Key Insights

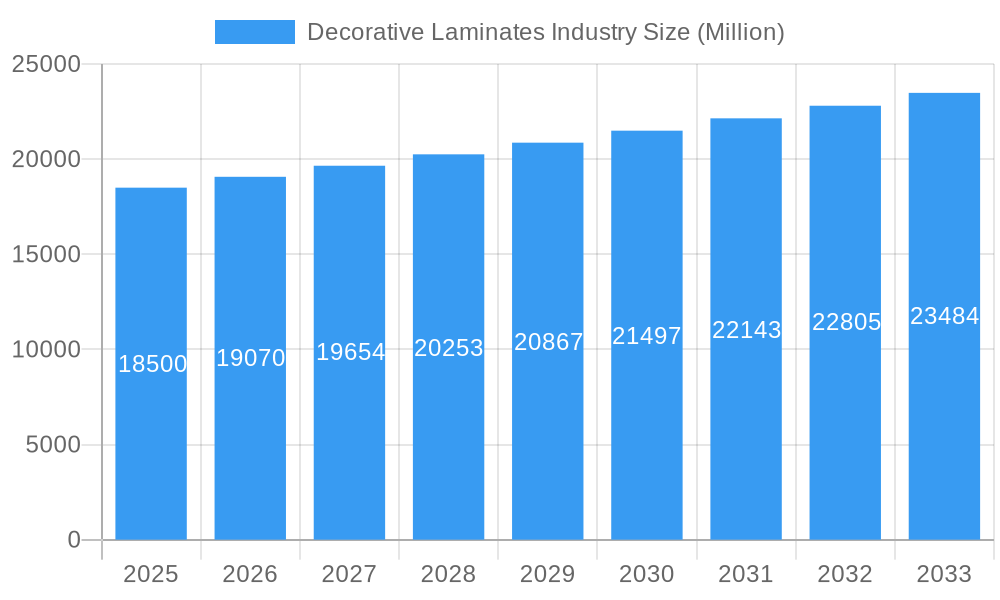

The global Decorative Laminates market is poised for steady expansion, projected to reach a substantial market size of approximately USD 18,500 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This robust growth is primarily fueled by escalating demand across residential and non-residential sectors, driven by the aesthetic appeal and functional benefits of decorative laminates. Key drivers include the increasing urbanization and a rising disposable income, which encourage home renovations and new construction projects, subsequently boosting the demand for visually appealing interior finishes. Furthermore, the growing emphasis on sustainable building materials and innovative product designs, such as eco-friendly laminates and those with enhanced durability and scratch resistance, are shaping market trends. The application segment is dominated by furniture and flooring, where laminates offer cost-effective and versatile alternatives to traditional materials like wood and stone.

Decorative Laminates Industry Market Size (In Billion)

However, the market faces certain restraints, including the volatility in raw material prices, particularly for plastic resins, which can impact manufacturing costs and profit margins. Supply chain disruptions and the increasing competition from alternative surfacing materials also pose challenges. Despite these hurdles, the market is witnessing significant innovation in product development, with manufacturers focusing on high-pressure laminates (HPL) and low-pressure laminates (LPL) to cater to diverse application needs. The Asia Pacific region is expected to lead the market growth, owing to rapid industrialization, burgeoning construction activities in countries like China and India, and a growing preference for modern interior design solutions. The competitive landscape is characterized by the presence of both established global players and emerging regional manufacturers, all striving to capture market share through product differentiation, strategic partnerships, and expansion into new geographies.

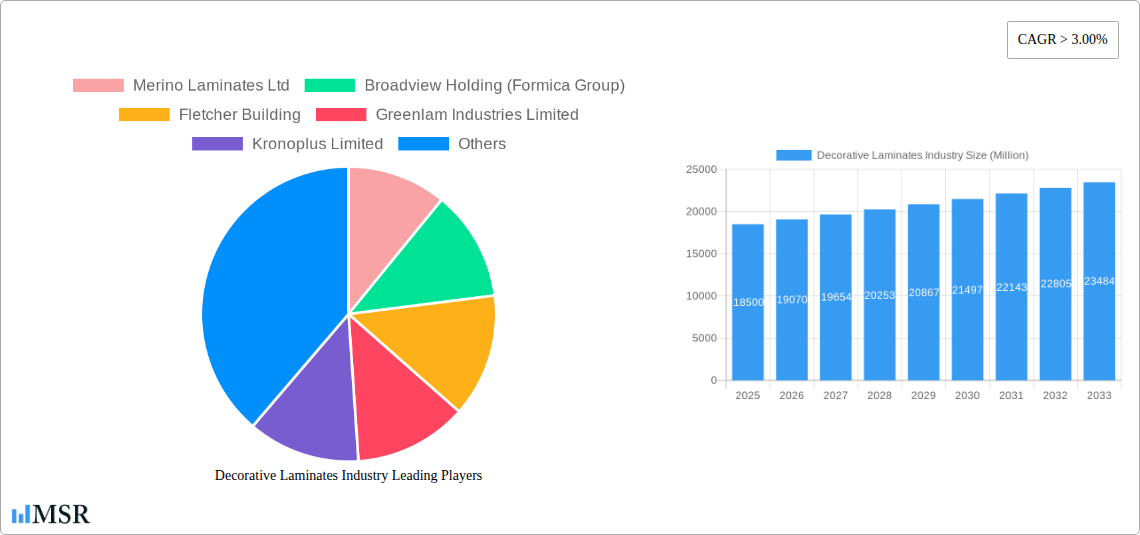

Decorative Laminates Industry Company Market Share

Decorative Laminates Industry Market Concentration & Dynamics (Report Description)

This comprehensive report delves into the intricate landscape of the decorative laminates industry, offering unparalleled insights into its market concentration, competitive dynamics, and strategic evolution. Spanning the historical period of 2019–2024 and extending through the forecast period of 2025–2033, with a base and estimated year of 2025, this study provides a robust analytical framework. The global decorative laminates market size is projected to reach XX Million by 2033, exhibiting a strong Compound Annual Growth Rate (CAGR) of XX%.

The decorative laminates market concentration is characterized by a blend of global leaders and regional players, fostering an innovative ecosystem driven by continuous product development and sustainable material exploration. Regulatory frameworks, while varying by region, are increasingly emphasizing environmental compliance and safety standards, influencing manufacturing processes and material choices. The threat of substitute products, while present, is mitigated by the unique aesthetic appeal, durability, and cost-effectiveness of decorative laminates. End-user trends lean towards personalization, eco-friendly options, and designs that mimic natural materials, directly impacting demand across applications like furniture, cabinets, flooring, and wall panels. Mergers and acquisitions (M&A) activities, while not consistently high in volume, are strategically significant, aiming to expand market reach, acquire new technologies, and consolidate market share. Key M&A deal counts for the period are estimated at XX. Analyzing these dynamics is crucial for stakeholders seeking to navigate the competitive terrain and capitalize on emerging opportunities within the decorative laminates market.

Decorative Laminates Industry Industry Insights & Trends

The decorative laminates industry is undergoing a significant transformation, propelled by a confluence of robust growth drivers, disruptive technological advancements, and evolving consumer preferences. The global decorative laminates market size was valued at approximately $XX Million in 2024 and is poised for substantial expansion, projected to reach an impressive $XX Million by 2033, registering a compelling CAGR of XX% throughout the forecast period of 2025–2033. This remarkable growth is underpinned by the escalating demand for aesthetically pleasing and durable interior design solutions across residential and non-residential sectors.

Key market growth drivers include the burgeoning global construction and real estate sectors, particularly in emerging economies, which are fueling the demand for interior finishing materials. Furthermore, a growing emphasis on interior aesthetics and customization among consumers worldwide is translating into a higher uptake of decorative laminates for applications ranging from furniture and cabinets to flooring and wall panels. Technological disruptions are playing a pivotal role in reshaping the industry. Innovations in manufacturing processes are enabling the production of laminates with enhanced durability, scratch resistance, and water repellency, thereby expanding their application spectrum. The development of eco-friendly and sustainable laminates, utilizing recycled materials and low-VOC adhesives, is also gaining considerable traction, aligning with the global shift towards greener building practices.

Evolving consumer behaviors are further shaping the market trajectory. A heightened awareness of interior design trends, coupled with the accessibility of design inspiration through digital platforms, is empowering consumers to make more informed and personalized choices. This trend necessitates a diverse product portfolio from manufacturers, catering to a wide array of aesthetic preferences, from minimalist to opulent designs. The plastic resin segment, particularly phenolic and melamine resins, remains a cornerstone of decorative laminate production, with ongoing research focused on improving their performance characteristics and environmental footprint. Similarly, advancements in overlays and adhesives are contributing to the creation of more resilient and visually appealing laminate products. The increasing adoption of digital printing technologies is allowing for intricate and customizable designs, further differentiating products and capturing niche market segments. The wood substrate sector, a fundamental component, is also seeing innovation in terms of engineered wood products that offer enhanced stability and sustainability.

Key Markets & Segments Leading Decorative Laminates Industry

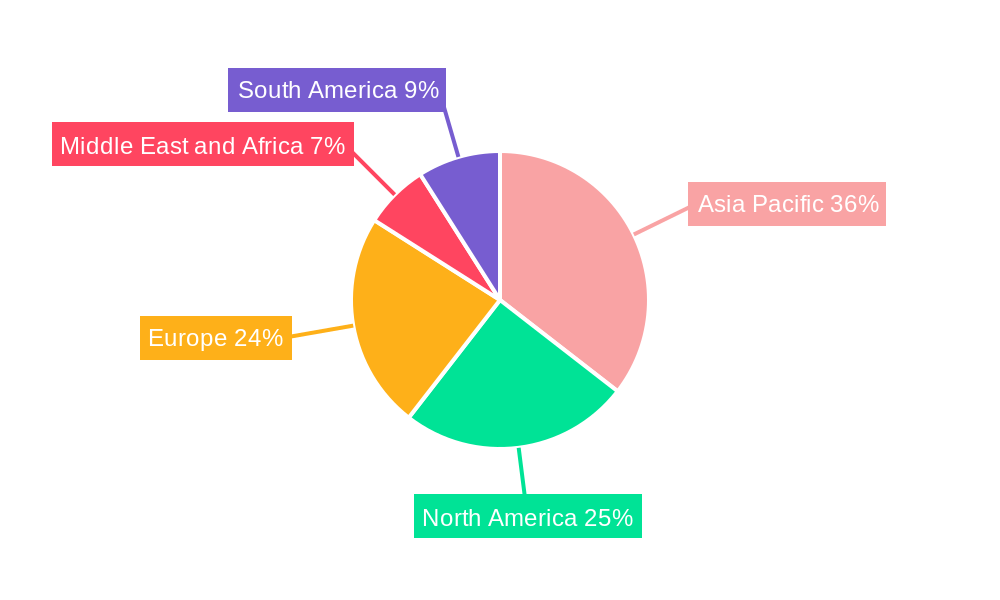

The decorative laminates industry exhibits a dynamic geographical and sectoral landscape, with specific regions and segments demonstrating dominant growth and market penetration. Asia-Pacific, particularly countries like India and China, is emerging as a powerhouse in the decorative laminates market. This dominance is fueled by rapid urbanization, a growing middle class with increasing disposable incomes, and a significant surge in construction and infrastructure development. The substantial demand from the residential and non-residential end-user industries, encompassing commercial spaces, hospitality, and healthcare facilities, further solidifies Asia-Pacific's leading position.

Within the raw material segment, plastic resin, primarily phenolic and melamine resins, forms the backbone of decorative laminate manufacturing and consequently commands a significant market share. Innovations in resin technology are continuously enhancing the properties of laminates, such as increased fire retardancy and superior scratch resistance, driving their adoption across diverse applications. The wood substrate segment is also critically important, with the availability of abundant timber resources and the development of engineered wood products contributing to its strong performance. The overlays segment, which provides the decorative print and protective surface, is witnessing innovation in terms of design complexity and durability. Adhesives are crucial for the structural integrity and longevity of laminates, with a growing focus on eco-friendly and low-VOC formulations.

In terms of application, the furniture segment consistently leads the market, driven by the constant demand for aesthetically pleasing and functional furniture in both residential and commercial settings. The cabinets segment also represents a substantial market, with decorative laminates being a preferred choice for kitchen and bathroom cabinets due to their durability, ease of maintenance, and aesthetic versatility. The flooring and wall panels segments are experiencing robust growth, fueled by the trend of enhancing interior aesthetics and the availability of innovative designs and textures.

The end-user industry analysis reveals that the residential sector forms the largest consumer base for decorative laminates, owing to the continuous demand for home renovation and new constructions. The non-residential sector, encompassing offices, retail spaces, hotels, and public buildings, presents a significant and growing market, driven by the need for durable, attractive, and cost-effective interior finishes. The transportation sector, while a smaller segment, is also showing potential for growth, particularly in the customization of interior elements in vehicles and public transport.

Key drivers for the dominance of these markets and segments include:

- Economic Growth and Urbanization: Accelerated economic development and increasing urbanization in regions like Asia-Pacific are directly translating into higher demand for construction materials and interior finishing solutions.

- Rising Disposable Incomes: As disposable incomes increase, consumers are willing to invest more in home improvement and aesthetically appealing living and working spaces, boosting demand for decorative laminates.

- Infrastructure Development: Large-scale infrastructure projects, including commercial complexes, hospitality venues, and public facilities, create substantial demand for decorative laminates across various applications.

- Consumer Preferences for Aesthetics and Durability: The inherent qualities of decorative laminates, offering a wide array of designs, textures, and superior durability at a competitive price point, align perfectly with evolving consumer preferences.

- Technological Advancements: Innovations in printing technology, material science, and manufacturing processes are continually enhancing the appeal and functionality of decorative laminates, expanding their application scope and market reach.

Decorative Laminates Industry Product Developments

Product innovation is a critical determinant of success in the competitive decorative laminates industry. Manufacturers are continuously investing in research and development to introduce laminates with enhanced functionalities and novel aesthetic designs. Key developments include the introduction of antimicrobial laminates, which are gaining traction in healthcare and food service environments. Furthermore, advancements in digital printing technologies are enabling the creation of highly customizable and intricate designs, including photorealistic wood grains, abstract patterns, and even personalized graphics. The development of laminates with superior scratch resistance, impact resistance, and UV stability is extending their application lifespan and broadening their use in high-traffic areas. Eco-friendly product lines, incorporating recycled content and low-VOC (Volatile Organic Compound) adhesives, are also a significant focus, catering to the growing consumer demand for sustainable building materials. These innovations not only enhance the competitive edge of the products but also expand their market relevance by addressing specific industry needs and consumer preferences.

Challenges in the Decorative Laminates Industry Market

The decorative laminates industry faces several significant challenges that impact its growth and profitability. One of the primary hurdles is the volatility in raw material prices, particularly for petroleum-based resins and wood pulp, which can significantly affect production costs and profit margins. Intense competition from both established global players and emerging regional manufacturers, often leading to price wars, also exerts pressure on the market. Regulatory compliance, especially concerning environmental standards and the use of chemicals, can pose challenges, requiring ongoing investment in sustainable practices and product reformulation. Furthermore, the threat of substitute products, such as natural wood, tiles, and paints, necessitates continuous innovation and product differentiation to maintain market share. Supply chain disruptions, as witnessed during global events, can also lead to delays in production and delivery, impacting customer satisfaction. The estimated impact of these challenges on market growth is an annual reduction of XX%.

Forces Driving Decorative Laminates Industry Growth

The decorative laminates industry is propelled by a robust set of growth drivers that underscore its expanding market potential. A primary catalyst is the sustained global growth in the construction and real estate sectors, particularly in developing economies, where increasing urbanization and rising disposable incomes are fueling demand for residential and commercial spaces. The escalating consumer preference for aesthetically pleasing and durable interior finishes further bolsters this demand. Technological advancements in manufacturing processes, such as high-definition printing and improved surface treatments, are enabling the creation of laminates that mimic natural materials with unparalleled realism and offer enhanced durability, scratch resistance, and ease of maintenance. The increasing focus on sustainability and eco-friendly products is also a significant driver, with manufacturers investing in laminates made from recycled materials and low-VOC components, aligning with global green building trends. These factors collectively create a favorable environment for the continued expansion of the decorative laminates market.

Challenges in the Decorative Laminates Industry Market

The decorative laminates industry is poised for long-term growth, driven by a consistent stream of innovations and strategic market expansions. The ongoing research and development into advanced material science are leading to the creation of laminates with superior performance characteristics, such as enhanced fire retardancy, improved water resistance, and greater durability. These advancements are not only expanding the application range of decorative laminates into more demanding environments but also increasing their lifespan, thereby reducing the need for frequent replacements. Strategic partnerships and collaborations between manufacturers and designers are fostering greater product innovation and market penetration. Furthermore, the increasing global demand for customizable and personalized interior design solutions presents a significant opportunity for manufacturers to leverage digital printing technologies and offer bespoke laminate products. Market expansion into emerging economies, coupled with the growing awareness of the aesthetic and functional benefits of decorative laminates, are key catalysts for sustained long-term growth.

Emerging Opportunities in Decorative Laminates Industry

Emerging opportunities within the decorative laminates industry are shaping its future trajectory. The growing trend towards smart homes and integrated technologies presents an opportunity for the development of laminates with embedded functionalities, such as touch-sensitive surfaces or integrated lighting. The burgeoning demand for sustainable and eco-friendly building materials continues to be a significant opportunity, driving innovation in bio-based resins and recycled content for laminates. The increasing focus on hygienic surfaces in public spaces and healthcare facilities is creating a niche for antimicrobial and easily cleanable laminate solutions. Furthermore, the expansion into niche applications such as marine interiors, aerospace interiors, and specialized furniture continues to offer untapped market potential. The digitalization of design and manufacturing processes also opens avenues for mass customization and on-demand production, catering to specific client needs.

Leading Players in the Decorative Laminates Industry Sector

- Merino Laminates Ltd

- Broadview Holding (Formica Group)

- Fletcher Building

- Greenlam Industries Limited

- Kronoplus Limited

- Panolam Industries International Inc

- Archidply

- FunderMax

- Stylam Pvt Ltd

- Abet Laminati S p A

- Bell Laminates

- Wilsonart LLC

- OMNOVA Solutions Inc

- Airolam decorative laminates

- AICA Laminates India Pvt Ltd

Key Milestones in Decorative Laminates Industry Industry

- 2019: Significant advancements in digital printing technology enable highly detailed and customizable laminate designs, increasing aesthetic appeal.

- 2020: Heightened global focus on sustainability leads to increased investment in eco-friendly laminates and bio-based raw materials.

- 2021: Introduction of advanced antimicrobial laminates gains traction, especially for healthcare and hospitality sectors, driven by pandemic-related concerns.

- 2022: Strategic M&A activities increase, aimed at expanding market reach and consolidating portfolios within the competitive landscape.

- 2023: Development of laminates with enhanced fire retardant and water-resistant properties opens up new application possibilities.

- 2024: Increased adoption of IoT and smart technologies begins to influence the development of laminates with integrated features.

Strategic Outlook for Decorative Laminates Industry Market

The strategic outlook for the decorative laminates industry market is characterized by strong growth acceleration, driven by a confluence of innovative product development and expanding market reach. The continued emphasis on sustainable materials and manufacturing processes will be a key differentiator and growth accelerator, aligning with global environmental mandates and consumer preferences. Investments in advanced digital printing technologies will enable greater customization and personalization, catering to evolving design trends and niche market demands. Strategic partnerships and market expansion into emerging economies will be crucial for capturing new customer bases and driving volume growth. Furthermore, the development of high-performance laminates with enhanced durability, scratch resistance, and antimicrobial properties will broaden their applicability across diverse end-user industries, including healthcare, transportation, and commercial spaces. The industry is set to benefit from ongoing urbanization, rising disposable incomes, and the persistent demand for aesthetically pleasing and functional interior finishes, solidifying its position as a dynamic and growth-oriented sector.

Decorative Laminates Industry Segmentation

-

1. Raw Material

- 1.1. Plastic Resin

- 1.2. Overlays

- 1.3. Adhesives

- 1.4. Wood Substrate

- 1.5. Others

-

2. Application

- 2.1. Furniture

- 2.2. Cabinets

- 2.3. Flooring

- 2.4. Wall Panels

- 2.5. Others

-

3. End-user Industry

- 3.1. Residential

- 3.2. Non-residential

- 3.3. Transportation

Decorative Laminates Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Decorative Laminates Industry Regional Market Share

Geographic Coverage of Decorative Laminates Industry

Decorative Laminates Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Construction Industry in the Asia-Pacific Region; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Furniture Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Plastic Resin

- 5.1.2. Overlays

- 5.1.3. Adhesives

- 5.1.4. Wood Substrate

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Furniture

- 5.2.2. Cabinets

- 5.2.3. Flooring

- 5.2.4. Wall Panels

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.3.3. Transportation

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Asia Pacific Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Plastic Resin

- 6.1.2. Overlays

- 6.1.3. Adhesives

- 6.1.4. Wood Substrate

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Furniture

- 6.2.2. Cabinets

- 6.2.3. Flooring

- 6.2.4. Wall Panels

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Residential

- 6.3.2. Non-residential

- 6.3.3. Transportation

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. North America Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Plastic Resin

- 7.1.2. Overlays

- 7.1.3. Adhesives

- 7.1.4. Wood Substrate

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Furniture

- 7.2.2. Cabinets

- 7.2.3. Flooring

- 7.2.4. Wall Panels

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Residential

- 7.3.2. Non-residential

- 7.3.3. Transportation

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Europe Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Plastic Resin

- 8.1.2. Overlays

- 8.1.3. Adhesives

- 8.1.4. Wood Substrate

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Furniture

- 8.2.2. Cabinets

- 8.2.3. Flooring

- 8.2.4. Wall Panels

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Residential

- 8.3.2. Non-residential

- 8.3.3. Transportation

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South America Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Plastic Resin

- 9.1.2. Overlays

- 9.1.3. Adhesives

- 9.1.4. Wood Substrate

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Furniture

- 9.2.2. Cabinets

- 9.2.3. Flooring

- 9.2.4. Wall Panels

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Residential

- 9.3.2. Non-residential

- 9.3.3. Transportation

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East and Africa Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Plastic Resin

- 10.1.2. Overlays

- 10.1.3. Adhesives

- 10.1.4. Wood Substrate

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Furniture

- 10.2.2. Cabinets

- 10.2.3. Flooring

- 10.2.4. Wall Panels

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Residential

- 10.3.2. Non-residential

- 10.3.3. Transportation

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merino Laminates Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Broadview Holding (Formica Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fletcher Building

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greenlam Industries Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kronoplus Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panolam Industries International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Archidply

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FunderMax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Stylam Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abet Laminati S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bell Laminates

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wilsonart LLC *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 OMNOVA Solutions Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Airolam decorative laminates

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AICA Laminates India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Merino Laminates Ltd

List of Figures

- Figure 1: Global Decorative Laminates Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 3: Asia Pacific Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: Asia Pacific Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 11: North America Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 12: North America Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: North America Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: North America Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 19: Europe Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 20: Europe Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 27: South America Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: South America Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: South America Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 35: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 36: Middle East and Africa Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Decorative Laminates Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 6: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 15: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 22: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Italy Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 31: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 38: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Decorative Laminates Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Decorative Laminates Industry?

Key companies in the market include Merino Laminates Ltd, Broadview Holding (Formica Group), Fletcher Building, Greenlam Industries Limited, Kronoplus Limited, Panolam Industries International Inc, Archidply, FunderMax, Stylam Pvt Ltd, Abet Laminati S p A, Bell Laminates, Wilsonart LLC *List Not Exhaustive, OMNOVA Solutions Inc, Airolam decorative laminates, AICA Laminates India Pvt Ltd.

3. What are the main segments of the Decorative Laminates Industry?

The market segments include Raw Material, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Construction Industry in the Asia-Pacific Region; Other Drivers.

6. What are the notable trends driving market growth?

Furniture Application to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Decorative Laminates Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Decorative Laminates Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Decorative Laminates Industry?

To stay informed about further developments, trends, and reports in the Decorative Laminates Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence