Key Insights

The European food pathogen testing market is experiencing robust growth, driven by stringent food safety regulations, increasing consumer awareness of foodborne illnesses, and the rising demand for safe and high-quality food products. The market's expansion is fueled by factors such as technological advancements in testing methodologies (like HPLC-based and LC-MS/MS-based techniques) offering faster, more accurate, and sensitive results. The increasing prevalence of foodborne illnesses across Europe necessitates comprehensive testing across various food segments, including meat and poultry, dairy, and fruits and vegetables. This demand is further amplified by the growth in processed food consumption and the expansion of the food processing industry in the region. Major players like Intertek, Eurofins, and SGS are strategically investing in advanced testing technologies and expanding their service portfolios to cater to this growing market.

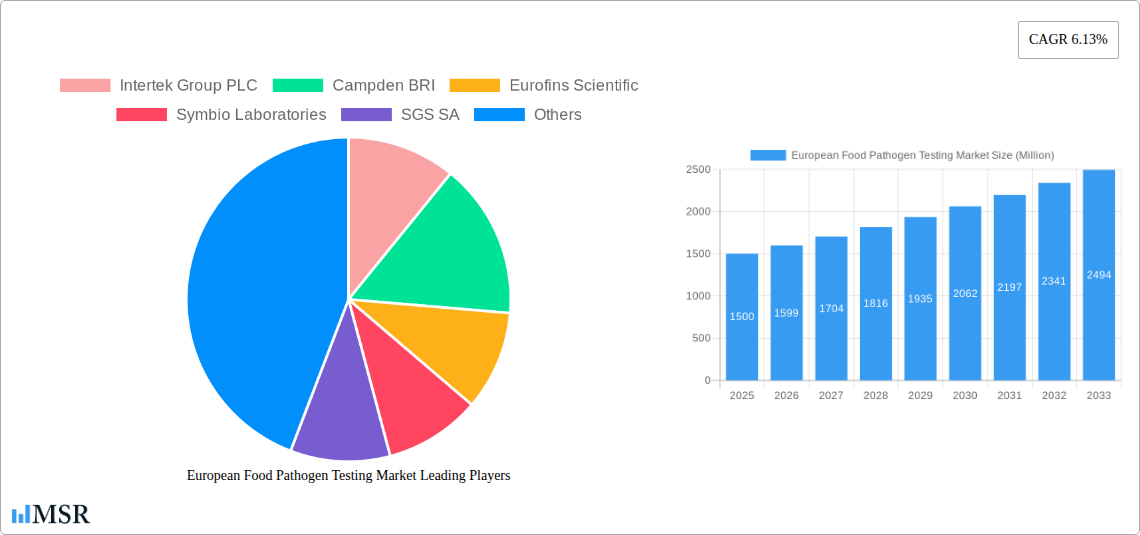

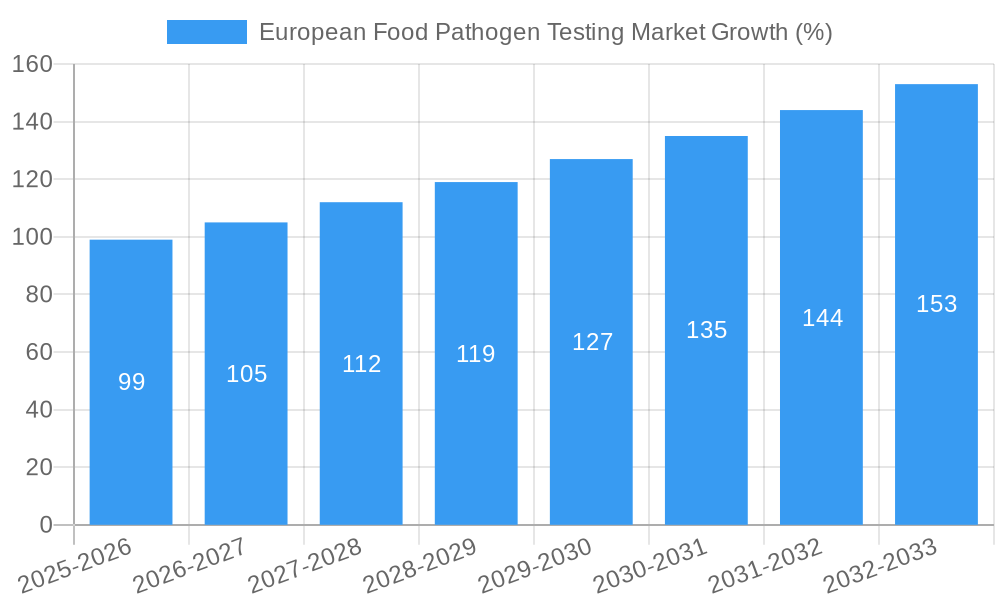

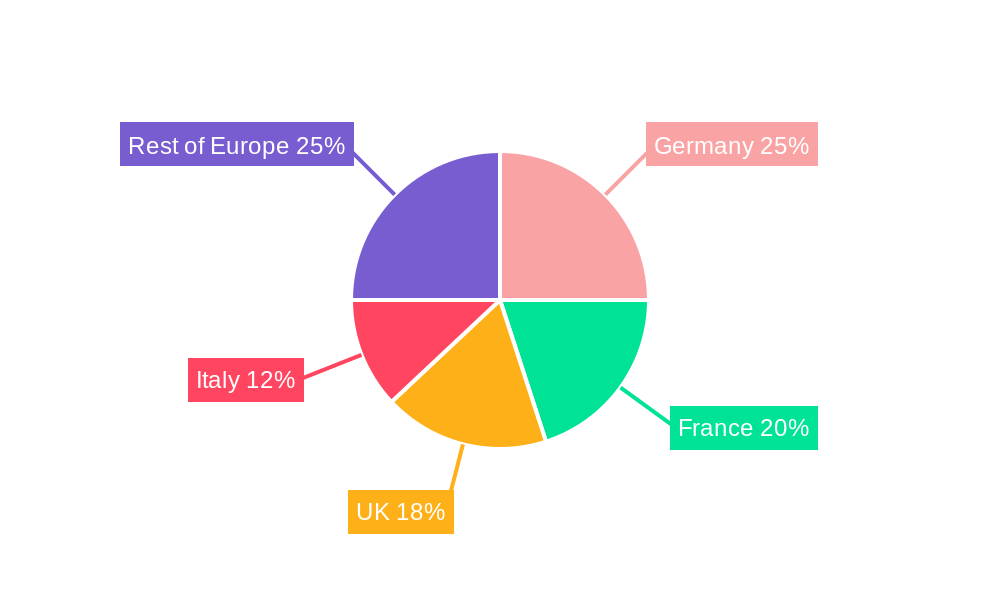

Segment-wise, pathogen testing holds a significant share, followed by pesticide and residue testing. The technological landscape is dominated by HPLC-based and LC-MS/MS-based methods due to their accuracy and high throughput. Geographically, Germany, France, and the UK represent significant market shares, reflecting their larger food production and processing sectors and stringent regulatory environments. However, other European nations are also witnessing notable growth, driven by increasing awareness and stricter food safety standards. While the market faces constraints like high testing costs and the need for skilled technicians, the overall positive trend indicates continued expansion throughout the forecast period (2025-2033), projected at a Compound Annual Growth Rate (CAGR) of 6.13%. This growth trajectory is expected to be sustained by ongoing technological improvements and strengthened regulatory frameworks in the European Union.

European Food Pathogen Testing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the European Food Pathogen Testing Market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, key segments, leading players, and future growth opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

European Food Pathogen Testing Market Market Concentration & Dynamics

The European food pathogen testing market exhibits a moderately consolidated structure, with several large multinational players and a number of smaller, specialized companies. Market share is largely driven by established players with extensive testing capabilities and global reach. Key players like Eurofins Scientific and SGS SA command significant market share due to their comprehensive service portfolios and global presence. The market's competitive landscape is characterized by intense competition, driving innovation and technological advancements.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Ecosystems: Significant investments in R&D are being made to develop rapid and high-throughput testing technologies, including advancements in genomics and molecular diagnostics.

- Regulatory Frameworks: Stringent EU regulations on food safety and hygiene drive demand for pathogen testing services. Compliance requirements shape industry practices and investment in technology.

- Substitute Products: While traditional methods remain prevalent, the market is witnessing increased adoption of rapid diagnostic tests, posing a challenge to established players.

- End-User Trends: The demand is driven by increasing consumer awareness of food safety and quality, alongside stringent regulatory standards across the food supply chain.

- M&A Activities: The market has seen considerable M&A activity in recent years, with major players like Eurofins Scientific actively expanding their footprint through acquisitions (e.g., the acquisition of Covance Food Solutions in 2018). The total number of M&A deals in the past 5 years stands at approximately xx.

European Food Pathogen Testing Market Industry Insights & Trends

The European food pathogen testing market is experiencing robust growth driven by several factors. Increasing consumer demand for safe and high-quality food products, coupled with stringent regulatory requirements across the EU, are key drivers. Technological advancements in pathogen detection, like the adoption of rapid and sensitive diagnostic technologies, are also propelling market expansion. The rising prevalence of foodborne illnesses further fuels the demand for effective and reliable testing solutions. The market size was valued at xx Million in 2024, and is projected to grow to xx Million in 2025.

Key Markets & Segments Leading European Food Pathogen Testing Market

The European food pathogen testing market is geographically diverse, with significant contributions from several countries. However, Germany, France, and the UK represent major markets due to their large food processing industries and strict regulatory environments. Within the segments, pathogen testing dominates, reflecting the core focus on ensuring food safety.

Key Drivers:

- Stringent Regulatory Environment: EU food safety regulations drive testing demand.

- Growing Consumer Awareness: Increasing consumer concern over food safety pushes demand.

- Technological Advancements: Rapid and sensitive testing technologies are accelerating adoption.

- Economic Growth: Growing food processing and retail industries fuel market expansion.

Dominance Analysis:

- By Type of Testing: Pathogen testing holds the largest market share, followed by pesticide and residue testing.

- By Technology: HPLC-based and LC-MS/MS-based technologies are widely used, but Immunoassay-based methods are gaining traction due to their speed and cost-effectiveness.

- By Application: Meat and poultry, dairy, and processed food segments are the largest contributors.

European Food Pathogen Testing Market Product Developments

Recent years have witnessed significant advancements in food pathogen testing technologies. Rapid diagnostic tests, utilizing techniques like PCR and ELISA, are gaining popularity due to their speed and sensitivity. Automation and miniaturization of testing platforms are enhancing efficiency and reducing costs. These technological improvements enable faster turnaround times and more accurate results, leading to enhanced food safety measures across the supply chain. Companies are focusing on developing portable and user-friendly devices to expand testing accessibility.

Challenges in the European Food Pathogen Testing Market Market

The market faces challenges including high testing costs, especially for advanced technologies, and potential delays caused by complex regulatory processes. Maintaining a skilled workforce is a persistent issue, while competition remains fierce in the industry. Supply chain disruptions can also impact the timely delivery of testing services. These factors could collectively impact the rate of market growth.

Forces Driving European Food Pathogen Testing Market Growth

The market is driven by several factors, including stringent food safety regulations within the EU, increasing consumer awareness, and the continuous development of advanced testing technologies. Economic growth within the food processing and retail sectors is further boosting demand. The rising prevalence of foodborne illnesses underscores the significance of robust pathogen detection methods and proactive food safety management.

Challenges in the European Food Pathogen Testing Market Market

Long-term growth is anticipated through strategic partnerships, innovation in testing methods, and the expansion into new geographical markets. Investments in research and development aimed at developing rapid, cost-effective, and high-throughput testing technologies are key to future growth.

Emerging Opportunities in European Food Pathogen Testing Market

Emerging trends include the increased adoption of molecular diagnostic techniques, the integration of automation and AI in testing workflows, and the development of point-of-care testing devices. Expanding into emerging markets, focusing on personalized food safety solutions, and developing tailored services for specific food types are key opportunities for market growth.

Leading Players in the European Food Pathogen Testing Market Sector

- Intertek Group PLC

- Campden BRI

- Eurofins Scientific

- Symbio Laboratories

- SGS SA

- Tuv Sud

- Bureau Veritas

- ALS Limited

- ifp Privates Institut fr Produktqualitt GmbH

- NFS International

Key Milestones in European Food Pathogen Testing Market Industry

- April 2018: Eurofins acquires Covance Food Solutions for USD 670 Million, significantly expanding its market share.

- July 2018: Eurofins acquires LABORATORIOS ECOSUR S.A., strengthening its position in the Spanish food testing market.

- July 2020: Bureau Veritas partners with The Ascott Limited, enhancing its service portfolio and revenue streams.

Strategic Outlook for European Food Pathogen Testing Market Market

The European food pathogen testing market holds significant growth potential driven by stringent regulations, technological advancements, and a growing focus on food safety. Companies that strategically invest in R&D, expand their service portfolios, and leverage technological advancements to deliver rapid and accurate testing solutions are well-positioned to capitalize on this growth. Future success will depend on agility in adapting to changing regulatory landscapes and consumer demands.

European Food Pathogen Testing Market Segmentation

-

1. Contaminant Testing

- 1.1. Pathogen Testing

- 1.2. Pesticide and Residue Testing

- 1.3. Mycotoxin Testing

- 1.4. GMO Testing

- 1.5. Allergen Testing

- 1.6. Other Types of Testing

-

2. Technology

- 2.1. Polymerase Chain Reaction (PCR)

- 2.2. Chromatography and Spectrometry

- 2.3. Immunoassay-based

- 2.4. Other Technologies

-

3. Application

- 3.1. Pet Food and Animal Feed

- 3.2. Dairy

- 3.3. Fruits and Vegetables

- 3.4. Processed Food

- 3.5. Crops

- 3.6. Meat and Poultry

- 3.7. Other Foods

European Food Pathogen Testing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Food Pathogen Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Food Safety Testing Emerging as a Pivotal Point Against Surging Number of Food Frauds Cases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Testing

- 5.1.1. Pathogen Testing

- 5.1.2. Pesticide and Residue Testing

- 5.1.3. Mycotoxin Testing

- 5.1.4. GMO Testing

- 5.1.5. Allergen Testing

- 5.1.6. Other Types of Testing

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Polymerase Chain Reaction (PCR)

- 5.2.2. Chromatography and Spectrometry

- 5.2.3. Immunoassay-based

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Pet Food and Animal Feed

- 5.3.2. Dairy

- 5.3.3. Fruits and Vegetables

- 5.3.4. Processed Food

- 5.3.5. Crops

- 5.3.6. Meat and Poultry

- 5.3.7. Other Foods

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Testing

- 6. Germany European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 7. France European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe European Food Pathogen Testing Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Intertek Group PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Campden BRI

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Eurofins Scientific

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Symbio Laboratories

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SGS SA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tuv Sud

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bureau Veritas

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ALS Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ifp Privates Institut fr Produktqualitt GmbH*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NFS International

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Intertek Group PLC

List of Figures

- Figure 1: European Food Pathogen Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Food Pathogen Testing Market Share (%) by Company 2024

List of Tables

- Table 1: European Food Pathogen Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Food Pathogen Testing Market Revenue Million Forecast, by Contaminant Testing 2019 & 2032

- Table 3: European Food Pathogen Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: European Food Pathogen Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: European Food Pathogen Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: European Food Pathogen Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: European Food Pathogen Testing Market Revenue Million Forecast, by Contaminant Testing 2019 & 2032

- Table 15: European Food Pathogen Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: European Food Pathogen Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: European Food Pathogen Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark European Food Pathogen Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Food Pathogen Testing Market?

The projected CAGR is approximately 6.13%.

2. Which companies are prominent players in the European Food Pathogen Testing Market?

Key companies in the market include Intertek Group PLC, Campden BRI, Eurofins Scientific, Symbio Laboratories, SGS SA, Tuv Sud, Bureau Veritas, ALS Limited, ifp Privates Institut fr Produktqualitt GmbH*List Not Exhaustive, NFS International.

3. What are the main segments of the European Food Pathogen Testing Market?

The market segments include Contaminant Testing, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

Food Safety Testing Emerging as a Pivotal Point Against Surging Number of Food Frauds Cases.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

In April 2018, Eurofins signed a contract with LabCorp to acquire Covance Food Solutions, a food testing and consulting business fro USD 670 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Food Pathogen Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Food Pathogen Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Food Pathogen Testing Market?

To stay informed about further developments, trends, and reports in the European Food Pathogen Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence