Key Insights

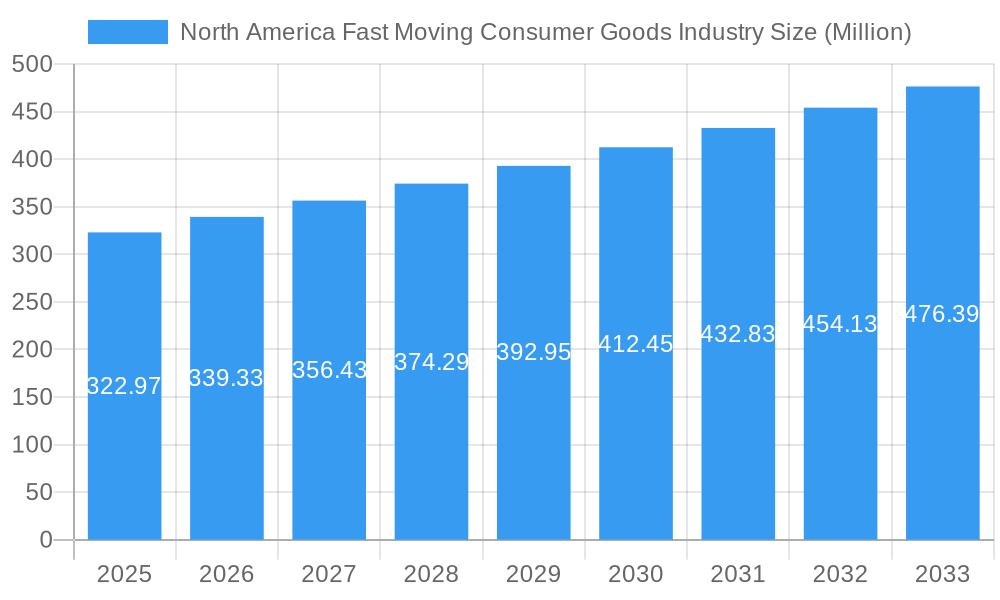

The North American Fast-Moving Consumer Goods (FMCG) logistics market, valued at $322.97 million in 2025, is projected to experience robust growth, driven by several key factors. E-commerce expansion continues to fuel demand for efficient and reliable delivery networks, particularly for temperature-sensitive goods like food and beverages. The rising popularity of subscription boxes and online grocery shopping necessitates sophisticated warehousing and inventory management solutions to ensure timely product delivery and minimize waste. Furthermore, increasing consumer demand for convenience and same-day or next-day delivery pushes logistics providers to invest in advanced technologies like automation and real-time tracking. This competitive landscape encourages innovation and efficiency improvements across transportation, warehousing, and distribution networks. Growth is also fueled by the expanding personal care and household care segments within the FMCG sector, reflecting shifting consumer preferences and lifestyle trends.

North America Fast Moving Consumer Goods Industry Market Size (In Million)

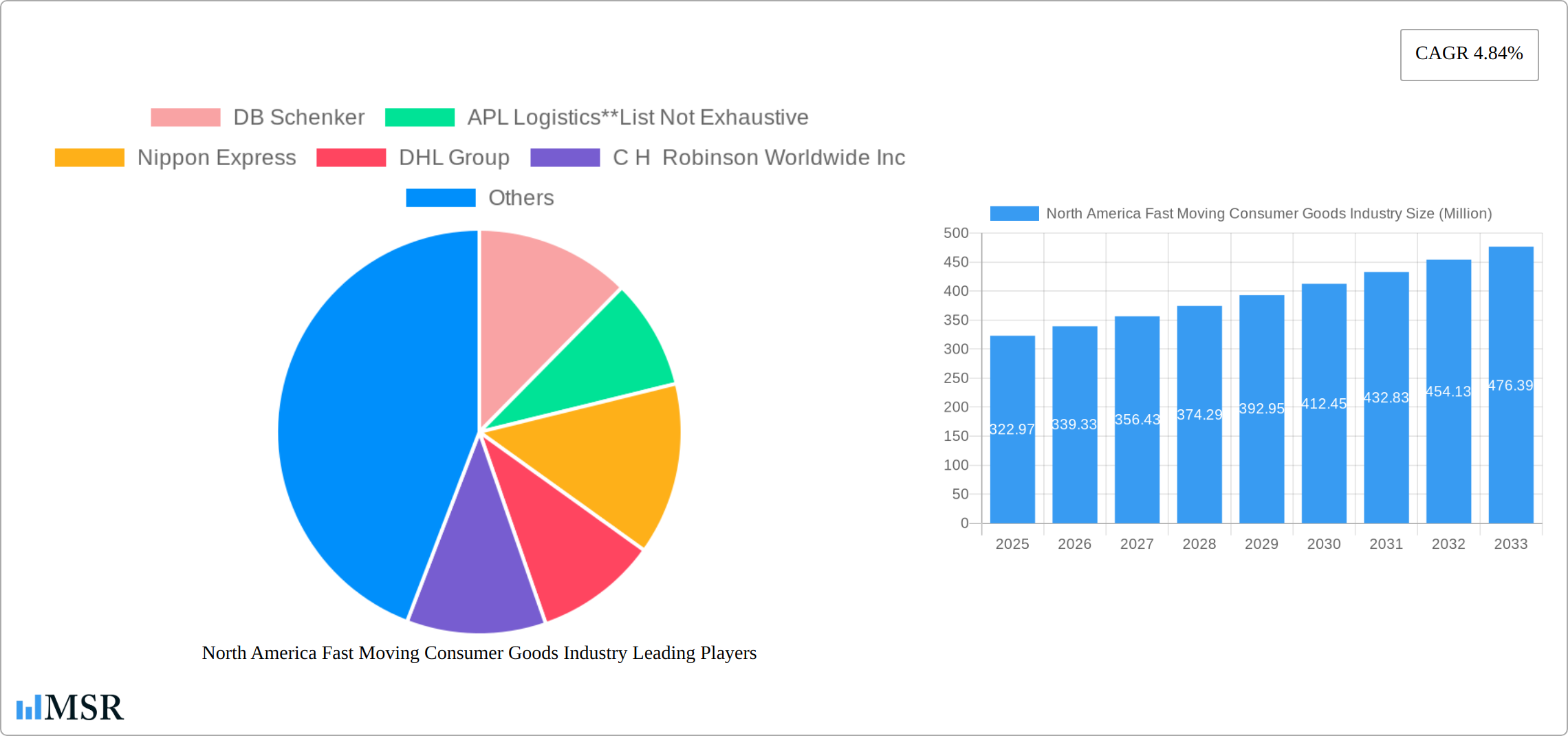

However, the market faces certain challenges. Rising fuel costs and driver shortages can negatively impact transportation expenses and delivery times. Supply chain disruptions, exacerbated by global events and geopolitical instability, continue to create uncertainty and necessitate robust risk management strategies. Competition among major players, including DB Schenker, APL Logistics, Nippon Express, DHL Group, C.H. Robinson, XPO Logistics, FedEx, CEVA Logistics, Agility Logistics, Kuehne + Nagel, and Hellmann Worldwide Logistics, intensifies the pressure to maintain cost-effectiveness and operational excellence. Despite these headwinds, the long-term outlook for the North American FMCG logistics market remains positive, supported by consistent growth in e-commerce, the demand for enhanced delivery options, and the ongoing expansion of the FMCG sector itself. Companies are increasingly focusing on technology adoption, strategic partnerships, and sustainable practices to navigate these challenges and capture market share.

North America Fast Moving Consumer Goods Industry Company Market Share

North America Fast Moving Consumer Goods (FMCG) Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the North America Fast Moving Consumer Goods industry, offering invaluable insights for stakeholders including manufacturers, distributors, logistics providers, and investors. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market's dynamics, key players, and future growth potential. The study encompasses detailed segmentation by service (transportation, warehousing, distribution, inventory management, and other value-added services) and product category (food and beverage, personal care, household care, and other consumables). Leading logistics providers like DB Schenker, APL Logistics, Nippon Express, DHL Group, C.H. Robinson Worldwide Inc, XPO Logistics, FedEx, CEVA Logistics, Agility Logistics, Kuehne + Nagel, and Hellmann Worldwide Logistics are analyzed within the context of this dynamic market.

North America Fast Moving Consumer Goods Industry Market Concentration & Dynamics

The North American FMCG market exhibits a moderately concentrated structure, with a few dominant players controlling significant market share. However, a significant number of smaller players contribute to the overall market volume. The market share of the top 5 players in transportation and warehousing is estimated at xx% in 2025. Innovation within the FMCG sector is robust, driven by evolving consumer preferences and technological advancements in areas like automation and supply chain optimization. The regulatory landscape is complex, with evolving food safety regulations and environmental concerns influencing business strategies. Substitute products pose a significant challenge, particularly in areas like personal care and household goods. End-user trends reflect a growing demand for sustainability, convenience, and personalization. M&A activity in the FMCG logistics sector has been significant in the historical period (2019-2024), with an estimated xx M&A deals recorded. This activity is expected to continue, driven by the pursuit of economies of scale and market expansion.

- Market Concentration: Top 5 players hold xx% market share (2025 estimate).

- Innovation: Focus on automation, sustainable packaging, and personalized products.

- Regulatory Framework: Evolving food safety and environmental regulations.

- Substitute Products: Growing competition from generic and private-label brands.

- End-User Trends: Emphasis on convenience, sustainability, and health.

- M&A Activity: xx M&A deals recorded between 2019-2024 (estimate).

North America Fast Moving Consumer Goods Industry Industry Insights & Trends

The North American FMCG market is experiencing robust growth, fueled by several key factors. The market size in 2025 is estimated at $xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by increasing disposable incomes, changing consumer lifestyles, and technological advancements that enhance efficiency and personalization. E-commerce continues to disrupt traditional retail channels, demanding robust logistics solutions and efficient inventory management. The rise of omnichannel retailing further complicates supply chain operations, prompting companies to invest in advanced technologies to enhance agility and responsiveness. Changing consumer preferences, with a heightened emphasis on health, sustainability, and convenience, drive product innovation and market segmentation. This necessitates tailored supply chain strategies for effective delivery and customer satisfaction. Technological disruptions, particularly the adoption of AI, big data analytics, and blockchain technology, are reshaping supply chains and improving efficiency throughout the FMCG industry.

Key Markets & Segments Leading North America Fast Moving Consumer Goods Industry

The key markets and segments within the North American FMCG sector vary by service and product category. Within the United States, and Canada, food and beverage is the largest product segment, driving the most significant demand for transportation, warehousing, and distribution services.

By Service: Transportation remains the largest segment, followed by warehousing and distribution, with inventory management and value-added services showing strong growth potential. The increasing reliance on e-commerce fuels demand for efficient last-mile delivery and specialized warehousing solutions.

By Product Category: The food and beverage segment dominates, followed by personal care and household care. The "other consumables" category demonstrates consistent growth, driven by rising demand for diverse product offerings.

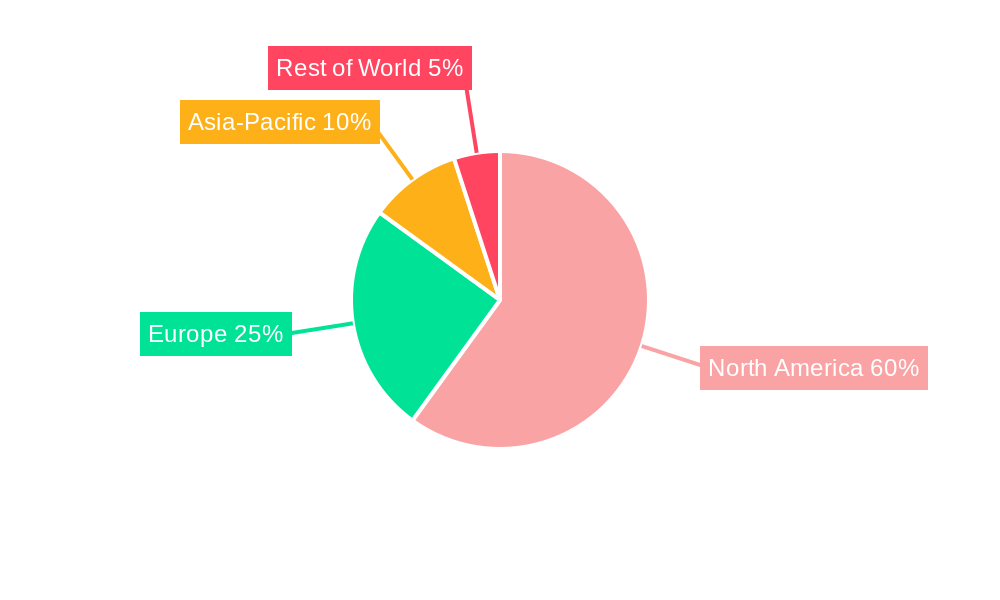

Regional Dominance: The United States holds the largest market share, due to its substantial population and advanced infrastructure. Canada follows as a significant market due to its robust economy.

Drivers:

- Strong economic growth in key regions.

- Well-developed transportation and logistics infrastructure.

- High consumer spending on FMCG products.

- Growing demand for e-commerce fulfillment services.

North America Fast Moving Consumer Goods Industry Product Developments

The North American Fast Moving Consumer Goods (FMCG) industry is experiencing a wave of dynamic product development, with a sharp focus on enhancing quality, convenience, and sustainability. This translates into a proliferation of healthier food and beverage options, including plant-based alternatives and reduced-sugar formulations. The drive for eco-friendliness is evident in the widespread adoption of sustainable packaging materials, such as biodegradable plastics, recycled content, and innovative reusable designs. Furthermore, the industry is increasingly embracing personalization, leveraging data analytics and advanced manufacturing to offer tailored products that cater to individual consumer preferences, dietary needs, and lifestyle choices. Technological advancements are also playing a pivotal role, with the integration of smart packaging featuring embedded sensors for real-time temperature monitoring, enhanced traceability through blockchain technology, and interactive consumer experiences. These innovations not only provide a significant competitive edge for manufacturers but also empower them to proactively meet evolving consumer demands, foster brand loyalty, and capture expanding market share in an increasingly discerning landscape.

Challenges in the North America Fast Moving Consumer Goods Industry Market

The sustained long-term growth of the North American FMCG industry is intrinsically linked to its ability to overcome critical challenges through proactive innovation and strategic adaptation. Embracing and scaling sustainable packaging solutions, moving beyond basic recyclability to explore innovative compostable materials and circular economy models, is paramount. The increasing consumer demand for highly customized product offerings, ranging from personalized nutrition plans to bespoke scent profiles, requires agile manufacturing and distribution capabilities. Furthermore, forging robust strategic partnerships between manufacturers, retailers, and third-party logistics providers is no longer optional but essential for building truly resilient and responsive supply chains capable of weathering unforeseen disruptions. Expanding into underserved new markets and identifying and capitalizing on untapped consumer segments, such as the growing senior demographic or specific ethnic communities, present significant and promising growth opportunities for forward-thinking companies.

Forces Driving North America Fast Moving Consumer Goods Industry Growth

Several powerful forces are propelling the long-term growth trajectory of the North American FMCG market. Continuous technological advancements, particularly in automation, artificial intelligence, and digitalization across manufacturing, warehousing, and last-mile delivery, are significantly enhancing operational efficiency and overall productivity throughout the supply chain. Robust economic growth, coupled with a steady rise in disposable incomes among a growing population, directly fuels consumer spending on a wide array of FMCG products. Favorable regulatory policies that actively encourage innovation, promote sustainable business practices, and streamline market entry further foster sector expansion. Moreover, the unrelenting expansion of e-commerce, driven by changing consumer shopping habits, necessitates and consequently drives the development of sophisticated and efficient logistics solutions, acting as a significant catalyst for broader market growth.

Challenges in the North America Fast Moving Consumer Goods Industry Market

The sustained long-term growth of the North American FMCG industry is intrinsically linked to its ability to overcome critical challenges through proactive innovation and strategic adaptation. Embracing and scaling sustainable packaging solutions, moving beyond basic recyclability to explore innovative compostable materials and circular economy models, is paramount. The increasing consumer demand for highly customized product offerings, ranging from personalized nutrition plans to bespoke scent profiles, requires agile manufacturing and distribution capabilities. Furthermore, forging robust strategic partnerships between manufacturers, retailers, and third-party logistics providers is no longer optional but essential for building truly resilient and responsive supply chains capable of weathering unforeseen disruptions. Expanding into underserved new markets and identifying and capitalizing on untapped consumer segments, such as the growing senior demographic or specific ethnic communities, present significant and promising growth opportunities for forward-thinking companies.

Emerging Opportunities in North America Fast Moving Consumer Goods Industry

Emerging trends like the increasing popularity of plant-based foods and sustainable living practices offer significant opportunities. The growing demand for personalized products and customized experiences calls for innovation in product development and targeted marketing campaigns. Expansion into new market segments, such as specialized health and wellness products, offers considerable growth potential. Technological advancements like AI-driven demand forecasting and predictive analytics are set to further optimize efficiency within the FMCG industry.

Leading Players in the North America Fast Moving Consumer Goods Industry Sector

- DB Schenker

- APL Logistics

- Nippon Express

- DHL Group

- C.H. Robinson Worldwide Inc.

- XPO Logistics

- FedEx Logistics

- CEVA Logistics

- Agility Logistics

- Kuehne + Nagel

- Hellmann Worldwide Logistics

Key Milestones in North America Fast Moving Consumer Goods Industry Industry

- 2020: Increased focus on e-commerce fulfillment and last-mile delivery.

- 2021: Supply chain disruptions due to the pandemic highlight the need for resilience.

- 2022: Rise in investment in automation and digitalization technologies.

- 2023: Growing emphasis on sustainable packaging and environmentally friendly practices.

- 2024: Increased M&A activity to consolidate market share and expand capabilities.

Strategic Outlook for North America Fast Moving Consumer Goods Industry Market

The North American FMCG market is robustly positioned for continued and accelerated growth, underpinned by a dynamic interplay of technological innovation, rapidly evolving consumer preferences, and strategic, forward-looking investments. Companies that proactively embrace digital transformation, from predictive analytics to advanced automation, and steadfastly prioritize genuine sustainability initiatives across their value chains, will be exceptionally well-equipped to thrive. Furthermore, significant investments in building agile and resilient supply chain solutions, capable of rapid adaptation to market shifts, are crucial. The ever-expanding e-commerce sector, alongside the burgeoning consumer demand for both ultimate convenience and deeply personalized product experiences, presents vast and lucrative opportunities for growth. By effectively anticipating and responding to these powerful market forces with strategic foresight and innovative execution, the North American FMCG industry is poised to unlock its substantial and enduring long-term potential.

North America Fast Moving Consumer Goods Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Fast Moving Consumer Goods Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Fast Moving Consumer Goods Industry Regional Market Share

Geographic Coverage of North America Fast Moving Consumer Goods Industry

North America Fast Moving Consumer Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Location; Economic diversification

- 3.3. Market Restrains

- 3.3.1. Infrastructure challenges; Skilled workforce

- 3.4. Market Trends

- 3.4.1. Increasing Growth in Food and Beverages Products are Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Household Care

- 6.2.4. Other Consumables

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Canada North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Household Care

- 7.2.4. Other Consumables

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Mexico North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Household Care

- 8.2.4. Other Consumables

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 DB Schenker

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 APL Logistics**List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nippon Express

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 DHL Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 C H Robinson Worldwide Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 XPO Logistics

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 FedEx

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 CEVA Logistics

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Agility Logistics

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kuehne + Nagel

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Hellmann Worlwide Logistics

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 DB Schenker

List of Figures

- Figure 1: North America Fast Moving Consumer Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fast Moving Consumer Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 7: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 11: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fast Moving Consumer Goods Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the North America Fast Moving Consumer Goods Industry?

Key companies in the market include DB Schenker, APL Logistics**List Not Exhaustive, Nippon Express, DHL Group, C H Robinson Worldwide Inc, XPO Logistics, FedEx, CEVA Logistics, Agility Logistics, Kuehne + Nagel, Hellmann Worlwide Logistics.

3. What are the main segments of the North America Fast Moving Consumer Goods Industry?

The market segments include Service, Product Category, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 322.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Location; Economic diversification.

6. What are the notable trends driving market growth?

Increasing Growth in Food and Beverages Products are Driving the Market Growth.

7. Are there any restraints impacting market growth?

Infrastructure challenges; Skilled workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fast Moving Consumer Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fast Moving Consumer Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fast Moving Consumer Goods Industry?

To stay informed about further developments, trends, and reports in the North America Fast Moving Consumer Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence