Key Insights

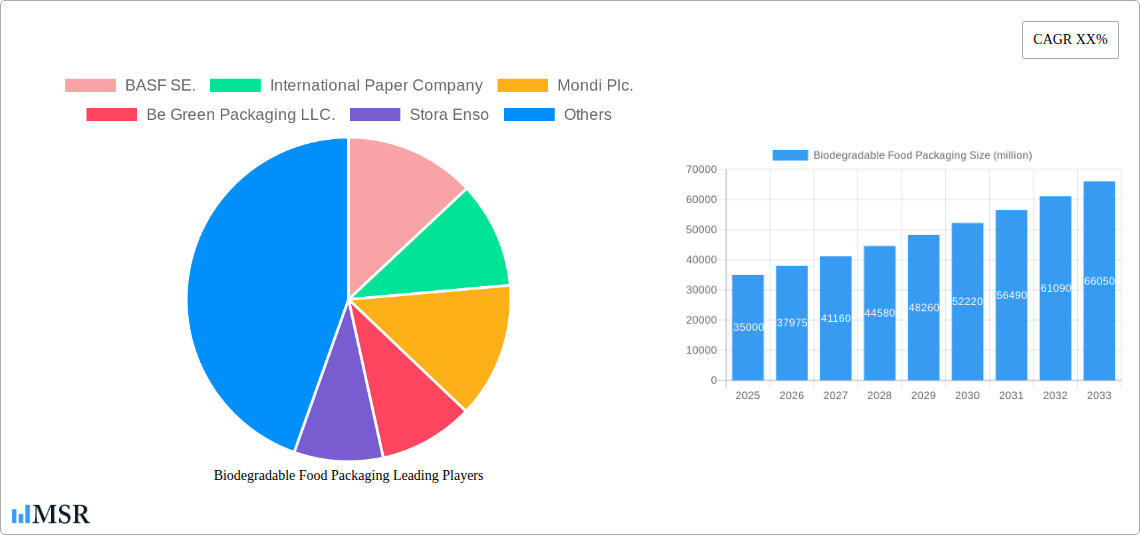

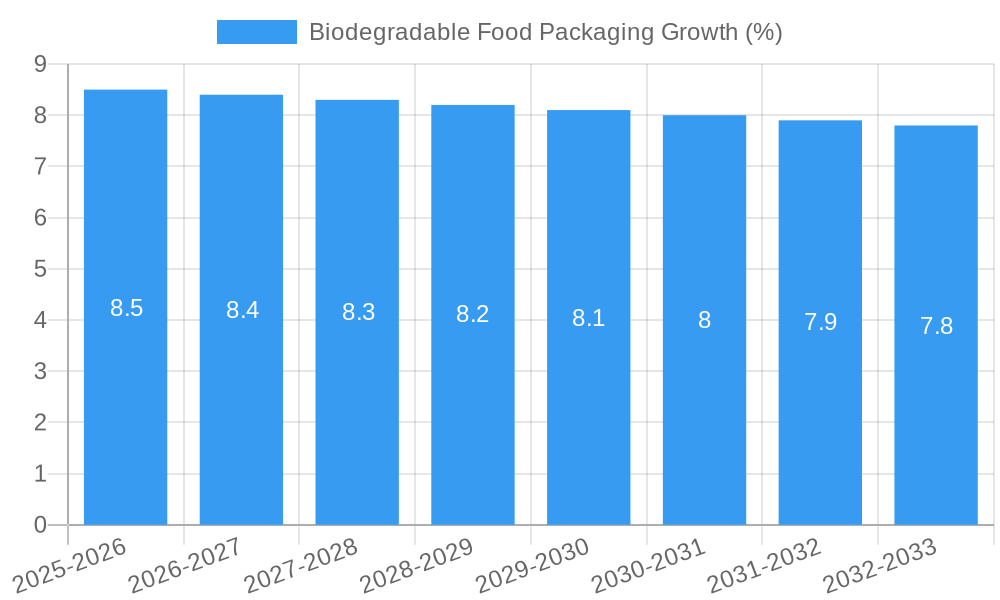

The global Biodegradable Food Packaging market is poised for significant expansion, projected to reach a substantial market size of approximately USD 35,000 million by 2025, and is expected to continue its robust growth trajectory. This impressive expansion is underpinned by a Compound Annual Growth Rate (CAGR) of roughly 8.5% during the forecast period of 2025-2033. This dynamic growth is primarily fueled by a confluence of increasing consumer awareness regarding environmental sustainability and stringent government regulations aimed at reducing plastic waste. Consumers are actively seeking eco-friendly alternatives to conventional packaging, driving demand for biodegradable solutions across all food segments, including Dairy & Beverages, Fruits, Vegetables, and Meat & Related Products. Manufacturers are responding with innovative packaging materials and designs, further accelerating market penetration.

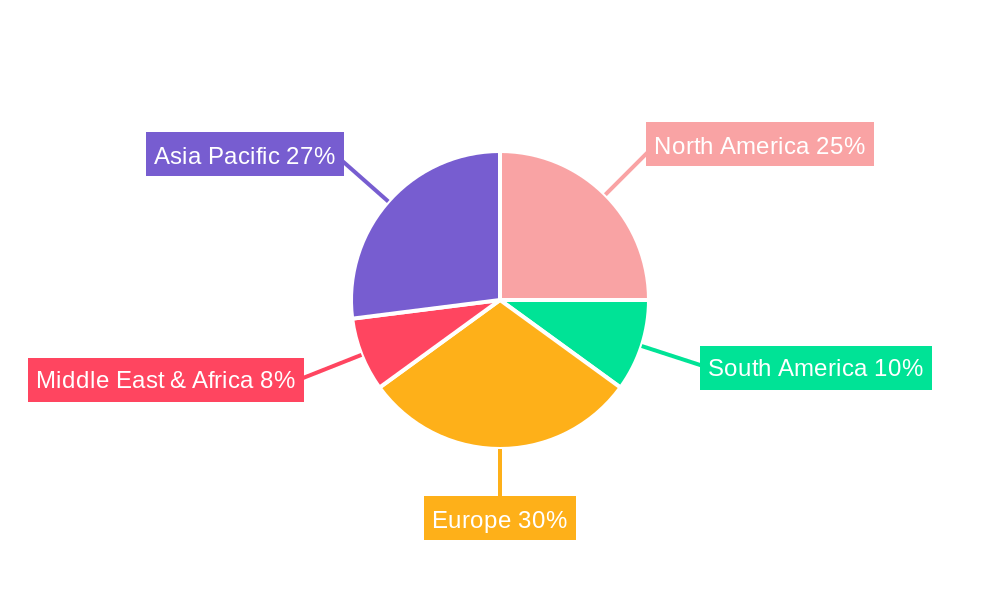

Key drivers for this market's ascent include the growing demand for convenience combined with a commitment to environmental responsibility. The surge in e-commerce and ready-to-eat meals further amplifies the need for sustainable packaging solutions that align with modern lifestyle choices and corporate social responsibility initiatives. While the market enjoys strong growth, certain restraints such as higher production costs compared to traditional plastics and limited availability of raw materials in specific regions, present challenges. However, ongoing research and development in biopolymer technology and advancements in waste management infrastructure are expected to mitigate these limitations. The market is segmented by type, with Plastic, Paper, and Aluminum representing the dominant categories, and by application, with Dairy & Beverages and Fruits & Vegetables holding substantial shares. Geographically, Asia Pacific, led by China and India, is emerging as a powerhouse due to rapid industrialization and a growing middle class, while North America and Europe continue to be significant markets with established sustainability initiatives.

Here is your SEO-optimized, engaging report description for Biodegradable Food Packaging, ready for immediate use:

Report Title: Global Biodegradable Food Packaging Market: Growth, Trends, and Strategic Outlook (2019–2033)

Report Description:

Unlock the immense potential of the rapidly expanding biodegradable food packaging market. This comprehensive report delivers critical insights into a global industry projected to reach xx million USD by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025–2033). Dive deep into market dynamics, technological advancements, and evolving consumer demands shaping the future of sustainable food packaging. With a historical analysis from 2019–2024 and a detailed examination of the base year 2025, this report is your definitive guide to identifying key growth drivers, emerging opportunities, and strategic imperatives. Essential for food manufacturers, packaging suppliers, investors, and regulatory bodies seeking to navigate this transformative sector.

Biodegradable Food Packaging Market Concentration & Dynamics

The global biodegradable food packaging market exhibits moderate to high concentration, with leading players like BASF SE., International Paper Company, Mondi Plc., Stora Enso, and Nature Works LLC. investing heavily in research and development to drive innovation. These companies are at the forefront of developing advanced bio-based and compostable materials, contributing to a vibrant innovation ecosystem. Regulatory frameworks, such as extended producer responsibility schemes and bans on single-use plastics, are increasingly influencing market dynamics, pushing for greener alternatives. While substitute products like conventional plastics persist, growing consumer awareness and preference for sustainable options are steadily eroding their market share. End-user trends highlight a strong demand for packaging solutions that minimize environmental impact, particularly within the Dairy & Beverages and Fruits segments. Mergers and acquisitions (M&A) activities, with xx M&A deals recorded in the historical period, are a significant indicator of market consolidation and strategic expansion. Key players are actively acquiring smaller, innovative companies to broaden their product portfolios and enhance their market presence, further shaping the competitive landscape.

Biodegradable Food Packaging Industry Insights & Trends

The biodegradable food packaging market is experiencing unprecedented growth, driven by a confluence of environmental consciousness, regulatory pressures, and technological advancements. The global market size was estimated at xx million USD in the base year 2025, and it is projected to reach a staggering xx million USD by 2033, growing at a compound annual growth rate (CAGR) of xx% during the forecast period (2025–2033). This robust expansion is fueled by increasing consumer awareness regarding the detrimental effects of traditional plastic packaging on ecosystems, leading to a pronounced shift towards sustainable alternatives. Governments worldwide are implementing stringent regulations and policies, such as plastic bans and incentives for eco-friendly packaging, further accelerating market adoption. Technological disruptions are playing a pivotal role, with continuous innovation in the development of novel biodegradable materials derived from renewable resources like corn starch, sugarcane, and algae. These advancements not only enhance the biodegradability and compostability of packaging but also improve its performance characteristics, including barrier properties and shelf-life extension for food products. Evolving consumer behaviors, characterized by a willingness to pay a premium for environmentally responsible products, are creating significant demand for biodegradable food packaging across various applications. The Meat & Related Products segment, in particular, is witnessing a surge in demand for advanced biodegradable solutions that ensure food safety and preservation while adhering to sustainability mandates. The convenience and aesthetic appeal of packaging also remain crucial factors, prompting manufacturers to develop solutions that are both functional and visually attractive. Furthermore, the growing emphasis on circular economy principles encourages the adoption of packaging that can be effectively composted or recycled, contributing to a reduced waste footprint. The Fruits and Vegetables segments are also significant contributors to market growth, with consumers increasingly seeking produce packaged in earth-friendly materials. The Dairy & Beverages sector, a major consumer of packaging, is actively exploring and adopting biodegradable options to align with corporate sustainability goals and consumer expectations. The "Others" segment, encompassing a wide array of food products, also presents substantial growth potential as awareness and availability of sustainable packaging solutions expand. The Paper type of biodegradable packaging is gaining significant traction due to its perceived environmental benefits and established recycling infrastructure in many regions. However, advancements in bioplastics are rapidly closing the performance gap, making them increasingly competitive for various food applications. The industry's commitment to research and development, coupled with strategic collaborations between material scientists, packaging manufacturers, and food brands, is continuously pushing the boundaries of what is possible in sustainable food packaging.

Key Markets & Segments Leading Biodegradable Food Packaging

The biodegradable food packaging market is experiencing dynamic growth across various regions and segments. Dominant regions include North America and Europe, driven by strong consumer demand for sustainable products, stringent environmental regulations, and well-established recycling and composting infrastructure. Within these regions, xx million USD worth of biodegradable packaging was utilized in the historical period. Economic growth and increasing disposable incomes in emerging economies in Asia-Pacific are also contributing significantly to market expansion, presenting substantial opportunities for future growth.

Application Dominance:

Dairy & Beverages: This segment leads the market due to the high volume of packaging required for milk, juices, yogurts, and other perishable beverages. Drivers include:

- Consumer preference for eco-friendly beverage packaging.

- Regulatory mandates for reducing plastic waste in the F&B sector.

- Advancements in biodegradable barrier technologies for extended shelf-life.

- The global market for biodegradable packaging in Dairy & Beverages was valued at xx million USD in 2025.

Fruits: Growing awareness of health and wellness, coupled with a demand for visually appealing and convenient produce packaging, propels this segment. Drivers include:

- Increased availability of biodegradable trays and films.

- Consumer perception of freshness and safety associated with bio-based packaging.

- Focus on reducing food spoilage through innovative packaging solutions.

Vegetables: Similar to fruits, this segment benefits from consumer demand for sustainable produce packaging that minimizes environmental impact. Drivers include:

- The growing trend of farm-to-table and local sourcing, requiring appropriate packaging.

- Development of breathable biodegradable films to maintain vegetable freshness.

Meat & Related Products: This segment is rapidly adopting biodegradable solutions, driven by the need for food safety, extended shelf-life, and odor containment. Drivers include:

- Development of high-barrier biodegradable films for meat and poultry.

- Consumer pressure to reduce plastic waste from meat packaging.

- The market for biodegradable packaging in Meat & Related Products is projected to grow at a CAGR of xx%.

Others: This broad category includes baked goods, snacks, and ready-to-eat meals, all contributing to market growth as consumers seek convenient and sustainable options. Drivers include:

- Versatility of biodegradable materials for various food types.

- Increasing adoption by food service providers and meal kit companies.

Type Dominance:

Plastic (Biodegradable): While a paradox, bio-based and biodegradable plastics like PLA and PHA are major contributors. Drivers include:

- Excellent barrier properties and moldability, mimicking traditional plastics.

- Significant investment in production capacity by companies like Nature Works LLC.

- The market share for biodegradable plastic packaging was approximately xx% in 2025.

Paper: This remains a strong contender due to its renewability and recyclability. Drivers include:

- Established manufacturing processes and infrastructure.

- Consumer perception of environmental friendliness.

- Innovations in paper coatings for improved moisture and grease resistance.

Aluminum: While not inherently biodegradable, its high recyclability makes it a sustainable choice, often used in conjunction with biodegradable liners.

Steel: Similar to aluminum, its durability and recyclability position it as a sustainable option for certain food products.

Others: This includes emerging materials like bagasse (sugarcane fiber) and bamboo, offering unique properties and sustainable advantages.

Biodegradable Food Packaging Product Developments

Product innovation is at the core of the biodegradable food packaging market. Companies are continuously developing advanced materials with enhanced functionalities. Notable advancements include the creation of high-barrier biodegradable films derived from polylactic acid (PLA) and polyhydroxyalkanoates (PHA) that effectively extend the shelf-life of perishable goods, such as Meat & Related Products and Dairy & Beverages. Innovations in paper-based packaging include the development of grease-resistant and water-repellent coatings using bio-based materials, making them suitable for a wider range of food applications, including fast-food packaging. Furthermore, advancements in compostable trays made from materials like bagasse are offering sustainable alternatives for Fruits and Vegetables. The competitive edge lies in developing cost-effective, high-performance, and aesthetically pleasing biodegradable solutions that meet diverse end-user needs and stringent regulatory requirements.

Challenges in the Biodegradable Food Packaging Market

Despite its significant growth potential, the biodegradable food packaging market faces several challenges.

- Cost Competitiveness: Biodegradable packaging often carries a higher price point compared to conventional plastics, making it a barrier for some price-sensitive consumers and businesses. The cost premium can range from 10-30%.

- Performance Limitations: Certain biodegradable materials may not offer the same level of barrier protection, durability, or heat resistance as traditional plastics, limiting their application in specific food categories requiring extended shelf-life or high-temperature processing.

- Consumer Misunderstanding & Infrastructure: Lack of widespread understanding about proper disposal methods (compostable vs. biodegradable) and insufficient industrial composting infrastructure in many regions lead to contamination of recycling streams and improper waste management. This impacts the perceived environmental benefit.

- Supply Chain Complexity: Sourcing raw materials for biodegradable packaging can be complex and subject to price volatility, impacting consistent supply and production costs.

Forces Driving Biodegradable Food Packaging Growth

Several key forces are propelling the biodegradable food packaging market forward. Growing environmental awareness and consumer demand for sustainable products are primary drivers, pushing brands to adopt eco-friendly packaging solutions. Stringent government regulations, including bans on single-use plastics and incentives for green alternatives, are creating a favorable market environment. Technological advancements in material science are leading to the development of more cost-effective, high-performance, and versatile biodegradable packaging options, such as PLA and PHA, offering competitive advantages over traditional plastics. The expanding food industry, particularly in emerging economies, coupled with the rise of e-commerce and ready-to-eat meals, further fuels the demand for innovative and sustainable packaging solutions.

Challenges in the Biodegradable Food Packaging Market

Long-term growth catalysts for the biodegradable food packaging market are deeply rooted in continued innovation and strategic market expansion. Ongoing research into novel bio-based polymers and advanced composite materials promises to overcome current performance limitations and reduce production costs. Strategic partnerships between material suppliers, packaging manufacturers, and food brands are crucial for scaling up production and developing tailored solutions for diverse applications, from Dairy & Beverages to Meat & Related Products. Furthermore, the development of robust and accessible composting infrastructure globally will be essential to realize the full environmental benefits of biodegradable packaging, creating a closed-loop system and enhancing consumer trust. Market expansion into developing regions, supported by favorable policy shifts and increasing consumer demand for sustainability, presents significant future growth potential.

Emerging Opportunities in Biodegradable Food Packaging

Emerging opportunities within the biodegradable food packaging market are abundant and diverse. The increasing focus on a circular economy is driving demand for packaging solutions that are not only biodegradable but also compostable under industrial or home conditions, creating significant opportunities for companies with advanced composting technologies. New market segments, such as the plant-based food industry and the growing demand for sustainable takeaway and delivery packaging, present untapped potential. Technological advancements in active and intelligent biodegradable packaging, which can monitor food freshness and extend shelf-life, offer a significant competitive advantage. Furthermore, the development of cost-effective and scalable bio-based inks and adhesives further enhances the sustainability profile of biodegradable packaging solutions. Opportunities also exist in niche applications requiring specialized barrier properties, such as for challenging food products within the Meat & Related Products segment.

Leading Players in the Biodegradable Food Packaging Sector

- BASF SE.

- International Paper Company

- Mondi Plc.

- Be Green Packaging LLC.

- Stora Enso

- BioPak Pty Ltd.

- Delta Packaging Ltd.

- SimBio USA, Inc.

- Nature Works LLC.

Key Milestones in Biodegradable Food Packaging Industry

- 2019: Increased investment in PLA (Polylactic Acid) production capacity by major chemical companies.

- 2020: Growing number of countries implementing bans or restrictions on single-use conventional plastics.

- 2021: Launch of advanced PHA (Polyhydroxyalkanoates) based packaging with enhanced flexibility and barrier properties.

- 2022: Significant mergers and acquisitions aimed at consolidating market share and expanding product portfolios in the biodegradable packaging sector.

- 2023: Increased adoption of paper-based biodegradable solutions for food service and takeaway packaging.

- 2024: Development of novel bio-based coatings for paper packaging to improve grease and moisture resistance.

Strategic Outlook for Biodegradable Food Packaging Market

The biodegradable food packaging market is poised for substantial growth, driven by a powerful combination of environmental imperative and market demand. Strategic imperatives for stakeholders include continued investment in R&D to enhance material performance and cost-effectiveness, particularly for the Meat & Related Products and Dairy & Beverages segments. Expansion of production capacities and strategic partnerships will be crucial to meet the escalating demand and achieve economies of scale. Developing robust supply chains and advocating for improved waste management infrastructure will foster market adoption and solidify the environmental benefits of biodegradable solutions. Embracing innovation in new material sources and functional packaging attributes will ensure long-term competitive advantage.

Biodegradable Food Packaging Segmentation

-

1. Application

- 1.1. Dairy & Beverages

- 1.2. Fruits

- 1.3. Vegetables

- 1.4. Meat & Related Products

- 1.5. Others

-

2. Types

- 2.1. Plastic

- 2.2. Paper

- 2.3. Aluminum

- 2.4. Steel

- 2.5. Others

Biodegradable Food Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Biodegradable Food Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biodegradable Food Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dairy & Beverages

- 5.1.2. Fruits

- 5.1.3. Vegetables

- 5.1.4. Meat & Related Products

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Plastic

- 5.2.2. Paper

- 5.2.3. Aluminum

- 5.2.4. Steel

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Biodegradable Food Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dairy & Beverages

- 6.1.2. Fruits

- 6.1.3. Vegetables

- 6.1.4. Meat & Related Products

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Plastic

- 6.2.2. Paper

- 6.2.3. Aluminum

- 6.2.4. Steel

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Biodegradable Food Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dairy & Beverages

- 7.1.2. Fruits

- 7.1.3. Vegetables

- 7.1.4. Meat & Related Products

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Plastic

- 7.2.2. Paper

- 7.2.3. Aluminum

- 7.2.4. Steel

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Biodegradable Food Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dairy & Beverages

- 8.1.2. Fruits

- 8.1.3. Vegetables

- 8.1.4. Meat & Related Products

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Plastic

- 8.2.2. Paper

- 8.2.3. Aluminum

- 8.2.4. Steel

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Biodegradable Food Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dairy & Beverages

- 9.1.2. Fruits

- 9.1.3. Vegetables

- 9.1.4. Meat & Related Products

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Plastic

- 9.2.2. Paper

- 9.2.3. Aluminum

- 9.2.4. Steel

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Biodegradable Food Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dairy & Beverages

- 10.1.2. Fruits

- 10.1.3. Vegetables

- 10.1.4. Meat & Related Products

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Plastic

- 10.2.2. Paper

- 10.2.3. Aluminum

- 10.2.4. Steel

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF SE.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 International Paper Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mondi Plc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Be Green Packaging LLC.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Stora Enso

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BioPak Pty Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Delta Packaging Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SimBio USA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nature Works LLC.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BASF SE.

List of Figures

- Figure 1: Global Biodegradable Food Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Biodegradable Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 3: North America Biodegradable Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Biodegradable Food Packaging Revenue (million), by Types 2024 & 2032

- Figure 5: North America Biodegradable Food Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Biodegradable Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 7: North America Biodegradable Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Biodegradable Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 9: South America Biodegradable Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Biodegradable Food Packaging Revenue (million), by Types 2024 & 2032

- Figure 11: South America Biodegradable Food Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Biodegradable Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 13: South America Biodegradable Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Biodegradable Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Biodegradable Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Biodegradable Food Packaging Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Biodegradable Food Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Biodegradable Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Biodegradable Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Biodegradable Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Biodegradable Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Biodegradable Food Packaging Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Biodegradable Food Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Biodegradable Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Biodegradable Food Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Biodegradable Food Packaging Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Biodegradable Food Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Biodegradable Food Packaging Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Biodegradable Food Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Biodegradable Food Packaging Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Biodegradable Food Packaging Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biodegradable Food Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Biodegradable Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Biodegradable Food Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Biodegradable Food Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Biodegradable Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Biodegradable Food Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Biodegradable Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Biodegradable Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Biodegradable Food Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Biodegradable Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Biodegradable Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Biodegradable Food Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Biodegradable Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Biodegradable Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Biodegradable Food Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Biodegradable Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Biodegradable Food Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Biodegradable Food Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Biodegradable Food Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Biodegradable Food Packaging Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biodegradable Food Packaging?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Biodegradable Food Packaging?

Key companies in the market include BASF SE., International Paper Company, Mondi Plc., Be Green Packaging LLC., Stora Enso, BioPak Pty Ltd., Delta Packaging Ltd., SimBio USA, Inc., Nature Works LLC..

3. What are the main segments of the Biodegradable Food Packaging?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biodegradable Food Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biodegradable Food Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biodegradable Food Packaging?

To stay informed about further developments, trends, and reports in the Biodegradable Food Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence