Key Insights

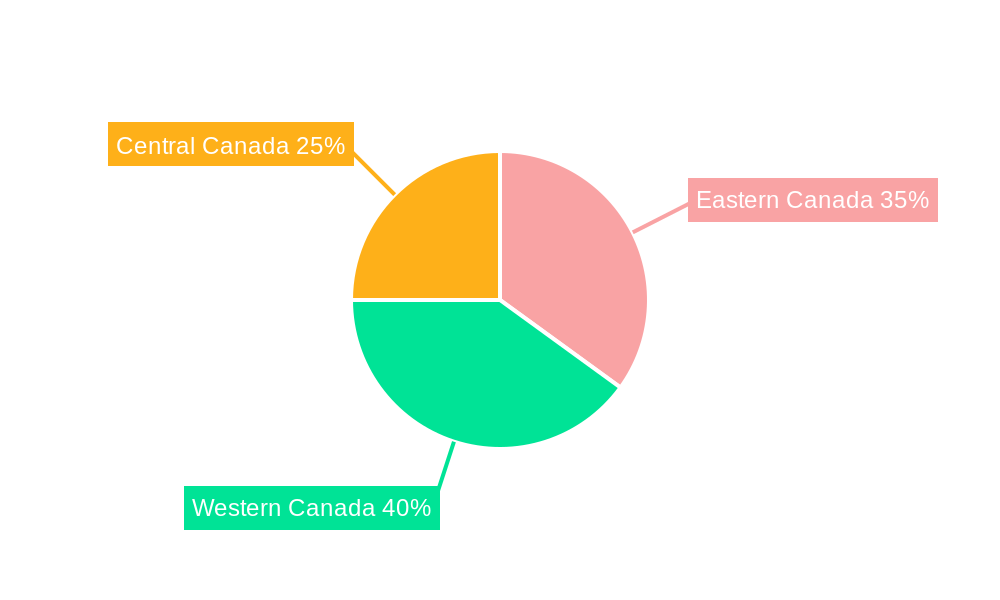

The Canada whey protein ingredients market, valued at approximately $150 million in 2025, is projected to experience steady growth, driven primarily by the burgeoning demand for protein-rich foods and beverages within the health-conscious Canadian population. The rising popularity of functional foods and dietary supplements, coupled with increased consumer awareness of the nutritional benefits of whey protein, are key factors stimulating market expansion. The isolates segment is expected to dominate, reflecting a preference for purer forms of whey protein with higher protein content. Growth in the animal feed segment is also anticipated, driven by the increasing demand for high-quality animal feed containing optimized protein profiles to enhance livestock productivity. The personal care and cosmetics sector offers a promising avenue for future growth, fueled by the incorporation of whey protein in skincare products for its moisturizing and anti-aging properties. However, potential market restraints include price fluctuations in milk-based raw materials and increasing competition from plant-based protein alternatives. The market's growth trajectory is expected to remain relatively stable, given the established demand and consistent consumer interest in health and wellness products. Regional variations may exist, with Western Canada, due to its robust agricultural sector, potentially showing higher growth rates compared to other regions. Key players, including Cooke Inc., Arla Foods, and others, are actively engaged in product innovation and strategic partnerships to consolidate their market positions.

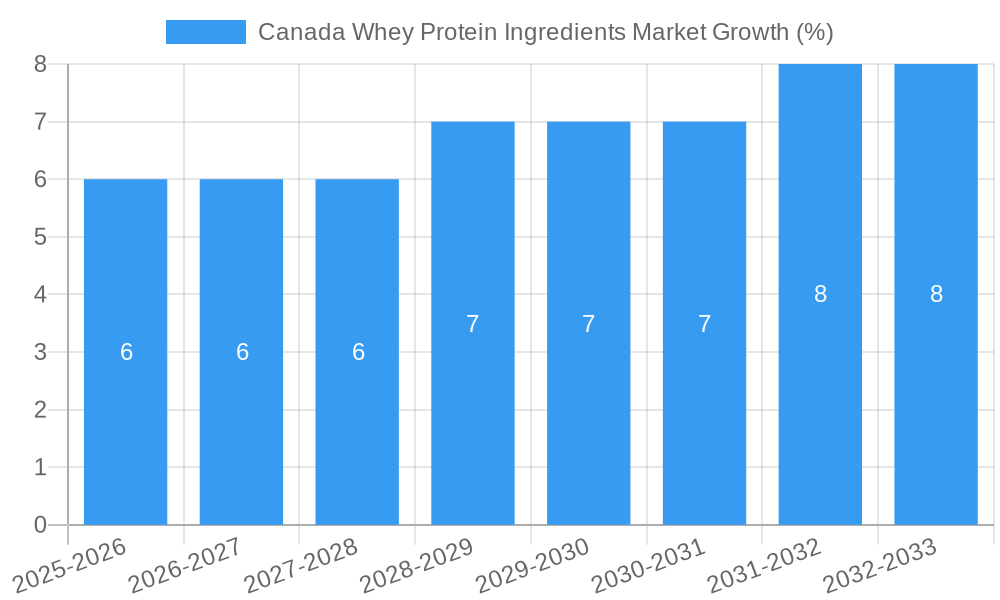

The forecast period (2025-2033) anticipates a continued expansion of the Canadian whey protein ingredients market, with a compound annual growth rate (CAGR) of 3.91%. This growth will likely be influenced by several factors, including technological advancements in whey protein processing, leading to more efficient and cost-effective production. Furthermore, government initiatives promoting sustainable agriculture and food production could positively impact market growth. The competitive landscape remains dynamic, with existing players investing in capacity expansions and new product development to meet increasing consumer demand. A strategic focus on product differentiation and superior product quality will be crucial for maintaining a competitive edge in this increasingly sophisticated market. While challenges remain, the long-term outlook for the Canada whey protein ingredients market remains positive, driven by the enduring demand for high-quality protein sources within the food, beverage, animal feed, and personal care sectors.

Canada Whey Protein Ingredients Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada whey protein ingredients market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market dynamics, key segments, leading players, and emerging trends, providing actionable intelligence to navigate this dynamic sector. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Canada Whey Protein Ingredients Market Concentration & Dynamics

The Canadian whey protein ingredients market exhibits a moderately concentrated landscape, with several major players holding significant market share. Cooke Inc, Arla Foods, DMK Group, Milk Specialties Global, Glanbia PLC, Agropur Dairy Cooperative, Farbest-Tallman Foods Corporation, Fonterra Co-operative Group Limited, Saputo Inc, and Groupe Lactalis are key players shaping market dynamics. Market share distribution reveals a competitive scenario, with the top five companies collectively holding approximately xx% of the market in 2025.

Innovation Ecosystems: The market is characterized by continuous innovation, with companies investing heavily in research and development to enhance product quality, functionality, and application versatility. This includes the development of novel whey protein isolates, hydrolysates, and concentrates catering to specific consumer demands.

Regulatory Frameworks: Government regulations related to food safety, labeling, and ingredient sourcing significantly influence market operations. Compliance with these standards is critical for market participation and maintaining consumer trust.

Substitute Products: The market faces competition from alternative protein sources, including soy protein, pea protein, and plant-based protein blends. However, whey protein's superior nutritional profile and functional properties maintain its dominant position.

End-User Trends: Growing health consciousness and rising demand for high-protein diets are key drivers fueling market expansion. The food and beverage sector, particularly the dairy and sports nutrition segments, represent major end-use applications.

M&A Activities: The Canadian whey protein ingredients market has witnessed xx M&A deals in the historical period (2019-2024), indicating a consolidated market environment. These activities reflect strategies to expand market presence and access new technologies.

Canada Whey Protein Ingredients Market Industry Insights & Trends

The Canadian whey protein ingredients market is experiencing robust growth driven by increasing consumer demand for high-protein foods and beverages, coupled with technological advancements in whey processing and product innovation. This growth is fueled by several factors: rising health awareness, expanding fitness culture, and advancements in product formulations. The market size, estimated at xx Million in 2025, is expected to reach xx Million by 2033, reflecting a CAGR of xx%. Technological advancements, such as micro-articulation technology as showcased by Arla Foods, are enhancing product quality and expanding application possibilities. Changing consumer preferences towards functional foods and convenient protein sources further propel market growth. This growth trajectory is also influenced by the rising popularity of plant-based alternatives, although whey protein maintains a significant competitive edge due to its superior bioavailability and amino acid profile. The increasing integration of whey protein into various food products, from yogurts to protein bars, is significantly impacting market growth. Government initiatives promoting healthy diets and initiatives encouraging domestic dairy production further support market expansion. The ongoing advancements in whey protein processing and the exploration of new functional properties further contribute to the positive outlook.

Key Markets & Segments Leading Canada Whey Protein Ingredients Market

The Canadian whey protein ingredients market is broadly segmented by form (concentrates, hydrolyzed, isolates) and end-user (animal feed, personal care and cosmetics, food and beverages). The food and beverage sector dominates the market, driven by the rising demand for high-protein products in this segment.

Dominant Segments:

Form: Whey protein concentrates hold the largest market share, due to their cost-effectiveness and wide range of applications. Whey protein isolates are witnessing strong growth, driven by their superior purity and functionality. Hydrolyzed whey protein, although a smaller segment, shows potential for expansion in specific applications.

End-User: The food and beverage industry accounts for the largest share of whey protein ingredient consumption, with dairy products, sports nutrition supplements, and bakery goods representing major application areas.

Drivers:

Food & Beverages: Growing health consciousness, increasing demand for convenient protein sources, and the proliferation of protein-enhanced foods and beverages are driving market growth in this sector.

Animal Feed: Whey protein is utilized as a high-quality protein supplement in animal feed, particularly for poultry and livestock. The expanding livestock and poultry industry in Canada contributes to market growth in this segment.

Personal Care & Cosmetics: The use of whey protein in skincare products is increasing, driven by its moisturizing and skin-conditioning properties. This is a niche segment but represents a market opportunity for whey protein producers.

Canada Whey Protein Ingredients Market Product Developments

Recent years have witnessed significant product innovations in the Canadian whey protein ingredients market. Companies are continuously developing new whey protein formulations with enhanced functionalities, such as improved solubility, digestibility, and taste profiles. Arla Foods’ introduction of micro-articulation technology and Fonterra’s launch of Pro-Optima highlight the ongoing pursuit of superior product quality and application versatility. These advancements are not only meeting evolving consumer preferences but also providing manufacturers with a competitive edge in the market. The focus is on developing sustainable and ethically sourced whey protein ingredients, responding to growing consumer demands for environmentally friendly and responsibly produced products.

Challenges in the Canada Whey Protein Ingredients Market

The Canadian whey protein ingredients market faces challenges related to price volatility of raw materials (milk), supply chain disruptions, and intense competition among producers. Regulatory compliance requirements can also add to operational costs. These factors can impact profitability and market expansion plans. The fluctuating global demand for dairy products also influences the price of whey protein ingredients. Competition from alternative protein sources also poses a challenge, requiring continuous innovation and product differentiation to maintain market share.

Forces Driving Canada Whey Protein Ingredients Market Growth

Several key factors are driving the growth of the Canadian whey protein ingredients market. The escalating demand for high-protein diets, fueled by increasing health consciousness and fitness trends, is a major catalyst. Technological advancements enabling the production of high-quality, functional whey protein ingredients are also driving market expansion. Government initiatives promoting the consumption of dairy products and the development of the food processing industry are also supporting the market's growth trajectory.

Long-Term Growth Catalysts in the Canada Whey Protein Ingredients Market

Long-term growth will be fueled by strategic partnerships and collaborations among industry players to develop innovative whey protein-based products. Expanding into new markets and product diversification will be crucial for sustaining market momentum. The focus on sustainability and ethical sourcing will also be key to attracting environmentally conscious consumers. Continuous innovation and research into novel applications of whey protein will maintain the sector's dynamism and growth.

Emerging Opportunities in Canada Whey Protein Ingredients Market

Emerging opportunities lie in developing specialized whey protein ingredients for niche markets, such as functional foods for seniors or specialized diets. The integration of whey protein into plant-based protein blends represents a significant opportunity. Exploring new applications in the personal care and cosmetic industries will also create avenues for market growth. Expanding into export markets is another significant avenue for expansion.

Leading Players in the Canada Whey Protein Ingredients Sector

- Cooke Inc

- Arla Foods

- DMK Group

- Milk Specialties Global

- Glanbia PLC

- Agropur Dairy Cooperative

- Farbest-Tallman Foods Corporation

- Fonterra Co-operative Group Limited

- Saputo Inc

- Groupe Lactalis

Key Milestones in Canada Whey Protein Ingredients Industry

- June 2021: Arla Foods Ingredients launched Nutrilac FO-7875, a whey protein ingredient for high-protein yogurts, showcasing innovation in meeting specific market demands.

- June 2022: Fonterra Co-operative's NZMP brand introduced Pro-Optima, a functional whey protein concentrate expanding its product portfolio and market reach.

- April 2023: Arla Foods unveiled new whey protein offerings using micro-articulation technology, highlighting technological advancements in product quality and versatility.

Strategic Outlook for Canada Whey Protein Ingredients Market

The Canadian whey protein ingredients market presents considerable future potential, driven by sustained consumer demand and ongoing technological innovation. Strategic opportunities lie in developing value-added products, focusing on sustainability, and expanding into new markets. Companies that effectively leverage technological advancements and cater to evolving consumer preferences will be best positioned to capitalize on the market's growth trajectory.

Canada Whey Protein Ingredients Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Hydrolyzed

- 1.3. Isolates

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. RTE/RTC Food Products

- 2.3.6. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Canada Whey Protein Ingredients Market Segmentation By Geography

- 1. Canada

Canada Whey Protein Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Protein-Rich Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Whey Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Hydrolyzed

- 5.1.3. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. RTE/RTC Food Products

- 5.2.3.6. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Eastern Canada Canada Whey Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Whey Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Whey Protein Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Cooke Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Arla Foods

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DMK Grou

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Milk Specialties Global

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Glanbia PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Agropur Dairy Cooperative

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Farbest-Tallman Foods Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fonterra Co-operative Group Limited

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Saputo Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Groupe Lactalis

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Cooke Inc

List of Figures

- Figure 1: Canada Whey Protein Ingredients Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Whey Protein Ingredients Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Whey Protein Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Whey Protein Ingredients Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Canada Whey Protein Ingredients Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Canada Whey Protein Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Whey Protein Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Whey Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Whey Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Whey Protein Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Whey Protein Ingredients Market Revenue Million Forecast, by Form 2019 & 2032

- Table 10: Canada Whey Protein Ingredients Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 11: Canada Whey Protein Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Whey Protein Ingredients Market?

The projected CAGR is approximately 3.91%.

2. Which companies are prominent players in the Canada Whey Protein Ingredients Market?

Key companies in the market include Cooke Inc, Arla Foods, DMK Grou, Milk Specialties Global, Glanbia PLC, Agropur Dairy Cooperative, Farbest-Tallman Foods Corporation, Fonterra Co-operative Group Limited, Saputo Inc, Groupe Lactalis.

3. What are the main segments of the Canada Whey Protein Ingredients Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Demand for Protein-Rich Products.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Arla Foods unveiled their latest whey protein offerings, harnessing cutting-edge micro articulation technology to deliver exceptional quality protein. These premium proteins find versatile applications in a range of products, from yogurt and desserts to dairy beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Whey Protein Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Whey Protein Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Whey Protein Ingredients Market?

To stay informed about further developments, trends, and reports in the Canada Whey Protein Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence