Key Insights

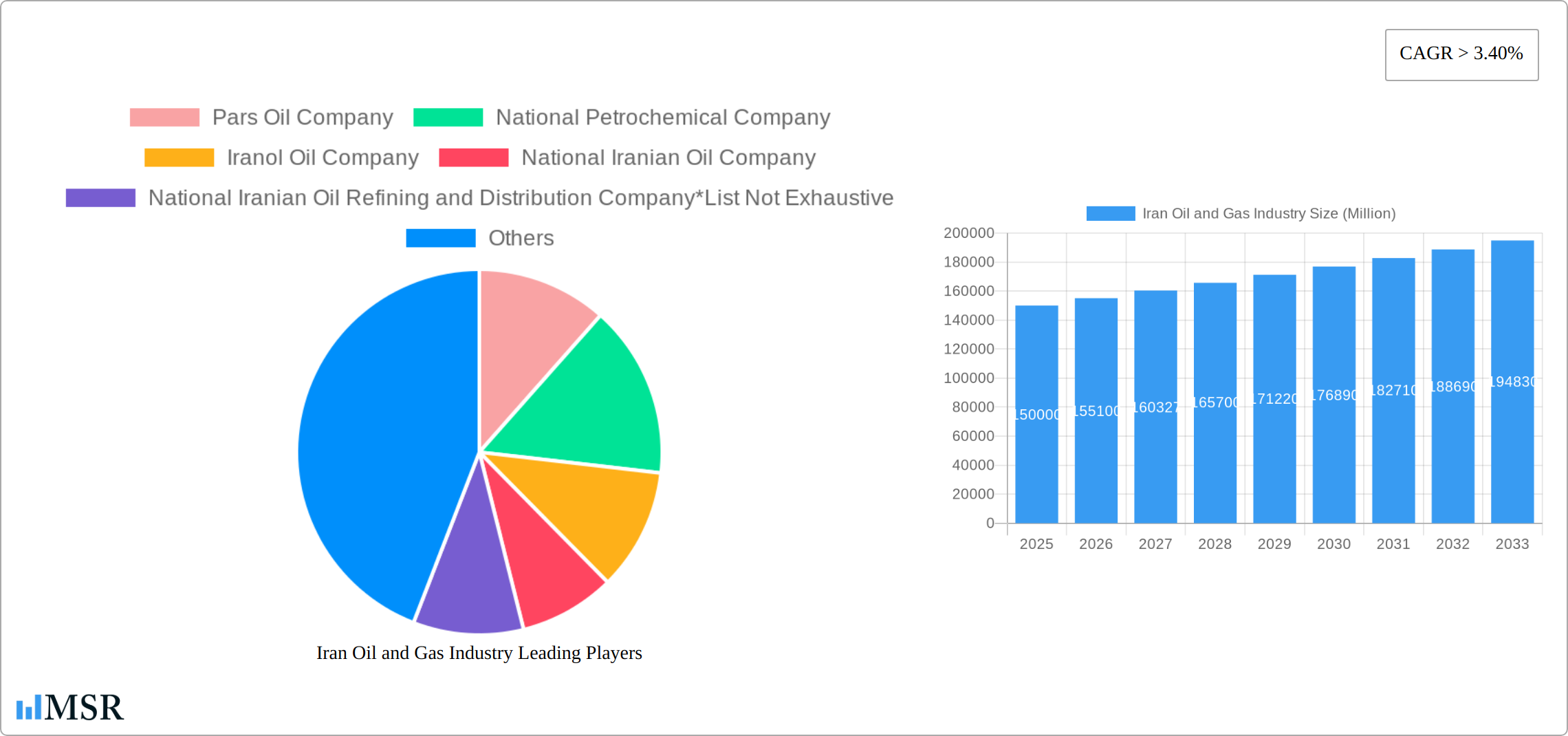

The Iranian oil and gas industry, while facing geopolitical challenges, presents a complex and evolving market landscape. The industry's substantial reserves, coupled with a projected Compound Annual Growth Rate (CAGR) exceeding 3.40%, indicate significant potential for expansion from 2025 to 2033. Key drivers include increasing global energy demand, particularly in Asia, and Iran's strategic location facilitating both domestic consumption and export opportunities. However, international sanctions and fluctuating global oil prices represent significant restraints. The market is segmented by product type (crude oil, natural gas, petrochemicals) and end-user (domestic, export). Major players like the National Iranian Oil Company (NIOC) and other national entities dominate the landscape, though the competitive dynamics are shaped by geopolitical factors influencing both production and trade. While precise market sizing for 2025 is unavailable, leveraging the provided CAGR and considering global oil price projections, a reasonable estimation for the overall market value in 2025 can be derived, allowing for a comprehensive analysis of future growth trajectories. Growth will likely be driven by investments in infrastructure upgrades and exploration activities, aiming to enhance efficiency and output. The industry’s future trajectory will depend heavily on the resolution of geopolitical concerns and the country's ability to attract international investment while navigating complex regulatory frameworks.

The segmentation of the market into crude oil, natural gas, and petrochemicals offers insights into varied growth patterns. Crude oil, being a primary export, will experience fluctuations aligned with global market prices. Natural gas, with increasing domestic demand for power generation and industrial uses, is poised for steady growth. Petrochemicals, a value-added segment, hold significant potential for expansion, given the availability of feedstock and growing regional demand. Export-oriented segments will be significantly influenced by global trade dynamics and sanctions. A comprehensive analysis necessitates examining the interplay of global energy prices, geopolitical stability, investment in upstream and downstream operations, and the impact of government policies and regulations on the industry's overall performance. Understanding these factors will be crucial for both stakeholders within the industry and external investors assessing the opportunities and challenges presented by the Iranian oil and gas market.

Iran Oil and Gas Industry: 2019-2033 Market Report - Unlock Growth Potential

This comprehensive report provides an in-depth analysis of the Iranian oil and gas industry, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study delivers actionable insights for stakeholders across the value chain. We analyze market dynamics, key segments, leading players (including Pars Oil Company, National Petrochemical Company, Iranol Oil Company, National Iranian Oil Company, and National Iranian Oil Refining and Distribution Company), and emerging opportunities, revealing the immense potential and challenges within this crucial sector. The report features detailed market sizing (in Millions of USD), CAGR projections, and M&A activity analysis, making it an indispensable resource for informed decision-making.

Iran Oil and Gas Industry Market Concentration & Dynamics

The Iranian oil and gas industry exhibits a concentrated market structure, dominated by state-owned enterprises. The National Iranian Oil Company (NIOC) plays a pivotal role, controlling a significant share of upstream activities. However, the landscape is gradually evolving with increased participation from private sector companies, albeit within a heavily regulated framework.

- Market Share: NIOC holds approximately xx% of the market, followed by National Petrochemical Company with xx%, and other players holding the remaining share.

- M&A Activity: The historical period (2019-2024) saw xx M&A deals, primarily focused on consolidation within the petrochemical segment. The forecast period (2025-2033) is projected to see xx deals, driven by anticipated investments and restructuring efforts.

- Innovation Ecosystem: The industry's innovation ecosystem is relatively nascent, with limited private investment in R&D. Government initiatives are aimed at fostering technological advancements, primarily in gas processing and petrochemical production.

- Regulatory Framework: Stringent regulations govern the industry, significantly impacting foreign investment and private sector participation. The regulatory landscape is expected to evolve over the forecast period, possibly creating opportunities for increased private sector involvement.

- Substitute Products: The primary substitutes for oil and gas are renewable energy sources, but their penetration remains limited due to infrastructural and policy-related constraints.

- End-User Trends: Domestic consumption is substantial, particularly in the power generation and transportation sectors. Export markets are crucial for revenue generation, but subject to geopolitical factors and international sanctions.

Iran Oil and Gas Industry Industry Insights & Trends

The Iranian oil and gas industry experienced significant market fluctuations during the historical period (2019-2024), primarily driven by global oil price volatility and international sanctions. However, the forecast period (2025-2033) anticipates considerable growth, propelled by rising domestic demand and strategic investments in upstream and downstream sectors. The market size in 2025 is estimated at USD xx Million, projected to reach USD xx Million by 2033, with a CAGR of xx%. Technological disruptions, such as the adoption of enhanced oil recovery techniques and advancements in gas processing, will play a crucial role in shaping industry growth. Evolving consumer behavior, particularly a growing focus on energy efficiency and environmental concerns, will necessitate adaptations within the sector.

Key Markets & Segments Leading Iran Oil and Gas Industry

The domestic market is the largest consumer of oil and gas products, driven by significant demand from the power sector and the transportation sector. Exports, while facing geopolitical challenges, remain a critical segment.

- Crude Oil: Dominance is driven by robust domestic demand and significant export potential, though subject to international sanctions. Drivers include economic growth and industrial expansion.

- Natural Gas: High domestic consumption, fueled by increasing urbanization and industrial activities. Planned investments in gas production capacity will further enhance its importance.

- Petrochemicals: This segment is experiencing significant growth, driven by government initiatives to diversify the economy and increase value-added products.

- Export Market: While facing sanctions-related challenges, the export market remains a crucial revenue stream. Geopolitical stability and international relations significantly impact this segment.

- Domestic Market: Significant growth is anticipated due to increasing energy demands from various sectors, including power generation, transportation, and manufacturing.

Iran Oil and Gas Industry Product Developments

Technological advancements are gradually transforming the industry, focusing on enhanced oil recovery techniques to maximize production from mature fields and upgrading refineries to enhance processing efficiency and produce higher-value petrochemicals. These advancements improve the competitiveness of Iranian products in both domestic and international markets.

Challenges in the Iran Oil and Gas Industry Market

The industry faces numerous challenges, including stringent international sanctions impacting investment and exports, supply chain disruptions due to geopolitical tensions, and intense competition in international markets. These factors have collectively reduced the industry's revenue generation capacity by an estimated xx% in the historical period.

Forces Driving Iran Oil and Gas Industry Growth

Key growth drivers include planned investments in gas production (USD 11 Billion planned in November 2021 for 240 Million cubic meters/day increase), government support for petrochemical expansion, and efforts to improve refining infrastructure. These initiatives aim to boost production capacity and create opportunities for economic diversification.

Long-Term Growth Catalysts in the Iran Oil and Gas Industry

Long-term growth will be driven by sustained investments in upstream and downstream infrastructure, technological advancements in production and refining, and potential easing of international sanctions. Strategic partnerships and investments from international companies could significantly accelerate future growth.

Emerging Opportunities in Iran Oil and Gas Industry

Emerging opportunities include expanding petrochemical production to meet growing regional and global demands, leveraging the country's significant gas reserves, and investing in renewable energy technologies to diversify the energy mix.

Leading Players in the Iran Oil and Gas Industry Sector

- Pars Oil Company

- National Petrochemical Company

- Iranol Oil Company

- National Iranian Oil Company

- National Iranian Oil Refining and Distribution Company

Key Milestones in Iran Oil and Gas Industry Industry

- January 2022: Lavan Refinery announces the construction of a 150,000-barrel petro-refinery and plans to increase production by one million liters per day. This signifies investment in refining capacity and enhanced product diversification.

- November 2021: Iran plans USD 11 Billion investment to increase gas production capacity by 240 million cubic meters/day, focusing on North Pars, Kish gas field, South Pars Phase 11, and onshore fields. This represents significant long-term commitment to production enhancement.

Strategic Outlook for Iran Oil and Gas Industry Market

The Iranian oil and gas industry holds significant long-term growth potential, contingent upon strategic investments, technological advancements, and a more favorable geopolitical environment. Successful implementation of planned projects and improved international relations could unlock substantial economic opportunities and establish Iran as a major energy player in the global market.

Iran Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Iran Oil and Gas Industry Segmentation By Geography

- 1. Iran

Iran Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pars Oil Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Petrochemical Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iranol Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Iranian Oil Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 National Iranian Oil Refining and Distribution Company*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Pars Oil Company

List of Figures

- Figure 1: Iran Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Iran Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: Iran Oil and Gas Industry Volume Tonnes Forecast, by Upstream 2019 & 2032

- Table 5: Iran Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: Iran Oil and Gas Industry Volume Tonnes Forecast, by Midstream 2019 & 2032

- Table 7: Iran Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: Iran Oil and Gas Industry Volume Tonnes Forecast, by Downstream 2019 & 2032

- Table 9: Iran Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Iran Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 11: Iran Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Iran Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

- Table 13: Iran Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 14: Iran Oil and Gas Industry Volume Tonnes Forecast, by Upstream 2019 & 2032

- Table 15: Iran Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 16: Iran Oil and Gas Industry Volume Tonnes Forecast, by Midstream 2019 & 2032

- Table 17: Iran Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 18: Iran Oil and Gas Industry Volume Tonnes Forecast, by Downstream 2019 & 2032

- Table 19: Iran Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Iran Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Oil and Gas Industry?

The projected CAGR is approximately > 3.40%.

2. Which companies are prominent players in the Iran Oil and Gas Industry?

Key companies in the market include Pars Oil Company, National Petrochemical Company, Iranol Oil Company, National Iranian Oil Company, National Iranian Oil Refining and Distribution Company*List Not Exhaustive.

3. What are the main segments of the Iran Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

Upstream Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, the Lavan Refinery, in the south of Iran, announced the construction of a 150,000-barrel petro-refinery next to the Lavan Refinery and its efforts to increase the refinery's production by one million liters per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Iran Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence