Key Insights

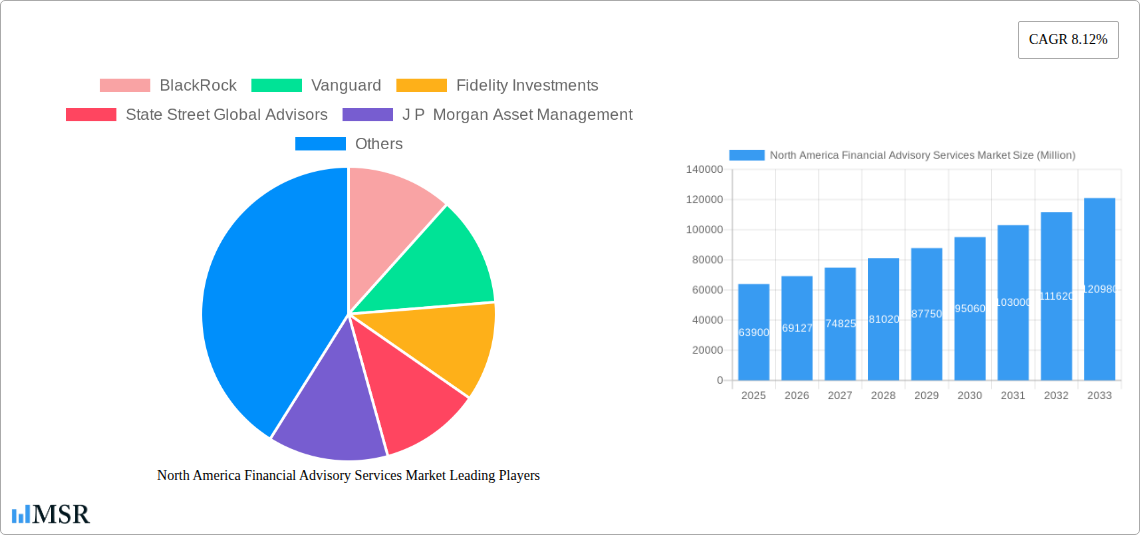

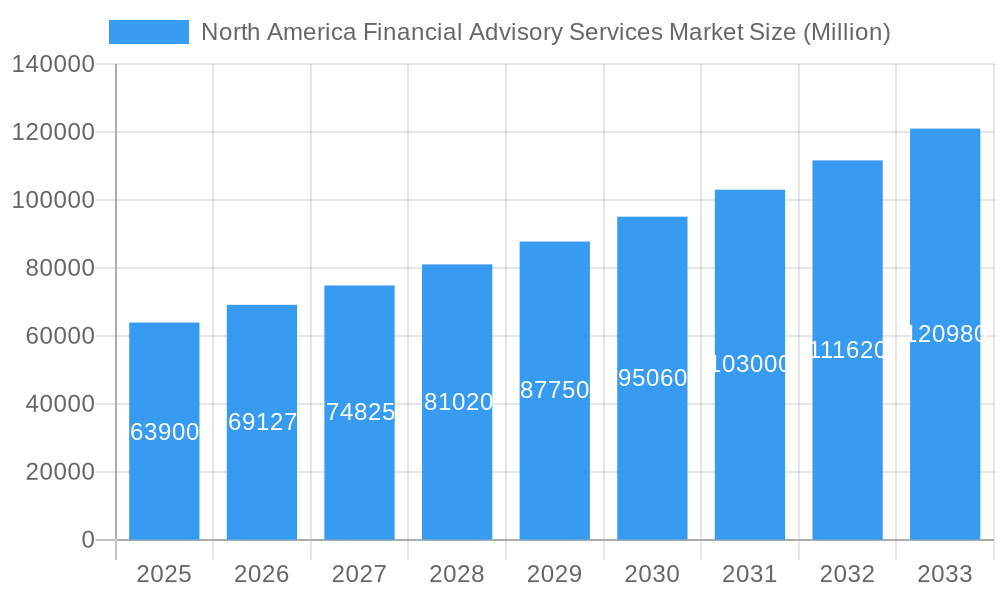

The North America financial advisory services market, valued at $63.90 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing complexity of financial instruments, coupled with a growing demand for personalized wealth management solutions among high-net-worth individuals and mass affluent populations, fuels market expansion. Technological advancements, such as robo-advisors and sophisticated financial planning software, are streamlining processes and increasing accessibility, attracting a broader client base. Furthermore, a rising awareness of retirement planning and the need for long-term financial security among millennials and Gen Z contributes significantly to market growth. Regulatory changes aimed at enhancing consumer protection and transparency also play a role, fostering trust and encouraging greater utilization of financial advisory services. Competition is fierce, with established players like BlackRock, Vanguard, and Fidelity Investments vying for market share alongside boutique firms and independent advisors. This competitive landscape fosters innovation and drives the development of more tailored and cost-effective solutions.

North America Financial Advisory Services Market Market Size (In Billion)

Despite the positive outlook, the market faces challenges. Economic fluctuations and market volatility can impact investor confidence and demand for advisory services. Maintaining client trust in the wake of economic downturns and ensuring regulatory compliance are critical concerns. The increasing penetration of robo-advisors, while driving growth, also presents a challenge for traditional advisory firms, necessitating adaptation and the integration of technology into their offerings. Attracting and retaining skilled financial advisors remains crucial to maintain high service quality and meet the evolving needs of a diverse clientele. Finally, the ongoing shift towards digital channels necessitates investments in robust online platforms and cybersecurity measures to ensure data protection and maintain customer trust. Overall, the market's growth trajectory is optimistic, indicating substantial opportunities for businesses willing to adapt and innovate within a dynamic and competitive environment.

North America Financial Advisory Services Market Company Market Share

North America Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Financial Advisory Services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects robust growth, driven by technological advancements, evolving consumer behavior, and strategic M&A activities. The market is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Financial Advisory Services Market Market Concentration & Dynamics

The North American financial advisory services market is characterized by a moderate level of concentration, with a few dominant players like BlackRock, Vanguard, and Fidelity Investments holding significant market share. However, a competitive landscape exists with numerous smaller firms and specialized boutiques catering to niche client segments. The market exhibits dynamic interplay of several key factors:

- Market Concentration: The top 5 players account for an estimated xx% of the market share in 2025, indicating a moderately concentrated market. Smaller players actively compete through specialization and innovative service offerings.

- Innovation Ecosystems: Fintech advancements and the emergence of robo-advisors are disrupting traditional models, pushing established players to embrace digital transformation and enhance their technological capabilities.

- Regulatory Frameworks: Stringent regulations, particularly concerning data privacy and financial security, impact market operations and necessitate compliance investments. Changes in regulatory landscapes influence market dynamics significantly.

- Substitute Products: The rise of self-directed investment platforms and online resources poses a degree of substitution, albeit with varying levels of risk and expertise required.

- End-User Trends: Increasing demand for personalized financial advice, sophisticated wealth management solutions, and sustainable investment options shape market growth. The millennial and Gen Z demographics particularly favor digital-first advisory models.

- M&A Activities: The market has witnessed a notable number of mergers and acquisitions (M&A) deals, especially in recent years (xx deals in 2024). These activities reflect the pursuit of scale, technology acquisition, and expansion into new market segments. Examples include Fidelity Investments' acquisition of Shoobx in January 2023 and Deloitte's expansion through acquisitions of multiple incubator companies.

North America Financial Advisory Services Market Industry Insights & Trends

The North American financial advisory services market is experiencing substantial growth, driven by several key factors:

The market size is projected to grow from xx Million in 2024 to xx Million in 2033, reflecting the increasing demand for professional financial guidance amidst economic uncertainty and market volatility. Technological advancements such as AI-powered robo-advisors are enhancing efficiency and accessibility of financial services. Simultaneously, evolving consumer preferences toward personalized, sustainable and ethical investment strategies necessitate tailored solutions, fueling growth in specialized advisory firms. Furthermore, demographic shifts, including an aging population with significant assets and a rising millennial investor base, contribute to the expansion of this market. Growing awareness of financial planning and wealth management, especially among younger generations, further drives demand. Rising disposable incomes in certain segments also positively impact market growth, enabling more individuals to access professional advisory services. The impact of macroeconomic fluctuations and geopolitical events, while capable of causing short-term uncertainty, does not fundamentally alter the long-term positive trajectory of the market.

Key Markets & Segments Leading North America Financial Advisory Services Market

The US remains the dominant market within North America, accounting for approximately xx% of the total market value in 2025. Key drivers include:

- Robust Economic Growth: A relatively strong economy fuels investment activity and demand for financial advisory services.

- Developed Financial Infrastructure: A sophisticated financial infrastructure facilitates market operations and supports various advisory models.

- High Net Worth Individuals: A significant population of high-net-worth individuals drives demand for sophisticated wealth management and investment strategies.

- Strong Regulatory Framework: While demanding, the robust regulatory framework instils investor confidence and safeguards market integrity.

Canada represents a substantial secondary market, contributing xx% of the total market in 2025. However, the growth in the US significantly outpaces that in Canada.

North America Financial Advisory Services Market Product Developments

Significant advancements in financial technology (Fintech) are shaping product development. AI-powered robo-advisors offer automated portfolio management, making financial advice more accessible and cost-effective. Sophisticated algorithms optimize investment strategies, improving returns while managing risk. Furthermore, personalized digital platforms provide customized financial planning tools and resources, enhancing client engagement and service delivery. These developments are increasing competition and forcing traditional advisory firms to adapt through the integration of such technologies.

Challenges in the North America Financial Advisory Services Market Market

The North American financial advisory services market faces several challenges:

- Intense Competition: The market is highly competitive, with numerous firms vying for market share. This necessitates continuous innovation and adaptation to maintain competitiveness.

- Regulatory Scrutiny: Stringent regulations impose compliance costs and necessitate ongoing adaptations to evolving rules.

- Cybersecurity Risks: The industry is vulnerable to cybersecurity threats, mandating significant investments in data protection and security measures. Breaches could lead to significant financial losses and reputational damage.

Forces Driving North America Financial Advisory Services Market Growth

Several factors drive market growth:

- Technological Advancements: Fintech innovations, including AI and machine learning, are enhancing efficiency and personalization of services.

- Rising Affluence: Increased disposable incomes enable more individuals to access financial advisory services.

- Favorable Regulatory Environment: Though demanding, a relatively stable regulatory landscape fosters investor confidence.

Long-Term Growth Catalysts in the North America Financial Advisory Services Market

Long-term growth is fueled by several factors:

The increasing adoption of innovative technologies, such as AI and blockchain, will continue to drive efficiency and enhance the client experience. Strategic partnerships between established financial institutions and Fintech companies will also foster innovation and market expansion. The growth of sustainable and responsible investment options will attract environmentally conscious investors, creating a new segment within the market. Finally, global economic expansion, while unpredictable, presents significant long-term opportunities for market growth.

Emerging Opportunities in North America Financial Advisory Services Market

Emerging opportunities include:

- Sustainable Investing: Growing demand for sustainable and ethical investment options creates significant opportunities for specialized advisory firms.

- Expansion into Underserved Markets: Reaching out to underserved populations, such as millennials and diverse communities, presents growth potential.

- Integration of Fintech Solutions: Innovative companies can leverage technologies to reach larger audiences and provide more affordable services.

Leading Players in the North America Financial Advisory Services Market Sector

Key Milestones in North America Financial Advisory Services Market Industry

- January 2023: Fidelity Investments acquired Shoobx, expanding its capabilities in automated equity management software for private companies.

- February 2023: Deloitte significantly boosted its start-up and scale-up services capabilities through the acquisition of 27 pilots, a German incubator, and venture capital entities. This enhances Deloitte’s ability to provide comprehensive support to its growing start-up clientele.

Strategic Outlook for North America Financial Advisory Services Market Market

The North American financial advisory services market holds significant future potential. Continued technological advancements, evolving consumer preferences, and strategic M&A activities will shape its growth trajectory. Companies focused on innovation, personalization, and sustainable investment solutions will likely experience stronger growth. The market’s future success hinges on firms’ ability to adapt to shifting regulatory landscapes and meet the evolving needs of a diverse client base. The continued integration of financial technology and sophisticated data analytics will further define competitive advantage.

North America Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Others

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Others

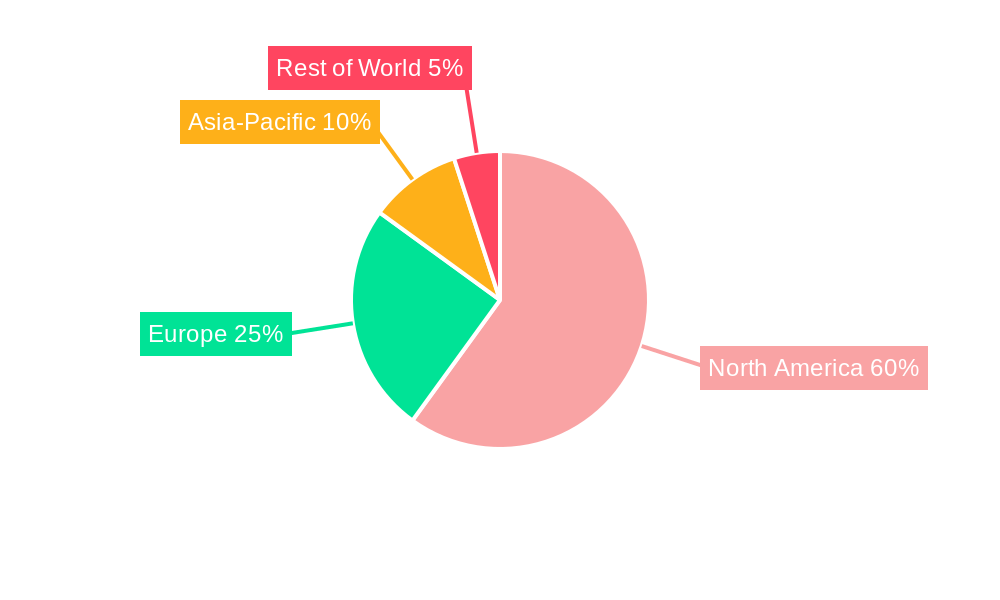

North America Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Financial Advisory Services Market Regional Market Share

Geographic Coverage of North America Financial Advisory Services Market

North America Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Use of Robot Advisory Services is Growing in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vanguard

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fidelity Investments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Street Global Advisors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J P Morgan Asset Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bain & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PWC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deloitte**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: North America Financial Advisory Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: North America Financial Advisory Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Financial Advisory Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: North America Financial Advisory Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Financial Advisory Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Financial Advisory Services Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the North America Financial Advisory Services Market?

Key companies in the market include BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, J P Morgan Asset Management, Boston Consulting Group, Ernst & Young Global Limited, Bain & Company, PWC, Deloitte**List Not Exhaustive.

3. What are the main segments of the North America Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Use of Robot Advisory Services is Growing in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities by acquiring 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 pilots as part of its portfolio, Deloitte can better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the North America Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence