Key Insights

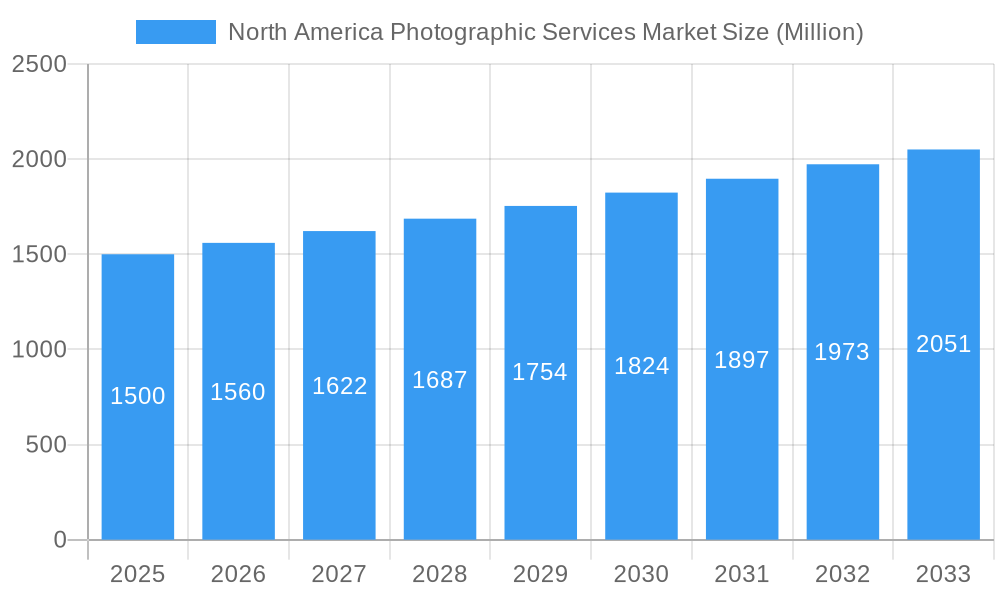

The North American photographic services market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and the provided CAGR), is experiencing robust growth, exceeding a 4% compound annual growth rate (CAGR). This expansion is driven by several key factors. The increasing popularity of social media and online platforms fuels demand for high-quality professional photography for personal and commercial use. Simultaneously, technological advancements, including higher-resolution cameras and sophisticated editing software, are lowering barriers to entry for both professionals and amateurs, leading to greater market competition and innovation. Furthermore, the burgeoning events industry, encompassing weddings, corporate events, and graduations, contributes significantly to market demand. While rising labor costs and competition from amateur photographers pose some constraints, the overall market outlook remains positive, propelled by consistent technological advancements and the ever-increasing consumer need for visual content.

North America Photographic Services Market Market Size (In Billion)

The market segmentation reveals diverse service offerings, including portrait photography, event photography, product photography, and aerial photography, among others. Key players like Getty Images, Meero, and several regional specialists cater to varied client needs. Regional data, while not explicitly provided, suggests that major metropolitan areas and regions with thriving tourism or event industries contribute most significantly to market revenue. The forecast period (2025-2033) anticipates sustained growth based on predicted trends, including increasing adoption of mobile photography solutions, growing demand for virtual photography experiences, and the continued integration of artificial intelligence in image processing and enhancement. The long-term projection highlights considerable potential for growth and profitability within the North American photographic services sector.

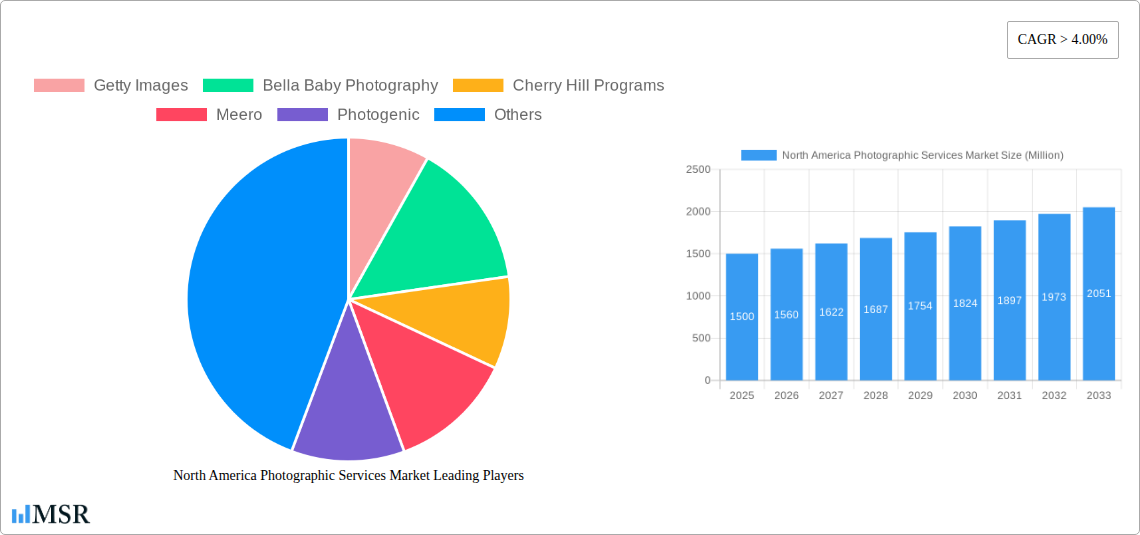

North America Photographic Services Market Company Market Share

North America Photographic Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Photographic Services Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period spanning 2025-2033, this report unveils the market's current state and future trajectory. The historical period analyzed is 2019-2024. The market size in 2025 is estimated at xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected for the forecast period. Key players like Getty Images, Bella Baby Photography, Cherry Hill Programs, Meero, Photogenic, WorldWide Photography, Classic Photographers, Telescope Pictures, GradImages, and Enchanted Fairies (list not exhaustive) are profiled, highlighting their market positions and strategic initiatives.

North America Photographic Services Market Concentration & Dynamics

The North America photographic services market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Getty Images, for instance, commands a substantial portion, while smaller firms cater to niche segments. The market's dynamics are shaped by a vibrant innovation ecosystem, driven by advancements in digital imaging technology, AI-powered editing tools, and evolving consumer preferences for high-quality visual content. Regulatory frameworks, particularly concerning data privacy and copyright, play a crucial role. Substitute products, such as smartphone cameras with advanced features, pose a competitive challenge. End-user trends indicate a growing demand for specialized services, such as drone photography and virtual reality experiences. The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024, primarily driven by consolidation efforts and expansion strategies. Market share distribution among the top five players is estimated at approximately xx% in 2025.

- Market Concentration: Moderately concentrated

- Innovation Ecosystem: Strong, driven by digital imaging and AI.

- Regulatory Framework: Significant impact on data privacy and copyright.

- Substitute Products: Smartphone cameras, impacting lower-end services.

- End-User Trends: Growing demand for specialized and high-quality services.

- M&A Activity: xx deals (2019-2024), primarily for consolidation and expansion.

North America Photographic Services Market Industry Insights & Trends

The North America photographic services market is experiencing robust growth, fueled by several factors. The increasing adoption of visual content across various platforms, from social media to e-commerce, is a primary driver. The rising demand for professional photography services for events, marketing, and commercial purposes further contributes to market expansion. Technological disruptions, including advancements in camera technology, image processing software, and AI-powered tools, are reshaping the industry landscape, creating new opportunities and efficiencies. Evolving consumer behaviors, such as a preference for personalized and high-quality visual experiences, are influencing service offerings. The market is anticipated to reach xx Million by 2033, reflecting a significant growth trajectory.

Key Markets & Segments Leading North America Photographic Services Market

The key segments driving growth in the North American photographic services market include event photography (weddings, corporate events), commercial photography (advertising, e-commerce), and portrait photography. The United States dominates the market, driven by a robust economy, advanced infrastructure, and high consumer spending. Canada also contributes significantly.

- Drivers of US Market Dominance:

- High consumer spending on visual content

- Large and diverse market segments

- Advanced digital infrastructure

- Strong presence of major players

- Drivers of Canadian Market Growth:

- Growing tourism industry

- Increased corporate spending on visual marketing

- High demand for professional photography services

North America Photographic Services Market Product Developments

Recent years have witnessed significant product innovations within the North American photographic services market. Advancements in camera technology, including improved image sensors and lens systems, have enabled higher-resolution images and enhanced creative control. The integration of artificial intelligence in image editing and processing has streamlined workflows and provided new creative possibilities. The rise of drone photography has expanded the scope of services, providing unique perspectives and capabilities. These advancements create competitive edges for firms that invest in and adapt to the latest technologies.

Challenges in the North America Photographic Services Market Market

The North America photographic services market faces several challenges. Intense competition from both established players and new entrants exerts downward pressure on prices. Fluctuations in economic conditions can impact consumer spending on non-essential services such as professional photography. Maintaining high quality standards while managing operational costs is a key challenge. Supply chain disruptions related to equipment procurement can affect service delivery.

Forces Driving North America Photographic Services Market Growth

Several factors drive the growth of the North American photographic services market. The increasing demand for visual content in marketing and advertising is a major catalyst. The growing popularity of social media platforms and e-commerce further fuels demand for high-quality photography and videography. Technological advancements, such as AI-powered image editing tools and improved camera technology, enhance efficiency and creativity, driving market expansion. Finally, rising disposable incomes in many parts of North America contribute to greater consumer spending on photographic services.

Long-Term Growth Catalysts in the North America Photographic Services Market

Long-term growth will be driven by the continued integration of artificial intelligence in image processing, offering enhanced efficiency and creative possibilities. Strategic partnerships between photography service providers and technology companies will foster innovation and expand service offerings. Expansion into new geographic markets and the exploration of new applications, such as virtual reality and augmented reality experiences, offer significant growth potential.

Emerging Opportunities in North America Photographic Services Market

Emerging opportunities lie in the growing demand for specialized photographic services, including drone photography, underwater photography, and virtual reality imaging. The increasing adoption of immersive technologies presents opportunities for creative applications of photography in various fields. Furthermore, the expanding e-commerce landscape requires high-quality product photography, providing significant growth potential for photographic services providers.

Leading Players in the North America Photographic Services Market Sector

- Getty Images (Getty Images)

- Bella Baby Photography

- Cherry Hill Programs (Cherry Hill Programs)

- Meero (Meero)

- Photogenic

- WorldWide Photography

- Classic Photographers

- Telescope Pictures

- GradImages

- Enchanted Fairies

Key Milestones in North America Photographic Services Market Industry

- September 2022: Cherry Hill Programs launched a fundraising campaign for St. Jude Children's Research Hospital, enhancing brand image and potentially attracting new customers.

- February 2023: Aputure's launch of new lighting products signifies technological advancements and potential improvements in the quality and efficiency of photographic services. This indicates an ongoing trend of innovation within the industry.

Strategic Outlook for North America Photographic Services Market Market

The North America photographic services market holds significant growth potential. Continued innovation in technology, strategic partnerships, and the expansion into new market segments will drive future growth. Companies that can effectively leverage technology, adapt to evolving consumer preferences, and offer specialized services are poised for success in this dynamic and expanding market.

North America Photographic Services Market Segmentation

-

1. Type Outlook

- 1.1. Shooting service

- 1.2. After-sales service

-

2. Application

- 2.1. Portrait Studio Services

- 2.2. Commercial Studios

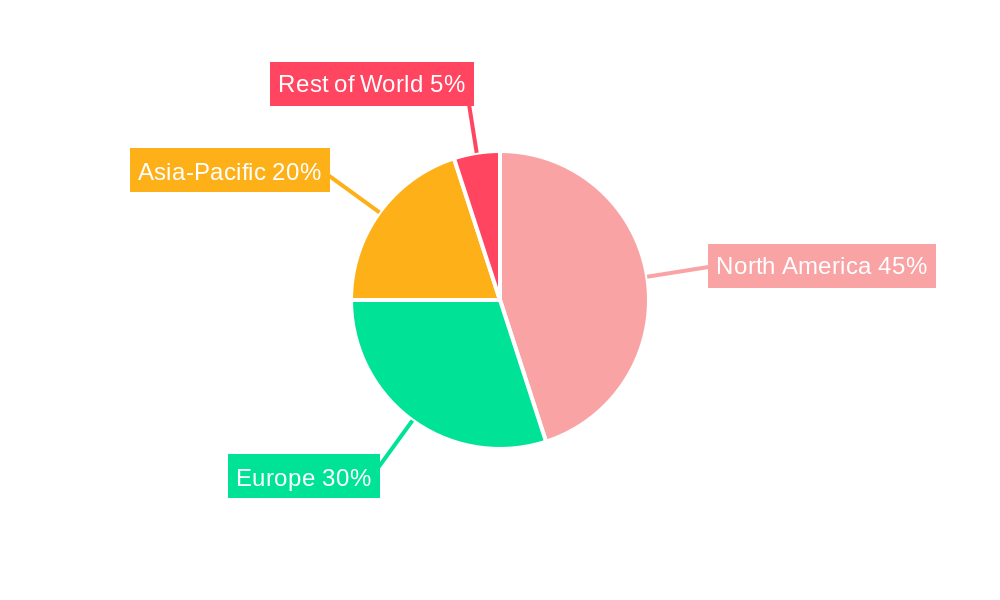

North America Photographic Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Photographic Services Market Regional Market Share

Geographic Coverage of North America Photographic Services Market

North America Photographic Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Revenue of Photographic Services in the United states

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Photographic Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 5.1.1. Shooting service

- 5.1.2. After-sales service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Portrait Studio Services

- 5.2.2. Commercial Studios

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Getty Images

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bella Baby Photography

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cherry Hill Programs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Meero

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Photogenic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WorldWide Photography

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Classic Photographers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telescope Pictures

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GradImages

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Enchanted Fairies**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Getty Images

List of Figures

- Figure 1: North America Photographic Services Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Photographic Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Photographic Services Market Revenue undefined Forecast, by Type Outlook 2020 & 2033

- Table 2: North America Photographic Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Photographic Services Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Photographic Services Market Revenue undefined Forecast, by Type Outlook 2020 & 2033

- Table 5: North America Photographic Services Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Photographic Services Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Photographic Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Photographic Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Photographic Services Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Photographic Services Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the North America Photographic Services Market?

Key companies in the market include Getty Images, Bella Baby Photography, Cherry Hill Programs, Meero, Photogenic, WorldWide Photography, Classic Photographers, Telescope Pictures, GradImages, Enchanted Fairies**List Not Exhaustive.

3. What are the main segments of the North America Photographic Services Market?

The market segments include Type Outlook, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Revenue of Photographic Services in the United states.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Aputure announced various new lighting products, including its first RGBWW full-color LED pixel bar, a four-foot battery-powered pixel tube, a smaller portable one-foot battery-powered pixel tube, and an improved 200-watt (W) bi-color Bowens Mount point-source light.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Photographic Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Photographic Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Photographic Services Market?

To stay informed about further developments, trends, and reports in the North America Photographic Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence