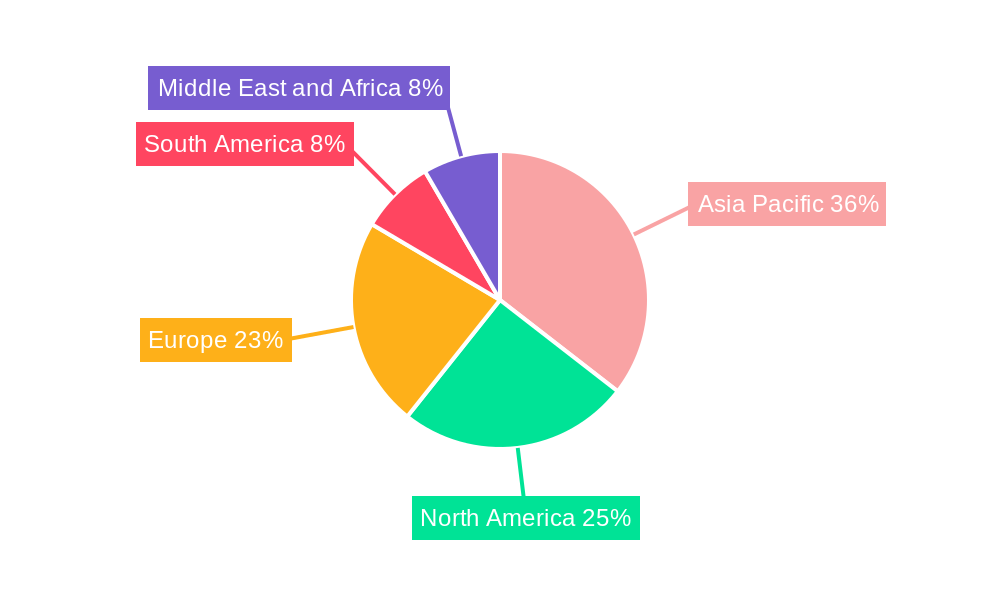

- Dominant Region: North America and Europe currently lead the market, owing to a well-established manufacturing base, high adoption rates of advanced technologies, and stringent quality standards. However, the Asia-Pacific region is emerging as a high-growth market, propelled by rapid industrialization and increasing investments in infrastructure and manufacturing.

- Drivers: Economic growth, infrastructure development projects, and expanding manufacturing capabilities.

- Dominant Type: Epoxy and Silicone adhesives represent the largest segments by volume and value. Epoxy adhesives offer exceptional strength and chemical resistance, making them ideal for structural bonding. Silicone adhesives provide excellent flexibility, UV resistance, and temperature stability, crucial for applications requiring durability and weatherproofing.

- Drivers: Superior performance characteristics, broad applicability across various substrates, and ongoing innovation in formulation.

- Key Applications: The Building & Construction segment also plays a pivotal role, with an increasing trend towards glass facades, skylights, and interior glass installations, all necessitating robust and durable bonding solutions. The Electrical & Electronics sector's demand for specialized adhesives for displays and components is also a notable contributor.

Glass Bonding Adhesives Industry Product Developments

Product development in the Glass Bonding Adhesives Industry is intensely focused on enhancing performance and expanding application capabilities. Innovations include the introduction of faster-curing UV-cured adhesives for high-volume manufacturing, enabling reduced cycle times. Development of high-temperature resistant adhesives is crucial for automotive applications. Furthermore, eco-friendly, low-VOC, and solvent-free formulations are gaining prominence due to increasing environmental regulations and consumer demand for sustainable products. Specialty adhesives with enhanced UV resistance, chemical inertness, and flexibility are being developed for niche applications in healthcare and electronics, offering a competitive edge to manufacturers who prioritize cutting-edge solutions.

Challenges in the Glass Bonding Adhesives Industry Market

The Glass Bonding Adhesives Industry faces several significant challenges. Regulatory hurdles, particularly concerning environmental impact and hazardous substance restrictions, can slow product development and market entry. Supply chain complexities and the volatility of raw material prices can impact production costs and profitability. Intense competitive pressures from established players and new entrants, coupled with the need for continuous R&D investment, pose significant financial strains. Furthermore, ensuring long-term bond durability and performance under extreme environmental conditions remains a technical challenge for certain applications.

Forces Driving Glass Bonding Adhesives Industry Growth

Several key forces are propelling the growth of the Glass Bonding Adhesives Industry. Technological advancements, such as the development of novel chemistries offering superior adhesion to various glass types and substrates, are significant drivers. The increasing adoption of lightweight materials across industries like automotive and aerospace, where glass plays a crucial role, is a major economic factor. Stringent regulations promoting energy-efficient building designs are also boosting the demand for specialized glass bonding adhesives in the construction sector. Furthermore, the growing trend of design aesthetics, favoring seamless integration of glass elements, further amplifies market demand.

Challenges in the Glass Bonding Adhesives Industry Market

Long-term growth catalysts for the Glass Bonding Adhesives Industry are rooted in continuous innovation and strategic market expansion. The development of adhesives with enhanced functionality, such as self-healing properties or embedded sensors, presents significant future potential. Strategic partnerships between adhesive manufacturers and glass producers, as well as end-user industries, can foster collaborative development and accelerate market penetration. Exploring emerging markets in developing economies and expanding applications into new sectors, such as renewable energy (e.g., solar panels), will be crucial for sustained growth.

Emerging Opportunities in Glass Bonding Adhesives Industry

Emerging opportunities in the Glass Bonding Adhesives Industry lie in the growing demand for smart glass technologies, which require specialized bonding for integrated electronics and films. The expansion of the electric vehicle market creates opportunities for lightweighting solutions where glass bonding is critical. Furthermore, the increasing use of glass in interior design, furniture, and decorative applications presents a growing niche. The development of bio-based and sustainable adhesives also represents a significant opportunity as environmental consciousness rises. The potential for adhesives in the repair and maintenance of existing glass structures, rather than just new installations, is another promising avenue.

Leading Players in the Glass Bonding Adhesives Industry Sector

- Henkel AG & Co KGaA

- Kiwo

- DuPont

- H B Fuller Company

- ThreeBond Holdings Co Ltd

- Bohle Ltd

- Sika AG

- Permabond LLC

- 3M

- Dymax Corporation

- Ashland

Key Milestones in Glass Bonding Adhesives Industry Industry

- 2019: Introduction of high-strength structural adhesives with enhanced UV resistance.

- 2020: Development of faster-curing UV-cured adhesives for automotive windshields.

- 2021: Increased focus on sustainable, low-VOC glass bonding solutions in response to regulations.

- 2022: Significant M&A activity as major players consolidate market share and technological expertise.

- 2023: Launch of specialized adhesives for bonding glass to dissimilar materials in electronics.

- 2024: Advancements in temperature-resistant adhesives for demanding industrial applications.

Strategic Outlook for Glass Bonding Adhesives Industry Market

The strategic outlook for the Glass Bonding Adhesives Industry Market is overwhelmingly positive, characterized by sustained growth and innovation. Future success will hinge on continued investment in R&D to develop next-generation adhesives with superior performance, enhanced sustainability, and expanded functionalities. Strategic collaborations and partnerships across the value chain will be crucial for market penetration and technology adoption. Companies that can effectively address the evolving demands for lightweighting, energy efficiency, and advanced functionality in glass bonding will be well-positioned for long-term success in this dynamic and expanding market.

Glass Bonding Adhesives Industry Segmentation

-

1. Type

- 1.1. Epoxy

- 1.2. Silicone

- 1.3. Polyurethane

- 1.4. UV Cured

- 1.5. Others

-

2. End-user Industry

- 2.1. Furniture

- 2.2. Healthcare

- 2.3. Electrical & Electronics

- 2.4. Automotive & Transportation

- 2.5. Building & Construction

- 2.6. Others

Glass Bonding Adhesives Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Glass Bonding Adhesives Industry Regional Market Share

Geographic Coverage of Glass Bonding Adhesives Industry

Glass Bonding Adhesives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Various End-user Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Epoxy

- 5.1.2. Silicone

- 5.1.3. Polyurethane

- 5.1.4. UV Cured

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Furniture

- 5.2.2. Healthcare

- 5.2.3. Electrical & Electronics

- 5.2.4. Automotive & Transportation

- 5.2.5. Building & Construction

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Epoxy

- 6.1.2. Silicone

- 6.1.3. Polyurethane

- 6.1.4. UV Cured

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Furniture

- 6.2.2. Healthcare

- 6.2.3. Electrical & Electronics

- 6.2.4. Automotive & Transportation

- 6.2.5. Building & Construction

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Epoxy

- 7.1.2. Silicone

- 7.1.3. Polyurethane

- 7.1.4. UV Cured

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Furniture

- 7.2.2. Healthcare

- 7.2.3. Electrical & Electronics

- 7.2.4. Automotive & Transportation

- 7.2.5. Building & Construction

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Epoxy

- 8.1.2. Silicone

- 8.1.3. Polyurethane

- 8.1.4. UV Cured

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Furniture

- 8.2.2. Healthcare

- 8.2.3. Electrical & Electronics

- 8.2.4. Automotive & Transportation

- 8.2.5. Building & Construction

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Epoxy

- 9.1.2. Silicone

- 9.1.3. Polyurethane

- 9.1.4. UV Cured

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Furniture

- 9.2.2. Healthcare

- 9.2.3. Electrical & Electronics

- 9.2.4. Automotive & Transportation

- 9.2.5. Building & Construction

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Glass Bonding Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Epoxy

- 10.1.2. Silicone

- 10.1.3. Polyurethane

- 10.1.4. UV Cured

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Furniture

- 10.2.2. Healthcare

- 10.2.3. Electrical & Electronics

- 10.2.4. Automotive & Transportation

- 10.2.5. Building & Construction

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kiwo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 H B Fuller Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ThreeBond Holdings Co Ltd*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bohle Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sika AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Permabond LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3M

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dymax Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ashland

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Glass Bonding Adhesives Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Glass Bonding Adhesives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Glass Bonding Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Glass Bonding Adhesives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Glass Bonding Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Glass Bonding Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Bonding Adhesives Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Glass Bonding Adhesives Industry?

Key companies in the market include Henkel AG & Co KGaA, Kiwo, DuPont, H B Fuller Company, ThreeBond Holdings Co Ltd*List Not Exhaustive, Bohle Ltd, Sika AG, Permabond LLC, 3M, Dymax Corporation, Ashland.

3. What are the main segments of the Glass Bonding Adhesives Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Various End-user Industries; Other Drivers.

6. What are the notable trends driving market growth?

Automotive and Transportation Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glass Bonding Adhesives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glass Bonding Adhesives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glass Bonding Adhesives Industry?

To stay informed about further developments, trends, and reports in the Glass Bonding Adhesives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence